Abstract

The trajectory of output growth, more precisely economic growth and its interaction with other phenomena of an economy follows a complex path. Among many phenomena the one that has caught the world attention at large scale especially since the work of Piketty and Saez is the “Rising Inequality in Incomes”. Though for some countries like India there was a reduction in the poverty level, there seems no positive bearing on economic growth in improving income distribution for past two decades. In this paper, we have used ARDL cointegration approach to analyze the relationship between income inequality (EHII, from UTIP-UNIDO) and its various determinants from 1964 to 2007. Besides using data on Estimated Household Income Inequality (EHII), we have used income share of top 1% as an alternative measure of inequality. Our results reveal no relevance of Kuznets Hypothesis, instead, the relationship is U-shaped in nature, implying that with the initial rise in GDP per capita inequality decreases, later on as GDP increases, inequality tends to increase. Among the control variables, CPI (price level) is found to be positively and Government expenditure negatively related to inequality, while trade openness showed no significant relationship.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

1950s marked the beginning of the post-colonial era of development in Asia and Africa. From the start of this period, a new area took its birth in the economic sphere with a more universal appeal, “economics of growth and development”; with initial years focusing on the development of growth models and structural disequilibrium theories. A pause in the process came almost for some 30 years before a new shift was made towards endogenous growth theories that focused on the importance of human capital and multidimensional aspects of development with priorities to social welfare and equal opportunities for all. During the same period failure of the state as an organ to provide maximum welfare to the individuals of the society came under a severe attack and new consensus developed to minimize the role and functions of the state with high resolution for individual liberties. New thoughts and philosophies developed since the 50s’ to look deeply toward the issues directly or indirectly, obstructing or harmonizing the living standards of people. In the initial years, great discourse arose with respect to convergence theory that made economists and policy makers put bullet emphasis on the growth of the national product especially in case of impoverished countries. This emphasis on growth of national product was backed by economic logic of narrowing down the high disparities in terms of different characteristics between the nations and regions of the world. But with the passage of time, it was realized that high growth rates and an increase in the GDP per capita provide no guarantee of trickle-down effect. So new aspects were defined and derived to look into the broad issues of development in combination with the process of growth, new dimensions got established to look towards links and lines that can help to broaden the prosperity of the deprived lot.

The trajectory of output growth, more precisely economic growth and its interaction with other phenomena of an economy follows a complex path. Eicher and Turnovsky (2003) from the paper titled “mechanics of economic development” of Robert Lucas (1988) deduced that, “The nature of growth is such that the welfare implications of small (and possibly simple) policy changes can be staggering. Even minute increase in the growth rate can compound into dramatic changes in the living standards over just one generation. However, the precise nature of such growth enhancing policies is often elusive, which highlights that the execution of such policies presupposes a clear understanding of the mechanics of economic growth.”

Though every economy in the world is a composite of a number of dynamic and static phenomenon and structures, some processes are such, any extreme outlier can have a devastating effect on the lives of the people, and can give rise to political and social instability. Among many phenomena, the one which has caught the world attention at large scale especially since the work of Piketty and Saez, is the “Rising Inequality in Incomes” especially in the countries which on an international platform were identified as highly developed economies. These developed economies served as the role model and mantra to be followed with respect to policy strategy and economic thinking for decades. Piketty and Saez with the help of tax data available for different countries created a dataset showing the income shares of the top tail of distribution for a very long period. The dataset on incomes of the top percentage of the population shows clearly a rising trend in inequality from almost past 30-year period. One can easily identify the severity of inequalities by looking towards the Gini Coefficients as calculated by the OECD for some of the highly developed countries of the world. For the USA, the Gini index stands at 38 followed by UK, Australia, Canada and France with coefficients 35, 33, 32, and 30, respectively, coming very close to some of the least developed countries of the world. Recently the much talked, discussed, debated, and reviewed, taken as the master class in the twenty-first century namely “Capital in the Twenty First Century” book by Piketty (2014), is wholly concerned with the evolution and level of the incomes of the top income groups especially top 1%. Piketty has shown that the rate of the growth of capital being more than the income growth over time is mainly responsible for the growth of large disparities in incomes.

Even the recent trends for some developing economies are now taking a shift, showing tendencies for an increase in the level of the inequalities with the process of development especially with respect to the third largest economy in the world, India. Many studies show that there is a clear indication that income inequalities have once again started to move in an upward direction. Thus, different questions have been raised about the ongoing development strategy and the forces that are working in the economic sphere to accentuate this dynamism. This study will mainly focus on the dynamics of income distribution, more correctly tries to investigate the movements in the degree of income inequality with respect to various economic forces that have their share in influencing the noisy process of income inequality as revealed by the past research findings.

2 Why Care About Inequality?

Here various big questions can be raised why to think of inequalities? What a common man has to do with this phenomenon? Why will a country prioritize inequality as a policy issue in its objectives? Why at international level slogan is raised to look towards growing inequalities within countries and regions? Why not put more emphasis to have high GDP per capita growth rates such that it will take care of other dimensions of the economy? DeSa, U.N. (2013: 25) mentions that, the domination of the debate on inequalities in income, wealth, and consumption is not only because they directly affect the well-being of individuals and society, they also obstruct the opportunities that people can enjoy in their future. There are many studies that talk about the merits of economic inequalities. One among them is that it provides an incentive to work hard and thereby help in pushing the growth rates upward. To look into the matter clearly regarding this shift in the concern with respect to the economic forces involved, one must be familiar with the negative consequences of the rising disparities. Better is to mention some important negative consequences that researchers have found out and which affect the social welfare from one side or the other. Inequality can generate socio-political instability (Alesina and Perroti 1996). It gives rise to economic distortions and disincentives (Alesina et al. 1994; Persson and Tabellini 1994). It can give an evolution to Rent Seeking and Corruption and can increase macroeconomic volatility (Stiglitz 2012). Reduces overall average investment especially in human capital (Galor and Tsiddon 1996). At the world level according to Ranciere and Kumhof (2010), one of the main cause behind the Great Depression of 1930s and Recession of 2007 was the uneven distribution of income. With the increase in the incomes of the top income group before crisis, for poor and middle-income group there was an increase in debt–income ratio.

The above-mentioned consequences in all decrease the living standard of the bottom section of the society and which can directly hamper the growth of income over the long period of time especially in the case of developing countries which contain a heavy chunk of the poor population. So the need of the hour is to find the cause or more specifically factors that affect the distribution of income positively or negatively to a great extent. The foundation for seeing that cause was almost laid by Kuznets (1955).

3 Kuznets Hypothesis

In his path-breaking work Simon Kuznets started with some basic and fundamental questions, “Does inequality in income distribution increase or decrease in the process of a country’s economic growth? What factors determine the secular level and trends of income inequalities?” (Kuznets 1955). In his seminal paper, which Kuznets presented while addressing American economic association, with the help of time series data for the United States, England and Germany and of cross-sectional data involving these three countries as well as Ceylon, India, and Puerto Rico, Simon Kuznets speculated that in the process of economic development, the income inequality usually upsurges during the initial phase, followed by levels off, and finally falloffs during the advanced stage. This relationship later came to be known as Kuznets inverted-U hypothesis. Though there were constraints in terms of availability of a sufficient and reliable data set which Kuznets himself admits, using his intellect he was successful to a great extent to be admired for carrying this great task. He used the ratio of the income of top 20% to that of the bottom 60% of the population (later on came to be known as Kuznets Ratio) as a measure of inequality. He found that this ratio (Kuznets Ratio) for India, Sri Lanka, and Puerto Rica were higher in comparison to the US and UK.

Also in his other study, Kuznets (1963) got further support for his inverted-U hypothesis, which involved finding wide inter-sectoral differences in per capita incomes in the less developed countries caused mainly by the disparities in income per worker between the agricultural sector and the nonagricultural one. A study carried out by Oshima (1962) predicted the same relationship.

