Abstract

The study examines the behavior pattern of the Indian Service Firms in matters related to the research and development (R&D) expenditure since 1999. A Firm-Level Analysis was done using data from Centre for Monitoring of the Indian Economy, prowess database. With the advent of new services over time, many non-tradeable services have become increasingly tradeable henceforth, the exports of services have improved and surpassed the merchandise exports. Taking this backdrop in mind, the study examines the role of R&D in promoting service exports. Results conclude that the innovation activity performed by the Indian service firms were less than 10%. The majority of innovating service firms were found to be firms concentrated in trading, gas and distribution, electricity generation, business consultancy, ITES, computer software, and other miscellaneous services. Hence, the more technology led innovation requires to be done as the innovation propensity of the service firm has declined.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Many rapidly growing emerging economies like Korea and China have witnessed a declining share of agriculture in the gross domestic product (GDP) share followed by a rising share in the manufacturing sector in GDP in its growth process. But in contrast to their growth story, India’s decline in the agricultural sector in the GDP share has been picked up by the service sector instead of the manufacturing sector. The manufacturing sector witnessed a stagnation since the year 1991 onwards stabilizing at around 15 percent of the GDP (Panagariya 2008). However, the Indian Service sector are contributing a higher share in the value-added as well as GDP. Presently, it’s contribution stands to be around sixty percent and India is witnessing a service-led growth.

The service sector can be classified using either the country’s own definition or by using the definition provided by United Nations Central Product Classification (UNCPC). In the case of India, the National Industrial Classification (NIC) provides a comprehensive outline for the services.

According to the NIC classification, services comprises of “wholesale and retail trade; repair of motor vehicles and motorcycles, transportation and storage, accommodation and food service activities, information and communication, financial and insurance activities, real estate activities, professional, scientific and technical activities, administrative and support service activities, public administration and defense, education, other service activities, arts, entertainment and recreation and activities of extraterritorial organization and bodies”. However, the NIC has undergone a definitional change from time to time. At present, the NIC (2008) classification is being used to categorize Indian services.

Among the fastest-growing developing countries, India is unique for its role regarding the service sector. India had to a greater extent relied on the services sector for its growth and vibrantly stood out for its dynamism of its service sector. The growth of the Indian service sector started accelerating since the mid-1980s. In the late 1990s, the service sector surpassed the other two sectors, agriculture and manufacturing, and became the fastest growing sector of the Indian Economy. Even in times of the global slowdown, the Indian service sector remained resilient to the external shocks. In the financial year 2009–10, the Indian service sector grew at 9.96% compared to 8.81% growth in the industries and 1.57% in agriculture. Presently, in the financial year 2016-17, the Indian Service sector has grown at an average of 7.7 percent at constant prices, as per Central Statistics Office.

According to the Economic Survey (2014–15), the growth of the services sector in the GDP share has been higher than that of the overall GDP between the periods FY2001 to FY2014. The Economic Survey (2013–14) said that India has the second fastest growing service sector where its compound annual growth rate is at around 9%, just below China’s 10.9% during the last eleven year period from 2001 till 2012. However, the service sector which was growing at a steady rate of around 10% since the year 2005–06 had shown a subdued performance in the last three years. Chances of revival are there with the expansion of increased business activity in the Indian economy.

Within the Indian service sector, some of the services like software and telecommunication services had grown faster not only in terms of India’s GDP share but also in terms of India’s trade and foreign direct investment (Banga 2005). Consistent with the expansion of the services sector, India’s service exports have grown rapidly over the last two decades. The India’s share in the world service exports increased from around 0.6% in the year 1990 to around 1.1% in the year 2000 and further to 3.3% in the year 2013. This growth in the service’s share has been faster than the growth in the world’s merchandise exports. The growth or expansion of the servicesFootnote 1 has been supported by a relatively cheap labor, a large tertiary-educated work force and the fact that English is spoken widely as an official language. This further gives an edge to the Indian economy to engage in business with the multinationals and foreign companies. The Indian service sector exports accounted for nearly about 8%Footnote 2 of the GDP in 2011. Figures show that in the Q1, Q2, and Q3 of 2014, the world services exports grew around 5.7, 6.4, and 4.7%, respectively, whereas the India’s service export growth was around 7.4% in Q1 but decelerated to 2.8 and 2.7% in Q2 and Q3. India’s share in global exports of commercial services further increased to 3.2% in 2013 from 1.2% in the year 2000, and its ranking stood to be sixth among the leading exporters in 2013.

