Abstract

Planning dams for regional economic developments and social welfare without addressing issues related to catastrophic risks may lead to dangerous clustering of people, production facilities, and infrastructure in hazard-prone areas. The concerned region may be exposed to very large losses from the low probability-high consequence event of a dam break. Endogeneity of risks on land use decisions represents new challenges for dam development planning. In this chapter we discuss an integrated risk management model that allows the planners to deal in a consistent way with the multiple aspects, views and objectives of dam projects. We introduce the notion of robust decisions, which are considered safe, flexible, and optimal because they account for multiple criteria, risks and heterogeneities of locations and stakeholders. Specific attention is paid to the choice of proper discount factors to address long-term planning perspectives of dam construction and maintenance. We illustrate how the misperception of proper discounting in the presence of potential catastrophic events may overlook the need for dam maintenance and undermine regional safety. The proposed model can be used as a learning-by-simulation tool for designing robust regulations and policies.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Dams and development

- Equity and efficiency

- Discount factors

- Catastrophic risks

- Multi-agent decision making

- Safety constraints

- Robust decisions

1 Introduction

The controversial debate about dams (World Commission on Dams 2000) is a debate about the very meaning, purpose and pathways for achieving development. Dams have been built for thousands of years to serve multiple purposes: to store water for hydropower, for household supply and for industrial or agricultural uses. Dams are beneficial for food security, and the expansion of infrastructure is important for micro- and macro-economic developments.

As a rule, the reliance on dams as powerful infrastructures results in the clustering of industries, people, capital, and increasing production intensity and population density in vicinal areas. On the one hand, dams may provide protection from frequent small floods; on the other hand, they create a possibility of rare but high-consequence disasters if they break. The reliance on dams in the absence of appropriate reinforcements and maintenance contributed to the Katrina hurricane disaster in New Orleans. As investigated by the American Society of Civil Engineers “A large portion of the destruction from Hurricane Katrina was caused not only by the storm itself, however, but also by the storm’s exposure of engineering and engineering-related policy failures. The levees and floodwalls breached because of a combination of unfortunate choices and decisions, made over many years, at almost all levels of responsibility” (Andersen et al. 2007).

In his studies, Hirschberg et al. (1998) warned about the catastrophic risk of dams, retrieving data on frequency of dams failures and fatalities by different dam types (Fig. 5.1 and Table 5.1).

Frequency of dams breaks, per dam-year, (scale 10−5) (Hirschberg et al. 1998)

The traditional analysis of dam safety is often restricted to the use of engineering models and safety assessment approaches (Harrald 2004; RESCDAM 2001). The first guideline for dam risk assessment was introduced in 1968 after the Malpasset dam failure in France that was responsible for more than 400 injuries. After that accident, a Permanent Technical Committee for Dams (CTPB) was constituted in France, which issued a decree that made emergency plans compulsory for owners or managers of large dams, including a simulation of the “would-be-flood” scenarios, along with assessment of consequence maps showing flooded areas, wave arrival times and potential losses (Harrald 2004; RESCDAM 2001).

However, uncertainties in the assessment may cause dramatic underestimation of potential consequences and related management strategies. As admitted in RESCDAM 2001, the breach formation model, the water flow interactions with infrastructures (bridges, embankments, channels, etc.), flow in urban areas, movement of sediment and debris, are among the major uncertain processes affecting dam risk assessment. Usually, the design of dams relies on the so-called “probable maximum flood (PMF)” or “maximum limit level of risk” (Bowles 2001, 2007; IAEA 1992), which have become standard criteria over the past decades (CETS 1985; Jansen 1988). However, the PMF calculation uses a combination of facts, theory and expert opinions. Alternative groups of experts may arrive at different evaluation of PMF. The discrepancies in opinions arise from technical, scientific and ethical issues (CETS 1985; Jansen 1988) underlying the professional judgments, different evaluation methodologies of the estimators, and values considered in the selection of design safety objectives.Footnote 1

As in other development programs, conflicting criteria may exist between economic efficiency and equity or ethics. Economic objectives seek to maximize benefits over costs, while equity objectives seek to find a balance between the expenditures borne by the dam owners (for dam construction and reinforcement) and the other parties, namely, those who may benefit from the dam and those who may be harmed or disadvantaged by the dam (World Commission on Dams 2000). Because of uncertainties and ambiguities, usual risk assessment methodologies are not able to determine the optimum measures to attain the economic objectives. Moreover, as we show in Sects. 5.4 and 5.5, building up public perception of dam safety on existing assessment methodologies may be dangerous. In Sect. 5.2 we limit the discussion to a few typical pitfalls. More in general, the public may have different dam acceptance criteria based on individual perception, preferences, and values (Renn 1992).

A specific emphasis of this chapter is on the management of catastrophe risks associated with possible dam breaks. Catastrophic losses have complex temporal and spatial profiles and depend on location-specific land use patterns, financial and structural mitigation decisions, and concentration of properties and population.

The design of risk management strategies calls for integrated approaches combining catastrophe models (Walker 1997) with specific decision support procedures. In Sects. 5.3, 5.4 and 5.5 we discuss an integrated modeling framework for catastrophic risk management which is being developed at the International Institute for Applied Systems Analysis (IIASA) (Amendola et al. 2000; Ermolieva et al. 2003, 2008a, b; Ermolieva and Ermoliev 2005; Compton et al. 2009) and is exemplified in other chapters of this book. In the proposed approach, the choice of decisions in the presence of catastrophic risks is supported by a spatially explicit and dynamic stochastic optimization model combining the goals and constraints of the involved agents. As safety constraints of the agents, it uses economically sound risk measures which have strong connection with the standard insolvency and stability constraints in the insurance business and Conditional Value-at-Risk (CVaR) type of risk measures (Artzner et al. 1999; Rockafellar and Uryasev 2000).

