Abstract

This study examines migration and cascading of credit default swaps (CDS) risks among four oil-related sectors -autos, chemical, oil and natural gas production, and utility—in two models. Model 1 encompasses fundamental variables, and Model 2 includes market risks. The key finding of the study suggests that replacing the two financial fundamental variables (the 10-year Treasury bond rate and the S&P 500 index) of Model 1 with the two market risk variables (the S&P VIX and the Oil VIX) of Model 2 reduce the long- and short-run risk migration and cascading in the second model for both the full sample and the subperiod. The CDS and VIX indices both reflect fear and risk on their own. Among the four oil-related CDS spreads, the chemical and auto spreads are the most responsive to the other credit and market risks and the fundamentals in the long-run, while those of utility and oil and natural gas sectors are not responsive. The recent quantitative easing in the United States adds to spikes in the levels of the chemical CDS and the S&P 500 index in Model 1, and to the S&P VIX and default risk spread in Model 2. Implications for model builders and policy makers are also discussed.

Corresponding author. This paper was written while the second author (R. Sari) was a visiting professor at Middle East Technical University-Northern Cyprus Campus.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Oil is the most wildly traded commodity and one of the most volatile commodities in the world. It plays a pivotal role in the modern economy since its impacts dominate many economic sectors including the oil-related sectors: automobile, chemical, oil and natural gas, and utility. Given the high volatility of this commodity, companies that deal with oil, whether as an output, a fuel or a feedstock, have opted to protect themselves by buying counterparty risk protection contracts against volatility and default events. These companies in those oil-related sectors buy credit default swaps (CDS) to protect themselves from credit risks related to events that impact the oil markets and the overall economy.

The CDSs for these oil-related sectors are pertinent measures of expected credit risk and fear in these sectors, which is relevant information on movements of oil prices and changes in the business cycles. Each of these sector CDSs may also relate to or reflect fear in other oil-related sectors, the stock market, and the government and private bond markets. It will be interesting to discern risk migration and the lead/lag causal relationships between these sector CDS indices and changes in the oil, bond and stock markets. The oil credit risk which is represented by these oil-related CDSs may also have directional relationships with credit risks of the expected volatility in the stock and bond markets. The credit risks of the equity and bond markets are measured by the CBOE volatility equity index VIX and the credit risk spread which is the difference between the Baa bond rate and the 10-year Treasury bond rate.

Similar to the rest of CDS sector indices, the oil-related CDS indices for the automobile, chemical, oil and natural gas production, and utility sectors are highly liquid, standardized credit securities that trade at a very small bid-ask spread. The CDS indices can be efficient at processing information on evolving risks in various sectors of the economy (see Norden and Weber 2004; Greatrex 2008, among others). The magnitude of the oil and oil-related sector credit spreads gauges the default risk exposure of the firms in the oil-related sectors. A widening of a CDS spread in response to certain oil or credit events indicates an increase in the level of credit risk in the pertinent sector, while a narrowing spread shows a decrease in the credit risk.

Several studies examine CDS indices for specific major sectors of the U.S. economy but not for the oil-related sectors. Berndt et al. (2008) assess the variations in the risk premium that forms a major component of the CDS spread for the U.S. corporate debt at the firm level in three sectors: broadcasting and entertainment, health care, and oil and gas for the period 2000–2004. Raunig and Scheicher (2009) compare the market pricing of the default risk of banks and non-banks before and after the 2008 financial crisis, using monthly data. Using the decomposition of the CDS premia (or market prices) divided as the expected loss and the risk premium, their results demonstrate that the CDS traders had drastically changed their judgments on the riskiness of banks after the crisis by viewing these financial institutions as at least as risky as the other firms. Hammoudeh and Sari (2011) employ the Autoregressive Distributed Lag (ARDL) approach to uncover the relationship between the financial CDS spread indices of the banking, financial services and insurance sectors and short- and long-term Treasury securities and the S&P 500 index. However, those authors do no account of other measures of financial stress and credit risks such as the default risk spreads and the expected volatility risk. More recently, Stanton and Wallace (2011) examine the relevance of the ABX.HE indices, which track CDSs on the US sub-prime residential mortgage-backed securities (RMBS), to the mortgage default rates during the financial crisis. Their results cast doubts on the suitability of the prices of the AAA ABX.HE index CDS as valuation benchmarks. Hammoudeh et al. (2013) examine the CDS spread indices for three financial-sectors, banking, financial services and insurance- in the short- and long-run and find the individual dynamic adjustments to the equilibrium to be different for those sectors.

To our knowledge, no published research has examined the CDS sector indices using the ARDL approach to figure out the relationship between the forcing variables in the four oil-related CDS sector indices and changes in the oil, equity and bond markets, equity VIX, oil VIX and default risk spread. The advantage of ARDL is that it allows one to define equations individually for all cointegrating vectors even if the variables have a mixed order of integration. Thus, the ARDL approach helps to define the forcing variables. The objective of this paper is to explore the lead/lag relationships between the risk and fundamental variables and examine risk migration between the market and credit risks in the oil-related sector CDS indices. We seek to fill the gap and complement the previous studies on sector CDS indices by focusing on the four oil-related sector CDS indices and their forcing variables, be they the fundamental variables or the market risk variables. These oil-related sectors are among the top S&P sectors.

The findings of our study underscore the relative importance of the CDS risks of the cyclical chemical and auto sectors over those of the utility and oil and natural gas production sectors. They also highlight the relative significance of the financial and oil fundamentals over the volatility market risk measures such as the equity VIX, oil VIX and default risk spreads.

