Abstract

The Great East Japan Earthquake, which struck on March 11, 2011, had a massive economic impact, primarily on the affected areas in Japan. In this chapter, we examine the economic and human damage inflicted on Iwate, Miyagi, Fukushima, and Ibaraki Prefectures by the Great East Japan Earthquake, as well as the current situation of industrial recovery, based on several statistical sources and a geographically weighted regression (GWR) model. In the latter part of this chapter, we will show the extent of fiscal transfers to date from the government for reconstruction and renewal of stricken areas and analyze the economic effect of the formation of new industrial clusters for reconstruction and renewal on these areas using a static two-regional computable general equilibrium (2SCGE) model. Our findings are as follows: (1) if production subsidies to support industries form new industry clusters, positive effects on regional economies could appear in the disaster regions; however, these impacts are weak and (2) formation of new industry clusters with productivity improvement has a positive effect on real gross regional product (GRP) and economic welfare in these regions, reducing the economic welfare gap between disaster and non-disaster regions.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Great East Japan Earthquake

- Economic and human damage

- Geographically weighted regression (GWR) model

- Two-regional computable general equilibrium (2SCGE) model

- New economic geography (NEG) model

- New industry clusters

- New industrial agglomeration

1 Introduction

Compared with past earthquake disasters in Chap. 1, the Great East Japan Earthquake , which struck on March 11, 2011, had a massive economic impact , primarily on the affected areas. The damage inflicted directly by the earthquake was compounded by damage from the tsunami arising from the earthquake and by the nuclear power plant incident. In the former part of this chapter, we examine the economic and human damage inflicted on Iwate, Miyagi, Fukushima, and Ibaraki Prefectures by the Great East Japan Earthquake, as well as the current situation of industrial recovery. In the latter part, we show the impacts of fiscal measures for reconstruction and industrial cluster in disaster-affected region for reconstruction on regiona economy using a simple computable general equilibrium model. Section 2.2 presents the economic and human damage wrought by the earthquake and the current situation of industrial recovery, based on several statistical sources and surveys such as industrial production indices. In particular, we discuss the impact of the nuclear power plant catastrophe in Fukushima Prefecture , distinguishing it from the damage in Iwate, Miyagi, and Ibaraki Prefectures. Section 2.3 then discusses which elements were prioritized in the allocation of government recovery funding measures to deal with the economic damage, the status of implementation, and additional challenges. In Sect. 2.4, we estimate impacts of this earthquake on firms’output, using a spatial econometric model. Section 2.5 moves on to present an economic model for natural disaster assessment and labor migration: a) the regional input-output and two-regional computable general equilibrium (2SCGE) models used in this tract to assess the policies of recent years, to analyze economic and human loss from the quake, and to assess recovery policies; b) a new economic geography (NEG) model that facilitates explicit analysis of population and labor migrations; and c) research about new industrial agglomeration s and clusters. Section 2.6 uses the static 2SCGE model to analyze the earthquake’s destruction and to describe a simulation analysis of regional renewal based on new industrial agglomerations and clusters. Finally, Section 2.7 presents conclusions for this chapter and discusses future topics.

2 Economic and Human Loss in the Disaster Areas and the Current State of Industrial Recovery

2.1 Economic Loss in the Disaster Areas and the Current State of Industrial Recovery

The Great East Japan Earthquake that struck on March 11, 2011 caused the greatest damage to the Japanese economy since World War II. Production activities in the automotive and electronics industries were hit not only in the affected areas but also throughout the country, as damage to factories in the stricken areas and power shortages disrupted the supply of products and raw materials. Industrial production plummeted due to this enormous supply shock. In this section, we shall consider supply shocks to major industries in the stricken areas immediately after the quake occurred and the extent to which production activities have subsequently recovered.Footnote 1 We begin with indices of industrial production. Fig. 2.1 shows these indices, and we can see that production in each prefecture took a 30%–50% fall immediately after the quake. Subsequently, the speed of the recovery differed among prefectures, with Miyagi Prefecture initially lagging behind but catching up 1 year after the quake. In Fukushima Prefecture , which suffered the largest impact from the nuclear power plant disaster , the impact of the quake was prolonged, with production levels stalling at approximately 90% in 2012 and subsequent years. At present, industrial production in the three affected prefectures, excluding Ibaraki, remains below national industrial production indices.

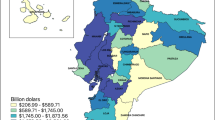

Table 2.1 shows the drop in manufacturing output by sector and the subsequent recovery. It is obvious that in the 6 months immediately following the disaster, production in all sectors declined in the affected areas, notably in Fukushima Prefecture . Therefore, as in Fig. 2.2, we see that while manufacturing sites damaged by the earthquake were concentrated in the coastal regions of Miyagi and Ibaraki Prefectures (where the automotive and electrical-related industries are concentrated) and in the coastal regions of Iwate and Miyagi Prefectures (where marine processing-related industries are concentrated), damaged factories were dispersed over a broad area, which caused enormous damage to the manufacturing industries of affected regions.

Sites Damaged by the Great Earthquake (Manufacturing Industry) (Source: Tokunaga and Okiyama (eds) (2014, p. 5). Note: The authors composed this based on the results of the “2011 Investigation of Damage to Firms due to Great East Japan Earthquake” survey conducted by the Economic and Industrial Research Laboratory as well as Figure 2.4 by Hamaguchi (2013))

However, visible differences can be seen in the recoveries for Fukushima Prefecture and the other three affected prefectures. This holds true both for the same industry and among industries. It is difficult to say whether this similarity is due to the nuclear power plant incident, the relative impact of fiscal measures, or non-earthquake factors such as the rise in the yen’s value, subsidies that stimulated demand for eco-friendly products, or some combination of these factors. From Table 2.1, we see that in the affected regions, for the 3 month period after the quake, manufacturing production reached 74.5% of pre-quake levels, rising to 90.0% during a 3–6 month period. Between 6 and 12 months after the quake, manufacturing production reached 94.0%, moving up to 97.8% between the first and second years. Four years after the quake, manufacturing production was 96.3%.

Some industries, such as the food and tobacco industry in Fukushima, showed noteworthy production recovery . Nevertheless, its recovery from the drop in production lagged behind other prefectures and other industries in Fukushima. It is conjectured that this was caused by negative rumors about radioactive pollution relating to the nuclear power plant incident. However, fiscal measures are effective against harmful rumors, and 1 year after the disaster, production levels in these industries had recovered to within 5% of pre-quake levels. Four years after the quake, however, production fell by 25%.

We also see contrasting patterns of recovery in the automotive and electronics equipment industries. Production after the quake dropped sharply in both industries by about the same amount. We can see from Fig. 2.3, which plots the automotive and electronics industries in the afflicted areas , how damaged factories were concentrated in the coastal area of the four affected prefectures where these industries were clustered. By contrast, damaged manufacturers of raw materials and parts were spread across a broad region, so supply shortages limited production at assembly firms. In particular, damage to the Naka plant of Renesas Electronics, which holds a 40% global share in microcontrollers, halted production of special-order microcontrollers, forcing automotive manufacturers, such as Toyota Motors and Honda, to reduce or stop production.Footnote 2 These supply chain interruptions in the affected areas caused automotive production in other geographic areas to fall even more. Three months after the quake, the automotive supply chain interruptions were being resolved, and with the help of eco-car subsidies, production recovered faster than in other industries. In the electronics industry, which suffered from the high value of the yen at that time, production in both affected and other areas was down by double digits , both 6 months and 4 years after the quake.

Let us now consider the earthquake’s damage to non-manufacturing industries and how they subsequently recovered. Table 2.2 shows the recovery from the tsunami and the earthquake in the agriculture and fisheries industries. Although a budget of 509 billion yen has been allocated to date to support these two industries, with the exception of Ibaraki Prefecture, a clear disparity in the degree of recovery exists between affected prefectures. The table shows that even 2 years after the earthquake and the tsunami, recovery from damage to farmlands in Fukushima Prefecture was 15.2%, a full 20 percentage points behind the recovery in Iwate Prefecture, the second-worst performer. With regard to fisheries, 1 year after the quake, nearly half of the fishing businesses had reopened. By contrast, in Fukushima Prefecture , virtually no fisheries were open 2 years later. Because radioactive pollution was the principal factor hindering the recovery of farming and fishing production in Fukushima Prefecture, it will probably take time for these industries to recover to pre-quake levels.

