Abstract

This paper presents selected evidence on the impact of uncertainty and sunk costs on firms’ decisions related to entry and exit, and investment expenditures. Evidence from a large sample of US manufacturing industries shows that greater uncertainty about profits significantly lowers net entry as well as investment. The negative effects are most pronounced in industries that are dominated by small firms and have high sunk costs. We note some implications for policy related to antitrust, employment and economic stabilization.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

This paper presents empirical evidence on the effects of uncertainty and sunk costs on firms’ decisions related to entry and exit, and investment. The theoretical background is spelled out in the real-options models highlighted in Dixit (1989), Dixit and Pindyck (1994) and numerous contributions since then. Theory shows that the presence of uncertainty and sunk costs imply an option value of waiting and are likely to be important determinants of firms’ entry, exit and investment decisions. While the theory is well developed, empirical evaluation of these models, particularly in the context of entry and exit, is somewhat limited.

A second channel that may affect outcomes relates to potential financial market frictions (Greenwald and Stiglitz, 1990; Williamson, 1988). This literature suggests that the presence of uncertainty and sunk costs may exacerbate financing constraints, which in turn may affect entry and exit decisions as well as firms’ investment decisions.

The empirical industrial organization literature has established several stylized facts about firms’ entry and exit dynamics: (a) the typical entering (exiting) firm is small compared to incumbents; (b) incumbent larger firms are older with higher survival probabilities; and (c) there is significant turnover of firms even in mature industries (Caves, 1998; Sutton, 1997). Given these findings, it is important to identify the forces that drive intertemporal dynamics of industry structure. While the role played by technology has been extensively researched in the literature (Caves, 1998; Sutton, 1997), other key forces identified in theory, such as uncertainty, have been somewhat neglected in the empirical literature.

In contrast, the empirical literature on examining firms’ investment decisions under uncertainty is relatively more developed: see, for example, Lensink et al. (2001), Carruth et al. (2001) and Ghosal and Loungani (1996, 2000). This literature shows that greater uncertainty tends to reduce investment, therefore supporting the theoretical predictions in general.

The evidence I present on the impact of uncertainty and sunk costs is based on a large sample of US SIC 4-digit manufacturing industries over 1958–92. The empirical evidence I present shows that: (1) periods of greater uncertainty, especially in conjunction with higher sunk costs, results in a reduction of the number of small establishments and firms, and marginally higher industry concentration; and (2) lower investment, particularly in industries that have a greater fraction of small businesses. On average, large establishments appear virtually unaffected.

The paper is organized as follows. In Sect. 2 I briefly discuss the underlying models related to option-value and financing-constraints. Evidence on the entry and exit patterns, and the volatility of firms is presented in Sect. 3. Section 4 highlights some evidence on the impact of uncertainty on investment. Section 5 concludes with some implications for public policy.

Role of Uncertainty and Sunk Costs

In this section I summarize specific aspects of two distinct literatures that provide us with a framework for examining firms’ entry and exit and investment decisions under uncertainty. Since there are numerous reviews of this literature, my discussion below is very brief. Carruth et al. (2001), Ghosal (2007), Ghosal and Loungani (2006, 2007), Lensink et al. (2001), for example, present summaries of different aspects of this literature.

Real-Options Literature

In the real-options literature, Dixit (1989) provides a broad framework to study time-series variations in entry, exit and the number of firms.Footnote 1 Dixit shows that uncertainty and sunk costs imply an option value of waiting for information and this increases (decreases) the entry (exit) trigger price. During periods of greater uncertainty, entry is delayed as firms require a premium over the conventional Marshallian entry price, and exit is delayed as incumbents know they have to re-incur sunk costs upon re-entry.Footnote 2

Our industry level data only contains information on the total number of firms and establishments. I do not have data on gross industry entry and exit flows (these data are not generally available over the long time period I conduct some of the analysis). Therefore, for our empirical analysis, we would like to know whether, during periods of greater uncertainty, the entry trigger price is affected more or less than the exit trigger? The numerical simulations in Dixit and Pindyck (Chaps. 7 and 8) show that increase in uncertainty given sunk costs results in the entry trigger price increasing by more than the decrease in the exit trigger price. Therefore, greater uncertainty results in negative net entry and an industry is expected to show a decrease in the number of firms.Footnote 3 The results in Dixit (1989) and the numerical simulations in Dixit and Pindyck (1994) also show that the effect is conditioned on the level of sunk costs. The greater are the sunk costs, the greater is the effect of uncertainty.

