Abstract

Land cover maps provide critical input data for global models of land use. Urgent questions exist, such as how much land is available for the expansion of agriculture to combat food insecurity, how much land is available for afforestation projects, and whether reducing emissions from deforestation and forest degradation (REDD) is more cost-effective than carbon capture and sequestration. Such questions can be answered only with reliable maps of land cover. However, global land cover datasets currently differ drastically in terms of the spatial extent of cropland distributions. One of the data layers that differ is cropland area. In this study, we evaluate how models designed to help in policy design can be used to quantify the differences in implementation costs. By examining these cost differences, we are able to quantify the benefits, which equal the loss from making a decision under imperfect information. Taking the specific example of choosing between REDD and carbon capture and storage under uncertainty about the available cropland area, we have developed a methodology on how the value derived from reducing uncertainty can be assessed. By implementing a portfolio optimization model to find the optimal mix of mitigation options under different sets of information, we are able to estimate the benefit of improved land cover data and thus determine the value of land cover validation efforts. We illustrate the methodology by comparing portfolio outputs of the different mitigation options modeled within the GLOBIOM economic land use model using cropland data from different databases.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

8.1 Introduction

Activities within the land use, landuse change, and forestry (LULUCF) sector will play an increasingly important role in climate change mitigation in the future. Although LULUCF was a significant factor in the negotiations of the original Kyoto agreement, the protocol did not specify how emissions and reductions from this sector would be incorporated into the accounting system. Instead, this function was assigned to the Subsidiary Body for Scientific and Technological Advice (SBSTA) of the United Nations Framework Convention on Climate Change (UNFCCC) and the Intergovernmental Panel on Climate Change (IPCC), where a working group on LULUCF formulated a special report (Watson et al. 2000). The framework was then accepted at the seventh conference of the parties (COP-7) in Marrakech in 2001 (Schlamadinger et al. 2007).

Reductions in greenhouse gas (GHG) emissions can be achieved in the LULUCF sector in several ways, such as Reducing Emissions from Deforestation and Forest Degradation (REDD), increasing the area of land cultivated with biofuels, and improving agricultural practices. REDD is a multi-agency initiative that aims to establish a framework for the coordination of actions at the country level by creating a financial value for the carbon stored in forests, offering incentives for developing countries to reduce emissions from forested lands, and investing in low-carbon paths to sustainable development. However, within the Kyoto Protocol’s first commitment period, 2008–2012, REDD in developing countries is not an allowable contribution, yet deforestation represents the main source of GHG emissions in, for example, Indonesia (Schlamadinger et al. 2007). The Bali Action Plan, an outcome of COP-13, held in Bali in December 2007, requires parties to include REDD in the post-2012 negotiations of the Kyoto agreement (FAO et al. 2008). At COP-15, in Copenhagen in December 2009, even though no overarching agreement was reached, leaders agreed to establish a “green climate fund,” which is designed to mobilize $30 million on REDD + (which includes forest conservation and sustainable management) for mitigation, adaptation, technology, and capacity building, and further progress on this has been made at the previous COP-16 in Cancun in 2010.

Satellite remote sensing is an important potential source of data for determining initial conditions of land cover and forest cover for LULUCF and other land use models (Watson et al. 2000). Urgent questions exist about the land available for the expansion of agriculture to combat food insecurity, the extent of future competition for land between food and bio-energy, as well as how much land is available for afforestation projects. Moreover, questions arise about the cost-effectiveness of REDD policies versus bio-fuel targets. Such questions can be answered only with reliable maps of land cover. Recent data sets on global land cover are the MODIS land cover, based on the MODIS sensor and produced by Boston University (Friedl et al. 2002); the GLC-2000, based on the SPOT-Vegetation sensor and produced by the Joint Research Center of the European Commission (Fritz et al. 2003); and the GlobCover product, based on the MERIS sensor and produced by a consortium supported by the European Space Agency (Defourny et al. 2009). However, these data sets differ drastically in terms of cropland distributions and, especially, cropland area. Ramankutty et al. (2008) estimated that the cropland area is between 1.22 billion and 1.71 billion ha (at the 90 % confidence interval), which translates to a 40 % difference between land cover products. For example, using the maximum cropland area as the upper limit from the legend definition (e.g. for single classes 100 % cover and for Mosaic classes 50–70 % cover), we find that MODIS records 1,693 million ha, GLC-2000 records 2,201 million ha and GlobCover records 1,902 million ha (Fig. 8.1). At the same time there have been questions regarding the cropland extent reported by the UN’s Food and Agriculture Organization (FAO), in particular for developing countries. For example, in the least developed countries, such as Malawi, the appropriate methods and tools to undertake reliable crop area estimates are simply not in place, and reported crop area contains a possible error of up to 30 % (World Bank, personal communication).

These large absolute and spatially distributed differences in cropland extent have implications for the GLOBIOM economic land use model used at the International Institute for Applied Systems Analysis because the data provide the initial conditions for the evaluation of mitigation options. To explore the value of this information, we construct a scenario with two mitigation options, REDD and the implementation of a new technology in the energy sector, carbon capture and storage (CCS). Each mitigation option has a different cost. However, the REDD mitigation option has increasing costs as less and less land is available. The uncertainty in these costs is also a function of which cropland extent layer is used as an input to the land use model. Uncertainty about whether the world is correctly represented by the figures reported by the International Food and Policy Research Institute (IFPRI) or the GLC-2000 land cover product or MODIS may carry substantial costs when choosing a mitigation policy portfolio. This is because the optimal mix of mitigation options under uncertainty might deviate substantially depending on whether IFPRI, GLC-2000, or MODIS reflects the true state of the world. This is also a function of the risk strategy of the decision maker. For example, a risk-averse strategy might typically be to accept higher portfolio costs to lower the overall risk. We acknowledge the potential importance of other sources of uncertainty, such as uncertainty in the economic land-use model and its underlying assumptions, as well as the exogenous drivers of the economic land-use model, such as the validity of population projections and assumptions about technological change. For example, higher than anticipated population would exert additional pressures on land, whereas unexpected technological breakthroughs that improve yields would reduce demand for agricultural land. Analyzing all sources of uncertainty is clearly beyond the scope of this paper. We therefore focus on land cover, since methods and tools are currently available to reduce this type of uncertainty. Moreover, we acknowledge that the value of information derived in this paper has itself a particular uncertainty attached, since not all types of uncertainties can be considered simultaneously without obscuring the mechanisms in which we are primarily interested at this stage.

In this paper a methodology is presented that demonstrates how the value of reducing uncertainty can be assessed. A portfolio optimization model is implemented to find the optimal mix of mitigation options using different estimates of cropland from two land cover datasets as inputs to the model. We therefore created two land cover layers, one using the GLC-2000 cropland minimum (the cropland class is covered 50 % by cropland and 50 % by a noncropland class) and the other using the MODIS cropland maximum (where the cropland class is covered 100 % by cropland). This can still be considered a relatively conservative approach, since the maximum cropland extent reported by GLC-2000 would be even higher.

It can be shown that an increase in the probability that either GLC-2000 or MODIS is correct will lower the expected portfolio costs compared with the case where both have the same probability of being correct. This finding proves that there is added value in continuing to improve land cover information through better validation.

In the remainder of this paper we review the concept of the value of information along with applications in the existing literature. Subsequently, we present an analytical framework valuing the information from having better land cover data for two mitigation options under differing assumptions of the behavior of the cost function, which will be illustrated with an application. Finally, we consider the implications of this approach for the merit of global Earth observations (EO) and applications of this approach in future research.

8.2 Value of Information

The expected value of information (VOI) is a concept that has been used in stochastic programming for a long time (Birge and Louveaux 1997). Another term frequently used to describe this concept is the so-called willingness to pay (for information). The idea is that decisions taken on the basis of imperfect information can differ from those taken in a situation of complete or perfect information, and thus the decisionmaker might be willing to pay the difference in costs or profits to be able to make a better-informed decision.

In the approach used in this paper, we compute the expected VOI for a portfolio model, where the optimal mitigation strategy depends crucially on the availability of information. The method that we use to optimize the decisions under perfect and imperfect information is standard portfolio theory (Markowitz 1952), using the variance of costs as a measure of risk. Even though both concepts are not original, the approach of using them to assess the VOI in the face of uncertainty about the availability of land, and thus the cost of one of the mitigation options, is worthy of demonstration, both in theory and with a practical example (using the case of avoided deforestation).

8.2.1 Review

Macauley (2006) provides a good overview of the literature from research using VOI and emphasizes that most models depend largely on the extent of the uncertainty of the decisionmakers, the cost of making a suboptimal decision in the light of better information, the cost of making use of the information and incorporating it into decisions, and the price of the next-best substitute for the information.

