Abstract

Feed-in tariffs have been the key support system for electricity from renewable sources in Spain and other European countries. However, given the growing criticism of this incentive scheme mainly due to its financial burden, the Spanish government has recently cancelled subsidies for any new electricity from renewable sources (RD-l 1/2012 2012). Since tariffs do not benefit from market signals, subsidies to some technologies may be either too high or too low to attain the regulator’s objectives. Existing literature on tradable green certificates suggests that a switch to a green certificates setup could be an efficient solution when substantial investments in renewable energy are already in place and technologies are at a mature stage. This chapter analyzes the implementation of a green certificates scheme as an instrument to foster renewables. We solve a sequential game where we analyze the interaction between the electricity pool and the tradable green certificates market. We focus on the retailer regulation design that would give lead to a decreasing green certificates demand and simulate the effect of such regulation on the price of certificates.

We would like to thank the Ministry for Science and Innovation (ECO2012-35820), the Basque Government (DEUI, IT-IT783-13) and UPV/EHU (UFI 11/46 BETS) for financial support. Cristina Pizarro-Irizar also thanks the financial support from a predoctorate grant from the Basque Government (BFI-2011-301).

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

New or emerging electricity from renewable sources (RES-E) is not profitable in a free market, due to relatively high production costs, and support instruments are hence introduced to help the penetration of renewable technologies (Menanteau et al. 2003). This promotion seeks to improve market efficiency, internalize external costs, accelerate investments in research and provide temporary incentives for early market development as such new technologies approach commercial readiness (Sims et al. 2003). Additionally, RES-E support systems increase the amount of RES-E produced through the merit order effect, since electricity production from conventional fossil-fuel sources (marginal plants) is then substituted by RES-E and the wholesale price of electricity drops.Footnote 1 However, the net effect on the consumer price level will depend on the way in which the RES-E support system is financed (Rathman 2007). The burden of RES-E deployment usually rests on final consumers and the choice of the promotion instrument and how it is implemented is crucial (Haas et al. 2011).

In this sense, RES-E has been promoted in some countries through feed-in tariff (FIT) schemes, or its variant feed-in premium (FIP). Under this system RES-E producers may sell their entire output at a guaranteed price that is set above the wholesale market clearing price. This higher price allows the generators of some renewable sources of energy to cover the higher costs of this type of energy and stay in the market.

A different way of promoting green sources of energy is the creation of tradable green certificate (TGC) markets. The regulator may create a demand for the renewable energy through the distributors’ obligation to meet a specified share of green energy. Green certificates, which are also referred to as renewable energy certificates (REC), tradable REC (T-REC), tradable renewable certificates or credits (TRC), renewable portfolio standards (RPS), green tickets or green tags, rely on market mechanisms for resource allocation. These markets aim at the promotion of green energy sources through the separation of electricity as a commodity (traded in the wholesale market) from the ecological attributes of electricity (avoiding CO2 emissions, etc.), which are traded as a different product on the green certificate market. Indeed, both markets are separated but there are strong interactions between the determination of the price of the certificate, the price of the electricity and the role of regulation (Jensen and Skytte 2002).

Comparing both systems in Europe, the FIT approach (price-based mechanism) is generally more popular than the TGC approach (quantity-based mechanism), as it guarantees the price and removes the risk from investors in renewable generation; whereas the TGC scheme may involve higher uncertainties, due to market outcomes, and investors consequently require higher payments (Neuhoff 2005). This conclusion may partly rest on the European experience, where FIT regimes in Germany or Spain outperformed the TGC scheme in other countries, such as the United Kingdom (Buttler and Neuhoff 2008). However, it is argued that FIT may serve mainly to shift the risk to other agents (i.e. consumers) but does not reduce it to society as a whole. Moreover, the problem with FIT is the need to set the tariff at an appropriate level, risking that it may be too high, creating excessive rents for some generators, or too low, restricting investment (Green and Vasilakos 2011). In fact, as has been seen, regulatory uncertainty is one of the main problems of the FIT system.

Although a TGC system provides less market certainty than price-based mechanisms, price fluctuations and market dynamics can be partly influenced by the design of the regime (Gan et al. 2005). Another source of evidence in favor of TGC is effectiveness in the achievement of the goal to secure a certain share of renewables in electricity consumption (Bye 2003). It is expected that competition between producers and increasing supply of green certificates will lead to a decline in the price of electricity from renewable sources, so in this respect, the green certificate system is considered as a cost effective way to meet the renewable energy target (Schaeffer et al. 1999). One more argument in favor of a TGC market is the issue of equity, i.e. the fairness of the distribution of costs and benefit between different actor groups (Bergek and Jacobsson 2010). The market decides the level of support given to renewable electricity production, so apart from guaranteeing the production of a certain quantity of RES-E, green certificates are added to the revenue that the producer can get for the electricity itself. Additionally, the introduction of market forces on the ‘non-electricity’ attributes of energy is supposed to bring about greater efficiency. The transition to market based solutions leads to effective competition between different forms of power from renewable energy sources, since producers must try to benefit from technical progress due to the pressures of bidding processes in the certificates market (Menanteau et al. 2003).

