Abstract

This paper investigates the problem of profit allocation under bilateral asymmetric information environment. More specifically, we consider a supply chain consisting of one risk-neural manufacturer and one risk-neural retailer for an innovation product. In order to facilitate the cooperation, the manufacturer and the retailer commit to share their private information under a commitment contract based on the AGV (d’Aspremont and Gerard-Varet) mechanism. We analyze the relationship between the expected information rents and the realized supply chain profit, and discuss the allocation rule implementation under three different cases by introducing the R-S-K negotiation. We show that the commitment contract can achieve truthful information revealing and allocate the ex post profit reasonably. Finally, one numerical example is presented to explain the main results.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The collaboration between supply chain members can significantly improve supply chain’s performance. However, the individual decisions based on information sharing fully are often unrealistic. The fact is that the supply chain members are separate and independent economic entities, they will act independently and opportunistically to optimize their individual benefits depending largely on their acquired information. In this case, an action plan should be complemented with an incentive scheme that can allocate the benefits of coordination among the supply chain members so as to align their objectives of coordination [14].

This paper focuses on the incentive mechanism designing, especially for the allocation rules implementation under asymmetric information case. For a supply chain consisting of one manufacturer and one retailer, neither of them can control the entire supply chain. Each supply chain member has its own state of information and decisions that can be made use to optimize its own interest. Thus, an ex ante incentive contract is needed to coordinate their action by allocating the supply chain’s profits. While some scholars have investigated the allocation rule designing under the bilateral asymmetric information case [17, 19], we have a different focus.

Our contributions to the literature will be two aspects: first, based on the basic asymmetric costs information model [19], we analyze three relationships between the realized supply chain profit and the sum of expected information rents. Second, by using the thought of R-S-K bargaining solution [12, 15], we discuss three cases to implement the allocation rule.

2 Literature

This paper can be regarded as a study of supply chain incentive mechanism designing. In order to highlight our contributions, we review only the literature that is particularly relevant to our study.

Information sharing mechanism has attracted substantial attention by many scholars [13, 16, 20]. However, a few researchers were motivated to explore supply chain models under the bilateral asymmetric information scenario. Chatterjee and Samuelson [5] analyze that the seller and the buyer achieve bilateral asymmetric information by bargaining strategy, and their private information is the evaluation of commodity price. Zhang and Luo [21] explore the trade credit in coordinating supply chain under bilateral information senior. In the proposed model the manufacturer possesses the private information regarding its own capital cost while the retailer has the private information about the budget constraint or capital cost. Esmaeili and Zeephongsekul [8] consider a supply chain, in which the buyer and seller have the private information about demand information and purchase costs respectively. Wang et al. [18] examine the supply chain efficiency under the bilateral information case. Some bilateral asymmetric information problem can be seen in the analysis of auction [3, 6, 7, 10]. Wang and Wang [17] consider a bilateral asymmetric information case and propose an ex ante informal contract to coordinate the supply chain. Wang et al. [19] analyze the bilateral cost asymmetric information sharing by the virtue of the AGV mechanism [1, 2], and design a set of improved transfer payments to coordinate the supply chain.

In order to align the supply chain member’s objectives of coordination, some incentive profit sharing mechanisms have also been proposed. Under this proposal, the system performance is first optimized and the resultant benefit is then shared between the manufacturer and the buyer. Its implementation, however, depends on the development of a profit sharing scheme that is acceptable to both parties. Goyal [9] proposed for the manufacturer and buyer to share the coordination benefit proportionally according to their costs. Joglekar and Tharthare [11] allocated the profit by making the buyers pay for the order processing cost they impose on the vendor every time they order.

With a bilateral asymmetric information case, allocation rules based on the information rents are firstly proposed by Wang and Wang [17]. In the works [17, 19], the expected information rents denote the negotiation power. However, they have not revealed the relationship between the information rents. Also, they design a set of compensate parameters related to the allocation rule, but the parameters are relatively complicated and con not easily implemented in practice. Thus, in this paper, the relationship between the information rents and the supply chain as well as allocation rule implement are our focus.