The 2014 results of the “State of Agricultural and Fishery Businesses in Regions affected by the Tsunami Disaster from the Great East Japan Earthquake,” published regularly by the Ministry of Agriculture, Forestry and Fisheries (MAFF) since the earthquake, show that the number of businesses that had intended to reopen but have not yet done so has shrunk, while the number of reopened businesses with turnover exceeding pre-quake levels has grown. In contrast, 40%–50% of businesses report that even after reopening, their turnover had not reached pre-quake levels.

Looking at Fig. 2.4, which uses public materials from Fukushima Prefecture , we see that production in the forestry and fisheries industries declined by 20.6% year-on-year to a production value of 185.1 billion yen in FY2011. Rice production dropped by 5% in 1 year but declined by 20% over 2 years. Fruits and vegetables also declined by 30% from the previous fiscal year. Agricultural production rose in fiscal 2012 and 2013, growing to the 200 billion-yen level, but with the national decline in rice prices 2014, agricultural production dropped back to the 2011 levels. Forestry production in fiscal 2011 was 8.52 billion yen, 30% lower than in the previous fiscal year, and fisheries’ production decreased to 52.3%. While forestry and fisheries’ output dropped in 2012, both industries began to grow again in FY2013.

Production in the forestry and fisheries industries of Fukushima Prefecture (2008–2014) (Source: Tokunaga and Okiyama (eds) (2014, p. 11), Reconstruction Agency in Fukushima (2008 through 2015))

To understand the state of production recovery in the construction and tertiary industries, we refer to the “Survey of Recipients of Group Subsidies,” carried out in September 2012 by the Tohoku Bureau of Economy, Trade and Industry (2013) (see Fig. 2.5). According to this publication, 70% of the businesses that managed to reopen have not reached pre-quake revenue levels and 30% show revenues of less than half their sales before the disaster. While half of the construction companies increased sales, nearly 30% of firms in the fisheries, foodstuffs, and hospitality industries reported sales less than 30% of pre-quake levels. From the degree of recovery in affected manufacturing industries and that in other manufacturing industries mentioned above, we analogized as a proxy for the degree of production recovery in the construction and tertiary industries. According to this measurement, through fiscal measures in the affected regions, the construction industry recovered more than 120% of its prior revenues, the transportation industry recovered all (100%), and the commerce and service industries recovered 95.3%. The Japanese-style inn and hotel, fisheries, and food processing industries, however, reported only approximately 60%–80% of pre-quake sales. The differences in recovery progress of affected regions and companies (the Tohoku Bureau of Economy, Trade and Industry reported that “there are notable regional disparities”) seem to be caused by differences in the degree of destruction between and within the affected prefectures as well as non-quake factors such as the extent of fiscal measures and the high value of the yen; all these factors influenced the progress of recovery in different regions and industries.Footnote 3

With regard to non-production recovery, according to the Reconstruction Agency ’s publication “Current State and Initiatives for Reconstruction” (2012), except for areas where houses were swept away and in nuclear power security districts, major lifelines such as electricity, natural gas, and water and nearly 100% of social infrastructure (other than ports and harbors) were restored on an emergency basis in the affected areas. The agency also noted that restoration of public services, such as communications, mail, hospitals, and schools, by and large was completed. The report also indicated that as of 2012, full restoration and recovery of the social infrastructure damaged in the disaster remained to be completed and that schedules for government and regional authorities’ reconstruction projects were in the process of being drafted.

2.2 Current State of Production Activities in Regions Affected by the Nuclear Power Plant Disaster

While production activities in the areas surrounding the Fukushima Dai-ichi Nuclear Power Plant incident resumed in some areas , where residents were permitted to return, production now has almost entirely halted. According to METI reports (2011), 619 manufacturing establishments and 1074 commercial establishments are located in the secured areas, the planned evacuation areas, and the emergency evaluation areas surrounding the Fukushima Dai-ichi Nuclear Power Plant. Total manufacturing shipments in 2008 were approximately 216.4 billion yen, and total sales by commercial establishments were approximately 89.2 billion yen. Even if only temporarily, these monetary gains from economic activities were lost due to the nuclear accident. We attempted to estimate production value, by industry, for one city, six towns, and three villages (excluding the bio-regional areas of Soma City and Shinchi Town) that were affected by the power plant disaster.Footnote 4 Our estimates were based on municipal reports for Fukushima Prefecture for FY2010 and FY2012 (on a value-added basis) and shipment values of manufactured items from the 2010 table of industrial statistics by the Ministry of Economy, Trade and Industry. Results are shown in Table 2.3. We estimated that production values for all industries in FY2010 and FY2012 in the regions affected by the nuclear power plant disaster were 1.4101 trillion yen and 707.0 billion yen, respectively. Of this, the total of electricity, natural gas, and water in FY2010 and FY2012 in the regions was 739.4 billion yen and 212.3 billion yen, respectively. Their share of the prefecture’s total production dropped from 64.8% in FY2010 to 37.1% in FY2012, principally because of a 520 billion-yen reduction in electricity production caused by the Fukushima nuclear power plant incident. Agriculture, forestry, and fisheries industries shrank from 26.3 billion yen in FY2010 to 2.6 billion yen in FY2012, while manufacturing overall decreased by 30%, from 213.4 billion yen to 62.4 billion yen, and commerce lost 6.8 billion yen in revenues.

Looking at gross regional product (GRP) for the same regions in Table 2.4, we see that worker compensation was 247.6 billion yen and 200.2 billion yen in FY 2010 and FY2012, respectively, dropping as a ratio of the prefecture’s total from 7.5% in FY2010 to 5.9% in FY2012. In addition, income from self-owned businesses dropped from 163.3 billion yen in FY2010 to 61.6 billion yen in FY2012, a decline of 101.7 billion yen, or 332.7 billion yen if corporate operating surpluses are included. The ratio to the prefectural total went down from 14.0% to 5.2%.

Human loss from the Great East Japan Earthquake was extensive; as of November 2013, 15,883 individuals died and 2651 were missing, mainly in the Iwate , Miyagi, and Fukushima Prefecture s. In addition to this enormous loss, nationally 280,000 people were evacuated over a prolonged period. These evacuations included 60,000 people outside Fukushima Prefecture and an additional 10,000 people from other affected areas. Including those who died in the disaster, population in the three ill-fated prefectures dropped by approximately 90,000.Footnote 5

3 Current State of Fiscal Reconstruction Measures in the Affected Areas

3.1 Current and Future Fiscal Measures for Reconstruction

Table 2.5 was prepared from the Reconstruction Agency ’s budget-related materials.Footnote 6 Emergency funds were used five times in FY2010 in response to the March 2011 disaster. In FY2011, budgeted expenditures in the first through third supplementary budgets for recovery and reconstruction were 14.9243 trillion yen, including emergency funds . Subsequently, in FY2012 and FY2013, another 9.7402 trillion yen and 7.5089 trillion yen, respectively, were budgeted as a Special Accounting Budget for Recovery. The total cumulative budgeted amount for FY2011–FY2014 reached 29.3946 trillion yen. Of this amount, 23.9132 trillion actually was disbursed, giving a disbursement ratio of 81.4%. The item with the lowest disbursement ratio was “Town Restoration and Recovery,” including recovery grants, for which 10.5687 trillion yen was budgeted. Only 7.5809 trillion yen, or 71.7%, of this total was disbursed. 1.698 trillion yen was carried over to the next fiscal year, with 70% of public project funds allocated to disaster recovery and restoration remaining unused. Fukushima Prefecture ’s “Recovery and Renewal from the Nuclear Power Plant Disaster ” project had a budget of 3.6952 trillion yen throughout FY2014, but only 2.7534 trillion yen was disbursed. This gave a disbursement ratio of 74.5%, with the majority of the extra 358.2 billion yen spent on pollution clean-up. A total of 3.9889 trillion yen was allocated throughout FY2014 by the Special Accounting Budget for Recovery as regional tax grants (the Extraordinary Disaster Recovery Grant Tax), of which 3.8 trillion yen was expended (a disbursement ratio of 95.3%). These grants added to local contributions and compensated for the reduction in local taxes in the Ministry of Internal Affairs and Communications’ budget for restoration and recovery projects, which amounted to 589.8 billion yen in FY2015 and an estimated 347.8 billion yen in FY2016.

