Abstract

This study, aiming to investigate the impact of research and development (Ramp;D) expenditures and the number of researchers involved on the exports of high and medium-high technology manufacturing industries using panel data analysis for countries with different levels of economic development for the period of 1996-2012, comprises three parts. In the first part, the theoretical and empirical literature on Ramp;D and exports is presented. In the second part, the impact of Ramp;D on exports is analyzed. Finally, empirical findings are interpreted. In two different models designed for empirical analysis, high and medium-high technology exports (HTEX) are selected as a dependent variable, and Ramp;D expenditures and the number of researchers (RP) are taken as a measure of technological capability. Panel co-integration parameter estimations show that Ramp;D expenditure elasticity of high-tech exports in developing countries is higher than that of developed ones. According to the results of the panel Vector Error Correction Model (VECM), while there is no short-run causality from Ramp;D and RP to HTEX, there is short-run causality from gross fixed capital formation (GFC) and foreign direct investment (FDI) to HTEX. In the light of these empirical findings which present some important policy implications for developing countries that experience a technological gap compared to developed nations, in order to realize high value-added and sustainable export performance, policies transforming the structure of production and exports from the low-tech towards the high-tech by way of supporting Ramp;D activities and scientific and technological infrastructure are strongly recommended.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

1 Introduction

This study is derived from the PhD thesis titled “Dynamics of technological progress and the structure of exports: A panel data analysis” prepared by the second author under the supervision of the first author.

National economic performance is closely connected more than anything else to the ability to develop and use technology in the global economy where competition and the speed of technological change are continuously increasing. Technological capacity as a way of production, utilization and dissemination of information has become the most critical determinant of international trade performance and prosperity of a country. In countries with advanced technology, a process of change in which a considerable part of economic activities consists of information, intensive elements has been experienced. As production of goods and services becomes increasingly technology inclusive, technological capability, taken as a reference to determine the development level of a country, has reshaped long‐run development perspectives.

An overview of the composition of international trade indicates that the proportion of technology content of goods or production processes in total world trade has a tendency to rise. Technology, rather than factor stock, is the focus of global competition, and value‐added and monopolistic advantages created by high tech goods and production processes make this tendency even more important.

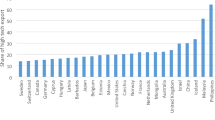

Technological differences among countries also determine which countries specialize in which areas of world production and trade, affect technological capacity and the ability to improve technology as well as the composition of foreign trade. When competitiveness in foreign trade is studied, it is important to examine the relationship between foreign trade and technological level. In this study, after examining the relevant empirical literature, the impact of R&D expenditures and the number of researchers on the exports of high and medium high technology manufacturing industries is investigated with a panel data method by using the data of 26 countries with different levels of development, 16 of which are developed and the remaining 10 developing, for the period 1996–2012. Domestic physical capital stock and foreign direct investment inflows are also used to explain high‐tech exports. The panel unit root tests are applied to determine the level of the stationarity of the variables and the long‐run relationship between the variables tested by using panel co‐integration tests.

Studies in literature, which analyze the relationship between R&D, innovation and exports usually focus on developed countries (DC). Including developing countries (LDC) in the analysis, this study gains further importance in terms of shedding light on the contribution of development level to the discussion. Moreover, unlike most of the empirical analyses, which either base on cross‐section data and do not take the effect of time into account or take the effect of time into account but only for a single country, a comparative analysis using 17 years of data from countries at different levels of development is done for this study. Panel data methods (panel unit root tests, panel co‐integration tests, panel error correction model) used for the estimation of the models enable a differentiation between the short and long‐run impacts of technological development indicators on export performance.

This study is designed in three parts. In the first part devoted to the literature, empirical studies on the subject are summarized; econometric methods, data sets, models and variables are introduced in the second part; empirical findings and economic interpretation of them are presented in the third and final part. The study is completed with a general overview and policy recommendations.

2 Theoretical Basis and Literature Review

Effects of differentiation in technology on exports and competitiveness have been the subject of different theories. In contrast to the Heckscher‐Ohlin model which assumes that technology is homogeneous (the same everywhere), the technological gap hypothesis (Posner 1961) and the product cycle theory (Vernon 1966) were the first steps towards differentiation in terms of technology that entered into foreign trade theories; Krugman (1979), Grossman and Helpman (1991) see technological differences between countries as a major source of international trade. While DC specialize in manufacturing and trade of technology products thanks to their high‐tech capabilities, LDC rather specialize in areas based on resources and/or labor due to their weakness in R&D and innovative factors, and relatively abundant (therefore cheap) labor. Unlike labor‐intensive products, the price elasticity of demand is low and the income elasticity is high for the products produced using high technology. Thus, the countries manufacturing and exporting technology products enjoy both a higher level of prosperity and high return.

The countries and companies, which design technology with long‐run strategies and place importance on R&D and innovation, have the advantage of being more competitive in international markets. There are three distinct connections between technological innovation and international competitiveness. Firstly, process innovation increases competitiveness by reducing production/output costs. Secondly, secondary product innovation makes the products more attractive both in domestic and foreign markets by improving quality. Thirdly, product innovation will allow a monopoly profit by creating a monopolistic position for a certain period of time that will help these products to gain a market share (Archibugi and Michie 1998, p. 10–11). Benefits of technological improvements for innovative countries are positive effects on the foreign trade balance in the short‐run by reducing the need for imports and foreign exchange spending, as well as the improvements in terms of trade, and the ability to specialize in sectors providing high returns in the long‐run.

As the value‐added created in high‐tech goods is high, the transformation of exports from low‐tech goods to mainly high‐tech ones leads a country to become more prosperous and competitive. Medium‐tech products are the complex products whose technological content does not change rapidly. R&D expenditures are important for them; they require advanced engineering capabilities and their production scale is large. Entry barriers to the market are quite high for these types of products due to the need for large amounts of capital and there are “learning effects”. For high‐tech products, high barriers to entry prevail due to their need for advanced and rapidly changing technology and complex skills (Lall 2000a, p. 341–343, 2000b, p. 8–9). Innovative technologies, a large amount of R&D expenditure, high‐tech infrastructure, and a strong collaboration and relations between firms and research institutions are among the main features of these products. Additionally, as the social benefits of the resources in the industry where these products are produced outreach private benefits, positive externalities arise (Krugman 1992, p. 14).