This paper is organized as follows. Section 55.2 reviews literature in the areas of information revealing mechanism designing. Section 55.3 introduces the model assumption and constructs the basic model. Section 55.5 analyzes the relationship between the information rents and the supply chain’s profit, then examines the implementation of the allocation rule. Section 55.7 provides a numerical example to illustrate the main results. Section 55.8 concludes this paper.

3 Model Assumptions and Notation

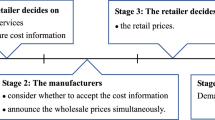

Consider a two-stage supply chain consisting of one manufacturer and one retailer, and both are risk neutral. Prior to production, the manufacturer and the retailer commit a formal agreement to ensure the latter trading. The formal agreement includes the trading quantity depending on the production cost and the retail cost, which are not clear at this point and the corresponding transfer payments. When the sample product is finished, the true production cost and retail cost can be obtained by the manufacturer and the retailer, thus the production cost and retail cost are their private information respectively. Then the two firms share their acquired private information to determine the trading quantity according the ex ante informal agreement (The sequence of events can be seen in Fig. 55.1). The retailer buys the product from the upstream manufacturer and sells it to a market in which demand is stochastic. The manufacturer and the retailer are both risk neutral. In order to simplify notation, without loss of generality we also assume the goodwill cost and the salvage cost are both zero.

The notation used in our study is summarized below:

- \(p\) :

-

Selling price per unit,

- \(q^*(\cdot )\) :

-

Optimal commodity trading quantity in the asymmetric information case,

- \(q^0(\cdot )\) :

-

Optimal commodity trading of the supply chain in the symmetric information case,

- \(t_1(\cdot )\) :

-

Transfer payment to the manufacturer,

- \(t_2(\cdot )\) :

-

Transfer payment to the retailer,

- \(c_s, \hat{c}_s\) :

-

Manufacturer’s true unit production cost and announcing unit production cost, belong to \([\underline{c}_s, \bar{c}_s]\),

- \(c_r, \hat{c}_r\) :

-

Retailer’s true unit retail cost and announcing unit retail cost, belong to \([\underline{c}_r, \bar{c}_r]\),

- \(F_1(\cdot ), f_1(\cdot )\) :

-

Strictly increasing distribution function and corresponding density function of \(c_s\),

- \(F_2(\cdot ), f_2(\cdot )\) :

-

Strictly increasing distribution function corresponding density function of \(c_r\),

- \(E_{c_r}(\cdot )\) :

-

Expectation function with respect to \(F_2(\cdot )\),

- \(E_{c_s}(\cdot )\) :

-

Expectation function with respect to \(F_1(\cdot )\),

- \(E_{c_r, c_s}(\cdot )\) :

-

Double expectations function with respect to \(F_1(\cdot )\) and \(F_2(\cdot )\),

- \(D>0\) :

-

Market stochastic demand during the selling season,

- \(G(\cdot ), g(\cdot )\) :

-

Strictly increasing distribution function and corresponding density of stochastic demand,

- \(S(q(\cdot ))\) :

-

Expected sales for retailer, equals \(\min (q(\cdot ), D)\),

- \(\varPi (\cdot )\) :

-

Profit function of the total supply chain,

- \(\varPi _1(\cdot )\) :

-

Manufacturer’s profit function,

- \(\varPi _2(\cdot )\) :

-

Retailer’s profit function.

As usual, we also assume that \(\underline{c}_s+\underline{c}_r<p<\bar{c}_s+ \bar{c}_r\) in order not to incur negative profit of the system or parties.

4 Model Based on AGV Mechanism

This subsection presents one supply chain model with bilateral asymmetric costs information based on the AGV mechanism.

Let \(\varPi _1(q(\hat{c}_s, \hat{c}_r), c_s)\) and \(\varPi _2(q(\hat{c}_s, \hat{c}_r), c_r)\) be the profit functions of manufacturer and retailer respectively, which are given by:

According to the AGV mechanism, the transfer payments can be written as:

The transfer payments require essentially that each party appropriates the expected externality he actions impose on other party. The expected profits of the agents are given by:

Proposition 55.1

The transfer payments can induce the manufacturer and the retailer share their private information truthfully, i.e.,\( \hat{c}_s=c_s, \hat{c}_r=c_r\).