Macauley (2006) further demonstrates that the value of information is clearly 0 in the situation where a decision maker attaches a probability of 0 or 1 to a given event, which means that she considers the occurrence of the event no longer uncertain. The other case in which the information has no value is when no alternative actions are available, even if information could be obtained, or when a wrong decision will not result in any added costs. Similarly, information is most valuable when (a) the costs associated with a wrong action are high; (b) when many alternative actions are available; or (c) when the decisionmaker has no clear preference for one or more of the alternatives.

The expected VOI has been measured by two kinds of methodsFootnote 1:

-

Hedonic pricing. These studies attempt to estimate the costs and benefits associated with environmental systems that have a direct effect on market values—for example, the use of wages or housing prices to infer the value of weather information or environmental quality as these affect wages or house prices.

-

Gains in output or productivity. The VOI is generally found to be rather small in most of these studies. Macauley (2006) attributes this to the fact that people are willing to pay for information only beforehand. Often they are unaware of the severe consequences that imperfect information in the case of an uncertain event can inflict. In the same vein, people often attribute a very low probability to catastrophic events and then choose not to pay for information that may well be rather costly.

Finally, Macauley (2006) acknowledges that computation of the expected VOI is a suitable tool for the valuation of EO benefits. In this case, the availability of better information can save costs and lives and alleviate problems in the face of disasters.

In economics, the expected value of information has also been widely used. Looking at climate change policy analysis in particular, Peck and Teisberg (1993) and Nordhaus and Popp (1997) adopted a cost-benefit approach targeted at finding the optimal policy response to damages due to climate change. They then proceeded to estimate the extent to which the world would be better off economically if, for example, climate sensitivity and the level of economic damages were known. Most of these studies use multistage optimization, where all information about the correct level of the uncertain parameters arrives in one time instance. Others, like Fuss et al. (2008), have used stochastic dynamic programming allowing for a good description of the development of the uncertain parameters but with the disadvantage of having less scope in terms of controls and states. The VOI is derived by comparing profits and emissions when optimizing with stochastic prices to profits and costs when prices are deterministic (in which case the optimal decisions would be different from those in the stochastic setting).

8.2.2 Current Applications of Measuring Value of Earth Observations

The 10 Year Implementation plan of the Global Earth Observation System of Systems (GEOSS 2005) lists nine societal benefit areas (SBAs): weather, climate, ecosystems, biodiversity, health, energy, water, disasters, and agriculture. Despite the extensive literature on the costs and benefits of weather forecasts (Katz and Murphy 1997; Center for Science and Technology 2007), there have been few attempts to quantify the value and benefits of EO data in other SBAs. Studies that have addressed the benefit of EO for health and energy applications have been particularly scarce.

Moreover, to date, there have been few integrated assessments of the economic, social, and environmental benefits of EO and the GEOSS. A project funded by the European Union called GEOBENE (Global Earth Observation—Benefit Estimation: Now, Next and Emerging) developed tools and methodologies for studies of GEOSS benefit assessment. Some of those tools continue to be developed in the EUROGEOSS project, and two case studies are presented here. In the course of the GEOBENE project, a conceptual framework for assessing the benefits of GEOSS via a benefit-chain concept was developed. The basic notion is that an incremental improvement, and hence an incremental benefit in the observing system, must be judged against the incremental costs needed to build the observing system. Since it is not always easy to quantify the costs and in particular the benefits in monetary terms, an order of magnitude estimation is proposed. Moreover, it was shown that an understanding of the shape of the cost benefit curve can help guide rational investment in EO systems (Fritz et al. 2008).

An example of improved data for biodiversity conservation planning illustrates how the benefit chain concept can be applied. This case study, described in Fritz et al. (2008), demonstrates the benefits of replacing commonly available coarse-scale global data (the non-GEOSS scenario) with finer-scale data used in conservation decision making. The national land cover data set for South Africa was compared with the global GLC-2000 dataset, whose finer-scale data are like those expected from GEOSS and can thus be used to estimate the potential benefits of GEOSS data. When one compares the estimated cost of producing higher-resolution data for the South African case study (200 million €) with the cost of not having this information (1.2 billion €), it becomes clear that the improved data have real value.

A second example is demonstrated by Bouma et al. (2009), who used Bayesian decision theory to quantify the benefits if decisionmakers use EO data versus a scenario in which these data were not available. The authors examined the added value of EO for preventing potentially harmful algal blooms in the North Sea. Using expert elicitation to assess the perceptions of decisionmakers regarding the accuracy of the GEO-based algal bloom early warning system, the analysis indicated that the value (i.e., avoided damage) of an early warning system would be approximately 74,000 € per week. Since this is less than the costs of establishing and maintaining such an early warning system, investing in satellite observation for preventing potentially harmful algal blooms is an economically efficient investment. Increasing the accuracy of the information system substantially increases the value of information, where the value of perfect information was estimated at 370,000 € per week (Bouma et al. 2009).

A third example, in the field of the disaster SBA, is elaborated by Khabarov et al. (2008), who investigated, by means of simulation studies, how improvements in the spatial resolution of weather observation systems can help reduce the area burned by forest fires in Portugal and Spain. A fire danger index was computed on a daily basis, which was assumed to be used in decisionmaking. Official aircraft-based forest patrolling rules were applied. In the model, the total area burned and the total observed area were both considered, and the benefit of having fine- versus coarse-resolution data was assessed. By modeling the stochastic process of fire spread, the researchers estimated how much area burned could be saved if the fires were detected quickly through an improved patrolling pattern. This pattern could be designed using a finer weather grid. Simulations revealed that the use of finer-resolution data reduced the area burned by 21 % and the patrols could be reduced by 4 %. The cost-benefit ratio points towards a higher incremental benefit than the incremental cost of establishing a finer-grid patrol system.

An overall assessment of the GEOBENE project showed that in the majority of case studies, the societal benefits of improved and globally coordinated EO systems were orders of magnitude higher than the investment costs. A strong coordinating institution is required to ensure that an integrated architecture takes full advantage of the increased benefits and cost reductions achieved by international cooperation.

8.3 Analytical Framework: Portfolio Approach to Mitigation

8.3.1 Independent Constant-Cost Mitigation Options

In this paper we are interested in a situation where the decisionmaker can mitigate climate change either in the land use sector (e.g., through avoiding deforestation) or in industry (e.g., by introducing a new technology, such as carbon capture and storage). The focus of our analysis is on the choice between these two options, where the land-use mitigation option exhibits increasing marginal costs, which differ between two scenarios depending on the land cover data set that is used. Scenario 1 is the GLC-2000 scenario, in which a substantial additional land resource is available for agriculture and cropland expansion; this is the “available land” scenario. Scenario 2 is the MODIS scenario, where most of the land is already in use and much less additional land is available for agriculture and cropland expansion; this is the “limited available land” scenario. The other mitigation option is assumed to be available at a constant cost at the beginning and is completely independent of the first option.Footnote 2

We use standard portfolio theory (Markowitz 1952) to approach the problem of determining the optimal mitigation portfolio and derive the expected value of perfect information for the results obtained (Birge and Louveaux 1997).Footnote 3 In particular, the objective to be minimized is a weighted average of expected costs and variance:

where the weight of the variance represents the level of risk aversion: the larger the weight of the variance in the objective, the more costs the decisionmaker will adopt to reduce this risk. E is the expected value operator; Var is the variance; ω is the measure of risk aversion and is larger than 0 for risk-averse decisionmakers and equal to 0 for risk-neutral decisionmakers; x is the share of emissions abated through avoided deforestation within the mitigation portfolio; and C is the mitigation costs.

Other studies analyzing mitigation strategies have also implicitly and explicitly incorporated risk-averse decisionmakers, but it is challenging to estimate the magnitudes of the risk aversion parameter for global decisionmakers, although much work has been conducted in eliciting farmers’ degree of risk aversion using different types of utility functions (Lin et al. 1974; Binswanger 1980; Dillon 1971; Dillon and Scandizzo 1978).

At the global scale, integrated assessment models include damages from warming in their optimization of social welfare (see, e.g., Weyant et al. 1996 for an overview of the early literature). Anthoff et al. (2009) find high estimates for the social cost of carbon when explicitly including risk aversion, even with a model that incorporates relatively conservative damage estimates.

More closely related to our work, Springer (2003) suggests that diversification of mitigation activities allows for a reduction in risk exposure while taking advantage of low-cost options. He uses the traditional Markowitz mean-variance approach to determine efficient international portfolios of carbon abatement options and derives information about expected returns from investing in emissions reduction from marginal abatement cost curves for CO2.