In Sects. 5.4 and 5.5, we illustrate the application of the model to a case study of catastrophic floods induced by dam breaks (see Chap. 15 by Hochrainer-Stigler in this book). Risk management decisions are being developed from the long-term perspective of welfare growth in a region when financial reserves and land use strategies for catastrophe risk management are evaluated over years. We discuss the implication of extreme events on the proper choice of discounting (Sect. 5.5). Misperceptions of discount rates may result in inadequate risk management strategies, which in turn contribute to increasing regional vulnerability and chances of catastrophes. In Sect. 5.6 we argue that the discount factors have to be linked to random arrival times of potential catastrophes (“stopping time” in our models) rather than time horizons of market interest. In general, discount rates are conditional on the degree of social commitment to mitigate risk. Random extreme events affect these rates, which alter decisions on the optimal mitigation efforts that, in turn, may change frequency and magnitude of concerned events. This endogeneity of the induced discounting restricts validity of traditional deterministic methods and calls for stochastic optimisation methods. In Sects. 5.4 and 5.5, the chapter provides insights in the nature of discounting that are critically important for developing robust long-term risk management strategies. Section 5.6 summarizes our conclusions towards directives and guidelines for integrated management of dam risks.

2 Ethical Goals and Constraints

Equity and ethical issues should be among the most important dimensions of dam design and maintenance. What benefits and losses the dams bring, what is a fair way of balancing them among stakeholders – these are the main questions (World Commission on Dams 2000). In many locations, the safety illusion that this powerful infrastructure creates results in intensive economic growth and concentration of properties and industries. However, without proper maintenance, the dams may deteriorate and cause major disasters. In many cases, as generally for flood protection dams, the costs for their maintenance and the responsibility for breaks are borne by central and local governments. They are the so-called social welfare maximizers responsible for the overall social wellbeing of a region. Meanwhile, the benefits and profits from dams are enjoyed by many other stakeholders. Directly and indirectly, the dams enforce and enable development not only for the current generation, but also for future generations. Therefore, misevaluation and misperception of the social and individual goals are at the heart of the debate around the (dis)utility of dams.

As far as risks are concerned, many existing dam assessment models are not capable of informing in an adequate manner the responsible authorities and agents (stakeholders) about the associated pros and cons. These models either focus on a very straightforward risk assessment involving primarily engineering concepts or use rather limited economic approaches, which do not reflect the nature of the dispute. Let us illustrate in the following some typical pitfalls of traditional approaches, which are overcome by the model in Sects. 5.3, 5.4 and 5.5.

2.1 Spatio-Temporal Heterogeneities

Temporal. The answer to ethical question about winners and losers is determined by the risk evaluation methodology. In traditional risk assessment approaches, extreme events are usually characterized by their expected recurrence periods, for example, a 1,000 year flood (e.g., associated with dam break) means a flood that occurs on average once in 1,000 years. The occurrence of a flood within a small interval \( \varDelta t \) is then evaluated by a negligible probability \( \lambda \varDelta t \), where \( \lambda \) reflects the event’s recurrence period, e.g., \( \lambda = 1/1000\). Accordingly, these events are ignored as they are evaluated as improbable during a human lifetime. This approach is frequently used in practical evaluations (ANCOLD 1998; Bowles 2007; CETS 1985; Jansen 1988). However, such an interpretation may be wrong over a long period, since the probability of a catastrophe in an interval \( [0,T] \) accumulates as \( 1 - {{(1 - \lambda \Delta t)}^{{T/\varDelta t}}}\approx 1 - {{e}^{{ - \lambda T}}}\). The proper assessment and management of such rare risks requires long-term perspectives. There are large uncertainties regarding the real occurrence of rare events: a 1,000-year flood may happen today, next year, or not happen at all. For example, floods across Central Europe in 2002 were classified as 1,000-, 500-, 250-, and 100-year events.

Another tendency in traditional risk assessment is to evaluate potential losses by using so-called annualization, i.e., by spreading damages, fatalities and compensation from a potential, say 50-year flood, equally over 50 years (ANCOLD 1998; CETS 1985; Jansen 1988). The main conclusion from this type of deterministic analysis is that catastrophic losses can be easily absorbed over time. However catastrophes hit as a “spike” in space and time requiring immediate financial support and adequate recovery actions.

Spatial and social. Traditional risk assessment often ignores spatial patterns of catastrophes. A general approach is to use so-called hazard maps. In most cases, these maps show catastrophe patterns that may never occur because they are developed by averaging all possible catastrophic patterns. Accordingly, social losses in affected regions are evaluated as the sum of individual losses computed on a location-by-location rather than pattern-by-pattern basis with respect to joint probability distributions. This highly underestimates the real socio-economic impacts of catastrophes dependent on simultaneous losses of assets. Furthermore losses grow exponentially with increasing network-interdependencies.

2.2 Multiagent Aspects

High potential impacts from a dam break call for the cooperation of various agents such as governments, insurers, investors, and individuals. The construction of a dam is a long-term project and it needs to be evaluated by taking into account the maximization of the intergenerational utility. Often, different views over the benefits of dams arise when individuals rate their instantaneous goals higher than the common-wealth, which results in dissent about the actions to be taken. Many recognize the benefits, yet, it may still be unclear how the losses associated with possible dam breaks may be shared in a fair way among the concerned agents. As estimated by many insurance companies, the losses from major dam failures cannot be borne by insurance or reinsurance companies alone. There is a need for appropriate balance between structural risk mitigation measures and risk sharing or other financial instruments involving the main concerned public and private agents. For this, the model provides a tool for a common learning from modeling and simulation.

2.3 Safety Constraints

For each agent, the occurrence of a disaster is often associated with his or her safety constraints, in other words, with the likelihood of some process abruptly passing individual “vital” thresholds. The design of risk management strategies therefore requires analysis and accounting of the safety constraints of the agents. For example, in the insurance industry, the vital risk process is defined by flows of premiums and claims, whereas thresholds are defined by insolvency constraints (Ermolieva and Ermoliev 2005). A similar situation arises in the control of environmental targets, in the balance of private incomes and losses, in the design of disaster management programs (Ermolieva et al. 2008a, b; see also Chap. 2 by Compton et al. in this book; Ermoliev and Hordijk 2006). Safety constraints may be represented as follows. Assume that there is a random process \( {{R}_t} \) describing the evolution of the insurer’s capital reserve or accumulation of wealth in a region. A threshold is defined by a variable \( {{\rho}_t} \). In spatial multiagent modeling, \( {{R}_t} \) and \( {{\rho}_t} \) can be large-dimensional vectors reflecting the overall situation in different locations of a region. Let us define the stopping time τ as the first moment t when \( {{R}_t} \) drops below \( {{\rho}_t} \) (e.g. because of catastrophic losses). By introducing appropriate risk management decisions, it is possible to stabilize \( {{R}_t} \) ensuring the safety constraints \( P\left[ {{{R}_{\tau }} \geq {{\rho}_{\tau }}} \right] \geq \gamma \), for some safety level γ, \( t = 0,1,2,\ldots \) (similar to model in Sect. 5.3).

