Abstract

The iron and steel industry is one of the world’s as well as China’s largest energy CO2 emission sources. We calculated the cost of CO2 abatement (CCA), and give the marginal abatement cost curve of the main process of iron and steel production. Based on this, we analyse the cost-effectiveness of CO2 abatement technologies. Also, we define a two-country (home and foreign), two-goods (home goods and foreign goods) partial equilibrium model to simulate China’s iron and steel industry, and analyse the influence of CO2 price and free allocation to the production, price, income, profit and total emissions of China’s iron and steel industry. We found that a carbon market would increase the abatement cost and then increase the domestic price, but a reasonable free allocation could offset the profit loss partly, so it would not result in a huge profit loss to the industry.

Dr. Ying Fan, Professor, Center for Energy and Environmental Policy Research, Institute of Policy and Management, Chinese Academy of Sciences; Email: yfan@casipm.ac.cn.

Dr. Lei Zhu, Associate Professor, Center for Energy and Environmental Policy Research, Institute of Policy and Management, Chinese Academy of Sciences.

Ms. Yuan Li, Ph.D. Student, Center for Energy and Environmental Policy Research, Institute of Policy and Management, Chinese Academy of Sciences.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

5.1 Introduction

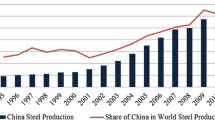

The iron and steel manufacturing industry is one of the world’s largest energy-consuming sectors, accounting for more than 5 % of the world’s annual energy demand. It is also one of the largest CO2 emission sources in the world. In 2010, China’s crude steel production reached 627 million tons, accounted for 44 % of global crude steel production, and its average growth rate has been 7 % over for the past ten years. The iron and steel industry is also one of China’s largest CO2 emission sectors, accounting for more than 17 % of China’s total CO2 emissions since 2006 (Fig. 5.1).

China’s iron and steel industry has two disadvantages. First, the main process of China’s steel production—the Blast Furnace-Basic Oxygen Furnace (BF-BOF)—consumes more energy than the Electric Arc Furnace (EAF) process, and emits more CO2. Second, coal accounts for more than 70 % of China’s energy consumption, making it a high CO2 emission source. And with the shares of petrol and gas lower than the international advanced level, this results in the high CO2 emissions from China’s iron and steel industry.

Improving energy efficiency is the best way to achieve reduced CO2 emissions from the iron and steel industry. To date, the Chinese government has been paying attention to the need to save energy and reduce CO2 emissions in the iron and steel industry, but many difficulties remain as to the issue of CO2 abatement. China’s iron and steel enterprises are much decentralised and the industrial concentration is still very low. At the same time, there is a huge gap between the large-to-medium iron and steel enterprises, and the small enterprises. The former has more advanced equipment and technologies than the former. These factors make it challenging to pursue energy saving and CO2 abatement in China’s iron and steel industry.

Promoting advanced energy-saving and CO2 abatement technologies is one of the main abatement measures for the iron and steel industry, especially advanced technologies which have good abatement effects. Because of the heterogeneity of the different enterprises, the promotion of technology varies within the specific contexts of different enterprises. That is to say, it is important to combine the abatement effect with the cost-effectiveness when promoting technologies. Especially in recent years, with weak demand for iron and steel products and the related enterprises facing a general decline in profits (indeed, some even running into deficit), the cost-effectiveness of technologies is ever more important to these iron and steel enterprises in their technology adoption decisions.

Many CO2 abatement technologies were promoted during the 11th and 12th Five-Year-Plans. There are currently seven carbon market pilots (Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong and Shenzhen) in China that are exploring an emissions trading scheme. However, enterprises are concerned about the cost of CO2 abatement technologies (CATs), as well as possible loss of their competiveness edge when joining the carbon market. Thus, we, the authors, first studied the cost of CO2 abatement in China’s iron and steel industry through so-called conserved supply curves (CSCs), and then obtained a MAC curve by fitting the CSCs. Finally, with a partial equilibrium analysis, we studied the impact of the carbon market on the iron and steel industry.

There have been studies of various sectors’ strategies for energy saving and CO2 abatement across many different countries. The main method used is the ranking of the energy-saving/CO2 abatement technologies based on their cost of energy savings/emissions reductions, in the form of so-called conserved supply curves (CSCs) or abatement cost curves (Worrell et al. 2000; Hasanbeigi et al. 2010; Fleiter et al. 2012). There is vast heterogeneity across the iron and steel industries of different countries; for example, in terms of production process, production structure, and technology adoption. CSC is a bottom-up method used to study the cost-effectiveness of different technologies, so it can be viewed as country-specific. Such curves could also show the CO2 abatement contribution, potential and related cost-effectiveness of various technologies and measures.

