Abstract

The article is dedicated to inquiring U.S. postwar economic structural breakpoints and the changes in its business cycle covering the period 1947–2011. By empirical analysis, post-war U.S. economic structural breakpoints are identified, based on which the U.S business cycle is explored, mainly into the its evolution and different characteristics in different time periods.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

After World War II, with many social, technological and economic changes, many scholars believed, that the mutations would inevitably be reflected in the economic fluctuation patterns [1, 3, 11]. In fact, some scholars have found that the fluctuation patterns of the postwar U.S. Economy are continuously changing [2, 4, 5, 7, 13]. Based on this theme, the article is devoted to a study over the postwar economic structural breakpoints and the changes in the U.S. business cycle covering the period 1947–2011. This research paper focuses on examining into the evolution course and different characteristics of U.S. economic fluctuation over the periods. And the U.S. GDP time series data except otherwise specified are from Federal Reserve Bank of St. Louis website database. The data presented is seasonally adjusted.

The postwar economic gradual changes lead to structural changes in economic indicators, herein GDP, forming some structural breaks [6, 9, 14]. Therefore, it is of necessity to identify structural breakpoints in U.S. gross domestic products (GDP) time series. Based on the break points, the period 1947–2011 has been identified, and the economic cyclical patterns are analyzed and generalized in this research paper.

Test methods for structural breakpoints identification fall into many typologies. Such as Chow’s, Perron’s, Zivot and Andrew’s, Lee’s and so forth. Chow’s test is used to determine whether a given point is a structural break point, which cannot scan out the unknown break points. For unknown break points, Perron firstly constructed an Augmented Dickey-Fuller (ADF) test model with structural break items. But, this model has a flaw: the exact location of the occurrence of a structural break should be identified in advance. As Christiano pointed out, the ADF test model is likely to lead to excessive over-rejection of unit root test against the null hypothesis.

Zivot and Andrew proposed a structural-break-root test method, which predicts break points, as those embedded in the structure of the data series, without prior location. Thus, Zivot and Andrew modified Perron’s model, took the breakpoint estimation of endogeneity, and presented unconditional unit root test with breakpoints. Lumsdaine broadened the scope of the identification of the single breakpoint test and obtained a two breakpoints test (LP Test). Lee et al. further proposed a more robust Minimal Lagrangian Test for dual structural breakpoint identification.

Bai and Perron put forward a method that employs statistics in determining the breakpoint, which can justify the identifying economic structural breakpoints, while it also meets multiple-breakpoint-identification requirements.

This article is based on ARMAX models and Bai’s and Perron’s method, to identify the structural breakpoint of the U.S. GDP from 1947Q4-2011Q4.

Let the linear model have “\(m\)” number of structural breaks with “\(T\)” as its length.

These can be rewritten in matrix form as follows: \(Y=X\beta +\bar{Z}\delta +U\).

Given the certified breakpoints \(T_{1}, T_{2}, \cdots , T_{m}\), the least squares method can be applied to estimate coefficients \(\beta \), \(\delta \). These coefficients \(\beta \), \(\delta \) are valid, when they are inserted into the following formula: \(S_{T}(T_{1},T_{2},\cdots ,T_{m})=\min (Y-X\beta -\bar{Z\delta })\).

We utilize Bai’s statistics \(\sup F_{\tau }(l+1|l)\) in identifying the number of breaks. And Bai’s statistics can be expressed by the equation as fellows:

where \(\varLambda _{i,\eta }=\{\tau ; \hat{T}_{i-1}+(\hat{T}_{i}-\hat{T}_{i-1})\eta \le \tau \le \hat{T}_{i}-(\hat{T}_{i}-\hat{T}_{i-1})\eta \}\),

Let, U.S. GDP be denoted as logarithmic values: \(y(t)\), and let \(y(t)\) be subject to ARMAX \((R, M)\) model with \(m\) structural-breakpoints, then we get the following:

where \(\{\phi _{ij}\}\) is auto-regression coefficient and \(\{\theta _{ij}\}\) is the moving average coefficient.