The use of safety constraints is a rather standard approach for coping with risks in insurance, finance, nuclear industries, etc. For example, typical safety regulations of nuclear plants require that the violation of safety constraints may occur only once in 106 years, i.e. \( \gamma = 1 - {{10}^{{ - 6}}} \) (IAEA 2001). Dams seem to have higher or comparable failure rate, see Fig. 5.1.

The ethical question about losers and winners concerns not only the evaluation of the economic benefits and costs associated with dam operation, it also relates to human and environmental values, which are often difficult to be appraised in monetary terms. The respect of safety constraints allows us to control the actions within admissible norms, say, environmental pollution, wellbeing, historical values and cultural preferences, in particular, impose regulations constraining the growth of wealth in risk prone areas. Therefore, in the model, ethical issues can be treated by evaluating the overall safety coherent with spatio- temporal goals, constraints, and indicators of involved agents – whether these are households, farmers, governments, water supplying utilities, inhabitants downstream of the dam, or insurance companies.

2.4 Discounting

One of the fundamental ethical parameters in the dam evaluation is the discount rate. In particular, the social discount rate reflects the level to which we discount the value of future generations’ well-being in relation to our own. A social discount rate of 0, for example, means we value future generations’ well-being equally to our own (Ramsey 1928). Ramsey argued that applying a positive rate \( r \) to discount values across generations is unethical. Koopmans (see Weitzman 1999), contrary to Ramsey, claimed that zero discount rate would imply an unacceptably low level of current consumption.

There are several aspects of discounting to be considered in relation to dams. Traditional approaches to evaluation of dams’ efficiency and safety (ANCOLD 1998; Bowles 2001; CETS 1985; Harrald 2004; ICOLD 2005; Jansen 1988; Netherlands Ministry of Housing 1989) often use principles of the so-called net present value (NPV) or modified net present value (MNPV) to justify a dam construction project. In essence, both approaches rely on the assumption that the project is associated with an expected stream of positive or negative cash flows \( {{V}_0},{{V}_1},\ldots, {{V}_T} \), \( {{V}_t} = E{{v}_t} \) over a time horizon \( T \le \infty \). The flows may comprise several years of negative cash values reflecting the costs of construction and commissioning, followed by positive cash flow during the years without essential maintenance costs and, finally, a period of expenditures on restoration. Typically, the spatio-temporal profiles of benefits and potential dam-induced losses are not included in the evaluation. Assume that r is a constant prevailing market interest rate, then alternative dam projects are compared with respect to NPV \( V = {{V}_0} + {{d}_1}{{V}_1} + \ldots + {{d}_T}{{V}_T} \), where \( {{d}_t} = {{d}^t} \), \( d = {{(1 + r)}^{{ - 1}}} \), \( t = 0,1,\ldots, T \), is the discount factor, r the discount rate (Ermolieva et al. 2008a, b; ICOLD 2005; Weitzman 1999). If the NPV is positive, the project has positive expected benefits and, therefore is justifiable for implementation.

The time horizon \( T \le \infty \) and the choice of a discount rate r substantially affect the evaluation of the dam’s project. Diverse assumptions about the discount rate may lead to dramatically different policy recommendations and management strategies, which may induce catastrophes and contribute to increasing vulnerability of the region.

According to Ramsey (Ramsey 1928), not facts, but ethics, are behind the choice of the discount factor and the evaluation model Lower discount rates emphasize the role of costs and benefits in the long term. The flat discount rate of 5–6% traditionally used in dam projects (Bowles 2001; CETS 1985; Jansen 1988), as Sects. 5.4 and 5.5 show, orients the analysis on a 20–30 year time horizon. Meanwhile, the explicit treatment of a 200-year disaster would require a discount rate of at least 0.5%. Section 5.5 shows that the expected duration of projects evaluated with standard discount rates obtained from traditional capital markets does not exceed a few decades and, as such, these rates cannot properly evaluate projects oriented on 1,000-, 500-, 250-, 100- year catastrophes (Ermolieva and Ermoliev 2005; Ermolieva et al. 2003; Ermoliev and Hordijk 2006).

Disadvantages of standard NPV criterion are analyzed extensively elsewhere (Chichilinskii 1997; Ermolieva et al. 2008a, b; Newel and Pizer 2000). In particular, the NPV depends on some average interest rate, which may not be implementable for evaluation of a practical project. For example, the problem that arises from the use of the expected value \( Er \) and the discount factor \( {{(1 + Er)}^{{ - t}}} \) implies additional significant reduction of future values in contrast to the real expected discount factor \( E{{(1 + r)}^{{ - t}}} \), since \( E{{(1 + r)}^{{ - t}}} > > {{(1 + Er)}^{{ - t}}} \). In addition, the NPV does not reveal the temporal variability of cash flow streams. Two alternative streams may easily have the same NPV despite the fact that in one of them all the cash is clustered within a few time periods, but in the other one it is spread out evenly over time. This type of temporal heterogeneity is critically important for dealing with catastrophic losses which may occur suddenly in time and space.

2.5 Assessment vs. Robust Solutions

The assessment of risk associated with a break of a flood protection dam is usually performed in a scenario-by-scenario (what-if) manner with respect to the so-called “would-be-floods”. The exact evaluation of interdependencies between all flood scenarios, potential strategies and related outcomes is impossible. It may easily run into a large number of alternative combinations. Besides, a strategy optimal against one flood may not be optimal against multiple floods. Therefore, a very important task is the design of management strategies robust with respect to all potential flood scenarios.

