Abstract

Global production networks have been an important feature of the world economy for several decades. They refer to the geographical location of stages of production (such as design, production, assembly, marketing, and service activities) in a cost-effective manner. Different production stages are increasingly located across different countries, linked by a complex web of trade in intermediate inputs and final goods. Multinational manufacturing firms and international buyers play a central coordinating role in guiding the geographical spread of production activities. Key decisions for a lead firm are which stages it keeps in-house, which it outsources to other firms and where it locates them. This type of sophisticated industrial organization is a far cry from the simple textbook notion of a single large vertically integrated factory situated in a country.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Global Production Networks and Economic Transformation

Global production networks have been an important feature of the world economy for several decades. They refer to the geographical location of stages of production (such as design, production, assembly, marketing, and service activities) in a cost-effective manner (Jones and Kierzkowski 1990; OECD 2013). Different production stages are increasingly located across different countries, linked by a complex web of trade in intermediate inputs and final goods.Footnote 1 Multinational manufacturing firms and international buyers play a central coordinating role in guiding the geographical spread of production activities. Key decisions for a lead firm are which stages it keeps in-house, which it outsources to other firms and where it locates them (Gereffi et al. 2005; Dedrick et al. 2010).Footnote 2 This type of sophisticated industrial organization is a far cry from the simple textbook notion of a single large vertically integrated factory situated in a country.

Production networks are sometimes labelled in the literature as production fragmentation, global value chains (GVCs), or global supply chains (Gereffi et al. 2005; Baldwin and Gonzalez 2014) but essentially mean the same basic concept with subtle differences. This new pattern of international specialization is intertwined with the international integration processes of globalization and regionalization. It is also underpinned by corporate strategies of multinational firms, technological advances (e.g., information, communications, and transport technologies), developments in logistics and trade facilitation, and falling barriers to trade and investment. Production networks were initially visible in clothing and electronics and have since penetrated a wide range of industries including automotives, aircraft, machinery, consumer goods, and food processing. The role of services in production networks is increasingly important but has been underestimated due to serious data problems (Low 2013).

Production networks are transforming the world economy and participating countries, firms, and workers. Several interesting trends emerge from recent research (Timmer et al. 2014):

-

(i)

International production fragmentation has rapidly increased since the early 1990s when it became noticeable on a world scale.

-

(ii)

In most GVCs, there is a trend toward value added by capital and high-skilled workers, and away from unskilled workers.

-

(iii)

Within GVCs, developed countries increasingly specialize in activities conducted by high-skilled workers.

-

(iv)

Developing countries are unexpectedly specializing in capital-intensive activities.

An alternative perspective highlights the transformations changing the governance structures of GVCs and global capitalism at various levels (Gereffi 2014):

-

(i)

The end of the Washington Consensus and the rise of contending centers of economic and political power.

-

(ii)

A combination of geographic concentration and value chain concentration in the global supply base which in some cases is shifting bargaining power from lead firms to large suppliers in developing countries.

-

(iii)

New patterns of strategic coordination among supply chain actors.

-

(iv)

A shift in the end markets of many GVCs accelerated by the global economic crisis of 2008–2009, which is redefining the regional geographies of trade and investment.

-

(v)

A diffusion of the GVC approach to major donor agencies, which is prompting a reformulation of established development approaches.

These trends present developed and developing countries with a myriad of opportunities for business and growth as well as policy challenges (Baldwin and Gonzalez 2014; Coe and Yeung 2015). Countries have the opportunity to achieve unprecedented economic prosperity or to risk economic marginalization in the face of expanding production networks. Governments, business, and workers will need to cooperate more closely than ever before to explore how to encourage production networks to improve the outlook for economic development. East Asia offers a potent example of successful economic development through participating in production networks.

2 The Dynamics of Production Networks in East Asia

The structural transformation of East AsiaFootnote 3 from a poor, less developed agricultural periphery to become a wealthy global factory over half a century is considered an economic miracle (World Bank 1993). The extent of East Asia’s participation in production networks is significantly greater than elsewhere and has spurred the region’s global rise to the coveted “Factory Asia” league with rapid economic growth over a long period (Athukorala 2011; WTO and IDE-JETRO 2011). By 1985, the region had already accounted for 19 % of world exports (largely manufactures) and this figure increased to 25 % in 1995 and further to 30 % in 2013. Similarly, the region’s share of world imports increased from 16 % in 1985, to 23 % in 1995, and further to 30 % in 2013.