Using Matlab software, \(R,M\) were calculated from 0–4, and thus the breaks at \(T_{1}=118,T_{2}=170\) are located. Furthermore, we obtained the coefficients, with residual normality for each time interval.

For \(1\le t\le T_{1}\), a model can be drawn: \(y(t)=4.4777+0.0137t+0.0207y(t-1)+0.1214y(t-2)-0.0049y(t-3) +0.0429y(t-4)+0.8876\varepsilon (t-1)+\varepsilon (t),t=1,2,\cdots ,T_{1}, \) where residual \(e(t)\) is white noise, and the roots of the characteristic polynomial \((x^{4}-0.0207x^{3}-0.1214x^{2}+0.0049x-0.0429)\) of auto-regressive part are \(-0.5250, 0.5269, 0.0094 + 0.3938i, 0.0094 - 0.3938i\), with the Eigen modulo value is less than 1.0. And the characteristic polynomial roots of sliding regressive part is \(-0.8876\), and the modulus is less than 1.0 as well.

When \(T_{1}+1\le t\le T_{2}\), a model can be drawn \(y(t)=5.7652+0.0207t+0.0669y\) \((t-1)+0.0031y(t-2)+0.0060y(t-3) -0.1468y(t-4)+\varepsilon (t),t=T_{1}+1,T_{2}+2,\cdots ,T_{2},\) where residual \(e(t)\) proves to be white noise by test, the characteristic polynomial \((x^{4}-0.0669x^{3}-0.0031x^{2}-0.0060x+0.1468)\) of auto-regressive part are \(0.4557 + 0.4322i, 0.4557 - 0.4322i, -0.4223 + 0.4402i, -0.4223 - 0.4402i\), with the Eigenvalue modulo is less than 1.0.

When \(T_{2}+1\le t\le T\), a model can be drawn: \(y(t)=5.0062+0.0092t+0.2797y\) \((t-1+0.0285y(t-2)+0.0072y(t-3) -0.0729y(t-4)+\varepsilon (t),t=T_{2}+~1,T_{2}+2,\cdots ,T,\) where residual \(e(t)\) is tested as white noise, and the characteristic polynomial \((x^{4}-0.2797x^{3}-0.0285x^{2}-0.0072x+0.0729)\) of auto-regressive part are \(0.4558 + 0.3330i, 0.4558 - 0.3330i, -0.3159 + 0.3592i, -0.3159 - 0.3592i\), with the eigenvalue modulo less than 1.0.

The results of the tests above show that the U.S. economic GDP series has two breakpoints at 1976 and 1989 respectively, which is different from certain academic findings, who found the U.S. economic structural breakpoint existing at 1983–1984 [6].

Factually, U.S. GDP average growth rate is 1.37 % from 1947 to 1976, and that from 1977 to 1989 is 2.07 %, while that from 1990 to 2011 the growth rate is only 0.92 %, which is quite different from each period, which proves the existence of the break points (Fig. 49.1).

Changes in U.S. economic growth trend (data resource http://www.research.stlouisfed.org/fred2/series/GDPC1)

Based on the findings above, the postwar U.S. economy can be divided into three periods 1947–1976, 1977–1989 and 1989–2011. The parts below are dedicated to analyzing economic fluctuation changes in these three periods and hence these fluctuations characterize the U.S. economic cycle.

2 Cycle Fluctuation Spectrum Analysis and Comparison

-

1.

The Overall Spectral Analysis: 1947–2011 U.S. GDP Growth Rate Fluctuation Analysis

Let \(\{y(t)\}\) a stationary random series \(ARMA(p,q)\), that is \(y(t)=a_{0}+\sum ^{p}_{i=1}a_{i}\) \(y(t-i)+\sum ^{q}_{i=1}b_{i}\varepsilon (t-i)+ \varepsilon (t),\) where \(a_{i}, b_{j}\) are constants, and \(\{\varepsilon (t)\}\) is normal white noise with density distribution of \(N(0,\sigma ^{2})\). Denoting the autocorrelation function of \(\{y(t)\}\) as \(R(k)\), thus the function can be written as the integral of a non-negative function \(f(\omega )\) as follows: \(R(k)=\frac{1}{2\pi }\int ^{\pi }_{-\pi }f(\omega )e^{\sqrt{-1k\omega }}d\omega ,\) where function \(f(\omega )\) is the spectral density of {y(t)}, and thus \(f(\omega )=\sum _{k}R(k)e^{-\sqrt{-1k\omega }}.\)