Kuznets himself gave the explanation for this phenomenon, by suggesting the presence of a dualistic model which to a large extent is related to the traditional model put forward by Lewis as a model of dualism, “Unlimited supply of labor” (1954). The basic logic behind the whole process provided by Kuznets is that of urbanization and industrialization; as in most underdeveloped economies large proportion of population is involved with the traditional agricultural sector, in the beginning of the economic development, due to higher growth and high level of incomes in the modern industrial sector, the labor force shifts or migrates from the depressed sector to the modern sector, which leads to increase in income inequality as large difference occurs in the mean income levels between the two sectors (Wolff 2009). There are several causes in operation that bring down the level of income inequality. “One of them is the heavy absorption of the labor force by the modern sector. Also because of the migration of people from agriculture to industry, there will be a decrease in the pressure on land, which will lead to increase in incomes of people associated with agriculture. Moreover, within modern sector expansion of education will also result in equal distribution of skills which can help in improving the distribution of income” (Wolff 2009).

Taking per capita income as a gauge of development, though suffers from different limitations of its own, as a good indicator of development, and plot it on the X-axis and some measure of income inequality (e.g., m) on the Y-axis, the plot formed on basis of Kuznets hypothesis looks like an inverted “U” called as Kuznets curve (Fig. 3.1) and accordingly the hypothesis named as Kuznets Inverted-U Hypothesis.

The bond among economic development and inequality is complex. Studies have confirmed that the fruits of economic growth did not operate in such a way to have a trickle-down effect. Though for some countries like India there was a reduction in the poverty level, there seems no positive effect of rising output growth on improving the distribution of income in the past two decades. As pointed by Chakravarty (1987) while speaking about the development policy and planning strategy followed in India after independence noticed that “there was a tolerance towards income inequality, provided it was not excessive and could be seen to result in a higher rate of growth than would be possible otherwise.”

There was a gradual shift in the policy strategy from socialist to a market-oriented one in case of India from mid 1980s. From the 1990s, a new turn developed with an accelerated speed of reforms concerning the whole structure of the economy by which the focal point hauled away from state intervention towards liberalization, privatization, and globalization. From academic point of view the change in the policy and planning strategy gave rise to different schools of thought categorically comprising the one who praised reforms with their own judgment of the benefits accrued from the adjustment based on analysis of the better performance of the macro indicators of the economy especially the rise in the GDP and the decrease in the level of poverty. On the other side of the game a broad group of intelligentsia came to the forefront that raised their voice against the vices of the reforms, it gave rise to the “Great Indian Debate on Poverty” which challenged the estimates that were showing a great decline in the poverty levels. The debate does not remain concentrated with the poverty issue; great attention was paid to the next big menace of “Inequality” as both shares a positive link and a kind of interdependence. The estimation of both rural and urban inequality, as well as national inequality in the case of India, rests on the household consumption expenditure surveys of NSSO. A large body of literature is available which have tried to explain regional disparities, rural–urban gap, and inequality in the case of states and also at the national level. This study will add the existing literature by using cointegration approach to analyze the relationship between inequality and its various determinants with the help of time series data.

Very few studies are in existence in the case of India, which has studied the phenomenon of income inequality and its various determinants on a longitudinal base. The reason is mainly that of the unavailability of time series data. This study will make use of the time series data estimated by Galbraith et al. (2014) under UTIP-UNIDO project and also will focus on how the income of top 1% is related to determinants of inequality

Mainly we will focus on;

-

To investigate the relevance of Kuznets U hypothesis in case of India.

-

To assess the direction and degree by which government expenditure, price level, and trade openness affect the income distribution.

-

To investigate the relationship between the income of top 1% of population and government expenditure, real GDP per capita, trade openness and price level.

4 Review of Literature

The empirical work carried out by Kuznets (1955), though controversial, became the base and the reference work for further research on the subject. Thereafter, research was carried out to analyze how the level of development affects the personal distribution of income and what other factors work in the economy that have their influence on the rising or falling of income inequality. Ahluwalia (1976) used multivariate regression to estimate cross-country relationship for a sample of 60 countries including 40 developing, 14 develop and six socialist countries. Modeling two separate equations one for full sample of 60 countries controlling for socialism by introducing dummy variable in order to capture higher degree of equality observed in socialist countries and another restricted to 40 developing countries by regressing inequality measured as income share of the lowest 40 and 60%, and top 20% of population on per capita GNP and other related variables he found a strong support for Kuznets hypothesis. Using internationally comparable data set for 32 countries both developed as well developing on the household income distribution, Ram (1988) with the help quadratic regression model where real per capita income was put in log form, found some empirical support for the inverted-U hypothesis. Anand and Kanbur (1993a, b) studied Kuznets hypothesis and the underlying pattern followed by Kuznets process when different indices are used to measure inequality. Using Ahluwalia’s data set they (Anand and Kanbur) did not find such type of relationship as was visualized by him, so from their results they inferred that the Kuznets relationship is missing. A lasting contribution in the area of studying development and inequality nexus came from Deininger and Squire (1996, 1998) in the form of compilation of a panel dataset for a vast majority of countries of the world which provided a new enthusiasm for the future research in this field by making use of panel and time series models to analyze the stylized hypothesis for individual countries based on almost a reliable dataset. Making use of their data set they failed to establish the very link in the vast majority of countries. They found little support for Kuznets hypothesis as either it was too flat to be noticeable or irrelevant for developing countries.

To overcome the limitation of parametric regressions, there are some studies which by using different econometric techniques have come with mixed support for Kuznets hypothesis. Among many studies, Ogwang (1994), Mushinski (2001), Frazer (2006), Zhou and Li (2011) used nonparametric and semiparametric regression and Lin et al. (2007) using parametric quantile regression model found mixed support for Kuznets hypothesis. Besides that many researchers used different models and made use of different macro variables which can influence the distribution of income. Daudey and Gracia-Penalosa (2007) taking a diversion from the previous studies, analyzed how the factor shares or rewards affect the personal distribution of income, showed that a higher labor share is associated with a lesser inequality. Angeles (2010) taking a new direction, used employment outside agriculture as the main regressor to test the Kuznets hypothesis using panel data, he does not find any support for Kuznets hypothesis. There are studies which are mainly country specific which also show variance in results. Based on surveys from 1975 to 1998 analyzing increasing inequality in Thailand, Motonishi (2006) in case of South Korea between 1975 and 1995 Sato et al. (2009) found limited support. Ho-chuan et al. (2012) reassessed the rationality of the Kuznets hypothesis with the help of alternative test strategy of Lind and Mehlum (2010). The empirical results overwhelmingly reject the inverted U relationship. To analyze the influence of urbanization on expenditure inequality in Indonesia, Sagala et al. (2013) performed panel data regression analysis in case of 33 provinces of Indonesia from 2000 to 2009. They found an inverted U relationship exists whether Gini coefficient or Thiel’s index is used.