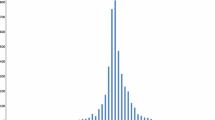

Following the above insights provided by theory, I present empirical evidence on the impact of uncertainty and sunk costs on net entry, firm volatility and investment. There is an important data feature that needs to be grappled with. As is well known, the within-industry firm size distribution is typically highly skewed. Our data displayed in Fig. 9.1 reveals this to be the typical characteristic. Previous studies show that (a) entrants are typically small compared to incumbents and have high failure rates, (b) typical exiting firm is small and young, and (c) larger firms are older with higher survival rates.Footnote 4 The implications of size distribution can be summarized as follows. Entry cohorts typically consist of relatively small firms, and exit cohorts of young and small firms. Based on the results discussed earlier, periods of greater uncertainty will delay entry more than exit, resulting in negative net entry. In other words, we can expect a decrease in the number of smaller firms. Further, based on the previous discussion, this effect will be larger when sunk costs are higher. Larger firms are more likely to show greater inaction regarding exit. Since data shows that entrants are rather small, entry of large firms is typically not an important consideration. Overall, we expect greater inaction in large firm net entry (little/no entry and lower exits) during periods of greater uncertainty.

Regarding firms’ investment outlays, in general we expect investment to decrease with greater uncertainty (Dixit and Pindyck, 1994). This negative effect is expected to be more pronounced when sunk capital costs are higher and for smaller businesses. Lensink et al. (2001), Leahy and Whited (1996), Ghosal and Loungani (1996, 2000) and Carruth et al. (2001) present extensive discussion of various aspects of the uncertainty-investment relationship.

Establishments by size, 1982. The figure represent the establishment size distribution for the typical SIC 4-digit industry (i.e., the average across the industries SIC 4-digit industries in our sample) for the Census year 1982. The establishment size groups correspond to the following number of employees (in parentheses). G1 (1–4); G2 (5–9); G3 (10–19); G4 (20–49); G5 (50–99); G6 (100–249); G7 (250–499); G8 (500–999); G9 (1,000–2,499); and G10 (2,500 or more). The vertical axis indicates the share of the number of establishments for that group in the industry total. Our data contain similar information for the other Census years (1963, 1967, 1972, 1977, 1987, 1992) in our sample and skewed size distribution pattern displayed above is observed for the other Census years (see Ghosal (2007) for additional discussion)

Financing Constraints Literature

Greenwald and Stiglitz (1990) model firms as maximizing expected equity minus expected cost of bankruptcy and examine scenarios where firms may be equity or borrowing constrained. A key result is that greater uncertainty about profits exacerbates information asymmetries, tightens financing constraints and lowers capital outlays. Since uncertainty increases the risk of bankruptcy, firms cannot issue equity to absorb the risk. Brito and Mello (1995) extend the Greenwald-Stiglitz framework to show that small firm survival is adversely affected by financing constraints. Second, higher sunk costs imply that lenders will be more hesitant to provide financing because asset specificity lowers resale value implying that collateral has less value (Williamson, 1988). Lensink et al. (2001) provide a lucid discussion of financing constraints in the related context of investment behavior. In short, periods of greater uncertainty, in conjunction with higher sunk costs, increase the likelihood of bankruptcy and exacerbate financing constraints. Incumbents who are more dependent on borrowing and adversely affected by tighter credit are likely to have lower probability of survival and expedited exits. Firms more likely to be adversely affected are those with little/no collateral, inadequate history and shaky past performance. Similarly, entry is likely to be retarded for potential entrants who are more adversely affected by the tighter credit conditions. Thus, periods of greater uncertainty, and in conjunction with higher sunk costs, are likely to accelerate exits and retard entry; i.e., negative net entry.

There exists an important literature which suggests that financial market frictions are more likely to affect smaller firms. These include Cabral and Mata (2003), Cooley and Quadrini (2001), Evans and Jovanovic (1989), Fazzari et al. (1988) and Gertler and Gilchrist (1994). Overall, for smaller firms, periods of greater uncertainty are likely to increase exits and lower entry, and the industry will experience loss of smaller firms, or negative net entry. This effect will be magnified in high sunk cost industries.