In the first half of 2014–15, the India’s services export grew up by 3.7% to US$75.9 billion. The major Indian service exports in the 2013–14 were computer services (45.8% share) followed by business services (18.8% share), professional and consulting services (10.2%), and trade and technical services (7.8%), travel (11.8% share), pension, insurance, and financial services (5.8% share). However, for the year 2013–14, there was a slight deceleration in the export growth of the software services to 5.4% and a negative growth of travel (−0.4%) and marginal growth in transport (0.3%) and business services (0.1%). However, moving in tandem with the global exports of financial services, India’s exports of financial services registered a high growth of 34.4%. Among the world’s top 15 countries in terms of GDP, India ranked 10th in matter of overall GDP and 11th in terms of services GDP in the year 2013. Lastly, for the period 2001–13, the maximum increase in services share in GDP was recorded by Spain (8.6 pp) followed by India.

According to the IMF report (2010), Balance of Payments Statistics, the share of India’s services trade in total trade (merchandise and services) has increased considerably over the years, from around 17.8% in the year 1995 to around 35.4% in 2008. This growth of the service exports was mainly due to increase in exports of information technology-enabled services (ITES) and other business services. Also, as per report, India’s gross domestic product also grew at a rate of 10.6% in case of India. This growth rate was higher as compared to the other developing countries including China. The service sector was responsible for the surge in the average GDP growth rate of the Indian economy. Presently, the service sector is said to be a major contributor to the India’s GDP growth (Bhattacharya and Mitra 1990).

According to a recent report by Confederation of Indian Industry Report 2016 (CII), the Indian service sector contributed to about nearly 61% to India’s GDP growing strongly at roughly about 10% per annum in the financial year 2015–16. The report also said that India is currently the second fastest growing service economy in the world. According to CII, the India’s share in the global service exports was nearly 3.2% in the financial year 2014–15, double that of its merchandise exports. Report also says that nearly 50% of the current account deficit is met from service exports. This fact has become very much true since the time when the service exports had overtaken the merchandise exports. Presently, India has secured an eighth place among the top ten exporters of service in the world.

Since the post-crisis (after 2008), service export growth has decelerated in all major economies. According to the latest data reported by the Economic Survey, 2016–17, India’s Compound Annual Growth Rate (CAGR) from 2001–08 was thirty percent followed by Russia (28%) and China at 23.6 percent. In contrast to this, the CAGR for 2010–16, declined to 5.6 percent for India and Mexico registering the highest growth at 7.9 percent. Statistics also report that in the year 2015, India’s merchandise and service exports were all in negative territory. Lastly, the post-crisis period witnessed a decleration in the service exports growth as compared to the world service exports growth.

Latest data released by the World Trade Organization (2016) reveal that service exports growth was in negative territory for many economies. India was an exception with a positive growth of 3.6 percent.

According to the Economic Survey, 2016–17, service exports growth recorded a positive growth of 5.7 percent. This was mainly due to the pick-up in the growth rate of some of its sub-sectors like transportation, business and financial services followed by a good increase in travel. However, software service exports accounting for around 45.2 percent of the services recorded a decline of 0.7 percent as domestic companies faced pricing pressure on traditional products and also due to the challenging global business conditions prevalent in the world.

Hence, all these data and facts point towards a solution which can enhance the service export growth in the future apart from entering into a number of regional and multilateral trade agreements with the other countries. Hence, a more composite solution like more focus on the technology-part embedded part within the service products may increase the demand of service exports in the world market. Keeping this background, the study will be discussing about the Indian service sector in details, Sect. 2 will summarize a brief literature review followed by Sect. 3 elaborating on the pattern of the R&D expenditures in the Indian service section, followed by the conclusion in Sect. 4.