Bahmani-Oskoee and Gelan (2008) by data from 1957 to 2002 for US with the help of Cointegration and Error Correction Modeling techniques found that in short-run economic growth worsens income inequality and in long run it leads to reduction in income inequality. Shahbaz (2010) explored the relationship considering other factors also for Pakistan with the help autoregressive distributed lag model (ARDL) and error correction model (ECM). The results revealed that there exist support for Kuznets curve, and when the cubic term was used for lnGDP per capita, the results confirmed the occurrence of inverted S-shaped curve. For other variables related to inequality measured in terms of Gini coefficient, he found that HDI and unemployment seem to increase inequality and urbanization decrease inequality in the long run. Similarly, literacy rate, life expectancy, and FDI showed a worsening impact on the distribution of income. Investigating Chinese economy from 1978 to 2011 Cheng and Wu (2014) employed ARDL technique of Pesaran and Shin (1998) and identified an inverted relationship in terms of both Theils index as well as Gini coefficient. They found urbanization as the main driving force behind the relation which was captured by way of including a square term for urbanization in the model. In a panel of 31 countries divided into lower middle, upper middle and higher income countries covering period from 1990 to 2011, employing General Method of Moments (GMM) Lim and Kun Sek (2014) found only a one-way relationship between inequality and growth. It is growth that affects inequality positively and significantly with respect to high-income countries, no effect from the results was seen of inequality for all the groups. Regarding India, to examine the validity of Kuznets hypothesis for Indian Economy, Sinha (2004) investigated the relationship between inequality and per capita income during the period 1980–81 through 1997–98. Based on the data from Ahluwalia (2000) for interstate inequality and Rao et al. (1999) for national inequality measured in terms of Gini coefficients, found that there exists an augmented Kuznets curve in the form of S-shaped relationship between inequality and growth rather than U or inverted U. In a working paper, Pal and Ghosh (2007) surveyed comprehensively about the recent trends in the inequality in India. Though different studies carried out on basis of NSSO data revealed a mixed evidence about the aggregate and regional trends in inequality, but after careful analysis they came to the conclusion that after economic liberalization in the 1990s, there seems evidence regarding the increase in inequality (horizontal as well a vertical) as well as persistent poverty.

In order to investigate how financial development and financial reforms affects inequality measured in terms of Gini coefficient, Ang (2010) using time series data for India estimated that underdevelopment of the financial system results in higher income inequality. Taking the same stand like Ang (2010), from a different perspective Tiwari et al. (2013) investigated, how financial development and its square term capture the inverted relationship in India and its effects on rural–urban inequality. They used ARDL approach for the annual data from 1965 to 2008. The study revealed that financial development, economic growth, and inflation have a negative and highly significant bearing on rural–urban inequality, meaning that these factors aggravate rural–urban income inequality. In the short-run output growth and inflation lower rural–urban income inequality and trade openness increases it. A brief and careful review of relevant literature and analysis of empirical studies shows that there does not exist any clear evidence; one can put forward to get a perfect support for the inverted-U hypothesis. What we have seen is that empirical findings vary a lot from study to study. As our study will mainly focus India, we have seen a dearth in terms of time series analysis of the relationship between inequality and its various determinants.

5 Methodology and Model Specification

5.1 Variables Description

5.1.1 Trade Openness (TO)

It is simply computed as the ratio of the sum of total exports and imports, to the gross domestic product of a country. There is a straight positive connection between trade liberalization and trade openness. The reforms of the 1990s in India laid down also different procedures to increase the domestic economy’s integration with the rest of the world and make a roadway towards competition instead of protection. Though from the beginning, the process of liberalization came under criticism from different thinkers and researchers, according to whom it was not the right time for the country to adopt such a regime in the backdrop of the low living standard of more than half of population. Before focusing on local studies, it is better to understand the framework that the economic theory builds in order to analyze how trade affects the country’s income distribution. From the very basic theory, an increase in international trade increases the relative share of abundant factor (Stolper and Samuelson 1941). From this perspective, one can hope that India being a labor-abundant country, trade liberalization must have led to increase in the wages especially of unskilled labor, so a decrease in wage inequality might have happened in the context of the theory. Bensidoun et al. (2005) found that trade has a negative effect on poor because most exporting firms use educated labor. In case of India Kumar and Mishra (2008) while analyzing the impact of 1991s trade liberalization on the industry wage structure found that it has a positive bearing on the relative incomes of the unskilled labor. On the basis of their findings, they came to the conclusion that trade liberalization has led to a decline in wage inequality.

The interest in analyzing the effects of trade liberalization got further momentum when some studies found that income inequality in 90s has increased especially during 1994 and 2000. Krishna and Sethupathy (2011) using Thiel’s index with respect to different states of India found that both tariff and nontariff measures of protection were uncorrelated with income inequality. According to them, though trade can have a positive impact on income distribution and abundant factor can receive an increasing share but certain factors may come in the way that can disturb this process. As different regions vary in terms of development levels, so there can exist differences in terms of access to trade, which can give way to increase in regional inequalities. Also as in the case of developing economies, there exists a restricted mobility in factors of production, that in turn can create allocative inefficiency. Thus the benefit of trade, in that case, cannot be harmonized. There may also exist economies of scale which can lead to the problem of agglomeration and fruits of economic progress in such case can get concentrated within some narrow area and other regions may fall back to keep track with developing regions in such instance. Such type of examples can be clearly noticed in the context of India where some states enjoy a kind of hegemony in terms of the industrial base and all other states with differences are lagging behind. To comment further on the issue of trade liberalization and its influence, better is to keep in mind what Baghwati and Srinivasan (2002, p. 7) have said about the issue;

While freer trade, or “openness” in trade, is now widely regarded as economically benign, in the sense that it increases the size of the pie, the recent anti-globalization critics have suggested that it is socially malign on several dimensions, among them the question of poverty. Their contention is that trade accentuates not ameliorates, deepens not diminishes, poverty in both the rich and the poor countries the theoretical and empirical analysis of the impact of the freer trade on poverty in the rich and in the poor countries is not symmetric, of course.

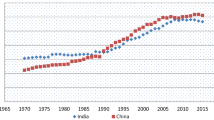

So to serve the purpose we will also include it as a control variable in order to analyze its impact with respect to the national inequality level. As an explanatory variable, it is first better to look how its dimension has changed over the period of time and at what pace it has moved. For that, it is better to look it in Fig. 3.2, as can be visualized almost up to 1990 the process was almost static, with the reforms a dynamic change occurred which over the period of time has moved at an accelerated speed supported by the policies of ease followed by the government from time to time.

5.1.2 Consumer Price Index (CPI)

Prices play a vibrant role in shaping the structure and process of the dynamism of the economy. One of the important objectives of the monetary policy of any country is the stability of prices and accordingly, policies from time to time are designed to check their diversion from the viable path. Prices act as a conditioning variable to transform nominal incomes into a particular utility or welfare level. So any movement in them can affect the welfare of households positively or negatively given the income level of households. In another way, they show the real value of the money income of a person theoretically defined as purchasing power. One limitation in case of prices as a better indicator of the welfare level of the individuals is because of the differences that exist in terms of the differing pattern of expenditure of households (Oosthuizen 2007). In what way prices exert their influence on the income inequality, there are both positive as well as negative findings revealed by the past research. Studies by Datt and Ravallion (1998), Ferreira et al. (2007), Litchfield (2001), Blejer and Guearero (1990) showed that higher inflation worsens the income distribution by lowering the relative share of income held by the poor. Walsh and Yu (2012) analyzing the impact of inflation both food and nonfood, found that higher nonfood inflation is associated with worsening of income inequality at world level and individually for China and India also. According to him the logic behind this result is that individual household’s income can benefit from higher prices only for goods and services they produce, and there is no individual likely to be producer of a sufficiently big share of nonfood items. Looking towards Fig. 3.3, one can easily derive the conclusion that from the start there exists rising trend in prices, though the speed of trend increases clearly after the reforms as preference shifted from government restricted model to the open market one. Ravallion (2000) while analyzing the relationship between food prices, poverty, and wages in India found that food prices do not appear to have an independent effect on rural wages. From his findings, he concluded that initially food prices can hit rural households, but in long run, due to increase in rural productivity the negative effect can be mitigated and also the effect of higher prices will be neutral in situations where a perfect adjustment in wages takes place with respect to the price increase. But there are studies that suggest that wages may not fully adjust to higher food prices. Thus poor will suffer more as food has a greater share in their consumption basket (Walsh and Yu 2012).