The effect on investment will be similar: smaller firms, via the financing constraints channel, are more likely to see a reduction in their investment outlays during periods of greater uncertainty.

Real-Options Versus Financing Constraints

As noted above, both the real-options and the financing constraints channels indicate similar qualitative effects of uncertainty on firms entry and exit, and investment, decisions. That is, a reduction in the industry number of firms or a reduction in investment during periods of greater uncertainty is consistent with both the channels described above. Unfortunately, with industry-level data, it appears rather difficult to disentangle the two channels. Access to firm-specific data, and using good proxies for sunk capital costs and potential financing constraints, may help us assess the relative importance of these two channels. This is left for a future research.

Uncertainty and the Dynamics of Net Entry

In this section I present evidence on: (1) cross-industry volatility of establishments; and (2) the within-industry intertemporal dynamics of the number of establishments. The data appendix provides information about the sources of data.

Data reveals wide differences across industries in the degree of volatility of firms and establishments. Caves (1998) and Sutton (1997), for example, document this and dwell on the underlying determinants. They mainly point to technological forces as the key driver of this volatility. Based on our discussion in Sect. 2 of the effects of uncertainty on firms’ entry and exit decisions, I present some evidence on the extent to which uncertainty might be an important determinant of the volatility of firms and establishments.

As noted in the data appendix, our data contain information on the number of firms and the number of establishments in an industry. To provide a perspective on the number of establishments relative to the number of firms, for each industry I calculate the ratio: the number of establishments divided by the number of firms. Across our sample of industries, the median value of this ratio is 1.1, and the 75th and 90th percentile values are 1.3 and 1.6. Therefore, even at the 90th percentile value of this distribution, there is a rough equivalence between firm and establishment. The underlying data shows that small businesses are overwhelmingly single-establishment, medium sized businesses tend to be largely single-establishment or a very small number of establishments, and large firms typically tend to be multi-establishment. Therefore, the vast majority of multi-establishment firms are the larger firms. I utilize this observation to study the effect of uncertainty on small and large business dominated industries, where the size metric is the number of employees per establishment. While we have data on the within-industry size distribution of firms, the Census of Manufactures does not provide data on the within-industry size distribution of firms.

To examine the determinants of the volatility of the number of establishments,I estimate the following equation:

where “i” indexes industry, ln denotes natural logarithm, σ(ESTB) is the standard deviation of the number of establishments, σ(π) measures profit uncertainty, Φ is a measure of sunk capital costs (see data appendix for construction), R&D is the research and development intensity as a proxy for technology, ADVT is advertising-intensity, GRS is industry growth and υ the random error term. The latter three variables are some of the standard control variables (see Ghosal (2006) for a more detailed discussion)

Industry profits are measured by: π = [(Sales Revenue-Variable Costs)/(Sales Revenue)]. To measure uncertainty, I use an industry profit forecasting equation. The residuals from this equation contain the unpredictable component of profits. The variance of the residuals measure uncertainty. This basic procedure is common in the literature: see Lensink et al. (2001), Carruth et al. (2001), Ghosal and Loungani (1996, 2000) and Ghosal (2006, 2007) and the references there. The profit forecasting equation can take many incarnations: see, for example, Ghosal (2006), Ghosal and Loungani (2000) and Lensink et al. (2001). The forecasting equation that I present here to provide a flavor of the results is:

where UNEMP is economy-wide unemployment rate designed to control for macroeconomic conditions. Using this, I obtain the measure of profit uncertainty σ(π)i.

The profit uncertainty variable σ(π) may be endogenous in (1) due to the linkages between market structure and movements in prices. Given this, I estimate (1) using OLS as well as Instrumental Variables methods and conduct Hausman tests. For IV estimation, the main instrumental variable used is industry-specific energy prices.

The results from estimating (1) are presented in Table 9.1. The estimates of σ(π)i are negative and highly significant. The results for the sunk cost measure Φ(W) indicate the same pattern. Given the standard errors, the Φ(W) effect is somewhat smaller than the σ(π) effect. Overall, higher profit uncertainty leads to lower endemic volatility of the number of establishments in an industry. This points to lower net entry and churning in industries that have structurally greater uncertainty – which is in our analysis is measured as the unforecastable component of industry profits. Given that the estimated (1) is log-linear (non-linear in levels), the estimates show that a combination of uncertainty and sunk costs exacerbate the effects. The implied quantitative effects are large and economically meaningful.