Although the objective function used in this paper is different from the original Markowitz formulation of the expected value model, it is an alternative formulation proposed independently by Freund (1956), whereas both Markowitz’s (1959) and Freund’s (1956) formulations yield identical efficient frontiers (McCarl and Spreen 2007). Relating this back to the notation in Eq. (8.1), the expected value frontier for the optimal decisions across all ω > 0 is identical to the one given by the Markowitz approach, with ω = 0 giving the case where the decisionmaker is risk neutral. The limit case ω→∞, on the other hand, represents the case where only variance is considered.

In Appendix 8.A we first derive analytically the optimal strategy and the expected VOI for a base case, where both mitigation options feature independently with constant costs. The expected value of perfect information (EVPI) is defined by the following equation:

where p is the probability that the first land cover map is closer to reality, \( \bar{x\,\,} \)is the optimal share of emissions abated through avoided deforestation within the mitigation portfolio, and C ij is the mitigation cost either for a strategy or for option j in scenario i.

The derivations indicate that the optimal mitigation strategy is always a pure strategy in the case of perfect information, which implies that the decisionmaker never chooses a portfolio of the mitigation options. This result is independent of the level of risk aversion of the decisionmaker. Whether the first or second mitigation option is preferred thus depends on the scenario (i.e., which land cover map is a “truer” representation of reality).

In the case of imperfect information, and assuming that on average the cost of the first mitigation option is higher than the cost of the second option, there are some cases in which the decisionmaker (within a given interval of risk aversion) prefers a combination of the two mitigation options to a pure strategy. For this to be true, the probability of the scenario in which the first mitigation is cheaper must be sufficiently high. Otherwise, the decisionmaker will always prefer the option that is on average cheaper—independently of his risk aversion measure.

It can be shown that the case of perfect information is in fact a limit of the strategy in the case of imperfect information. Furthermore, the strategy is a decreasing function of the level of risk aversion (for a probability larger than the threshold). This means that the more expensive mitigation option enters the mitigation portfolio with a higher share if the decision-maker is more risk averse. In other words, the decisionmaker trades higher costs for a decrease in the variance—that is, risk.

8.3.2 Constant-Cost and Increasing-Cost Mitigation Options

The derivations for scenarios 1 and 2 and two mitigation options, where one has constant costs and the other one has increasing costs (Appendix 8.B), show that the introduction of imperfect information causes the decisionmaker to choose a mitigation strategy that is a compromise between the strategies optimal in the individual scenarios. This effect is independent of the risk attitude of the decisionmaker, so even without risk aversion, we get a mix of the two mitigation options as the optimal strategy.

Furthermore, for a given probability of the first scenario (i.e., a given land cover map is more correct than another), the optimal mitigation strategy of a risk-averse decisionmaker is the same as that of a risk-neutral investor, who perceives the probability attached to the first scenario differently. This probability is uniquely defined by the probability that the first scenario is correct and the level of risk aversion of the decisionmaker. It can be shown—independently of the level of risk aversion—that this probability is always closer to 0.5 than the probability that scenario 1 is true; that is, it is always closer to the solution where the decisionmaker is risk neutral, which is equivalent to the solution where she believes that the two land cover maps have equal probability of being correct.

Finally, the VOI is always found to be positive and it can be shown that there is a unique probability threshold below (above) which the VOI is increasing (decreasing) in the probability that the first land cover scenario is true. This implies that the decisionmaker’s willingness to pay for having perfect information ex ante is highest at a given probability threshold, to the right of which the probability of scenario 1’s being correct increases and to the left of which it decreases. That is, in both directions we move to a more informed situation, so that the marginal value of additional information decreases.

In the following section we present an empirical analysis, where we use the analytical model with two options, where one has increasing and the other one has constant costs (Appendix 8.B).

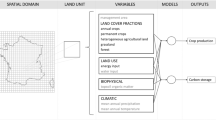

8.4 Mitigation Option Portfolio Example

Having defined the problem and the properties of the solution in a simple setting in Sect. 8.3, we now turn to an application of the second analytical model from Appendix 8.B using the GLOBIOM model to derive the function of the cost of the REDD mitigation option. The alternative mitigation option (a new technology, carbon capture and storage, in the industry and energy sector) is assumed to have constant costs. GLOBIOM is a global recursive dynamic partial equilibrium model that integrates the agricultural, bioenergy, and forestry sectors to give policy advice on global issues concerning land-use competition between the major land-based production sectors (Havlík et al. 2010). The global agricultural and forest market equilibrium is computed by choosing land-use and processing activities to maximize the sum of producer and consumer surplus subject to resource, technological, and political restrictions, as described by McCarl and Spreen (1980). Prices and international trade flows are endogenously computed for 28 world regions.

GLOBIOM enables one to estimate the marginal cost of REDD (C iREDD ) as the opportunity cost of activities that could take place on the deforested land, namely agriculture and biomass for bioenergy production. This cost is obtained from the dual value associated with a constraint that forces the model to respect a certain level of GHG emissions determined as a percentage of the business-as-usual emissions from deforestation. By varying the reduction level from 0 to 100 %, the entire marginal abatement cost curve can be uncovered.

The two alternative scenarios were differentiated by the underlying land cover maps; we used the GLC-2000 cropland minimum (the cropland class is covered 50 % by cropland and 50 % by a noncropland class) and the MODIS cropland maximum (the cropland class is covered 100 % by cropland). We calculated the ratio between the MODIS cropland maximum and the GLC-2000 cropland minimum area at the national level taking the GLC-2000 cropland minimum as the reference. To mimic the MODIS maximum cropland scenario, we multiplied the cropland reference area by this ratio and divided the crop yield level by the same ratio, assuming that total production of the reference year is known and valid for both scenarios. In those countries where the MODIS maximum cropland extent exceeded the GLC-2000 minimum cropland area, the additional cropland was assigned to the land category previously labeled “other natural land.” This reduced the possibility of agricultural production expansion beyond forests. We consider the difference of cropland area chosen between the two land cover scenarios as relatively conservative, since we could also have modeled the difference between the MODIS cropland minimum and the GLC-2000 cropland maximum. Such scenarios would have increased the differences in cropland extent and consequently be more extreme.

We then test the sensitivity of the optimal mitigation strategy and the associated VOI to the cost of this “safe” alternative and the responsiveness to different levels of risk aversion, where we refer to a weight (ω) close to 0 as being risk neutral and then increase it to 0.002 in intervals of 0.0002.

For the latter, we fix the cost of the constant-cost mitigation option at $20 per tCO2. Because the maximum potential from REDD between 2020 and 2030 is about 20 GtCO2 with a price varying between $0 and $50 per tCO2, the total amount to be mitigated by the combination of the constant-cost and REDD options is set equal to 20 GtCO2.

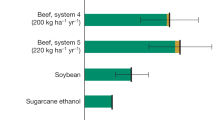

In Fig. 8.2, the contribution of the REDD option to the overall mitigation contingent is shown for an increasing probability that the land cover map, for which REDD is relatively cheaper, is correct. In the risk-neutral case, where the decisionmaker minimizes expected costs irrespective of the variance (i.e., the risk aversion coefficient is equal to 0), we see that the red line rises from 13,000 million tons (mt) of CO2 to more than 16,000 mt as we become more confident that the land cover map with more additional land is correct. This implies that as the certainty that this map is correct increases, the REDD option becomes more and more attractive.Footnote 4 However, as the decisionmaker grows more risk averse (i.e., the lines in light green, blue, pink), we observe a different pattern: until a threshold of 40 % probability, the share of the REDD mitigation option actually decreases before it starts to increase. This can be interpreted in the following way: the points where the probability of having more land available is 0 and 100 % represent points with complete certainty. In the first case, the map with less available land is correct, whereas in the second case, the map for which REDD is cheaper is the true state of the world. These points thus also coincide with the risk-neutral results. At the probability threshold referred to above, the share of the REDD mitigation option is at a minimum, left of which the probability that the map with less available land is correct increases (and so the share of the constant-cost mitigation option increases at the expense of the current one). To the right of the minimum, the probability that the map with more available land is correct is higher, so the share of the REDD option is increased. Figure 8.3 shows the amount of mitigation using the second option (constant cost), which is clearly the mirror image of the first option’s amount.

As we move from the risk-neutral to the more and more risk-averse case, the curves change shape: they are sharply sloped at the ends, where certainty in the land cover data sets is highest, and flatter where uncertainty increases. This indicates that for increasing risk aversion, the patterns described above are reinforced, and more mitigation happens through the constant cost option. If we look at Figs. 8.4 and 8.5, which display the total expected cost of the mitigation portfolio and the variance, respectively, we can see that the decisionmaker will accept higher costs to reduce the overall risk (or the variance). These results are in line with the theoretical, general findings explained in the previous section and derived in the appendixes.

