Abstract

Governments worldwide have introduced various types of e-tax systems, as an important e-government agenda, to provide citizens and residents with a channel to lodge their tax claims at their convenience. An understanding of what constitutes taxpayer satisfaction with using e-tax systems is thus important for government agencies to further improve the quality of services delivered through these systems. However, to date limited research has been devoted to evaluate user satisfaction with e-tax systems. In this paper, we thus report on the development of a satisfaction construct which is rigorously evaluated using a three stage process. We find the emergence of several dimensions which require further investigation.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The proliferation of the Internet and Web 2.0-based technologies has encouraged government agencies worldwide to offer electronic government (e-government) initiatives [7]. These initiatives enable government agencies to disseminate important information and encourage the public to receive government services at their convenient time and location [18]. E-government initiatives can be of different types. However, Government-to-Citizen (G2C) initiatives have received considerable attention in the literature [26]. One interesting example of G2C initiative is e-tax systems [8]. According to Fu et al. [20], e-tax systems refer to the automation of all business processes and transactions relevant to taxation for improving the efficiency of lodging and collecting taxes.

Information Systems (IS) and e-government literature streams report studies on e-tax systems for developed and developing countries alike. Examples include those undertaken in such countries as Australia [4], Greece [18], India [22, 34], Japan [6], Malaysia [2, 16, 35], Nigeria [33], Philippines [8], and Taiwan [7]. The primary focus of these studies is however on the adoption and acceptance of e-tax systems, and relatively less attention has been given to post-implementation aspects. As a good proportion of citizens, particularly in the developed nations, are known to use e-tax systems for a considerable time, we thus argue that research attention needs to be shifted to the post-implementation issues of these systems. Given the fact that the use of e-tax systems is not mandated in most countries, user satisfaction with these systems in particular needs to be evaluated because the continuous use of IT systems is known to be largely influenced by the level of user satisfaction with those systems [13].

Some studies have been reported on user satisfaction with e-government in general [1, 32]. A few studies [21, 25] also exist that concern with e-tax user satisfaction. Despite the existence of these studies, it is important to undertake further studies in this area because perceptions of citizens towards e-government services differ among countries [22]. Such differences in perceptions are attributed to the variations in legislative issues, public access to government information, and public access to government services [43]. Moreover, technological awareness and readiness of a country and its citizens vary widely across countries. We further note the existence of a disagreement in the e-tax literature about the dimensions included to measure e-tax user satisfaction. This is because e-tax satisfaction has been evaluated from two different perspectives: tax officers and tax payers. Hence, several scholars have called for more research on e-tax systems [33]. In response, we have thus undertaken an exploratory study with an aim to develop a measurement scale for the Australian e-tax users’ (citizens) satisfaction by identifying its key dimensions. We acknowledge that in Australia a few studies have examined e-tax systems implementation success (e.g. [4, 5]) but they do not look at success from the taxpayer (user) satisfaction perspective. The aim of our research is addressed by developing a conceptual model which is then empirically evaluated using a rigorous three-stage process. We find the scale to be made of four integrated dimensions (information trustworthiness, e-tax usability, time related benefits, and accessibility) unlike others reported in the broader satisfaction literature. The implications of this finding are discussed and further explorations are recommended. Our paper makes a modest contribution to theory and practice. The integrated nature of most dimensions included in our e-tax satisfaction construct indicates the need for further exploration for the conceptual clarity of the dimensions of e-tax satisfaction. We believe the satisfaction construct would still encourage government agencies responsible for developing e-tax systems in Australia to further improve their online services by specifically focusing on the dimensions included in the construct.

2 E-tax System: An Introduction

2.1 Characteristics of E-tax Systems

Electronic taxation systems (e-tax) or online tax systems represent one type of electronic applications provided by government agencies. These systems are classified as revenue-collection applications and considered to be one of the most critical innovations offered by governments [11]. Therefore, in those countries in which paying taxes is mandatory, tax agencies have expressed interest in moving from manual, paper-based tax filing process to the use of IT applications [11]. The viewpoint regarding e-tax systems varies among researchers. For example, Fu et al. [20] introduce a broad definition of the electronic filing of personal income taxes as the automation of all business processes and transactions relevant to taxation to improve the efficiency of lodging and collecting taxes. In another study, Hu et al. [24] define an e-tax system as an online service that helps in improving service quality by reducing costs for taxpayers as well as enhancing the efficiency of the tax agency. According to Shao et al. [39], e-tax systems include such services as the provision of tax filing software, process of taxpayers’ e-filing, and tax related online consulting. These systems are designed to unify tax preparation, tax filing, and tax payment by providing enhanced tax service for businesses and government alike [24]. It appears that Fu et al. [20] has defined e-tax systems from the perspective of efficiency improvement. On the other hand, Hu et al. [24] define e-tax systems from the service quality perspective. Neither of these viewpoints acknowledges the distinction between online tax Web sites and e-tax software. In this paper, the term “e-tax systems” is used to refer to both tax Web sites and e-tax software.

2.2 Benefits of E-tax Systems

A number of benefits can be experienced by the users and tax authorities as a result of acceptance and use of e-tax systems by taxpayers. Yusuf [50] claims increased taxpayers’ compliance level and revenue generation of a country through wider adoption and use of e-tax systems. In addition, e-tax systems have the possibility to ease the process of tax filing for individuals, providing them with time saving and cost efficiency benefits [38]. These benefits can be achieved when e-tax systems are introduced to meet the expectation of individuals using these systems.