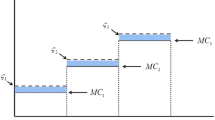

At present there is no general agreement on the appropriateness of the different schemes. Existing literature supports that the type of allowance given to each renewable technology must be adapted according to their stages of maturity (Christiansen 2001; Meyer 2003; Jacobsson and Lauber 2006). Technological maturity is closely related to the cost per MWh of each technology. In this sense, three main categories may be distinguished according to their merit order (Jensen 2003):

-

Cost-competitive technologies. These technologies are not eligible for policy support, since their production cost is similar to (or even lower than) conventional sources. This category includes large hydro.

-

Moderately non-competitive technologies. These technologies are to be complemented with a relatively modest support system. The production cost of RES-E included in this category is higher than the cost of electricity generated by some conventional sources. Such technologies may include small hydropower, some biomass-based technologies and onshore wind power.

-

Non-competitive technologies. Those technologies that are still far from being market-ready, but have the potential to join the first category in the longer term, should be supported by incentive schemes. These technologies would not survive without incentives, since the investment in R&D needed to make them competitive would never take place. Expensive technologies and technologies in the technical development phase, such as solar-photovoltaic or offshore wind power technologies, are included in this category.

When designing appropriate renewable energy support frameworks, one of the main criticisms of TGC markets concerns the competition between renewable technologies at different stages of development. On the one hand, if the certificate price corresponds to the most expensive renewable technology included in the system, all technologies with lower costs would receive an extra profit (Verbruggen 2004) and the promotion of the total renewable portfolio would be more expensive than necessary. On the other hand, if the certificate price corresponds to the moderately non-competitive technologies, one possible solution is to reserve the green market for the most mature renewable technologies (Meyer 2003); and so, photovoltaics being at an early stage could benefit from a FIT approach, while wind or biomass would be ready for competition in a TGC market (Midttun and Gautesen 2007). Moreover, instead of FIT, additional investment subsidies for solar power could be available, improving the economic incentives for investments in solar electricity.

In this chapter, we therefore suggest that, since many renewable technologies are nowadays at a quite mature stage (moderately non-competitive technologies, e.g. wind, biomass or small hydro), green certificates could work properly as a promotion instrument in a country such as Spain. Additionally, the European Commission considers the model of green certificates as the preferable candidate for a European common support scheme for renewable energy (Ringel 2006). The Commission also claims that the existing promotion framework should be improved in order to reach the target of a 20 % share of renewables in the EU’s total energy consumption by 2020 at the lowest possible cost (European Commission 2011). Moreover, some authors claim that allowing for EU-wide trade in green certificates can ensure a cost-effective distribution of renewable energy production (it cuts the overall cost of achieving the EU’s renewable target by almost 70 %), but differentiated renewable targets across countries reduce the cost-effectiveness of the TGC system as national targets prevent a cost-effective distribution of energy (Aune et al. 2012). We therefore examine, both theoretically and empirically, using actual data of the Spanish electricity market, the feasibility of a TGC market in Spain and conclude that it may help to reduce the financial burden derived from the FIT-FIP system.

Regarding the instruments for the promotion of RES-E, price-driven instruments (i.e. FIT) are designed to support the costs of electricity production, whereas quantity-driven instruments (i.e. TGC) fix a capacity target to be met. Generally, those instruments are implemented separately, but there are three cases in which the combination of them could be relevant for the promotion of RES-E (Schaeffer et al. 1999):

-

During the transition phase from one instrument to another.

-

When a country with a certain promotion scheme decides to allow producers to take part in a trading system with other countries, where another promotion scheme is implemented.

-

In order to compensate for the disadvantages of one instrument, a permanent combination of instruments could be useful.

In the first case, a gradual introduction of the TGC market should be applied and transition schemes for existing plants should be established to ensure that the new investors have stable economic conditions until the market is fully functional. Regarding the second case, international trade with certificates can exploit comparative resource advantages and lower costs, as long as common rules for the trade of certificates and the period of validity are implemented. In the latter case, combining two different instruments may help to offset some of the disadvantages of each instrument. For instance, the market-based nature of TGC helps to reduce the regulatory uncertainties of the FIT scheme, but at the same time, non-competitive technologies might not be ready for a TGC system, so they would need a FIT to survive.

The chapter is structured as follows. Section 2 develops a theoretical model to analyze the interaction between the electricity pool and the TGC market. Simulations and results for the Spanish electricity market are presented in Sect. 3. Finally, Sect. 4 summarizes the main conclusions of this work.