The conventional economic theory exposes several links through which increasing prices can have an adverse effect on the income or welfare of the people. Among one of them is the reducing ability to borrow of the poor households, so due to inflation they will fail to continue the consumption at previous levels which can in broad terms accentuate the problem of inequality. Another is the saving link; with inflation the savings of individuals with low incomes may see a decline. Thus, they in no way can make productive investments, broadening the disparity between them and those at the top level of income. With respect to India, this study will try to investigate whether any such relationship between inflation and income distribution exists or not.

5.1.3 Government Expenditure (GEXP)

Throughout history, the effective working of the economy has mostly rested on the well-functioning of the institutions present within the national territorial boundaries. Almost all the economies which are viewed as market economies, one can easily visualize that in no way the design of the policies catering to the needs and the welfare of the society rests perfectly on the public institutions working side by side with the private Diasporas. However, with respect to the importance of public body, there developed a lot of differences among the scholars from time to time. Looking from the mainstream economics dimension, one can expect a less relevance to a government institution to be involved in the economic activity, and it looks great to restrict its influence within some narrow matters mostly peace and security. It was within this context Washington Consensus of 1989 came to the forefront though the emphasis on it does not come from thin air. There exist some shortcomings or cons within the government sector one can easily spot. But a clear analysis, taking the ills of free market into consideration, there exists a large empty space with respect to those dimensions which has a direct bearing on the living standards of people, giving ample room for the government sector to interfere in the economic policy designing for a country. Not pulling the stretches more, better is to look deep within the existing economic research which broadly has investigated the impact and influences that government spending or more exactly the fiscal policy can exert within the space of income distribution.

Chu et al. (2000) found that income distribution before tax is less unequal in developing countries than developed ones, but they have failed to use the revenue generated from taxes to reduce the inequality levels properly. In a cross-country study Mello and Tlongson (2003) came to the conclusion that more unequal societies do spend less on redistribution; and also the results showed that periods of sustained growth are associated with reductions in poverty but no guarantee that this will make improvements in income distribution. Fiscal policies have been significant in bringing down income inequality in advanced countries, but a decline was visualized since the reforms of mid-1990s (Bastagli et al. 2012). To see the influence of communist regime Bandelj and Mahutga (2010) while analyzing Central and Eastern Europe came with the findings that income inequality has increased after the fall of communist regime in these countries. According to them the main forces which shaped the unequal distribution include expansion of the private sector, shrinkage in redistribution, and most importantly the injection of foreign investment in the domestic market.

As the main aim of social programs is to shift the national pie towards the bottom sections of the population, Salloti and Trecroci (2013) found that government spending improves the income distribution and in the reverse fiscal consolidation deteriorates it. There exist different links through which government expenditure can affect the distribution. Among them, the important ones are health expenditure and spending on education which have much to do with the welfare of the poor sections. Without the presence of public sector in those areas, a significant disturbance will occur because private sector in no way is going to do well in providing these necessary goods at an affordable price. Much of the research shows that health expenditure and spending on education improves the distribution of income in the long run. Almost much of the differences in the wage incomes are because of the differences in the skills that to a great degree depends on the level and quality of education. Indeed due to large disparities in the income levels, much of the poor strata will fail to achieve good skills as demanded by the labor market. It is in such situation there exists a dire need for the government intervention to have a large proportion of the revenue to spend on the basic services which otherwise can distort the social structure if market intervenes. It in no way means that government expenditure in all would guarantee the increase in the welfare levels, there are models which from time to time have come on the screen and have put a red mark on the work of public authority. One among them is the breeding corruption, which overall has a negative impact on the distribution of income. The biggest fault in such case is that on welfare basis more disparity will be created by creating unearned riches for the bureaucratic class.

In this study, due to methodological concerns, total government expenditure variable (GEXP) instead of government final consumption expenditure was used. The difference between them is that the total government expenditure variable involves the later (government final consumption expenditure) and also it includes the expenditure that increases the assets of the state. So total government spending is the mixture of social spending as well as investment expenditure. From Fig. 3.4 , one can easily identify the effect of the reforms of the 1990s in the form of the decline in the total expenditure though for a short time. But it can be seen that the growth before the reforms became stagnant after the reform period. After the great recession of the 2007 new thinking has developed which has once again provided the room for the government intervention. But because of the rising deficits more emphasis are put on the fiscal consolidation in case of India. Assuming government spending as a positive factor to improve the distribution of income, this paper tries to explore the dynamics of this relationship.

6 Model Specification

This work aims to investigate the Kuznets Hypothesis in the case of India empirically. There are many techniques in econometric literature to analyze the long-run relationship among various macroeconomic factors of interest empirically. For bivariate analysis, Engle-Granger (1987), and Fully Modified Ordinary Least Square (FOMLS) (Hansen and Phillips 1990) methods are noticeable. While for multivariate cointegration, Johansen (1988); Johansen and Juselius (1990); and Johansen’s (1995) are common. All of the above techniques require that all e same order of integration. If the order of integration among variables is different, it will create inefficiency and hence affecting the predictive powers (Kim et al. 2011; Perron 1989, 1997). Autoregressive Distributive Lag Model (ARDL) or ARDL bounds test developed by Pesaran et al. (2001) approach to cointegration overcomes major limitation of the above procedures along with some additional improvements (see for the details Nain and Kamaiah 2012; Ahmad et al. 2014; Nain et al. 2017; among others) that has been used in this study. As time series data is used in this study, it is important to check for stationarity of variables before running the causality tests. The ARDL bounds test assumes that the variables should be I(0) or I(1). So, before applying this test, we determine the order of integration of all variables so as to ensure none of them is I(2) by using the unit root tests. In this study we have used conventional Augmented Dickey–Fuller (ADF) tests, the Phillips-Perron test following Phillips and Perron (1988) and KPSS, The ARDL model used in this study is expressed as follows:

where \(\delta_{i}\) are the long-run multipliers, \(c_{0}\) is the drift and \(\varepsilon_{t}\) are the white noise errors. The first step in the ARDL bounds testing approach is to estimate Eq. (3.1) by ordinary least squares (OLS) to test for the existence of a long-run relationship among the variables. To examine the presence of long-run association among variables, the below hypothesis is tested based upon F-test given by Pesaran et al. (2001). This test is simply a hypothesis of no cointegration against the existence of cointegration among the variables.

i.e., there is no cointegration among the variables, against the alternative,

i.e., there is cointegration among the variables.

In the second step, once cointegration is established the conditional ARDL \((p,q_{1} ,q_{2} ,q_{3} ,q_{4} , \ldots q_{k} )\) long-run model for \({\text{GINI}}_{t}\) can be estimated as:

The above specification is also based on the assumption that the error terms are serially uncorrelated for given specification. Therefore, it is imperative that the lag order (p) of the underlying process is selected appropriately. The orders of variables in the ARDL \((p,q_{1} ,q_{2} ,q_{3} ,q_{4} , \ldots q_{k} )\) model are selected using different information criteria widely used in the literature like Akaike Information Criteria (AIC), Schwarz Bayesian Criterion (SBC), etc.

In the final step, short-run dynamic parameters are estimated by an error correction model associated with the long-run estimates. The specification runs as:

Here \(\phi ,\omega ,\varphi ,\gamma ,\,{\text{and}}\,\eta\) are the short-run dynamic coefficients of the model’s convergence to equilibrium and \(\zeta\) is the speed of adjustment. Besides, various diagnostic tests are used to ascertain the efficiency, unbiasedness, and stability of the estimates.

