Abstract

Nowadays challenging world of business forces managers to evaluate which factors are crucial for their organization continuousness. One of the most important competitive advantages is employee empowerment. The aim of this study is applying a model to rank bank branches by consider the main influence factors that affect employee empowerment. Proposed approach is based on Fuzzy Analytic Hierarchy Process (FAHP) and VIKOR (VlseKriterijumska Optimizacija I Kompromisno Resenje) methods. FAHP method is used in determining the weights of the criteria by decision makers and then rankings of the banks were determined by VIKOR method. The proposed method in this study is used for ranking the five branches of Agri bank in field of employee empowerment by eight indexes that have major impacts on it.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Rapid technological and economic change and also increased global competition has made more attention to the empowerment of employee’s issues. From 1990 it has been suggested that organizations with strong, committed, skilled and motivated employees will be able to better adapt to changes and compete with other organizations [15].

Employees’ organizational commitment is considered a critical factor which influences the employees’ behavior of bringing positive benefits to an organization. Committed employees tend to be more willing to make personal sacrifices for their organizations. In addition, highly committed employees are more likely to relate themselves with the goals and values of the organization. These employees oftentimes devote extra time to work and are proud of being members of the organization. However, given increasing work redesign issues in responding to external as well as internal business environments, many organizations have tried to maintain job effectiveness and efficiency by empowering employees in order to foster more committed workers to overcome problems such as complex job features, demanding customer needs, diverse work groups, flatter organizational structures, and so on. However, employees’ commitment oftentimes is sabotaged by downsizing, a business practice aimed at reducing overhead expenses with the goal of enhancing performance [12].

The modern banking system is not excluded from it and requires empowered employees to survive and continue as well as other organizations. Communication and interaction of this system with various factors such as government, private sector, financial supporters and other international banks and also Social, economic, cultural and diplomat factors has led to the creation of turbulent environment for banking system. Creation institutional capacity in the Bank can largely protect banking system against changes [15].

By using MADM techniques, this research is going to determine which factors have more influence on employee empowerment in banking system. It will use VIKOR method to rank bank branches.

2 Literature Review

Definitions of the nature of empowerment have fallen within a common frame in some aspects. On the other hand, despite a common frame being formed, there is no fully agreed definition of empowerment [20]. Conger and Kanungo propose that empowerment be viewed as a motivational construct-meaning to enable rather than simply to delegate. Therefore they definition of empowerment as a process of enhancing feelings of self-efficacy among organizational members through the identification of conditions that foster powerlessness and through their removal by both formal organizational practices and informal techniques of providing efficacy information [6]. The Oxford Dictionary defines empowerment as: “give (someone) the authority or power to do something, make (someone) stronger and more confident, especially in controlling their life and claiming their rights”. Bowen and Lawler [2] and Carless [4] described Empowerment as a venue to enable employees makes decisions. Humborstad and Perry [10] suggest that Managers use empowerment to allow workers to solve problems themselves but they must also include actions that foster job satisfaction and organizational commitment, to ensure that empowerment would affect turnover intention among employees. Trust between employees and managers are an important contributor to goal congruence, and a determinant of both the long-term success of the organization and the well-being of its employees. Without trust, employees become self-protective and defensive. Therefore, managers need to demonstrate trust in their employees by “distributing power, exhibiting confidence in employees, providing necessary resources and accepting new ideas”.

Conger and Kanungo believed that for empowerment, first, the effectiveness of the model should be tested. Specifically, the concept of self-efficacy should be further operational and tested. A more direct link between empowerment practices and leadership should be studied [6].

According to evaluation of the major dimensions in empowerment during 21th century researches it could be considered some influence factors in surveys. Tubbs and Moss found that information, authority, training, access to resources, and responsibility are the major dimensions of empowerment. Vecchio suggested clarity of goals and visions, organization belonging, cooperation as main influence factors in empowerment. Huczynski and Bachnan showed that the dimensions of empowerment are: authority, style of leadership, organizational belonging, cooperation, responsibility, and job enrichment. Rue and Byars suggested that there are two factors that are more important than other factors in empowerment and they are authority and Decentralization. Seyyed javadin and others evaluated major dimensions of empowerment since 1983 to 2003 and extracted twenty of them. By using factor analysis technique they recognized five dimensions as most important factors in employee empowerment in banking system [22]. Ogden and Others found that there are three factors that affect the empowerment: authority, attitude, and experiences of other organizational changes. They believed that the third factor of those is the most significantly dimension [16]. Men [14] showed that employees’ perceptions of empowerment have impact on quality of empowerment.