2 Literature Review on R&D and Service Firms

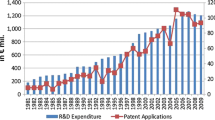

Innovative activity can be measured in various ways: by research and development (R&D) effort, by patents, and by identifying innovations of major importance. The continuous creation of new services and the uninterrupted commercialization, industrialization, and reorganization of services on a global scale suggests that services are at the fundamental of the modern structural change in the present economies. Technology and innovation activities represent a major force behind such structural transformation with the role of information and communication technology playing a central role in transforming the ways the most of the traditional services being produced, traded, and delivered. An increasing number of evidence shows that technology plays an important role in services. Service industries are heavily relying on the information technologies, and the bulk of the information technology investment is actually used by services,Footnote 3 that is, around 80% in the UK and USA (OECD 1996). Recent studies also do show that services are those industries which have benefitted in terms of productivity gains from the use of embodied technology in the new capital goods (OECD 1996).

Firms competing in the international foreign markets face the challenge and opportunities of changes in the market and technologies. Given the less certain returns and shorter life cycles, R&D expenses have become very much important for the survival of the firm.

The significant role played by innovation in elucidating the dynamic properties of firms, industries, and economic systems had been recognized since the origin of economic thought, i.e., from the works of Smith and Marx. This is nowadays part of the general consensus among the most noted economists. The topic was further highlighted and advanced by Joseph Schumpeter. He had put the topic of innovation at the core of his first major contribution, the theory of economic development (Schumpeter 1942). In this work, the role of innovation was fully endogenized and considered first and primary as an “entrepreneurial fact” which is the principal of competition and the dynamic efficiency of firms. Whatever be the main source of technical advance and technological change, it is the fruitful introduction of product, process, and managerial innovation that permits the firms to supersede the pre-existing circumstances of markets and further improvement of market shares at the cost of the non-innovating firms.

Dynamic efficiency is what matters in the procedure of creative destruction brought through innovation. Innovation permits the firm to form monopolistic rents which tend to be gradually eroded alongside the imitative diffusion of new products and developments. The significance of this mechanism is nowadays recognized by neo-Schumpeterian scholars and gradually by neo-classical economists (Verspagen 2005).

Over the time, services have been widely recognized as important actors in innovation processes. In the context of the Indian economy, service’s role as R&D performers still spears to be problematic. Until recently, very few services (as evident from Table 1) were believed to be performing R&D. However, several pioneering studies related to service innovation find practically no evidence of services being engaged in formal R&D. For example, Belleflamme et al. (1986) studied a sample of innovative Belgian service companies. They found that the R&D activities which were not identified were typically performed by ad hoc groups rather than by permanent departments. Lastly, they found out that the R&D activities were not recorded or reported. Sundbo (1993, 1997) did not find either in-house research nor R&D departments in case of the Danish firms. Gadrey et al. (1995) found little by way of discussion of services and R&D and concluded that the concept of R&D has evolved in lune historic sans services (p. 272). However, presently, there is overwhelming evidence of service activities in R&D. For example, MicrosoftFootnote 4 spent over US$6.5 billion on R&D in 2006 and made it fifth among the world’s largest R&D spenders in the USA. A study by Leiponen’s (2005) align with the suggestion that corporate service innovation is often ad hoc in nature. Also, R&D investments on permanent R&D units are weakly associated with the overview of new services. However, the CIS studies have documented that service firms tend to rely more than manufacturing firms on consulting companies as sources of inputs for innovation.

Examples by Hipp and Grupp (2005: 532) conclude that the import of R&D inputs in services is indefinite (p. 532) and Cainelli et al. (2006) suggest that R&D “is not at all appropriate as an indicator for service firms” innovation activity (p. 436). In other words, service innovation is less reliant on R&D activities as compared with manufacturing innovation.