2 The Model

In this section, we set up a model for the certificates market, the electricity market and the interaction between them. Electricity considered as a commodity is a homogenous good, independently of the energy source, and it is sold as such in a liberalized physical electricity market. The eco-services provided by some sources of energy are sold separately on the green certificates market. The ecological impact of different renewable energy sources may be different, along with the cost associated to the electricity system management. However, we assume here for simplicity that the ecological services of the renewable sources of energy are also a homogeneous good, ignoring for example differences between hydro and wind sources of energy.

We present a two-stage model under autarky (we consider a one country closed-economy without international trading) and we assume that both markets work under perfect competition. The game takes place in two stages:

-

Stage 1: Electricity generators take supply decisions at the pool, retailers take demand decisions and the wholesale market clears. Generators are awarded certificates depending on their green production.

-

Stage 2: Generators decide how many green certificates to sell. Retailers buy certificates to fulfill their obligations. The market for certificates clears.

Here it is assumed that the TGC are issued at the end of stage 1 to be sold at stage 2. We solve the game using backwards induction, i.e. we solve first the market for certificates (stage 2). We assume that each generator produces both renewable and non-renewable electricity and that each producer is endowed a certain amount of TGC depending on the clean electricity delivered to the network. We assume a one-to-one link between the number of green certificates endowed and the number of MWh produced by renewable technologies (i.e. 1 MWh = 1 TGC). Those TGC are assumed to have a regulator’s defined life of one periodFootnote 2 so banking is not allowed in our model and unused certificates are withdrawn from the market when the period expires.

With regard to the technology mix of RES-E, some authors are in favor of a technology neutral design in order to promote competition between the certificate-eligible technologies, so that the market decides which technologies are preferable to achieve the target, which encourages a cost-efficient deployment of renewable energy sources (Nilsson and Sundqvist 2007). On the contrary, other authors (Schmalensee 2011) suggest that technology-specific multipliers could be used to penalize some intermittent technologies, such as wind, for the costs they impose on the electric power system or even to reward some technologies because of the perceived external effect of induced learning-by-doing if their production is increased, such as biomass. For the sake of simplicity, we consider the technology neutral design and we treat all renewables as a whole in our analysis.

All things considered, there are three main actors in our model: the regulator, retailers (demand side), and generators (supply side); and two interacting markets. We do not consider any uncertainty for the sake of simplicity. Since retailers and generators behave competitively in both markets, they are unable to affect the price of electricity.

The notation used in the model is compiled in Table 1.

2.1 The Tradable Green Certificates Market

2.1.1 Regulation in the TGC Market

The market for TGC should be regulated due to information asymmetries: the energy attribute being sold in this market is not observable for the end-use consumer. The regulator therefore needs to certify the resources used in the energy production process and to assign the property rights of a TGC for each MWh produced by a generator (for example, issuing a certificate with a serial number). These certificates can then be marketed and their sale and use should be closely monitored.

Certificates are generally issued by government decision. This obligation could be transferred to the supply side (e.g. Italy) or to the demand side (e.g. retailers in the UK or end-users in Sweden). Our model considers that the obligation to buy TGC is set on retailers (calculated on the basis of the desired share of renewable consumption), in order to avoid the free-riding problem due to the public-good nature of the ecological benefit of green electricity (Menanteau et al. 2003). Relying renewable electricity demand on consumer choice has also been proposed as an alternative to obligatory schemes, but this option seems to have little impact on the deployment of renewable energy technologies (EWEA 2004), since most consumers prefer renewable energy but are not willing to purchase it at higher prices (Rader and Norgaard 1996). Moreover, we would expect the demand coming from end-use consumers to be so low that the equilibrium price would not reflect the social value of the ecological benefit of green energy. Thus, a mandatory quota of TGC for retailers may solve this market failure.

Clear consistent government policy is thus needed to set a stable green certificate system (Schaeffer et al. 1999). In order to protect both TGC producers and consumers, minimum and maximum prices could be established. Minimum values are secured when the government itself also acts as a buyer of green certificates (e.g. the Walloon region in Belgium), whereas maximum values are set through a penalty system for non-compliance. The role of policy makers in our TGC model lies in the establishing of (i) the amount of certificates that each green producer receives in relation to the proportion of green electricity produced (here one-to-one relationship), (ii) the retailers’ obligation to purchase a minimum number of TGC (quota α) and (iii) the payment penalty if retailers do not meet their obligation.

2.1.2 The Role of Retailers in the TGC Market

Two parties are involved on the demand side: the end-users of electricity and the retailers. Retailers get their margins from buying wholesale and selling to end-users. We model demand for TGC as reflecting the retailer’s obligation to pay for the environmental attributes of energy, which are related to the way it has been produced. Regulation may establish the obligation for retailers to meet some renewable energy requirements, and these obligations determine the demand on the TGC market. Each retailer must buy a fraction of total consumption.