2.3 E-tax Systems in Australia

Australian Taxation office (ATO) E-tax is a government owned software developed to help lodging tax return. The software can be installed from ATO website. It is a stand alone application that can be installed and run in a desktop or a laptop computer. According to e-tax accountants’ website (etax.com.au), individuals’ using ATO E-tax are on their own with insufficient help and assistance to lodge their tax return. ATO E-tax might involve more than a hundred pages, which makes it a complex and difficult technology to use.

3 Related Background Literature

Literature on e-tax systems although limited but is gradually evolving. A review of the e-tax literature indicates the presence of three key themes that received much of the attention from the scholars. These include: e-tax adoption factor, usage of e-tax, and post-adoption issues of e-tax systems. For example, scholars like Connolly and Bannister [11] and Schaupp et al. [37] have looked at the adoption of e-tax systems. Likewise, Chu and Wu [9] have examined the factors contributing to usage of e-tax systems. Lai [28] and Lai and Choong [29] looked at the challenges faced by the taxpayers for using e-tax systems. Post-implementation impacts like benefits and satisfaction have also received some attention [36]. As this paper is concerned with satisfaction, a brief but critical analysis of satisfaction literature related to e-tax, e-government, and IS in general is provided in order to understand how various scholars have conceptualized ‘satisfaction’ construct in the IS and e-government literatures.

The notion of satisfaction is not new; however its application to e-government context represents a relatively new phenomenon. In general, satisfaction within e-government context is conceptualized by scholars in two broad ways. One group of scholars view satisfaction as an independent variable that has an effect on other human behaviors (e.g. sustained usage, word of mouth recommendation). Three key characteristics of e-government studies adopting this view include: (a) satisfaction is evaluated without focusing on a specific e-government application and/or service (e.g. e-tax and e-voting), (b) the primary focus is not on the assessment of various dimensions comprising satisfaction (e.g. [10, 47]), and (c) satisfaction is regarded as an independent factor that relates to either adoption or success of e-government initiatives (dependent factor) (e.g. [19]). According to these studies, only 3 to 4 indicators are used to operationalize the concept of “satisfaction”. The works of Colesce and Dobrica [10] and Wang and Liao [47] represent examples of this stream of literature. The primary focus of Colesce and Dobrica [10] is to evaluate the adoption of electronic government services, while that of Wang and Liao [47] is to assess the success of e-government systems. By drawing on IS adoption theories and 481 responses received from Romanian respondents, Colesce and Dobrica [10] evaluate citizens’ adoption of e-government services. While investigating adoption, they identify several factors (e.g. information quality and accuracy) that can be used to evaluate user satisfaction with online government services. Colesce and Dobrica [10] find correlations between the constructs identified to evaluate users’ adoption of e-government, whereas perceived ease of use, perceived usefulness, and perceived quality were found to affect user satisfaction. In another study, [47] identify different dimensions of user satisfaction. The dimensions are basically drawn from the IS success model proposed by DeLone and McLean [13]. According to Wang and Liao [47], user satisfaction can be measured indirectly through information quality, service quality, and system quality.

In contrast, another group of e-government scholars considers satisfaction as a dependent variable. According to them, factors from different theoretical backgrounds are used to develop satisfaction construct. Typical works representing this view of satisfaction include those of Abhichandani et al. [1], Verdegem and Hauttekeete [44] and Verdegem and Verleye [45]. Abhichandani et al. [1] have proposed the EGOVSAT framework to measure user satisfaction with online transportation systems as an example of e-government services. The framework includes five factors (utility, reliability, efficiency, customization, and flexibility) to affect user satisfaction. In their work, Verdegem and Hauttekeete [44] focus on quality of access and quality of service indicators to formulate a conceptual model for measuring user satisfaction with e-government services in general. Based on their quantitative analysis, the following indicators are considered significant measures of user satisfaction with electronic government services in general: reduced administrative burden, reliability, security, usability, content readability, ease of use, content quality, cost effective, privacy/personal information protection, transparency, courtesy, responsiveness, accessibility, flexibility, and personal contact. Yet in another study, Verdegem and Verleye [45] have developed a model to explain how satisfaction with e-government services in general is influenced by the actual use of e-government services. Their results indicate that nine indicators are considered to be significant in measuring the level of user satisfaction with regard to e-government services. Those indicators are: cost, awareness, security/privacy, content, usability, technical aspects, customer friendliness, availability, and infrastructure.

The viewpoint of the second group of e-government scholars is in line with scholars from other relevant disciplines. For example, in taxation information systems satisfaction research, the focus is on identifying a set of factors to measure satisfaction with e-tax systems. These factors are generally identified from system and service quality perspectives (e.g. [7, 21]). In Business-to-Consumer (B2C) e-business satisfaction literature, quality (e.g. [27, 30]) and security and convenience perspectives (e.g. [41, 51]) are used to frame the factors affecting satisfaction with e-business applications. Self-Service Technology (SST) satisfaction literature is popularly represented by the work of Meuter et al. [31] who used critical incident technique whereas customers told the experiences they have had with technology-based self-services. Based on those incidents, a set of self-service technology characteristics (in other words, factors) were identified that contributes towards making users satisfied. The literature on End-User Computing satisfaction is fundamentally influenced by the pioneering work of Doll and Torkzadeh [15]. They develop End-User Computing Satisfaction model to evaluate user satisfaction with IT applications within organizational contexts. Their model is based on non-Internet IS/IT applications; but still has received considerable recognition from the IS/IT scholars.

IS Success Model takes the lead in developing the constructs for satisfaction with IT applications and services. The model is developed by DeLone and Mclean [13]. The model includes “satisfaction” along with “use” as factors affecting IS success in organization. Both satisfaction and use can be measured indirectly through information quality, systems quality and service quality. The model has its influence on IT satisfaction research in which quality dimensions are widely used as a guide to develop satisfaction models. For example, Chen [7] and Gotoh [21] acknowledge that satisfaction is influenced by factors related to quality (e.g. system, services, information, preparation, process, and result).