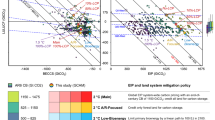

Finally, we compute the expected VOI according to the definitions presented in Sect. 8.3. In Fig. 8.6, the VOI is increasing to the left of 50 % and decreasing to the right of 50–60 % in the risk-neutral case. Only as risk aversion rises do the curves get skewed; that is, the maximum of the lines in Fig. 8.6 moves toward 70 % and then 80 %. This implies that the more risk averse you are, the more you value information, but after a certain probability threshold, you start to value additional information less because you are already relatively confident in the data. This probability threshold also increases for higher levels of risk aversion. In economic terms you see the marginal value of information switch signs at ever-higher probability levels, starting at 50 % for the risk-neutral case and ending around 80 % for higher levels of risk aversion. Once you are sure that the land cover map with more land available is correct, the VOI is 0 again.

We then investigated the response of the expected VOI to changes in the assumption about the cost of the alternative mitigation option, carbon capture and storage—what we have called the constant-cost option above. In Fig. 8.7, the red line is derived for costs of this option of $10/tCO2, and the other lines (light green, blue, pink, etc.) represent progressively higher costs per ton of CO2.

In this risk-neutral case, we see all the lines in Fig. 8.7 increasing, with more and more of the REDD option being adopted because the alternative (constant-cost) option is assumed to be comparatively more expensive. At $60 per tCO2, we observe a mitigation portfolio consisting of 100 % REDD, irrespective of the probability of having more land available being high. This is also why expected the VOI is equal to 0 in this case (see Fig. 8.8).

In Fig. 8.8, The VOI assuming the constant-cost option costs $20 per tCO2 is above the VOI assuming only a $10 cost. This is because the decisionmaker regards the REDD option as less competitive if the alternative is so cheap. The VOI is then highest for the blue line, corresponding to $30 per tCO2, at around 50 % probability that the land cover data with more available land are correct. Beyond that, the alternative mitigation option gets less and less attractive than the REDD option, and the value of knowing with more certainty that this cover is correct decreases—that is, the pink line is underneath the blue one, followed by the dark blue and brown lines (at 0). Also, the maximum of expected VOI curves is to the left of the 50 % probability of having more land in the latter case (i.e. the constant-cost option is relatively more expensive) and to the right of 50 % in the case where the constant-cost option is cheap. This means that the marginal value of information decreases as the alternative option becomes more expensive, and vice versa, and the probability threshold beyond which additional information is valued at a decreasing rate gets lower and lower, too. In other words, the probability threshold required to commit more to the REDD mitigation option is not so high anymore.

8.5 Discussion and Outlook

This study has taken a very simple and straightforward approach to derive some powerful conclusions. We have used standard portfolio optimization to derive the optimal mitigation strategy, where one option to mitigate is avoided deforestation and the other option is outside the LULUCF sector, where we assume that a new technology, carbon capture and storage, becomes available at constant costs. The REDD option, however, displays increasing costs because other land uses compete with increasing land needs for REDD. In addition, the uncertainty surrounding the availability of land due to the inadequacy of existing land cover maps implies that the cost of REDD could be very different for different scenarios of land cover. In this study, we have used two land cover products, one of which shows more land available than the other, which means that the REDD option would be relatively cheaper if the first product is used. The purpose was to estimate the expected VOI and thus give us an idea about how much decisionmakers would be willing to pay to gain more certainty in the accuracy of land cover information.

An important conclusion (that can also be proven mathematically; see Appendix 8.B) is that even if the decisionmaker is risk-neutral, the existence of uncertainty leads to a portfolio of the two mitigation options and a positive expected VOI rather than a pure strategy using only the option that is on average cheaper. Only if the constant-cost option is so expensive that the REDD option is preferred under both land cover types do we find expected VOIs equal to 0 for any probability that more land is available. If we interpret the expected VOI as the willingness to pay for becoming more certain that a given land cover data set is true, then we can use Fig. 8.8 to provide the magnitudes of funds potentially involved: if the constant-cost option was $30 per tCO2 (the light blue line) and we were 30 % certain that the land cover map showing more land available was true, it would be worth more than $1 billion to increase this probability to 40 %. For another 10 % improvement, we would still be willing to pay a little less than $1 billion, and later this would decrease, since we are already relatively certain that this map is the right one. Since the “total” cost of the mitigation contingent is in the order of hundreds of billions of dollars, this represents only a small percentage. However, in absolute terms it implies huge funding potential for marginal improvements in the existing products. For example, the AFRICOVER project, undertaken for 12 countries in Africa by FAO at a cost of several million dollars, provides a significant marginal improvement over coarser land cover maps such as GLC-2000 and improves our knowledge about land availability. The cost-benefit ratio points towards a positive return on investment.

Risk aversion increases the expected VOI even further. In addition, it also shifts the point at which the marginal change in VOI ceases to be positive. This implies that even for relatively high levels of certainty, a risk-averse decisionmaker would be willing to pay for further security, until the value of information falls to 0 in the case of complete certainty.

Future research should look more closely at the interaction between mitigation options arising within the LULUCF sector, since these options might have complementary features or compete with each other, thereby reinforcing the costs. Also, it will be of major interest to zoom into the properties of cost distributions when more options are considered and test other risk measures than just the variance, should potential losses not be normally distributed (i.e., if much could be lost in the tails of the distribution). Finally, uncertainties other than those arising from the costs surrounding the use of different land cover products should be analyzed. These include technological uncertainties, uncertainty about the correct stabilization target, and uncertainty about policy and regulation.

The example shown above has illustrated the tremendous value of information that reduces uncertainties in global land cover. It has shown that there is a high value in being able to map and quantify cropland extent accurately, in particular in Africa, where uncertainties are the highest. This demonstration involves one specific application. However, there are many other applications in which better land cover maps can help improve decisions, ranging from improved conservation planning for maximizing biodiversity on a local level to overall better land-use planning on a national level. This implies that there are co-benefits of having improved land cover information, and the VOI is probably much higher than what has been shown in this chapter.

Notes

- 1.

This review mainly applies to the Value of Information in the context of Earth Observations. The principles could equally have been applied within other scientific fields, but reviewing all of these is beyond the scope of this paper.

- 2.

If two options in the land use sector were analyzed, these could be competing or complementary, so that costs would either decrease or increase as more of one option was chosen. This is not the topic of this particular study, but will be of interest in future research that will also consider bio-fuel policies.

- 3.

We acknowledge that this implies that we focus on the perfect information case, which will never materialize in reality. For this reason, the expected VOI derived should be interpreted as an upper bound of the VOI that can be attained by having increasingly accurate information.

- 4.

Note that the optimal mitigation portfolio is never a pure strategy—not even in the case of risk-neutrality: it is always a mixture of both options, as explained in Sect. 8.3 and proven in the appendix.

References

Anthoff, D., Tol, R. S. J., & Yohe, G. W. (2009). Risk aversion, time preference, and the social cost of carbon. Environmental Research Letters, 4(2), 024002 (7 pp).

Binswanger, H. E. (1980). Attitudes toward risk: Experimental measurement in rural India. American Journal of Agricultural Economics, 62, 395407.

Birge, J. R., & Louveaux, F. (1997). Introduction to stochastic programming. New York: Springer.

Bouma, J. A., van der Woerd, H. J., & Kuik, O. J. (2009). Assessing the value of information for water quality management in the North Sea. Journal of Environmental Management, 90(2), 1280–1288.

Center for Science and Technology. (2007). Weather and climate forecast use and value bibliography. University of Colorado. http://sciencepolicy.colorado.edu/. Accessed 20 Aug 2007.

Defourny, P., Schouten, L., Bartalev, S., Cacetta, P., De Witt, A., Di Bella, C., Gerard, B., Heinimann, A., Herold, M., Jaffrain, G., Latifovic, R., Lin, H., Mayaux, P., Mucher, S., Nonguierma, A., Stibig, H-J., Bicheron, P., Brockmann, C., Bontemps, S., Van Bogaert, E., Vancutsem, C., Leroy, M., & Arino, O. (2009, May 4–8). Accuracy assessment of a 300 m global land cover map: the GlobCover experience. In: Proceedings of 33rd international symposium on remote sensing of environment (ISRSE), Stresa, Italy.

Dillon, J. L. (1971). An expository review of Bernouillian decision theory in agriculture: Is utility futility? Review of Marketing and Agricultural Economics, 39, 3–80.