In the present study, for the inequality index we will wholly rely on the dataset from UTIP-UNIDO, which contains a time series account of the augmented Gini coefficient created by the Galbraith and Kum (2005) for a number of countries. The inequality measure available exists under the name of Estimated Household Income Inequality (EHII) for a time period from 1963 to 2007. Revealing the merits of the index Galbraith et al. (2014) notes that the measure is a useful alternative to other available inequality measures from different studies; it is more steady than the collations of the World Bank and WIDER. They concluded that EHII works fine in analyzing the trend of inequality and is near to the “survey based measures as an estimate of the gross income inequality”. The only demerit according to them is that it does not capture fluctuations in capital mainly a problem in the US case. In our study, we will take EHII as Gini coefficient.

Besides that, to measure the robustness of the results to be derived from using EHII, we will use income share of top 1% as an alternate index for inequality, data for it is taken from the data set compiled by Piketty et al. available at the World Top Income Database for a period from 1973 to 1999. The list of independent variables include real per capita GDP and its Square term to capture the inverted U relationship, consumer price index to capture the effect of increase in prices as witnessed in case of India, General Government Total Expenditure to see the influence of government interference in the economy and Trade openness to measure the effect of globalization which received heavy criticism from different corners. The data for real GDP per capita with $ as a unit of measurement (RGDPC) and Trade openness as a share of GDP has been taken from Heston et al. Pen World Table Version 7.1 (2012). The data from that is accepted as a reliable source throughout the world. It gives due consideration to the difference existing between countries with respect to purchasing power parity (PPP) to measure the real GDP per capita (RGDPC). For consumer price index (CPI), annual series data with the base year 2005 has been taken from World Bank. With respect to Total Government expenditure as a share of GDP, we have totally relied upon International Monetary Fund which collects statistics on the total expenditure of the general government available within country-specific data collecting bodies. The study utilizes annual time series data from 1963 to 2007 for the variables Gini Coefficients, real GDP Per Capita, consumer price index, trade openness and general government total expenditure. But for the variable share of gross domestic product by top 1% of population data is taken from 1973 to 1998. Notations of the variables used in the study hereafter are as follows:

-

LGINI and LTOP are the measures of inequality in the model A and B respectively.

-

LRGDPC is the natural log of real gross domestic product per capita.

-

LRGDPSQ is the natural log of the square of the real gross domestic product.

-

LCPI is the natural log of the combined consumer price index.

-

LGEXP is the natural log of total government expenditure.

-

LTO is the natural log of the ratio of exports and imports as the share of gross domestic product and taken as a measure of trade openness.

7 Empirical Analysis

To assess the stationarity of the variables, we have used three alternative unit root tests viz, ADF (Augmented Dickey–Fuller), PP (Phillips–Perron), and KPSS (Kwiatkowski–Phillips–Schmidt–Shin). The results of the unit root tests are shown in Table 3.1. This is to confirm that no variable is integrated of order I(2). In case some variable is I(2), ARDL is inappropriate due to invalid calculated F-statistics (Ouattara 2004).

7.1 Model A

The testing procedure of the ARDL involves three stages. The first step involves the selection of lag order on the basis of different criteria for the selection of lag order because the value of F-statistic is very much sensitive to lag order. So lag order 4 is chosen considering lowest value of the AIC and SBC as shown in Table 3.2.

First, we took LGINI as dependent variable with LRGDPC, LGEXP as independent variables and imposed 3, 2, 2 lags, respectively, and found evidence of cointegration on the basis of calculated F-statistic of 4.959, greater than the critical level of the upper bound [see Pesaran et al. 2001 (Table CI (iii), case (III), with 3.79 I(0) and 4.85 I(1) at 0.05 level of sig.)]. The next step is to estimate parameters of the model and check for various diagnostic tests needed for a good model. Looking at Table 3.3 for diagnostic tests shows that the results are free from the problem of heteroscedasticity and serial correlation. The functional form is correct and the assumption of normality also gets satisfied.

Moreover the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMsq) tests are also done (Fig. 3.5). These figures show that CUSUM and CUSUM square statistics are within 5% confidence interval bands which indicate the stability of estimates.

7.2 Long-Run and Short-Run Coefficients for Model A

The estimated long-run coefficients using the ARDL approach are reported in Table 3.4. The results indicate that RGDPC is associated positively and is statistically highly significant with income inequality. The coefficient of government expenditure is statistically significant at 5% level with a negative sign indicating that the increase in government expenditure results in the reduction of income inequality. Thus, we can say that with the increase in the level of development in terms of GDP Per Capita there is an increase in the inequality in the long run.

With respect to short run, the estimates show a change in sign and significance at levels. At lag 1 and 2 the coefficient of LRGDP per capita shows a significant negative relationship, means that in a short run increase in lagged GDP per capita is followed by decrease in inequality. So based on short run and long-run estimates following Bahmani-Oskoee and Gelan (2008), we may conclude that in the beginning with the increase in the level of development there is a decrease in inequality, but over the period of time inequality starts to increase with the increase in the level of development. So that means there is a U-shaped relationship instead of Kuznets inverted U. In case of Govt. expenditure, the results show a significant lagged positive effect on inequality, opposite to the long-run estimates. The sign of ECM term being negative with a high level of significance provides the additional proof of stable long-run relationship (Banerjee et al. 1998; Shahbaz 2010). From Table 3.4 it is clear that the coefficient of ECMt-1 is equal to −0.261 and statistically significant at 1% level of significance. There by implying that the deviance from short run is corrected by 26.05% over each year in long run.

To fully capture Kuznets inverted U we will make use of Square of GDP per capita like previous researches (Table 3.5). Accordingly, we found that for both GDP per capita and its square estimates are insignificant. However, for govt. expenditure coefficient is once again negative and significant. The insertion of Sq. term for GDP per capita affects its significance, but the sign remains same.

Besides that, we tried to use variables like price level and trade openness as control variables as revealed from the literature to analyze how they affect income inequality in case of India. First using only price level with the GDP per capita and govt. expenditure, we find that there exists cointegration among these three variables having lag order (3 2 2 1) respectively with F-statistic equal to 4.42 F(4, 27) which is greater than the upper bound as given in Pesaran et al. (2001) at 5% level of significance [Table CI (iii), case (III), with 3.23 I(0) and 4.35 I(1), for K = 4 at 0.05 level of sig. Pesaran et al. (2001)]. Also, diagnostic tests were found satisfactory. The long-run estimates as in Table 3.6 show that price level is positively related to inequality and accordingly expenditure has a same negative effect on it as was noticed earlier. But in this case, both sign, as well as the significance of GDP per capita, has changed may be due to high multicollinearity with the CPI.

Taking trade openness (TO) also as the independent variable, we got F-statistic 4.16 with the lag order of 3,2,1,2,1 for LGini, LRGDPC, LCPI, LGEXP, and TO, respectively, which is greater than upper bound value of Pesaran et al. (2001), (Table CI(iii), case (III), with 2.86 I(0) and 4.01 I(1) at 0.05 level of sig.), thus confirms presence of cointegration. The results in Table 3.7 show the diagnostic tests for the model, all tests are satisfactory.

The estimated long-run coefficients using the ARDL approach are reported in Table 3.8. The results indicate that RGDPC is associated negatively but statistically insignificant with income inequality. The results also reveal that the consumer price index (CPI) is associated positively and significantly at 2% level of significance with income inequality. In other words, we can say that a rise in CPI leads to higher income inequality. The coefficient of government expenditure is statistically significant with a negative sign indicating that the increase in government expenditure results in the reduction of income inequality. The coefficient of trade openness is negative thereby implying that as the country approach more and more toward free trade, income inequality tends to decline. Looking at the coefficients, the impact of government expenditure on income inequality is highest followed by real GDP per capita and trade openness with Consumer price index having an adverse impact.