Next, I examine the within-industry intertemporal dynamics of the total number of establishments.

The measure of profits and the equation to measure industry-specific profit uncertainty is the same as in (2). The procedure of constructing a within-industry time-series in uncertainty is quite different. The steps are as follows. First, for each industry in the sample, I first estimate (2) using annual data over the entire sample period 1958–1994. The residuals represent the unsystematic components. Second, the standard deviation of residuals, σ(Π)i,t, are the measure of uncertainty. The industry structure data are for the five-yearly Censuses 1963, 1967, 1972, 1977, 1982, 1987 and 1992. The standard deviation of residuals over, e.g., 1967–1971 serves as the uncertainty measure for 1972; similarly, the standard deviation of residuals over 1982–1986 measures uncertainty for 1987, and so on. Using this procedure I get seven time-series observations on σ(Π)i,t. The within-year cross-industry statistics for σ(Π) shows a relatively high standard deviation compared to the mean value indicating large cross-industry variation in uncertainty. Key to our empirical analysis, the data show significant variation in uncertainty within-industries over time. More details on these measures and summary statistics can be found in Ghosal (2007).

The dynamic panel data model estimated is given by:

where ESTB is the number of establishments in an industry in a Census year “t”, σ(Π) is profit uncertainty constructed as noted earlier, TECH is a measure of technical progress proxies by industry-specific total factor productivity growth,Footnote 5 Π is the level of industry profits, GROW is industry sales growth, and AESTB is the total number of establishments in all of U.S. manufacruting designed to capture aggregated macroeconomic (in this case, manufacturing-wide) effects. The variables ESTB, σ(Π), Π, GROW and AESTB are measured in logarithms; these coefficients are therefore interpreted as elasticities. TECH (total factor productivity) is not measured in logarithms as it can be negative or positive. Ghosal (2007) contains detailed description of the construction of the variables and the justification for these controls.

Since the dynamic panel data model contains a lagged dependent variable, it needs to be instrumented. In addition, the industry variables related to σ(Π), GROW and TECH are all likely to be endogenous, jointly-determined in industry equilibrium. Lagged values of the respective variables, as well as AESTB, are used as instruments. I also use variables constructed at the durable and non-durable levels of aggregation as instruments. Ghosal (2007) provides justification of these instruments.

Table 9.2 presents the estimates. In the discussion of the results, I only focus on the uncertainty related effects. The Hausman test statistics show that theindustry-specific explanatory variables are best treated as jointly-determined. The estimated coefficients on the uncertainty variable shows that greater uncertainty reduces the number of establishments in the industry, and, based on the estimates across the establishment size sub-samples, all of the negative effect is arising from the industries where there is a preponderance of small businesses. The greater is the small establishment dominance, for example moving from sample Size < 500 to Size < 50, the greater is the negative effect of uncertainty. Note that the uncertainty variable is measured in logarithms, so the estimated coefficients are interprerted as elasticities. In industries that are dominated by large establishments (sample: Size ≥ 500), uncertainty has no impact on the number of establishments.

In Sect. 2 it was noted that greater sunk capital costs would exacerbate the effects of uncertainty. Table 9.3 presents estimates of the effect of uncertainty on the number of establishments by size groups as well as by high versus low sunk cost sub-samples. If we look at the estimates in row 1 (Size: All), we see that the negative effect of uncertainty is arising only in the high sunk-cost industries. None of the estimates of uncertainty are significant in column A. This implies that irrespective of establishment size, greater uncertainty has no effect in industry sub-samples where sunk costs are low. In contrast, as we look down the estimates in column B, we see that uncertainty has no effect on large establishments (Size > 500) even when sunk costs are high. As we examine the estimates for the smaller size groups, we find that the estimated elasticities get much larger. Given the estimated standard errors, the differences between the Size < 500 and Size < 50 is highly significant and the point estimate for the elasticity is almost double.

Overall, the estimates from Tables 9.2 and 9.3 reveal that greater uncertainty results in negative net entry and the vast majority of this effect is concentrated in the relatively small establishments. Large establishments are unaffected.