In summary, studies done suggest that many service firms are innovative in nature, but they are relatively more likely than manufacturing firms to make non-technological innovations that are disembodied, organizational, and market oriented. The innovation process is also most likely to be based on individual’s skills, professional knowledge, and cooperation rather than R&D (Howells (2007) Tether (2004); Tether 2001).

Taking this backdrop in mind, we would like to further explore the R&D expenditure or investment pattern for the Indian service firms since 1999.

3 Pattern of R&D Expenditure and Indian Service Firms

The Indian service sector has been readily investing in the Information, Communication and Technology (ICT) and other modern servicesFootnote 5 in improving its performance in terms of productivity and competitiveness. Many non-tradeable services have become increasingly tradeable with the usage of the updated ICT technologies. This has further helped in boosting the service exports (especially computer software) in the global market. India has notched a top place in matters of service exports. Investment in human capital goods has yielded a positive return. The Indian service sectors have profoundly invested in human resources, which is one of the key competitive elements, of the firms’ innovative strategies. However, in spite of that, an unsatisfactory picture comes in front when we talk regarding innovation.

As evident from the prowess database, the degree of innovation performed by the Indian service firms is done in the form of R&D expenditures. A preliminary snapshot shows that the Indian service firms have not innovated much as compared to the Indian manufacturing firms. For example, in the Indian manufacturing sector, extensive R&D expenditure has been done by the pharmaceuticals, electronics and food and tobacco group of firms. As compared to this, the R&D expenditure done on banking services,Footnote 6 and R&D related to electronic banking and insurance, internet-related services, and e-commerce applications stands to be zero since 1999. A similar picture can be seen if we look into the R&D related to improved financial services (new concepts for accounts, loans, insurance, and saving instruments). Very few service firm groups such as commercial complexes, computer software and IT-enabled services, natural gas and distribution, and electricity distribution have done considerable expenditure on R&D. However, some important services like education, courier, transport, health, and telecommunication services still remain excluded on matter regarding R&D expenditures. All the group firms and private firms operating have reported a zero value on the R&D expenditure.

Hence, a big question comes in mind as to how the Indian service firms can innovate its important services in the future and retains its position (i.e., in terms of service exports) in the global market.

The aim of the study is to examine the pattern and trend of R&D expenditures over the years (since 1999). The aim of the article is twofold: first, to observe the trend of R&D expenditure over the years and second, how this pattern has undergone a change and what policies should be adopted so that Indian firms do innovation (i.e., in terms of R&D expenditure) on a regular basis. The study contributes to the literature by investigating the pattern and trend of R&D expenditure of service firms in India. The database, CMIE prowess database, is a broad sample of around 2300 service firms, unbalanced and heterogeneous in nature. This database contains extensive information about the R&D expenditures and ownership group as reported since 1999. The highly diversified nature of the Indian service firms, changing ownership pattern, and a preliminary analysis since 1999Footnote 7 reveal that the Indian service firms have witnessed a decline in the R&D expenditure in the coming years. The majority of Indian service firms have not been keen in investing in R&D with exceptions.Footnote 8 Keeping this backdrop in mind, a detailed analysis on the R&D expenditure done by the Indian services firms is presented in the table (Table 1).

Table 1 clearly shows the majority of Indian service sector firms investing a lump-sum amount R&D consist of a few. Electricity generation, natural gas and distribution and computer software firms were the only ones who had invested in R&D in the last fifteen years. The other notable investors found were commercial complexes, business consultancy, fund-based financial services, other miscellaneous services, trading, other financial services, and industrial construction. The service firms investing in latest technology in their products had done that through either through their own internal R&D arrangements or outsourced from external vendors (via cheap suppliers). However, when compared with the Indian manufacturing sector, more needs to be done in terms of innovation. It may be in either way, such as outsourcing R&D facility or setting up an in-house R&D. This will help the service firms to retain their position in the global markets. One of the reasons attributed behind the low R&D expenditure is that the service firms have never felt the necessity of investing in updated technology as service exports have gained a good position in the world market (within the top 15 countries). Henceforth, over the years, the percentage of non-innovating service group of firms has increased, whereas the innovating group firms have declined. This is evident from the table (Table 2).