In terms of future fiscal measures for recovery , while the budget for FY2015 was 3.9087 trillion yen and the expected budget for fiscal 2016 is 3.2469 trillion yen, the numbers are going down. The “Requirements Policy for the Fiscal 2016 Recovery Agency Budget” presents the following four policies to move ahead steadily with initiatives required for recovery in the affected areas during the “Recovery and Creation Period”: (1) Institute a budget for solving challenges faced by the affected areas, (2) accelerate the renewal of Fukushima Prefecture after the nuclear power plant disaster , (3) create a sustainable regional society, including a “new Tohoku;” and (4) prioritize projects truly necessary for recovery. In the future, fiscal measures for recovery likely will be defined both qualitatively and quantitatively by these policies.

3.2 Fiscal Measures for Recovery in Fukushima Prefecture

Regarding fiscal measures for recovery in Fukushima Prefecture , the FY2014 budget detailed items listed explicitly in the “Recovery and Renewal after the Nuclear Power Plant Disaster ” project, including, in addition to pollution removal costs and damage from negative rumors, items such as “Fukushima Renewal Accelerator Grants” and “Project to Support Restoring Hope in Local Areas.” Between FY2014 and FY2016, the renewal budget in Fukushima increased from 660.0 billion yen (2014) to 780.7 billion yen (2015) to 1.167 trillion yen (2016). In particular, the FY2014 budget of 108.8 billion yen for “Fukushima Renewal Accelerator Grants” will remain almost constant at 100.0 billion yen for FY2015 and FY2016. Fiscal transfer from the government to Fukushima Prefecture reached nearly two trillion yen during the 2 years after the disaster, and fiscal measures in excess of one trillion yen annually are planned going forward, continuing the fiscal support for recovery in Fukushima Prefecture.

Concerning the effectiveness of these kinds of fiscal measures, Table 2.6 shows the rate of progress in restoring and developing the social infrastructure, based on publications from Fukushima Prefecture . We can see that more than 90% of public infrastructure projects have begun. Project completion is 90% for roads and bridges and 80% for rivers and harbors but only 50% for bays and fishing port facilities. These metrics clearly demonstrate how the impact of the nuclear power plant disaster has become a major barrier to recovery in Fukushima Prefecture.

4 Impact of the Great East Japan Earthquake on Firm Output

In the preceding section, we took a general view of the 5 years of recovery after the Great East Japan Earthquake , and we clarified that in the Iwate , Miyagi, Fukushima, and Ibaraki Prefectures, which suffered heavy damages, the effects of the earthquake varied greatly regionally and by industry type. In this section, we will focus on the effects of the tsunami and nuclear disaster on the manufacture of processed marine, food, general-purpose machinery (which suffered damage over a broad area), and motor vehicles and motor vehicle parts (which encompass a broad range of supporting industries). First, using data from 2011 when the Great Earthquake occurred, we will analyze the impact the earthquake had on production by these industries. Next, based on those results, using data from before and after the earthquake (from 2010 and 2012), we will analyze the process of recovery of those manufacturing firms’ production according to a geographically weighted regression (GWR) model.Footnote 7 For these analyses, by measuring the spatial adjacency of individual similar firms in areas affected by the disaster, i.e., the degree to which similar firms are clustered, using a revised version of Moran’s I (an index of spatial autocorrelation), for each industry type we will also analyze the relation between the degree of industrial concentration and the degree of impact by the earthquake.Footnote 8

4.1 Impact on Production by Manufacturing Firms in Regions Affected by the Great Earthquake

From Fig. 2.6, which shows the tsunami -flooded areas of Iwate , Miyagi, Fukushima, and Ibaraki Prefectures (these areas also took heavy damage from the Great East Japan Earthquake), as well as the distribution of seismic intensity and the 20–50 km area around the Fukushima Daiichi nuclear plant, it is clear that the damage from the earthquake was on a large scale and extended over a broad area, from the coastal and central areas of the Tohoku region to the Kanto region. Next, if we compare that map with Fig. 2.2, which plots manufacturing business sites that were at least partially damaged by the earthquake, a correlation between the distribution of business sites that were damaged and the geographical data of the damage by the earthquake is apparent. Next, targeting the areas of “manufacture of food (9),” “manufacture of fisheries and seafood product manufacturers (processed marine)”, “manufacturer of general-purpose machinery (25),” and “manufacture of automobile products,” all of which suffered heavy financial damage, we will analyze the impact of decreases in employment due to the earthquake on firm production in the affected areas using individually contributed data from “Economic Census” that studied relevant business sites with thirty or more employees in 2011. The production function of an individual firm uses the volume of production as the explained variable and the number of employed workers as the explanatory variable. The estimation formula is the log linear of Eq. (2.1). Since the relation between the explanatory variable and the explained variable is nonstationary, it is estimated using a geographically weighted regression (GWR) model that gives regression coefficients that vary for each location (business site).Footnote 9

Here, output i is the production volume of an individual firm in region i, labor i is the number of employees in an individual firm in region i, and ε i is the error term.Footnote 10 The estimation result is illustrated in Fig. 2.7. This is mapped for each industry type, since the GWR estimates different coefficients for each location. It also shows the estimation result of the spatial autocorrelated Moran’s I .Footnote 11 The labor coefficient (labor elasticity) is positive for all four industry types. However, the value of this elasticity varies greatly by region and industry type, so it can be seen that the impact on production from labor decreases due to the earthquake also varies greatly by region and industry type. The estimation result of Moran’s I for “manufacture of food (9)” and “manufacture of processed marine” in 2011 shows that similar firms were spatially adjacent at a significance level of 1% and that its value is around 1 or higher. In contrast, the value of Moran’s I for both “manufacturer of general-purpose machinery (25)” and “manufacture of automobile products” was positive, showing that similar firms are spatially adjacent at a significance level of 1%, i.e., industrial concentration exists . However, that value was below 1. This shows that damage from the earthquake was significant for areas that experienced seismic shock above 6 on the Richter scale, tsunami -flooded areas, areas within 20–50 km of the Fukushima Daiichi nuclear reactor, and areas of industrial concentration.

4.2 Recovery Process of Production by Manufacturing Industry Firms in Areas Affected by the Great Earthquake

Next, based on these results and using data from before and after the earthquake, we will analyze the industrial concentration conditions and the recovery process of manufacturing firms in the affected areas using the GWR model. Here, we use individually contributed data from “industrial statistical surveys” (for business sites employing four or more workers) from before the 2010 earthquake and after the 2012 earthquake. The analysis targets the four industry types mentioned above. First, for business sites in four of the affected prefectures (Iwate , Miyagi, Fukushima, and Ibaraki), we extracted data from across the country and performed geocoding from the address data. For geocoding, we used an address matching service within Tokyo University’s “Geographic Spatial Information System”; then, we converted the address data into longitude and latitude data. For the analysis, we used samples from this that matched at the street block level or higher (match level 6 or higher). The match rates for all industry types as a whole were 84.5% for 2010 and 84.7% for 2012. As for administrative districts, we sought to consolidate them using MLIT’s “Land Numerical Data, Administrative Districts 2015 Version” as the standard. The geographical coordinate system was GCS-JGD-2000, and the geodetic survey standard system was D-JGD-2000 (the Japanese standard system).

Next, to analyze the conditions of business sites being restored/continuing to be used, continuing with data from 2010 to 2012, we created a “continuation/restoration” dummy in which sites that were restored or are still being used received a 1 and all others received a 0 for both 2010 and 2012. Also, using these data and with the production volumes of individual firms being the explained variable, we made labor and the continuation/restoration dummy the explanatory variables as in Eq. (2.2) and estimated these using GWR.Footnote 12

Here, i represents locationi. Forthecoefficient ln(labor) , estimated by GWR, the regression coefficient is averaged by municipality , as depicted in the maps Fig. 2.8a (2010) and Fig. 2.8b (2012). The labor coefficients were positive for both 2010 and 2012 for the four industry types, and production volume increased as labor increased. For “manufacture of food (9)” and “manufacture of processed marine,” the comparison of the value of labor elasticity from before and after the earthquake showed an increase; moreover, we found that the intervals between maxima and minima varied greatly by region. However, for “manufacturer of general-purpose machinery (25)” and “manufacture of automobile products,” the value of labor elasticity fell, and though the intervals between maxima and minima were small, they still varied by region.

The estimation results of the spatial autocorrelated Moran’s I for “manufacture of food (9)” in 2010 and 2012 for all target regions show that similar firms are spatially adjacent at a significance level of 1%, i.e., industrial concentration exists, but also that this value tends to remain constant or decrease somewhat. This was seen in 2010 in the industrial concentration present along the coastal regions of Miyagi and Fukushima Prefectures , but in 2012, only weak industrial concentration was observed in the same regions, which in turn coincided with a slight increase in new concentration in the inland region of the Fukushima Prefecture . For “manufacture of processed marine” as well, at both points in time for all target regions, we see that similar firms are spatially adjacent at a significance level of 1% and that this value tends to remain constant. In contrast, for “manufacturer of general-purpose machinery (25),” we see that when Moran’s I tends to increase, the degree of concentration increases and tends toward recovery. We see that when Moran’s I for “manufacturer of automobile” tends to decrease, the degree of concentration decreases and there is no clear tendency toward recovery.