Proposition 55.1 states that with the transfer payments each party is induced to internalize the whole supply chain’s decision and is effectively maximizing the system’s objective.

5 The Information Rents and Allocation Rule

5.1 Information Rents

In general, the allocation proportion also denotes the negotiation power in the economic game. While in the unilateral asymmetric information problem of the supply chain, the information rent for revealing information truthfully is seen as a reservation profit, and it can be seen as the informed party’s negotiation power. Thus, we can define an allocation proportion of supply chain’s profit based on the manufacturer and retailer’s expected information rents at ex ante stage. Since the manufacturer and the retailer have their information advantages, neither of them can control the supply chain system, thus, this allocation rule is acceptable for two parties and is reasonable.

We first compute the two firms’ expected information rents. According to the Proposition 55.1, announcing cost information truthfully \((\hat{c}_s=c_s )\) means that the following formula is satisfied.

In the similar way, for the retailer it holds that:

By the Eqs. (55.7) and (55.8), we have the proposition below.

Proposition 55.2

Constraints Eqs. (55.7) and (55.8) can be reduced to two differential equations and two monotonicity constraints,

By the differential equations in Proposition 55.2, we can obtain that

Equations (55.9) and (55.10) can be regarded as the information rents for the manufacturer and retailer [4]. Thus the expected information rents of the supplier and the retailer at ex ante age are

As usual, we can assume that at the optimum the least efficient manufacturer and retailer receives his reservation utilities: \({E_{{c_s},{c_r}}}\left( {{\varPi _1}({{\bar{c}}_s},{c_r})} \right) = 0\) and \({E_{{c_s},{c_r}}}\left( {{\varPi _2}({c_s},{{\bar{c}}_r})} \right) = 0\). These two formulas exclude the case that one part with the highest cost enters the trade.

Definition 55.1

In the model of bilateral asymmetric information, the allocation rule of the total supply chain is given as \({K_1} = {{{H_1}} / {({H_1} + {H_2})}},{K_2} = {{{H_2}}/ {({H_1} + {H_2})}},\) where \({H_1} = {E_{{c_s},{c_r}}}\left( {{\varPi _1}({c_s},{c_r})} \right) , ~~ {H_2} = {E_{{c_s},{c_r}}}\left( {{\varPi _2}({c_s},{c_r})} \right) .\)

6 Implementation of Profit Allocation

Note that to avoid misrepresenting the private information, the manufacturer and the retailer must get information rents, but the sum of the expected rents may exceed the supply chain profit in some contingencies. This is similar to the conclusion discussed in bilateral trade by Bolton and Dewatripont [4]. Thus, the relationship between the realized total supply chain profit and the sum of expected information rents can be expressed as follows: \( \lambda {E_{{c_s},{c_r}}}\left[ {{\varPi _1}({c_s},{c_r}) + {\varPi _2}({c_s},{c_r})} \right] = \left[ {{\varPi _1}({{\hat{c}}_s},{{\hat{c}}_r}) + {\varPi _2}({{\hat{c}}_s},{{\hat{c}}_r})} \right] .\) It is equivalent to:

Here \(\lambda \) is a nonzero parameter. If \(\lambda <1\), the total expected rents are larger than the realized total chain profit; \(\lambda =1\), the total expected rents equal the realized total chain profit; \(\lambda >1\), the total expected rents are less than the realized total chain profit. The different cases can be illustrated from Figs. 55.2, 55.3 and 55.4. The line segment CD denotes the realized chain’s profit, and the point “O” denotes the reference point of expected information rents. If the point of expected information rents is out of the region OCD, it means that \(\lambda <1\) (Fig. 55.2); If the point of expected information rents is in the region OCD, it means that \(\lambda >1\) (Fig. 55.3).