The impact of R&D, innovation, technological development level and factors affecting these variables on exports is discussed in various empirical studies. The level of technology is analyzed with different indicators in these studies conducted on a country, industry or company basis. Competitiveness, which is measured by the share of exports at transnational and sector level, is usually described by variables related to labor costs, fixed investments and the level of technology; the impact of technological development resources on export performance is typically determined in line with theoretical expectations. Empirical literature including featured studies is summarized in Table 3.1.

Magnier and Toujas‐Bernate (1994) studied price (export price) and non‐price (R&D expenditures and fixed capital investments) determinants of export market share at the sectoral level using the 1975–1987 period data of 20 manufacturing industry sectors in the USA, Japan, Germany, Britain and France. Although there are important differences in some countries and sectors, estimation results of the model including price and non‐price effects indicate the importance of non‐price effects like R&D for the export market share.

In order to explain export performances of countries, Fagerberg (1997) uses independent variables such as direct and indirect R&D activities (capital and intermediate goods purchases from domestic and foreign companies), the share of foreign companies in indirect R&D, unit labor costs, gross fixed capital formation and domestic demand (domestic market size) for the year of 1985 in 10 OECD countries and 22 industries. A positive relationship is found between direct and indirect R&D and competitiveness. Domestic indirect R&D provides a greater contribution to competitiveness than indirect R&D from foreign resources. R&D investments affect competitiveness twice as much as physical capital investments. While the impact of domestic market size on competitiveness is negative, there is no significant effect of low wages.

Wakelin (1998) has investigated the determinants of bilateral trade for 9 OECD members and 22 manufacturing sectors, taking relative innovation, labor costs and investment rates as determinants of export performance, and questioning how these determinants differ across the countries and industries. In addition, the sensitivity of results to the selection of an innovation variable is investigated by using relative R&D intensity and relative patents; and a new industrial classification is developed taking the impact of innovation on trade performance into account in net innovation user or developer sectors. Despite the heterogeneity between sectors and countries, with the analysis of pooled data it is concluded that innovation and investment variables affect trade performance positively and labor costs affect it negatively. It is found that differences in innovation have more impact on the trade performance of sectors developing technology than those using technology.

Montobbio (2003) has associated export market share in a given sector with the three explanatory variables R&D expenditures, unit labor costs and gross fixed capital formation in 14 countries for the periods 1980–1983, 1984–1987 and 1988–1990 by evaluating the impact of sectoral differences on the dynamic relationship between technological level and export performance, Sectors are divided into three sub‐categories, namely high‐tech, medium‐tech and low‐tech; and it is recognizable that differences in the technological content of sectors affect the relationship between technological variables and export market shares.

Sanyal (2004) has investigated the impact of technological factors (R&D intensity and technological facilities), factor endowment (arable land per employee and relative capital/labor ratio) and variables on bilateral trade flows (export performance) by taking 18 industries of the USA, UK, France, Germany and Japan as a sample for the 1980–1998 period. The whole period is sub‐grouped into 1980–1989 and 1990–1998, and it is concluded that at an aggregate level innovation there is an important factor influencing bilateral trade performance.

Vogiatzoglou (2009) examines the impact of R&D expenditures (as percentage of GDP), the number of R&D personnel per million people (human capital), the real effective exchange rate index, total expenditures on information and communication technologies (ICT), the size of manufacturing industry (value‐added), the openness index, the number of phone lines per one hundred people and the FDI inflows/GDP export specialization by using a multiple regression method for the period 2000–2005 of 28 countries; and statistically significant effects of R&D and human capital are found.

Seyoum (2005) studies the determinants of high‐tech exports using the data of 55 countries for the year 2000. Factor analysis and multivariate regression analysis are used to investigate the relationship between high‐tech exports and R&D expenditures, the number of engineers and scientists working in R&D, FDI inflows and the development level of the importer country (demand conditions of host country). It is concluded that all the variables have an impact on high‐tech exports; and the highest impact arises from FDI inflows.

Braunerhjelm and Thulin (2008) examine the impact of R&D expenditures and market size on high‐tech exports using every second year data for the 1981–1999 period of 19 OECD countries. A panel regression model is used in the analysis and it is found that while R&D expenditure is an important determinant of high‐tech exports, market size has no effects.

Tebaldi (2011) investigates the determinants of high‐tech exports using averages of five year data of the 1980–2008 period. As a result of the panel data analysis using the fixed effects method, human capital, FDI inflows and openness are determined to be important determinants of high‐tech exports. In addition, it has been shown that although the institutions do not have a direct impact on high‐tech exports, they somehow have an indirect impact on human capital and FDI inflows; no significant impact of fixed capital investments, savings, exchange rate and macroeconomic volatility (inflation) on high‐tech exports is found.

Alemu (2013) examines the impact of R&D investments and the number of researchers on high‐tech exports for the 1994–2010 period of 11 East Asian countries. The analysis using the panel GMM estimation method concludes that the R&D expenditures/GDP ratio and the rise in the number of R&D personnel increase high‐tech exports.

The related literature regarding technology and exports or high‐tech export performance usually focuses on DC. Although different results are obtained from these multi‐country, single country or industry level studies; the impact of variables used as a representative of technological development on exports stands out in accordance with the theoretical expectations.

3 Model and Data

As value‐added is higher in technology intensive goods, the transformation of exports composition from low‐tech goods to mainly high‐tech goods allows a country to be more prosperous and competitive. Technological capacity and capability and human capital stock play a critical role in the development of competitiveness. Based on this fact, by using the panel data method, the relationship between the technological development indicators and high‐tech exports in DC and LDC is analyzed with annual data of the 1996–2012 period. Export structure is formed on the base of the export proportions of low, medium and high‐tech goods; in order to determine the technological nature of exports, absolute value, per labor value of medium and/or high‐tech exports, their share of total exports, etc. can be utilized. High and medium high technology export per labor is preferred as the dependent variable in this study. The technology development capability is measured by two different variables, namely R&D expenditures and the number of researchers. Domestic physical capital stock and foreign direct investment flows are used to explain the export performance of high‐tech products.

Two different models to examine the impact of R&D expenditures, the number of researchers, the fixed capital investments and foreign direct investments on high‐tech exports are analyzed using panel co‐integration methods. The two econometric models presented below are used with the annual data of 16 DC and 10 LDC for the 1996–2012 period; these models are tested separately for DC and LDC.

The variables used in the analysis, their definitions and the data source, and the countries in the sample are presented in Tables 3.2 and 3.3. Country classification is based on the IMF World Economic Outlook Database 2014.

The exports of high and medium high‐tech manufacturing industries are used as a dependent variable in the models defined in Eqs. 3.1 and 3.2; the R&D expenditure is used as an independent variable in the first model while the number of researchers is used in the second one. Fixed capital investment and FDI inflows are also independent variables in both models.