In our analysis, electricity retailers have an incentive to buy certificates from the producers, because penalties are set if they are not able to meet their obligation. Retailers must pay a non-compliance fine depending on the number of certificates not bought. Our analysis models the penalty as a linear-quadratic loss function that leads to a decreasing demand for TGC. Therefore, the demand function has a price-cap, since no retailer would demand green certificates at a higher price than the penalty incurred for non compliance. Retailers not complying with the target would pay depending on the number of certificates not acquired. Retailers buying more than the target would neither pay for it nor receive any reward for the extra certificates acquired. The penalty function for a retailer is then given by:

where \( f > 0 \) and \( - \frac{1}{2} < d \le 0 \) are the parameters of the penalty function, x is the retailers’ obligation to purchase TGC and \( x_{R} \) is the amount of TGC bought by the retailer.

By allowing retailers to choose the amount of TGC they want to buy in the market, we give an active role to demand. The elasticity of the demand for certificates will depend on the obligation x and the parameters of the penalty function, f and d. If we set \( f = 0 \), there would be no penalty in case the obligation to purchase certificates is not met. Retailers decide \( x_{R} \) in the second stage and the number of TGC traded is determined endogenously. Thus, the optimization problem for retailers is defined as follows:

where \( q_{R} \) is the total amount of electricity bought by one retailer, s is the price to the end-users of electricity, \( p_{e} \) is the price of electricity at the pool and \( p_{c} \) is the certificate price at the TGC market.

Since the retailer’s obligation to acquire TGC depends on the demand for electricity in the previous period and the government target, the relation \( x = \alpha q_{R} \) holds, where α is the quota of renewable electricity imposed by policy makers and \( 0 \le \alpha \le 1 \). Hence, the optimization problem is equivalent to the following one:

Notice that the price s that end-consumers pay is perceived by the retailer as given. Likewise, the demand for electricity \( q_{R} \) and the selling price \( p_{e} \) are given at this stage, since when the TGC market opens, the energy production decisions have already been made and the energy market has cleared.

The first order condition reads:

It follows that a retailer’s demand for certificates is:

where \( 0 \le \alpha \le 1 \) and \( f > 0 \).

The certificate system therefore is steered by the two parameters of the penalty function f and d, but also influenced by the regulated obligation α.

Aggregate demand for TGC is the total demand for certificates in the retailing sector:

where \( X_{R} = \sum x_{R} \) is the aggregate demand for certificates, \( Q_{R} = \sum q_{R} \) is the aggregate electricity consumption by end-users, \( D = \sum d \) and \( \frac{1}{F} = \sum \frac{1}{f} \).

We therefore may conclude that retailers’ demand for TGC depends on the total amount of energy sold to the final consumer, the price of the certificates, the TGC percentage requirement α and the parameters of the penalty function D and F. The number of TGC that a retailer is willing to buy depends negatively on the certificate price. Zero demand occurs when \( p_{c} \ge F(\alpha Q_{R} + D) \), while there is a positive demand for certificates as long as \( p_{c} < F(\alpha Q_{R} + D) \) holds. Since the price of the certificates cannot be negative, the condition \( F(\alpha Q_{R} + D) > 0 \) must always hold.

2.1.3 The Role of Generators in the TGC Market

Since generators hold the property rights on the energy they produce and the renewable attribute of energy, TGC supply is determined by the optimal generators’ decisions concerning the selling of green certificates. Each generator can produce both renewable and non-renewable electricity and it is endowed a certain amount of TGC depending on the clean electricity delivered to the network. Hence, total supply of certificates is constrained to the production of green electricity. We assume a one-to-one link between the number of green certificates endowed and the number of MWh produced by renewable technologies.

Regarding costs, we assume additively separable cost functions with respect to the quantities of conventional and renewable energy sources. We also assume linearly increasing marginal costs. Total costs for black and green generation are respectively:

with \( c_{g} > c_{b} \), since the technologies subject to green certificates are classified as moderately non-competitive (see Sect. 1). By assuming the same parameter h \( (h > 0) \) for both cost functions, we ensure that the marginal cost function of renewable electricity is always higher than the marginal cost function of fossil electricity (the marginal cost curves do not cross).Footnote 3

We assume that there is perfect competition in the certificates market, so firms are not able to modify the market price by means of changing its own certificates production or demand.

The maximization problem that each generator solves reads as follows:

subject to:

where \( q_{g} \) and \( q_{b} \) are the quantity of green and black electricity sold by one generator, \( x_{G} \) is the amount of TGC sold by the generator and h, \( c_{g} \) and \( c_{b} \) are parameters of the cost function.

