Abstract

At present, private sector firms in India are only allowed to mine coal for its own use (captive mining) in cement, steel, power, and aluminum plants, etc. Coal India Ltd. (CIL) is the sole commercial miner in India with 80% market share and the world’s largest coal producer by production. In a major “reform” in the coal sector since its nationalization in 1973, the government on February 20th, 2018 allowed private companies to mine the fossil fuel for commercial use, ending the monopoly of state-owned CIL. With this latest development, decision-makers expect private players to bring in competition along with private investment, technology adoption, and international best practices. However, with this decision, still there may be some key questions associated with proposed mining approach such as, is land acquisition being easy for private players, whether private players will do rehabilitation and resettlement as per government norms, will the firms be sensitive toward the environmental degradation caused by mining, was this decision needed because CIL was not able to cater current demand of coal. Therefore, in this chapter, the impact of private mining is discussed and presented along with its economic, environmental, and social viability.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

1.1 History

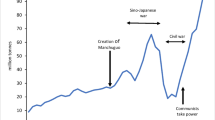

India was involved in commercial coal mining since 1774 by M/s John Sumner and Suetonius Grant Heatly of East India Company. The first coalfield was Raniganj coalfield in the bank of river Damodar. The production growth was very static in those days. The introduction of steam engines in 1853 gave a drastic boom to the demand of coal. The average production raised to 1 Mty (million tons per year) and by the end of 1900, India started producing 6.12 Mty. The pace of coal production again boosted during the first world war but again got dull in the 1930s. Before the independence of the country, the production level reached to 30 Mty. Till 1980, the coal production was around 100 Mty, which was drastically doubled by 1990 and crossed 200 Mty, and by the end of 2010, the production of coal reached around the 550 Mty.

After independence, during the introduction of first five-year development program, the leader and planners felt the need of increasing the coal production efficiently by the introduction of new technology. The Government of India now decided to form National Coal Development Corporation (NCDC), a government of India undertaking in 1956. Another coal company Singareni Collieries Company Limited (SCCL), which was already operating since 1945 was given control to the Government of Andhra Pradesh (Coal India Limited 2018; Lahiri-Dutt 2016).

1.2 Nationalizations of Coal Mines

The unscientific mining practices and substandard living condition of labors involved in coal mining industry becomes the matter of concern for the government of India. Taking all these matters into account, the government of India decided to take a revolutionary step to nationalize the private coal sectors.

As per the government’s national energy policy, the nationalization of coal mine took place in two stages in the 1970s. In the first stage, The Coking Coal Mines (Emergency Provisions) act 1971 was formed by Government of India (GoI) on October 16, 1971, which states that the captive mines of IISCO (The Indian Iron & Steel Company), TISCO (Tata Iron and Steel Company Limited), and DVC (Damodar Valley Corporation), the GoI took over the management of all 226 coking coal mines and nationalized them on May 1, 1972. The company under central government was formed that is known as Bharat Coking Coal Limited. In second the stage, the Government of India announced the Coal Mines (Taking over of Management) Ordinance 1973 on January 31, 1973, which empowers the central government to take control over all 711 noncoking coal mines. In the next phase of nationalization, these mines were nationalized with effect from May 1, 1973 and a public sector company named Coal Mines Authority Limited (CMAL) was formed to manage these noncoking mines (Coal India Limited 2018; Singh and Kalirajan 2003). A formal holding company in the form of Coal India Limited (CIL) was formed in November 1975 to manage both the companies.

Now, again the union cabinet of India on February 20, 2018 decided to open up the coal sector to commercial mining by private entities. It is a revolutionary move that puts an end to its own Coal India Limited (CIL) monopoly and removing one of the last vestiges of the licence-quota raj of the 1970s.

1.3 Existing Scenario for Private Companies

In the present scenario, the government has a monopoly over the coal production that accounts for more than 90% through state-owned mines. In 1993, the policy of captive mining was introduced. The introduction of this policy opened the door for the private investment in the coal sector. Though the performance of captive block was not promising as the production from all these captive blocks were 32.54 Mt in 2016–17. So far, the private companies are allowed to do coal mining for their captive use. Captive coal mining means that the coal mined could be used only in the said industry for which the allocation/auction of the block has been done. It cannot be used for any other purposes. Any surplus coal would have to be sold to Coal India at the notified price. A captive coal block is not allowed to sell its produce in the open market and all of that must go to the end-use industry for which it is approved.

2 The Proposed Policy

Under this new reform, the coal blocks will be allocated on the basis of price per ton of coal offered to the state government and there shall be no restriction on the sale and/or utilization of coal from the coal mine to power plants, steel mills, and other users (Goyal 2018). The move is also seen as lowering prices and imports while introducing better technology, apart from saving on foreign exchange and improving energy security. The policy is expected to usher in competition in coal supply, reduce coal imports, and help stressed power plants to attempt a turnaround through better fuel management. The move will also increase supply in the market and help achieve the target of producing a billion ton of coal by 2022. However, it is still unsure about the pros and cons of this policy. In this chapter, benefits and drawback are presented of coal sector privatization in terms of short term and long-term impacts (Yilmaz 2015).