Finally, the regression coefficient of the continuation/restoration dummy variable estimated by the GWR is averaged by municipality, as depicted in Fig. 2.8c (2012). The value of the coefficient of the continuation/restoration dummy ranges from negative to positive (including zero). The results varied greatly, by industry type as well as region. For “manufacture of food (9),” the estimation value of the regression coefficient of the continuation/restoration dummy was positive for Iwate , Miyagi, and Fukushima (excluding areas within 20 km of the Fukushima Daiichi nuclear reactor), and we see that they are headed toward recovery. However, for “manufacture of processed marine,” although there were regions for which the estimation value of the regression coefficient of the continuation/restoration dummy partially took a positive value, such as the coastal regions of Iwate /Miyagi, it took a negative value in the northern part of the Iwate Prefecture and the southern part of the Fukushima Prefecture (including areas within 50 km of the Fukushima Daiichi nuclear reactor); this showed that recovery has not progressed very much. Conversely, for “manufacturer of general-purpose machinery (25),” it took a positive value in the inland area of the Fukushima Prefecture (excluding areas within 20 km of the Fukushima Daiichi nuclear reactor), and we see that recovery is progressing. Contrary to expectations, for “manufacture of automobile products” in 2012, the value of the regression coefficient of this continuation/restoration dummy was negative for parts of Iwate , Miyagi, Fukushima (excluding areas within 20 km of the Fukushima Daiichi nuclear reactor), and northern Ibaraki, and we see that there has still hardly been any progress toward recovery . From these data, for manufacturers of general-purpose machinery and the manufacture of automobile products, we can surmise that damage from the tsunami extended not only to regions that were directly hit by the tsunami but also that supply lines were disrupted in Miyagi, Fukushima, and Ibaraki Prefectures, which delayed the recovery of production.Footnote 13

5 Economic Model for Natural Disaster Assessment and Labor Migration

In preceding sections, as we examined the economic and human damage inflicted on the affected areas by the Great East Japan Earthquake, as well as the current situation of industrial recovery, we move on to present an economic models for natural disaster assessment and labor migration: (a) the regional input–output and two-regional CGE models to analyze economic and human loss from the quake, and to assess recovery policies; (b) NEG model that facilitates explicit analysis of population and labor migrations; and (c) research about new industrial agglomerations and clusters as recovery policy in this section.

5.1 Regional Input–Output Model and Two-Regional SAM and CGE Models

First, we present the multiregional input–output model using a regional technical coefficients matrix A r. For simplicity, we consider the case of a small two-sector, two-region economy. The basic structure of inter-regional input–output models is as follows:

where \( {c}_i^{rs}\left(={z}_i^{rs}/\sum \limits_{r=1}^2{z}_i^{rs}\right) \) is the proportion of all of good i used in s that comes from each region r and \( {\widehat{\mathbf{c}}}^{rs}=\left(\begin{array}{cc}{c}_1^{rs}& 0\\ {}0& {c}_2^{rs}\end{array}\right) \), x is the regional total output vector, and f is the final demands vector. Thus, Eq. (2.3) can be represented as (I − CA)x = Cf, where \( \mathbf{A}=\left(\begin{array}{cc}{\mathbf{A}}^r& \mathbf{0}\\ {}\mathbf{0}& {\mathbf{A}}^s\end{array}\right),\mathbf{C}=\left(\begin{array}{cc}{\widehat{\mathbf{c}}}^{rr}& {\widehat{\mathbf{c}}}^{rs}\\ {}{\widehat{\mathbf{c}}}^{sr}& {\widehat{\mathbf{c}}}^{ss}\end{array}\right),\mathbf{x}=\left[\begin{array}{l}{\mathbf{x}}^{\mathrm{r}}\\ {}{\mathbf{x}}^{\mathrm{s}}\end{array}\right],\mathbf{f}=\left[\begin{array}{l}{\mathbf{f}}^{\mathrm{r}}\\ {}{\mathbf{f}}^{\mathrm{s}}\end{array}\right] \), and the solution will be given byFootnote 14

In Chap. 8 of this book, using the regional input–output model , Dr. Kunimitsu will analyze the economic ripple effects of a biogas electricity power plant as part of earthquake disaster restoration in the coastal area of Iwate Prefecture, Japan. Furthermore, in Chap. 9, based on an inter-regional input–output model, Prof. Ishikawa will analyze the economic impacts of population decline due to massive earthquakes using 47 inter-regional input–output table s at Japan’s prefectural level.

Second, let us provide an overview of the two-regional social accounting matrix (SAM), which is the basis of our model. The base data used in the SAM is a 2005 inter-regional input–output table of all 47 prefectures, jointly created by Yoshifumi Ishikawa and the Mitsubishi Research Institute.Footnote 15 We calculated additional data that could not be obtained from this table, such as income and expenditures for households, enterprises, governments, and other segments within the two regions, using values from the 2005 National Economic Accounts and the 2005 Economic Accounts for each prefecture. In accordance with Ito’s (2008) two-regional SAM framework, we created a 70 × 70 dimensional matrix, with production activities comprising 20 sectors for each of the two regions, production factors of labor and capital comprising two sectors for each region, and institution, savings, and investment comprising nine sectors for each region. We added seven additional sectors and one overseas sector. Our model partially modifies the above-mentioned SAM, using a simplified 58 × 58 dimensional SAM as the database.Footnote 16 In Chap. 3 of this book, using this two-regional social accounting matrix , we will analyze the impacts of the Great East Earthquake.

Third, the static two-regional computable general equilibrium (2SCGE ) model was built using GAMS code provided by EcoMod Modeling Schools.Footnote 17 This code is a basic system that uses a static single-country open-economy model with the country divided into two regions, each region having economies made up of 14 agents: one household, 10 industries, one enterprise, one local government, and one investment bank. There are also 10 product markets, two production factors of labor and capital, and two additional agents for central government and overseas sectors. Labor and capital for each region can move inside the 10 industries of their respective region, and the endowment for each region is fixed.

While the overview for our model is shown in Fig. 2.9 for the model structure . We explain further the primary blocks of the model below. First, in the domestic production block in Fig. 2.10, we note that each production activity sector (i.e. industry) produces one product, and we assume multi-stage profit-maximizing behavior. In the first stage, industries operate within Leontief production technology constraints, producing aggregate intermediate goods with added value. In the second stage, aggregate intermediate goods are extracted from that region’s Armington composite goods, along with Armington composite goods from regions unaffected by the disaster. The model also incorporates constant elasticity of substitution (CES) production technology constraints of a certain scale, and the value added is likewise created from labor and capital within each region, with CES production technology constraints of a certain scale. Earnings are equal to production expenditures as producer pricing meets the “zero profit condition,” and return on capital and wage rates are equal for all industries because they can move between all industries in that region. Pricing for aggregate intermediate goods is derived from an expression that defines the supply and demand equilibrium of intermediate goods. Moreover, within the trading block, the ratio of produced goods shipped domestically and those shipped overseas is derived from a constant elasticity of transformation (CET)-type function. Armington composite commodities , comprising both domestic and imported supplies of goods, were derived using a CES-type production function. Export pricing was calculated using international pricing, adjusted with an exchange rate, and import pricing included import taxes and tariffs. International pricing denominated in foreign currency is fixed in our model, and of the two regions, the disaster-affected region ’s foreign savings is modeled as an exogenous variable using a foreign trade balance formula.

Next is the household block with households exhibiting utility-maximizing behavior. As depicted in Fig. 2.11, in the first stage, households maximize aggregate goods within budgetary constraints using the Cobb–Douglas utility function . The propensity to save is a set value. In the second stage, aggregate goods are extracted from that region’s Armington composite goods, along with Armington composite goods from the regions unaffected by the disaster, within CES production technology constraints of a certain scale. Aggregate pricing is derived from an expression that defines the supply and demand equilibrium of such goods.