Perfect competition in the certificates market ensures that \( x_{G} = q_{g} \) and \( X_{G} = Q_{g} \), so the aggregate supply of certificates under perfect competition is the electricity produced by green sources.

2.1.4 Market Balance for Green Certificates

In order to determine the equilibrium certificate price we use the condition of market balance for tradable green certificates. The total number of certificates has to be equal to the demand for certificates: \( X_{G} = X_{R} \). From (1), the market balance equation for the TGC market is therefore given by:

Hence, the price of certificates may be written as:

The higher the deviation \( \alpha Q_{R} - Q_{g} \), the higher the price. With no deviation, \( \alpha Q_{R} - Q_{g} = 0 \), the certificate price is \( p_{c} = FD \). The price increases with the deviation from the objective and therefore provides the incentives for investment in green energy sources.

Finally, since \( Q_{R} = Q_{g} + Q_{b} \), the TGC price and quantity in equilibrium can be expressed as:

This means that the certificate price would be zero if the quantity of green electricity \( (Q_{g} ) \) were higher than the target \( (\alpha (Q_{b} + Q_{g} )) \). Remember that by the time the certificate market meets, the electricity market has already cleared, so the volume of green energy produced will be known.

2.2 The Electricity Market

2.2.1 The Generators’ Behavior in the Electricity Market

We assume that each generator has renewable (green) and non-renewable (black) energy production (\( q_{g} \) and \( q_{b} \), respectively) and that both types of production plants are necessary to satisfy the demand for energy. We also consider that there are no capacity constraints and that production costs are higher for renewable energy production. The generator decides about its level of electricity supply in stage 1. Hence, the optimization problem to be solved by each generator is:

The first order conditions are:

Generators are assumed perfectly competitiveFootnote 4 in both markets and they produce green electricity so that marginal revenue \( (p_{e} + p_{c} ) \) equals marginal cost \( (c_{g} + hq_{g} ) \).

The supply functions of black and green energy are respectively:

Under a TGC system the payment received by green producers for each certificate should cover the extra costs involved in producing green electricity in comparison with fossil fuel-based electricity. Thus, the certificate price corresponds to the difference between the marginal cost of renewables \( (c_{g} + hq_{g} ) \) and the market price for electricity \( (p_{e} ) \). As long as firms are able to cover their costs they will be willing to stay in operation.

The aggregate supply is:

where \( \frac{1}{H} = \sum \frac{1}{h} \).

2.2.2 The Retailers’ Behavior in the Electricity Market

We assume a linear demand function for electricity with parameters a \( (a > 0) \) and b \( (b \ge 0) \):

We assume that b is not large and that the condition \( b(H - \alpha F) + 2 > 0 \) holds.

2.2.3 Market Balance for Electricity

In equilibrium, total supply of electricity \( (Q_{G} = Q_{b} + Q_{g} ) \) has to be equal to the net demand for electricity \( (Q_{R} ) \):

And, thus, we get the following electricity price in terms of the expected certificate price:

This result shows that there is a negative relationship between the electricity price and the certificate price: the higher the expected certificate price, the lower the electricity price.

Similarly, the quantity of electricity in equilibrium is as follows:

Inserting the price (4) in the quantity functions yield:

Equations (5)–(7) show that the price of certificates increases the production of green electricity and decreases the production of black electricity. But this effect seems to be stronger in the green production and, hence, the total production of electricity is positively affected by the price of certificates, showing a greater influence as parameter b of the demand function rises. Regarding costs, the supply of non-renewable electricity is positively affected by the cost parameter of renewable energy, whereas the supply of green electricity is increased by the cost parameter of black production. Both supplies are negatively affected by their own generation costs.

2.3 Equilibrium in the Electricity Market and the Green Certificates Market

As stated before, the game is played sequentially (electricity market clears first and TGC market second), so we proceed using backward induction. We thus start from the demand for certificates Eq. (1), determined in stage 2, and we substitute the expression for the equilibrium quantity of electricity (7). Since \( Q_{R} = Q_{G} = Q_{b} + Q_{g} \), the demand for certificates can be expressed in terms of the certificate price as:

In order to have a negative relationship between the number of TGC and the certificate price, we need \( b(H - \alpha F) + 2 > 0 \), which holds by assumption. Note that for values of b close to zero, this inequality always holds.

Additionally, from the equilibrium of the TGC market (3) we get that \( X_{R}^{*} (p_{c}^{*} ) = Q_{g}^{*} (p_{c} *) \), so using (8) and (6) we get the final expression for the certificate price in equilibrium.

Equation (9) shows that a decrease in the costs of renewable electricity decreases the certificate price. Therefore, any efficiency improvement in the production of green electricity would have the effect of decreasing the price of the certificates, even if the regulator were not aware of the efficiency gain. This is an advantage of TGC versus FIT.