Dillon, J. L., & Scandizzo, E. L. (1978). Risk attitudes of subsistence farmers in Northeast Brazil: A sampling approach. American Journal of Agricultural Economics, 60, 425–435.

FAO, UNDP, & UNEP. (2008). UN Collaborative Programme on reducing emissions from deforestation and forest degradation in developing countries (UN-REDD). URL: http://www.un-redd.org/

Freund, R. (1956). The introduction of risk into a programming model. Econometrica, 21, 253–263.

Friedl, M. A., McIver, D. K., Hodges, J. C. F., Zhang, X. Y., Muchoney, D., Strahler, A. H., Woodcock, C. E., Gopal, S., Schneider, A., Cooper, A., Baccini, A., Gao, F., & Schaaf, C. (2002). Global land cover mapping from MODIS: Algorithms and early results. Remote Sensing of Environment, 83, 287–302.

Fritz, S., Bartholomé, E., Belward, A., Hartley, A., Stibig H. J., Eva, H., Mayaux, P., Bartalev, S., Latifovic, R., Kolmert, S., Roy, P., Agrawal, S., Bingfang, W., Wenting, X., Ledwith, M., Pekel, F. J., Giri, C., Mücher, S., de Badts, E., Tateishi, R., Champeaux, J.-L., & Defourny, P. (2003). Harmonisation, mosaicing and production of the Global Land Cover 2000 database (Beta Version). Luxembourg: Office for Official Publications of the European Communities, EUR 20849 EN, 41 pp. ISBN 92-894-6332-5*.

Fritz, S., Scholes, R. J., Obersteiner, M., Bouma, J., & Reyers, B. (2008). A conceptual framework for assessing the benefits of a Global Earth Observation System of Systems. Systems Journal, IEEE, 2, 338–348.

Fuss, S., Johansson, D., Szolgayova, J., & Obersteiner, M. (2008). Impact of climate policy uncertainty on the adoption of electricity generating technologies. Energy Policy, 37(2), 733–743. doi:10.1016/j.enpol.2008.10.022.

GEOSS. (2005). The global earth observation system of systems (GEOSS) 10-year implementation plan. See http://www.earthobservations.org/documents/10-Year%20Implementation%20Plan.pdf

Havlík, P. Schneider, U. A., Schmid, E., Böttcher, B., Fritz, S., Skalský, R., Aoki, K., De Cara, S., Kindermann, G., Kraxner, F., Leduc, S., McCallum, I., Mosnier, A., Sauer, T., & Obersteiner, M. (2010). Global land-use implications of first and second generation biofuel targets. Energy Policy, Corrected proof available online 7 April 2010.

Katz, R. W., & Murphy, A. H. (Eds.). (1997). Economic value of weather and climate forecasts. Cambridge: Cambridge University Press. 237 pp.

Khabarov, N., Moltchanova, E., & Obersteiner, M. (2008). Valuing weather observation systems for forest fire management. IEEE, 2, 349–357.

Lin, W., Dean, G., & Moore, C. (1974). An empirical test of utility vs. profit maximization in agricultural production. American Journal of Agricultural Economics, 56, 497–508.

Macauley, M. K. (2006). The value of information: Measuring the contribution of space-derived earth science data to resource management. Space Policy, 22(4), 274–282.

Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7(1), 77–91.

Markowitz, H. M. (1959). Portfolio selection: Efficient diversification of investments. New York: Wiley.

McCarl, B. A., & Spreen, T. H. (1980). Price endogenous mathematical programming as a tool for sector analysis. American Journal of Agricultural Economics, 62, 87–102.

McCarl, B.A., & Spreen, T.H. (2007). Applied mathematical programming using algebraic systems. Available at http://agecon2.tamu.edu/people/faculty/mccarl-bruce/mccspr/thebook.pdf

Nordhaus, W. D., & Popp, D. (1997). What is the value of scientific knowledge? An application to global warming using the PRICE model. The Energy Journal, 18, 1–45.

Peck, S. C., & Teisberg, T. J. (1993). Global warming uncertainties and the value of information: An analysis using CETA. Resource and Energy Economics, 15, 71–97.

Raiffa, H., & Schlaifer, R. (1961). Applied statistical decision theory. Boston: Harvard University Graduate School of Business Administration.

Ramankutty, N., Evan, A. T., Monfreda, C., & Foley, J. A. (2008). Farming the planet: 1. Geographic distribution of global agricultural lands in the year 2000. Global Biogeochemical Cycles, 22(1). doi:10.1029/2007GB002952

Schlamadinger, B., Bird, N., Johns, T., Brown, B., Canadell, J., Ciccarese, L., Dutschke, M., Fiedler, J., Fischlin, A., Fearnside, P., Forner, C., Freibauer, A., Frumhoff, P., Hoehne, N., Kirschbaum, M. U. F., Labat, A., Marland, G., Michaelowa, A., Montanarella, L., Moutinho, P., Murdiyarso, D., Pena, N., Pingoud, K., Rakonczay, Z., Rametsteiner, E., Rock, J., Sanz, M. J., Schneider, U. A., Shvidenko, A., Skutsch, M., Smith, P., Somogyi, Z., Trines, E., Ward, M., & Yamagata, Y. (2007). A synopsis of land use, land-use change and forestry (LULUCF) under the Kyoto Protocol and Marrakech Accords. Environmental Science & Policy, 10, 271–282.

Springer, U. (2003). International diversification of investments in climate change mitigation. Ecological Economics, 46, 181–193.

Watson, R. T., Bolin, B., Ravindranath, N. H., Verardo, D. J., & Dokken, D. J. (2000). IPCC special report on land use, Land-use change and forestry, UNEP. URL: http://www.grida.no/publications/other/ipcc_sr/

Weyant, J., Davidson, O., Dowlatabadi, H., Edmonds, J., Grubb, M., Parson, E. A., Richels, R., Rotmans, J., Shukla, P. R., Tol, R. S. J., Cline, W. R., & Fankhauser, S. (1996). Integrated assessment of climate change: An overview and comparison of approaches and results. In J. P. Bruce, L. Lee, & E. F. Haites (Eds.), Climate change 1995: Economic and social dimensions of climate change (pp. 367–439). Cambridge: Cambridge University Press.

Acknowledgments

This research was conducted in the frame of the EU-funded EUROGEOSS (grant no. 226487) and CC-TAME (grant no. 212535) and GEOCARBON (grant no. 283080) projects.

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

Appendices

Appendixes

8.1.1 AIndependent Mitigation Options with Constant Costs

8.1.1.1 A.1Problem Formulation and Assumptions

Let us denote C ij as the mitigation costs for option j in scenario i (\( i,j \in \{ 1,2\} \)), representing the mitigation costs needed in the case where the observations from scenario j are correct and mitigation is carried out by option i. We will analyze the optimal mitigation strategy for both a case where the correct scenario is known beforehand and a case where this information is not available. The comparison between the two optimal mitigation strategies enables us not only to qualitatively assess the effect of uncertainty in the observations, but also to derive the value of information regarding which scenario is the correct one.

Let us assume that the mitigation cost is a linear function of the mitigation measures needed; that is, in the case where mitigation is carried out jointly by options 1 and 2 with options having shares of x and 1−x respectively (\( x \in [0,1] \)), the cost in scenario i is given by

Let us further assume that the observations represented by the scenarios are in principle diverse, such that neither of the mitigation options dominates the other; that is, without loss of generality, we can assume

Let us further assume that without loss of generality,

8.1.1.2 A.2Model Formulation

Let us assume the optimal mitigation strategy is determined by the solution of the optimization problem

where \( E[.] \) and \( Var[.] \) denote the expected value and variance, respectively. This formulation is a standard portfolio optimization approach, where the objective consists of the expected cost penalized by its variance. \( C(x) \)is the mitigation cost, which in our case is a random variable given by

The parameter \( \omega \) is the measure of risk aversion of the decisionmaker, where \( \omega = 0 \) models a risk-neutral and \( \omega \,> \,0 \) a risk-averse behavior, with the level of risk aversion increasing with increasing \( \omega \). The probability p represents the information or belief of the decisionmaker about the reliability of individual scenarios. As already mentioned, we will investigate two cases:

-

perfect information: the correct scenario is known, i.e., \( p \in \{ 0,1\} \)

-

imperfect information: there is no such information available at the decision moment, i.e., \( p \in (0,1) \)

8.1.1.3 A.3Solution

It is important to realize that the optimal mitigation strategy (i.e., the solution to the problem in Eq. (8.A.5)) is a function of the underlying parameters \( p,\omega \). Therefore, let us denote the optimal mitigation strategy by \( \bar{x}(p,\omega ) \).