This paper is organized as follows. Following this introduction, Sect. 2 presents the descriptive statistics of the series, and Sect. 3 gives a summary of the relevant literature. Section 4 discusses the methodology and the results, and Sect. 5 concludes.

2 Data and Descriptive Statistics

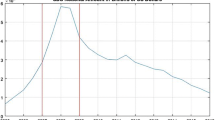

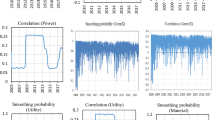

The data series include the closings for the CDS sector indices for the auto, chemical, oil and natural gas production and utility sectors, the 3-month West Texas Intermediate (WTI) crude oil futures price, the 10-year Treasury bond rate (DGS10), the default risk spread (DFR) and the measures of expected equity, and oil volatility indices, VIX and OVX respectively. The data on the four CDS series were obtained from DataStream, and on WTI were sourced from the database of Energy Information Administration (EIA). Moreover, the data on the default risk spread and the 10-year T bond rate were accessed from the database of the Federal Reserve Bank of Saint Louis, and on the S&P 500 VIX and the oil OVX were obtained from CBOE’s Market Statistics Summary Data. All variables are expressed in the logarithmic form. The four oil–related CDS indices, particularly the auto and chemical indices, register a jump around January 2009, displaying greater default fear near the end of 2008 and beginning of 2009 (Fig. 1). This default fear is also reflected in the S&P VIX and the oil VIX around that time. Correspondingly, there is a dip in the S&P 500 index and the WTI.

The expected market volatility indices are for the equity market (S&P VIX) and the oil market (oil VIX).Footnote 1 It’s worth noting that the series for the oil VIX started on May 10, 2007. We examine these series for the full period January 2, 2004 to July 13, 2011. Thus, the series do not include the oil VIX over the whole sample. However, the subperiod June 1, 2009 to July 13, 2011 spanning the recovery period after the 2008/2009 Great Recession includes the oil VIX. The dummy variables QE1 and QE2 represent quantitative easing for the second half of 2009 and first half of 2010, respectively.

CDS sector indices, which are based on the most liquid 5-year term, are equally weighted and reflect an average mid-spread calculation of the given index’s constituents. These proprietary indices are rebalanced every six months to better reflect liquidity in the CDS market. The identification of the CDS sector indices follows the DJ/FTSE Industry Classification Benchmark (ICB) supersectors as their basis and reflects the price performance of a basket of corporate 5-year CDSs within a given sector. As stated, the data for the CDS sector indices are available from 2004 only. The years 2004–2007 of the full sample for the CDS market were rapid growth years. However, the years 2008–2009 were troubling years for this market, which experienced fiscal stimulus packages and two monetary quantitative easings. The economic recovery years of 2009–2011 make up our subperiod.

As indicated above, the equity VIX is an index which measures expectations of volatility of the S&P 500 index and typically moves in an adverse direction to the latter. That is, an increase in equity VIX is associated with a decrease in the S&P 500 index to reflect fears in the equity market. VIX assembles risk information on events related to more than the stock market. In fact, the equity VIX increased by more than 30 % in the week following the major earthquake with a magnitude of 9.0 in Eastern Japan on March 11, 2011. This index has sentiment extremes where the range (30–32) signals excessive bearishness in the stock market that foreshadows bullish reversals, while (16–18) signals excessive bullishness that presages bearish reversals.

Oil VIX, ticker OVX, is the CBOE crude oil ETF volatility index which measures the market’s expectations of 30-day volatility of crude oil prices by applying the VIX methodology to the United States Oil Fund (USO) options spanning a wide range of strike prices. Its range since its inception on May 10, 2007 is 25.42–100.42. Unlike the S&P VIX, which typically rises when there is panic in the U.S. stock market and equity prices fall, the OVX goes up as oil prices, which incorporate a fear component, also increase. When there is uncertainty in the crude oil market, both oil prices and the OVX are more likely to rise in tandem because the tail risk is to the upside rather than the downside. Thus, the oil VIX is positively correlated with oil prices because higher risk levels will increase oil prices rather than discount them. There are those who believe that oil VIX can predict oil prices (Jagerson 2008).

Finally, the default risk spread is the difference between the corporate BAA bond rate and the 10-year Treasury bond rate, which measures the rises and falls in corporate credit risk in anticipation of recessions and booms, respectively.Footnote 2 A rise in the default risk spread presages a decline in economic activity and vice versa.

The descriptive statistics for the first logarithmic (L) differences of the series are presented in Table 1. The average percentage change over the sample period is the highest for the WTI futures price, followed by the CDS indices for the utility and oil/natural gas production sectors. It is negative for the 10-year Treasury bond rate (DGS10). In sum, the average return for the futures oil price is much higher than for any of the CDS sector indices.

The highest percentage change volatility as measured by the standard deviation is for the S&P VIX, followed by the 10-year Treasury bond rate (DGS10) over the full period. The lowest volatility is for the utility CDS index, followed by the WTI oil futures price. It is interesting to note that the volatilities for the S&P VIX, the 10-year Treasury rate, and the CDS indices of auto and chemicals in Table 1 are similar on the relatively high side, while those for CDS indices for utility, oil and gas production and the oil futures price are close on the low side. The volatility for oil VIX and default risk comes in the middle of the spectrum. In sum, the volatilities of the four oil-related CDS indices are dissimilar.