The underlying assumption of the robustness accounts for safety, flexibility, and optimality criteria of all agents against multiple potential scenarios of catastrophic events. Foremost, the robustness is associated with the safety constraints as described in Sects. 5.2.3 and 5.3, which deal with the Value-at-Risk considerations. The introduction of safety constraints identifies a trade-off between ex-ante (or precautionary) and the ex-post (or adaptive) measures. A balance between precautionary and adaptive decisions depends on financial capacities of the agents: how much they can invest into ex-ante risk reduction measures, such as reinforcement of dams, improving building quality or insurance coverage; and how much they are ready to spend for recovery and loss compensation if a catastrophe occurs. The future losses depend strongly on currently implemented strategies. The ex-post decisions may turn out to be much costlier, and these costs occur unexpectedly. Therefore the capacity for adaptive ex-post decisions has to be created in an ex ante manner.

3 Flood Management Model

Evaluation of measures to deal with dam breaks and induced floods is a challenging task. There is a dilemma about a proper balance between the structural and financial measures (also see Chap. 2 by Compton et al. in this book). One can argue that the increase of safety by means of investments into structural measures may avoid the need for other measures. In traditional dam management, for example, a typical goal is to reduce the probability of flooding induced by a dam break to below a certain value, the Maximum Probable Flood (MPF). Because of uncertainties in the estimates of the MPF likelihood, the investments into dam reinforcement may be essentially miscalculated.

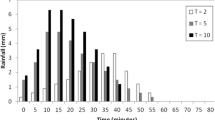

In our case, to gain additional information on the interdependencies and ranges of potential outcomes, the analyses of risks, i.e., event probability and associated losses, are based on integrated catastrophe modeling. GIS-based Monte Carlo computer models simulate in a stochastic manner natural disasters as they may happen in reality. Catastrophe models incorporate the knowledge of the involved processes, experts and stakeholders judgments, scientific equations and variables describing them. For a flood, the latter are precipitation patterns, water discharges, river characteristics, etc. The data for developing and tuning catastrophe models are often available only on aggregated levels unsuitable for direct location specific analysis. For example, rich data on occurrences of extreme events may exist on the country level without providing information on their occurrences at specific locations. The problem of data downscaling is typical in the analysis of precipitation and discharge curves, weather related disasters associated with changing climate, livestock epidemics modeling, missing location-specific socio-economic data, etc. All these require the development of appropriate downscaling procedures, which can be coupled with catastrophe modeling.

Indeed, catastrophe models aid scarce historical data with simulated samples (scenarios) of mutually dependent catastrophic losses, which can be scaled down to the level of individual households, municipalities, cities, or regions from various natural hazards, e.g., floods, droughts, earthquakes, hurricanes, epidemics. These models are becoming a key tool for land use planning, capital and industry allocation, emergency systems, lifeline analyses, and loss estimation.

Catastrophe models consist of three main modules: hazard, vulnerability, and a multi-agent accounting system. In the case of floods, the hazard module contains a river module, a rainfall-runoff, and a spatial inundation modules. The river module performs calculations for a specific river. The main elements of a river network are branches. Each branch contains several computational grid points, and several branches are connected with nodes into a network. The mathematical model of a branch is based on a Saint-Venant system of partial differential equations of 1-D flow mass and momentum conservation. The module transforms rainfall-runoff water discharges into the flow dynamics using a representation of conservation laws. Additional information on structures, reservoirs or dams along the river is introduced. The river module may calculate the volume of discharged water into the study region from different river branches for given heights of dams, given scenarios of their failures or removals, and rainfall-runoff scenarios. Modeling of breaching may be introduced as a gated weir.

The spatial GIS-based inundation module usually has a very fine resolution, say, of 5 by 5 m grids, to capture ground elevations, soil types, water percolation characteristics, etc. This module maps water released from the river into levels of standing water and, thus, it estimates the area of the region affected by different floods. For each flood event it is possible to estimate two types of maps: Inundation maps that show the depth of standing water and Duration maps that represent how long the water is standing on a floodplain. The module may calculate inundation zones with inundation level of 0–2, 2–4 and more than 4 m. Duration maps show zones covered by water, e.g., for less than 12, 12–24, 24–48 and more than 48 h. Combination of inundation and duration maps provide time-depth-area relations, which are used in the vulnerability module for estimation of losses caused by a flood.

In the vulnerability module, a combination of inundation and duration maps with so called vulnerability curves estimates potential flood losses. These can be agricultural losses depending on the inundation time, the crop and the time of the year; property losses in buildings, depending on the depth and duration of a flood, as well as deterioration of buildings material (wood, concrete, brick etc.). Usually, vulnerability curves are derived from historical observations. If there is no detailed GIS information on types of buildings in a case study region, the loss estimation can be done in relative or percentage terms. For example, in a certain sub-area of the region the damages to wooden houses are 50% of total building value, brick houses – 40%, and concrete houses – 10% (see Amendola et al. 2000; Ermolieva and Ermoliev 2005 and related references therein). Once the GIS distribution of building types becomes available, the relative losses can be converted into absolute ones. The vulnerability module is able to indicate changes in losses depending on changes in risk reduction measures. As an output, histograms of aggregate losses for a single location, a particular catastrophe zone, a country or worldwide can be derived from catastrophe modeling.

The integrated catastrophe model includes modules related to multiagent activities (multi-agent accounting system), e.g., farmers, infrastructure, businesses, water management, economic, financial, (re)insurance, investors, households, etc. Such multiagent accounting systems share catastrophic impacts among losses and gains of concerned agents and measure their exposure as a function of implemented strategies. These modules assist to tailor decisions accounting for complex interplay between the rainfall-runoff patterns, topography of the river, land use practices, flood defense measures in place, towards fulfillment of safety and stability constraints of agents. The outputs from a catastrophe model could show the distribution of impacts to farmers (both the distribution and across the whole sector), water authorities, urban dwellers, insurers, governmental representatives.