2.1 Need and Impact of New Policy

2.1.1 Need for Privatization

The rising demand in the power sector resulted in an increase in coal-based power capacity, in the draft national energy policy by the NITI Ayog (think tank of India) stated that coal-based power generation capacity of 125 GW in 2012 is likely to go up to more than 330–441 GW by 2040 (192 GW in FY 2017). This huge demand in near future requires sustainable exploitation of our available resources. As per the assessment of NITI Ayog the production level requires to be more than 1.3 billion tons per year (Draft Energy Policy 2017).

The shortage in coal supply can lead to the pressure on import of coal. Imported coal is generally more expensive than the locally mined coal and as the Coal India cannot meet the expected demand, and imports are expected to rise. The linkages are pending to the power sector by 600 GW for which more than one-billion-ton production is required. This is about three times India’s current installed coal-based power capacity. Now, the question arises that how will India meet the target of huge coal demand. This gives rise to the need for privatization in the coal sector to cater to the need of power in coming future (Modak et al. 2017).

2.1.2 Impact of Privatization

In the current scenario, if we see then that huge gap between demand and supply can be met through the import of coal only. The government also has not formed any policy regarding the import of coal. The stakeholders mainly related to power sectors and their financers also never make their business plan based on the import of coal. They always believed on the huge availability of domestic coal which was never promised.

As discussed above, the cost of imported coal is much higher compared to domestic coal. The reason for this, in India 90% coal is extracted from surface mining (open cast mining) and world’s average production through surface mining is 40%. China is doing their 90% coal production through underground mining. The cost of surface mining is one-fourth of underground mining. But due to surface mining, the heavy environmental degradation takes place and most of the coal blocks that are given to private players are open cast projects.

The government’s intensions behind this policy is that the private players will bring the competition and price will lower down. However, this does not imply that state-owned Coal India limited is not capable of meeting the expectation of government. It is also important to look that on what stake private players are reducing the price. They will make a profit by giving lower wages to labors as mining is a labor-intensive sector and a lot of miners are involved in the production of coal. In the state-owned company, average wages are more than 40,000 per month, on a other hand, private players give them 10,000–12,000 per month. That comes from strong representation from the union side. With such heavy labor-oriented industry, their wages cost around 50% of the coal in pit head.

2.1.3 Where Coal India Is Lagging

The biggest hurdle for the state-owned Coal India to meet the given target is environmental and forestry clearances. Out of all total mines, around 66 projects are short of environmental clearances and 132 projects are short of forestry clearance from the state. Apart from environmental and forestry clearances, the second biggest reason is an investment in R&D sector. The company is not investing much in the R&D sector for the implementation of new technology. The biggest reserve of cash is taken up by the government in form of a dividend. Inspite of these dividends, if government push to Coal India to invest in R&D for better technology and sustainable growth then much of the environmental issues will be sorted out by giving a scientific solution.

2.2 SWOT (Strength Weakness Opportunity Threat) Analysis

The SWOT analysis of coal would help visualize the relative strength and weakness of the scenario of commercial coal mine sector along with the opportunities and challenges that lie ahead. Based on the analysis of exogenous and endogenous forces, following SWOT has been derived which is shown in Fig. 7.1. Strengths and weaknesses are endogenous whereas threats and opportunities are exogenous in nature.

2.3 Advantages Proposed and/or Suggested Benefits of the Policy

-

To bring efficiency into the coal sector by moving from an era of monopoly to competition.

-

To increase the energy security of the country as 70% of the country’s electricity is generated from thermal power plants.

-

To ensure assured coal supply, accountable allocation of coal, and affordable coal as well as power prices for consumers.

-

To give the highest priority to transparency, ease of doing business, and ensure that natural resources are used for national development.

-

To allow the use of the best possible technology in the sector, drive investments, and create direct and indirect employment in coal-bearing areas.

-

To collect revenue from private commercial mining to help to the coal-bearing States, this approach shall incentivize them with increased revenues which can be utilized for the growth and development of backward areas and their inhabitants including tribals, especially in the eastern parts of the country.

-

Opening up the sector will also lead to energy security through assured coal supply, accountable allocation, and affordability.

-

Opening up of commercial coal mining marketing will speed up the opening of new mines and create direct and indirect jobs.