The series of the auto and chemicals CDS indices and the 10-year Treasury rates are skewed to the left over the full period, suggesting that the mass of the distributions for these three series is concentrated on the right of the figure, and have a few extremely low values in the distributions. This means the spreads for the returns of these series are bunched up on the high end of the spread scale. In comparison, the utility, oil and gas CDS indices, S&P VIX, oil VIX, and DFR are skewed to the right.

The kurtosis results indicate that the distributions of the series are more leptokurtic (peaked with fat tails) for the returns or first log differences over the full period. The Jarque-Bera statistics reject the null hypothesis of a normal distribution for all the series during the full period. This result is consistent with the statistics for skewness and kurtosis for most speculative assets.

The ADF and Phillips-Perron (PP) unit root tests for the intercept and the intercept plus trend were calculated for all variables over the full period and the subperiod. The unit root results are mixed for the subperiod, indicating that some variables are I(1) while others are I(0). A summary of these results is reported in Table 2 for the full period for both models. It can be contended that the VIX’s are implied option volatility indices, and thus are proxies for option prices. This explains why VIX has a unit root behavior. The same logic applies for the CDS indices. Due to limited space, the results for the subperiod are not presented but are available on request.

These results warrant the use of the ARDL approach. We also run the Johansen-Juselius cointegration technique for the model with the same order of integration.Footnote 3

3 Review of the Literature

Data series on the CDS sector index spreads start in 2004. Therefore, the literature on these credit risks is still quite sparse, particularly studies that examine the 2008 financial and 2010 sovereign debt crises. As indicated above, the available studies deal with financial sectors’ CDS indices (see Stanton and Wallace 2011; Hammoudeh et al. 2013, among others). Clearly, there is a substantial scope for contributions in this area, particularly on oil-related sector CDSs.

The recent CDS literature examines the difference between the spread in the cash/asset market and the CDS credit market, known as the “basis” (Das and Hanouna 2006). Longstaff et al. (2005) examine the basis using an approach that extracts the corporate bond-implied CDS spreads. When comparing it with the actual market CDS spreads, they find the corporate bond-implied CDS spreads to be higher.

Berndt et al. (2008) investigate the variations in the credit risk premium that comprises a major component of the CDS spread for three sectors, namely broadcasting and entertainment, health care, and oil and gas. They find striking differences in the spread variations between these sectors. Zhang et al. (2009) use an approach that identifies the volatility and jump risks of individual firms from high frequency stock prices to explain the CDS premium. Their empirical results suggest that the volatility risk alone predict 48 % of the variations in CDS spread levels, whereas the jump risk alone forecasts 19 %. After controlling for credit ratings, macroeconomic conditions, and firm balance sheet information, they predict 73 % of the total variations. Simulation results suggest that the high frequency-based volatility measures can help explain the credit spreads above and beyond what is already captured by the true leverage ratio.

Other studies have examined the relationships between the equity and credit markets using time series instead of cross section data, as in the cases discussed above. Bystrom (2006) examines the properties of the Dow Jones iTraxx index, which is an index of CDS securities on 12 European reference entities. He finds that the CDS spreads are significantly autocorrelated in the seven sectors comprising the iTraxx index, and are also significantly negatively related to the contemporaneous stock returns in all sectors, except for energy, consumers, and financials.

Fung et al. (2008) study the relationship between the stock market and high yield and investment grades and the CDS markets in the United States and find that the lead/lag relationship between them depends on the credit quality of the underlying reference entity. Forte and Lovreta (2008) examine the relationship between company-level CDS and stock market-implied credit spreads (ICS) in recent years. They find the relationship to be stronger, and the probability that the stock market leads in the price discovery to be higher at lower credit quality levels. However, the probability of CDS spreads leading in the price discovery rises with increases in the frequency of the severity of credit downturns.

Zhu (2006) discovers a long-run (cointegrating) relationship between credit risk in the corporate bond market and the CDS market, although a substantial deviation from the theoretical parity relationship can arise in the short-run. The VECM analysis suggests that the deviation is largely due to the higher responsiveness of CDS premia to changes in the credit conditions. Norden and Weber (2009) examine the relationships between CDS, bond and stock markets during the 2000–2002 period. They investigate monthly, weekly and daily lead-lag relationships using VAR/VEC models, and find that stock returns lead the CDS and bond spread changes. They also find that the CDS spread changes Granger-cause the bond spread changes for a higher number of firms than the reverse. They contend that the CDS market is more sensitive to the stock market than the bond market, and that this sensitivity increases for the lower credit quality. Finally, they find that the CDS market contributes more to price discovery than the bond market, with this result being stronger for the U.S. than for European firms.

On the informational content of VIX, Luo and Zhang (2010) extended this volatility index to other maturities and constructed daily VIX term structure data, proposing a simple two-factor stochastic volatility framework for VIX. Their results indicate that the framework captures both the time series dynamics of VIX and the rich cross-sectional shape of the term structure. Consistent with previous studies, it has been found that VIX contains more information than historical volatility.

Becker et al. (2009) examine two issues pertinent to the informational content of the VIX implied volatility index. One relates to whether it subsumes information on how historical jump activity contributed to the price volatility, and the other one relates to whether VIX reflects any incremental information pertaining to future jump activity relative to model-based forecasts. It is found that VIX both subsumes information linked to past jump contributions to total volatility and reflects incremental information relevant to future jumps.