8.1.1.3.1 Perfect Information

In the case where the correct scenario is known, there is no uncertainty concerning the mitigation costs, resulting in \( Var(C(x)) = 0 \).

If \( p = 0 \) (i.e., the second scenario is the correct one), then \( E[C(x)] = x{C_{21}} + (1 - x){C_{22}} \). Since (8.A.2) holds, the solution of (8.A.5) is attained for \( x = 0 \). Similarly, in the case where\( p = 1 \), the optimal strategy is \( x = 1 \).

This implies that the optimal mitigation strategy is in the case of perfect information always a pure strategy, never resulting in a portfolio of the mitigation options independently of the risk aversion of the decisionmaker. Whether the first or second mitigation option is preferred depends on the scenario: \( \bar{x}(0,\omega ) = 0 \), \( \bar{x}(1,\omega ) = 1 \) for any \( \omega \ge 0 \).

8.1.1.3.2 Imperfect Information

The solution of problem (8.A.5) is derived in Sect. 8.A.5. The most important result is summarized in the following Lemma:

Lemma 8.A.1

There exists \( \hat{p} \in (0,1) \), functions \( \underline \omega (p),\bar{\omega }(p) \) and a function \( \tilde{x}(p,\omega ) \) such that

\( \tilde{x}(p,\omega ) \in (0,1) \) for \( p > \hat{p} \) and \( \omega \in (\underline \omega (p),\bar{\omega }(p)) \,\)and

for \( p \in (0,1) \) and any \( \omega \ge0 \). The proof and analytical expressions for the probability threshold \( \hat{p} \)and risk aversion thresholds \( \underline \omega (p),\bar{\omega }(p) \) together with the analytical expression for \( \tilde{x}(p,\omega ) \) are presented in Sect. 8.A.5.

Lemma A.1 discloses a quite natural but important conclusion. Assumption (8.A.4) states that, on average, the cost of the first mitigation option is higher than the cost of the second option. Lemma A.1 shows that, if \( p \) is high enough (i.e., the probability of the scenario where the first mitigation option is cheaper is high enough), then in some cases the decisionmaker (if his measure of risk aversion is within the given interval) prefers a combination of the two mitigation options to a pure strategy. On the other hand, if the probability threshold is not met, the investor prefers the option that is on average cheaper independently of his risk aversion.

As is proven in Sect. 8.A.5, the optimal mitigation strategy in the case of perfect information is a limit of the strategy in the case of imperfect information. In addition, the strategy is a decreasing function of \( \omega \) for \( p \,> \,\hat{p} \), i.e., the more risk averse the decisionmaker, the higher is the share of the second mitigation option in the optimal strategy, meaning that a risk-averse investor is willing to sacrifice some part of the expected costs for the benefit of a lower variance.

8.1.1.4 A.4Value of Information

Using the notion of expected value of perfect information (EVPI) and the results derived in the previous section, we can quantify the value of the information on which scenario is the correct one.

EVPI (or often VOI) is a common term in decision theory used to quantify the maximum amount a decisionmaker would be ready to pay in return for complete (and accurate) information about the future (Birge and Louveaux 1997). The concept of EVPI was first developed in the context of decision analysis and can be found in classical references, such as Raiffa and Schlaifer (1961). The expected value of perfect information is, by definition, the difference between the value of the objective (i.e., costs) in the case where the information is unknown at the time of the decision and the expected value of the objective in the case where the information is known. In our case it can be expressed as

with \( E[\bar{x}(p,\omega )] \),\( Var[\bar{x}(p,\omega )] \) given by Lemma 8.A.1. Since \( \bar{x}(0,\omega ) = 0 \) and \( \bar{x}(1,\omega ) = 1 \), we have

and

Since \( Var[C(\bar{x}(p,\omega ))] \,>\, 0 \) for \( p \in (0,1) \), the sum of \( p \) multiple of (8.A.8) and \( (1 - p) \) multiple of (8.A.9) yields

8.1.1.5 A.5Formal Proofs

To derive the results presented in Sect. 8.3, we first need to prove some preliminary lemmas:

Lemma 8.A.1

Proof: The first expression follows directly from the definition of the mean and (8.A). The second expression is obtained after some rearranging of terms by substituting (8.A) into the definition of variance, \( Var(C(x)) = E[C{(x)^2}] - E{[C(x)]^2} \).

Lemma 8.A.2

The minimum of \( Var(C(x)) \)over \( x \in [0,1] \) is attained in \( x = 0 \) for any \( p \in (0,1) \).

Proof: After rearranging the expression for \( Var(C(x)) \) derived in Lemma 8.A.1, we obtain the following:

\( Var(C(x)) \) is a quadratic function which is due to (8.A) increasing on \( x \in [0,1] \); thus its minimum on the interval is attained in \( x = 0 \) independently of p.

Lemma 8.A.3

The minimum of \( E[C(x)] \) over \( x \in [0,1] \) is attained in

where

Proof: Since \( E[C(x)] \) is a linear function in \( x \), its minimum on a compact interval is attained on its border, except for the case where \( E[C(x)] \) is constant. Rearranging of terms in the expression for \( E[C(x)] \) from Lemma 8.A.1 yields that this is the case if and only if \( p = \hat{p} \). For \( p \,< \,\hat{p}, \) \( E[C(x)] \) is decreasing in x by (A), (A), hence the minimum is attained in \( x = 0 \). \( E[C(x)] \) is increasing for \( p > \hat{p} \), thus its minimum over \( x \in [0,1] \) is attained in \( x = 1 \).

These results enable us to derive the solution to problem (A) for the case of imperfect information—that is, \( p \in (0,1) \).

Lemma 8.A.3 in combination with Lemma 8.A.2 yields that if \( p < \hat{p} \), then the minimum of both \( E[C(x)] \) and \( Var(C(x)) \) over \( x \in [0,1] \) is attained in \( x = 0 \). Since \( E[C(x)] \) is independent of \( x \) if \( p = \hat{p} \), the solution of (8.A) is attained in \( x \)minimizing \( Var(C(x)) \). Hence the solution of (8.A.5) is

for \( 0 \,< \,p \le \hat{p} \) for any \( \omega \ge 0 \).

In the following, we will assume \( p > \hat{p} \), \( p \in (0,1) \). The objective of (8.A) is a quadratic function with a global minimum \( \tilde{x}(p,\omega ) \) which attained in \( x \) satisfying the first-order condition, which is a linear equation. After some rearranging, the first-order condition yields

with

It should be noted that \( K,k,L \,> \,0 \) by (8.A.2), (8.A.3), and (8.A.4) and \( p \,> \,\hat{p} \), \( p \in (0,1) \). Thus the global minimum of the objective of (8.A.5) is attained in

It should be noted that \( \tilde{x}(p,\omega ) \in (0,1) \) if and only if

where

This observation is crucial, since \( \bar{x}(p,\omega ) \) is equal to \( \tilde{x}(p,\omega ) \) if and only if \( \tilde{x}(p,\omega) \in[0,1] \). If \( \tilde{x}(p,\omega ) \ge 1 \), the objective of (3.5) is decreasing on \( [0,1] \) and thus \( \bar{x}(p,\omega) = 1 \). On the other hand, the objective of (3.5) is increasing if \( \tilde{x}(p,\omega ) \le 0 \), hence \( \bar{x}(p,\omega ) = 0 \). Therefore, we see that the set of \( (p,\omega ) \) on which \( \tilde{x}(p,\omega ) \in (0,1) \) is the same as the set of \( (p,\omega ) \) for which the optimal mitigation strategy is a portfolio of mitigation options. The derived results can be summarized as follows:

The analytic expressions for both the probability and risk-aversion measure thresholds and the optimal mitigation strategy enable us to study their properties.

First of all, it is important to realize that for a given probability level \( p \), the optimal mitigation strategy \( \bar{x}(p,\omega ) \) is a continuous function of \( \omega \). Second, comparing back to the results derived in Sect. 8.A.3 for the perfect information case, we see that

and since \( \mathop {{\lim }}\limits_{p \to 1} \underline w (p) = + \infty \) also

for any \( \omega \geqslant 0 \). In other words, the perfect information case is a limiting case of the case with imperfect information.

In addition, using the analytical expression for the global minimum\( \tilde{x}(p,\omega ) \), it can be easily shown that the optimal mitigation strategy \( \bar{x}(p,\omega ) \) is a decreasing function of \( \omega \).