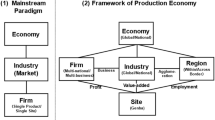

Japan’s industrial rise had a catalytic effect on the industrial development of neighboring Asian economies. Akamatsu (1962) put forward a paradigm whereby less developed economies in Asia followed the different phases of industrial development of more advanced economies in a wild flying geese pattern. Japan was the lead goose in this pattern and followed by others in East and Southeast Asia. Rising wages and factor costs in Japan encouraged internal industrial restructuring and relocation of labor-intensive manufacturing assembly operations to Asian economies. The first generation of newly industrialized economies (NIEs), including Hong Kong, China; the Republic of Korea; Singapore; and Taipei,China emerged in the 1960s and 1970s. A second generation soon followed including middle-income Association of Southeast Asian Nations (ASEAN) member states and the People’s Republic of China (PRC) in the 1980s and 1990s. With the gradual spread of production networks to South Asia, a third generation (including India and Bangladesh) seems to be emerging.

Table 1.1 provides data on trends in world production network trade since 2001 for East Asia and other major economies and regions. These were computed using the so-called gross trade approach of Athukorala (2011). The data highlight the growing role of East Asia in world production network trade over the 2000s. Between 2001–2004 and 2009–2013, East Asia’s share of world production network trade rose significantly from 39 % to 48 %. An opposite trend, however, was visible in developed economies. The share of the United States fell from 11 % to 7 % during the same period and the European Union from 32 % to 28 %. Meanwhile, some developing regions witnessed an increase in production network trade but their shares remain relatively modest compared to East Asia. Accordingly, Latin America’s share rose from 5 % to 6 %, Eastern Europe’s from 3 % to 5 %, and South Asia’s from 1 % to 2 %. Africa remains a marginal player with a sluggish share of less than 1 % over the 2000s. Within East Asia, the PRC is a notable player in world production network trade with a large rise in its share from 13 % to 25 %.Footnote 4 The Republic of Korea’s share also rose modestly from 4 % to 5 %. In contrast, Japan’s share fell from 11 % to 8 % and ASEAN’s from 10 % to 9 %.

A combination of factor endowments, favorable initial conditions, national policies, and firm-level strategies explain East Asia’s success in production networks (Lall and Teubal 1998; Hobday 2001; ADB 2008; Baldwin 2008). Until the 2000s, outward-oriented development strategies, high domestic savings rates, the creation of modern physical infrastructure and export processing zones, and investment in human capital were key domestic policy ingredients behind East Asia’s successful economic performance. A booming world economy hungry for labor-intensive imports from East Asia, falling tariffs in developed country markets, inflows of trade-related foreign direct investment (FDI), generous foreign aid flows, and supplies of inexpensive and productive labor all favored outward-oriented growth in East Asian economies. These economies were also geographically close to an expanding high-income Japan, with efficient multinational corporations seeking to relocate production to less costly economies in East Asia.

This success of East Asian growth has been accompanied by market-driven integration through trade and FDI, while embracing a multilateral liberalization framework under the General Agreement on Tariffs and Trade (GATT)/World Trade Organization (WTO) and unilateral liberalization through Asia-Pacific Economic Cooperation (APEC) (Kawai and Wignaraja 2014a). The region has typically avoided discriminatory trade practices, although some economies in East Asia used industrial policy instruments to support entry into production networks. The PRC, the Republic of Korea, and Taipei,China are reputed to have deployed sector-specific interventions to attract FDI, build domestic technological capabilities, provide finance to domestic suppliers, and strengthen institutional support. FDI flows to the East Asian economies, driven initially by Japanese multinational corporations after the Plaza Accord in the mid-1980s, have generated vertical intra-industry trade within the region and have contributed to deeper economic integration. More recently, NIEs and some middle-income ASEAN countries have become active as outward investors, particularly in the PRC, whose rise as a large trading nation has also strengthened trade—particularly intra-industry trade—linkages among the East Asian economies. Intra-regional trade as a share of total trade has risen from 38 % to 50 % between 1985 and 2013. East Asia’s figure is above that of the North American Free Trade Agreement (NAFTA, 41 %) but below that of the European Union (64 %).Footnote 5 Thus, the market-driven process of trade and FDI has naturally formed production networks within East Asia.

It is notable that the global financial crisis of 2008 had a marked negative impact on production networks and economic growth in East Asia (see Kawai and Wignaraja 2014a). Average annual manufacturing growth in East Asian economies slowed down sharply in the global financial crisis period and after. Bolstered by past industrial achievements and capacity, the manufacturing-to-GDP ratio and the share of high technology exports in East Asian economies experienced a slight correction in the global financial crisis period and after but these figures remain well above those of other developing countries. Average annual GDP growth in East Asian economies also slowed down in the global financial crisis period and after, but remained faster than other developing economies. Increased connectivity through participation in global production networks has made countries and firms more economically interdependent with implications for Factory Asia’s performance. There is an increased risk that unexpected global, national, and even local events can disrupt production networks and cause a domino effect leading to system-wide failure (OECD 2013).