However, catastrophe models usually do not incorporate decision-making procedures. The integrated catastrophe management model proposed below combines catastrophe modeling and stochastic optimization procedures. Stochastic optimization (Ermoliev and Wets 1988) provides the framework necessary for incorporating interactions among decisions, agents, scenarios of catastrophes and losses into the catastrophe models (Ermoliev et al. 2000; Ermolieva and Ermoliev 2005; Ermoliev and Hordijk 2006). Adaptive Monte Carlo stochastic optimization works as follows: initial policy variables are input in the catastrophe model. The latter simulates a catastrophe and induced direct and indirect losses. The efficiency of the policies is evaluated with respect to safety (Sect. 5.2.3) performance indicators of the agents, e.g., water authorities, governments, individuals, farmers, insurers, insured, etc. If these do not fulfill the desired requirements, goals and constraints, the policies are further adjusted. In this manner it is possible to take into account complex interdependencies between patterns of catastrophes, resulting losses, policies, and safety constraints. A crucial aspect is the selection of safety constraints appropriately reflecting the risks of agents, e.g., to avoid bankruptcies.

Contrary to risk assessment, the integrated catastrophe management model estimates robust decisions, which are safe, flexible, and near to optimal, taking into account multiple criteria and heterogeneities of agents and locations affected by catastrophes. These new spatial, temporal and multi-agent distributional aspects of the integrated catastrophe management model might be the basis for policy development and implementation processes. These advantages have been explored in Amendola et al. 2000; Ermolieva et al. 2003, 2008a, b; Ermoliev et al. 2000 for the case of insurers, illustrating how the sequential optimization can improve the policies and lead them towards goals and constraints of multiple agents, e.g., on the part of insurers – to their optimal fair coverages of losses, and on the part of insured – to fair premiums, in an environment of spatial and temporal dependencies. Such improved policies suggest robust conclusions on the insurability of catastrophic risks, providing profits and stability to insurers and premium holders.

Furthermore, in contrast to models that are solely focused on simulation-based assessment of loss prevention or loss reduction measures, the multi-agent multi-objective risk-reduction and risk-sharing orientation make integrated catastrophe management models suitable for their applicability to negotiation processes. The ability of a model to clarify the results of a particular decision on the distribution of losses and benefits or to reveal potential unintended consequences allows parties to examine and identify robust policies and decisions within their own interests. The IIASA Tisza study (see Ekenberg et al. 2003; Ermolieva et al. 2003, 2008a, b, and the relevant chapters in Part III of this book) and earthquake risks management (see Amendola et al. 2000; Baranov et al. 2002; Ermolieva and Ermoliev 2005) examined the use of integrated catastrophe management models in the negotiations between stakeholders (including citizens, local and national government officials, engineers, and insurers) dealing with flood risks on the Tisza River and with policy relevant discussions of earthquake risks management for insurance legislation in Italy and Russia. The use of catastrophe models to examine the concrete impacts of different concepts of fairness as a tool in negotiations on risk may prove to be one of the most novel applications of the technique.

4 Case Study

We illustrate the main idea of the proposed integrated catastrophe management model by a fragment of flood risks case study on Tisza river in Hungary and Ukraine (Ekenberg et al. 2003; Ermolieva et al. 2003; Ermolieva and Ermoliev 2005) emphasizing the role of discounting for evaluation of catastrophic risks management decisions.

The main concern in the case study was the possibility of catastrophic floods due to dam breaks. The problem was to estimate the optimal reserve of a catastrophe fund to finance flood management measures including costs for dams’ maintenance and loss coverage to households if dam break provokes a flood. Floods could be caused by the break of one of nine dams, which may occur as a result of a 100-, 150- and 1,000-year water discharge event into a specific river section of the region. The reliability of dams decreases without proper maintenance, which increases the chances of their failures. The system is modeled until a first catastrophic flood induced by dam break within a given time horizon. This moment is defined as the stopping time.

Let \( \xi \) be the time of a dam break. The stopping time is defined as \( \tau = \xi \) for \( \xi \le T \) and \( \tau = T \) for \( \xi > T \). Let us denote by \( L_j^{\tau } \) random losses at sub-location j in the study region, at time \( t = \tau \), \( j = \overline {1,m} \), and by \( \pi_j^t \) the premium rate paid by location j to the mutual catastrophe fund at time \( t = 0,1,\ldots \). Let \( {{\delta}_t} \) be expenditures enabling to support the system of dikes on a specific safety level. The wealth of the fund at time τ together with a fixed partial compensation of losses \( \chi \sum\limits_j {L_j^{\tau }} \) by the government is equal to

where \( L_j^t = 0 \) for \( t\ne \xi \), \( 0 \le \varphi_j^t \le 1 \), is a coverage provided to location j by the catastrophe fund, \( \sum\limits_j {\pi_j^t} \) are premiums paid by locations to the fund, \( {{I}_t} \) is an exogenously determined governmental investment into the fund for dike maintenance and partial coverage of losses. It is assumed that the compensation \( \chi \sum\limits_j {L_j^{\tau }} \) to flood victims is paid by the government through the mutual fund. Indicators applied to describe the vulnerability of the flood management program are associated with insolvency of the fund, i.e., with crossing the threshold 0 by \( {{W}_{\tau }} \). In other words, on the probability of the event defined by inequality:

The likelihood of insolvency determines the resilience of the program and, thus, the vulnerability of the region and its capability to sustain a catastrophe:

where γ is a specified “survival” level requiring, say, that a collapse of the fund may occur only once in 104 years, \( \gamma = {{10}^{{ - 4}}} \).

Individuals (at locations) j receive compensation \( \varphi_j^{\tau }L_j^{\tau } \) from the fund when losses occur, and pay insurance premiums \( \pi_j^t \) to support catastrophe mitigation program involving dams maintenance for \( t = 0,1,\ldots, \tau \).

The fairness of the flood management program is associated with the lack of overpayments by individuals determined by the indicator

i.e., when the level of premiums paid by a location to the fund exceeds the level of claimed losses. This is specified in the form of probabilistic constraints

where ρ ensures the fairness by allowing overpayments with a reasonable likelihood, say, only once in 100 years, \( \rho = 0.01 \). Sustainable performance of the fund depends on the inflow of premiums determined by the willingness of individuals to accept the premiums, which, in turn depends on the probability of premiums overpayments (5.5).