After the investigation of long-run relationship among the variables, the subsequent stage is to obtain the short-run dynamics of these variables. The results are presented in Table 3.8. An ECM (Error Correction Model) has two important parts. First, estimated short-run coefficients and the second one, error correction term (ECT) which provides the feedback or the speed of adjustment from short-run to long-run equilibrium. From Table 3.8, it is clear that the coefficient of ECMt-1 is equal to −0.301 and statistically significant at 1% level of significance. It thus implies that the aberration from short run is corrected by 30.181% over each year in the long run.

The short-run results also point that inequality decreases with increase in real GDP per capita, but the coefficient is statistically insignificant. The coefficient of CPI is positive and statistically significant, there by implying that increase in CPI inflation leads to worsening of income distribution. Similarly, the coefficient of government expenditure is negatively associated but statistically insignificant with income inequality there by indicating that increase in government expenditure leads to better and fair distribution of income. But its lag has a worsening impact. Finally, Trade openness shows the income inequality declining impact with statistically significant at 1% level.

Figure 3.6 shows the CUSUM and CUSUMsq figures indicating the stability of parameters.

7.3 Model B

The study uses an alternative approach to assess whether growth is pro-poor or anti-poor in the similar fashion. That is incorporated by using another model with different specification than the model used above. In this model the share of income of top 1% of population is taken as an index of inequality with the same set of independent and control variables as in model A. The reason behind this is that, if the increase in GDP results in decrease of the above share then, we can infer that the growth is pro-poor in nature. In other words, we can say that society moves towards the fair and equitable distribution of income. The econometric methodology used for the estimation of model B is same as model A, i.e., ARDL approach of cointegration. First, we checked the order of integration of logarithmic share of top 1% (hereafter LTOP) by using three alternative unit root tests with results stated in Table 3.1. The results reveal that the variable is stationary at first difference.

Lag order 2 is selected on the basis of the lowest value of the AIC and SBC as shown in Table 3.9. When 2 lags are involved, there is a solid indication for cointegration as the F-statistic is 4.197 larger than the critical value of bound [see, Pesaran et al. 2001, at 5% level of significance (Table 4(A))]. The estimates for the ARDL model pass all the diagnostic checks as shown in Table 3.10. The CUSUM and CUSUMsq tests are also showed in Fig. 3.7.

The estimated long-run coefficients using the ARDL approach are stated in Table 3.11. The results specify that RGDPC is associated negatively but statistically insignificant with the share of GDP of top one percent of the population which is taken as a measure of inequality. That implies growth in GDP increases the share of rest of the population in a society more than the share of the top one percent of the population. In other words, we can say that there is a reduction in the income inequality. The coefficient consumer price index (CPI) is positive but insignificant, thereby, implying that increase in CPI gives rise to income inequality. The coefficient of trade openness is positive but insignificant thereby implying that as the country approaches more and more toward free trade, income inequality tends to worsen. In other words, we can say that trade openness is pro- rich in nature. The estimate of government expenditure is also positive and statistically insignificant, thereby, implying that the increase in government expenditure gives rise to an in-egalitarian society or increase in government expenditure increase the share of GDP by top one percent more than that of the rest of the population which in turn ends with the worsening of inequality.

From Table 3.11, it is clear that the coefficient of ECMt-1 is equal to -0.406 and statistically significant, thereby implying that any aberration from the equilibrium is corrected by 40.55% over each year. The short-run dynamics results show that the share of top one percent of population decreases with increase in real GDP per capita, but the coefficient is insignificant. The coefficient of CPI shows that increase in inflation leads to increase in the share of top one percent and reduction in the share of the rest. Thus, we can say that increase in the CPI leads to the deterioration of income distribution. The coefficient of trade openness is positive but insignificant, implying that the liberalization of trade reduces the share of rest of the population in GDP whereas; it increases the share of top one percent of population. Thus openness of the trade is somewhat pro-rich in nature. Finally, the coefficient of government expenditure is also positive and insignificant thereby affecting the income inequality in the same way as CPI and trade openness.

8 Conclusion

Remaining as the most inconclusive relationship, Kuznets Inverted-U Hypothesis has been an important topic in development economics, especially the economics of income distribution since its inception. Though the hypothesis faced both criticism and acceptance as deduced from the past research, there were researchers who, with their empirical finding totally designated this relationship as a mess. However, a deep look at the literature reveals its importance; it served as the guide for future research. Kuznets was almost the first academician who showed a deep concern to study the change in pattern and process that will happen because of change in the national product. The angle he used to analyze the sectoral transformation of the economy is all alive debated and discussed to date. Admitting the importance of Kuznets’ hypothesis, Piketty says that, it was the first theory of this sort to rely on a formidable statistical apparatus. According to him, Kuznets’ work was the first high-powered effort to capture inequality in concrete terms to give a forceful push to the subject of income distribution.

To push Kuznets hypothesis forward a remarkable contribution came from Ahluwalia (1976), who not only studied the effect of GDP per capita on income distribution, but also made deep analysis to investigate the influence of other forces like share of agriculture, education levels, etc., and after that study a cluster of research flowed mostly based on the cross section data. After the compilation of Deininger–Squire data set focus was shifted toward time series and panel analysis using different tools of econometrics to gather deep understanding on the subject. Besides that different types of models were developed A new wave has started after the work of Thomas Piketty and Emmanuel Saez who, with the help of Tax data available within the country succeeded in creating a database for many countries which shows the income share of the top 1% of the population for a long time period. The data on top 1% draw high attention from the world community as it showed clear evidence regarding the rising income disparities between the top and the bottom income group over the period of time. Studies have revealed that a higher degree of disparity can give rise to political and social instability besides inefficiency and decrease in standard of living.

The debate on rising inequalities has evolved in India since planning era, but rising income inequalities gained much attention after reforms. Various studies have shown that with high growth rates though poverty levels came down same was not visualized in case of income inequality. There is clear evidence from the consumption expenditure data and data on wage levels supporting the view that in recent times inequalities have once again started to rise. This situation has put a red mark on the development process, witnessed in India since the 1990s. Because of that process of globalization has come under severe attack for creating higher disparities. The rising inequality is a matter of deep concern especially with respect to India was a large proportion of the population has failed to come above the official poverty line. Negligence to the subject of the income distribution can prove fatal for the whole country both in terms of decreasing living standard and can hamper high growth rates witnessed after the reform period.

In order to deal with the rising inequalities, and to find solutions to stop its rising trend, there is critical need to find the causes that can have great say in determining the order of distribution of income. The subject of income distribution is not new, although it was taken seriously from recent past. This study mainly analyzed the relationship between inequality and development from the empirical point of view over the period of time in the context of India. This study mainly focused on to investigate the Kuznets inverted-U hypothesis. Besides GDP Per Capita, certain control variables are found important from the investigation of past research were also used to capture the relationship perfectly. To completely understand the relationship cointegration approach of ARDL was used and due consideration was given to the functional form, serial correlation, normality assumption, and heteroscedasticity. The main empirical findings of the study are as follows:

The results indicate that RGDPC is associated positively with income inequality. The coefficient of government with a negative sign indicated that the increase in government expenditure results in the reduction of income inequality. Thus, we can say that with the increase in the level of development in terms of GDP Per Capita there is increase in the inequality in the long run.

The estimate of LCPI showed that increase in price level leads to increase in income inequality. In the short run, the estimates show a change in sign and significance at levels. At lag 1 and 2 the coefficient of LGDP per capita shows a significant negative relationship, means that in a short run increase in lagged GDP per capita leads a decrease in the inequality. So based on short run and long-run estimates following Bahmani-Oskoee and Gelan (2008), we may conclude that in the beginning with the increase in level of development there is a decrease in inequality, but over the period of time inequality starts to increase with the increase in the level of development. So that means there is a U-shaped relationship instead of inverted U. In case of Govt. expenditure, the results show a significant lagged positive effect on inequality, opposite to the long-run estimates. To fully capture Kuznets inverted U we make use of Square of GDP per capita like previous studies. Accordingly, we found that for both GDP per capita and its square, estimates are insignificant. However for govt. expenditure coefficient is once again negative and significant. The inclusion of Sq. term for GDP per capita affects its significance, but the sign remains same.