Toward the end of the twentieth century, market-driven trade policy was altered by a shift in East Asia’s international trade policy toward free trade agreements (FTAs). Alongside multilateralism, in the late 1990s Asian economies began emphasizing FTAs as a trade policy instrument (Kawai and Wignaraja 2014b). Many policy makers in the region believe that deep FTAs can reduce residual tariffs and behind-the-border regulatory barriers that hamper FDI and production networks. Furthermore, slow progress in over a decade of negotiations for the WTO Doha Development Round has encouraged countries to consider FTAs as an alternative approach to trade and investment liberalization in the region. By the end of 2013, East Asia had concluded 77 FTAs and others are in various stages of preparation. Underlining East Asia’s commitment to open regionalism, several FTAs are with partners outside East Asia. Negotiations are also ongoing for two mega-regional FTAs—the Trans-Pacific Partnership (TPP) and the Regional Comprehensive Economic Partnership (RCEP)—which could form the basis for an eventual Asia-wide FTA with coherent trade rules and regulatory barriers (see Petri, Plummer, and Zhai 2012 for a model-based evaluation of the TPP and an Asian FTA track).

It is early days in East Asia’s FTA experience. Evidence suggests that FTAs have brought net benefits to enterprises in East Asia such as the stimulus of competition and market access (Kawai and Wignaraja 2011, 2014b; Wignaraja 2014). However, as the number of FTAs increases, there is a future risk of an Asian “noodle bowl” effect of multiple tariffs and rules of origin which can raise transactions costs for firms, especially small and medium-sized enterprises (SMEs).

3 Aim of the Book

This book aims to provide a comprehensive examination of patterns and determinants of production networks in East Asia. It offers the reader an accessible understanding of the theoretical literature on comparative advantage and production networks as well as recent developments in empirical analysis at the industry and firm levels. The empirical topics covered in the book include gross trade in parts and components and gravity models, trade in value added using input–output tables, case studies of industries and countries, microdata econometric studies of firm heterogeneity in production networks, and exploration of policy implications for latecomers and donor support.

A noteworthy feature of the book is the attempt to provide and statistically analyze available microdata on the behavior of firms in production networks and trade in East Asia. Multicountry multienterprise firm surveys of East Asia are an expensive and difficult undertaking. The firm-level research in this book was facilitated by the recent availability of large enterprise datasets from the World Bank as well as the Asian Development Bank and Asian Development Bank Institute. The microdata econometric studies in the book explore important aspects of firm heterogeneity in production networks such as the relationship between engaging in production networks and innovative activity, analysis of alternative measures of innovation (such as research and development (R&D) and an index of technological capability) on trade, the determinants of SME internationalization via joining production networks and using FTAs, and firm-level exports and access to credit. The book blends new sources of data, empirical tools, and econometric methods to understand the workings of the complex web of production networks in East Asia.

The summary of the remainder of the volume may not do sufficient justice to the breadth, technical analysis, and quality of the individual chapters. The following summary of the chapters is intended to provide an overview of the contents of the volume and highlight critical issues. Readers are encouraged to explore individual chapters according to their interest.

4 Understanding Comparative Advantage, Production Networks, and Firms

The spread of production networks in East Asia and elsewhere poses significant intellectual challenges for traditional theories of international trade and trade policy analytical tools. This has led to the development of new conceptual and empirical approaches which place the firm and industrial organization at center stage (Greenaway and Kneller 2007; Baldwin and Gonzalez 2014).

In Chap. 2, Lucian Cernat explores the treatment of firms in theories of international trade and trade policy analytical tools. Traditional Ricardian and Heckscher–Ohlin trade theories were based on aggregate concepts under simplifying assumptions and did not elaborate much on trading firms. Likewise, traditional trade policy analytical tools such as computable general equilibrium (CGE) models simulate economic effects of policy scenarios at the macroeconomic level and remain imperfect at analyzing firm-level behavior in trade. It is only relatively recently that firm heterogeneity assumed a more central role in explaining trade flows in the so-called “new new trade theory” of Melitz and its variations. The defining feature of the theory is that not all firms became exporters and only those that achieved a certain productivity threshold were able to participate successfully in international trade. Empirical testing of the “new new trade theory” is a growing research area. The European Commission has identified firm-level statistics as an important priority and Eurostat has been working on modernizing enterprise and trade statistics. Based on these observations, Cernat makes the case for upgrading current analytical tools used for trade policy analysis and complementing them with more detailed firm-level data. Such an upgrade should be based on the latest developments in trade theories and greater availability of firm-level data. Firm-level data would permit more careful ex ante and ex post assessments of trade patterns (e.g., production network trade) and policy initiatives (e.g., free trade agreements). An upgraded “Trade Policy Analysis 2.0” could contribute to several trade policy priorities and to a better understanding of the gains from trade for enterprise competitiveness, job creation, and consumer welfare. Trade policy analysis using firm-level data would enrich stakeholder dialogues and help reduce public misconceptions about the economic effects of trade policy.