In China, studies have focused on the iron and steel industry’s energy savings and CO2 abatement. Some of them used macro-analysis (Price et al. 2012; Guo et al. 2010; Wang et al. 2007; Zhang et al. 2012), while others have paid more attention to the micro level of China’s iron and steel industry (Hasanbeigi et al. 2012). Technology-based micro-level research may be more practical in terms of allowing the governments and industries to set benchmarks for the iron and steel industry. There is presently no micro-level CATs database in China’s iron and steel industry, which has made it difficult for further study of sectoral emission abatement potential estimation from the bottom-up perspective. At the same time, for enterprises, this method could be more operable than the macro-research. We, the authors, therefore collected CATs widely used in the iron and steel industry. Basing this current study on the previous, we have extended this research’s range to 41 CO2 abatement technologies, including most of the energy CATs of China’s iron and steel industry. In addition, after several rounds of discussions and interviews with experts and specialists from the iron and steel industry, we have significantly calibrated the data collected in the technology list so as to reflect the actual situation in China.

There were three steps in our research: first, we analysed the production process of iron and steel and listed 41 CATs. After calculating the cost of conserved energy based on the Chinese data from 2010, we obtained a CSC for China’s iron and steel industry. Second, we forecasted the CO2 abatement potential of China’s iron and steel industry in 2020 and 2030 by changing the diffusion rate of technologies and the share of BOF and EAF, and we compared the change in the CSC depending on the year and the CO2 abatement potentials in three scenarios for 2020 and 2030, respectively. Third, we fitted a MAC curve based on the CSC, and then analysed the impact on enterprises’ competiveness using partial equilibrium analysis.

5.2 Methodology

We use a CSC to rank the CATs and measures according to their cost of CO2 abatement (CCA). From this curve, we can obtain the related cost of operating and maintaining a technology, as well as the total cost of choosing a specified technology, which includes investment, operational costs, and so on. The calculation of a CCA is shown in Formula (5.1). Formula (5.1) is referred to Worrell (2001), and then we made a change in the numerator, which subtracts the cost of saved energy. As different technologies save different energy, we calculated the cost of saved specific energy and then removed it from the numerator, which could reflect different kinds of saved energy from different CATs. Of course, when we removed the cost of saved energy, zero is used as the compare line but not the averaged energy price as with Worrell (2001).

The calculation of annualised investment is shown in Formula (5.2).

In formula (5.2), d represents the discount rate, and n represents the payback time of the CATs. Although different technologies have different payback times, from an accounting perspective, we assume that all technologies have the same payback time. Enterprises prefer a short payback time and a high internal rate of return. We thus assume a unified payback time here, which is not only easy to account for, but also reflects the preference for a short payback time in the iron and steel industry.

Also, we defined a two-country (home and foreign), two-goods (home goods and foreign goods) model to simulate China’s iron and steel industry. The model adopted here is an improved version of Demailly/Quirion (2008). Here we considered the prices and elasticities of home and imported goods, as well as the potential benefit of loss resulting from emission trading schemes (ETS) in the profit calculation. And based on historical data, we estimated the price elasticities of imports and exports of China’s iron and steel industry.

- \( p_{h} \) :

-

Price of home goods that are consumed domestically

- \( p_{x} \) :

-

Price of home goods that are exported

- \( p_{m} \) :

-

Price of imported goods

- \( q_{h} \) :

-

Production of home goods that are consumed domestically

- \( q_{x} \) :

-

Production of export goods

- \( q_{m} \) :

-

Production of import goods

- \( c_{e} (ua) \) :

-

Abatement cost of home goods, which is a function of unitary abatement (ua) and determined by the MAC curve

- \( p_{{\text{CO}_{2} }} \) :

-

Price of CO2, which is exogenous

- \( u_{e} \) :

-

Unitary emissions of the industry

- FA:

-

Free allowance that government gives to the industry

- \( \sigma_{x} \) :

-

Export price elasticity

- \( \sigma_{m} \) :

-

Import price elasticity

- \( \theta \) :

-

Price elasticity of demand

Thus the profit of the iron and steel industry at t = 1 could be defined in Formula (5.3):

The first three parts of Formula (5.3) could be defined as the profit on production.