After that, we tried another model by involving price level as an additional control variable. The long-run estimates showed that price level is positively related with inequality, and accordingly expenditure has a same positive effect on it as was noticed earlier. But in this case, both sign, as well as the significance of GDP per capita, has changed may be due to high multicollinearity with the CPI. The short-run estimates show that coefficient of price level is significant and stable. Though the sign of GDP per capita remains same, it is again insignificant. However once again we find that the lag of govt. expenditure shows a significant positive relationship as was noticed earlier. Moreover, ecm(−1) is also negative with a significant coefficient.

Moreover when we added trade openness as an additional variable in the model, following were the main findings:

-

1.

The coefficient of LGEXP is statistically significant with a negative sign indicating that the increase in government expenditure results in the reduction of income inequality.

-

2.

The coefficient of LTO is negative thereby implying that as the country approach more and more toward free trade, income inequality tends to decline.

The short-run dynamics results of the above variables are on the same lines as mentioned above but with slight changes in the significance level. Third, the study uses an alternative approach assessing whether growth is pro-poor or not. For this purpose another model with different specification was used. In this model, the income share of the top one percent of the population is taken as a measure of inequality with the same set of regressors as in model A. The estimated long-run coefficients using the ARDL approach indicate that LRGDPC is associated negatively but statistically insignificant with the income share of top 1% of the population. This implies that growth in GDP increases the share of the rest of the population in a society more than the share of top 1%. In other words, we can say that there is a reduction in the income inequality. The effect of control variables in the model B are as follows:

-

1.

The coefficient of LCPI is positive but insignificant thereby implying that increase in price level leads to increase in income inequality.

-

2.

The coefficient of LTO is positive but insignificant thereby implying that as the country approach more and more towards free trade, income inequality tends to worsen.

The short-run dynamics showed that the coefficient of LRGDPC is negative but insignificant. The coefficient of LCPI is positive and statistically significant. Thus, we can say that increase in the CPI leads to the deterioration of income distribution. The coefficient of LTO is positive but insignificant implying that the liberalization of trade reduces the share of the rest of the population in GDP whereas it increases the share of top 1%. Finally, the coefficient of LGEXP is also positive and insignificant thereby effect the income inequality in the same way as CPI and trade openness does.

Our results reveal that the relationship is U shaped in nature. That implies an initial increase in GDP per capita leads to decrease in inequality, later on as the former increases, inequality tends to increase. Among the control variables, CPI (price level) is found to be positively related to inequality in all the models used in this study. Government expenditure is negatively related to inequality when Estimated Household Income Inequality (EHII) is taken as measure of inequality, while it (Government Expenditure) is positively related to inequality when income share of top 1% of the population is taken as a measure of inequality. A clear picture can be drawn from this result is that government expenditure is biased towards the upper income group. Moreover, there remained much to explore, the true dynamics of inequality that can be taken care in the future work.

References

Ahluwalia, M. S. (1976). Income distribution and development: some stylized facts. The American Economic Review, 66, 128–135.

Ahluwalia, M. S. (2000). Economic performance of states in post-reforms period. Economic and Political Weekly, 35, 1637–1648.

Ahmad, W., Nain, M. Z., & Kamaiah, B. (2014). On the role of the trend and cyclical components in electricity consumption and India’s economic growth: A cointegration and cofeature approach. OPEC Energy Review, 38(1), 107–126.

Alesina, A., & Perotti, R. (1996). Income distribution, political instability, and investment. European Economic Review, 40(6), 1203–1228.

Alesina, A., Perotti, R., Alesina, A., Rodrik, D., Barro, R., BÃnabou, R., et al. (1994). Is inequality harmful for growth? Theory and evidence. The American Economic Review, 84(3), 600–621.

Anand, S., & Kanbur, S. R. (1993a). Inequality and development a critique. Journal of Development Economics, 41(1), 19–43.

Anand, S., & Kanbur, S. R. (1993b). The Kuznets process and the inequality development relationship. Journal of Development Economics, 40(1), 25–52.

Ang, J. B. (2010). Finance and inequality: The case of India. Southern Economic Journal, 76(3), 738–761. http://journal.southerneconomic.org/doi/abs/10.4284/sej.2010.76.3.738.

Angeles, L. (2010). An alternative test of Kuznets hypothesis. The Journal of Economic Inequality, 8(4), 463–473. doi:10.1007/s10888-009-9117-4.

Bahmani-Oskooee, M., & Gelan, A. (2008). Kuznets inverted-U hypothesis revisited: A time-series approach using US data. Applied Economics Letters, 15(9), 677–681. doi:10.1080/13504850600749040.

Bandelj, N., & Mahutga, M. C. (2010). How socio-economic change shapes income inequality in post-socialist Europe. Social Forces, 88(5), 2133–2161.

Banerjee, A., Dolado, J., & Mestre, R. (1998). Error-correction mechanism tests for cointegration in a single-equation framework. Journal of Time Series Analysis, 19(3), 267–283. doi:10.1111/1467-9892.00091.

Bastagli, F., Coady, D., & Gupta, S. (2012). Income inequality and fiscal policy. Tech. rep., International Monetary Fund. http://ideas.repec.org/p/imf/imfsdn/12-08r.html.

Bensidoun, I., Jean, S., & Sztulman, A. (2005). International trade and income distribution: Reconsidering the evidence. Tech. rep. http://ideas.repec.org/p/cii/cepidt/2005-17.html.

Bhagwati, J., & Srinivasan, T. N. (2002). Trade and poverty in the poor countries. American Economic Review, 92, 180–183.

Blejer, M. I., & Guerrero, I. (1990). The impact of macroeconomic policies on income distribution: An empirical study of the Philippines. The Review of Economics and Statistics, 414–423.

Bourguignon, F., & Morrisson, C. (1998). Inequality and development: The role of dualism. Journal of Development Economics, 57(2), 233–257.

Chakravarty, S. (1987). Development planning: The Indian experience. Oxford: Clarendon Press.

Chambers, D. (2007). Trading places: Does past growth impact inequality? Journal of Development Economics, 82(1), 257–266.

Charles-Coll, J. A. (2011). Understanding income inequality: Concept, causes and measurement. International Journal of Economics and Management Sciences, 1(3), 17–28.

Chen, Z. (2007). Development and inequality: Evidence from an endogenous switching regression without regime separation. Economics Letters, 96(2), 269–274.

Cheng, W., et al. (2014). Understanding the Kuznets process: An empirical investigation of income inequality in China 1978–2011. Tech. rep., Monash University, Department of Economics. http://ideas.repec.org/p/mos/moswps/2014-12.html.

Chu, K.-Y., Davoodi, H. R., & Gupta, S. (2000). Income distribution and tax and government social spending policies in developing countries. International Monetary Fund.

Datt, G., & Ravallion, M. (1998). Farm productivity and rural poverty in India. The Journal of Development Studies, 34(4), 62–85.

Daudey, E., & GarcÃ-a-Peà alosa, C. (2007). The personal and the factor distributions of income in a cross-section of countries. Journal of Development Studies, 43(5), 812–829. doi:10.1080/00220380701384406.

Deininger, K., & Squire, L. (1996). A new data set measuring income inequality. The World Bank Economic Review, 10(3), 565–591.

Deininger, K., & Squire, L. (1998). New ways of looking at old issues: Inequality and growth. Journal of Development Economics, 57(2), 259–287.

DeSa, U. N. (2013). Inequality matters. Report on the World Social Situation 2013. New York, United Nations.