Uncertainty and Investment Expenditures

The final set of results we examine relate to the effect of uncertainty on investment. As noted earlier, there is a relatively large empirical literature that shows that greater uncertainty tends to reduce investment. While I present estimates for the overall effect, the main focus here is to note the results that reveal the role played by establishment (firm) size in the relationship between uncertainty and investment. The estimated investment equation is given by:

where σ(Π) measures uncertainty, (I/K) is current investment divided by begining of year capital stock, (CF/K) is current year cashflow divided by begining of year capital stock, and AINV is economy-wide aggregate investment. All variables are measured in logarithms. For more details about such estimated investment equations, see Chirinko (1993), Chirinko and Schaller (1995), Ghosal and Loungani (2000) and the references there.

Since the above investment equation is estimated using annual data on all the variables, the following procedure is used for measuring profit uncertainty σ(Π). First, for each industry, a profit forecasting equation is estimated over the entire sample period. The residuals contain the unsystematic (or unforecastable) components. Second, collect the residuals over five-year overlapping periods (1960–1964, 1961–1965, 1962–1966, …) and the standard deviation of the residuals over the 5-year periods are the measure of uncertainty σ(Π). For example, the standard deviation of residuals over 1960–1964 serve as the observation on uncertainty for the year 1965. This procedure provides an industry-specific time-series on σ(Π). Alternative forecasting equations are used to obtain σ(Π). A general specification is (2) given earlier. An alternate specification is a more basic autoregressive-distributed lag specification where industry profits Π are regressed on their own lags as well as current and lagged values of the economy-wide unemployment rate. As before, σ(Π) is treated as endogenous. The two instruments used are energy prices and the Federal Funds Rate. The link between both of these variables and economic activity, prices and profitability are well documented.

Next, the following information is used to classify industries into small and large business dominated groups. Using the US Small Business Administration classification (see data appendix, and Ghosal and Loungani, 2000), the industries are segmented into two groups: (a) SMALL and (b) OTHER (i.e., not small). The SMALL sub-sample is further refined using the Census establishment size distribution data. As an illustration, the size metric of “100 workers” is used to represent a small firm (this is in contrast to the SBA size metric of 500 workers). The sub-sample “SMALL and Size(100)” is created consisting of industries that are SMALL and also satisfy the constraint that the percentage of establishments with more than 100 employees is “greater than or equal to” 0.9037 (50th percentile value).

Table 9.4 presents the estimates. Since the equation is estimated in logarithms, the coefficient estimates are interpreted as elasticities. For the full sample (col. A), periods of greater uncertainty about profits leads to a decrease in investment. Across columns B, C and D, the main conclusion is that the negative impact of uncertainty on investment is the greatest for the “SBA SMALL and Size(100)” sub-sample. Given the standard errors, the effect on the smallest size group is statistically significant compared to the “SBA SMALL” group. The key findings, therefore, are that the sign of the investment-uncertainty relationship is negative, and the quantitative negative impact is substantially greater in the small firm dominated industries. Ghosal and Loungani (2000) present additional results with alternative measures of profit uncertainty and further refinements of the size classification; the key inferences remain intact.

Discussion and Some Implications for Public Policy

The evidence presented here indicates that greater uncertainty about profits appears to significantly lower net entry as well as investment. The effects are most pronounced in industries that are dominated by small firms and have high sunk costs. Some complementary evidence on the effect of uncertainty on industry structure is provided by Ghosal (1995, 1996). The empirical results in these two papers show that industries with greater uncertainty have significantly lower number of firms and greater output concentration (as measured by the industry four-firm concentration ratio). The quantitative effect on the number of firms is greater than the effect on industry concentration. Taken together, these results seem to indicate indicate that greater uncertainty creates a barrier-to-entry leading to less smaller firms and a more concentrated industry structure.

There is also an older literature that examined firms’ input choices under uncertainty: for example, Hartman (1976) and Holthausen (1976). These theoretical papers, however, do not model the real-options or financing constraints channels. These papers rely on firms’ risk-preferences (often risk-aversion) and technology to derive the impact of demand uncertainty on the capital-labor input mix. Empirical evaluation of these models by Ghosal (1991, 1995) shows that greater uncertainty about demand tends to increase firms’ capital-labor ratio. Both the theoretical models as well as the empirical results on the input-mix are probably best viewed as firms’ longer-run response to greater uncertainty. In contrast, the more recent theoretical models that explore the real-options channel, and the empirical evidence presented in this paper, are to be viewed as firms’ short-run response to greater uncertainty.