In a related study, Figuerola-Ferretti and Paraskevopoulos (2010) consider the cointegration and the lead in the price discovery process between credit risk, as represented by CDS spreads, and market risk embedded in the equity VIX. They find that CDS and VIX are cointergated and that VIX has a clear lead over the CDS market in the price discovery process, implying that CDS adjusts to market risk when there is temporary mispricing from the long-run equilibrium. They find that there are long-term arbitrage relationships between VIX and CDS for most companies, implying that excess returns may be earned using “pairs trading” strategies.Footnote 4

Fernandes et al. (2009) examine the time series properties of daily equity VIX. Their results suggest that VIX display long-range dependence. They confirm the evidence in the literature that there is a strong negative relationship between VIX and S&P500 index returns, as well as a positive contemporaneous link with the volume of the S&P500 index. Moreover, they demonstrate that equity VIX tends to decline as the long-run oil price increases, reflecting the high demand from oil in recent years, as well as the recent trend of shorting energy prices in the hedge fund industry.

Gogineni (2010) examines the impact of changes in daily oil price on the equity returns of a wide array of industries. He finds that stock returns both of industries that depend heavily on oil and those that use little oil are sensitive to changes in oil price. The latter industries are impacted because their main customers are affected by oil prices. The results also demonstrate that the sensitivity of industries’ returns to the oil price changes depends on the cost-side as well as the demand-side dependence on oil.

In this study, we will examine the counterparty credit risks embedded in the oil-related sectors, and their relations to market risks including the expected option volatility in the stock (equity VIX), and oil (oil VIX) markets, when fundamental variables such as the S&P 500 index, WTI oil futures price and the 10-year Treasury bond rate are accounted for. This analysis will provide room to examine the migration of risks in the different sectors and markets. The near bankruptcy of GM attests to the importance of such a risk-related examination.

We will also study the dynamic dependent-forcing relationships between these markets in the recovery period that followed the 2008/2009 financial crisis. Thus, our approach contrasts with the previous literature, which focused on the firm level, by examining forcing-dependent variable relationships at the sector level. We will use the ARDL approach which has flexibility to the degree of integration of these highly mixed and diversified variables.

4 The ARDL Procedure and Results

Technically, the ARDL approach is a multiple step procedure (Pesaran and Pesaran 2009). In the first step, the bounds testing procedure is utilized to test the presence of cointegration among the variables to identify the long-run relationship(s) between a dependent variable and its forcing variables (independent variables). In the second step, the ARDL models are constructed based on the results obtained in the first step. The short-run dynamics are estimated in the third step. To use the bounds test procedure, we estimate the following regressions for the first model (Model 1) which consists of the four oil-related sectors CDS spreads, the S&P 500 index, the oil futures price, and the 10-year Treasury bond rate, as well as two dummies QE1 and QE2 representing quantitative easing over the full period.

The coefficients b, c, d, e, f, g and h are the short-run coefficients for the respective variables, while the λs are the long-run coefficients of the ARDL model. The null hypothesis of no cointegration is that λ 1j = λ 2j = λ 3j = λ 4j = λ 5j = λ 6j = λ 7j = 0, where j represents one of the seven variables. We will construct the second model (Model 2) by replacing LDGS10 and SPINDEX by LSPVIX and LDFR over the full sample and replacing LSPVIX with the oil VIX over the subsample.

To determine the appropriate lag length for the bounds testing procedure, we utilize various criteria with two dummy variables. The Final Prediction Error (FPE), Akaike Information Criterion (AIC), Schwarz Information Criterion (SIC), Hannan-Quinn Information Criterion (H-Q), and the Sequential Modified LR Test Statistic are the common criteria used to determine the lag lengths. These criteria yielded mixed results. We used the mostly suggested lags for the models. In the case of conflict, we utilized the lag length suggested by AIC due to the preservation of the degrees of freedom.

The results of the bounds testing procedure are estimated for the two models in the full period January 2, 2004 to July 13, 2011 and the 2009 recovery subperiod June 1, 2009 to July 13, 2011. Model 1, which is comprised of seven variables including the four oil-related credit risks and three fundamental variables, focuses on the dependent-forcing variable relationships for the oil-related CDS sector indices and the fundamentals: the 10-year Treasury bond rate, the oil futures price and the S&P 500 index. As indicated above, Model 2 concentrates on the oil credit risks’ relationships with the measures of market risks including the equity VIX, and the oil VIX as well as the default risk spread. The second model strives to examine the migration of risks between the oil credit risks and the market risks.

4.1 Model 1

4.1.1 Cointegration in Model 1

In Model 1 for the full period, there are five significant cointegration hypotheses for the dependent variables, suggesting the presence of five long-run relationships that bind the seven variables included in this model. The two important dependent variables that do not have a significant cointegration hypothesis are the CDS index for the oil and natural gas production sector, and the CDS index for the utility sector (see Table 3).

For the equation with the auto sector CDS index as the dependent variable, the cointegration hypothesis in this model is

F(LAUTCD t | LCHECD t , LOILCD t , LUTICD t , LDGS10 t , LWTI3M t , LSPINDEX t )

which yields significant F-statistics for all variables in the model, whether they are oil- related CDS indices, or the fundamental variables such as the 10-year Treasury bond rate, the oil price and the stock market. Based on Eq. (1), the most specific hypothesis is λ 1A = λ 2A = λ 3A = λ 4A = λ 5A = λ 6A = λ 7A = 0. Thus, the variable on the left-had side of “|” indicates the dependent variable, while those on the right-hand side are the potential forcing variables. This result indicates a long-run equilibrium relationship between the credit risk in the utility sector and the three other oil-related credit risks, the 10-year Treasury rate and the S&P500 index. All right-hand side variables are the forcing variables of the left-hand side auto sector CDS index. This finding demonstrates the degree of sensitivity of the auto credit risk to oil-related credit risks and oil/financial variables. The auto sector has forward and backward linkages with the rest of the economy and is highly sensitive to the business cycle.