Imports could be defined as seen in Formula (5.4):

Exports could be defined in Formula (5.5):

Total demand, which is equal to total consumption, could be defined in Formula (5.6):

5.3 CO2 Conservation Supply Curve

After converting the energy savings into CO2 abatement from previous work by Li/Zhu (2014), according to the energy savings of all BATs and the emission factor of each energy, we convert the energy savings of all BATs into CO2 emissions. Figure 5.2 shows the CO2 conservation supply curve when the discount rate is 20 %. A 20 % discount rate was selected mainly because it could reflect the expectation of payback period of steel enterprises (in general, the enterprises would like to have a short payback time and high internal rates of return when adopting such technologies). The CO2 emissions per unit of steel for China’s iron and steel industry are 1547.65 kg/ton steel output, and these 41 CATs could achieve 443.21 kg reductions in CO2 emission, which would account for 22.3 % of total CO2 emissions per unit of steel. Also, with an assumed CO2 price which is equal to 0.1 yuan/kg, there are 28 cost-effective technologies. If we double the CO2 price, the number of cost-effective CATs changes only slightly. Based on current allowance prices in China’s pilot emission trading markets, the CO2 price fluctuated from 0.05 yuan/kg (50 yuan/tCO2) to 0.2 yuan/kg (200 yuan/tCO2). Even with the CO2 price as 200 yuan/tCO2, it would still be little influence on the cost-effectiveness of the CATs. This is because a great number of CATs can generate negative adoption cost with the accounting of energy-saving benefits, so their CO2 abatement costs are relatively low. Through our analysis, we found that only CATs that have positive costs will be influenced by the CO2 price, which means, even with energy-saving benefit, some extra payment or loss will be made by enterprises in their adoption of these CATs (the number of such CATs is 16). Because there is no unique carbon market in China, we could not obtain a precise carbon price.

CO2 conservation supply curves of the discount rate 20 %. Source Li/Zhu (2014)

We now come to the CO2 abatement cost curves of the specified process. Figure 5.3 shows the CO2 abatement cost curves of sintering, coking, iron-making and BOF. The CATs of sintering and iron-making are all cost-effective. The CATs of the iron-making process have the largest cumulative CO2 abatement. The CATs of coking and BOF are not cost-effective, and the cumulative CO2 abatement of these two processes is also less than that of the iron-making process.

Figure 5.4 shows the CO2 abatement cost of the EAF process. The CATs of the EAF process almost have good cost-effectiveness except for flue gas monitoring and control and foamy slag practices. Considering the small share of EAF (10 % in 2010), the cumulative CO2 abatement is not very large. However, as the EAF share increases, the CO2 abatement potential of the EAF process will become huge.

Figure 5.5 shows the CO2 abatement costs of three additional processes. The CATs of the general technologies are all cost-effective, and also, this process has the largest cumulative CO2 abatement in this group. This is mainly because the CATs of this process are mutually beneficial and all have a larger adoption rate. The CATs of the cold rolling and finishing process are not cost-effective, except the automated monitoring and targeting system. Also, in the hot rolling and casting process, only half the CATs are cost-effective, and waste heat recovery and insulation of furnaces have very high CO2 abatement costs, which will make them difficult to promote in the near future.

We should note that although the general technological process, casting and hot rolling currently have great CO2 abatement, their adoption rate is almost maximised, so their future development potential is limited. EAF technologies are cost-effective, but their adoption rate is small. As the diffusion rate increases in the future, they will reach greater CO2 abatement potentials.

5.4 CO2 Abatement Potentials Analysis in 2020 and 2030 Under Different Situations

We have analysed the theoretical CO2 abatement potential of these CATs as Fig. 5.6 shows. During this process, because about 1/3 of the crude steel of the world is produced by EAF, we assumed the share of BOF and EAF to be 7:3, which is approaching the advanced level of the world. We also assumed the CATs could reach a 100 % adoption. In this situation, the additional CO2 abatement could achieve 537.54 kg/t, which is more than the 2010 level. This is to say, the CO2 abatement potential of China’s iron and steel industry is still very large. To achieve this level, the EAF share should reach 30 %, and all CATs should be 100 % adopted—but since this situation is based on assumption, this abatement potential is also overestimated. Further, we found that the potentials of CATs with abatement costs below 0 to be very large (more than 300 kg/t)—these technologies both have cost-effectiveness as well as the abatement effect, and they should be promoted in the industry. We also noted that the CATs which had a higher adoption in 2010 tended to have lower CO2 abatement potential due to the limitations for improvement.