Each agent in the model is concerned with maximizing his wealth and minimizing risks of insolvency which to major extent determine the feasibility and the demand for insurance. The main goal of the program can be formulated as the minimization of uncovered losses to households together with governmental aid and investments subject to (5.3) and (5.5):

It can be shown that minimization of function

4.1 Discounting and Robust Decisions

The traditional risk assessment analysis often relies on discounting future losses and gains to their present values. These evaluations are used to justify risk management decisions for examples such as construction and maintenance of flood protection dams. The misperception of proper discounting rates critically affects evaluations and may be rather misleading. A common approach is to discount future costs and benefits using a geometric (exponential) discount factors as \( V = \sum\nolimits_{{t = 0}}^{\infty } {{{d}_t}{{V}_t}} \), where \( {{d}_t} = {{(1 + r)}^{{ - t}}} \), r is a discount rate, and \( {{V}_t} = E{{v}_t} \) is an expected cash flow for some random variables \( {{v}_t} \), \( t = 0,1,\ldots\). According to this standard approach, the minimization of function (5.6) has to be replaced by minimization of expected present value

where

The infinite time horizon in \( V(x) \) creates an illusion of truly long-term analysis. The choice of discount rate r as a market interest rate within a time horizon of existing financial markets is well established. The following simple fact shows that the standard discount factors obtained from markets orient policy analysis only to few decades, which is not appropriate for catastrophic impacts.

Let \( p = 1 - d \), \( d = {{(1 + r)}^{{ - 1}}}\) , \( q = 1 - p \), and let \( \eta \) be a random variable with the geometric probability distribution \( P[\eta = t] = p{{q}^t}\), \( {{V}_t} = E{{v}_t} \), where random variables \( v_t \) are independent of \( v_{{t + 1}} \), \( v_{{t + 2}} \), …. It is easy to see that

where \( d = {{d}^t} \), \( t = 0,1,\ldots \). This is also true for general discounting \( {{d}_t} = {{(1 + {{r}_t})}^{{ - t}}} \) with time varying discount rate \( {{r}_t} \), where the stopping time is defined as \( P[\eta \ge t] = {{d}_t} \). From (5.10) follows, that (5.8) can be written as undiscounted random sum with a new stopping time s instead τ:

i.e., standard criterion (5.10) unlike proposed undiscounted criterion (5.11) orients the long-term evaluation of risk management decisions on time horizons not exceeding random horizon \( \eta \) associated with market interest rate r.

The expected duration of \( \eta \), \( E\eta = 1/p = 1 + 1/r\approx 1/r \) for small r. The same holds for the standard deviation \( \sigma = \sqrt {q} /p \). Therefore, for the interest rate of 3.5%, \( r\approx 0.035 \), the expected duration is \( E\eta \approx 30 \) years, i.e., this rate orients the policy analysis on an expected 30-year time horizon. Certainly, this horizon has no relation to how society has to deal with, say, an expected 100-, 150-, 300-, 1,000- year catastrophe flood. It is essential that the proposed undiscounted criterion (5.6) links the long term evaluation of risk management decisions to horizons τ of potential catastrophic events rather than horizons of market interests. In this sense, the use of stopping time and undiscounted criterion (5.11) instead of standard discounted criterion (5.10) leads to robust flood management decisions, which are sensitive to rare catastrophic events under the analysis. That is, in the presence of catastrophic events, robust decisions are fundamentally different from decisions ignoring them.

5 Risk Communication, Public Perception and Participation

Communication of dam risks with the public plays a crucial role in ensuring that a community assumes the correct attitude towards dams, understands the risks posed by a dam versus benefits that it offers, and promotes efforts for better dam maintenance and regulations for land use planning and control (Amendola 2001).

A correct risk communication may build upon a set of robust strategies derived with an integrated management framework described above. The model does not provide exact remedies and answers as to the costs and benefits of each individual alternative, rather it identifies the preference structure for the actions. Let us illustrate how very simple order of actions having relation to discounting may contribute to increasing the safety of a region over a long time period.

5.1 Intertemporal Inconsistency of Discounting

In the case of a flood management program outlined in Sect. 5.3 (Project Proposal 2000), the problem of dam maintenance is considered to be a community responsibility. Public awareness is characterized by the perception of actions required to maintain a system of dams. In the simplest case, this may be reflected in the choice of an appropriate discounting factor. There may be several major differences in discounting approaches. For example, underestimation of dam risks may lead to the choice of the so-called time consistent discounting.

Time consistent discounting means that the evaluation of a project today (\( t = 0 \)), will have the same discount factor as the evaluation of the same project after any time interval \( [0,T] \) in the future. Hence, independently of waiting time t delayed until the implementation of the actions, the probability of the stopping time occurrence (dam break) at \( t + s \) is the same, as at the initial time moment \( t = 0 \).

For example, traditional geometric or exponential discounting used in risk assessment, \( {{d}_t} = {{d}^t} = {{e}^{{(\ln d)t}}} = {{e}^{{ - \lambda t}}} \), \( \lambda = - \ln d \), defines time consistent preference:

This is also connected with the geometric probability distribution of the discount related stopping time τ in (5.2), (5.3):

if \( P\left[ {\tau \ge t} \right] = {{d}^t} \), \( 0 < d < 1 \), then \( P\left[ {\tau = t} \right] = {{d}^t} - {{d}^{{t + 1}}} = (1 - d){{d}^t} \), \( t = 0,1,\ldots \).

In reality, dams wear out and the probability of their failure changes with time, i.e., the discount factors have explicit time-dependent structure. The time inconsistency of delayed projects requires appropriate adjustments of discount factors for projects undertaken later rather than earlier. If a community is responsible for dam maintenance, as in the program outlined in Sect. 5.3, the misperception of this inconsistency may provoke increasing vulnerability and catastrophic losses. Let us consider typical scenarios of such developments.