3 Challenges to Private Coal Companies

3.1 Land Acquisition

It is not the first time where private coal companies are doing mining. Many private companies have got the coal blocks for their captive use but still many mines have not started till now. The big challenge to them is land acquisition. The land acquisition can only be done under Coal Bearing (Areas Acquisition and Development) (CBA) Act 1957 or Land acquisition act 2013. Although the mining land is acquired through CBA act 1957, it is mandated that compensation and rehabilitation should be provided under the new Land Acquisition, Rehabilitation and Resettlement Act, 2013(LARR). The CBA Act 1957 is applicable only for the government companies. Under this act and its different notification, government can take the land under which coal is present. It is strictly limited to the coal-bearing areas. Other than coal-bearing areas, land acquisition is done under Land Acquisition, Rehabilitation and Resettlement act, 2013.

The CBA act 1957 is a strong act for the acquisition of land under coal-bearing area and the government has the power to take that land easily under CBA act 1957 but now new LARR act, 2013 is a strong act for the people who are losing their land. This act empowers to the land loser. The private companies have to acquire their land under LARR act, 2013, which is again a very tedious job for the private player as in case of LARR act, 2013 consent of 80% people is required. The compensation is also very high in this case (Lahiri-Dutt et al. 2012).

The state-owned company Coal India Limited has a monopoly in the coal sector in India. The company provides good R&R packages to landowners whose land falls under coal-bearing areas. The company has got different R&R schemes and give options to landowners to choose which R&R package they want. Landowner can opt either respective state government’s R&R package or Coal India’s own R&R package or CIL’s subsidiary’s own R&R package. Generally, people choose subsidiary’s R&R package because these packages are designed taking into account of the local people’s interest. Coal India Limited or its subsidiary, in its R&R package, provides a job in Coal India Limited as per the norms.

The troublesome for private companies arises here. It has been seen that generally private companies or any other public sector unit (PSU’s) provides the R&R package of respective state government or company’s own R&R. In case of own R&R package, they provide an extra package to attract the local people. In spite of all, none of the companies provides the job against the land. The coal block which is allocated to these private companies or other PSUs are near to the CIL coal blocks. People residing nearby start comparing and questioning that if Coal India can provide a job then why not them. In spite of providing jobs by private firms against the land, people do not have much faith in private jobs. Moreover, usually people have more inclination towards government mining firms such as Coal India Limited, as compared to any other private firm. Even for the Coal India Limited to provide a job against land is not very profitable but for short term, they are succeeding in achieving their goal.

3.2 Coal Demand Growth in Power Sector

In India, the quality of coal is not very good and it is generally of power grade. The major consumer of our coal is the power sector. As India, after Paris summit (COP21 commitments) working hard to shift from nonrenewable source of power generation to renewable source of power generation. It can be seen that due to competition and government policy the per unit charge of power generation through solar power plants are less or equivalent to coal-driven power plants. So, the future of coal is not very much in our country. Before any private company would make a huge investment, they will take into account if they earn profit for long-term, which may come to stake as policy changes.

3.3 Adverse Geology Can Constrain the Competitiveness of Future Coal Production

Most of these blocks left for the auctions are difficult ones—in that they are either in densely populated areas or have difficult terrain. Some have coal seams buried deep underground. The stripping ratio in India is worsening leading to increased cost of production. On the other hand, the grade of coal is also worsening. Therefore, with increasing cost of production and lowering of grade, the competitiveness of coal would get increasingly constrained. This does not take into account the increase in capital cost due to revised land acquisition policy and overall inflation. Compared to alternative sources, particularly solar, coal could be increasingly disadvantaged. Cost of operations on these blocks are likely to be high.

To overcome all these constraints, it is necessary to bring down the following points into the consideration:

-

Prepare the roadmap regarding the future of coal in India, so that participation from private player is boosted.

-

The coal block opened for the auction of private players should be competitive for them based on stripping ratio, coal reserve, and forest cover.

-

The single window system should be developed for the statutory clearances. The ease of doing business should be there which must be regulated by the ministry of coal.

-

During land acquisition, local administration should come up with the proponent to deal with local situation.

4 Environment and Forest Clearances

It is the irony of coal that it is present in abundance where forest is there. In India, the open cast projects are only profitable and productive. For the extraction of coal in open cast projects, heavy degradation of forest and land occurs which affects socioeconomic structure of society residing nearby area. Other than that air pollution, fall of water table in nearby areas are also big challenges. MoEF&CC (Ministry of Environment & Forest and Climate Change) is regulatory body to monitor all these things. As discussed above, the biggest hurdle for the state-owned Coal India Limited was environmental and forestry clearances and the same will be applied to private players also. The time required for environmental and forestry clearances are very high. Minimum of 1 year will be required to get the environmental clearance from MoEF&CC and that too if everything is in order. If some poor technology or any poor environment management is sought by the experts of MoEF&CC, then that can go long for an indefinite time until and unless proper environmental management plan is not promised from the proponent. Similar to the environment clearance, forest clearance is another time-consuming process. It takes several years to get the forest clearance. Huge investment is required for the getting a coal block. The biggest challenge to private players are with such huge investment still it is very uncertain that when will mine come in operation phase due to this stringent law and regulation.

