Abstract

Public health insurance for Japan’s working generations is divided into several systems. There are disparities among these systems in terms of their state of financing due to differences in the income level of premium payers. The state of financing of National Health Insurance is particularly problematic. Risk adjustment can adjust disparities in premiums without hindering the management efforts of insurers. This would make it possible to adjust disparities in premiums arising from factors such as the age structure and income level of subscribers, which cannot be controlled by insurers, while disparities due to other factors would still occur. The introduction of risk adjustment to the National Health Insurance system could be expected to resolve the system’s financial problems.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Public health insurance

- Kyokai Kenpo

- National Health Insurance

- Disparity in financing

- Risk adjustment

- Age-related risk

- Incentive for insurers

- Reduction of medical costs

Public health insurance for Japan’s working generations can be divided into association-managed health insurance for employees of large corporations, health insurance managed by the Japan Health Insurance Association, or “Kyokai Kenpo,” for employees of small and medium-sized enterprises, mutual aid association insurance for civil servants, and National Health Insurance for the self-employed and unemployed. Because the financing of these forms of health insurance is fundamentally independent, there are disparities in their state of financing due to differences in the income level of the premium payers. The financing of association-managed health insurance and mutual aid association insurance is comparatively stable, but the financial status of Kyokai Kenpo insurance is poorer than that of association-managed health insurance, and the state of financing of National Health Insurance is even more problematic.

In addition to the significant disparity in financing among public health insurance systems, there are also disparities within the systems themselves. The maximum disparity in National Health Insurance premiums between different prefectures is 2.6 times. Even within the association-managed insurance system, when the average income of insurees is low, there is no choice but to increase the premium rate in order to ensure a sufficient source of funds for benefit payments.

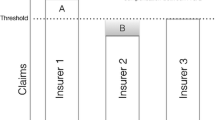

Financial adjustment mechanisms have been introduced in order to reduce the disparities originating in the independent financing of Japan’s health insurance systems. For example, the government and prefectures share the burden of the public funding of the National Health Insurance system. Prefectures bear 9% of the burden of benefit expenses (by means of financial adjustment subsidies), and prefectures and municipalities share the burden of reinsurance programs for high-cost medical treatment and measures to reduce insurance premiums for low-income individuals, to a total of approximately 1.28 trillion yen (as of the FY 2014 closing of accounts). In addition, local administrations have supplemented the National Health Insurance deficit from their general accounts to a total of approximately 380 billion yen (as of the FY 2014 closing of accounts).

Nevertheless, despite these adjustment measures, the disparities in premium payments discussed above continue to exist. The reason for this is that at present, financial adjustment measures are applied only system by system, because the application of universal measures which would entirely eliminate such disparities would also have a negative impact on incentives for insurers to make improvements that would reduce medical expenses.

However, it would in fact be possible to fundamentally correct disparities in premium payments without affecting incentives for insurers. The Kyokai Kenpo system provides us with an example of how to do so. Workers and their dependent family members throughout the country are members of the Kyokai Kenpo system. Branches in each of the nation’s prefectures are the basic administrative units, and insurance premiums differ between prefectures. This mechanism incorporates the concept of risk adjustment.

Because the cost of medical treatment increases as the age of the members of the medical insurance system (with the exception of children) increases, under conditions of independent financing, a high proportion of seniors among the members would necessitate an increase in premiums. In addition, because there are disparities between prefectures in terms of the income level of insurees, under a system of independent financing, premium rates would be extremely high in Okinawa, and extremely low in Tokyo.

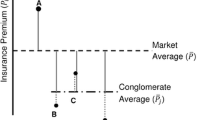

The difference in medical costs between prefectures can be divided into (1) a component that can be explained by differences in the age makeup of residents, (2) a component that can be explained by differences in the income levels of residents, and (3) a component that cannot be explained by either. Financial adjustment is therefore conducted in order to ensure that premium rates do not differ due to factors (1) and (2). This is risk adjustment. Factor (3) is a result of the independent financing of the systems, and remains reflected in premium rates.

Risk adjustment adjusts disparities in premiums without hindering the management efforts of insurers. This makes it possible to adjust disparities in premiums arising from factors such as the age structure and income level of members, which cannot be controlled by insurers, while disparities due to other factors still occur. If insurers make efforts to reduce premiums resulting from these other factors, the outcomes will not be passed on to other insurance systems, but their benefits will be enjoyed within the original system.

In 1996, the author proposed introducing risk adjustment to all of Japan’s health insurance systems. The practical advantage offered by this proposal was that disparities in premiums could be corrected with no need to amalgamate the existing multiple systems, and transitional costs would be low. It would be necessary to introduce a system for the adjustment of finances between the insurance systems, but there is already a mechanism for financial adjustment in relation to 65–74 year olds which could function as the infrastructure for financial adjustment for the systems overall. This mechanism could be improved and put into effect.

Even if risk adjustment cannot be introduced at once to all of Japan’s public health insurance systems, it would be possible to expand its application in stages from the Kyokai Kenpo system to the other systems. For example, based on the National Health Insurance Reform Act established in FY 2015, risk adjustment will be introduced to the system from FY 2018. There has been no fundamental risk adjustment in relation to age-related risk in the National Health Insurance system up to the present. Because of this, there are significant disparities in premiums. However, because the current system of financial adjustment applied to National Health Insurance is reflected to a considerable extent in benefit payments, there is little incentive for insurers to make efforts to reduce medical costs.

The introduction of risk adjustment to the National Health Insurance system can be expected to reduce disparities in insurance premiums and promote management initiatives on the part of insurers.

Reference

Iwamoto, Yasushi (1996), “Shian: Iryohokenseido Ichigenka (Designing an Integration of Health Insurance Groups),” Nihon Keizai Kenkyu (JCER Economic Journal), No. 33, November, pp. 119–142 (included in Hatta, Tatsuo, and Yashiro, Naohiro (eds.) (1998), “Shakaihoken Kaikaku (Social Insurance Reforms),” Shirizu gendai keizai kenkyu 16 (Contemporary Economic Study Series Vol. 16), Nihon Keizai Shimbun) (in Japanese).

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Iwamoto, Y. (2018). Designing New Systems Through Risk Adjustment. In: Hatta, T. (eds) Economic Challenges Facing Japan’s Regional Areas. Palgrave Pivot, Singapore. https://doi.org/10.1007/978-981-10-7110-2_11

Download citation

DOI: https://doi.org/10.1007/978-981-10-7110-2_11

Published:

Publisher Name: Palgrave Pivot, Singapore

Print ISBN: 978-981-10-7109-6

Online ISBN: 978-981-10-7110-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)