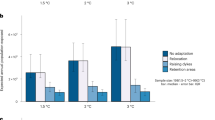

5.2 Commitment to Actions

The analysis of social commitments to mitigate risks would require sociological studies which are outside the scope of our work. We only exemplify possible courses of (in-)actions after the model by Winkler (2006) who has defined a naïve, a sophisticated and a committed (ideal) community. The main differences between these communities and how their inappropriate choice of discounting can result in wrong decisions are studied in Ermolieva et al. 2008a, b. Below we summarize the main idea. Let us assume that planning of actions to mitigate flood risk has a fixed 100-year horizon T, in which three communities, the naïve, the sophisticated, and the committed, live and plan for coping with the catastrophic losses that may occur due to break of a dike from 150-year flood with a time consistent geometric probability distribution. The communities are able to maintain the reliability of dams by collecting money in a catastrophe fund for further investing them into dam retrofitting. But, depending on their perception of risk profiles or induced discounting, the results may be dramatically different.

The current generation of the Naïve Community is aware of a possible catastrophe but it has a misleading view on the catastrophe, namely, if the catastrophe has not occurred in the previous generation the community believes that there is the same probability that it will not occur within the current generation. Thus, it relies on the geometric probability distribution and fails to take into account the increasing probability of a dike break due to aging processes. The risk profiles, time preferences, premiums, and retrofitting actions are not adjusted towards the real escalating risks. In a similar way behave the other generations of the Naïve community. The plans are never implemented and the view on a catastrophe remains time-invariant despite dramatic increase of risk.

The Sophisticated Community, even if it has a correct understanding of the time-inconsistent discounting induced by the deteriorating dams, postpones the decisions because they value much more the present welfare and prefer to pay larger premiums delaying the actions. Due to these delays, the risk burden is increasingly shifted to the next generation, calculated premiums become higher and higher. If a catastrophe occurs, the region will also not be prepared to cope -with losses as ex-ante risk financing measures are not implemented. The unpreparedness of these communities can be explained by their misperception of risks, and, the lack of commitment to act.

In contrast, the Committed Community is able to implement decisions, they understand that the delays in actions may dramatically affect individuals and the growth of societies as a whole. Individuals could be better off if their consumption options were limited and their choices constrained by anticipated risks. As a direct consequence of the committed actions, the premiums that the members of community pay for coping with catastrophes become much lower than those of the sophisticated one.

6 Some Conclusions for Policy Evaluations

Explicit full representation of dam break risks represents new challenges for dam development planning. Pure engineering approaches, risk assessment strategies and tolerability curves are not sufficient to reflect complex interdependencies between technical and societal (ethical) criteria. According to a risk tolerability approach, the cost-effectiveness of risk reduction measures relies on the ratio of the annualized costs of risk-reduction measures divided by the annualized losses. This approach is typical to currently existing cost-benefit analysis. However, the major challenge for dam evaluation is the ability to account for the endogeneity of risks affecting large territories and to design robust strategies to simultaneously improve the well-being of multiple agents across generations. This requires the development of new type of spatio-temporal integrated models and decision support procedures, where evaluation of dam safety is connected with the evaluation of the overall safety of socio-economic and developments. The safety constraints are represented in the form of vital thresholds. In regulations of insurance business this type of constraints is called Value-at-Risk measure indicating that an insurer may become bankrupt only within the time interval specified by the board of insurers. In stochastic optimization, these are called probabilistic or chance constraints. They introduce implicit risk aversion in the selection of risk management strategies and, therefore, stress the importance of ex-ante mitigation measures.

Rare catastrophes set a restriction on the choice of discounting for evaluation of dam projects. Traditional discounting rates, based on a lifespan of current financial markets, set evaluation horizons only for 20–30 years, which may dramatically underestimate potential dam break losses and contribute to increasing vulnerability of the society. For the evaluation of “catastrophic” projects, say, long-term investments into a dam system, the discount factors have to be relevant for the expected horizons of potential catastrophes.

Our conclusion is that the integration of multiple models, concepts and views within a catastrophe management model is feasible and yields valuable insights into the robustness of the different mitigation alternatives. Major challenges, though, are due to the different perception and representation of the dam risks by agents and different disciplines. The studies suggest that integration of models and views is not simply a sum of individual components. The development of a truly integrated model should be at the basis of a societal process of model-based learning-by-simulations and communication of results. The model becomes a truly valuable tool if academic experience and expertise provides rigorous proofs and examples of where and how it can be used and what are the related consequences.

Notes

- 1.

As discussed in the following, stochastic simulation allows the analysts to consider multiple scenarios and uncertainties (see also Chap. 2 by Compton et al. in this book).

References

Amendola A (2001) Integrated management of technological disasters, first annual IIASA-DPRI meeting on integrated disaster risk management: reducing socio-economic vulnerability. IIASA, Laxenburg, Austria, 1–4 Aug 2000. http://www.iiasa.ac.at/Research/RMS/dpri2001

Amendola A, Ermoliev Y, Ermolieva T (2000) Earthquake risk management: a case study for an Italian region. In: Proceedings of the second Euroconference on global change and catastrophe risk management: earthquake risks in Europe. IIASA, Laxenburg, Austria 6–9 July 2000

ANCOLD (1998) Guidelines on risk assessment. Working group on risk assessment. Australian National Committee on Large Dams, Sydney, NSW, Australia

Andersen CF, Battjes JA, Daniel DE, Edge B, Espey W, Gilbert RB, Jackson TL, Kennedy D, Mileti DS, Mitchell JK, Nicholson P, Pugh CA, Tamaro G, Traver R, Buhrman J, Dinges CV, Durrant JE, Howell J, Roth LH (2007) The New Orleans hurricane protection system: what went wrong and why. American Society of Civil Engineers, Reston

Artzner P, Delbaen F, Eber JM, Heath D (1999) Coherent measures of risk. Math Financ 9(3):203–228

IAEA (International Atomic Energy Agency) (1992) The role of probabilistic safety assessment and probabilistic safety criteria in nuclear power plant safety. Safety series no. 106. IAEA, Vienna, Austria

IAEA (International Atomic Energy Agency) (2001) Applications of probabilistic safety assessment (Psa) for nuclear power plants IAEA-TECDOC-1200, Vienna, Austria

Baranov S, Digas B, Ermolieva T, Rozenberg V (2002) Earthquake risk management: a scenario generator. International Institute Applied Systems Analysis, Interim report IR-02-025, Laxenburg, Austria