Although the trade sector includes exports and imports between each region and the foreign sector, as shown in Fig. 2.12, trade also occurs through imports and exports between the disaster-affected region and non-disaster region. Specifically, the structure incorporated into the 2SCGE model allocates products produced in region for the domestic market and for export, with being derived by solving the problem of sales maximization under the constraint of the Constant Elasticity of Transformation function. In addition, for the composite commodity according to the Armington assumption , which is the composite commodity for domestic supply comprising producer goods for the domestic market and imported goods, this part is derived by solving the constrained optimization problem by minimizing its total costs subject to the CES function constraint. The 2SCGE model fixes the foreign-currency denominated international price and, in the trade balance formula, it sets net overseas transfers of labor and net overseas transfers of capital as exogenous variables for foreign savings in region, whereas the common exchange rate for the regions is set as endogenous variables.

To give a simplified explanation of the other blocks, savings within the government block for both central and local governments is obtained by adding a certain percentage to revenues. Local government expenditures for goods are allocated by adding a certain percentage to revenues after excluding transfers to savings and other system sectors. In our model, savings are allocated by agents called “banks” in response to investment demand from each of the 10 industries , according to a linearly homogeneous Cobb–Douglas utility function . Finally, within the market equilibrium conditions block, equilibrium conditions for the nine markets are given a set formula. In the system of equations described above, one equation becomes redundant due to Walras’ law. We must therefore select one of the goods’ prices as the numéraire. In this case, the wage rate in regions unaffected by the disaster is selected and fixed.

Previous sections provided an overview of the economic and human loss in the affected areas and the state of fiscal measures for recovery . In Sect. 2.6, we introduce a computable general equilibrium (CGE) model , which will be useful in assessing the damage from the earthquake as well as recovery policies using the formation of new industrial clusters. Futhermore, in Chap. 6, using a dynamic regional CGE model, we analyze the economic impact of the formation of new food and automotive industry clusters with productivity improvement. In Chap. 7, we also analyze the production recovery of fisheries and seafood manufacturing and the economic impacts of the Tokai Earthquake in Chap. 11 of this book using a dynamic regional CGE model .

5.2 New Economic Geography Model

Next, we introduce the NEG theory, which is useful in analyzing population and labor migration stemming and regional renewal from the earthquake and the nuclear power plant disaster . As opposed to traditional trade theories exemplified by Ricardo’s theory of comparative advantage and the Heckscher–Ohlin model, the 1980s produced new trade theories within the framework of monopolistic competition according to Krugman (1980), Helpman and Krugman (1985), which introduced factors such as the production function of increasing returns, transport expenses, and product discrimination; intra-industry trade , namely, the mechanism by which trade is conducted between countries having the same industries, was elucidated. However, these new trade theories had models that assumed that international labor migration does not exist. Therefore, Krugman (1991) as well as Fujita et al. (1999), while employing the framework of these new trade theories, developed the new economic geography (NEG) model , which accounts for labor migration internationally (and regionally). In particular, Krugman (1991) presented a simple general equilibrium model for monopolistic competition assuming regional migration of labor, the so-called core–periphery (CP) model .

In this section, following the research by Fujita and Thisse (2013), we introduce the CP model , which is a spatial version of the Dixit–Stiglitz model (1977).Footnote 18 The economic space is made of two regions, and there are two sectors, agriculture (A) and manufacturing (M), with two production factors, the farmers (immobile, L) and workers (perfectly mobile, H). First, consumers have a Cobb–Douglas utility function , U = Q μ A 1 − μ/μ μ(1 − μ)1 − μ0 < μ < 1, where Q is an index of the consumption of manufacturing goods and A is the consumption of agricultural goods given by \( Q={\left[{\int}_0^M{q}_i^{\rho}\; di\right]}^{1/\rho } \); \( A=\left(1-\mu \right)Y/{p}^{\mathbb{A}} \). The parameter ρ is the inverse of the intensity of love for variety, and σ is the elasticity of substitution between any two varieties, defied by σ ≡ 1/(1 − ρ). The individual demand functions are \( {q}_i=\left(\mu Y/{p}_i\right)\left({p}_i^{-\left(\sigma -1\right)}/{P}^{-\left(\sigma -1\right)}\right)=\mu {Yp}_i^{-\sigma }{P}^{\sigma -1}. \) The price index of the differentiated product is \( P\equiv {\left[{\int}_0^M{p}_i^{-\left(\sigma -1\right)} di\right]}^{-1/\left(\sigma -1\right)}. \) Next, for the behavior of producers, the agricultural technology ensures that one unit of output requires one farmer, and the manufacturing technology ensures that production of the quantity q i requires workers l i (=f + cq i ), where f and c are the fixed and marginal labor requirements, respectively. Using the “iceberg” form for trade cost, the notation of the market access of exports from region s to region r as \( {\phi}_{sr}\left(\equiv {\tau}_{sr}^{-\left(\sigma -1\right)}\right) \) is introduced, which shows the freeness of trade. Thus, if variety i is produced in region r and sold by p r , then the delivered price in region s(≠r) p rs is p rs = p r τ rs . The price index P r in region r is \( {P}_r={\left\{\sum \limits_{s=1}^R{\phi}_{sr}{M}_s{p}_s^{-\left(\sigma -1\right)}\right\}}^{-1/\left(\sigma -1\right)}. \) Each firm sets its mill prices to maximize profits. Following Dixit and Stiglitz (1977), firms treat the elasticity of substitution, σ, as if it was the price elasticity of demand. The nominal wage rate of workers in region r sets w r . As there is free entry and exit, zero profit occurs in equilibrium; thus, the income of region r is Y r = λ r Hw r + v r L. Hence, the profit function of a firm producing variety i in region r is π r (i) = p r (i)q r (i) − w r [f + q r (i)] = (p r − w r )q r − w r f as the total demand of firm produced variety i is\( {q}_r=\mu {p_r}^{-\sigma}\sum \limits_{s=1}^R{Y}_s{\phi}_{rs}{P}_s^{\sigma -1} \).

Next, we explain how firms and workers are distributed between regions using these equations for the behavior of consumers and producers. In the short-run equilibrium for immobile workers among regions, the equilibrium wage for workers in region r is \( {w}_r^{\ast }={k}_2{\left[\sum \limits_{s=1}^R{\phi}_{rs}{Y}_s{P}_s^{\sigma -1}\right]}^{1/\sigma}\kern1em r=1,\dots, R, \) where k 2 ≡ (σ − 1/σ)[μ/(σ − 1)f]1/σ, and the real wage in region r is \( {V}_r={\omega}_r=\frac{w_r^{\ast }}{P_r^{\mu }}\kern1em r=1,\dots, R. \) In contrast, in the long-run equilibrium, a spatial equilibrium arises when no worker may get a higher utility in another region.Footnote 19 Following migration modeling, the myopic evolutionary process in which workers are attracted by regions providing high utility levels is as follows: \( {\dot{\lambda}}_r={\lambda}_r\left({\omega}_r-\overline{\omega}\right)r=1,\dots, R, \) where \( {\dot{\lambda}}_r \) is the time derivative of λ r , ω r is the equilibrium real wage corresponding to the distribution (λ 1, …, λ R ), and \( \overline{\omega}\equiv \sum {\lambda}_s{\omega}_s \) is the average real wage across all regions. In this context, the equilibrium equations for the two regional CP model , assuming that farmers are equally split between two-region (r = 1, 2) are as follows:

If λ ≡ λ 1, then λ 2 = 1 − λ. Thus, there exists a unique short-run equilibrium. Using the system (2.5, 2.6, 2.7 and 2.8) of nonlinear equations, Krugman (1991) got the following results of the agglomeration: for a large value of transport costs, there is one stable equilibrium corresponding to the full dispersion of the manufacturing sector (λ ∗ = 1/2), and for a low value of transport costs, the symmetric equilibrium becomes unstable; thus, the core–periphery structure is the only stable outcome.Footnote 20 The above is a summary of the basic CP model . Afterwards, the NEG model based on this CP model was developed by Venables (1996), Ottaviano et al. (2002), Baldwin and Krugman (2004) for agglomeration, Okubo et al. (2010) for heterogeneous firms, Tabuchi and Thisse (2002, 2011) and Mori and Smith (2011) for central place, Head and Mayer (2004) and Takatsuka and Zeng (2012) for the home market effect, and Fujita and Hamaguchi (2011, 2014) for coagglomeration of intermediate and final sectors. For the two-regional CGE model in Sect. 2.6, Chaps. 4, 5 and 6 of this book, we try to take some basic ideas of this NEG model in the two-regional CGE model to analyze the industrial agglomeration effects.Footnote 21 Furthermore, using NEG model based on this core–periphery model, we analyze the impact of labor migrations brought on by massive earthquakes in Chap. 10.