3 Quantitative Analysis of the Effect of TGC in Spain

We simulate the implementation of a TGC incentive scheme in this section. In Spain, renewable producers are under a pure FIT or a FIP scheme, which is a fixed premium on top of the market price (RD 661/2007 2007). Under the FIT system, renewable generators sell their electricity under a guaranteed fixed tariff, whereas under the FIP option they take part in the daily market and get the price of the pool plus a guaranteed premium. In case of FIP, a cap and floor system has been introduced in order to protect renewable generators when the market price is too low and prevent excessive gains when the price is high enough. The floor is the lowest level of premium plus the electricity price, whereas the cap is the maximum electricity price to where a premium is still paid (Interactive EurObserv’ER Database 2012). The FIT approach isolates renewable generators from market prices and risks and consumers carry the price risk. In contrast, the FIP option let RES-E producers face some market risk. Generators are then exposed to market price signals and the premium is adjusted to keep both generators’ risks and revenues within a particular range (Klessmann et al. 2008).

As Table 2 shows, only a minor part of the solar electricity is sold under the FIP scheme in Spain, whereas the majority of wind uses this promotion option rather than FIT. The high financial support level given to solar generators under the FIT scheme induced solar producers to choose the FIT system rather than FIP. However, due to the great burden of the current tariffs in the deficit of regulated activities,Footnote 5 FIT-FIP to new capacity have been removed, affecting all technologies. It is commonly argued that solar energy may not be competitive enough to take part successfully in a TGC system, but the market participation shares also show that there are other technologies that may be able to compete in a TGC market, such as wind power.

We simulate a switch to a TGC system in this section. The correct definition of the regulation parameters could lead to an efficient TGC system, achieving a certificate price that could send the correct signals for investment in renewable energy sources.

We calibrate our model according to the data of the year 2010 (see Table 3). For the sake of simplicity, as final price we take the sum of the price of the pool \( (p_{e} ) \) and the premium \( (p_{FIP} ) \), even though there are other components in the final price of the Spanish electricity system.Footnote 6 The price \( p_{FIP} \) is computed as the equivalent premium divided by the total renewable electricity sold in the pool and under tariff (provided by the CNE).

We compute the costs of renewable and non-renewable electricity by applying the equilibrium condition marginal revenue equals marginal cost. The relationship \( p_{e} = c_{b} + HQ_{b} \) provides the intercept of the marginal cost function of black electricity is \( c_{b} = 28.09 \). From the expression \( p_{e} + p_{FIP} = c_{g} + HQ_{g} \) we get the parameter for green electricity \( c_{g} = 106.73 \). The value for the parameter \( H = 10^{ - 7} \) is chosen in order to scale the cost functions for green and black electricity.

We assume an inelastic demand for electricity for the year 2010, taking \( a = 193,345 \) and \( b = 0 \). We fix \( D = - 0.01 \) and \( F = 50 \) and see how the certificate price would have been for different values of the obligation and cost of green electricity. The values for the parameters have been selected so that the certificate price is high enough to promote investment.Footnote 7

If the regulator knows the cost function for each generator, the TGC system is equivalent to the FIT-FIP in the sense that F can be set at a value that replicates the outcome of the FIT-FIP system (see columns (1) and (2) in Table 4). The advantage is that the TGC market reacts to efficiency gains in the production of green energy even if the regulator does not observe these gains or react to them (see column (3) in Table 4). If the decrease in \( c_{g} \), from 106.73 to 82,Footnote 8 is unobserved to the regulator, the FIT-FIP would not reflect this efficiency gain in the cost of promoting renewable energy. The TGC market however would translate the lower cost into a lower price of the certificate and the cost to the system of producing a green MWh (from 116.14 to 91.41 €/MWh).

Additionally, if the regulator increases the obligation for renewable electricity, say from 0.49 to 0.60, the TGC market would determine the price of certificates necessary to implement the new share of renewables (see column (4) in Table 4). With such an ambitious renewable target, considering actual costs for green production and the values chosen for the penalty function, the FIT-FIP system would be more cost-effective (the certificate price would be 82.51 €/MWh, higher than the price for the FIT-FIP system). This proves the importance of the correct setting of the regulation parameters and the renewable target. However, as the renewable cost falls, the TGC system once again shows this efficiency gain and the certifcate price drops without changing the penalty function (see column (5) in Table 4).

Finally, our analysis assumes that agents are price takers and behave competitively. In particular, the supply of certificates must be competitive. For this reason, the proposal of a TGC market would not be appropriate if the number of producers of a given technology is not large enough. Thus, a FIT-FIP could be more adequate for the initial stages.

4 Conclusions

We have analyzed the interaction between the TGC market and the electricity market when both markets work under perfect competition, even though a high concentration in generation and a low demand elasticity may indicate the presence of market power (Green and Newbery 1992; Cardell et al. 1997; Fabra and Toro 2005). The analysis of these markets with price-maker agents is left for future research.