Chapter 3 by Fukunari Kimura and Ayako Obashi undertakes a survey of the emerging literature on production networks in East Asia to assess what is known and what needs further investigation. They classify the literature into three categories: (i) the structure and mechanics of production networks, (ii) the conditions for production networks, and (iii) the properties and implications. Fragmentation theory pioneered by Jones and Kierzkowski (1990) and its development has played a key role in explaining the spread of production stages across geographical space but does not fully reflect the sophistication of East Asian production networks. Furthermore, there is limited research on the conditions for production networks underlying the skewed distribution of production networks between countries and within countries. Some research, however, provides insights on the policy influences on production networks in East Asia (including trade liberalization, free trade agreements, trade facilitation, infrastructure, and exchange rates). Kimura and Obashi conclude that further research is required in three areas: (i) the formulation of more rigorous theory for empirical work, (ii) more exploration of the transformative aspects of production networks, and (iii) better interdisciplinary analysis.

5 Industry-Level Analysis: Gross Trade and Trade in Value Added

The mainstay of empirical work by international economists on production networks in East Asia has been measurement of trade in parts and components using gross trade data (Athukorala 2011). In part, this may be because gross trade data are high frequency and readily available. In this vein, econometric analysis has relied heavily on gravity models. More recently, with the development of comparable international input–output tables for many countries in East Asia, there has been growing interest in measuring trade in value added (WTO and IDE-JETRO 2011). Each of these industry-level approaches to studying production networks has its merits and is useful depending on the purpose at hand.

In Chap. 4, using gross trade statistics, Matthias Helble and Boon-Loong Ngiang analyze how East Asia’s trade composition and orientation have changed over the past decade and the implications for the region and beyond. Over the last two decades, global and regional supply chains have emerged in which production is divided into production stages or tasks across the most competitive locations. East Asia has been the most successful region in the world in joining global and regional supply chains and has been described by Baldwin (2008) as “Factory Asia.” Introducing a simple tool to represent the distance traveled by goods in conjunction with a gravity model, the authors show that East Asia has successfully consolidated its role as the “Global Factory” over the past decade. Furthermore, studying East Asia’s recent trade patterns in primary, intermediate, capital, and consumption goods, the results indicate that East Asia is on track to becoming one of the biggest “malls” in the world, i.e., East Asia is increasingly consuming more of the consumption goods produced in the region. Whereas in 1999/2000 around half of all consumption goods exported by East Asia went to the US and the European Union, in 2011/12 half stayed in the region or were traded with the rest of the world. If the present trend continues, Helble and Ngiang conclude that the region may host an increasing share of higher value-added downstream value chain activities (e.g., distribution, marketing, and customer services) and that average lead times for East Asia’s exports to reach end consumers are likely to shorten.

Chapter 5 by Hyun-Hoon Lee, Donghyun Park, and Jing Wang investigate the PRC’s gross trade pattern using a gravity model to better understand its structural transformation into the leading economy in global and East Asian production networks. They use disaggregated Harmonised System (HS) 8-digit product-category level data collected by the PRC’s Customs Office to assess the PRC’s exports of two types of manufactured goods—parts and components and final goods—and nonmanufactured goods. What is innovative about their approach is that they also examine the PRC’s exports of all three types of goods by different types of firms—foreign firms, domestic private firms, and domestic public firms. Lee, Park, and Wang find that the gravity model works well for all specifications and the results are largely consistent with economic intuition. All three different types of firms in the PRC export more to larger countries and less to countries that are farther away, irrespective of the types of products. Such firms also export less to landlocked countries and island economies and more to countries which are more open to trade. In a related exercise in the chapter, the value of exports is replaced with the goods-extensive margin (i.e., number of goods) and the goods-intensive margin (i.e., value of exports per good). Again, the results were found to be largely consistent with economic intuition meaning that the PRC exports fewer goods and less of each exported good to more distant countries.

Chapter 6 by Hubert Escaith and Satoshi Inomata examines the link between trade facilitation policies and the evolution of production networks in East Asia. Deepening industrial interdependency in East Asia was not a spontaneous phenomenon but has been carefully aided and facilitated by policies implemented by national governments. The chapter seeks to provide an accessible introduction to the use of input–output analysis and graph theory for understanding trade from the GVC perspective. Applying these topological properties to the East Asian and Pacific context, the chapter shows that the inter-industry network moved from a simple hub-and-spokes cluster to a much more complex structure with the emergence of the PRC and the specialization of several countries as secondary pivots. The densification of production networks resulted from synergies between business strategies of firms and the promotion of export-led growth strategies by developing East Asian countries. These countries applied a series of trade facilitation policies that lowered tariff duties and reduced other transaction costs. Tariff escalation was greatly reduced, lessening the anti-export bias attached to high effective rates of protection and improving the competitiveness of second-tier national suppliers. The other axis of trade facilitation focused on improving logistics services and cross-border procedures. Escaith and Inomata conclude that although East Asia is well ahead of the rest of developing Asia in trade facilitation, there is still room to close the gap with best international practices.