The “big-picture” inferences from the evidence presented here on the impact of uncertainty and sunk costs on net entry and investment outlays are broadly consistent with a number of other studies, including Bloom et al. (2008), Chirinko and Schaller (2008) and Driver and Whelan (2001). Estimates in Chirinko and Schaller, for example, provide evidence that the irreversibility premium is both economically and statistically significant. Bloom, Bond and van Reenen show that uncertainty increases real option values making firms more cautious when investing or disinvesting, and that the cautionary effects of uncertainty are large. They conclude that the responsiveness of firms to any given policy stimulus may be much weaker in periods of high uncertainty.

Our findings could be useful in several areas. First, they may provide guidance for antitrust. Analysis of entry is an integral part of antitrust and competition law enforcement guidelines. Sunk costs are typically explicitly considered as a barrier to entry, but uncertainty is typically not considered at all or de-emphasized. Our results suggest that uncertainty compounds the sunk cost barriers, retards entry and lowers the survival probability of smaller incumbents. Therefore, uncertainty could be an added consideration in the forces governing market structure. Second, determinants of M&A activity is an important area of research; see Jovanovic and Rousseau (2001) and the references there. If periods of greater uncertainty lowers the probability of survival and increases exits, it may have implications for reallocation of capital. For example, do the assets exit the industry or are they reallocated via M&A? It may be also be useful to explore whether uncertainty helps explain part of M&A waves. Third, Davis et al. (1996) find that job destruction/creation decline with firm size/age. Cooley and Quadrini (2001) and Cabral and Mata (2003) suggest that small firms may have greater destruction (exits) due to financial frictions. Our results provide additional insights: periods of greater uncertainty, in combination with higher sunk costs, appear to significantly influence small firm turnover.

Data Appendix

Complete details about the data used can be found in Ghosal and Loungani (1996, 2000) and Ghosal (2006, 2007). I provide a brief description below of the sources and variables. The data are for the US manufacturing sector and at the SIC 4-digit level of disaggregation. The source of the industry time-series data are the Annual Survey of Manufactures (“NBER-CES Manufacturing Industry Database,” by Eric Bartelsman, Randy Becker and Wayne Gray, and available at www.nber.org). These data are on a wide range of industry-specific variables related to costs, inputs (materials, energy) used, price deflators, investment, capital stock, sales, wages, among others. I collected industry-specific data from the 5-year Census of Manufactures on: (a) number of firms; (b) number of establishments; (c) size distribution of establishments (d) four-firm concentration ratio; (e) intensity of used capital; (f) intensity of rental capital; (g) percent depreciation of capital. We also have industry-specific data from the US Small Business Administration reports (The State of Small Business: A Report of the President, 1990.) The Small Business Administration classifies a small business as one that employs 500 workers or less. An industry is classified as “consistently small business dominated” if at least 60% of industry employment is in firms with fewer than 500 employees over 1979, 1983 and 1988.