4 Research Model

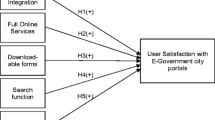

From a review of literature on satisfaction (from such areas as e-government, B2C e-commerce, SST and EUC), a total of 85 dimensions were identified that could potentially constitute taxpayer satisfaction with e-tax systems. It would be difficult to operationalize and empirically evaluate a model based on the inclusion of so many dimensions. As such, a two-phase filtering process was followed to shortlist these dimensions relevant for e-tax context. Phase 1 identifies the dimensions that have overlapping meanings. A total of 46 dimensions were identified after removing all redundant dimensions. Phase 2 identifies those dimensions that are supported in the literature from both the theoretical and empirical perspectives. By applying these criteria, the number of dimensions was further reduced from 46 to 15 (Fig. 1).

Appearance:

According to Kim and Stoel [27], appearance emphasizes how well a system guides its users and how easy it is to follow. They examine the effect of systems’ appearance and design on users’ perception of quality and satisfaction, and report that appearance is one of the most critical factors that influence user satisfaction with online systems. For e-tax context, we thus believe that appearance would influence taxpayer satisfaction with e-tax systems.

Ease of use:

It refers to the ability of users to operate electronic systems with minimal difficulties [7]. Ease of use is an important dimension in measuring user satisfaction in the context of End-User Computing [15], e-government services [32] and e-tax systems [7, 19, 25].

Interactivity:

It refers to “the extent to which the communicator and the audience respond to, or are willing to facilitate, each other communication needs” [23]. The definition can be conceptualized in terms of electronic services as the ability of electronic systems to intelligently respond to user needs. Interactivity has been found to be a significant factor to measure user satisfaction with online and electronic services. Interactivity is one of the significant dimensions that constitute Web customer satisfaction [30]. In the electronic services literature, interactivity is considered to be a significant dimension that can be used to measure taxpayer satisfaction with e-tax systems as well [7].

Accessibility:

It is defined as the ability to access the system at all times [30]. Web site accessibility is an important dimension of measuring user satisfaction with online services [49]. In terms of e-government satisfaction, Verdegem and Hauttekeete [44] use accessibility to measure citizens’ satisfaction with e-government services. In addition, accessibility was found to be related to taxpayer satisfaction with e-tax systems [7].

Content Quality:

For the context of e-tax satisfaction, it is defined as the adequacy and clarity of information provided by a system so that it meets users’ needs [32]. The content quality of information is considered to be an important indicator in measuring citizen satisfaction with e-government services [44]. For the context of e-tax satisfaction, content quality is a significant construct of taxpayer satisfaction with e-tax systems [7].

Usefulness:

It refers to the degree to which a user can believe that a system will enhance performance [12]. In terms of the recipients’ perspective, usefulness refers to the degree to which a person believes that using an e-tax Web site will enhance his or her efficiency and provide benefits. Devaraj et al. [14] examine the relationship between usefulness and satisfaction and find that it is a key determinant of user satisfaction with e-commerce.

Accuracy:

It is defined in terms of information as being free from errors [17]. Accuracy is one of the most significant factors that affect End-Users Computing Satisfaction [15]. In terms of measuring satisfaction with e-tax systems, accuracy is a vital dimension to measure taxpayer satisfaction [7].

Timeliness:

This indicates that a system can provide up-to-date information for a required task [42]. Timeliness has been widely used in satisfaction literature. In e-commerce literature, timeliness is found to positively affect user satisfaction [14]. In terms of e-tax satisfaction, Hwang [25] and Fu et al. [19] find that timeliness is significantly relevant to citizens’ satisfaction with e-tax systems.

Reliability:

It is the ability of a system to provide information and service dependably [48]. Service and system reliability have been proven to impact user satisfaction in the context of e-services. Reliability is an important antecedent of online service quality that affects user satisfaction with online services [49]. In the e-tax satisfaction literature, Chen [7] finds reliability to be an important factor to measure taxpayer satisfaction with e-tax systems.

Privacy:

It refers to users’ perception that their personal information is protected and is not disclosed to a third party [44]. Privacy is a very important determinant for citizens and should be used to measure satisfaction [44, 45].

Security:

It is defined as “freedom from risk or doubt during the service process” [51]. In e-services literature, security is found to be more important than the appearance of Web sites as well as information provided by these Web sites. Various satisfaction studies have considered security to be one significant factor affecting user satisfaction [41, 44].

Transaction Capability:

It refers to the extent to which a system can support its business functions [27]. Transaction capability can significantly affect online user satisfaction. This argument is supported by Kim and Stoel’s [27] findings, as they find that transaction capability is a significant factor that affects user satisfaction with e-retailing.

Convenience:

It refers to simplifying business processes by the adoption of information technology [41]. For the e-retailing context, online convenience is known to influence user satisfaction with online retailing services [30].

Responsiveness:

It refers the quality of services offered by employees who are willing to help electronic system users [7].

Empathy:

It refers to the ability of employees to pay attention to electronic system customers’ needs [7]. Responsiveness and empathy are significant constructs for satisfaction with e-services [14].

5 Research Approach

A qualitative approach involving two techniques was used to refine the model: expert panel evaluation of the conceptual model and a pilot evaluation of the survey instrument developed based on that model. This was followed by an exploratory survey. These are now briefly described below.