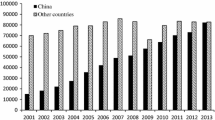

We next forecasted the CO2 abatement potentials of China’s iron and steel industry in 2020 and 2030, respectively. Here we also referred to Li/Zhu (2014), and assumed three scenarios based on changing the diffusion rate, business as usual (BAU), cost-effective, and technical diffusion. The technical diffusion rate is exogenous. Because it is difficult to obtain data regarding the unique annual growth rate of each technology, we designed a share change per ten years to predict the change in the diffusion rate change. We gave unified share increases in 2020 and 2030, and these share increases were compared with those in 2010. The specific results are listed in Table 5.1.

The production of EAF is still very low in China (less than 10 % in 2010), mainly due to the scarcity of scrap steel and electricity. However, in recent years, the Chinese government has become more and more receptive to the advantages of EAF, such as the low level of investment and the ability to smelt special steel. It still has large development potential, so we assumed than by 2020 the share of EAF will have reached 20 % and that by 2030, it will hit 30 %. This percentage is close to the EAF levels of developed countries.

The CO2 conservation supply curves of the three scenarios in 2020 are shown in Fig. 5.7. Figure 5.7 shows the differences between the three scenarios for 2020 and 2030. The higher the technical diffusion rate, the flatter the CO2 abatement curve, and more emission abatement could be achieved by cost-effective CATs. The CO2 abatement potentials also show an increasing trend over the same time period.

5.5 Impact of the Carbon Market on the Iron and Steel Industry

Because the carbon market will increase the production cost of enterprises, the loss of competiveness is a major concern for enterprises within the iron and steel industry. Since there is no clear definition of “competiveness loss”, we think of it along the following lines: domestic production loss and domestic profit loss.

Here our MAC curve can be defined as shown in Formula (5.7):

In Formula (5.7), ua refers to the unitary abatement, and this MAC curve is fitted based on our CSC curve. Different allocation schemes will result in different sorts of anticipation. Because companies generally seek to maximise profits, and allocations do not take place every year, but every three or five years (in the European Union Emission Trading Scheme, EU ETS, they were first allocated every three years, then every five), the behaviour of these firms will depend on the allocation arrangement of the next period. We chose two allocation schemes—grandfathering and emission-based allocation—which are two main allowance allocation methods. Grandfathering is allocated according to the historical average emissions in the base period while emission-based allocation is based on the emissions in the last period.

5.5.1 Case 1: Grandfathering (GF) with Free Allocation (FA)

First, we defined Case 1, in which the allocation method is grandfathering and the share of FA is 50 %, meaning 50 % of the total carbon quota would be allocated to the enterprises freely. The purpose of free allocation is to maintain a reasonable level of profit, and to avoid dramatic profit losses.

We assumed that the CO2 prices were 50, 80, 100 and 200 yuan/t, and obtained the following results. Unitary abatement’s proportion of the total emissions is shown in Fig. 5.8. The proportion of unitary abatement increased as the CO2 price increased; the higher the CO2 price, the better the emission reduction effect. When the CO2 price reached 200 yuan/t, the share of emissions reduction was over 50 %. The change of total emission reductions is shown in Fig. 5.9. Via a comparison with Fig. 5.8, we can see that the total emissions decreasing trend is similar to the trend for unitary abatement change. This means that the decrease in total emissions is mainly due to the increase in unitary abatement, and that the production change only impacts the total emissions change slightly.

The impact of various CO2 prices on the iron and steel price, domestic production, total income and domestic profit compared with the 2010 baseline data is shown in Table 5.2. Based on the model of Chap. 2, when the CO2 price fluctuated, the price, production, cost, income and profit changed with the CO2 price. And when the CO2 price changed, the impact of these changes on the key factors is illustrated in Table 5.2. The higher carbon price would increase the price of domestic iron and steel products; and the higher the CO2 price, the higher the domestic price. As a result, the domestic production will decrease due to the price increase; however, the CO2 price will not greatly impact production. Total production went up as the CO2 price increased, as did the income of enterprises. The profit change is very slight in this case. Only when the CO2 price reached 200 yuan/t did the profit go down slightly, suggesting that the carbon market will not result in a huge loss of profits for the iron and steel industry.