6 Firm-Level Analysis: Industrial Organization and Technological Capabilities

The role of firms in production networks is a new frontier in international economics. While there are some insightful and detailed case studies of the organizational aspects of individual firms in production networks in East Asia, relatively little micro-level work exists on attempting to generalize the findings of case studies to multiple firms through statistical analysis. A notable topic surrounds the firm-level characteristics influencing the participation of firms in production networks in East Asia (Wignaraja 2015).Footnote 6 In this vein, investigation of the relationship between engagement in production networks, innovative activity, and skills at the firm level in East Asia offers an exciting direction for empirical research.

In Chap. 7, Daisuke Hiratsuka undertakes a detailed industry case study of the procurement system of a hard disc drive (HDD) assembler operating in Thailand. East Asia’s largest industrial sector is electronics, in which Thailand is an important player. The Thai case study on the organization of the HDD production network leads to several interesting findings. First, this particular production network consists mostly of arm’s-length suppliers, who are independent and on an equal footing with the assembler. These suppliers are mostly located in the assembling country, but some are located in neighboring countries. This proximity is necessary to establish a good relationship between the customer and suppliers and allows problems to be solved as soon as they occur. Second, the arm’s-length suppliers engaged in each country’s leading industries (e.g., electronics in Malaysia and Singapore and automotives in Thailand) have extended their business to supply the HDD industry. They have formed an industrial cluster in each country within a 2- or 3-h drive radius. Each cluster that spans different countries is linked by a well-developed logistics network employing the just-in-time production method that prevails in East Asia. Third, on a regional level, these separate clusters tend to form international production networks that connect to each other across neighboring countries within a distance that provides a quick response time for problem solving. Fourth, US HDD assemblers outsourced to indigenous suppliers in Malaysia and Singapore because US suppliers did not follow the assemblers’ move to the region. However, since Japanese suppliers did follow the Japanese HDD assemblers to the Philippines and Thailand, indigenous suppliers were not outsourced. Hiratsuka concludes that the case studies provide valuable micro-level insights which are not found in industry-level approaches to the study of production networks such as the gross trade or trade in value added approaches.

Chapter 8 by Ganeshan Wignaraja, Jens Krüger, and Anna-Mae Tuazon maps the evolution of production networks and conducts firm-level econometric analysis of production networks involving Malaysia and Thailand. The analysis of gross trade statistics shows that cross-border production networks have been playing an increasingly important role in trade among the ASEAN member states in recent years. There is a major dearth of studies in the literature on East Asia dealing with the relationship between participation in production networks and innovative activity at the firm level. Using a dataset of over 2,000 firms from Malaysia and Thailand, the two most active ASEAN countries in production networks, the chapter also examines the effect of participating in production networks on profits and technological capabilities of firms. Inspiration for the research on Malaysian and Thai firms lies in theoretical work by Glass and Saggi (2001) on outsourcing and technology upgrading, empirical work by Görg and Hanley (2011) on outsourcing and R&D, and the literature on technological capabilities conceptualized by Lall (1992), among others. The empirical results suggest that participating in production networks raises profits and value added. The evidence also suggests that participation is positively correlated with technology upgrading, measured by an index of technological capabilities (comprising technical functions performed by firms to use imported technology efficiently). Thus, firm-level econometric analysis of production networks is useful for generalizing findings from individual case studies.

In Chap. 9, Ganeshan Wignaraja explores the “black box” of innovation in the electronics production network in East Asia by mapping technological capabilities and conducting econometric analysis of firm-level exports in the PRC, the Philippines, and Thailand. The Lall taxonomy is used to develop an index of technological capabilities for nearly 800 firms in the three countries. The mapping exercise shows that firms in the PRC generally have higher levels of technological capability than those in either the Philippines or Thailand. Differences in technological development may partly explain the PRC’s export success in electronics. The econometric results confirm the importance of foreign ownership and innovation in increasing the probability of exporting in electronics. Higher levels of skills, manager education, and capital also matter in the PRC, as does accumulated experience in Thailand. Furthermore, the index of technological capabilities emerges as a more robust indicator of innovation than the R&D-to-sales ratio. Accordingly, technological effort in electronics in these countries mostly focuses on assimilating and using imported technologies rather than formal R&D by specialized engineers. Thus, technology-based approaches to trade offer a plausible explanation for firm-level exporting behavior in East Asia and complement the literature on production networks.

7 Firm-Level Analysis: Finance and SME Internationalization

SMEs are in the policy spotlight in East Asia. Rising income inequality in the region amid a fragile world economy has prompted governments and regional organizations to place increasing emphasis on the role of SMEs to create jobs and reduce inequality. SMEs contribute a significant proportion of employment and gross domestic product in East Asian economies. There is relatively little evidence, however, about the extent of SME internationalization in East Asia (Harvie 2010). There is an ongoing debate on whether small firm size is a disadvantage for SMEs to engage in production networks either as direct exporters or as industrial suppliers (Wignaraja 2015). There is also discussion on whether SMEs benefit from institutional and policy support in East Asia such as access to finance from commercial banks and use of trade policy instruments such as FTA preferences (Tambunan and Chandra 2014; Wignaraja 2014; Wignaraja and Jinjarak 2015).