The cointegration hypothesis for the equation with the chemical CDS as the dependent variable is

F(LCHECD t |LAUTCD t , LOILCD t , LUTICD t , LDGS10 t , LWTI3M t , LSPINDEX t ).

This hypothesis also attests that all other oil-related CDS indices and the fundamental variables are also forcing variables, as is the case with the auto CDS index. The chemical sector is cyclical and can be negatively related to oil which it uses as a feedstock.

When the dependent variable is the benchmark 10-year Treasury rate, the F-statistic for its cointegration hypothesis

F(LDGS10 t |LAUTCD t , LCHECD t , LOILCD t , LUTICD t , LWTI3M t , LSPINDEX t )

is also significant, underscoring the importance of the CDS, oil and stock market variables to this benchmark of the bond market. The same significant result holds for the oil and S&P 500 index equations.

However, no significant findings are reported for the equations of the CDS index for oil and gas and for utility. Parity between natural gas and oil prices has been weakening, particularly after the development of the technique that cracks gas shale, leading to the multiplication of natural gas reserves. The utility sector includes natural monopolies regulated by local authorities, which may have something to do with failing to have the other variables as its forcing variables.

4.1.2 Estimation of Long-Run and Short-Run Relationships in Model 1

The next step in the ARDL procedure is to estimate the coefficients of the long-run relationships using the following ARDL(x,y,z,l,m,n,s) models. The models are determined by the bounds testing procedure. The long-run relationships are given by:

where QE1 and QE2 stand for quantitative easing for the two six months: one in the second half of 2009, and the other for the first half of 2010, respectively. For the ARDL models, we use a maximum lag order of 4, which can be considered as sufficiently high, given the fact that we use daily data.

The long-run results for the auto sector CDS spread show a significant relationship with only the CDS risk for the chemical sector. An increase in the chemical market risk leads to a spike in the risk in the auto sectors (Table 4). This sector is highly dependent on oil as a feedstock and is cyclical. Therefore, the auto and the chemical sectors have a common factor, namely the business cycle. However, the CDS spreads of the oil and natural gas production and utility sectors have no significant influence on the auto CDS spread in the long-run. In terms of the fundamentals factors strength in both the oil and stock market gives rise to less credit risk in this sector. When commodity and stock markets are improving, there is less need for traders and investors to buy protection against credit risk.

The short-run error-correction representation for the auto CDS spread shows more significant relationships than in the long-run. There are significant relationships with CDS spreads of the chemical, oil and natural gas production and utility sectors. Thus, in this representation there is a migration of credit risk from other oil-related sectors to the auto sector. There are also significant relationships with the three fundamental variables—the oil futures price, the S&P 500 index and the 10-year Treasury bond rate. These relationships are negative, suggesting that when the business cycles strengthen, the CDS spread drop in the auto sector. In this framework, neither QE1 nor QE2 has an impact on increasing the auto CDS spread in the short-run (Table 5).

The behavior of the chemical sector’s CDS spread is somewhat different from that of the auto sector in the short- and long-run. The results show that the CDS credit risk migrates from both the auto and oil and natural gas production sectors to the chemical sector in the long-run. As in the auto CDS framework, there is no significant directional relationship between the chemical CDS spread and the risk-free 10 year Treasury bond market in the chemical CDS framework. Interestingly, the chemical CDS spread is positively sensitive to QE1, which is not the case for the auto CDS spread.

In the short-run, all sector CDS spreads and fundamental variables have an influence over the chemical CDS spread. The financial fundamental factors (excluding the oil price) have an inverse directional relationship with the chemical CS spread. On the other hand, surges in the oil price lead to significant increases in the chemical CDS spread, and this is clearer than in the case of the auto CDS spread. Rises in the CDS spreads of all sectors also increase the CDS spread in the chemical sector.

In the long-run, the relationships between the oil price and the credit risks and the fundamental variables are less potent than in the short-run. In the long-run, the CDS spreads for the chemical, auto and utility sectors have differential impacts on the oil futures prices, with the auto and utility sector having a positive impact while the chemical having a negative relationship. This is somewhat surprising because auto and chemical sectors are cyclical while the utility sector is defensive. The fundamental variables also have varying impacts, with the S&P 500 index sharing a common business cycle with the “financialized” oil while the 10-year bond rate moves counter cyclically with the oil price.

For oil in the short-run over the full sample, rises in the CDS risk spread for the chemical and auto sectors cause the oil futures price to increase. The auto and chemical sectors use oil as a feedstock and are also highly cyclical, which may imply that during the expanding phase of the business cycle these sectors experience an increase in their risk protection in the form of higher option prices. The oil price includes a fear premium component, which possibly picks up spikes in fears in those cyclical oil-related sectors. On the other hand, increases in the CDS risks for the utility sector have mixed effects on oil futures, increasing the oil futures in the current period and reducing it in the previous period. As indicated previously, this differential cycling impact is probably linked to the nature of the utility sector, which is regulated by state governments and is considered a defensive sector at times of recessions.

When it comes to the financial fundamentals and the oil price in the long-run, there is a common factor that commoves the oil futures price with those variables, namely the strength of the business cycle and the overall economy. The result is also consistent with the notion of the “financialization” of oil. This finding should explain the positive relationship between the S&P500 index and the 10-year bond rate and the oil price.