We have modelled a decreasing demand for TGC and we have shown, both theoretically and empirically, that a decrease in the costs of renewable electricity may decrease the certificate price. Therefore, any efficiency improvement in the production of green electricity would have the immediate effect of decreasing the price of the certificates, even if the regulator were not aware of the efficiency gain. This transmission of market signals makes the TGC more efficient when compared to the FIT system.

However, the certificate price may be too low for the non-competitive technologies. In order to avoid this problem, we propose the combination of TGC and FIT, even if there is a wide variety of promotion schemes. The combination of a certificate system and a feed-in scheme could be used for a more efficient promotion of RES-E. It is known that the FIT scheme helps to maintain investor confidence, so technologies not being competitive under a TGC system (e.g. solar energy), because of their high cost and their need of R&D investments, could adopt a FIT regulation; whereas competitive renewable technologies (e.g. wind power) would work under a purely TGC setup. With this approach, the less mature technologies will be protected and gradually integrated into the certificate market. Moreover, the TGC scheme is more cost-effective, because the certificate price would be set by a low-cost technology rather than a high-cost one, avoiding the windfall profits for low-cost technologies that could offset the potential efficiency gains of a TGC system when the price is set by a high-cost technology. Thus, instead of separating FIT and TGC, an interesting possibility for solar energy could be the implementation of a complementary FIT added to the TGC price. This regulation could help to finance solar technologies, since they would receive a higher price than the certificate (FIT + TGC), and at the same time it would help to reduce the actual burden, because one component of the incentive would be market-based (TGC) and would adjust easily to the efficiency gains of the technologies. This system that combines both renewable promotion schemes tries to take advantage of both TGC and FIT.

Notes

- 1.

- 2.

Certificates may have a longer life, and there may be certificates in the market with different lifespans and different trading prices. We ignore this issue for the moment.

- 3.

Other authors have modelled these cost functions with two different parameters to allow for differences in the level of marginal costs of black and green electricity (Ciarreta et al. 2011).

- 4.

- 5.

- 6.

- 7.

However, changes in the value of the parameter D do not affect the price substantially.

- 8.

According to Sallé et al. (2012), average costs of wind power are 82 €/MWh.

References

Aune FR, Dalen HM, Hagem C (2012) Implementing the EU renewable target through green certificate markets. Energy Econ 34:992–1000

Bergek A, Jacobsson S (2010) Are tradable green certificates a cost-efficient policy driving technical change or a rent-generating machine? Lessons from Sweden 2003–2008. Energy Policy 38(3):1255–1271

Buttler L, Neuhoff K (2008) Comparison of feed-in tariff, quota and auction mechanisms to support wind power development. Renew Energy 33:1854–1867

Bye T (2003) On the price and volume effects from green certificates in the energy market. Discussion papers 351. Statistics Norway, Oslo

Cardell JB, Hitt CC, Hogan WW (1997) Market power and strategic interaction in electricity networks. Resour Energy Econ 19:109–137

Christiansen AC (2001) Technological change and the role of public policy: an analytical framework for dynamic efficiency assessments. Report of the Fridtjof Nansen Institute 74 pp

Ciarreta A, Espinosa MP (2010a) Market power in the Spanish electricity auction. J Regul Econ 37(1):42–69

Ciarreta A, Espinosa MP (2010b) Supply function competition in the Spanish wholesale electricity market. Energy J 31(4):137–157

Ciarreta A, Georgantzis N, Gutiérrez-Hita C (2011) On the promotion of renewable sources in spot electricity markets. The role of feed-in-tariff systems. In: 4th annual conference on competition and regulation in network industries, Brussels

Ciarreta A, Espinosa MP, Pizarro-Irizar C (2012a) The effect of renewable energy in the Spanish electricity market. Lect Notes Inform Technol 9:431–436

Ciarreta A, Espinosa MP, Pizarro-Irizar C (2012b) Efecto de la energía renovable en el mercado diario de electricidad. Escenario 2020. Cuadernos Económicos de ICE 83:101–116

Ciarreta A, Espinosa MP (2012) The impact of regulation on pricing behavior in the Spanish electricity market (2002–2005). Energy Econ 34(6):2039–2045

CNE (2011) Información Estadística sobre las Ventas de Energía del Régimen Especial

European Wind Energy Association. Wind Energy (2004) The Facts, an analysis of wind energy in the EU-25, funded by EU Commission

Espinosa MP, Pizarro-Irizar C (2012) Políticas para la reducción del déficit tarifario. Papeles de Economía Espaola 134:117–126

Espinosa MP (2013a) Understanding the electricity tariff deficit and its challenges. Span Econ Fin Outlook 2(2):47–55