In Chap. 10, Menaka Arudchelvan and Ganeshan Wignaraja examine SME internationalization through firm-level econometric analysis of Malaysian firms participating in GVCs and FTAs. Malaysia, one of ASEAN’s more industrialized economies, is reputed in East Asia for its notable engagement in GVCs and is actively pursuing FTAs, bilaterally and through ASEAN. Drawing on a survey of 234 Malaysian SMEs conducted across different regions in the country, the chapter examines the characteristics of enterprises and explores the policy implications. This is very likely the first study to investigate the characteristics of SMEs participating in both GVCs and FTAs. It finds that even among SMEs, firm size matters. Larger SMEs benefit from economies of scale and set lower prices than smaller SMEs. Moreover, larger SMEs have better access to finance and resources critical to growth. However, size is not the whole story for SME internationalization. Licensing of foreign technology and investment in R&D are also positively associated with SMEs joining GVCs. Furthermore, increased exposure to international trade, knowledge of FTA provisions, and central location positively affect the use of FTAs by SMEs. Arudchelvan and Wignaraja conclude that a market-friendly business environment with more effective business support for SMEs is essential to better realize the gains from participating in GVCs and FTAs. This would involve more resources for SME support as well as close coordination among public and private sector institutions that support them.

Chapter 11 by Yothin Jinjarak, Paolo Jose Mutuc, and Ganeshan Wignaraja studies factors associated with the participation of firms in export markets, focusing primarily on firm size and access to credit. The starting point of their study is the observed large gap between the credit-related needs of SMEs and the financing actually available from formal financial institutions (e.g., commercial banks) which dominate East Asia’s financial system. Their analysis is based on a survey sample of 8,080 SMEs (with fewer than 100 employees) and non-SME firms in developing East Asian countries (the PRC and five ASEAN economies—Indonesia, Malaysia, the Philippines, Thailand, and Viet Nam) across different industrial sectors. To verify the sensitivity of the results, a battery of econometric specifications and robustness tests were applied to the data. The main findings suggest the interdependent relationship among export participation, firm size, and access to credit. SMEs participating in export markets tend to gain more access to credit, while potential scale economies (firm size) of SMEs are positively associated with participation in export markets. The estimation results also point to the supportive influences of foreign ownership, worker education, and production certification on export participation, as well as the positive effects of financial certification, managerial experience, and collateral and/or loan value on access to credit for SMEs. Jinjarak, Mutuc, and Wignaraja conclude by raising important issues with respect to SME finance in East Asia such as broad-based versus targeted credit approaches to SMEs and the scope for central bank regulation of SME financing institutions.

8 Latecomers and Donor Support

Another issue in the policy spotlight is whether industrial latecomers, particularly least developed countries (LDCs), can benefit from the growth of production networks in East Asia. Concerns have been expressed that production networks have remained concentrated in a handful of East Asian countries due to the significant organizational and technological demands placed on participating firms and the policy-making capacity of host economies (Abe 2013). Exploring the cost and capability requirements for LDCs in the periphery of Asia to participate in production networks may provide new insights. Bearing in mind the link between participating in production networks and economic prosperity, it is also worthwhile to examine how foreign aid might be used to support LDC participation in trade and production networks in East Asia (Gereffi 2014).

In Chap. 12, Jodie Keane and Yurendra Basnett use a literature survey and case studies of two Asian LDCs, Cambodia and Nepal, to examine their limited experience in engaging with GVCs. The literature survey suggests that the production fragmentation and trade in tasks mean new trade opportunities for Asian LDCs. Although LDCs may lack the prerequisite capabilities to export sophisticated goods, they can obtain these through engagement with GVCs characterized by the vertical fragmentation of production. This tends to be FDI-led and characterized by more hierarchical GVC governance structures. However, there is tension between the comparative costs that create the incentive to unbundle and the co-location or agglomeration forces that may bind some parts of a process together. There are also risks for LDCs, such as concerns that once plugged into GVCs producers may be locked into low stages of production and unable to upgrade their functional position over time. Cambodia has benefited from the growth of formal jobs through FDI-led GVC integration, but is struggling with functional upgrading. Meanwhile, landlocked Nepal is in the early stages of engaging with GVCs and upgrading within them. Both case studies exhibit different economic geographies which influence the cost and capability considerations of GVC integration. There are governance capability issues regarding the ability to effectively design and implement industrial policy. Keane and Basnett conclude by describing how the powerful new trade opportunities in GVCs could be more effectively, and also realistically, harnessed in both case studies.