To the series \(\{y(t)\}\) of \(ARMA(p,q)\), its spectral density function \(f(\omega )\) is:

Take the natural logarithm of U.S. GDP in 1947–2011. The growth rate is the gap between the preceding item and the consequent item. And through AIC and BIC test on \(\{y(t)\}\), the approximation orders of \(p,q\) can be drawn, then by the means of the scanning test with programming, \(p=10,~q=19\), and \(f(\omega )\) (the spectral density of \(\{y(t)\}\)) graphed as Fig. 49.2, with two maxima \(\frac{2\pi }{28.3186}\) and \(\frac{2\pi }{12.5490}\), indicating that \(\{y(t)\})\) has two cycles with wavelengths \(12.5490\) and \(28.3186\) quarters respectively.

U.S. economic cycle spectral density of 1947 (IV)–2011 (IV) (data resource http://www.re-search.stlouisfed.org/fred2/series/GDPC1)

Now presume:

where \(T_{1},T_{2}\) are cycle length, and \(\varepsilon (t)\) is normal white noise. By curve fitting and normalizing residuals, the following equation is obtained:

The equation indicates that there are two cycles with wavelength \(12.5490\) quarters (3 years approximately) and \(28.3186\) quarters (7.8 years approximately) respectively. Therefore, it can be shown that, from 1947 to 2011, there is a presence of 28–31 quarter cycles (Juglar Cycle) and 12–12.5 quarter cycles (Kitchin Cycle). According to these estimates, we can further predict the amplitude of the two kinds of cycles as follows:

Kitchin Cycle’s amplitude is: \(\sqrt{a^{2}_{1}+b^{2}_{1}}=\sqrt{0.00000673}=0.0025942244\).

Juglar Cycle’s amplitude is: \(\sqrt{a^{2}_{2}+b^{2}_{2}}=\sqrt{0.00000425}=0.0020615528\).

-

2.

Periodic Spectral Analyses and Comparison

Using the methods shown above, this section analyzes U.S business cycles, in the three distinct periods, based on the two breakpoints identified above and then comparing them.

Under MATLAB 7.10 environment, the business cycle’s spectral density maps and test results of the three periods are demonstrated as follows (See Fig. 49.3 and Table 49.1). With the tests above, we obtained U.S. postwar wavelength and amplitude of business cycles. (see Table 49.2) of 1947 (IV)–2011 (IV). From Table 49.2, we can see that the wavelength of the postwar U.S. Kitchin Cycles is 11.9936 quarters (about 3 years), with an amplitude of 0.002594224. While that of Juglar Cycles is 28.58 quarterly ( about 7 years),with an amplitude of 0.002061553.

According to the structural breakpoints identified, the U.S. economy is divided into three time sections: 1947 (IV)–1976 (IV), 1977 (I)–1989 (IV) and 1990 (I)–2011 (IV). Based on the wavelength and amplitude of the business cycles in these three periods, we find that postwar U.S. business cycle-length went through course from elongating to shortening and then from shortening to elongating. And postwar U.S business cycles have also experienced varying from waning to waxing and from waxing to waning, in amplitude. Generally, the postwar U.S. Kitchin Cycles have shown an elongation trend, while Juglar Cycles show contraction trends.

Based on the above analyses, we found that there is a presence of 2–3 year Kitchin Cycles and 6–9 year Juglar Cycles, in U.S. postwar economy. As to the wavelength, the Kitchin Cycles experienced an elongating-shortening-elongating process, but largely, Kitchin Cycles have a trend towards elongation. And the amplitude change of Kitchin Cycles presents a trend of waning?Cwaxing-waning cycles. For Juglar Cycles, the wavelength of the postwar U.S. economy followed the same trend as the Kitchin Cycles, as witnessed. Particularly, since the 1970s, the wavelength of Juglar Cycles is elongating consistently.