From Table 2, the trend shows that the number of innovating service firms has declined over the time.Footnote 9 With the decline, the pace of innovation has also slowed down. The overall picture clearly indicates a further need for product, process, and organizational innovation to be done as in the case of Indian manufacturing firms. Another important conclusion is that some important sectors such as health, education, and telecommunication are clearly outliers in matters of R&D. More technology enabled expenditure is needed in these sectors in the near future.

Looking at the different groups of service firms, like computer software, and others, we tend to find a similar picture. Firms such as computer software, ITES, other miscellaneous services, commercial complexes, and business consultancy have invested in R&D, but the pattern of and amount of investment have varied across the years. All these service firms have more or less shown a declining trend in terms of R&D investment, and the ownership structure has also undergone a similar change. The private firms have entered, and the group firms have exited with time. Tables 3, 4, 5, 6, 7, 8, and 9 elaborate the situation in details.

Table 3 clearly shows that R&D expenses made by the computer software firms have witnessed a decline over the years. There was a slight increase in the year 2005. However, the overall picture shows a decline. The reason attributed behind the decline in the share of R&D investment in the computer software could be due to the subdued performance of the service sector in the last three years. Lastly, the ad hoc group firms were also replaced by the private firms over the years.

Table 4 shows that the R&D expenses of the business consultancy services firms had declined on a regular basis after the time period (1999). The ownership structure had also undergone a slight change with the exit of the private (foreign) firms and retention of the state and the private (Indian) firms. Lastly, the amount invested in the R&D had not been of a significant amount as compared to the computer software firms.

Table 5 clearly shows R&D expenses in IT-enabled service firm have begun only after the year 2010. One significant group firm, Asea Brown Boveri group, was found to incur a large amount of R&D expenses. This leaves scope for other services firms in the future to invest more in the IT-enabled service, in terms of R&D in the future. Lastly, the R&D expenditure shows a downward trend, and more innovative activities can improve the quality of the service exports in the future.

Table 6 clearly shows that not much investment in R&D has been done since 1999. Hence, to carry out innovation, more R&D expenditures are needed to be done. Only one service group has invested in R&D which gives sufficient scope for other groups and private firms to invest in R&D in the near future.

From Table 7, it is clear that the investment in R&D increased till 2004. However, since 2005, it declined on a continuous basis (until 2009Footnote 10). Two main groups, ITC group and Vardhaman group, operated till 2005. However, the current scenario indicates that the private Indian service firms are the only one involved in the R&D activity. Lastly, the amount of R&D expenditure appeared to be of a meager amount since 2005.

For the miscellaneous service sectorFootnote 11 firms, we see that the maximum investment had been done by the Essar (Ruia) group till the year 2005. This was followed by the Modi Bhupendra Kumar group. However, data reveal that both these groups have exited the market since 2009. It is evident from the table that the group firms had a prominent share in R&D. However, from 2009 onwards, private players have entered their space. No prominent group firm was found in the miscellaneous service sector.

From Table 9, it is evident that the commercial complex was considered to be the monopoly of the Emami Group. They had invested a good amount in the R&D and were functional till 2009. However, thereafter the private service firms replaced the group firm (Emami Group) and started investing in R&D. In spite of that, there has been a decline in R&D expenditure since 2009.

4 Conclusion

From the consecutive tables (Tables 2, 3, 4, 5, 6, 7, 8, and 9), we find that innovation in the Indian service firms has witnessed a considerable decline, i.e., in terms of R&D expenditures. The decline has been sharp since 2009 onwards followed by a shift in the pattern of ownership from ad hoc group firms to private firms. However, the reason behind the change in the ownership pattern is yet to be explored. One probable reason behind this decline may be subdued to subdued performance of the economy since the global economic crisis. However, if we compare the service sector firms with the Indian manufacturing firms, we see that considerable amount of innovation in terms pf patents, licenses, and R&D expenses has risen over the years. The percentage of innovating firm or the number of innovating firms has risen in case of the Indian manufacturing firms.