5.3 Trends in Research on New Industrial Agglomeration

Next, we focus on the formation of new industrial clusters as a strategy for recovery and local renewal from the earthquake in Sect. 2.6 and Chap. 6. Since the 1980s there has been much research into industrial clusters and regional planning, but starting in the 1990s, research into industrial clusters began to bloom. We present these trends here.

Classical research on industrial clusters began with Alfred Marshall (1890), who elucidated the origins of the economies of agglomeration . He argued that the three factors driving the emergence of economies of agglomeration are (1) spillover of new ideas based on the exchange of information and knowledge and face-to-face communications, (2) sharing of non-traded elements of production in the region, and (3) access to a large pool of similar and specialized workers in the region.Footnote 22 These Marshall-type external economies are categorized into economies of localization and economies of urbanization. Concerning these two types of external economies, Jacobs (1969) claimed that economies of urbanization are dominant. However, Porter (1998, 2000), in a series of studies, advocated for industrial clusters, arguing that in a global economy, the primary reason for the success of industrial clusters lies in the existence of strong economies of localization. The conclusion of this debate depends on the characteristics of the industry and scale of the region in question . The micro-foundation for the notion of external economies was provided by the NEG model of Krugman (1991) and others ( Fujita et al. 1999; Belleflamme et al. 2000; Fujita and Thisse 2013). The seminal studies elucidating the economies of agglomeration in an empirical fashion were by Nakamura (1985) and by Henderson (1988). The latter half of the 1990s was marked by a great deal of empirical analysis about the economics of agglomeration, inspired by Krugman ’s (1991) study. Ellison and Glaeser ’s (1997) study also provided pioneering research. Additional papers validating the economies of agglomeration in Japanese manufacturing include those by Mori et al. (2005), Kageyama and Tokunaga (2006), Tokunaga and Kageyama (2008), Nakajima (2008), Duranton et al. (2010), Tabuchi (2014), and Tokunaga et al. (2014). To distinguish these studies from traditional industrial agglomeration research by Marshall (1890) and others, they are called studies in “new industrial agglomeration s” or “new industrial cluster.”

Porter examined competitive superiority under conditions of growing competition due to the rapid progress of globalization. This presented a concept whereby the clustering of diverse, heterogeneous companies increases exchanges, including face-to-face communication, between different fields, using ideas arising from the development of new products and technologies. This strategy finds not just external economies in clusters of firms but promotes regional revitalization in a systematic fashion, in conjunction with organizations near the firm, such as universities and research institutions. The IT industry cluster in America’s Silicon Valley, and the wine and food industry clusters in France, are particularly famous examples of clustering. Studies analyzing industrial clusters in Japan and Asia include Kuchiki and Tsuji (2005), Tawada and Iemori (2005), and Kiminami and Nakamura (2016). The formation of industrial clusters is moving ahead not only in developed countries but also in developing countries, where it is revitalizing local economies. In Sect. 2.6, we use a static computable equilibrium model for a simulation analysis of local revitalization, stemming from the formation of industrial clusters. In Chap. 6, based on a dynamic CGE model based on the NEG model, we analyze the economic impact of the formation of new food and automotive industry clusters on reconstruction and local revitalization .

6 Impacts of the Disaster and Recovery Using the Static 2SCGE Model

Before explanation about simulation for impacts of the disaster and recovery from the Great East Japan Earthquake using a static 2SCGE model, we now review of previous literature for the models on impacts of the great earthquake. The economic impacts of the earthquake have been analyzed using the input-output , CGE, and econometric models (Okuyama 2004; Xie et al. 2014; Shibusawa and Miyata 2011). The CGE model is widely recognized as policy evaluation tool (Dixon and Rimmer 2002; Kehoe et al. 2005; Hosoe et al. 2010). For the Great East Japan Earthquake, Tokui et al. (2012, 2015) examined the economic impact of supply chain disruptions caused by the earthquake using regional input–output tables. Fujita and Hamaguchi (2011) and Hamaguchi (2013) studied the characteristics of the supply chain and the impact of the disaster based on a survey of manufacturing facilities located in areas affected by the earthquake. In addition, Saito, Y. (2012) and Todo et al. (2013) analyzed the nature of corporate networks in the supply chain, while Fujimoto (2011) and Otsuka and Ichikawa (2011) particularly assessed the supply chain in the automotive industry. In addition to the automotive industry, Nemoto (2012) discussed the reconstruction of local economies, including supply chains in the logistics and fishery industries. On the other hand, Okiyama et al. (2014) and Tokunaga and Okiyama (eds) (2014) analyzed the impacts of the Great East Japan Earthquake on production loss using an inter-regional SAM and Ishikawa (2014) also showed the economic impacts of population decline due to the Great East Japan Earthquake using an inter-regional input-output data. Furthermore, Saito, M. (2015) and Karan and Suganuma (2016) provided a comprehensive account of the devastation caused by this earthquake, tsunami, and nuclear radiation. From these previous research surveys, we find that there are no studies to evaluate the impacts of industry clusters with innovation on the regional economy for regional reconstruction after the Great East Japan Earthquake. Thus, we construct a static 2SCGE model based on the idea of NEG model and evaluate its impacts of industry clusters on regional economy after the Great East Japan Earthquake. Based on the considerations outlined in Sects. 2.2, 2.3 and 2.4, we will now simulate the impacts of the damage from the disaster in the affected prefectures as the base scenario (Base Simulation for Great Earthquake) and supply chain disruptions under Base Simulation (Simulation I). We will examine how the affected agriculture, forestry and fisheries industries, and the manufacturing industry can rebuild themselves using the fiscal measures policy under Base Simulation (Simulation II); the fiscal measures policy and commodity-grade products policy under Base Simulation (Simulation III); and the fiscal measures policy, commodity-grade products policy, and the industrial clusters policy under Base Simulation (Simulation IV) using the simulations of the static 2SCGG model

6.1 Establishment of Four Scenarios

-

(a)

Base Scenario for the Great Earthquake

The base scenario, that the Great Earthquake occurred, assumes that no fiscal measures or supply chain changes took place.Footnote 23 In the two regions, by comparing simulation results that either did or did not incorporate an earthquake, we found that labor and capital endowments decreased (see Sects. 5.2.1, 5.2.2 in Chap. 5). To reflect this in our model, we adjusted labor and capital endowments in the disaster-affected region with multipliers of 0.9858 and 0.9430, respectively, using 2005 labor and capital endowment data for the region. In non-disaster regions, labor and capital endowments were adjusted using multipliers of 0.9872 and 0.9866, respectively. These coefficients were estimated based on real GRP results of two simulations, one with and one without the Great Earthquake.

-

(b)

Scenario for Supply Chain Disruptions under the Base Scenario

To verify the effects of supply chain disruptions with and without disasters, we focused on the automotive and electronics machinery industries.Footnote 24 Hence, the inter-regional elasticity of substitution in the CES functions for the electronic devices/parts and parts of automotive industries (intermediate goods) was set at 0.5, as shown in Table 2.7. In other words, we assumed that these two industries’ supply chains were more closely connected in the two regions in light of post-earthquake circumstances.

-

(c)

Scenario for Fiscal Measures for Reconstruction under the Base Scenario

This scenario assumes that the Great Earthquake occurred and that fiscal measures were implemented for the disaster-affected region as follows: local governments in disaster-affected areas obtain 1.5 trillion yen in additional annual revenue from the central government by distributing a portion of local allocation tax grants to the non-disaster region. These grants make use of (1) the subsidy for inviting new firms and forming two new industry clusters , as shown in Chap. 6, (2) the partial restoration of public infrastructure, and (3) social security expenditures, such as a partial pension benefit, as shown in Table 2.8.Footnote 25

-

(d)

Scenario for New Industrial Agglomeration under the Base Scenario

In this scenario, we incorporate three factors for the formation of a new industry cluster and new industrial agglomeration .Footnote 26 The first is a subsidy policy after the intensive reconstruction period supporting agricultural, forestry, and fishing industries, as well as food and beverage industries that make up the new food industry cluster . The policy also supports the automotive and auto parts industry, the electronic parts and devices and electronic circuits industry, and other manufacturing and mining industries that make up the new automobile industry cluster . Revenues are sourced from local allocation tax grants paid to disaster regions. Second, we incorporate the key terms of commodity-grade products for intermediate goods and differentiated products for final goods in the formation of the new food and automobile industry clusters. More specifically, we alter the inter-regional elasticity of substitution for intermediate goods in the CES function from 2.0 to 3.0 for inter-regional products for the above six categories and set the inter-regional elasticity of substitution for final goods in the CES function at 0.5 as emphasized by the NEG model, as shown in Table 2.7. Third, we continue the round of policies and countermeasures mentioned above in the new food and automobile industry clusters, incorporating productivity increases by agglomeration effects in the aforementioned six categories, as shown in Table 2.8.Footnote 27