Desbordes, R., & Verardi, V. (2012). Refitting the Kuznets curve. Economics Letters, 116(2), 258–261.

Eicher, T. S., & Turnovsky, S. J. (2003). Inequality and growth: Theory and policy implications (Vol. 1). US: MIT Press.

Engle, R. F., & Granger, C. W. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica: Journal of the Econometric Society, 55, 251–276.

Ferreira, F. H., Leite, P. G., & Wai-Poi, M. (2007). Trade liberalization, employment flows, and wage inequality in Brazil.

Fields, G. S. (1980). Poverty, inequality, and development. CUP Archive.

Foster, J. E. (1985). Inequality measurement. Fair Allocation, 33, 31–68.

Frazer, G. (2006). Inequality and development across and within countries. World Development, 34(9), 1459–1481.

Galbraith, J. K. (2007). Global inequality and global macroeconomics. Journal of Policy Modeling, 29(4), 587–607.

Galbraith, J. K., Halbach, B., Malinowska, A., Shams, A., & Zhang, W. (2014). The UTIP global inequality data sets 1963–2008. http://utip.gov.utexas.edu/papers/UTIP_68.pdf.

Galbraith, J. K., & Kum, H. (2005). Estimating the inequality of household incomes: A statistical approach to the creation of a dense and consistent global data set. Review of Income and Wealth, 51(1), 115–143. doi:10.1111/j.1475-4991.2005.00147.x.

Galor, O., & Tsiddon, D. (1996). Income distribution and growth: The Kuznets hypothesis revisited. Economica, 63, S103–S117 (2554811).

Hansen, B. E., & Phillips, P. C. (1990). Estimation and inference in models of cointegration: A simulation study. Advances in Econometrics, 8(1989), 225–248.

Higgins, M., & Williamson, J. G. (1999). Explaining inequality the world round: Cohort size, Kuznets curves, and openness. Tech. rep., National Bureau of Economic Research. http://www.nber.org/papers/w7224.

Huang, H. C., Lin, Y. C., & Yeh, C. C. (2012). An appropriate test of the Kuznets hypothesis. Applied Economics Letters, 19(1), 47–51. doi:10.1080/13504851.2011.566172.

Jha, S. K. (1996). The Kuznets curve: A reassessment. World Development, 24(4), 773–780.

Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12(2), 231–254.

Johansen, S. (1995). Identifying restrictions of linear equations with applications to simultaneous equations and cointegration. Journal of Econometrics, 69(1), 111–132.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford Bulletin of Economics and Statistics, 52(2), 169–210. doi:10.1111/j.1468-0084.1990.mp52002003.x.

Kanbur, R., & Zhuang, J. (2013). Urbanization and inequality in Asia. Asian Development Review, 30(1), 131–147. doi:10.1162/ADEV_a_00006.

Kapoor, R. (2013). Inequality matters. Economic Political Weekly, 48(2), 58–65.

Kim, D. H., Huang, H. C., & Lin, S. C. (2011). Kuznets hypothesis in a panel of states. Contemporary Economic Policy, 29(2), 250–260. doi:10.1111/j.1465-7287.2010.00218.x/full.

Krishna, P., & Sethupathy, G. (2011). Trade and inequality in India. Tech. rep., National Bureau of Economic Research. http://www.nber.org/papers/w17257.

Kumar, U., & Mishra, P. (2008). Trade liberalization and wage inequality: Evidence from India. Review of Development Economics, 12(2), 291–311. doi:10.1111/j.1467-9361.2007.00388.x/full.

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review, 45(1), 1–28.

Kuznets, S. (1963). Quantitative aspects of the economic growth of nations: VIII. Distribution of income by size. Economic development and Cultural Change, 11.2, 1–80.

Lewis, W. A. (1954). Economic development with unlimited supplies of labour. The Manchester School, 22(2), 139–191. doi:10.1111/j.1467-9957.1954.tb00021.x.

Lim, C. Y., & Sek, S. K. (2014). Exploring the two-way relationship between income inequality and growth. Journal of Advanced Management Science, 2(1), 33.

Lin, S. C., Suen, Y.-B., Yeh, C. C., et al. (2007). A quantile inference of the Kuznets hypothesis. Economic Modelling, 24(4), 559–570.

Lind, J. T., & Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxford Bulletin of Economics and Statistics, 72(1), 109–118. doi:10.1111/j.1468-0084.2009.00569.x/full.

List, J. A., & Gallet, C. A. (1999). The Kuznets curve: What happens after the inverted-U? Review of Development Economics, 3(2), 200–206. doi:10.1111/1467-9361.00061/full.

Litchfield, J. (2001). Updated Income Distribution and Poverty Measures for Chile: 1987–1998. Background Paper, 1, 1987–1998.

Lorenz, M. O. (1905). Methods of measuring the concentration of wealth. Publications of the American Statistical Association, 9(70), 209–219. doi:10.1080/15225437.1905.10503443.

Lubrano, M. (2012). The econometrics of inequality and poverty. Lecture 4: Lorenz curves, the Gini coefficient and parametric distributions. http://www.vcharite.univ-mrs.fr/PP/lubrano/cours/Lecture-4.pdf.

Motonishi, T. (2006). Why has income inequality in Thailand increased?: An analysis using surveys from 1975 to 1998. Japan and the World Economy, 18(4), 464–487.

Mushinski, D. W. (2001). Using non-parametrics to inform parametric tests of Kuznets’ hypothesis. Applied Economics Letters, 8(2), 77–79. doi:10.1080/13504850150204093.

Nain, M. Z., Ahmad, W., & Kamaiah, B. (2017). Economic growth, energy consumption and CO2 emissions in India: A disaggregated causal analysis. International Journal of Sustainable Energy, 36(8), 807–824.

Nain, M. Z., & Kamaiah, B. (2012). On the relationship between nominal and real effective exchange rates in India: Evidence from the ARDL bounds tests. IUP Journal of Applied Economics, 11(4), 50.

Ogwang, T. (1994). Economic development and income inequality: A nonparametric investigation of Kuznets’ U-curve hypothesis. Journal of Quantitative Economics, 10, 139–153.

Okun, A. M. (1975). Equality and efficiency, the big tradeoff. Washington, D.C.: Brookings Institution Press.

Oosthuizen, M. (2007). Consumer Price inflation across the income distribution in South Africa. Development Policy Research Unit, University of Cape Town. http://core.kmi.open.ac.uk/download/pdf/6261866.pdf.

Oshima, H. T. (1962). The international comparison of size distribution of family incomes with special reference to Asia. The Review of Economics and Statistics, 44, 439–445.

Ouattara, B. (2004). Foreign aid and fiscal policy in Senegal. Tech. rep., Mimeo University of Manchester Manchester.

Pal, P., & Ghosh, J. (2007). Inequality in India: A survey of recent trends. Economic and Social Affairs Working Paper (Vol. 45).

Paukert, F. (1973). Income distribution at different levels of development: A survey of evidence. International Labour Review, 108, 97.

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica: Journal of the Econometric Society, 1361–1401.

Perron, P. (1997). Further evidence on breaking trend functions in macroeconomic variables. Journal of econometrics, 80(2), 355–385.

Pesaran, M. H., & Pesaran, B. (1997). Working with Microfit 4.0: Interactive econometric analysis. London: Oxford University Press.

Pesaran, M. H., & Shin, Y. (1998). An autoregressive distributed-lag modelling approach to cointegration analysis. Econometric Society Monographs, 31, 371–413.

Persson, T., & Tabellini, G. (1994). Is inequality harmful for growth? The American Economic Review, 84(3), 600–621.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326. doi:10.1002/jae.616/full.

Phillips, P. C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346.

Piketty, T. (2014). Capital in the twenty-first century. Harvard (US): Harvard University Press.