Now we analyze how to allocate the ex post total chain’s profit by the manufacturer and retailer according the allocation proportion, \(K_1, K_2\). As in Fig. 55.2, by using the idea of R-S-K bargaining solution [12, 15], we connect profit reference point “O” and expected rents point “A”, thus line OA is the corresponding allocation route. Compute the slope of the line OA, \(k_{\text {OA}}=K_1/K_2\), and we can easily get \(\text {BC}/\text {BD}=K_2/K_1\). Consequently, the realized total chain’s profit is divided into two parts, for the manufacturer is line segment BD and for the retailer is line segment BC. In the similar way, in Fig. 55.3, we can connect the point O and point A, and extend into line segment CD at point B. Thus, we also get that \(\text {BC}/\text {BD}=K_2/K_1\). In Fig. 55.4, the expected information point B is on the line segment CD. Hence we can easily get the allocation proportion which is independent to the slope of the line OB.

Actually, in the current asymmetric information model based on the AGV mechanism, both the manufacturer and retailer announce their true costs information simultaneously. This action coordinates the supply chain as well as realizes their individuals’ optimal profits. By the allocation rule, the profits of the manufacturer and the retailer are:

7 Numerical Example

In this section, we present the numerical results that allocate the realized chain’s profit in three different cases.

Assume that \(p=8, c_s ,\hat{c}_s\in [2,4] c_r, \hat{c}_r \in [1,2]\) and \(y\in [0,100]. F_1 , F_2 ,G\) are uniform distribution functions. Then \(F_1(c_s)=(c_s-2)/2, f_1(c_s)-1/2, F_2(c_r)=c_r -1, f_2(c_r)=1, G(y)=y/100\). We can easily have the order quantity \({q^*}({c_s}, {c_r}) = 100[ 1 - (c_s + c_r) / 8] \). The expected information rent for the manufacturer is \(H_{1}=39.58\), and the expected information rent for the retailer is \(H_2 = 20.83\). Thus the allocation rule is \(K_1=0.655, K_2=0.345\). The sum of expected information rents is \(H_1+H_2=60.41\), and the realized total supply chain profit is \(\varPi ({c_s},{c_r}) = 6.25{\left[ {8 - ({c_s} + {c_r})} \right] ^2}\).

Table 55.1 illustrates the relationship between the sum of expected information rents and the realized chain’s profit for \(c_r=1.5\). Three cases exist in Table 55.1, which verify the analysis in Sect. 55.4. As shown in the table, for \(c_s+c_r<4.9\), the total chain’s profit is larger than the sum of expected information rents, whereas the total chain’s profit is less than the sum of expected information rents for \(c_s+c_r>4.9\).

Table 55.2 presents the variation of the total chain’s profit and the individual’s profit for different production cost and retail cost. The chain’s profit decreases with the increasing production cost and the retail cost, which can be seen on Fig. 55.5. This will raises the case that the supply chain’s profit is less than the sum of information rents. As shown in Table 55.2, if \(c_{s}+c_{r}>=3.4+1.7\), the two parties’ information rents can not be ensured. Thus, the profit can be allocated using the method shown in Fig. 55.2.

8 Conclusions and Future Research

The bilateral asymmetric information case in many supply chains is very common, and it is worthwhile to investigate for improving performance and coordinating the supply chain. This paper addresses the supply chain with bilateral asymmetric costs information.

We first construct a model based on the AGV mechanism and propose an ex ante informal contract. We find that the proposed contract associated with the AGV mechanism is able to reveal the costs information truthfully. Meanwhile, the manufacturer and retailer will maximize their individual’s profit by announcing the true costs information.

We then propose an allocation rule based the expected information rents, which is acceptable for each party. Additionally, we analyze three relationships between the realized chain’s profit and the expected information rents. By using the idea of R-S-K bargaining solution, the realized total chain’s profits are allocated reasonably.

Our research yields some key managerial insights that can be applied generally despite the restrictive assumptions that the costs information are asymmetric for the manufacturer and retailer. Additionally, some factors, such as leftover inventory and lost-sales, have been omitted for simplicity. Further research can extend our model to include the asymmetric market demand information and leftover inventory.