Abstracting from depreciation considerations, sunk capital costs correspond to the non-recoverable component of entry capital investment \(\Phi = (\mathrm{r} - \varphi )\mathrm{K}\), where K is the entry capital requirement, r the unit price of new capital and φ the resale price (or scrap value) of this capital. Obtaining data on φ is extremely difficult implying that we can’t measure Φ directly for our industries. Instead, we pursue an alternative approach to measuring sunk costs. We adopt the methodologies outlined in Kessides (1990) and Sutton (1991) to obtain proxies for sunk capital costs. The extent of sunk capital outlays incurred by a potential entrant will be determined by the durability, specificity and mobility of capital. While these characteristics are unobservable, one can construct proxies. Following Kessides we construct the following three measures. Let RENT denote the fraction of total capital that a firm (entrant) can rent: RENT = (rental payments on plant and equipment/capital stock). If a potential entrant can lease capital, then sunk costs are correspondingly lower. Let USED denote the fraction of total capital expenditures corresponding to used capital goods: USED = (expenditures on used plant and equipment/total expenditures on new and used plant and equipment). Availability of used capital goods at lower prices reduces the embedded sunk costs. Finally, let DEPR denote the share of depreciation payments: DEPR = (depreciation payments/capital stock). Higher depreciation makes capital less sunk; in the limiting scenario if capital lives only for one period, then sunk costs, which arise from the non-depreciated component of capital, are negligible. We create the following three measures: Φ(RENT) = (1/RENT); Φ(USED) = (1/USED); and Φ(DEPR) = (1/DEPR). High Φ(RENT) indicates low-intensity rental market, implying higher sunk costs. High Φ(USED) signals low-intensity used capital market, implying higher sunk costs. High Φ(DEPR) indicates that capital decays slowly, implying higher sunk costs which arise from the undepreciated portion of capital. We collected data to construct Φ(RENT), Φ(USED), Φ(DEPR) and Φ(EK) for the Census years 1972, 1982 and 1992. Collecting these for some of the additional (particularly, earlier) years presented problems due to changing industry definitions and many missing data points. Our data revealed fairly high correlation (between 0.6 and 0.9) for the sunk cost proxies across the different years, indicating a fair degree of stability in these measures.

Notes

- 1.

Pakes and Ericson (1998), Hopenhayn (1992), among others, study firm dynamics under firm-specific uncertainty and evaluate models of firm dynamics under active v. passive learning. These class of models can be better subjected to empirical evaluation using micro-datasets. Since our data is at the industry level, we are not in a position to evaluate the predictions of these models.

- 2.

Caballero and Pindyck (1996) examine the intertemporal path of a competitive industry where negative demand shocks decrease price along existing supply curve, but positive shocks may induce entry/expansion by incumbents, shifting the supply curve to the right and dampening price increase. Their evidence from a sample of U.S. manufacturing industries shows that sunk costs and industry-wide uncertainty cause the entry (investment) trigger to exceed the cost of capital.

- 3.

The above models assume perfect competition. Models of oligopolistic competition (e.g. Dixit and Pindyck, p. 309–315) highlight the dependence of outcomes on model assumptions and difficulties of arriving at clear predictions. As in models of perfect competition, the entry price exceeds the Marshallian trigger due to uncertainty and sunk costs, preserving the option value of waiting. But, for example, under simultaneous decision making, neither firm may wants to wait for fear of being preempted by its rival and losing leadership. This could lead to faster, simultaneous, entry than in the leader-follower sequential entry setting. Thus fear of pre-emption may necessitate a faster response and counteract the option value of waiting.

- 4.

In Audretsch (1995, p. 73–80), mean size of the entering firm is seven employees, varying from 4 to 15 across 2-digit industries. Audretsch (p. 159) finds 19% of exiting firms have been in the industry less than 2 years with mean size of 14 employees; for exiting firms of all ages, the mean size is 23. Dunne, Roberts and Samuelson (1988, p. 503) note that about 39% of firms exit from one Census to the next and entry cohort in each year accounts for about 16% of an industry’s output. While the number of entrants is large, their size is tiny relative to incumbents. Data indicate similar pattern for exiters.

- 5.

References

Audretsch D (1995) Innovation and industry evolution. Cambridge, MIT Press

Basu S (1996) Procyclical productivity: increasing returns or cyclical utilization? Q J Econ719–751

Bloom N, Bond S van Reenen J (2008) Uncertainty and investment dynamics. Rev Econ Stud 74(2):391–415

Brito P, Mello A (1995) Financial constraints and firm post-entry performance. Int J Ind Organiz 543–565

Caballero R, Pindyck R (1996) Investment, uncertainty and industry evolution. Int Econ Revlinebreak 641–662

Cabral L, Mata J (2003) On the evolution of the firm size distribution: facts and theory. Am Econ Rev 1075–1090

Carruth A, Dickerson A, Henley A (2001) What do we know about investment under uncertainty? J Econ Surv 14:119–154

Caves R (1998) Industrial organization and new findings on the turnover and mobility of firms.J Econ Lit 1947–1982

Chirinko R, Schaller H (1995) Why does liquidity matter in investment equations? J Money Credit Banking 27:527–548

Chirinko R (1993) Business fixed investment spending: modeling strategies, empirical results, and policy implications. J Econ Lit 31:1875–1911