As expected, the S&P 500 index as a dependent variable has fewer directional relationships with the oil-related CDS spreads and the fundamental variables in the long-run over the full sample. Increases in the auto and utility CDS spreads move this major stock index negatively, with the CDS spread of the other two sectors having no effects. This is due to the non-oil- related sectors that are included in the index. Among the fundamental variables, only the oil price positively co-moves the stock index. Interestingly, QE2 but not QE1 adds to the spike in the level of the S&P 500 index in this sector CDS framework.

In the short run, similarly to the oil price, the S&P 500 index has many directional relationships with the oil-related sector CDSs and the fundamental variables. In terms of the relationships with the sector CDS indices, increases in the credit risk spread of the chemical, auto and utility sectors reduce the S&P 500 index as more traders and investors purchase options to hedge against the rising credit risk in these oil-sensitive sectors. On the other hand, rising risk in the oil and natural gas production sector leads to a higher S&P 500 index. As for the short-run links with the fundamentals, this stock index responds positively to both the oil price and the 10-year Treasury bond rate. Thus, the relationship between the S&P 500 index and the oil price is positive and bidirectional. As in the long run, QE2 and not QE1 adds to increases in the stock index. Among the other fundamentals, only the S&P 500 index is significant in influencing the long-run interest rate benchmark and the relationship is negative, suggesting that a rising stock market index in this framework imply a lower 10-year bond rate.

The risk-free 10-year Treasury bond rate has a greater directional relationship with the sector CDS spreads and the other fundamental factors than the oil price and the S&P 500 index. In the long-run, this benchmark has a positive directional relationship with only the CDS risk in the oil and natural production sector. The unilateral causal relationship may reflect changes in the credit risk in the oil sector on inflationary expectations which also capture another measure of risk.

In the short run, the risk-free interest rate has fewer relations than the oil price and the stock index. Spikes in the chemical and delayed auto CDS spreads lead to a higher Treasury bond rate. On the other hand, increases in risk spreads in the utility and oil production and gas sector dampen the risk-free interest rate benchmark.

4.1.3 The Recovery Subperiod for Model 1

Model 1 is also estimated for the recovery subperiod which spans the period June 1, 2009 to July 13, 2011. There are five cointegration hypotheses for the dependent variables that are significant in Model 1 as in the previous model but the dependent variables that are significant have changed somewhat (see Table 6). In this model, the hypothesis for the utility CDS index becomes significant, while that for the S&P 500 index loses its significance. However, the CDS for oil and natural gas production remains exogenous in both periods for Model 1.

In the long-run relationship for the auto CDS spread, the significance of the variables has changed somewhat in the subperiod. The chemical CDS spread remains a significant forcing variable for the auto CDS spread (Table 7). But unlike the case of the full period, in the subperiod the CDS spread for the oil and natural gas production has become significant as a forcing variable for the auto CDS spread, while the oil price becomes insignificant. This is probably a sign of an increase in the long-run credit risk. The stock market also remains a significant forcing variable. In the short-run error correction representation, the dependent-forcing variable relations for the auto CDS spread basically remain the same. A notable difference is the change in the role of the oil and natural gas production CDS from a credit risk-elevation forcing variable in the full period to a dampening forcing variable in the subperiod. The oil price has also become a risk dampening risk forcing variable under the subperiod probably because of its steep decline as a result of the Great Recession.

The long-run relationship for the chemical CDS spread has weakened in the subperiod. Only the S&P 500 index is the significant forcing variable and has a cooling effect on the chemical CDS in this subperiod. Whereas the current effect elevates the credit risk, the delayed effect is risk-cooling (Table 8). Among the fundamentals, only the S&P 500 index maintains a consistent risk-dampening effect on the chemical CDS.

There is no long-run equation for the utility CDS spread in the full period. In the subperiod, the CDS spreads of both oil and natural gas production are risk-elevating forcing variables for the utility CDS spread. The only fundamental variables forcing the utility CDS spread is the 10-year Treasury bond rate, causing dampening of this spread. In the short-run error correcting representation, the utility CDS spread has multiple relationships in the subperiod. All the CDS spreads for all the sectors as well as the three fundamentals influence the utility CDS spread.

Finally, in this subperiod all three financial and oil fundamentals have fewer long- and short-run representations whether in terms of the other sectors’ CDS spreads or the other fundamentals. This could be due to the persistently high uncertainty in the markets.

4.2 Model 2

While this model has seven variables as in Model 1, the two financial fundamental variables in the previous model, specifically the S&P 500 index and the 10-year Treasury bond rate, are replaced with two measures of market and credit risks, namely the S&P VIX index and the default risk spread. Thus, the aim of this model is to examine the spillovers among the CDS credit risks for the four oil-related sectors and with the market risks of the stock and bond markets. The default risk spread is a much better measure of credit risk than the Merrill Lynch option volatility estimate (MOVE), which interrelates little with market and credit risks other than the S&P VIX. As in the previous model, we will examine the results for the full period and the subperiod in Model 2.

4.2.1 Cointegration in Model 2

This model has four cointegration relationships, compared to five in the previous model (Table 9). This suggests that replacing the financial variables with two market risk variables in Model 2 reduces the long-run relationships with the CDS credit risks of the four oil-related sectors. The significant cointegration hypotheses are found for the CDS indices of the auto and chemical sectors, the S&P VIX and the default risk variables. In the model, the CDSs of the utility sector and the oil and natural gas production are not significant like in the previous model. For the equation with the auto sector CDS index as the dependent variable, the cointegration hypothesis in this model is:

F(LAUTCD t | LCHECD t , LOILCD t , LUTICD t , LSPVIX t , LWTI3M t , LDFR t ).