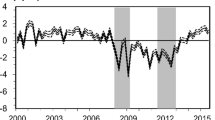

In addition, by comparing the business cycle in 1947 (IV)–1976 (IV), 1977 (I)–1989 (IV) and 1990 (I)–2011 (IV), growth variances [here mainly referring to the GDP annual volatility] of the three sections are featured with decreasing trend (see Fig. 49.4), reflecting the overall economic fluctuation was gradually smoothening in postwar U.S. economy, which tallies with the findings of many scholars [8, 10, 12, 13].

U.S. economic growth variance comparison of the postwar three sections (data resource http://www.research.stlouisfed.org/fred2/series/GDPC1)

Additionally, based on the data from U.S. NBER, U.S. postwar business cycle lengths prove slight elongations, particularly after 1990. This fact is consistent with the findings of this study (Table 49.3).

3 Conclusions

This paper explores empirically into post-war U.S. economic structural breakpoints identification. Based on our research, the U.S business cycles are evaluated, and we draw the following conclusions.

First, U.S. economic GDP series has two breakpoints in 1976 and 1989, and thus the postwar U.S. economy can be divided into three periods 1947–1976, 1977–1989 and 1989–2011.These findings are different from previous academic findings, to the effect that the U.S. economic structural breakpoint is at 1983–1984.

Second, the U.S. Juglar cycles have an elongating trend. Particularly, after 1990, the trend seems even significant. And U.S. Kitchin cycles have a lengthening trend as well, but the trend proves somewhat slight when compared with the former. Additionally, the amplitude of Juglar Cycle and Kitchin Cycles has witnessed a deceasing trend after WWII.

References

Backus D, Kehoe PJ (1991) International evidence on the historical properties of business cycles. Technical report, Federal Reserve Bank of Minneapolis

Eckstein O, Sinai A (1986) The mechanisms of the business cycle in the postwar era. In: The American business cycle: continuity and change, University of Chicago Press, Illinois, pp 39–122

Francis XD (1999) A nonparametric investigation of duration dependence in the american business cycle. Bus Cycles Durations, Dyn Forecast, pp 64

Friedman BM (1986) Money, credit, and interest rates in the business cycle. In: The American business cycle: continuity and change. University of Chicago Press, Illinois, pp 395–458

Gordon RJ (2005) What caused the decline in US business cycle volatility? Technical report, National Bureau of Economic Research

Kent C, Norman D (2005) The changing nature of the business cycle. In: Proceedings of a Conference, Reserve Bank of Australia

Mejía-Reyes P (2004) Classical businesscycles in America: are national business cycles synchronised? Int J Appl Econ Quant Stud 1(3):75–102

Nath HK, Hegwood N (2012) Structural breaks and relative price convergence among US cities. Available at SSRN 2130762

Nolan C, Thoenissen C (2009) Financial shocks and the US business cycle. J Monetary Econ 56(4):596–604

Romer CD (1999) Changes in business cycles: evidence and explanations. Technical report. National Bureau of Economic Research

Siegler MV (1998) American business cycle volatility in historical perspective: Revised estimates of real GDP, 1869–1913. Technical report, Department of Economics of Williams College

Stock JH, Watson MW (2005) Understanding changes in international business cycle dynamics. J Eur Econ Assoc 3(5):968–1006

Temin P (1998) The causes of American business cycles: an essay in economic historiography. Technical report, National Bureau of Economic Research

Zarnowitz V, Moore GH (1986) Major changes in cyclical behavior. In: The American business cycle: continuity and change, University of Chicago Press, Illinois, pp 519–582

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Liu, J., Feng, Z. (2014). Inquiring into the Economic Structural Breakpoints and Postwar U.S. Business Cycle. In: Xu, J., Cruz-Machado, V., Lev, B., Nickel, S. (eds) Proceedings of the Eighth International Conference on Management Science and Engineering Management. Advances in Intelligent Systems and Computing, vol 280. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-55182-6_49

Download citation

DOI: https://doi.org/10.1007/978-3-642-55182-6_49

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-55181-9

Online ISBN: 978-3-642-55182-6

eBook Packages: EngineeringEngineering (R0)