Chapter 13 by William Hynes and Frans Lammersen assesses the role of donors in supporting national strategies to connect Asian firms to GVCs. The study examines the aid strategies and programs for linking firms in developing Asia to value chains (including via regional approaches) and assesses their trade and development results. The chapter also reviews aid-for-trade data, findings from evaluations, and empirical studies. The research shows that Asia has taken numerous measures to reduce regional and national trade and transport costs. Furthermore, the evidence indicates that programs supported through aid for trade and broader official development assistance have been generally effective. Increasingly, this donor support needs to be complemented by other development finance flows, private sector instruments (e.g., guarantees and non-concessional finance), and the actions of leading multinationals. Aid-for-trade flows to Asia have stimulated infrastructure investment in transport and energy, streamlined trade facilitation, and supported the creation of a market-friendly business environment. Donors have also provided vital financing for developing the private sector, improving access to finance, and overcoming market failures. SMEs in particular have been helped to integrate into national and regional value chains. Hynes and Lammersen conclude that much of Asia’s success in reaping trade opportunities is due to national and regional authorities and to the dynamism of enterprises.

9 Concluding Observations

The chapters in this book provide the latest developments in conceptual work and empirical analysis on production networks in East Asia. A novel feature of the book is that it attempts to unpack production networks in East Asia by blending industry-level approaches with detailed micro-level analysis using case studies and econometric analysis of microdata. We have a better understanding of what makes production networks tick, but this is a moving target. Production networks in East Asia are constantly changing due to the strategies of lead multinational firms and their suppliers, exogenous shocks (e.g., demand in major markets, technological change, and organizational innovations), and public policies. The chapters indicate several areas for further research. Keeping up with current developments in production networks is a challenging but worthwhile research task. Developing better theoretical frameworks for understanding the key drivers of production networks is also vital. Furthermore, future statistical work should attempt to integrate industry and micro-statistics to enable richer explanations of the determinants and implications of production networks. Finally, work is needed on the impacts of alternative government policies for building production networks to enable the formulation of good practices for latecomers and for donor programs.

Notes

- 1.

Baldwin and Gonzales (2014) use an example of car exports from Mexico to the United States to illustrate supply chain trade through the value added trade approach. They show that a $10 (million) car export from Mexico to the US may be made up of intermediates of iron and steel purchased abroad worth $3, intermediates of plastics and rubber bought in Mexico worth $2.5 and $4.5 of Mexican value added in the car industry.

- 2.

Dedrick, Kraemer, and Linden (2010) illustrate a production network for the assembly of the iPod from hundreds of parts and components across the planet. Apple (a multinational corporation based in the United States) leads such a network and conducts research and development, design, branding, marketing, and after-sales activities. Apple is estimated to realize profits worth between one third and one half of the iPod’s retail price. Toshiba (Japan) and Samsung (Republic of Korea), both from East Asia, realize an additional slice of profits by making high-value parts and components such as hard-disc drives, displays, and memory devices. Meanwhile, the final assembly stage of the iPod in the People’s Republic of China only sees as little as 2 % of profits.

- 3.

East Asia in this book refers to the ten member states of the Association of Southeast Asian Nations (ASEAN); the People’s Republic of China (PRC); Hong Kong, China; Japan; the Republic of Korea; and Taipei,China.

- 4.

However, the value added and profit accruing to the PRC may be relatively small as pointed out by Dedrick, Kraemer, and Linden (2010) in their insightful case study of the assembly of the iPod.

- 5.

Author’s estimates are based on the United Nations Comtrade database.

- 6.

Wignaraja (2015) undertakes a comparative, firm-level analysis of joining supply chain trade in five Southeast Asian economies to improve our understanding of fragmentation of manufacturing across borders. He finds that firm size (reflecting economies of scale to overcome entry costs) matters for joining supply chain trade with large firms playing the dominant role in Southeast Asian economies. However, firm size is not the whole story. Efficiency—particularly investment in building technological capabilities and skills—and access to commercial bank credit also influence joining supply chain trade.

References

Abe, M. 2013. Expansion of global value chains in Asian developing countries. In Global value chains in a changing world, ed. D. Elms and P. Low. Geneva: World Trade Organization, Fung Global Institute, and Temasek Foundation Center for Trade and Negotiations.

ADB (Asian Development Bank). 2008. Emerging Asian regionalism: A partnership for shared prosperity. Manila: ADB.

Akamatsu, K. 1962. A historical pattern of economic growth in developing countries. Journal of Developing Economies 1(1): 3–25.

Athukorala, P. 2011. Production networks and trade patterns in East Asia: Regionalization or globalization? Asian Economic Papers 10(1): 65–95.

Baldwin, R. 2008. Managing the noodle bowl: The fragility of East Asian regionalism. Singapore Economic Review 53(3): 449–478.

Baldwin, R., and J.V. Gonzalez. 2014. Supply-chain trade: A portrait of global patterns and several testible hypotheses. The World Economy. Article first published online: 13 May 2014. doi:10.1111/twec.12189.