Bowles D (2001) Evaluation and use of risk estimates in dam safety decisionmaking. In: Proceedings of the united engineering foundation conference on risk-based decision-making in water resources IX, 20-year retrospective and prospective of risk-based decision-making, Santa Barbara, California. American Society of Civil Engineers, Aug 2001

Bowles D (2007) Tolerable risk of dams: how safe is safe enough? In: Proceedings of dams annual conference, Philadelphia, PA, Mar 2007

Chichilinskii G (1997) What is sustainable development? Land Econ 73:467–491

Commissions on Engineering and Technical Systems (CETS) (1985) Safety of dams: flood and earthquake criteria. http://www.nap.edu/openbook.php?record_id=288&page=11

Compton KL, Faber R, Ermolieva TY, Linnerooth-Bayer J, Nachtnebel H-P (2009) Uncertainty and disaster risk management: modeling the flash flood risk to Vienna and its subway system. International Institute Applied Systems Analysis, IIASA research report RR-09-002, Laxenburg, Austria

Ekenberg L, Brouwers L, Danielson M, Hansson K, Johannson J, Riabacke A, Vári A (2003) Flood risk management policy in the upper Tisza Basin: a system analytical approach. International Institute Applied Systems Analysis, Interim report IR-03-003, Laxenburg, Austria

Ermoliev Y, Hordijk L (2006) Global changes: facets of robust decisions. In: Marti K, Ermoliev Y, Makowski M, Pflug G (eds) Coping with uncertainty: modeling and policy issue. Springer, Berlin/New York

Ermoliev Y, Wets R (1988) Numerical techniques of stochastic optimization. Computational mathematics. Springer, Berlin

Ermoliev Y, Ermolieva T, MacDonald G, Norkin V (2000) Stochastic optimization of insurance portfolios for managing exposure to catastrophic risks. Ann Oper Res 99:207–225

Ermolieva T, Ermoliev Y (2005) Catastrophic risk management: flood and seismic risks case studies. In: Wallace SW, Ziemba WT (eds) Applications of stochastic programming. MPS-SIAM Series on Optimization, Philadelphia

Ermolieva T, Ermoliev Y, Fischer G, Galambos I (2003) The role of financial instruments in integrated catastrophic flood management. Multinatl Financ J 7(3&4):207–230

Ermolieva T, Ermoliev Y, Fischer G, Makowski M (2008a) Induced discounting and risk management. International Institute Applied Systems Analysis, Interim report IR-07-040, Laxenburg, Austria

Ermolieva T, Ermoliev Y, Fischer G, Makowski M (2008b) Integrated modeling for management of catastrophic risks: spatial stochastic optimization model. In: Knopov PS, Pardalos PM (eds) Simulation and optimization methods in risk and reliability theory. Nova, New York

Harrald J (2004) Review of risk based prioritization/decision making methodologies for dams. US army corps for engineers, The George Washington University, Institute for Crisis, Disaster, and Risk Management, Washington, DC, 29 Apr

Hirschberg S, Spiekerman G, Dones R (1998) Severe accidents in the energy sector. PSI Report Nr. 98–16, Villigen, Switzerland

ICOLD (2005) Risk assessment in dam safety management: a reconnaissance of benefits, methods and current applications. International Commission on Large Dams (ICOLD) Bulletin 130, Paris

Jansen R (1988) Advanced dam engineering for design, construction, and rehabilitation. Springer, New York. ISBN 0442243979, 9780442243975

Netherlands Ministry of Housing (1989) Physical planning and environment. Dutch national environmental policy plan – premises for risk management, second chamber of the states general, session 19881989, 21 137, No. 5

Newel R, Pizer W (2000) Discounting the distant future: how much do uncertain rates increase valuations? Economics technical series, Pew Center on Global Climate Change, Arlington, VA, USA. htpp://www.pewclimate.org

Project Proposal (2000) Flood risk management policy in the upper Tisza Basin: a system analytical approach. International Institute for Applied Systems Analysis, Laxenburg, Austria

Ramsey F (1928) A mathematical theory of savings. Econ J 138:543–559

Renn O (1992) Concepts of risk: a classification. In: Krimsky S, Golding D (eds) Social theories of risk. Praeger Publishers, Westport, pp 53–82

RESCDAM (2001) Development of rescue actions based on dam-break flood analysis. Community action programme in the field of civil protection, Finnish Environment Institute, final report June 1999–March 2001

Rockafellar T, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2:21–41

Walker G (1997) Current developments in catastrophe modelling. In: Britton NR, Oliver J (eds) Financial risks management for natural catastrophes. Griffith University, Brisbane, pp 17–35

Weitzman M (1999) Just keep on discounting. But …. In: Portney P, Weyant J (eds) Discounting and intergenerational equity. Resources for the future (RFF) Press, Washington, DC

Winkler R (2006) Now or never: environmental protection under hyperbolic discounting. Working paper 06/60, CER-ETH Center of Economic Research at ETH, Zurich

World Commission on Dams (WCD) (2000) Dams and development: a new framework for decision-making. The report of world commission on dams. Earthscan Publications Ltd., London/Sterling

Acknowledgements

The authors are grateful to Aniello Amendola for valuable suggestions and references that he provided for improving the chapter.

The chapter is partially based on a paper published in the book “Dam-break Problems, Solutions and Case Studies”, Wrachien and Mambretti (eds), WIT Press, Southampton, UK, pp. 241–272. Permission by the Publisher to use previous material is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer Science+Business Media Dordrecht

About this chapter

Cite this chapter

Ermolieva, T., Ermoliev, Y., Obersteiner, M., Makowski, M., Fischer, G. (2013). Dams and Catastrophe Risk: Discounting in Long Term Planning. In: Amendola, A., Ermolieva, T., Linnerooth-Bayer, J., Mechler, R. (eds) Integrated Catastrophe Risk Modeling. Advances in Natural and Technological Hazards Research, vol 32. Springer, Dordrecht. https://doi.org/10.1007/978-94-007-2226-2_5

Download citation

DOI: https://doi.org/10.1007/978-94-007-2226-2_5

Published:

Publisher Name: Springer, Dordrecht

Print ISBN: 978-94-007-2225-5

Online ISBN: 978-94-007-2226-2

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)