3 Fuzzy Sets

In order to deal with vagueness of human thought, Zadeh first introduced the fuzzy set theory. A fuzzy set is a class of objects with a continuum of grades of membership. Such a set is characterized by a membership function which assigns to each object a grade of membership ranging between zero and one [25]. A fuzzy set is an extension of a crisp set. Crisp sets only allow full membership or non-membership at all, whereas fuzzy sets allow partial membership. In other words, an element may partially belong to a fuzzy set [8]. Fuzzy sets and fuzzy logic are powerful mathematical tools for modeling: uncertain systems in industry, nature and humanity; and facilitators for commonsense reasoning in decision-making in the absence of complete and precise information. Their role is significant when applied to complex phenomena not easily described by traditional mathematical methods, especially when the goal is to find a good approximate solution [1]. Fuzzy sets theory providing a more widely frame than classic sets theory, has been contributing to capability of reflecting real world [9]. Modeling using fuzzy sets has proven to be an effective way for formulating decision problems where the information available is subjective and imprecise [26].

4 Fuzzy Analytic Hierarchy Process

First proposed by Thomas L. Saaty (1980), the analytic hierarchy process (AHP) is a widely used multiple criteria decision-making tool. The analytic hierarchy process, since its invention, has been a tool at the hands of decision-makers and researchers, becoming one of the most widely used multiple criteria decision-making tools [23]. Although the purpose of AHP is to capture the expert’s knowledge, the traditional AHP still cannot really reflect the human thinking style [11]. The traditional AHP method is problematic in that it uses an exact value to express the decision maker’s opinion in a comparison of alternatives [24]. And AHP method is often criticized, due to its use of unbalanced scale of judgments and its inability to adequately handle the inherent uncertainty and imprecision in the pairwise comparison process [7]. To overcome all these shortcomings, fuzzy analytical hierarchy process was developed for solving the hierarchical problems. Decision-makers usually find that it is more accurate to give interval judgments than fixed value judgments. This is because usually he/she is unable to make his/her preference explicitly about the fuzzy nature of the comparison process [11]. The first study of fuzzy AHP is proposed by Laarhoven and Pedrycz [13], which compared fuzzy ratios described by triangular fuzzy numbers. Buckley [3] initiated trapezoidal fuzzy numbers to express the decision makers evaluation on alternatives with respect to each criterion Chang [5] introduced a new approach for handling fuzzy AHP, with the use of triangular fuzzy numbers for pair-wise comparison scale of fuzzy AHP, and the use of the extent analysis method for the synthetic extent values of the pair-wise comparisons. Fuzzy AHP method is a popular approach for multiple criteria decision-making. In this study the extent fuzzy AHP is utilized, which was originally introduced by Chang [5]. Let \(X = \{x_1, x_2, x_3, \cdots , x_{n}\}\) an object set, and \(G = \{g_1, g_2, g_3, \cdots , g_{n}\}\) be a goal set. Then, each object is taken and extent analysis for each goal is performed, respectively. Therefore, \(m\) extent analysis values for each object can be obtained, with the following signs:

where \(\widetilde{M}^{j}_{g_i}(j=1, 2, 3, \cdots , m)\) are all triangular fuzzy numbers. The steps of the Chang’s [5] extent analysis can be summarized as follows:

- Step 1. :

-

The value of fuzzy synthetic extent with respect to the \(i\)th object is defined as:

$$\begin{aligned} S_i = \sum \limits _{j = 1}^m {\widetilde{M}^j_{g_i}} \otimes \left[ {\sum \limits _{i = 1}^n {\sum \limits _{j = 1}^m {\widetilde{M}^j_{g_i}} }} \right] ^{-1}, \end{aligned}$$(10.2)

where \(\otimes \) denotes the extended multiplication of two fuzzy numbers. In order to obtain \(\sum _{j = 1}^m {\widetilde{M}^j_{g_i}}\), it performs the addition of \(M\) extent analysis values for a particular matrix such that,

and for obtain \([ {\sum _{i = 1}^n {\sum _{j = 1}^m {\widetilde{M}^j_{g_i}} }} ]^{ - 1}\), it performs the fuzzy addition operation of \(\widetilde{M}_{g_i}^j\;(j =1, 2, \cdots , m)\) values such that,

Then, the inverse of the vector is computed as,

where \(u_i, m_i, l_i>0\).

Finally, to obtain the \(S_j\), it performs the following multiplication:

- Step 2. :

-

The degree of possibility of \(\widetilde{M}_{2}=(l_2, m_2, u_2)\ge \widetilde{M}_{1}=(l_1, m_1, u_1)\) is defined as \(V(\widetilde{M}_2 \ge \widetilde{M}_1 ) = \sup [ {\min (\widetilde{M}_1 (x),\widetilde{M}_2 (x))} ].\)

This can be equivalently expressed as,

Literature [5] illustrates \(V(\widetilde{M}_2 \ge \widetilde{M}_1 )\) for the case \(d\) for the case \(m_1< l_1< u_2< m_1\), where \(d\) is the abscissa value corresponding to the highest crossover point \(D\) between \(\widetilde{M}_1\) and \(\widetilde{M}_2\), to compare \(\widetilde{M}_1\) and \(\widetilde{M}_2\), it need both of the values \(V(\widetilde{M}_1 \ge \widetilde{M}_2 )\) and \(V(\widetilde{M}_2 \ge \widetilde{M}_1 )\).