The other three cointegration hypotheses for the dependent variables LCHECD t, LSPVIX t and LDFR t in the model are similar to the above cointegration hypothesis but alternate their dependent variables. The S&P VIX detects fears in all markets, while the default risk spread presages changes in economic activity where it spikes if it predicts a recession and dips if it forecasts a boom.

4.2.2 Estimation of Long-Run and Short-Run Relationships in Model 2

The next step in the ARDL procedure is to estimate the coefficients of the long-run relationship using the ARDL(x,y,z,l,m,n,s) specifications for Model 2. This model is determined by the bounds testing procedure. The long-run results for the dependent variable, the auto CDS, indicate significant relationships with both the CDS risks for the chemical and oil and natural sectors as well as with the oil price and the default risk spread (Table 10). Surprisingly, the auto CDS has no long-run directional relationship with the S&P VIX.

The short-run error-correction representation for the auto CDS spread in Model 2 shows fewer significant relationships than Model 1. There are significant relationships with the other three CDS spreads, the S&P VIX and the default risk spread in the short-run (Table 11). Thus, there is a migration of market risk to the auto credit risk in this equation. In this framework, as in Model 1, neither QE1 nor QE2 has an impact on increasing the auto CDS spread in the short-run.

The chemical CDS credit risk has no long-run relations with the other sectors’ CDSs, VIX or default risk in this model. This is surprising given the similarity between the oil and chemical sectors. But in the short-run, the chemical CDS has a dependence relationship with the oil and natural gas production, utility CDSs and the oil price but not with the S&P VIX or the default risk spread in Model 2. There is no migration from the market risks to the credit risk in the chemical sector.

The estimate of the long-run relationship for the S&P VIX index has four long-run forcing variables, including specifically the CDS of the oil and natural gas production and the default risk spread as well as QE2. Thus, in this framework there is a spillover from the oil and natural gas credit risk to the market risk S&P VIX, and a market to market risk migration between the VIX and the default risk spread. In the short-run, the S&P VIX has more significant relationships with the credit and market risks than in the long-run, including relationships with the utility and oil and natural gas CDSs, the default risk spread and QE2.

Finally, the long-run and short-run results for the dependent variable default risk spread indicate that there is a directional relationship between this market risk and its forcing variables the S&P VIX, and also with the oil and gas production CDS, and QE1. In the short-run, there is a relationship with the CDSs of the chemical, oil and gas production sectors, the oil price and QE1.

4.2.3 The Recovery Subperiod for Model 2

The S&P VIX in Model 2 of the full period is replaced in this subperiod with the oil VIX which has available data from May 17, 2007. The purpose of modeling this subperiod is to understand the directional relationships between the oil VIX and the oil-related sector CDSs which should focus on credit and market migration and cascading with the oil-related sectors. The sample size is dictated by the length of the oil VIX series which influenced the estimation in this subperiod.

Model 2 has one cointegrating hypothesis for this subperiod, compared to five for Model 1 over the recovery subperiod (Table 12). In this subperiod, there is no long-run relationship between these market risks and credit risks in the oil related sectors (Table 13).

In the short-run, the dependent variable default spread risk, has four forcing variables: Oil VIX, chemical CDS and auto CDS (Table 14).

5 Conclusions

Given the pivotal role that the oil price plays in the economy and financial markets and the rising risk and uncertainty, this study analyzes primarily the dependent-forcing variable relationships for the insurance protections for four oil-related sectors- auto, chemical, oil and natural gas production, and utility, as well as their relations with the other risk and fundamental variables. The oil-related sectors are considered among the largest S&P sectors. The first two sectors are highly cyclical and follow the business cycle, while the last sector is defensive and could fare better even during a contractionay phase of the business cycle. Buyers of debt protection pay a premium or a spread which increases during periods of high risk.

This study examines migration and cascading of credit risks among those sectors, while controlling for the oil and financial fundamentals and market risks. It also examines the 2009/2010 impact of quantitative easing on market and CDS credit risks. The analysis is performed within the framework of two models estimated over the full sample period and a subperiod that spans the 2009 recovery following the 2007/2008 recession. Model 1 examines the relationships for the four oil-related credit risks, given the presence of three fundamental variables: the WTI oil futures price, the 10-year Treasury bond rate and the S&P 500 index. Model 2 examines the four oil-related credit risks and controls for two market risks represented by the S&P VIX and the default risk spread. Moreover, in this model the S&P VIX of the full sample is replaced with the oil VIX in the 2009 recovery subperiod due to the availability of data in May 2007.

The main finding of the study indicates that replacing the two financial fundamental variables with the two market risks reduces the long- and short-run risk migration and cascading in the second model relative to the first model in both the full sample and the subperiod. This finding underscores the importance of including fundamental variables when are modelling and examining credit risks that also reflect risk. The oil price has more and varying credit risk spillover effects in the short-run than in the long-run; it has a dampening effect on the auto CDS spread and a heightening effect on the chemical CDS spread. A surging10-year Treasury bond rate has a dampening effect in the short-run, suggesting that the position of monetary policy matters for oil-related CDS risks. The S&P 500 index moves in the opposite direction to those CDS risks, benefiting from greater liquidity.

Among the two market risk variables, the default risk spread which foreshadows changes in economic activity has a stronger lead/lag relationship with the other types of the credit and market risks than the S&P VIX index which gauges fears in the overall economy. When the S&P VIX is replaced with the oil VIX in the subperiod of Model 2, the directional relations weaken significantly, abating the migration and cascading of different risks among the risk variables.