-

I.

High‐tech Exports: Manufacturing industry data is grouped on the basis of OECD technology‐intense industry classification. As seen in Table 3.4, based on the technological intensity, industries are divided into 4 groups: high tech, medium high‐tech, medium low‐tech, low‐tech. High and medium high‐tech industries are counted as high tech sectors in this study.

Table 3.4 Classification of Manufacturing Industries Based on Technology Intensity. (Source: OECD (2015), Structural Analysis (STAN) database) -

II.

R&D Expenditures, and the Number of Researchers: R&D expenditures and the number of R&D personnel are the most commonly used variables to define technological capabilities of a country. R&D expenditures and R&D personnel are of great importance in every stage of technological activities such as developing a new product and/or production method, efficient use of current or imported technology and adapting or changing technology. Thus, even the firms and countries that only import technology have to make R&D expenditure and must have sufficient R&D personnel to obtain the highest efficiency from imported technology. In this context, the resources allocated for R&D activities and the number of researchers are significant, not only for the production of new scientific and/or technological information or implementation of current information with the aim of producing goods and services; but also for gaining knowledge and experience in the process of improving technological abilities (Saygılı 2003, p. 70). R&D expenditure is one of the most critical determinants of international competitiveness. A positive relationship between R&D expenditures and specialization/competitiveness of high‐tech sectors in manufacturing industry exports is expected.

-

III.

Gross Fixed Capital Formation: Fixed capital investments are one of the basic elements that accelerate capital accumulation and technological development. Innovative activities carried out for production and productivity increase depend upon investments on buildings, machinery and equipment, various tools of experiments, tests and measurement equipment, etc. On the other hand, investments in physical infrastructure are a prerequisite for the spread of emerging technological innovations among firms and sectors. Investments are necessary to transfer technological innovations to other companies and sectors, because innovations in the form of production methods created by innovative companies are usually embodied in machinery and equipment. Investments are a means of transferring, adapting and changing technology developed in other countries. With this in mind, fixed capital investments are included in the model.

-

IV.

Foreign Direct Capital Inflows: From the 19th century until World War I, and since the 1960s, national economies have become even more dependent on each other as a result of the increasing internationalization of goods, services and capital markets, developments in communications technology, the increasing rate of integration in the goods market as a result of growing foreign trade and transforming foreign trade links (Bayraktutan 2013, p. 162). Foreign direct capital investment, which is one of the most important reasons behind this process, contributes to the technological developments both by increasing the physical capital stock, and allowing the transfer of new production methods and organization forms (Saygılı 2003, p. 93). In particular, attracting new technologies to home country or activities of foreign firms towards technological improvement support the technological capabilities of the host countries. With the aim of finding an opportunity to evaluate different interpretations of its effects on technological developments in the literature, FDI inflows are included in our models as an independent variable.

4 Econometric Methods and Findings

The models defined for analyzing the impact of R&D expenditure, the number of researchers, fixed capital investments and foreign direct investments on high‐tech exports are analyzed by panel co‐integration methods. The first stage of the co‐integration analysis is to examine the unit root characteristics of the variables. In the second stage, whether variables have a long‐run co‐integration relationship is determined by panel co‐integration tests, and in the third stage, an estimation of the panel co‐integration vector is made. Finally, the short and long‐run causality relationship between variables is investigated.

4.1 Panel Unit Root Analysis

Since unit root characteristics of variables play an important role in performing co‐integration analysis, the panel unit root test suggested by Im et al. (2003) was firstly applied to the seriesFootnote 1.

Prior to the unit root test, logarithms of all variables were taken. For both the level and the first difference of the logarithmic series, unit root tests were applied and the results of the DC and LDC were presented in Tables 3.5 and 3.6 respectively. The optimal lag length eliminating the problem of autocorrelation between errors was determined using the Schwarz information criterion.

When we look at the results of the unit root test applied to the level values of logarithmically transformed variables for DC in Table 3.5, it is obvious that the findings in the model with constant and the model with constant and trend for the series of the number of researchers (LnRP) do not demonstrate a complete consistency in terms of stationarity. Results regarding high‐tech exports (LnHTEX), R&D expenditures (LnR&D), gross fixed capital investment (LnGFC) and foreign direct investment inflows (LnFDI) series show that variables are not stationary at level and have a unit root problem. Therefore, by taking the first differences of series, it was reinvestigated if there is a unit root. When we look at the results of the unit root analysis for DC according to the first difference, it is observed that high‐tech exports (∆LnHTEX), R&D expenditures (∆LnR&D), the number of researchers (∆LnRP), gross fixed capital investment (∆LnGFC) and foreign direct investment inflows (∆LnFDI) are stationary [I (1)] in the first difference of their series.

In Table 3.6, when we examine the results of the unit root tests applied to the level values of logarithmically transformed variables for LDC, the results concerning the series of high‐tech exports (LnHTEX), R&D expenditures (LnR&D), the number of researchers (LnRP), gross fixed capital investment (LnGFC) and foreign direct investment inflows (LnFDI) show that all series are not stationary in level and they have a unit root problem. Therefore, by taking the first difference of the series, it was reinvestigated if there is a unit root. When the results of the unit root analysis concerning the first difference of variables regarding LDC are examined, it is observed that all series are stationary [I (1)] at their first difference.

Following the unit root tests, co‐integration tests are performed.

4.2 Panel Co‐integration Tests

Since the series of high‐tech exports (LnHTEX), R&D expenditures (LnR&D), the number of researchers (LnRP), gross fixed capital investment (LnGFC) and foreign direct investment inflows (LnFDI) are stationary in their first difference, the long‐run relationship between these series is examined with Pedroni (1999, 2004), and Kao (1999) co‐integration tests for both models. Panel co‐integration test results for DC and LDC are presented in Tables 3.7 and 3.8 respectively.

In the Model‐1 Pedroni co‐integration test for DC, according to the model, constant Panel PP and Panel ADF statistics are significant at 5% and 1% levels, and Group PP and Group ADF statistics are significant at 1% level. In terms of the relevant test results, the H0 hypothesis concerning the fact that there is no co‐integration between the series has been rejected and the alternative hypothesis H1 claiming that there is a co‐integration between the series has been accepted. As for the model with constant and trend, by looking at the test results of Panel PP, Panel ADF, Group PP and Group ADF, the H0 hypothesis arguing that there is no co‐integration between the series is rejected, and the alternative hypothesis H1 claiming that there is a co‐integration between the series is accepted. Panel PP and Panel ADF statistics as well as Group PP and Group ADF statistics are significant at 1% level, and indicate that there is a co‐integration. In general, the results of the Pedroni co‐integration test for Model‐1 indicate that there is a co‐integration between the relevant variables for DC.