Still much remains to be done for improving this innovation scenario in the services. Although diversified groups of service firms operate in the Indian service sector, many of them have either not reported their R&D expenses or not invested in R&D. Some foreign and Indian service group firms had initially done a good amount of R&D expenses (from 1999 to 2005). However, this process has slowed down since 2009.

The solution to the problem is either setting up a R&D house investing in latest technological equipments or outsourcing through specialized external suppliers. All these should be done on an urgent basis. One priority is the health services that require latest technological improvement in order to treat and satisfy its consumer.

The India’s service sector was found to be technologically sound through usage of latest services like ICT, knowledge based and various other services, investment in human capital, but the pace of the innovation through R&D is quite low. Some of the service firms like telecommunication service firms, tourism service firms, education have not yet invested in R&D since the last fifteen year. They can think of investing in R&D in the future in order to remain competitive in the international level.

Another problem which can develop in the future is diversification of the service export in non-English speaking region. Many Indian service firms have increased their service export considerably over the years mainly through ITES exportsFootnote 12 to export base like USA, UK, and Europe. However, to remain competitive in the global markets, some form of quality improvement and product differentiation is always required. If a customer finds that the product quality is better, superior, and sound from the Indian service exporters, then the demand for the service exports will automatically increase in the future. However, if this is not the case, the service exports will tend to decline in the coming future. Service firms need to have a good in-house R&D or enter into contracts/agreements with external suppliers or resort to licenses and patents. In short, a service firm has to innovate its product on a continuous basis for maintenance in position in the export market.

It is generally found that the services firms do normally rely on a wide range of innovation in the form of acquisition of software, purchase of machinery, and training of employee and engaging more in the form of engineering, technical consultancy, business consultancy, computer software, and ITES. Such techniques can also be used or applied by the Indian service firms.

With the service sector, financial services are considered to be the most innovative service sectors. Special focus should be given to improve the financial services in terms of innovation. ITES is also considered to be a priority service sector. Interestingly, in case of India, the ITES export has not reached the non-English speaking countries. It is being more or less confined to two destinations (US and UK). Hence, to diversify the export market further, more investment in R&D should be done. Latest technology could be clubbed with the export product itself to increase its demand further.

Lastly, the Indian service firms can also take assistance from in-house production departments, clients, outside suppliers of materials and equipment when introducing an innovation on a massive scale. Apart from this, help from public and private research institutions can also go a long way in matters of service innovation.

Notes

- 1.

The growth in the Indian services is relatively labor intensive in nature as compared to manufacturing or mining.

- 2.

This share is more or less higher than most of the advanced countries with the exception of South Korea.

- 3.

Here, services signify the financial and communication services being the major technology adopters within the services sector.

- 4.

Microsoft is classified as a software company, and while it does supply computer services but of course a great deal of Micro-soft’s activity concerns packaged software-more a manufactured product like print publications than a classic computer service.

- 5.

Business services and knowledge processing outsourced services

- 6.

R&D on banking services encompasses banking and insurance mathematical research relating to financial risk analysis, development of risk models for credit policy, experiment development of new software for home banking.

- 7.

The year 1999 has been chosen due to the availability of data for service firms in CMIE (prowess) database and also to see the impact of the second economic reforms undertaken by India.

- 8.

The exceptions include airport transport infrastructure services, banking services, and courier services.

- 9.

Data on service firms available till the year 2014 as per reporting by the Indian service firms to CMIE.

- 10.

Data by the Indian service firms have been reported until the year 2009 in the prowess database.

- 11.

The miscellaneous service sector comprises a wide array of service firms like repair services, commission agent’s services, sanitary services, and others.

- 12.

Information technology accounted for nearly $108 billion worth of services exports in the last financial year, exporting primarily to destinations like USA, UK, and Europe.