6.2 Simulation Designs and Results

6.2.1 Simulation Designs

In this section, we implemented five simulations based on the above scenarios. First, we implemented a simulation based on the Base Scenario as the “Base Simulation for the Great Earthquake.” Second, we implemented a simulation based on the scenario for supply chain disruptions under Base Simulation as “Simulation I.” Third, we implemented a simulation based on the scenario for fiscal measures in a reconstruction under Base Simulation as “Simulation II.” Fourth, we implemented a simulation based on assumptions about fiscal measures for reconstruction and commodity-grade product under Base Simulation as “Simulation III.” Finally, we implemented a simulation based on assumptions about fiscal measures for reconstruction, commodity-grade products, and productivity increases under Base Simulation as “Simulation IV.” Simulations II, III, and IV are simulations for the formation of an industry cluster and industrial agglomeration under Base Simulation. The contents of these simulations are summarized in Table 2.9. In this Table, each factor marked with a “〇” is incorporated in the above simulations.

6.2.2 Simulation Results

Simulation results of changes from base value in 2005 are shown in Tables 2.10 and 2.11. First, we examine real GRP, the equivalent variation (EV) , and the volume of unemployment for disaster-affected and non-disaster regions, under the Base Scenario for the Great Earthquake. Because of the earthquake, real GRP for the disaster-affected region declines to 3.86%, and in the non-disaster region it decreases to 1.31%. EVs for disaster-affected and non-disaster regions go down by roughly one trillion yen and 4.7 trillion yen, respectively. Changes in unemployment in the disaster-affected region rise to 8.21% compared with before the earthquake, while in the non-disaster region, it declines to 1.29%. In Table 2.11, production volume in the disaster-affected region shows a decline, from 2% to 6.7%, while in the non-disaster region , it also decreases by approximately 1%.

Looking at the industry’s rate of change in production volume in Simulation I with its disrupted supply chains (semi-core parts ) under Base Simulation, production volume in the automotive and electronic devices and parts industries in the non-disaster region drop by 1.05% and 0.75%, respectively, compared with 1.04% and 0.73%, respectively in the Base Scenarios shown in Table 2.11. Therefore, we regard the difference between Simulation I and the Base Simulation as supply chain disruptions .

Next, we evaluate fiscal measures for reconstruction and economic recovery under Base Simulation (after the earthquake), as shown in Simulation II, using indexes from Table 2.10. In Simulation II, real GRP in the disaster-affected region improves by 1.72% points and EV also gains 989 billion yen compared with the Base Simulation. Real GRP for the non-disaster region drops by 0.08% point and EV loses 500 billion yen compared with the Base Simulation. This explains why fiscal support is funded by a portion of locally allocated tax grants distributed to the non-disaster region. The employment level in the disaster-affected region improves, with unemployment decreasing by 48% points compared with the Base Simulation. In the non-disaster region, unemployment worsens, rising to 0.72%. Regarding production volume in the disaster-affected region in Simulation II, as shown in Table 2.11, each industry’s production volume rate of change is uneven. The food and beverage, construction, motor vehicles and parts, and other tertiary industries recover. In particular, the construction industry’s production records a robust increase of 33.9%, and the automotive industry’s production rises to 7.37%. However, excluding the four mentioned above, most industries show worse results . In particular, production in the electronic devices and parts and fishery industries decreases by 6.98% and 6.77%, respectively. Because of these fiscal measures, imports from the non-disaster region increase and exports decrease due to commodity price increases in the disaster-affected region .

Finally, we evaluate the impact of the formation of an industry cluster from the results of Simulations II, III, and IV. In Simulation IV, based on assumptions about fiscal measures for reconstruction, commodity-grade products, and productivity increases for the full formation of a new industry cluster under Base Simulation, real GRP in the disaster-affected region improves by 2.15% points and EV also gains 1107 billion yen compared with the Base Simulation. Real GRP for the non-disaster region drops by 0.09% point and EV loses 531 billion yen compared with the Base Simulation. From the difference between Simulations III and IV for real GRP and EV, we see that Simulation IV outperforms Simulation III in the disaster-affected region because of productivity increases in the new food and automobile industries clusters. Thus, we regard the difference between Simulation III and Simulation IV as a productivity increase by agglomeration effects. In contrast, from the difference between Simulations II and III for real GRP and EV in the disaster-affected region , we find that real GRP is higher by 0.01% point, EV improves to 47.8 billion yen, and unemployment decreases by 2.7% points compared with Simulation II. This is because of the introduction of commodity-grade products. Therefore, we regard the difference between Simulation II and Simulation III as commodity-grade products for intermediate goods and differentiated products for final goods in the formation of industry clusters.

Looking at industries’ production volume rate of change in Simulations II, III, and IV in detail, for the disaster-affected region in Simulation III, most industries’ production volume rate of change, excluding the construction and automobile industries, declines compared with Simulation II, despite commodity-grade products in the food and beverage and electronic devices and parts industries. Often, commodity-grade products increase imports and lower exports. However, the reason for the construction industry’s production volume increasing was higher investment demand in the disaster-affected region. Savings rise with higher income transfers from the non-disaster to the disaster-affected region due to the inter-regional current account balance. Therefore, even if products in the disaster-affected region had become commodity-grade under fiscal measures, the production volume of most industries would have declined. However, in Simulation IV, for the full formation of industry clusters, industrial productivity rose compared with Simulation III, and due to the formation of the two industry clusters, all industries’ production volumes recovered. In particular, the food and beverage industry’s production increased by 1.47% points compared with a 3.38% drop in Simulation III, and the automotive industry’s production increased by 1.02% points compared with an 8.31% drop in Simulation III. In addition, real GRP for the disaster-affected region in Simulation IV recovered by 0.43% point compared with Simulation II. As a result, the difference between real GRP in disaster-affected and non-disaster regions declines by 0.31%, from 2.55% in the Base Simulation.

These simulations showed that the formation of these two industry clusters with productivity improvement in a disaster region has a positive effect on real GRP and economic welfare in these regions, reducing the economic welfare gap between disaster and non-disaster regions.

7 Conclusions

In this chapter, we have examined the economic and human damage inflicted on Iwate , Miyagi, Fukushima, and Ibaraki Prefectures by the Great East Japan Earthquake, as well as the devastation caused in Fukushima Prefecture by the nuclear power plant disaster . We used various materials, including industrial production indices, Fukushima prefectural statistics, and surveys done by the Tohoku Bureau of Economy, Trade and Industry. In the latter part of this chapter, we have shown the extent of fiscal transfers to date from the government for reconstruction and renewal in the stricken areas. In addition, we analyzed the economic effect of the formation of industrial clusters using a static two-regional computable general equilibrium (2SCGE ) model and found that (1) if production subsidies to support industries form industry clusters, positive effects on regional economies could appear in disaster regions; however, these impacts will be weak and (2) formation of industry clusters with productivity improvement has a positive effect on real GRP and economic welfare in these regions, reducing the economic welfare gap between disaster and non-disaster regions.

Leaving aside the areas affected by the nuclear power plant catastrophe, fiscal recovery measures exceeded 20 trillion yen. Stricken prefectures and industries achieved steady recovery in the affected regions (with some differences in degree) compared to the pre-earthquake situation. However, almost 5 years after the earthquake, except for areas affected by the nuclear power plant incident, the livelihood of residents in the tsunami-hit areas in Iwate and Miyagi Prefectures has yet to stabilize despite some recovery of regional industries. While there are limits in extrapolating from prefecture-level, macroeconomic statistics, and reconstruction budget s, unless these two gaps are filled, one cannot claim to have done an economic analysis of the recovery from the earthquake.