4.1 Environmental Norm’s Violation

Although the private mining companies are supposed to strictly follow the all environmental norms but previous experiences of privatization of others sectors are such that there are always remain some flaws in the process of performing their activities. Therefore, the government needs to take care of all previous policies and experiences related to the similar type of activities. It is important to mention here that new/private firms must go through strict screening round for final selection. Bidding the highest price for per ton of coal should not be the only criteria for the selection.

4.2 Threat Due to Privatization of Coal Sector

4.2.1 Environmental Threats

The private companies must be under severe surveillance of MoEF&CC or SPCB (State Pollution Control Board) or CPCB (Central Pollution Control Board) for the betterment of environment otherwise it will lead to questions that are these private companies as much as responsible and sensitive toward environmental parameters? Do they take care of everything that comes under rules and regulation and making a profit will not be the only motive for them? From the past, it has been seen many times that private players have the main motive of making money and making a profit is their main objective. With respect to them, PSUs are more responsible and sensitive for the environmental issues. Like in Coal India Limited, a dedicated subsidiary CMPDIL (Central Mine Planning and Design Institute Limited) is working for environmental issues with coal mining. They have a dedicated department for the proper monitoring of air pollution, water pollution and water table monitoring and providing environmental management plan related to any issues. It cannot be said that PSU’s or Coal India Limited, all along have adopted the best practices but at least they have got a system which is evolved and inherited from past long experiences.

4.2.2 Socioeconomic Issues

The biggest socioeconomic issues are associated with the privatization is following labor laws. As the mining is labor-intensive industry, so the involvement of labors is very high in the production of coal. There will always be a chance that the shift hours are long and wages are very small compared to the hazardous nature of work or compared to the wages in PSUs. The need for nationalization in 1973 was due to the ill-treatment of labors by the mine owners. So in this case also strong monitoring should be done for labor law department for the better status of labors in the mining industry.

5 Conclusions

Considering the huge coal demand (>1.3 billion tons per year) in near future as well as the sustainable exploitation of our available resources, the union cabinet of India on February 20, 2018 decided to open up the coal sector for commercial mining by private entities. Under this new reform, the coal blocks will be allocated on the basis of price per ton of coal offered to the state government. Furthermore, there shall be no restriction on sale and/or utilization of coal from the coal mine to power plants, steel mills, and other potential users. The proposed policy will not only meet the country’s coal demand but also lower down the production cost of coal due to competitiveness. In spite of these expected benefits, it will not be much easy for private investment in the coal sector. The biggest hurdle for private players includes land acquisition, future coal demand, as the country is shifting from conventional to renewable sources of energy so the demand for coal may be decreased in the future. Another major barrier is to get environmental and forest clearances which is very time taking process. The greatest risk associated with this policy is that private players may tend to overshadow environmental regulations and other ethical concerns of labor laws, just for their economic growth.

References

Coal India Limited. https://coal.nic.in/ (site accessed on 20 June, 2018)

Draft Energy Policy, Niti Ayog, Government of India, 2017

Goyal Y (2018) The coal mine Mafia of India: a mirror of corporate power. Am J Econ Sociol 77(2):541–574

Lahiri-Dutt K (2016) The diverse worlds of coal in India: energising the nation, energising livelihoods. Energy Policy 99:203–213

Lahiri-Dutt K, Krishnan R, Ahmad N (2012) Land acquisition and dispossession: private coal companies in Jharkhand. Econ Polit Wkly, 39–45

Modak M, Pathak K, Ghosh KK (2017) Performance evaluation of outsourcing decision using a BSC and fuzzy AHP approach: A case of the Indian coal mining organization. Resour Policy 52:181–191

Singh K, Kalirajan K (2003) A decade of economic reforms in India: the mining sector. Resour Policy 29(3–4):139–151

Yilmaz F (2015) The relationship between privatization and occupational safety in coal industry in Turkey; a statistical review of coal mine accidents. J Sci Res Rep 5(4):265–274

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Yadav, M., Singh, N.K., Gautam, S. (2019). Commercial Coal Mining in India Opened for Private Sector: A Boon or Inutile. In: Agarwal, R., Agarwal, A., Gupta, T., Sharma, N. (eds) Pollutants from Energy Sources. Energy, Environment, and Sustainability. Springer, Singapore. https://doi.org/10.1007/978-981-13-3281-4_7

Download citation

DOI: https://doi.org/10.1007/978-981-13-3281-4_7

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-3280-7

Online ISBN: 978-981-13-3281-4

eBook Packages: EnergyEnergy (R0)