Domain panel evaluation:

A group of domain experts involving four academics (whose areas of research include e-government) and three senior tax agents working in professional tax agencies evaluated the model. A brief profile of these experts is shown in Table 1. The academics were chosen by reviewing their profiles appearing in the university websites. The tax agents were selected from the yellow pages. An email was sent inviting them to participate in our research project as a domain expert. The email contained an explanatory statement and a consent form. Upon receiving their consents (via email replies), a document outlining 15 satisfaction dimensions included in the model was sent to these experts. A short interview was later organized with each domain expert after one week of sending the evaluation document. During each interview, the domain expert was requested to: a) evaluate the importance of each dimension on a scale of 1 to 5, in which 1 means “extremely unimportant” and 5 means “extremely important”, and b) identify any new dimensions not mentioned in our document.

Pilot evaluation of the survey instrument:

To improve the clarity of the survey instrument drawn from the dimensions shortlisted through the expert panel evaluation process, feedback from several experienced e-tax users was obtained. Various sessional tutors from a large Melbourne-based university were contacted via email. They were invited to participate in our research project. Among those who agreed to participate, four tutors were chosen because they met the following criteria: (a) they have at least 3 years’ experience of using the e-tax system, (b) they have used the e-tax system within the past five years, and (c) they are interested in the findings of our research project. An email was sent to these tutors including a document for evaluating the survey instrument and its items. The document consists of three sections. In Section A, they were advised to evaluate each item based on its relevance to the dimension it is associated with on a scale of 1 to 5, where 1 means “strongly irrelevant”, 2 means “somewhat irrelevant”, 3 means “neutral”, 4 means “somewhat relevant”, and 5 means “strongly relevant”. In section B, they were required to provide any suggestions regarding any changes to these items (e.g. revision, deletion, addition). In section C, the survey instrument was attached for general comments about the layout and the design of the questionnaire.

Administration of Survey:

Participants involved at this stage of our research project include staff and students from a large Australian university. They were chosen randomly and survey questionnaires were distributed at such public places as campus centers, recreation facilities, and cafes where staff and students generally spend their free times on campuses. Participants were personally contacted to fill out the survey questionnaire. The purpose of our research was explained to the participants and the questionnaire was given to them. A total of 300 survey questionnaires were distributed among staff and students. However, only 162 responses were received. Of these, 100 (representing a response rate of 33 %) participants have acknowledged using the e-tax system. The survey data analysis was performed using SPSS. Those 62 non-e-tax users indicated the following four reasons for not using the e-tax system: (a) lack of time, (b) lack of confidence, and (c) availability of easily tax agents to prepare tax lodgment, among others.

6 Initial Analysis

Qualitative Evaluation of Domain Experts Feedback:

The responses given by the experts for each dimension are summarized in Table 2. Based on the feedback collected from the domain experts, the following observations were made and actions were undertaken.

First, all but one domain experts evaluated the dimensions. This expert, however, provided many useful insights about the relevance and redundancy of the dimensions included in our model. Despite this, there is a broad agreement among the experts regarding the importance of the dimensions. We however decided to remove ‘empathy (D15)’ as a dimension because it received an overall average score 3.8 out of 5.

Second, two domain experts distinguished between the Australian Taxation office (ATO) Web site and e-tax software downloaded from that Web site and argued that responsiveness (D14) is more relevant for measuring satisfaction with online queries and interactions between citizens and ATO staff. In contrast, as the e-tax software downloaded from the Web site does not allow online communication through “live chatting” with ATO employees, responsiveness (D14) is of little relevance in measuring taxpayer satisfaction with the e-tax system. Thus, we decided to exclude ‘responsiveness (D14)’ from our model.

Third, two domain experts considered content quality (D5), transaction capability (D12), and usefulness (D6) to have overlapping in their meanings and advised for combining them into a single dimension (usefulness). In addition, two other domain experts found security (D11) and privacy (D10) dimensions to be interrelated and recommended combining them into another single dimension (security and privacy). Based on these recommendations, we decided to merge content quality, transaction capability, and usefulness into one dimension (usefulness), while security (D11) and privacy (D10) dimensions are to be combined in one dimension (security and privacy).

Fourth, a number of issues regarding various e-tax aspects were suggested by the domain experts for consideration of possible inclusion in the research model. These include: Online help/support, Ease of download, List of items and transactions that are taxable or tax-deductable, Is the e-tax user friendly for the first time user, Is there any problem in lodging first tax return using e-tax?, Does it create any problem before lodgment?, Does it preserve data accurately?, and How efficient is the identification process? These suggestions were compared against the definitions of the existing dimensions already identified in this research. We find that each aspect can be addressed by the existing dimensions. Hence, no new dimensions are included in the model.

After making amendments, the revised taxpayer satisfaction construct now includes 10 dimensions: appearance, ease of use, interactivity, accessibility, usefulness, accuracy, timeliness, reliability, security & privacy, perceived convenience.

Pilot Evaluation:

An initial survey questionnaire consisting of 38 items was then developed from those ten dimensions shortlisted by the domain experts. The items were chosen from various scholarly sources and adapted for e-tax context. An operationalization of these dimensions is shown in Appendix A. As discussed earlier, a group of four experienced e-tax users evaluated the initial questionnaire. Based on their feedback, we note a broad agreement among these users about the relevance of these items. However, one item measuring ease of use dimension was removed as it received a median score of 3.5 out of 5 (See Appendix B).

The participating experienced e-tax users also provided insightful suggestions regarding removing items, rephrasing items, and improving the overall clarity of the survey questionnaire. Drawing on their suggestions, eleven items were identified for removal. Of these, five items were removed because they had exactly similar meanings to other items, two items were removed because they were considered to be vague and did not have specific meanings, and four items were removed because they did not actually measure the intended dimensions. Additional suggestions were offered to improve the clarity of the items. According to them, these items require rephrasing to improve clarity. Thus, further revisions were made and an improved version of the survey instrument was developed. The number of the items included in this refined instrument was reduced from 38 to 28 items which still measured those ten dimensions.