Coe, N.M., and H.W. Yeung. 2015. Global production networks: Theorizing economic development in an interconnected world. Oxford: Oxford University Press.

Dedrick, J., K.L. Kraemer, and G. Linden. 2010. Who profits from innovation in global value chains? A study of the iPod and notebook PCs. Industrial and Corporate Change 19(1): 81–116.

Gereffi, G. 2014. Global value chains in a post-Washington consensus world. Review of International Political Economy 21(1): 9–37.

Gereffi, G., J. Humphrey, and T. Sturgeon. 2005. The governance of global value chains. Review of International Political Economy 12(1): 78–104.

Glass, A., and K. Saggi. 2001. Innovation and wage effects of international outsourcing. European Economic Review 45(1): 67–86.

Görg, H., and A. Hanley. 2011. Services outsourcing and innovation: An empirical investigation. Economic Inquiry 49(2): 321–333.

Greenaway, D., and R. Kneller. 2007. Firm heterogeneity, exporting and foreign direct investment. The Economic Journal 117(February): 134–161.

Harvie, C. 2010. East Asian production networks—The role and contribution of SMEs. International Journal of Business and Development Studies 2(1): 27–62.

Hobday, M. 2001. The electronics industries of the Asia-Pacific: Exploring international production networks for economic development. Asian-Pacific Economic Literature 15(1): 13–29.

Jones, R.W., and H. Kierzkowski. 1990. The role of services in production and international trade: A theoretical framework. In The political economy of international trade: Essays in honour of R.E. Baldwin, ed. R.W. Jones and A.O. Krueger. Oxford: Basil Blackwell.

Kawai, M., and G. Wignaraja (eds.). 2011. Asia’s free trade agreements: How is business responding? Cheltenham: Edward Elgar.

Kawai, M., and G. Wignaraja. 2014a. Trade policy and growth in Asia. ADBI working paper no. 495. Tokyo: Asian Development Bank Institute.

Kawai, M., and G. Wignaraja. 2014b. Policy challenges posed by Asian free trade agreements: A review of the evidence. In A world trade organization for the 21st century: The Asian perspective, ed. R. Baldwin, M. Kawai, and G. Wignaraja. Cheltenham: Edward Elgar.

Lall, S. 1992. Technological capabilities and industrialization. World Development 20(2): 165–186.

Lall, S., and M. Teubal. 1998. Market-stimulating technology policies in developing countries: A framework with examples from East Asia. World Development 26(8): 1369–1385.

Low, P. 2013. The role of services. In Global value chains in a changing world, ed. D. Elms and P. Low. Geneva: Fung Global Institute, Nanyang Technological University, and World Trade Organization.

OECD (Organisation for Economic Co-operation and Development). 2013. Interconnected economies: Benefitting from global value chains. Paris: OECD.

Petri, P., M.G. Plummer, and F. Zhai. 2012. The Trans-Pacific Partnership and Asia-Pacific integration: A quantitative assessment. Washington, DC: Peterson Institute for International Economics.

Tambunan, T., and A.C. Chandra. 2014. Utilisation rate of free trade agreements (FTAs) by local micro-, small- and medium-sized enterprises: A story of ASEAN. Journal of International Business and Economics 2(2): 133–163.

Timmer, M.P., A.A. Erumban, B. Los, R. Stehrer, and G.J. de Vries. 2014. Slicing up global value chains. Journal of Economic Perspectives 28(2): 99–118.

Wignaraja, G. 2014. The determinants of FTA use in Southeast Asia: A firm-level analysis. Journal of Asian Economics 35: 32–45.

Wignaraja, G. 2015. Factors affecting entry into supply chain trade: An analysis of firms in Southeast Asia. Asia & the Pacific Policy Studies 2(3): 623–642. Article first published online: 24 Mar 2015. doi:10.1002/app5.78.

Wignaraja, G., and Y. Jinjarak. 2015. Why do SMEs not borrow more from banks? Evidence from the People’s Republic of China and Southeast Asia. ADBI working paper no. 509. Tokyo: Asian Development Bank Institute.

World Bank. 1993. The East Asian miracle: Economic growth and public policy. New York: Oxford University Press for the World Bank.

WTO and IDE-JETRO (World Trade Organization and Institute of Developing Economies-Japan External Trade Organization). 2011. Trade patterns and global value chains in East Asia: From trade in goods to trade in tasks. Geneva: WTO and IDE-JETRO.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Asian Development Bank Institute

About this chapter

Cite this chapter

Wignaraja, G. (2016). Introduction. In: Wignaraja, G. (eds) Production Networks and Enterprises in East Asia. ADB Institute Series on Development Economics. Springer, Tokyo. https://doi.org/10.1007/978-4-431-55498-1_1

Download citation

DOI: https://doi.org/10.1007/978-4-431-55498-1_1

Publisher Name: Springer, Tokyo

Print ISBN: 978-4-431-55497-4

Online ISBN: 978-4-431-55498-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)