The long- and short-run relationships among the oil-related credit risks and with the other variables are more diverse. The cyclical chemical and auto CDS spreads are the most responsive of these sector CDS and the oil and natural gas production and utility CDS spreads are least responsive.

The recent quantitative easing QE1 and QE2 has limited impact affecting mainly the financial variables. In Model 1, the impact is on the chemical CDS and the S&P 500 index, while in Model 2 it affects the S&P VIX and the default risk spread. Therefore, QE does not seem to contribute considerably to the oil-related credit risks.

Notes

- 1.

Each volatility index series has a given number of reference entities at a fixed coupon. The coupon is determined prior to the onset of each index series, and is the current spread of the underlying reference entities that equate the value of the index to par value (100 %) at the time of calculation. The levels of the indices are calculated at the end of each business day at around 5:15 pm.

- 2.

The BAA rate has more default risk than AAA which is almost close to zero default.

- 3.

We will not report the results for the Johansen-Juselius approach due to the lack of space. Those results are available from the authors.

- 4.

The pairs trade or pair trading is a market neutral trading strategy which enables traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. One pairs trade would be to short the outperforming asset and to long the underperforming one, betting that the “spread” between the two assets would eventually converge.

References

Becker R, Clements AE, McClelland A (2009) The jump component of S&P 500 volatility and the VIX index. J Banking Finan 33(6):1033–1038

Berndt A, Douglas R, Duffie D, Ferguson M, Schranz D (2008) Measuring default risk premium from default swap rates and EDFs. Working paper 173, bank of international settlements. http://www.andrew.cmu.edu/user/aberndt/Beetal08.pdf. Accessed 25 April 2011

Bystrom H (2006) Credit default swaps and equity prices: the iTraxx CDS index market. Finan Anal J 62:65–76

Das SR, Hanouna P (2006) Credit default swap spreads. J investment Manag 4:93–105

Fernandes M, Medeiros MC, Scharth M (2009) Modeling and predicting the CBOE market volatility index. http://webspace.qmul.ac.uk/mfernandes/Papers/Vix.pdf

Figuerola-Ferretti I, Paraskevopoulos I (2010) Pairing market with credit risk. http://ssrn.com/abstract=1553863

Forte S, Lovreta L (2008) Credit risk discovery in the stock and CDS markets: who, when and why leads. http://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2008-athens/Lovreta.pdf

Fung HG, Sierra GE, Yau J, Zhang G (2008) Are the U.S. stock market and credit default swap market related? Evidence from the CDX indices. J Altern Invest 11:43–61

Gogineni S (2010) Oil and stock market: an industry level analysis. Finan Rev 45(4):891–1123

Greatrex C (2008) The credit default swap market’s determinants, efficiency and relationship to the stock market. ETD collection for Fordham University. Paper AAI3301438. http://fordham.bepress.com/dissertations/AAI3301438

Hammoudeh S, Nandha M, Yuan Y (2013) Dynamics of CDS spread indices of US financial sectors. Appl Econom 45:213–223

Hammoudeh S, Sari R (2011) Financial CDS, stock market and interest rates: which determine which? North Am J Econom Finan 22(3):257–276

Jagerson J (2008) Using the oil VIX (OVX) to forecast energy prices. http://www.learningmarkets.com/using-the-oil-vix-ovx-to-forecast-energy-prices/. Accessed 3 Oct 2011

Longstaff F, Mithal S, Neis E (2005) Corporate yield spreads: default risk or liquidity? New evidence from the credit default swaps market. J Finan 60:2213–2253

Luo X, Zhang JE (2010) The term structure of VIX. http://hdl.handle.net/10722/127838

Norden L, Weber M (2009) The co-movement of credit default swap, bond and stock markets: an empirical analysis. Eur Finan Manag 15:529–562

Norden L, Weber M (2004) Informational efficiency of credit default swaps and stock market. J Bank Finan 28:2813–2843. Also available as discussion paper DP 4250, Center for Economic Policy Research. London, United Kingdom. www.cepr.org/pubs/dps/DP4250.asp

Pesaran MH, Pesaran B (2009) Time series econometrics using Microfit 5.0. Oxford University Press, New York

Raunig B, Scheicher M (2009) Are the banks different? Evidence from CDS market, working paper 152, Oesterreichische National Bank. https://www.bis.org/bcbs/events/cbrworkshop09/raunigscheicher.pdf. Accessed 2 Oct 2011

Stanton R, Wallace N (2011) The Bear’s lair: index credit default swaps and the subprime mortgage crisis. https://fisher.osu.edu/blogs/efa2011/files/REF_2_2.pdf. Accessed 2 Oct 2011

Zhang B, Zhou H, Zhu H (2009) Explaining credit default swap spreads with the equity volatility and jump risks of individual firms. Rev Finan Stud 22(12):5099–5131

Zhu H (2006) An empirical comparison of credit spreads between the bond market and the credit default swap market. J Finan Serv Res 29:211–235

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Hammoudeh, S., Sari, R. (2014). Forcing Variables in the Dynamics of Risk Spillovers in Oil-Related CDS Sectors, Equity, Bond and Oil Markets and Volatility Market Risks. In: Ramos, S., Veiga, H. (eds) The Interrelationship Between Financial and Energy Markets. Lecture Notes in Energy, vol 54. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-55382-0_5

Download citation

DOI: https://doi.org/10.1007/978-3-642-55382-0_5

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-55381-3

Online ISBN: 978-3-642-55382-0

eBook Packages: EnergyEnergy (R0)