In the Model‐2 Pedroni co‐integration test for DC, the H0 hypothesis, which states that there is no co‐integration between the series in the model with constant, is rejected in Panel PP, Panel ADF, Group PP and Group ADF tests. The alternative hypothesis H1 indicating that there is a co‐integration between the series is accepted. Test results are significant at 1% level. As for the model with constant and trend, the H0 hypothesis is rejected in Panel PP, Panel ADF, Group PP and Group ADF tests and the alternative hypothesis is accepted instead. Relevant test statistics are also significant at 1% level. When Pedroni co‐integration test results are reviewed as a whole for Model‐2, it is recognizable that there is a co‐integration between the relevant variables of DC.

Following Model‐1 and Model‐2 Kao co‐integration tests for DC, the H0 hypothesis, which states that there is no co‐integration between the series is rejected, the alternative H1 hypothesis indicating that there is a co‐integration between the series is accepted. In other words, high‐tech exports, R&D expenditures, the number of researchers, gross fixed capital investments and foreign direct investment inflows in DC move together in the long‐run and the analysis shows that there is a co‐integration between these variables. Thus, a significant relationship between high‐tech exports, R&D expenditures, and the number of researchers, gross fixed capital investments, and foreign direct investment inflows variables is observed in the long‐run in both models.

Co‐integration test results for LDC are presented in Table 3.8.

In Model‐1 Pedroni co‐integration test for LDC, Group PP statistics and Group ADF statistics are significant at 1% and 10% levels respectively in the model with constant and trend. Based on the relevant test results, the H0 hypothesis is rejected and the alternative hypothesis H1 indicating that there is a co‐integration between the series is accepted. With a general evaluation of Pedroni co‐integration test results for Model‐1, it can be observed that there is no clear co‐integration relationship between variables.

In Model‐2 Pedroni co‐integration test for LDC, Panel v and Panel ADF statistics are significant at 5% level; Group PP and Group ADF statistics are significant at 1% level in models with constant and trend. Based on relevant test results, the H0 hypothesis, which states that there is no co‐integration between the series is rejected and the alternative hypothesis H1 indicating that there is a co‐integration between the series is accepted. When generally evaluated, Pedroni co‐integration test results for Model‐2 indicate a co‐integration relationship between variables.

According to Model‐1 and Model‐2 Kao co‐integration tests for LDC, the H0 hypothesis, which states that there is no co‐integration between the series, is rejected; the alternative hypothesis H1 indicating that there is a co‐integration between the series is accepted. There is a co‐movement of high‐tech exports, R&D expenditures, the number of researchers, gross fixed capital investments and foreign direct investment inflows in LDC in the long‐run and the analysis shows that there is a co‐integration between the variables. From this point forth, it can be stated that there is a significant relationship between high‐tech exports, R&D expenditures, and the number of researchers, gross fixed capital investments and foreign direct investment inflows variables in the long‐run in both models.

When Pedroni and Kao co‐integration tests are reviewed together, a long‐term relationship between high‐tech exports, R&D expenditures, and the number of researchers, gross fixed capital investments and foreign direct investment inflows was observed in both models for the samples of DC and LDC in general.

4.3 Panel Co‐integration Parameters Estimation

The FMOLS (Full Modified Ordinary Least Square) method developed by Pedroni (2000; 2001) is used to predict the long‐run relationship coefficients after the co‐integration tests.

Table 3.9 shows the estimated FMOLS results for DC. According to the FMOLS estimation results, the sign of the coefficient of R&D expenditures (LnR&D) variable is positive as expected and it is statistically significant at 1% level, i.e. in the long‐run, an increase in R&D expenditures affects high‐tech exports in a positive way across the panel. The signs of gross fixed capital investments (LnGFC) and foreign direct investment inflows (LnFDI) variables are also positive as expected and they are statistically significant at 1% level. The elasticity of R&D expenditures variable is estimated to be 0.46 across the panel. Thus, a 1% increase in R&D expenditures in 16 DC leads to a 0.46% increase in high‐tech exports in the long‐run. The elasticity of gross fixed capital investments (LnGFC) variable is estimated to be 0.41 across the panel. Thus, a 1% increase in fixed capital investments in 16 DC leads to a 0.41% increase in high‐tech exports in the long‐run. Similarly, the elasticity of foreign direct investment inflows (LnFDI) variable is calculated as 0.23. Thus, a 1% increase in foreign direct investment inflows in DC leads to a 0.23% increase in high‐tech exports in the long‐run.

According to the results of the Model‐2 FMOLS estimation, the signs of the coefficients of LnRP, LnGFC, and LnFDI variables are positive as expected, and they are statistically significant at 1% level. Elasticity of the number of researchers (LnRP) variable is estimated to be 0.65 across the panel. Thus, a 1% increase in the number of researchers in DC leads to a 0.65% increase in high‐tech exports in the long‐run. The elasticity of fixed capital investments (LnGFC), and foreign direct investment inflows (LnFDI) variables are estimated to be 0.48 and 0.32 respectively. Thus, across the panel, a 1% increase in fixed capital investments and foreign direct investment inflows leads to a 0.48% and a 0.32% increase in high‐tech exports respectively.

When the Panel FMOLS estimation results regarding the impact of R&D expenditures (LnR&D) on high‐tech exports (LnHTEX) presented in Table 3.9 within the framework of Model‐1 for DC are evaluated on the basis of each country, it is recognizable that the coefficient of the relevant variable is positive in the Czech Republic, Denmark, Ireland, Japan, S. Korea, Latvia, the Netherlands, Slovakia, Slovenia, and the USA and it is statistically significant; i.e. R&D expenditures increase high‐tech exports in these countries. The highest increases are in the following countries: Japan (1.40%), Latvia (1.25%), the Netherlands (1.06%), and the USA (1.03%). In the relevant model, the sign of the coefficient showing the impact of fixed capital investments (LnGFC) on high‐tech exports (LnHTEX) is also positive and significant in all DC except Latvia, Spain, and the USA. The relevant coefficient is bigger particularly in the Netherlands (1.07), the Czech Republic (0.65), and Germany (0.64). The coefficient of foreign direct investment inflows (LnFDI) is positive and statistically significant in Austria, the Czech Republic, Germany, Ireland, South Korea, Slovakia, Slovenia, and England in the same model; i.e. an increase in foreign direct investment inflows (LnFDI) leads to an increase in high‐tech exports in these countries. The relevant coefficient is bigger especially in Germany (0.52) and Slovakia (0.45).