7 Findings and Discussion

The demographic characteristics of the survey participants who have used the e-tax system are summarized in Table 3. The following observations can be deduced: (a) a majority of e-tax users are male (70 %), (b) except users over 40 years, each age group is well-represented, (c) dominance of the participants with income in the range of A$35,001 – A$80,000 is observed, and very few participants (2 %) have income exceeding AU$180,000. This makes sense, as the context in which the survey was conducted represents a tertiary educational institution where the number of people from very high income group is very limited, and (d) a majority of the participants (62 %) have a postgraduate degree. This also makes sense for the tertiary educational institution.

An exploratory iterative factor analysis was performed on data collected from 100 e-tax users. Factor analysis is a well-known statistical method which is generally used to investigate to what extent a group of variables (items) are associated with their underlying factors. A total of 15 items loaded on four distinct single constructs (Table 2), indicating that only four dimensions constitute taxpayer satisfaction with e-tax systems. This factor solution was obtained after applying a multiple iterative process of factor analysis and item deletion. Items were deleted when either of the following conditions was met: (a) an item had a factor loading of less than 0.40, and (b) an item loaded on more than a single dimension. The retained four factors together account for 66.63 % of the variation in satisfaction. The Eigenvalues and the percentage variance explained by these factors are also shown in Table 2. This factor solution is also statistically significant. The Kaiser-Meyer-Olkin Measure of Sampling Adequacy and Bartlett’s Test of Sphericity were examined to evaluate the reliability of responses received from participants. The Kaiser-Meyer-Olkin Measure of Sampling Adequacy was found to be 0.821, and Bartlett’s Test of Sphericity was 0.000, which was significant at p < 0.001 (Table 4).

Drawing on the factor analysis, we now observe that only four dimensions appeared to be relevant for the e-tax system satisfaction context. We now review the meanings of these four dimensions. In our conceptual model (Fig. 1), ‘accuracy’ and ‘security and privacy’ were considered as two separate dimensions. However, the factor analysis demonstrated that these two dimensions could be grouped together into a single dimension (D1: Information trustworthiness). Likewise, ease of use and interactivity were found to be grouped into a single dimension and is called as ‘E-tax Usability” (D2). Another dimension (D3) grouped some of the items belonging to three such dimensions as usefulness, timeliness, and perceived convenience. This new dimension is now renamed as “Time Related Benefits” (D3). The last dimension (D4) represents a single dimension (i.e. accessibility) identified in our model. The reliability of each of these new dimensions is calculated (last row of Table 2) and is found to be satisfactory [23].

In our research model, ‘accuracy’ and ‘security and privacy’ were considered two separate dimensions. However, the factor analysis demonstrated that these two dimensions are to be grouped together into a single dimension (D1). In the e-tax literature, accuracy is considered as one antecedent of information quality [7]. Accuracy constitutes an important construct concerning data for measuring End-User Computing Satisfaction [15]. Thus, ‘security and privacy’ and ‘accuracy’ are clearly about the information received and sent via e-tax systems. In other words, together they measure how trustworthy is information. It is important that such systems as e-tax must provide sufficient security and privacy to users’ information (e.g. income sources) and maintain accuracy of income related information required to submit an application. The two factors together have thus be renamed as “Information trustworthiness”.

Ease of use and interactivity were found to be grouped into one dimension (D2). A possible justification for that is that ease of use and interactivity items are related to usability. Usability is defined as the individuals’ ability to interact with a website with no required training due to the ease of use [3]. Although usability is generally conceptualized as a multi-dimensional concept, It is reported that some studies about IS consider usability as one single dimension [46]. Ease of use and interactivity could thus be renamed as “E-tax usability”.

Another dimension (D3) is renamed as “Time Related Benefits” because it includes some of the items belonging to 3 dimensions: usefulness, timeliness, and perceived convenience. Upon close inspection, we find that these items have one common characteristic – which is receiving a benefit involving time. For example, one item is about flexibility of usage from time perspective, another item is about completion of a task on time, and yet another item is about auto closure of the application after certain time.

These findings bear the following observations. First, the integrated nature of dimensions discussed above for the e-tax systems context indicate the construct of user satisfaction is more complex than previously identified by the researchers. Second, e-tax systems involve dealing with income and expenses related data for which users expect the government to provide a secured platform that is capable of handling sensitive data. Satisfaction will suffer when users perceive an inability of the tax authorities to deliver such a secured platform. Third, no matter how secured an e-tax platform is delivered by the tax authorities, user satisfaction will decline when such a system is perceived to be unusable and unable to deliver benefits that relate to time (e.g. flexibility, on time completion of task, and auto closure after a certain time).

8 Conclusion

In this paper, we have reported the development of a scale for measuring taxpayer satisfaction with e-tax systems for the Australian context. Drawing on a three-stage process, our measurement scale is developed which eventually contains four dimensions. Three of these dimensions (e.g. Information trustworthiness, E-tax usability, and time related benefits) are however found to be integrated in nature which according to other scholars, exist as an independent dimension. This finding was not expected but they still raise an interesting question. Do these three dimensions really reflect a higher level aspects of satisfaction as we have discovered in this paper or are they artificially created due to the small sample used in this study (n = 100)? Further studies are thus required to answer this question. Nevertheless, our study is still useful to theory and practice.