Starting from Chap. 3 in this book, we will construct an inter-regional SAM, integrating various statistics such as prefecture-level input–output tables and reports on prefectural accounts, and conduct multiplier analysis. Based on this inter-regional SAM, from Chaps. 4, 5, 6 and 7, we will construct a dynamic regional computable general equilibrium model and empirically analyze the long-run impact of fiscal measures and industrial clusters on regional economies in Tohoku. Furthermore, in Chaps. 8, and 9, we will analyze the impact of a biogas electricity power plant and population decline on prefectures due to the Great East Japan Earthquake using an inter-regional input–output model. In addition, using a new economic geography (NEG) model and a dynamic regional CGE model, we will empirically analyze the massive economic impact , primarily on the affected areas, of the Nankai Megathrust Earthquake and the Tokay Earthquake in Chaps. 10, 11, respectively. Finally, we will analyze the impact of the Indian Ocean tsunami on Indonesia and the process of reconstruction and rehabilitation in Asia in Chap. 12.

Notes

- 1.

- 2.

See Nikkei Shimbun from March 19, 2011 and March 26, 2011.

- 3.

For a rigorous spatial econometrics analysis, see Sect. 2.4.

- 4.

The one city, six towns, and three villages are Minami Soma City, Hirono Town, Naraha Town, Tomioka Town, Okuma Town, Futaba Town, Namie Town, Kawauchi Village, Katsurao Village, and Iitate Village. We define these municipalities as those affected by the nuclear power plant meltdown. The population of this area, as of March 2014, is approximately 13,600.

- 5.

We shall analyze the depopulation stemming from the disaster in detail in Chap. 9.

- 6.

- 7.

The first author, Tokunaga, obtained fruitful advice at a spatial computation seminar by Professor L. Anselin held at Arizona State University in 2011 Dec.

- 8.

Moran’s I is defined as \( I=\frac{n}{S_0}\frac{\sum_{i=1}^n{\sum}_{j=1}^n{w}_{i,j}{z}_i{z}_j}{\sum_{i=1}^n{z}_i^2} \). Here, \( {\mathrm{S}}_0={\sum}_{i=1}^n{\sum}_{j=1}^n{w}_{i,j} \), z is deviation from the average value of feature i (which refers to the location of each region), wi , j is a spatial weight (which shows the relation of proximity between regions i and j ), n is the total number of regions, and S0 is the sum of all spatial weights. The z score of Moran’s I is defined as \( {\mathrm{z}}_{\mathrm{I}}=\frac{I-E\left[I\right]}{\sqrt{V\left[I\right]}} \). Here, E \( \left[I\right]=-\frac{1}{n-1} \) and V[I] = E[I 2] − E[I]2 (regarding Moran’s I and the spatial econometrics, see LeSage and Pace 2009; Anselin L 1988; Arbia 2014).

- 9.

We used “area-to-point kriging” in the geographical data system ArcDIS10.3.

- 10.

In this section, we analyze the impact of decreases in employment due to the earthquake on production, but in Ch. 3.4., the impact on production from private capital stock loss is elucidated according to the SAM multiplier analysis. Moreover, in Ch. 9, we analyze the impact of decreases in population due to the earthquake on regional economics, and in Ch. 10, we analyze population movements due to the earthquake.

- 11.

Here, we consider the index showing this clustering to represent the degree of recovery in the production aspect by individual firms.

- 12.

In this section, in measuring Moran’s I of the GWR model, we used the reciprocal of the distance; however, further improvement is necessary. Note that we cannot compare with Fig. 2.7 for 2011 and Fig. 2.8b for 2012 as we use the different data of “Economic Census” for 2011 and “industrial statistical surveys” for 2012.

- 13.

In Chap. 4 of this book, along with the analysis of supply chain disruption due to the Great East Japan Earthquake in the electrical/electronics/automotive industries, we also analyze economic recovery by the formation of new industrial agglomeration. This is also discussed in Sect. 2.6 below and in Chap. 6.

- 14.

For input–output models at the regional level, see R. Miller and P. Blair (2009, in Chap. 3).

- 15.

An inter-industry relations table, with two regions of the four prefectures hit by the Stricken and other areas, was provided by Prof.Yoshifumi Ishikawa of Nanzan University.

- 16.

Please refer to the macro SAM based on this SAM, shown in Table 3.1 in Chap. 3.We partially modified the SAM to satisfy the homogenous zero prices in our model.

- 17.

The authors, Tokunaga and Okiyama, attended EcoMod Modeling School: Advanced techniques in general equilibrium modeling with GAMS (Singapore, 2011 and 2012) and obtained useful advice there. For the spatial CGE model, see Dixon and Rimmer (2002), Tokunaga et al. (2003), Hosoe et al. (2010), EcoMod Modeling School (2012), and Okiyama et al. (2014). For 2SCGE model in detail, see Appendix 1 of this book.

- 18.

- 19.

For the long-run equilibrium, see Fujita and Thisse (2013, pp. 297–298).

- 20.

- 21.

Especially, we calibrate the parameter of the CES production function for the intermediate goods and adopt the value of the inter-regional elasticity of substitution for intermediate goods in the CES function as commodity-grade products policy simulation of industry cluster in Sect. 2.6 and Chap. 6.

- 22.

- 23.

- 24.

- 25.

- 26.

- 27.

For the emergence of industrial clusters in equilibrium, see Fujita and Thisse (2013, pp. 375–379).

References

Anselin L (1988) Spatial econometrics: methods and models. Kluwer Academic Publishers, Dordrecht

Arbia G (2014) A primer for spatial econometrics: with application in R. Palgrave Macmillan, Hampshire

Baldwin R, Krugman P (2004) Agglomeration, integration and tax harmonization. Eur Econ Rev 48:1–23

Belleflamme P, Picard P, Thisse J (2000) An economic theory of regional clusters. J Urban Econ 48:158–184

Cabinet Office (2014a) Basic policies for the economic and fiscal management and reform 2014-from deflation to an expanded economic virtuous cycle (in Japanese). http://www5.cao.go.jp/keizai-shimon/kaigi/minutes/2014/0624/shiryo_01.pdf

Cabinet Office (2014b) Japan revitalization strategy as revised in 2014 (in Japanese). http://www5.cao.go.jp/keizai-shimon/kaigi/minutes/2014/0624/shiryo_02_1.pdf

Dixit A, Stiglitz J (1977) Monopolistic competition and optimal product diversity. Am Econ Rev 67(3):297–308

Dixon PB, Rimmer MT (2002) Dynamic general equilibrium modeling for forecasting and policy. North-Holland, Amsterdam

Duranton G, Martin P, Mayer T, Mayneris F (2010) The economics of clusters. Oxford University Press, Oxford

EcoMod Modeling School (2012) Advanced techniques in cge modeling with gams global economic modeling network, Singapore, January 9–13

Ellison G, Glaeser EL (1997) Geographic concentration in U.S. manufacturing industries: a dartboard approach. J Polit Econ 105(5):898–927

Fujimoto T (2011) Supply chain competitiveness and robustness: a lesson from the 2011 Tohoku Earthquake and ‘Virtual dualization.’ MRC (Tokyo University Manufacturing Management Research Center) Discussion Paper Series, 354 (in Japanese)

Fujita M, Hamaguchi N (2011) Japan and economic integration in East Asia: post-disaster scenario. RIETI Discussion Paper Series, 11-E-079

Fujita M, Hamaguchi N (2014) Supply chain internationalization in East Asia: inclusiveness and risk. RIETI Discussion Paper Series, 14-E-066

Fujita M, Thisse J (2002, 2013) Economics of agglomeration: cities, industrial location, and globalization, 2nd edn. Cambridge University Press, New York

Fujita M, Krugman P, Venables AJ (1999) The spatial economy: cities, regions, and international trade. MIT Press, Cambridge

Hamaguchi N (2013) Impact of the great East Japan earthquake on local industries: synthesis and analysis from a survey. RIETI Discussion Policy Discussion Paper Series, 13-P-001 (in Japanese)

Head K, Mayer T (2004) Market potential and the location of Japanese investment in the European union. Rev Econ Stat 86(4):959–972

Helpman E, Krugman P (1985) Market structure and foreign trade. MIT Press, Cambridge

Henderson JV (1988) Urban development: theory, fact and illusion. Oxford University Press, Oxford

Hosoe N, Gasawa K, Hashimoto H (2010) Textbook of computable general equilibrium modeling. Palgrave Macmillan, New York

Ishikawa Y (2014) Economic impacts of population decline due to the great East Japan earthquake using an inter-regional input-output approach. In: Tokunaga S, Okiyama M (eds) Reconstruction the disaster-affected region of the great East Japan earthquake and recovery of the regional economy. Bunshindou, Tokyo, pp 219–238. (in Japanese)

Ito H (2008) Interregional SAM model and structure path analysis focusing on institution sector. J Commer Sci Kwansei Gakuin Univ 56(1):33–70. (in Japanese)