References

Arrow K (1979) The property rights doctrine and demand revelation under incomplete information. Economics and human welfare, New York Academic Press, New York

Aspremont C, Gerard-Varet LA (1979) Incentives and incomplete information. J Pub Econ 11(1):25–45

Babaioff M, Walsh W (2005) Incentive-compatible, budget-balanced, yet highly efficient auctions for supply chain formation. Decis Support Syst 39(1):123–149

Bolton P, Dewatripont M (2005) Contract theory. The MIT Press Cambridge, Massachusetts London, England

Chatterjee K, Samuelson L (1987) Bargaining with two-sided incomplete information: an infinite horizon model with alternating offers. Rev Econ Stud 54(2):175–192

Chen F, Federgruen A, Zhang Y (2001) Coordination mechanism for a distribution system with one supplier and multiple retailers. Manage Sci 47(5):693–708

Dutta S, Sarmah S, Goyal S (2010) Evolutionary stability of auction and supply chain contracting: an analysis based on disintermediation in the Indian tea supply chains. Eur J Oper Res 207(1):531–538

Esmaeili M, Zeephongsekul P (2010) Seller-buyer models of supply chain management with an asymmetric information structure. Int J Prod Econ 123(1):146–154

Goyal SK (1976) An integrated inventory model for a single supplier-single customer problem. Int J Prod Res 15(1):107–111

Jin M, Wu S (2004) Coordinating supplier competition via auctions. Citeseer 1–23

Joglekar P, Tharthare S (1990) The individually responsible and rational decision approach to economic lot sizes for one vendor and many purchasers. Decision Sci 21:492–506

Kalai E, Smorodinsky M (1975) Other solutions to Nash’s bargaining problem. Econometrica J Econ Soc 43(3):513–518

Li L (2000) Information sharing in a supply chain with horizontal competition. Manage Sci 48(9):1196–1212

Li X, Wang Q (2007) Coordination mechanisms of supply chain systems. Eur J Oper Res 179(1):1–16

Luce RD, Raiffa H (1957) Games and decisions. Wiley, New York

Mishra BK, Srinivasan R, Yue XH (2007) Information sharing in supply chains: incentives for information distortion. IIE Trans 39(9):863–877

Wang X, Wang X (2014) Contracting to share bilateral asymmetric information in supply chain. In: The 7th international conference on management science and engineering management, pp 881–892

Wang X, Wang X, Su Y (2012) Coordination and efficiency analysis of supply chain with bilateral asymmetric information. Comput Integr Manuf Syst 18(6):1271–1280

Wang X, Wang X, Su Y (2013) The coordination mechanism of supply chain with bilateral asymmetric costs information. J Ind Eng Eng Manage 105(27(4)):196–204

Xiao T, Yang D (2009) Risk sharing and information revelation mechanism of a one-manufacturer and one-retailer supply chain facing an integrated competitor. Eur J Oper Res 196(3):1076–1085

Zhang Q, Luo J (2009) Coordination of supply chain with trade credit under bilateral information asymmetry. Syst Eng Theory Pract 29(9):32–40

Acknowledgments

This work was supported by the Foundation of National Nature Science of China (Grant NO. 71071103) and the Ministry of Education, Humanities and Social Science Planning Fund for the Western and Frontier (NO. 13XJC630014), and the Dr. Innovation Research for the Central University (NO. 13NZYBS08).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Wang, X., Guo, H., Wang, X., Zhong, J. (2014). Profit Allocation Mechanism of Supply Chain with Bilateral Asymmetric Costs Information. In: Xu, J., Cruz-Machado, V., Lev, B., Nickel, S. (eds) Proceedings of the Eighth International Conference on Management Science and Engineering Management. Advances in Intelligent Systems and Computing, vol 280. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-55182-6_55

Download citation

DOI: https://doi.org/10.1007/978-3-642-55182-6_55

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-55181-9

Online ISBN: 978-3-642-55182-6

eBook Packages: EngineeringEngineering (R0)