For theory, developing a reliable instrument for measuring user satisfaction with e-tax systems represents a contribution to the IT/e-business literature. In particular, e-government researchers can adopt this instrument as a template to measure user satisfaction with other innovative online government service delivery systems for citizens. To practice, the government officials, responsible for promoting customer relations between government agencies and citizens, are advised to concentrate to those dimensions that can help design an improved version of e-tax systems. This could help in creating more satisfied taxpayers.

Finally, we caution about some of the limitations of our work reported in this paper. The survey response rate was relatively low (33 %) which constrains the generalizability of the research findings. One reason for the low responses rate is that many students were found to be non-users of e-tax systems. Hence, future research should involve a large sample involving staff and students from all campuses and faculties. In particular, it would be interesting to examine whether a large sample has any impact on the relationship between users’ demographic characteristics and their level of satisfaction. Another limitation is that this study was conducted for a tertiary educational institution context. Future studies should involve participants from a wide range of professions including doctors, accountants, IT specialists, businessmen, and employees from a wide variety of organizations. It would be interesting to find out how the relevance of satisfaction dimensions can change over time. Hence, longitudinal studies should be conducted to identify the importance of dimensions comprising satisfaction with e-tax systems. In this study, some of the dimensions were merged into a single integrated one (e.g. information trustworthiness). We however acknowledge that the rationale used in proposing such an integrated dimension is not without questions. Hence, the indicators used to operationalize these dimensions need further theoretical scrutiny and a large survey needs to be undertaken to empirically confirm the existence of such integrated dimensions.

References

Abhichandani, T., Horan, T.A., Rayalu, R.: EGOVSAT: Toward a robust measure of e-government service satisfaction in transportation. In: International Conference on Electronic Government, pp. 1–12, Ottawa (2005)

Azmi, A.A.C., Bee, N.L.: The acceptance of the e-filing system by Malaysian taxpayers: a simplified model. Electron. J. e-Gov. 8, 13–22 (2010)

Benbunan-Fich, R.: Using protocol analysis to evaluate the usability of a commercial web site. Inf. Manag. 39, 151–163 (2001)

Chamberlain J., Castleman, T.: Transaction with citizens: Australian government policy, strategy, and implementation of online tax lodgement. In: 11th European Conference on Information Systems, Naples, Italy (2003)

Chamberlain, J., Castleman, T.: Moving personal tax online: the Australian taxation office’s E-Tax initiative. Int. J. Cases Electron. Commer. 1, 54–70 (2005)

Chatfield, A.T.: Public service reform through e-government: a case study of ‘E-tax’ in Japan. Electron. J. E-Gov. 7, 135–146 (2009)

Chen, C.: Impact of quality antecedents on taxpayer satisfaction with online tax-filing systems- an empirical study. Inf. Manage. 47, 308–315 (2010)

Chen, J.V., Jubilado, R.J.M., Capistrano, E.P.S., Yen, D.C.: Factors affecting online tax filing–an application of the is success model and trust theory. Comput. Hum. Behav. 43, 251–262 (2015)

Chu, P.Y., Wu, T.Z.: Factors influencing tax-payer information usage behavior: test of an integrated model. In: PACIS 2004, Shanghai (2004)

Colesce, S.E., Dobrica, L.: Adoption and use of e-government services: the case of Romania. J. Appl. Res. Technol. 6, 204–217 (2008)

Connolly, R., Bannister, F.: eTax filing & service quality: the case of the revenue online service. Int. J. Soc. Behav. Educ. Econ. Bus. Ind. Eng. 2, 56–60 (2008)

Davis, G.B., Olson, M.H.: Management Information Systems: Conceptual Foundations, Structure, and Development. McGraw-Hill Inc, New York (1984)

DeLone, W.H., McLean, E.R.: The DeLone and McLean model of information systems success: a ten-year update. J. Manage. Inf. Syst. 19, 9–30 (2003)

Devaraj, S., Fan, M., Kohli, R.: Antecedents of B2C channel satisfaction and preference: validating e-commerce metrics. Inf. Syst. Res. 13, 316–333 (2002)

Doll, W.J., Torkzadeh, G.: The measurement of end user computing satisfaction. MIS Q. 12, 259–274 (1988)

Dorasamy, M., Marimuthu, M., Raman, M., Kaliannan, M.: E-Government services online: an exploratory study on tax E-filing in Malaysia. Int. J. Electron. Gov. Res. (IJEGR) 6, 12–24 (2010)

Fisher, C.W., Kingma, B.R.: Criticality of data quality as exemplified in two disasters. Inf. Manage. 39, 109–116 (2001)

Floropoulos, J., Spathis, C., Halvatzis, D., Tsipouridou, M.: Measuring the success of the Greek taxation information system. Int. J. Inf. Manage. 30, 47–56 (2010)

Fu, J.R., Chao, W.P., Farn, C.K.: Determinants of taxpayers’ adoption of electronic filing methods in Taiwan: an exploratory study. J. Gov. Inf. 30, 658–683 (2004)

Fu, J.R., Farn, C.K., Chao, W.P.: Acceptance of electronic tax filing: a study of taxpayer intentions. Inf. Manage. 43, 109–126 (2006)

Gotoh, R.: Critical factors increasing user satisfaction with e-government services. Electron. Gov. Int. J. 6, 252–264 (2009)

Gupta, G., Zaidi, S., Udo, G., Bagchi, K.: The effect of espoused culture on acceptance of online tax filing services in an emerging economy. Adv. Bus. Res. 6(1), 14–31 (2015)

Ha, L., James, E.L.: Interactivity reexamined: a baseline analysis of early business web sites. J. Broadcast. Electron. Media. 42, 457–474 (1998)