Espinosa MP (2013b) An austerity-driven energy reform. Span Econ Fin Outlook 2(5):51–61

European Commission (2011) Communication from the commission to the European parliament and the council. Renewable energy: progressing towards the 2020 target. COM(2011) 31 final

Fabra N, Toro J (2005) Price wars and collusion in the Spanish electricity market. Int J Ind Organ 23:155–181

Gan L, Eskeland GS, Kolshus HH (2005) Green electricity market development: lessons from Europe and the US. Energy Policy 35:144–155

Green RJ, Newbery DM (1992) Competition in the British electricity spot market. J Polit Econ 100(5):929–953

Green R, Vasilakos N (2011) The economics of offshore wind. Energy Policy 39(2):496–502

Haas R, Panzer C, Resch G, Ragwitz M, Reece G, Held A (2011) A historical review of promotion strategies for electricity from renewable energy sources in EU countries. Renew Sustain Energy Rev 15(2):1003–1034

Interactive EurObserv’ER Database (2012) http://www.eurobserv-er.org

Jacobsson S, Lauber V (2006) The politics and policy of energy system transformation-explaining the German diffusion of renewable energy technology. Energy Policy 34(3):256–276

Jensen JC (2003) Policy support for renewable energy in the European Union. Energy Research Centre of the Netherlands, ECN Publication, ECN-C-03-113

Jensen S, Skytte K (2002) Interaction between the power and green certificate markets. Energy Policy 30:425–435

Klessmann C, Nabe C, Burges K (2008) Pros and cons of exposing renewables to electricity market risks—a comparison of the market integration approaches in Germany, Spain, and the UK. Energy Policy 36:3646–3661

Mejía P (2010) Los retos del mercado. I Foro permanente de la energía. Desafíos energéticos del futuro

Menanteau P, Finon D, Lamy M-L (2003) Prices versus quantities: choosing policies for promoting the development of renewable energy. Energy Policy 31(8):799–812

Meyer NI (2003) European schemes for promoting renewables in liberalised markets. Energy Policy 31(7):665–676

Midttun A, Gautesen K (2007) Feed in or certificates, competition or complementarity? Combining a static efficiency and a dynamic innovation perspective on the greening of the energy industry. Energy Policy 35:1419–1422

Nilsson M, Sundqvist T (2007) Using the market at a cost: How the introduction of green certificates in Sweden led to market inefficiencies. Util Policy 15:49–59

Neuhoff K (2005) Large-scale deployment of renewables for electricity generation. Oxf Rev Econ Policy 21(1):88–110

OMIE (2007) Daily and intraday electricity market activity rules, version 01/07/2007

Rader N, Norgaard R (1996) Efficiency and sustainability in restructured electricity markets: the renewables portfolio standard. Electr J 9(6):37–49

Rathman M (2007) Do support systems for RES-E reduce EU-ETS-driven electricity prices? Energy Policy 35(1):342–349

Real Decreto 661/2007, May 25 de mayo. Regulation of renewables. Boletín Oficial del Estado 126, 22846-22886

Real Decreto-ley (2012). Elimination of incentives to new renewable capacity. Boletín Oficial del Estado 24:8068–8072

Ringel M (2006) Fostering the use of renewable energies in the European Union: the race between feed-in tariffs and green certificates. Renew Energy 31:1–17

Sallé C, López JM, Muñoz M, Martín I, Sáez de Miera G, Laverón F (2012) El déficit de tarifa y la importancia de la ortodoxia en la regulación del sector eléctrico. Cuadernos de Energía 35:1–32

Schaeffer GJ, Boots MG, Martens JW, Voogt MH (1999) Tradable green certificates—a new market-based incentive scheme for renewable energy: introduction and analysis. Energy Research Centre of the Netherlands. ECN-I-99–004

Schmalensee R (2011) Evaluating policies to increase the generation of electricity from renewable energy. MIT Center for Energy and Environmental Policy Research. CEEPR WP 2011-008

Sims REH, Rogner H-H, Gregory K (2003) Carbon emission and mitigation cost comparisons between fossil fuel, nuclear and renewable energy resources for electricity generation. Energy Policy 31(13):1315–1326

Verbruggen A (2004) Tradable green certificates in Flanders (Belgium). Energy Policy 32(2):165–176

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Ciarreta, A., Espinosa, M.P., Pizarro-Irizar, C. (2014). Switching from Feed-in Tariffs to a Tradable Green Certificate Market. In: Ramos, S., Veiga, H. (eds) The Interrelationship Between Financial and Energy Markets. Lecture Notes in Energy, vol 54. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-55382-0_11

Download citation

DOI: https://doi.org/10.1007/978-3-642-55382-0_11

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-55381-3

Online ISBN: 978-3-642-55382-0

eBook Packages: EnergyEnergy (R0)