The evaluation of the Panel FMOLS estimation results regarding the impact of the number of researchers (LnRP) on high‐tech exports (LnHTEX) presented in Table 3.9 within the framework of Model‐2 for DC on the basis of each country indicates that the coefficient of the relevant variable is positive in the Czech Republic, Denmark, Finland, Ireland, Japan, S. Korea, the Netherlands, Slovakia, Slovenia, and the USA and it is statistically significant. As the number of researchers increases, high‐tech exports rise in these countries. The highest increases are in the following countries: Japan (2.70%), Latvia (1.95%), the USA (1.58%) and the Netherlands (1.42%). In the relevant model, the coefficient showing the impact of fixed capital investments (LnGFC) on high‐tech exports (LnHTEX) is positive and significant in all DC except Latvia, Spain, and the USA, and particularly bigger in Finland (1.50) and the Netherlands (1.15). The coefficient of foreign direct investment inflows (LnFDI) is also positive and statistically significant in the Czech Republic, Germany, Ireland, Japan, Latvia, the Netherlands, Slovakia, Slovenia, Spain and England in the same model. Countries with the biggest coefficient are Latvia (1.55) and Germany (0.57).

Table 3.10 shows the estimated FMOLS results for LDC. According to the Model‐1 FMOLS estimation results, the coefficient sign of the R&D expenditures (LnR&D) variable is positive as expected and it is statistically significant at 1% level. Thus, in the long‐run, an increase in R&D expenditures affects high‐tech exports in a positive way across the panel. The sign of the coefficient of gross fixed capital investments (LnGFC) is also positive as expected and it is statistically significant at 1% level. The coefficient sign of foreign direct investment inflows (LnFDI) variable is negative and it is statistically insignificant. The elasticity of R&D expenditures (LnR&D) variable is estimated to be 0.94 across the panel. Thus, a 1% increase in R&D expenditures in 10 LDC leads to a 0.94% increase in high‐tech exports in the long‐run. The elasticity of the gross fixed capital investments (LnGFC) variable is estimated to be 0.46 across the panel. Thus, a 1% increase in fixed capital investments in 10 LDC leads to a 0.46% increase in high‐tech exports in the long‐run.

According to the results of the Model‐2 FMOLS estimation, the sign of the coefficients of LnRP, LnGFC, and LnFDI variables are positive as expected and statistically significant at 1% level. The elasticity of the number of researchers (LnRP) variable is estimated to be 0.65 across the panel, i.e. a 1% increase in the number of researchers in LDC leads to a 0.65% increase in high‐tech exports in the long‐run. The elasticity of the fixed capital investments (LnGFC), and foreign direct investment inflows (LnFDI) variables are estimated to be 0.51 and 0.23 respectively. Thus, across the panel, a 1% increase in fixed capital investments and foreign direct investment inflows leads to a 0.51% and a 0.23% increase in high‐tech exports respectively.

The evaluation of the Panel FMOLS estimation results regarding the impact of R&D expenditures (LnR&D) on high‐tech exports (LnHTEX) presented in Table 3.10 within the framework of Model‐1 for LDC on the basis of each country indicates that the coefficient of the relevant variable is positive in Bulgaria, China, Hungary, India, Lithuania, Mexico, Russia, and Turkey as expected. However, the coefficient is not statistically significant in Hungary, Poland, Russia, and Turkey. R&D expenditures increase high‐tech exports in Bulgaria, China, India, Lithuania, Mexico, and Romania. Countries with the highest rate of increase are Lithuania (2.51%), Bulgaria (1.81%), Romania (1.30%), and China (0.99%). In the relevant model, the coefficient showing the impact of fixed capital investments (LnGFC) on high‐tech exports (LnHTEX) has a positive sign and is statistically significant in China, India, Lithuania, Mexico, Poland, and Russia. An increase in fixed capital investments in these countries contributes to the increase in high‐tech exports. Countries with the highest effect are China (1%), Mexico (0.70%), and India (0.69%) respectively. For the same model, the impact of foreign direct investment inflows (LnFDI) on high‐tech exports (LnHTEX) is statistically significant in China, Hungary, Lithuania, Poland, and Romania. However, the sign of this coefficient is found to be negative in China and Lithuania. FDI inflows to these countries reduce rather than increase the export of high‐tech commodities.

When the Panel FMOLS estimation results regarding the impact of the number of researchers (LnRP) on high‐tech exports presented in Table 3.10 within the framework of Model‐2 for LDC is evaluated on a country basis, it is seen that the coefficient of the relevant variable is positive and statistically significant in Bulgaria, China, Hungary as expected; i.e. the increase in the number of researchers increases high‐tech exports in these countries. The countries with the highest rate of increase are Bulgaria (2.58%), China (1.47%), and Hungary (1.22%). In the relevant model, the sign of the coefficient showing the impact of fixed capital investments (LnGFC) on high‐tech exports (LnHTEX) is also positive and significant in Mexico, Poland, Romania, and Russia. An increase in fixed capital investments in these countries contributes to the increase in high‐tech exports. Countries with the highest effect are Mexico and Romania with 0.98%, and 0.89% respectively. The impact of foreign direct investment inflows on high‐tech exports is not statistically significant in countries other than Bulgaria and Poland in the same model.

4.4 Panel VECM Estimation

Co‐integration analyses, according to Model‐1 and Model‐2, show that there is a co‐integrated relationship between high‐tech exports (LnHTEX), R&D expenditure (LnR&D), the number of researchers (LnRP), gross fixed capital investments (LnGFC), and foreign direct investment inflows (LnFDI). The Panel Vector Error Correction Model (VECM) is used to differentiate long‐run balance and short‐run dynamics between the co‐integrated series and to determine short‐run dynamics. Panel VECM for Model‐1 and Model‐2 is illustrated by Eqs. 3.3 and 3.4.

Panel VECM for Model‐1 and Model‐2 is illustrated by Eqs. 3.3 and 3.4, where k stands for optimal lag length and eit−1 stands for one‐period lagged residual term obtained from panel FMOLS. Moving forward from this point, it is possible to investigate both short and long‐run causality relationships within the framework of the panel VECM. In accordance with this purpose, the VAR model is first estimated by stationary values of variables and then the optimal lag length is determined. Panel VECM is estimated within the framework of pre‐determined optimal lag length.