8.1.2 BIncreasing-Cost LULUCF Mitigation Option

8.1.2.1 B.1Assumptions

Let us denote \( {C_i}({x_1},{x_2}):{{\hbox{R}}^2} \to {\hbox{R}}_0^{+} \), \( {C_i} \in {C^2} \) the mitigation cost function depending on the scenario i (\( i \in \{ 1,2\} \)) representing the mitigation cost depending on the extent of mitigation \( {x_j} \)performed by option j (\( j \in \{ 1,2\} \)). We assume that the mitigation cost function is scaled such that the total mitigation needed in both scenarios is equal to 1 and that no mitigation action results in 0 costs; that is, \( {C_i}(0,0) = 0 \).

We will analyze the optimal mitigation strategy for both a case where the correct scenario is known beforehand and a case where this information is not available. The comparison between the two optimal mitigation strategies enables us not only to qualitatively assess the effect of uncertainty in the observations, but also to derive the value of information on which scenario is the correct one. First let us formulate the assumptions on the mitigation cost that are necessary for the analysis:

The first three assumptions are mathematical representations of the following situation: The marginal costs of the second mitigation option are constant and independent of the scenario (since the option is part of the analyzed industry) and the cost of the first function is assumed to be increasing and convex.

The fourth and fifth assumptions form necessary conditions, so there does not exist a dominant mitigation option; that is, the optimal choice of the investor is a combination of the two options. The last assumption states a relationship between the options, implying that the cost in the case of the second scenario is rising less steeply than in the first one.

Let us further introduce some simplifying notation and basic properties of the functions considered. Let \( {K_i}(x) = {C_i}(x,1 - x) \), i.e., \( {K_i}(x) \) is a function of one variable only and denotes the mitigation cost as a function of the mitigation done in the first mitigation option, assuming the total mitigation is such that the mitigation target is met. \( {K_i}(x) \) is an increasing (from (8.B.1) and (8.B.2)), convex (8.B.3) function of \( x \). The first-order condition for minimization of \( {K_i}(x) \) can be formulated in terms of function \( {C_i} \) as

(8.B.1), (8.B.3), (8.B.4), and (8.B.5) imply that there exists a unique solution of (8.B.7), which we denote \( \hat{x}_G^i \). Moreover, (8.B.3) ensures that the global minimum of \( {K_i}(x) \) is attained in \( \hat{x}_G^i \). (8.B.6) in turn implies that

8.1.2.2 B.2Model Formulation

Similar to the baseline case, we are interested in finding the optimal mitigation strategy, which will be the solution of the same optimization problem as in the baseline case, which can be equivalently formulated in terms of functions \( {K_i}(x) \) as

where \( E[.] \) and \( Var[.] \) denote the expected value and variance, respectively. This formulation is a standard portfolio optimization approach, where the objective consists of the expected cost penalized by its variance. \( K(x) \)is the mitigation cost, which in our case is a random variable defined as

The parameter \( \omega \) is the measure of risk aversion of the decisionmaker, \( \omega = 0 \) modeling a risk-neutral and \( \omega \,> \,0 \) a risk-averse behavior, with the level of risk aversion increasing with increasing \( \omega \). The probability p represents the information or belief of the decisionmaker about the reliability of individual scenarios. We analyze the following four cases:

-

I.

Perfect information. The information on which scenario is correct is available prior to the decision point; that is, \( p \in \{ 0,1\} \).

-

II.

Imperfect information. Such information is not available; that is, \( p \in (0,1) \). The three subcases represent different levels of risk aversion of the decisionmaker.

-

(a)

Risk neutrality. The decisionmaker does not care about the risk associated with the decision and is concerned only about the expected mitigation costs; that is, \( \omega = 0 \).

-

(b)

Absolute risk aversion. The decisionmaker cares only about the risk measured by the variance and neglects the expected cost.

-

(c)

Risk aversion. The decisionmaker prefers mitigation strategies leading to lower expected costs and a lower variance at the same time. The preference over them is measured by the risk aversion coefficient \( \omega > 0 \) present in the target function. The risk-neutral and absolute risk aversion case are the limits of this case for \( \omega \to 0 \) and \( \omega \to \infty \), respectively.

-

(a)

8.1.2.3 B.3Solution

8.1.2.3.1 Perfect Information

Let us denote the optimal strategy for the cases analyzed here; that is, \( p = 0 \), \( p = 1 \) as \( {\hat{x}^2}, \) \( {\hat{x}^1} \), respectively. In the case where the correct scenario is known, there is no uncertainty concerning the mitigation costs, resulting in \( Var({K_p}(x)) = 0 \). If \( p = 0 \) (i.e., the second scenario is the correct one and \( E[K(x)] = {K_2}(x) \)), then if \( p = 1 \), \( E[K(x)] = {K_1}(x) \). Thus the optimal mitigation strategies in the perfect information case are strategies in which the minimum of \( {K_i}(x) \) is attained for\( x \in [0,1] \). We have already shown that \( {K_i}(x) \) have global minima, which are attained in \( [0,1] \). Therefore

where \( \hat{x}_G^i \) is the unique solution of (8.B.7), \( i \in \{ 1,2\} \) and from (8.B.8)

8.1.2.3.2 Imperfect Information

8.1.2.3.2.1 Risk-Neutral Case

In this case we analyze a situation where \( \omega = 0 \). That is, the problem (8.B.9) is equivalent to

Let us denote the optimal strategy \( {\hat{x}^p} \) as a function of p for which the minimum of (8.B.14) is attained. It can be proven that

and in addition

where

Results (8.B.15) through (8.B.18) express that if the information about which scenario will turn out to be true in the future is not available at the decision moment, a risk-neutral decisionmaker will always prefer a strategy that lies in between the strategies that are optimal for each scenario if the information is available. They further show that the share of the first mitigation option in the mitigation strategy is decreasing with increasing probability, converging to the optimal strategy for the first scenario for \( p \to 1 \), and to the strategy optimal for the second scenario for \( p \to 0 \). The proof of results (8.B.15) through (8.B.18) is presented in Sect. 8.B.6

8.1.2.3.2.2 Absolute Risk Aversion

By definition of variance we have

which means that for absolute risk aversion, the problem (8.B.9) can be formulated as

In Sect. 8.B.6 we prove that the global minimum of \( p(1 - p){({K_1}(x) + {K_2}(x))^2} \) is attained on \( [0,1] \) in \( {\hat{x}^{0,5}} \).

This discloses an interesting implication about the behavior of an absolutely risk-averse decisionmaker. We see that the optimal mitigation strategy is the same as in the case of a risk-neutral investor who believes that each scenario is equally probable.

8.1.2.3.2.3 Risk Aversion

As in the baseline case, let us denote the

\( \omega > 0 \), \( p \in (0,1) \). In Sect. 8.B.6 we prove that

and

This implies, in comparison with the risk-neutral case, that the decisionmaker prefers a more balanced mitigation strategy, choosing a strategy that is always closer to \( p = 0.5 \). More importantly, we saw in (8.B.15) through (8.B.18) that \( {\hat{x}^p} \) is a continuous decreasing function mapping \( [0,1] \) on\( [{\hat{x}^1},{\hat{x}^2}] \). This means that for any \( p \in (0,1) \) there exists a unique \( q \in (0,1) \) such that

where \( q \in (p,0.5) \) for \( p \in (0,0.5) \) and opposite otherwise. In other words, the solution of the risk-averse case is equal to the solution of the risk-neutral case when the probability is equal to \( q \). This shows that, in reality, the risk-averse decisionmaker behaves in the same way as a risk-neutral investor, but in fact attaches a different probability to the scenarios, which is always closer to 0.5.

8.1.2.4 B.4Value of Information

As in the baseline, we measure the value of information by EVPI. (8.B.24) implies that in a further analysis of the results it is sufficient to consider only a risk-neutral decisionmaker. Therefore, in this case EVPI is a function of probability only and can be expressed as

As in the baseline case, we can show that

As we prove in Sect. 8.B.6.3, there exists \( \hat{p} \in (0,1) \)such that

Moreover, \( EVPI(p) \,\)is an increasing function of \( p \,\)for \( p \in (0,\hat{p}) \) and decreasing for \( p \in (\hat{p},1) \).