Hu, P.J.H., Brown, S.A., Thong, J.Y., Chan, F.K., Tam, K.Y.: Determinants of service quality and continuance intention of online services: the case of eTax. J. Am. Soc. Inf. Sci. Technol. 60, 292–306 (2009)

Hwang, C.S.: A comparative study of tax-filing methods: manual, internet, and two-dimensional bar code. J. Gov. Inf. 27, 113–127 (2000)

Jaeger, P.T.: The endless wire: e-government as global phenomenon. Gov. Inf. Q. 20, 323–331 (2003)

Kim, S., Stoel, L.: Apparel retailers: website quality dimensions and satisfaction. J. Retail. Consum. Serv. 11(2), 109–117 (2004)

Lai, M.L.: Electronic tax filing system: benefits and barriers to adoption of system. In: The Chartered Secretaries Malaysia, pp. 14–16 (2006)

Lai, M.L., Choong, K.F.: Motivators, barriers and concerns in adoption of electronic filing system: survey evidence from Malaysian professional accountants. Am. J. Appl. Sci. 7, 562–567 (2010)

McKinney, V., Yoon, K., Zahedi, F.M.: The measurement of web-customer satisfaction: an expectation and disconfirmation approach. Inf. Syst. Res. 13, 296–315 (2002)

Meuter, M.L., Bitner, M.J., Ostrom, A.L., Brown, S.W.: Choosing among alternative service delivery modes: an investigation of customer trial of self-service technologies. J. Mark. 69, 61–83 (2005)

Mohamed, N., Hussin, H., Hussein, R.: Measuring users’ satisfaction with Malaysia’s electronic government systems. Electron. J. e-Gov. 7, 283–294 (2009)

Musptapha, B.: Evaluation of E-tax quality implementation criteria: the case of self-employed taxpayers in Nigeria. IJCER 4, 39–45 (2015)

Ojha, A., Sahu, G.P., Gupta, M.P.: Antecedents of paperless income tax filing by young professionals in India: an exploratory study. Transforming Gov. People Process Policy 3, 65–90 (2009)

Ramayah, T., Ramoo, V., Ibrahim, A.: Profiling online and manual tax filers: results from an exploratory study in Penang, Malaysia. Labuan e-J. Muamalat Soc. 2, 1–8 (2008)

Saha, P.: Government E-service delivery identification of success factors from citizens’ perspective. Ph.D. thesis. University of Technology, Luleå (2009)

Schaupp, L.C., Carter, L., ME, M.: E-file adoption: a study of US taxpayers’ intentions. Comput. Hum. Behav. 26, 636–644 (2010)

Schaupp, L.C., Carter, L.: The impact of trust, risk and optimism bias on E-file adoption. Inf. Syst. Frontiers 12, 299–309 (2010)

Shao, B., Luo, X., Liao, Q.: Factors influencing E-tax filing adoption intention by business users in China” electronic government. Int. J. 11, 283–305 (2015)

Straub, D., Boudreau, M., Gefen, D.: Validation guidelines for IS positivist research. Commun. Assoc. Inf. Syst. 13, 380–427 (2004)

Szymanski, D.M., Hise, R.T.: E-satisfaction: an initial examination. J. Retail. 76, 309–322 (2000)

Tee, S.W., Bowen, P.L., Doyle, P., Rohde, F.H.: Factors influencing organizations to improve data quality in their information systems. Acc. Financ. 47, 335–355 (2007)

United Nations: From e-government to Connected Governance. Department of Economic and Social Affairs (2008). http://unpan3.un.org/egovkb/portals/egovkb/Documents/un/2008-Survey/unpan028607.pdf

Verdegem, P., Hauttekeete, L.: User centered e-government: measuring user satisfaction of online public services. In: IADIS International Conference e-Society (2007)

Verdegem, P., Verleye, G.: User-centered e-government in practice: a comprehensive model for measuring user satisfaction. Gov. Inf. Q. 26, 487–497 (2009)

Wang, J., Senecal, S.: Measuring perceived website usability. J. Internet Commer. 6, 97–112 (2007)

Wang, Y.S., Liao, Y.W.: Assessing e-government systems success: a validation of the DeLone and McLean model of information systems success. Gov. Inf. Q. 25, 717–733 (2008)

Wixon, B.H., Todd, P.A.: A theoretical integration of user satisfaction and technology acceptance. Inf. Syst. Res. 16, 85–102 (2005)

Yang, Z., Fang, X.: Online service quality dimensions and their relationships with satisfaction. Int. J. Serv. Ind. Manage. 15, 302–326 (2004)

Yusuf, S.M.: The influence of taxpayers consciousness, tax services and taxpayers compliance on tax revenue performance. (Survey on the Individual Taxpayer in South Tangerang). Undergraduate thesis, Syarif Hidayatullah State Islamic University Jakarta (2013)

Zhang, X., Prybutok, V., Huang, A.: An empirical study of factors affecting e-service satisfaction. Hum. Syst. Manage. 25, 279 (2006)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

A Appendix A List of Items Used to Operationalize the Dimensions

Dimensions | Items | Literature source |

|---|---|---|

Accessibility | The e-tax system is always accessible | [49] |

The e-tax system quickly loads all the contents | [30] | |

I can get all relevant information from the e-tax system in time | [7] | |

All the content of the e-tax system are accessible | Developed | |

Ease of use | It is easy for me to learn how to use the e-tax system | [7] |

It is easy for me to navigate through the e-tax system | [7] | |

The e-tax system is user-friendly | [15] | |

Using the e-tax system is easy for me | [14] | |

Accuracy | The e-tax system is an accurate source of information for me | [7] |

The information content is consistent with my previous experience | [7] | |

The content of the e-tax system helps me to understand the system | Developed | |