Error correction terms of Model‐1 and Model‐2, ECT1 (−1) and ECT2 (−1), were estimated to be −0.69 and −0.67 respectively as shown in Table 3.11 in which the Panel VECM results for DC are presented. The fact that these coefficients have negative signs and are statistically significant show that the vector error correction mechanism works and there is a causality relationship from LnR&D, LnGFC and LnFDI to LnHTEX; from LnRP, LnGFC and LnFDI to LnHTEX in the long‐run.

The value of the error correction coefficients refers to how much of the imbalance which occurred in the short‐run, is eliminated in the next term (Tarı 2005, p. 417). In this context, the findings of the analysis show that in subsequent terms, 69% of the short‐run imbalance is eliminated for Model‐1; and 67% of the short‐run imbalance is eliminated for Model‐2. In other words, for Model‐1 and Model‐2, deviations occurring between the short‐run series in DC will converge to a long‐run balance, approximately after 1.5 terms.

With reference to the panel VECM estimation results in Table 3.11, the Wald test is performed by placing restrictions on ∆LnR&D (−1), ∆LnGFC (−1) and ∆LnFDI (−1) for Model‐1; and ∆LnRP (−1), ∆LnGFC (−1), and ∆LnFDI (−1) for Model‐2. The Wald test results, which are performed to test short‐run causality relationships between the variables are presented in Table 3.12 for Model‐1 and Model‐2.

According to Table 3.12, while no short‐run causality relationship from R&D expenditures (LnR&D) to high‐tech exports (LnHTEX) in DC for Model‐1 is detected, it is found that there is a 1% significance level short‐run causality from each of the fixed capital investments (LnGFC) and foreign direct investment inflows (LnFDI) variables to high‐tech exports (LnHTEX).

In terms of the results of the short‐run causality analysis for Model‐2, while no short‐run causality relationship from the number of researchers (LnRP) to high‐tech exports (LnHTEX) in DC is detected, it is found that there is a 1% significance level short‐run causality from each of the fixed capital investments (LnGFC) and foreign direct investment inflows (LnFDI) to high‐tech exports (LnHTEX).

The Panel VECM estimation results calculated for LDC are presented in Table 3.13. Error correction coefficients ECT1 (−1) and ECT2 (−1) for Model‐1 and Model‐2 were estimated as −0.24 and −0.19 respectively. The fact that these coefficients are negative and statistically significant shows that the vector error correction mechanism works and there is a causality relationship from LnR&D, LnGFC, and LnFDI to LnHTEX; from LnRP, LnGFC, and LnFDI to LnHTEX in the long‐run. The findings regarding the error correction coefficients, which show how much of the imbalance occurring in the current term is eliminated in the subsequent term state that 24% of the imbalance for Model‐1 and 19% of the imbalance for Model‐2 is eliminated in the subsequent term. In other words, deviations between the short‐run series in LDC will converge to a long‐run balance after approximately 4 terms for Model‐1 and 5 terms for Model‐2.

With reference to the panel VECM estimation results in Table 3.13, the Wald test is performed by placing restrictions on ∆LnR&D (−1), ∆LnGFC (−1) and ∆LnFDI (−1) for Model‐1; and ∆LnRP (−1), ∆LnGFC (−1) and ∆LnFDI (−1) for Model‐2. The Wald test results, which are performed to test short‐run causality relationships between the variables are presented in Table 3.14 for Model‐1, and Model‐2.

According to Table 3.14, while no short‐run causality relationship from R&D expenditures (LnR&D) to high‐tech exports (LnHTEX) in LDC for Model‐1 is detected, it is found that there is a short‐run causality from each of the fixed capital investments (LnGFC) and foreign direct investment inflows (LnFDI) variables to high‐tech exports (LnHTEX) at 1% significance level.

According to the findings of the Model‐2 short‐run causality analysis, while no short‐run causality relationship from the number of researchers (LnRP) to high‐tech exports (LnHTEX) in LDC is detected, it is found that there is a 1% significance level short‐run causality relationship from each of the fixed capital investments (LnGFC) and foreign direct investment inflows (LnFDI) variables to high‐tech exports (LnHTEX).

4.5 Discussion and Implications

In this part of the study, the panel co‐integration and panel VECM estimation results of the models, which were developed to investigate the impact of R&D expenditure, the number of researchers, fixed capital investments, and FDI inflows on high‐tech exports will be interpreted in terms of the theoretical background of international economics.

In order to explain the exports of high and medium high‐tech manufacturing industries, R&D expenditures and the number of researchers that were used in two models in addition to fixed capital investments and FDI inflows as explanatory variables. It is found that relevant variables influence exports of high and medium high‐tech goods in a way, which is compatible with previously conducted empirical analysis (Montobbio 2003; Sanyal 2004; Seyoum 2005; Alemu 2013) and theoretical expectations in countries with different levels of development. In developed countries, R&D expenditures and the number of researchers are the two most important variables affecting high‐tech exports; the impacts of fixed capital investments and FDI inflows, however, they are relatively low compared to R&D expenditures and the number of researchers.

In LDC, similarly to DC, the impact of R&D expenditures and the number of researchers on high‐tech exports is greater than that of fixed capital investments and FDI inflows. However, it is noteworthy that the impact of R&D expenditures on high‐tech exports in LDC is nearly twice as high as in DC. This finding is quite important for LDC, as there is a significant technological gap between them and DC. Since the sensitivity of high‐tech exports to R&D expenditures in LDC is greater than other variables and higher compared to DC, it seems possible for LDC to increase exports of high value‐added and high‐tech goods by allocating more resources from national income to R&D expenditure and investing more to increase highly qualified human capital which is necessary for R&D activities and thus, it is possible to reduce or close the technological gap between LDC and DC.

Evaluating empirical findings on a country basis indicates that there is a positive and significant relationship between both R&D expenditures, the number of researchers, and high‐tech exports for more than half of the DC and LDC; also the improvements in these indicators let the high‐tech exports increase. The result is consists of our theoretical expectations and it is possible to interpret it in the following way: Technological development dynamics, such as R&D expenditures and the number of researchers are two basic tools, not only to develop new technologies, but also to gain experience and expertise for the utilization, adaptation and modification of imported technology for countries which are in the process of acquiring technological skills. In this sense, it is crucial for both DC which have a leading role in terms of technological development indicators and LDC which are far behind DC in terms of technology level to allocate a significant amount of their budget to make regulations with the aim of increasing the quality of labor to be employed in R&D activities, and to take innovation incentive measures in order to increase the export performance of the high‐tech industry.