8.1.2.5 B.6Formal Proofs

8.1.2.5.1 Risk-Neutral Case

First let us prove the following lemma:

Lemma 8.B.1

Let \( q \in (0,1) \) and \( {F_i}:R \to R \), \( {F_i} \in {C^2} \), \( i \in \{ 1,2\} \) satisfy

-

$$ {{{\partial^2}{F_1}}}{{\partial {x^2}}} > \frac{{{\partial^2}{F_2}}}{{\partial {x^2}}} > 0 $$

-

The global minimum of \( {F_i}(x) \) is attained in \( {x_i} \in [0,1] \) with \( {x_1} < {x_2} \)

Then \( {F_q}:R \to R \) defined by \( {F_q}(x) = \alpha (q{F_1}(x) + (1 - q){F_2}(x)) \) satisfies

and the global minimum of \( {F_q} \)is attained in \( \,x \in ({x_1},{x_2}) \). Moreover, for any \( x \in ({x_1},{x_2}) \) there exists \( q \in (0,1) \) such that the global minimum of \( {F_q} \) is attained in \( x \).

Proof: Since \( \,{F_i} \in {C^2} \), also \( {F_q} \in {C^2}\, \)and from the definition of \( {F_q} \,\)and \( \frac{{{\partial^2}{F_1}}}{{\partial {x^2}}} > \frac{{{\partial^2}{F_2}}}{{\partial {x^2}}} > 0 \) we have

Hence if a global minimum of \( {F_q}(x) \) exists, it is attained in \( x \) solving the first-order condition

\( {x_1} \) and \( {x_2} \,\)are the global minima of \( {F_1} \) and \( {F_2} \), respectively. Since \( {x_1} < {x_2} \) and \( \frac{{{\partial^2}{F_1}}}{{\partial {x^2}}} > \frac{{{\partial^2}{F_2}}}{{\partial {x^2}}} > 0 \), we have \( \frac{{\partial {F_q}}}{{\partial x}}({x_1}) < 0 \,\)and \( \frac{{\partial {F_q}}}{{\partial x}}({x_2}) > 0 \). Since \( \frac{{\partial {F_q}}}{{\partial x}} \in {C^1} \), there exists a unique \( x \in ({x_1},{x_2}) \) such that \( 0 = \frac{{\partial {F_q}}}{{\partial x}}(x) \), which is thus the global minimum of \( {F_q}(x) \). Furthermore, since \( \frac{{{\partial^2}{F_1}}}{{\partial {x^2}}} > \frac{{{\partial^2}{F_2}}}{{\partial {x^2}}} > 0 \), the implicit function theorem ensures, that (8.B.29) defines a unique smooth function \( x(q) \) on \( q \in [0,1] \) and thus \( {x_1} = \mathop {{\lim }}\limits_{q \to 1} x(q) \,\)and\( {x_2} = \mathop {{\lim }}\limits_{q \to 0} x(q) \), which in turn implies that for any \( x \in ({x_1},{x_2}) \) there exists \( q \in (0,1) \) such that the global minimum of \( {F_q} \) is attained in \( x \).

In the following let us denote \( {K_p}(x) = E[K(x)] = p{K_1}(x) + (1 - p){K_2}(x) \). (8.B.15) is implied directly by Lemma B.1 for \( q = p \,\)and \( {F_i}(x) = {K_i}(x) \), (8.B.17) and (8.B.18) by the proof of Lemma B.1 (Note that the conditions of Lemma 8.B.1 are satisfied because of (8.B.6) and (8.B.8)). The implicit function theorem, as applied in Proof of Lemma 8.B.1, ensures that \( \partial {\hat{x}^p} \) is a smooth function of \( p \), which implies that \( \frac{{\partial {{\hat{x}}^p}}}{{\partial p}} \) exists. For any \( 0 < {p_2} < {p_1} < 1 \) we have, after some rearranging,

for \( q = \frac{{{p_1} - {p_2}}}{{1 - {p_2}}} \), where indeed \( q \in (0,1) \). Thus, by Lemma 8.B.1 for q,\( {F_1} = {K_1} \), \( \,{F_2} = {K_{{p_2}}} \)we have \( {\hat{x}^{{p_1}}} \in ({\hat{x}^1},{\hat{x}^{{p_2}}}) \), which proves (8.B.16).

8.1.2.5.2 Risk-Averse Case

First let us realize that since\( {C_i}(0,0) = 0 \), (8.B.1) and (8.B.2) imply that \( {K_i}(x) > 0 \). If the global minimum of \( {L_p}(x) = E[K(x)] + \omega Var[K(x)] \) exists and is attained in \( \bar{x}(p,\omega ) \), then \( x = \bar{x}(p,\omega ) \) must solve the first-order condition, which is equivalent to

Note that \( L \in {C^2} \,\)and \( {K_i}(x) > 0 \). For \( p < 0.5 \) we have \( {\hat{x}^p} > {\hat{x}^{0.5}} \,\)and thus \( 0 < \frac{{\partial {L_p}}}{{\partial x}}({\hat{x}^p}) \) and \( 0 > \frac{{\partial {L_p}}}{{\partial x}}({\hat{x}^{0.5}}) \). Hence there exists \( \bar{x}(p,w) \) such that \( 0 = \frac{{\partial {L_p}}}{{\partial x}}(x) \) for \( x = \bar{x}(p,\omega ) \) where \( \bar{x}(p,w) \in ({\hat{x}^{0.5}},{\hat{x}^p}) \). Similarly for \( p > 0.5 \).

8.1.2.5.3 Value of Information

After rearranging terms and utilizing the first-order condition for \( {\hat{x}^p} \), we obtain

which is a continuous function of p. From (8.B.15), (8.B.17), and (8.B.18) we obtain

Moreover, because of (8.B.6), after some rearranging, we obtain

Thus \( \frac{{\partial EVPI}}{{\partial p}}(p) \)is an increasing continuous function of \( p \), hence there exists \( \hat{p} \in (0,1) \)such that \( \frac{{\partial EVPI}}{{\partial p}}(\hat{p}) = 0 \). Furthermore, (8.B.35) ensures that the global maximum of \( EVPI(p)\, \)is attained in\(\, \hat{p} \).

Commentary: The Uncertain Value of Reducing Uncertainty

Fritz et al. have an ambitious research agenda to determine the value of information about the extent of land cover in determining optimal mitigation choices for global climate change. The mitigation alternatives they investigate are an assumed industrial carbon capture technology and an alternative that reduces deforestation. They determine the optimal mix, including corner solutions, of the alternatives when there is uncertainty about the amount of land cover and the decisionmaker may exhibit varying degrees of risk aversion. Uncertainty about the amount of land cover determines the opportunity cost of the deforestation alternative and hence the cost of any mitigation policy.

The chapter is ambitious both because of its empirical modeling and in the development of a theoretical structure. The body of the text focuses on a general description of the models used to estimate the value of information and the quantitative results for various elements, such as mitigation costs and the value of information based on an economic land-use and impact model, GLOBIOM. The appendixes contain the mathematical development of two VOI models, one based on different but constant costs across the two mitigation options, and the other based on one increasing-cost option (reducing deforestation) while the carbon capture technology is assumed to be constant cost.

The careful development of the background mathematical model and its potential link to the empirical work is to be praised. However, improving the explanation of the linkages between the theory, specific equations, and the empirical model would be a substantial help to the reader. The authors state that the empirical results are based on the increasing-cost model, but some of the issues that could receive more attention are also apparent in the constant-cost model, with which I begin.

8.1.1 C.1Core of Models Presented

The heart of the analysis is the expected value of perfect information. In the two constant-cost case, the authors in Eq. (8.A.7) define the value of information as

Where (see their text for more detail)

-

EVPI is the expected value of perfect information;

-

p is belief, expressed as a probability, about the reliability of two measures of land cover;

-

ω is a measure of risk aversion, ≥ 0;

-

E and Var are expected value and variance, respectively;

-

\( \bar{x} \) is the optimal share of deforestation in the mitigation strategy; and

-

C, Cij are the mitigation costs either for a strategy or for option j with strategy i.

The first two terms on the right-hand side are the objective function when the decisionmaker chooses an optimal strategy under uncertainty; the last two terms constitute the expected value when the information is known at the time of decision.

Although the authors characterize the objective function as a portfolio optimization approach, in that the variance as well as the expected value linearly affect the objective, no empirical evidence or interpretation is provided to interpret ω other than 0 represents risk neutrality and there is an upper bound of infinity. Its units are the change in the objective function per unit change in the variance of costs in this problem. Is such a number very small? Or not? This is most obviously important in the two constant-cost models, where a mixed strategy requires various combinations of probability and risk aversion such that, as the authors present,

Consequently, the scale of ω is important conceptually and empirically. Further, the authors derive the bounds in which ω leads to a mixed strategy as Eq. (8.C.3), where L, k, and K are functions of probability and cost:

Although generated by the later increasing-cost model, the authors report substantial increases in the value of information when there is risk aversion, as in Fig. 8.C.1 below; although the effect is presumably due to suddenly incorporating some weight on a large variance. However, we don’t know the scale of ω and its plausibility in practice.