Chirinko R, Schaller H (2008) The irreversibility premium. Chicago University of Illinois at Chicago

Cooley T, Quadrini V (2001) Financial markets and firm dynamics. Am Econ Rev 1286–1310

Davis S, Haltiwanger J, Schuh S (1996) Job creation and destruction. Cambridge, MIT Press

Dixit A (1989) Entry and exit decisions under uncertainty. J Polit Econ 620–38

Dixit A, Pindyck R (1994) Investment under uncertainty. Princeton, Princeton University Press

Driver C, Whelan B (2001) The effect of business risk on manufacturing investment. J Econ Behav Organiz 44:403–412

Dunne T, Roberts M, Samuelson L (1988) Patterns of entry and exit in US manufacturing industries. Rand J Econ 495–515

Evans D, Jovanovic B (1989) An estimated model of entrepreneurial choice under liquidity constraints. J Polit Econ 808–827

Fazzari S, Hubbard G, Petersen B (1988) Financing constraints and corporate investment. Brookings Pap Econ Act 141–195

Gertler M, Gilchrist S (1994) Monetary policy, business cycles, and the behavior of small manufacturing firms. Q J Econ 309–340

Ghosal V (1991) Demand uncertainty and the capital-labor ratio: evidence from the US manufacturing sector. Rev Econ Stat 73:157–161

Ghosal V (1995) Input choices under uncertainty. Econ Inq 142–158

Ghosal V (1995) Price uncertainty and output concentration. Rev Ind Organiz 10:749–767

Ghosal V (1996) Does uncertainty influence the number of firms in an industry? Econ Lett 30:229–37

Ghosal V, Loungani P (1996) Product market competition and the impact of price uncertainty on investment. J Ind Econ 217–228

Ghosal V, Loungani P (2000) The differential impact of uncertainty on investment in small and large businesses. Rev Econ Stat 338–343

Ghosal V (2006) Endemic volatility of firms and establishments. USA, Georgia Institute of Technology

Ghosal V (2007) Small is beautiful but size matters: the asymmetric impact of uncertainty and sunk costs on small and large businesses. USA, Georgia Institute of Technology

Greenwald B, Stiglitz J (1990) Macroeconomic models with equity and credit rationing. In:Hubbard, R Glenn (ed.) Asymmetric information, corporate finance, and investment. Chicago, University of Chicago Press, pp 15–42

Hartman R (1976) Factor demand with output price uncertainty. Am Econ Rev 66:675–681

Holthausen D (1976) Input choices under uncertain demand. Am Econ Rev 66:94–103

Hopenhayn H (1992) Entry, exit and firm dynamics in long run equilibrium. Econometrica1127–1150

Jovanovic B, Rousseau P (2001) Mergers and technological change. Mimeo, Chicago, University of Chicago

Kessides I (1990) Market concentration, contestability and sunk costs. Rev Econ Stat 614–622

Leahy J, Whited T (1996) The effect of uncertainty on investment: some stylized facts. J Money Credit Banking 28:64–83

Lensink R, Bo H, Sterken E (2001) Investment, capital market imperfections, and uncertainty. Edward Elgar, London

Pakes A, Ericson R (1998) Empirical implications of alternate models of firm dynamics. J Econ Theory 1–45

Stiglitz J, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 393–410

Sutton J (1991) Sunk costs and market structure. Cambridge, MIT Press

Sutton J (1997) Gibrat’s legacy. J Econ Lit 40–59

Williamson O (1988) Corporate finance and corporate governance. J Finance 567–591

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2010 Springer Physica-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Ghosal, V. (2010). The Effects of Uncertainty and Sunk Costs on Firms’ Decision-Making: Evidence from Net Entry, Industry Structure and Investment Dynamics. In: Calcagnini, G., Saltari, E. (eds) The Economics of Imperfect Markets. Contributions to Economics. Physica-Verlag HD. https://doi.org/10.1007/978-3-7908-2131-4_9

Download citation

DOI: https://doi.org/10.1007/978-3-7908-2131-4_9

Published:

Publisher Name: Physica-Verlag HD

Print ISBN: 978-3-7908-2130-7

Online ISBN: 978-3-7908-2131-4

eBook Packages: Business and EconomicsEconomics and Finance (R0)