The e-tax system provides information that I can trust | Developed | |

The e-tax system is accurate | [15] | |

Interactivity | I believe that my interaction with the e-tax system does not require much attention | [7] |

The e-tax system has natural and predictable screen changes | [7] | |

My interaction with the e-tax system is clear and understandable | [7] | |

Reliability | The e-tax system meets all my needs | Developed |

Any problems resulting from using the e-tax system can be quickly solved | [7] | |

The e-tax system is credible | [30] | |

The e-tax system is trustworthy | [30] | |

Usefulness | Information on the e-tax system is informative | [30] |

I find the e-tax system to be quite useful | [14] | |

The e-tax system provides precise information I need | [15] | |

The content of the e-tax system is readable | Developed | |

The content of the e-tax system is understandable | Developed | |

The contents of the e-tax system provide sufficient information | [15] | |

Timeliness | The e-tax system provides me with up-to-date information. | [15] |

The e-tax system accomplishes tasks very quickly | [14] | |

When my account is logged off due to time-out, it does not bother me | Developed | |

Security and privacy | I feel that my personal information is safe | [44] |

I feel that lodging my tax application using the e-tax system is secure | Developed | |

ATO guarantees that my personal information will not be shared or disclosed | Developed | |

Transactions using the e-tax system are safe | [44] | |

Perceived convenience | I spend less time on lodging my taxes online than doing my taxes manually | [41] |

I can use the e-tax system whenever and wherever I am | [41] | |

Appearance | The e-tax system provides an easy-to-follow interface | [41] |

The e-tax system displays a visually pleasing design | [27] | |

The e-tax system is visually appealing | [27] |

B Appendix Item Evaluation by Experienced E-tax Users

Item code | Expert users | Median | Retained item? | |||

|---|---|---|---|---|---|---|

A | B | C | D | |||

A1 | 5 | 5 | 5 | 5 | 5 | Yes |

A2 | 4 | 4 | 3 | 5 | 4 | Yes |

A3 | 4 | 4 | 5 | 3 | 4 | Yes |

A4 | 5 | 4 | 5 | 5 | 5 | Yes |

EU1 | 5 | 2 | 5 | 5 | 5 | Yes |

EU2 | 5 | 5 | 5 | 5 | 5 | Yes |

EU3 | 4 | 5 | 5 | 5 | 5 | Yes |

EU4 | 4 | 3 | 5 | 1 | 3.5 | No |

AC1 | 5 | 3 | 5 | 4 | 4.5 | Yes |

AC2 | 4 | 4 | 5 | 3 | 4 | Yes |

AC3 | 3 | 4 | 5 | 4 | 4 | Yes |

AC4 | 5 | 5 | 5 | 5 | 5 | Yes |

AC5 | 5 | 3 | 5 | 5 | 5 | Yes |

I1 | 5 | 3 | 5 | 3 | 4 | Yes |

I2 | 4 | 4 | 5 | 1 | 4 | Yes |

I3 | 5 | 5 | 5 | 1 | 5 | Yes |

RE1 | 4 | 3 | 5 | 5 | 4.5 | Yes |

RE2 | 4 | 3 | 5 | 5 | 4.5 | Yes |

RE3 | 4 | 5 | 5 | 5 | 5 | Yes |

RE4 | 5 | 5 | 5 | 5 | 5 | Yes |

U1 | 5 | 5 | 5 | 4 | 5 | Yes |

U2 | 5 | 5 | 5 | 5 | 5 | Yes |

U3 | 3 | 5 | 5 | 5 | 5 | Yes |

U4 | 5 | 3 | 5 | 3 | 4 | Yes |

U5 | 4 | 5 | 5 | 3 | 4.5 | Yes |

U6 | 5 | 5 | 5 | 3 | 5 | Yes |

T1 | 5 | 5 | 5 | 5 | 5 | Yes |

T2 | 5 | 3 | 5 | 5 | 5 | Yes |

T3 | 5 | 5 | 5 | 5 | 5 | Yes |

SP1 | 5 | 5 | 5 | 5 | 5 | Yes |

SP2 | 5 | 5 | 5 | 5 | 5 | Yes |

SP3 | 5 | 5 | 5 | 5 | 5 | Yes |

SP4 | 5 | 5 | 3 | 4 | 4.5 | Yes |

PC1 | 5 | 5 | 5 | 5 | 5 | Yes |

PC2 | 5 | 5 | 5 | 5 | 5 | Yes |

AP1 | 4 | 5 | 5 | 5 | 5 | Yes |

AP2 | 5 | 3 | 5 | 1 | 4 | Yes |

AP3 | 5 | 3 | 5 | 5 | 5 | Yes |

W1 | 5 | 5 | 5 | 1 | 5 | Yes |

W2 | 5 | 5 | 5 | 5 | 5 | Yes |

CI1 | 5 | 5 | 5 | 3 | 5 | Yes |

CI2 | 5 | 5 | 5 | 5 | 5 | Yes |

Rights and permissions

Copyright information

© 2016 Springer-Verlag GmbH Germany

About this chapter

Cite this chapter

Alghamdi, A., Rahim, M. (2016). Development of a Measurement Scale for User Satisfaction with E-tax Systems in Australia. In: Hameurlain, A., et al. Transactions on Large-Scale Data- and Knowledge-Centered Systems XXVII. Lecture Notes in Computer Science(), vol 9860. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-53416-8_5

Download citation

DOI: https://doi.org/10.1007/978-3-662-53416-8_5

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-662-53415-1

Online ISBN: 978-3-662-53416-8

eBook Packages: Computer ScienceComputer Science (R0)