In Case 1, the share of free allocation could help to maintain a reasonable profit level for enterprises. We also analysed as well how the free allocation share will affect profit change (Table 5.3), and found that the profit increased as the free allocation share increased. When FA was between 50 and 75 %, the enterprises’ profit did not change much. The higher the percentage of free allocation was, the more the profit increased. However, considering the emission reduction target, the free allocation percentage should not necessarily be maximised.

The net purchase of sale allowance for the iron and steel industry is shown in Table 5.4. When the CO2 price varied between 50–100 yuan/t, the iron and steel industry was a net buyer of CO2 allocation. However, when the CO2 price reached 200 yuan/t, the iron and steel industry then became a net seller in the carbon market.

5.5.2 Case 2: Emission-Based (EB) Allocation

We then changed the allocation method, basing it on the emissions during the previous period. The free allocation of enterprise during period t can be defined as in Formula (5.8):

Above, s refers to the stringency of the carbon allocation, and it could be adjusted by the government.

Here, we assumed three situations: s = 60 %, which means high stringency; s = 80 %, which means moderate stringency; and s = 90 %, which means low stringency. The impact of allocation stringency on key factors is shown in Table 5.5 (PCO2 = 50 yuan/t). The allocation stringency has an impact on domestic price, domestic production, exports and imports, export and import prices. When s = 90 %, the domestic price decreased, as did profits. This implied that the allocation stringency should be held around 80 %, which could keep profits stable.

Table 5.6 shows the impact of allocation stringency on profit, as well as on production. It shows that a lower allocation stringency results in higher profits than in Case 1. However, the profit on production is lower than Case 1. Considering the carbon market, the lower the allocation stringency, the higher the profit—because enterprises profit through the sale of allocations. If we consider the profit on production, a lower allocation stringency would decrease the profit that occurred during the production process. Actually neither of these two cases has much effect on industry profit (the change ranges between −0.3 and 0.3 %); in the EB case, the allocation stringency of 80 % could help to keep the industry profit and the profit on production stable (the change in both ranges between −0.1 and 0.1 %).

The total emissions under various allocation stringencies are shown in Table 5.7. The total emissions do not change greatly, because when the CO2 price is fixed, the unitary emission is also fixed. Thus, as the production difference among these three situations is slight, the total emission difference is also slight. Compared with the 2010 data, total emissions decreased by about 27 %.

The net purchase or sell allocation under various allocation stringencies is shown in Table 5.8. As the allocation stringency increases, the iron and steel enterprises become net buyers in the carbon market; and when stringency is lower, the enterprises become net sellers in the carbon market.

5.6 Conclusion and Policy Implications

We first studied the cost of CO2 emission reductions in China’s iron and steel sector. Forty-one CATs were selected based on various iron and steel production processes, and their investments, operation costs, CO2 abatements and current shares in China’s iron and steel industry were determined on the basis of references published in China. The CO2 conservation supply curves for China’s iron and steel industry were all calculated according to the data we collected.

We found that currently, general technologies, casting and hot rolling, and blast furnace have been making the largest CO2 abatement contributions. This is probably the case since technologies involved in these processes are widely used. At the same time, it also means that their potential for growth is limited in the future. EAF technologies are almost all cost-effective. However, due to their low adoption rate, they have modest CO2 abatement contributions at the present stage. Thus, we can predict that the share of EAF will increase in the future, and that the CO2 abatement potential in the iron and steel industry will mainly come from EAF technologies. The development of EAF is mainly limited by the shortage of electricity and scrap, so the government should try to guide investment to improve the share of EAF and resolve technology barriers.

We then analysed the impact of the carbon market on China’s iron and steel industry using partial equilibrium analysis. We defined Case 1 (a free allocation share is 50 %) and analysed the impact of an exogenous carbon price on the key factors in China’s iron and steel industry, including domestic price, domestic production, imports and exports, import and export prices.

We established that a carbon market would increase the abatement cost and then increase the domestic price. The higher the CO2 price, the higher will be the increase in domestic price, and as the result, domestic production will decrease—though only very slightly. In this case, the income of enterprises increased, and the change in profit was very little. Only when the CO2 price reached to 200 yuan/t did the profit decrease slightly, which is to say that the CO2 price did not result in a huge profit loss for the iron and steel industry. A carbon market could reduce total CO2 emissions. However, most of the contribution would come from unitary emission reductions, not production reductions. When a carbon market increases import and export prices, imports will increase, but exports will decrease. At the same time, total consumption will also dwindle due to the rise in abatement costs.