Reviewing empirical findings regarding fixed capital investments on a country basis, it is concluded that there is a positive and significant relationship between the relevant variable and high‐tech exports and improvements in this area increase high‐tech exports in most of the countries classified as DC and LDC. As it is consistent with theoretical expectations, this result can be interpreted in the following terms: physical investments in buildings, roads and machinery equipment support technological development and dissemination of technological innovation embodied in machinery equipment in form of production methods among companies and sectors contributes to increases in high‐tech exports.

When findings regarding FDI inflows are reviewed on a country basis, it is seen that while the relationship between the relevant variable and high‐tech exports is positive in most of the DC, this relationship is negative in most of the LDC. FDI inflows contribute to technological developments both by increasing the physical capital stock and enabling countries to transfer new production methods and organizational forms.

Attracting new technologies to the country or the activities of foreign firms aimed at developing the technological level of the host country particularly support the technological capabilities of the countries concerned. The inverse relationship found between FDI inflows and high‐tech exports in LDC implies that the FDI inflows toward these countries aim to make use of the advantages like low labor costs, the large domestic market or natural resources. In this context, it can be stated that MNCs operating in LDC engage in production processes requiring low quality/paid labor rather than high technology production and that FDI inflows to these countries reduce rather than increase high‐tech exports. The insufficient regulations for the protection of intellectual property rights in LDC discourage FDI for high‐tech industries and direct them to labor‐intensive industries. High‐tech export in China is not a result of intensive R&D expenditures and technological developments. Advanced technology products predominantly contain imported components and consist of assembled high‐tech (Xing 2012, p. 4–9; Srholec 2005, p. 24).

The findings of the analysis in the case of Turkey do not indicate that technological development indicators have an impact on high‐tech exports. A statistically insignificant relationship between R&D expenditures, the number of researchers and high technology exports in countries like Turkey with weak technological development dynamics and high‐tech exports was the expected result. Indeed, Lall (2000b, p. 25) has also emphasized the necessity for Turkey, which has a weak outlook in terms of high‐tech exports, to transform its production and export composition to technology‐intensive products by increasing technological capability. As a result of the developments in technology intensive industries, an increase will also be achieved in the productivity of low technology industries with the spread of new technologies and an increase in technological capabilities at the country level.

The VECM results investigating short‐run dynamics show that short‐run imbalances are eliminated in the long‐run. While short‐run imbalances in DC are eliminated in 1.5 terms, the convergence of long‐run equilibrium in LDC requires more time; it may take up to 5 terms. This finding is compatible with empirical literature (Amendola et al. 1993) which emphasizes delayed (4 years) effects of technological development on exports.

There is a short‐run causality from fixed capital investments and FDI inflows to high‐tech exports. However, no short‐run causality is found between R&D expenditures, the number of researchers and high‐tech exports. Outcomes of the policies aiming to improve technological development indicators and hence increase high‐tech exports, are not seen in the short‐run. Therefore, keeping the findings of the long‐run analysis in mind, stable and strategic long‐run policies of science, technology, and innovation rather than short‐run and unstable approaches need to be implemented in order to improve technological development indicators.

4.5.1 Conclusion

Technological developments shape global competition; countries producing technology and using it effectively in economic activities have a developed economy. When the commodity composition of international trade is examined, it is seen that the share of products or production processes with technological content in total world trade is gradually increasing; increased high value‐added products and monopolistic advantages obtained from products or production processes with complex technological content make this process more attractive than ever. The reflection of technology on the production process usually takes the form of an output and/or by‐product of R&D activities. The fact that the countries with competitive power in high‐tech goods are also the countries allocating a significant amount of their budget to scientific research proves that there is a direct relationship between competitiveness and export capability on the one hand and technological development and R&D on the other.

Using the data of countries with different development levels, the impact of R&D expenditures and the number of researchers on the exports of high and medium high‐tech manufacturing industry is analyzed using the panel data method in this study. Domestic physical capital stock and FDI inflows are also used to explain high‐tech exports. Stationarity characteristics of the variables were investigated by using panel unit root tests, and the long‐run relationship between variables was tested by using panel co‐integration tests.

Since the results of the co‐integration test present a long‐run equilibrium relationship between the relevant variables for both models tested, co‐integration coefficients were investigated by using the Pedroni FMOLS estimator. The Panel FMOLS estimation results show that across the panel, R&D expenditures and the number of researchers are the most important determinants of high‐tech exports in both DC and LDC. In addition, the estimation results revealed that the elasticity of HTEX to R&D of technological development indicators is higher in LDC than in DC. While no short‐run causality is found from R&D and RP to HTEX, short‐run causality is detected from GFC and FDI to HTEX in the panel VECM estimation. Furthermore, the fact that the error correction coefficient was found to be significant and negative for both models proves that the error correction mechanism works and that short‐run imbalances are corrected in the long‐run.

In the light of the empirical findings, in order for those LDC which are far behind DC in terms of technology to achieve a sustainable increase in high value‐added exports, it seems worthwhile recommending to design/adapt, and implement policies that will transform production and export formation from low‐tech to high‐tech industrial goods by supporting scientific and technological infrastructure and R&D institutions. As terms of trade tend to change for high‐tech goods and against low‐tech ones, technological development performance is fundamental, not only for foreign trade volume, but also for national welfare gains obtained through improvements in terms of trade. Thus, LDC should give strategic priority to technological developments and their sources in order to increase national prosperity thanks to convergence, providing structural solutions for the current deficit problem and advantages arising from domestic value‐added and improvements in terms of trade. In this context, it is necessary to develop policies and mechanisms towards allocating more funds from national income for R&D, making educational regulations to train highly qualified labor (human capital) required by the R&D sector, taking initiative to protect property rights to encourage innovative activities, implementing incentive policies to attract FDI inflows producing technology‐intensive goods, increasing investments in physical infrastructure which is significant in terms of supporting scientific and technological infrastructure and R&D institutions of a country, as well as increasing the share of the private sector in R&D activities by providing coordination and information by sharing between the public and the private sector.

References

Alemu, M.A. (2013). The nexus between technological infrastructure and export competitiveness of high-tech products in East Asian economies. Journal of Economic Development, Management, IT, Finance and Marketing, 5(1), 14–26.

Amendola, G., Dosi, G., & Papagni, E. (1993). The dynamics of international competitiveness. Review of World Economics (Weltwirtschaftliches Archiv), 129(3), 451–471.

Archibugi, D., & Michie, J. (1998). Technical change, growth and trade: new departures in institutional economics. Journal of Economic Surveys, 12(3), 1–20.