References

Banga, R. (2005, October). Critical issues in India’s service-led growth. ICRIER Working Paper No. 171.

Belleflamme, C., Houard, J., & Michaux, B. (1986, September). Innovation and research and development process analysis in service activities. EC, FAST Occasional papers no. 116, Brussels.

Bhattacharya, B. B., & Mitra, A. (1990, November 3). Excess growth of tertiary sector in the Indian economy: Issues and implications. Economic and Political Weekly, 15(44), 2445–2450.

Cainelli, G., Evangelista, R., & Savona, M. (2006). Innovation and economic performance in services: A firm-level analysis. Cambridge Journal of Economics, 30(3), 435–458.

Centre for Monitoring of the Indian Economy database, Prowess.

Confederation of Indian Industries Report. (2016). www.cii.in/PublicationDetail.aspx?id=50631.

Economic Survey (2016–17). Government of India. New Delhi. www.indiabudget.nic.in/es2016-17/echapter.pdf.

Eichengreen, B., & Gupta, P. (2012). Export of services: Indian experience in perspective. Working Paper No. 2012-102. http://www.nipfp.org.in.

Gadrey, J., Gallouj, F., & Weinstein, O. (1995). New modes of innovation. How services benefit industry. International Journal of Service Industry Management, 6(3), 4–16.

Hipp, C., & Grupp, H. (2005). Innovation in the service sector: The demand for service specific innovation measurement concepts and typologies. Research Policy, 34, 517–535.

Howells, J. (2007). Fostering innovation in services. Report of the Expert Group on Innovation in Services, European Commission.

Howells, J., & Tether, B. (2004). Innovation in services: Issues at stake and trends. Brussels, Belgium: Inno Studies Programme (ENTR-C/2001), Commission of the European Communities.

IMF report (2010). World Economic Outlook Database. https://www.imf.org/external/pubs/ft/weo/2010/02/weodata/index.aspx

Leiponen, A. (2005). Organization of knowledge and innovation: The case of Finnish business services. Industry and Innovation, 12(2), 185–203.

Ministry of Finance. Economic survey: 2014–15. www.indiabudget.nic.in/budget2015-2016/survey.asp.

National Industrial Classification (2008). Government of India. http://mospi.nic.in/sites/default/files/main_menu/national_industrial_classification/nic_2008_17apr09.pdf.

Organization of Economic Cooperation of Developing Countries Report. (1996). https://www.oecd.org/about/2080175.pdf.

Panagariya, A. (2008). India the emerging giant. New York: Oxford University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. Unwin: London, UK.

Sundbo, J. (1993). Innovative networks, technological and public knowledge support systems in services. Mimeo, Institute of Economics and Planning, Roskilde University.

Sundbo, J. (1997). Management of innovation in services. Service Industries Journal, 17(3), 432–455.

Tether, B. S. (2001). Identifying innovation, innovators and innovative behaviors: A critical assessment of the Community Innovation Survey (CIS). CRIC Discussion Paper No. 48. Manchester: University of Manchester, Centre for Research on Innovation and Competition.

Tether, B. S. (2004). Do services innovate (differently)? CRIC Discussion Paper No. 66. Manchester: University of Manchester, Centre for Research on Innovation and Competition.

Verspagen, B. (2005). Innovation and economic growth. In J. Fagerberg, D. Mowery, & R. Nelson (Eds.), The Oxford handbook of innovation. New York/Oxford: Oxford University Press.

World Trade Organization data (WTO). (2016). www.stat.wto.org.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Mukherjee, S. (2018). Pattern of R&D Expenditure in the Indian Service Sector: A Firm-Level Analysis Since 1999. In: Tan, LM., Lau Poh Hock, E., Tang, C. (eds) Finance & Economics Readings. Springer, Singapore. https://doi.org/10.1007/978-981-10-8147-7_9

Download citation

DOI: https://doi.org/10.1007/978-981-10-8147-7_9

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-8146-0

Online ISBN: 978-981-10-8147-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)