Free allocation’s largest contribution is how it helps maintain a reasonable profit level for the iron and steel industry. If the free allocation is zero, the profit of the enterprises will be decreased, no matter the price of CO2. We found that the reasonable range for free allocation is about 50–75 %, which could ensure that the profit of enterprises does not fluctuate too greatly. With increasing allocation stringency, iron and steel enterprises will become net buyers in the carbon market, and when stringency is lowered, the enterprises will in turn become net sellers in the market.

References

Demailly, D. and P. Quirion (2008) “European Emission Trading Scheme and Competitiveness: A Case Study on the Iron and Steel Industry”. Energy Economics 30: 2009–27.

Fan, J., Y. Wang and J.W. Liang (2004) “Study on the Import and Export of China”. Modern Economic Science 26: 87–92.

Fischer, C. and A.K. Fox (2012) “Comparing Policies to Combat Emissions Leakage: Border Carbon Adjustments versus Rebates”. Journal of Environmental Economics and Management 64: 199–216.

Fleiter, T., D. Fehrenbach, E. Worrell and W. Eichhammer (2012) “Energy Efficiency in the German Pulp and Paper Industry—A Model-Based Assessment of Saving Potentials”. Energy 40: 84–99.

Guo, Z.C. and Z.X. Fu (2010) “Current Situation of Energy Consumption and Measures Taken for Energy Saving in the Iron and Steel Industry in China”. Energy 35: 4356–60.

Hasanbeigi, A., C. Menke and A. Therdyothin (2010) “The Use of Conservation Supply Curves in Energy Policy and Economic Analysis: The Case Study of Thai Cement Industry”. Energy Policy 38: 392–405.

Hasanbeigi, A., W. Morrow, J. Sathaye et al. (2012) Assessment of Energy Efficiency Improvement and CO 2 Emission Reduction Potentials in the Iron and Steel Industry in China. Berkeley, CA: Lawrence Berkeley National Laboratory.

Li, Y. and L. Zhu (2014) “Cost of Energy Saving and CO2 Emissions Reduction in China’s Iron and Steel Industry”. Applied Energy 130: 603–16.

Ministry of Industry and Information Technology (2010) “Total Energy Consumption Per Unit of Industry Added Value Decreased More than 25 % during the 11th Five-Year-Plan”. http://finance.ifeng.com/news/20101124/2946133.shtml.

Price, L., A. Hasanbeigi, N. Aden et al. (2012) A Comparison of Iron and Steel Production Energy Intensity in China and the U.S. Berkeley, CA: Lawrence Berkeley National Laboratory.

Wang, K., C. Wang, X. Lu and J. Chen (2007) “Scenario Analysis on CO2 Emissions Reduction Potential in China’s Iron and Steel Industry”. Energy Policy 35: 2320–35.

Worrell, E., N. Martin and L. Price (2000) “Potentials for Energy Efficiency Improvement in the US Cement Industry”. Energy 25: 1189–214.

Zhang, B., Z. Wang, J. Yin and L. Su (2012) “CO2 Emission Reduction within Chinese Iron & Steel Industry: Practices, Determinants and Performance”. Journal of Cleaner Production 33: 167–78

Acknowledgments

The authors acknowledge the financial support of the Chinese Academy of Sciences (No. XDA05150700) and the National Natural Science Foundation of China (No.71273253 and No.71210005). We deeply appreciate the weekly seminars at CEEP in CAS, from which improvements on an earlier draft of this paper were made.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 The Author(s)

About this chapter

Cite this chapter

Fan, Y., Zhu, L., Li, Y. (2016). Potential of CO2 Abatement Resulting from Energy Efficiency Improvements in China’s Iron and Steel Industry. In: Su, B., Thomson, E. (eds) China's Energy Efficiency and Conservation. SpringerBriefs in Environment, Security, Development and Peace, vol 30. Springer, Singapore. https://doi.org/10.1007/978-981-10-0737-8_5

Download citation

DOI: https://doi.org/10.1007/978-981-10-0737-8_5

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-0735-4

Online ISBN: 978-981-10-0737-8

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)