Bayraktutan, Y. (2013). Global Ekonomide Bütünleşme Trendleri: Bölgeselleşme ve Küreselleşme (7th edn.). Ankara: Nobel Y.

Bıdırdı, H. (2015). Teknolojik Gelişme Dinamikleri ve İhracatın Niteliği: Panel Veri Analizi (Yayımlanmamış Doktora Tezi), Kocaeli Üniversitesi Sosyal Bilimler Enstitüsü, Kocaeli.

Braunerhjelm, P., & Thulin, P. (2008). Can countries create comparative advantages? R&D-expenditures, high-tech exports and country size in 19 OECD-countries, 1981–1999. International Economic Journal, 22(1), 95–111.

Breitung, J. (2000). The local power of some unit root tests for panel data. In B. H. Baltagi (ed.), Nonstationary panels, panel cointegration and dynamic panels, advances in econometrics. Amsterdam: JAI Press.

Fagerberg, J. (1997). Competitiveness, scale and R&D. In J. Fagerberg, P. Hansson, L. Lundberg & A. Melchior (eds.), Technology and international trade. Cheltenham: Edward Elgar.

Grossman, G. M., & Helpman, E. (1991). Innovation and growth in the global economy. Massachusetts: MIT Press.

Hatzichronoglou, T. (1997). Revision of the high-technology sector and product classification. OECD Science, Technology and Industry Working Papers, 1997/02. Paris: OECD Publishing.

Im, K., Pesaran, H. M., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal Of Econometrics, 115(2003), 53–74.

Kao, C. (1999). Spurious regression and residual–based tests for cointegration in panel data. Journal of Econometrics, 90(1), 1–44.

Krugman, P. (1979). A model of innovation, technology transfer, and the world distribution of income. The Journal of Political Economy, 87(2), 253–266.

Krugman, P. R. (1992). Technology and international competition: a historical perspective. In M. Caldwell Haris & G. E. Moore (eds.), Linking trade and technology policy. Washington, D.C: National Academy Press.

Lall, S. (2000a). The technological structure and performance of developing country manufactured exports, 1985–98. Oxford Development Studies, 28(3), 337–369.

Lall, S. (2000b). Turkish performance in exporting manufactures: a comparative structural analysis. QEH Working Paper Series, QEHWPS47.

Levin, A., Lin, C., & Chu, C.-S.J. (2002). Unit root tests in panel data: asymptotic and finite-sample properties. Journal of Econometrics, 108(2002), 1–24.

Maddala, G. S., & Wu, S. (1999). A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics, 61(S1), 631–652.

Magnier, A., & Toujas-Bernate, J. (1994). Technology and trade: empirical evidences for the major five industrialized countries. Weltwirtschaftliches Archiv, 130(3), 494–520.

Montobbio, F. (2003). Sectoral patterns of technological activity and export market share dynamics. Cambridge Journal of Economics, 27(4), 523–545.

OECD (2015). http://stats.oecd.org. Accessed 28. Feb. 2015.

Pedroni, P. (1999). Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics, 61(1), 653–570.

Pedroni, P. (2000). Fully modified OLS for heterogeneous cointegrated panels. In Baltagi & H. Badi (eds.), Nonstationary panels, panel cointegration and dynamic panels (advances in Econometrics) (pp. 93–130). New York: Elsevier Science Inc.

Pedroni, P. (2001). Purchasing power parity tests in cointegrated panels. Review of Economics and Statistics, 83, 727–931.

Pedroni, P. (2004). Panel cointegration, asymptotic and finite sample properties of pooled time series tests with an application to the purchasing power parity hypothesis. Econometric Theory, 20(3), 597–625.

Posner, M. V. (1961). International trade and technical change. Oxford Economic Papers, 13(3), 323–341.

Sanyal, P. (2004). The role of innovation and opportunity in bilateral OECD trade performance. Review of World Economics, 140(4), 634–664.

Saygılı, Ş. (2003). Bilgi Ekonomisine Geçiş Sürecinde Türkiye Ekonomisinin Dünyadaki Konumu. No. 2675. Ankara: DPT Yayını.

Seyoum, B. (2005). Determinants of levels of high technology exports an empirical investigation. Advances in Competitiveness Research, 13(1), 64–79.

Srholec, M. (2005). High-tech exports from developing countries: a symptom of technology spurts or statistical illusion? Working Papers on Innovation Studies. Oslo: Centre for Technology, Innovation and Culture, University of Oslo.

Tarı, R. (2005). Ekonometri. Kocaeli: Umuttepe Yayınları.

Tebaldi, E. (2011). The determinants of high technology exports: a panel data analysis. Atlantic Economic Journal, 39, 343–353.

UNCTAD (2015). http://unctadstat.unctad.org. Accessed 28. Feb. 2015.

UNESCO (2015). http://data.uis.unesco.org. Accessed 28. Feb. 2015.

Vernon, R. (1966). International investment and international trade in the product cycle. The Quarterly Journal of Economics, 80(2), 190–207.

Verspagen, B., & Wakelin, K. (1997). Trade and technology from a Schumpeterian perspective. International Review of Applied Economics, 11(2), 181–194.

Vogiatzoglou, K. (2009). Determinants of export specialization in ICT products: a cross-country analysis. Working Papers 2009.3. Athens/Greece: International Network for Economic Research – INFER.

Wakelin, K. (1998). The role of innovation in bilateral OECD trade performance. Applied Economics, 30(10), 1335–1346.

World Bank (2015). http://databank.worldbank.org/data. Accessed 28. Feb. 2015.

Xing, Y. (2012). The people’s republic of China’s high tech exports: myth and reality. ADBI Working Paper No. 5055. Tokyo: Asian Development Bank Institute.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Fachmedien Wiesbaden GmbH

About this paper

Cite this paper

Bayraktutan, Y., Bıdırdı, H., Kutlar, A. (2018). Research and Development and High Technology Exports in Selected Countries at Different Development Stages: a Panel Co-integration and Causality Analysis. In: Bakırcı, F., Heupel, T., Kocagöz, O., Özen, Ü. (eds) German-Turkish Perspectives on IT and Innovation Management. FOM-Edition(). Springer Gabler, Wiesbaden. https://doi.org/10.1007/978-3-658-16962-6_3

Download citation

DOI: https://doi.org/10.1007/978-3-658-16962-6_3

Published:

Publisher Name: Springer Gabler, Wiesbaden

Print ISBN: 978-3-658-16961-9

Online ISBN: 978-3-658-16962-6

eBook Packages: Business and ManagementBusiness and Management (R0)