- Step 3. :

-

The degree of possibility for a convex fuzzy number to be greater than \(k\) convex fuzzy numbers \(M_i(i=1, 2, \cdots , K)\) is defined as \(V(\widetilde{M} \ge \widetilde{M}_1 ,\widetilde{M}_2,\cdots , \widetilde{M}_K ) = \min V(\widetilde{M} \ge \widetilde{M}_i ),\;i = 1,2, \cdots ,k.\)

- Step 4. :

-

Finally, \(W=(\min V(s_1 \ge s_k ) , \min V( s_2 \ge s_k ), \cdots , \min V( s_n \ge s_k ))^T\), is the weight vector for \(k = 1, 2, \cdots ,n\).

5 VIKOR Method

-

1.

Introduction to VIKOR The VIKOR method is a compromise MADM method, developed by Opricovic and Tzeng [17, 18] started from the form of \(Lp\)-metric:

$$\begin{aligned} L_{pi} = \left\{ {\sum \limits _{j = 1}^n {\left[ {\frac{\omega _j (f_j^*- f_{ij} )}{(f_j^*- f_j^ - )}} \right] ^p}} \right\} ^{\frac{1}{p}}1 \le p \le + \infty ; \quad i = 1,2, \cdots ,I. \end{aligned}$$(10.8)The VIKOR method can provide a maximum “group utility” for the “majority” and a minimum of an individual regret for the “opponent” [17–19].

-

2.

Working Steps of VIKOR Method

All papers must be in Microsoft Word format, including figures, tables and references. The file of each paper cannot be larger than 2,000 Kb. Please embellish the figures in detail more carefully. Please improve the definition of all the figures appeared in your paper with the distinguish rate as high as possible.

-

(1)

Calculate the normalized value

Assuming that there are \(m\) alternatives, and \(n\) attributes. The various \(I\) alternatives are denoted as \(x_i\). For alternative \(x_j\), the rating of the \(j\)th aspect is denoted as \(x_{ij}\), i.e. \(x_{ij}\) is the value of \(j\)th attribute. For the process of normalized value, when \(x_{ij}\) is the original value of the \(i\)th option and the \(j\)th dimension, the formula is as follows: \( f_{ij} = \frac{x_{ij}}{\sqrt{\sum \nolimits _{j = 1}^n {x_{ij}^2}}}, i = 1,2, \cdots ,m, j = 1,2, \cdots ,n.\)

-

(2)

Determine the best and worst values For all the attribute functions the best value was \(f_{j}^*\) and the worst value was \(f_{j}^-\), that is, for attribute \(J=1-n\), it get Eqs. (10.9) and (10.10):

$$\begin{aligned} f_j^*&=\max f_{ij},\quad i = 1,2,\cdots ,m, \end{aligned}$$(10.9)$$\begin{aligned} f_j^ -&= \min f_{ij},\quad i = 1,2,\cdots ,m, \end{aligned}$$(10.10)where \(f_j^*\) the positive ideal solution for the \(j\)th criteria is, \(f_j^-\) is the negative ideal solution for the \(j\)th criteria. If one associates all \(f_j^*\), one will have the optimal combination, which gets the highest scores, the same as \(f_j^-\).

-

(3)

Compute the distance of alternatives to ideal solution

This step is to calculate the distance from each alternative to the positive ideal solution and then get the sum to obtain the final value according to equation:

$$\begin{aligned} S_i = \sum \limits _{j = 1}^n {w_j\left( f_j^*- f_{ij}\right) }/ \left( f_j^*- f_j^ -\right) , R_i = \max _j \left[ w_j\left( f_j^*- f_{ij}\right) / \left( f_j^*- f_j^ -\right) \right] , \end{aligned}$$(10.11)where \(S_i\) represents the distance rate of the \(i\)th alternative to the positive ideal solution (best combination), \(R_i\) represents the distance rate of the \(i\)th alternative to the negative ideal solution (worst combination). The excellence ranking will be based on \(S_i\) values and the worst rankings will be based on \(R_i\) values. In other words, \(S_i\), \(R_i\) indicate \(L_{1i}\) and \(L_{*i}\) of \(L_{p^-}\) metric respectively.

-

(4)

Calculate the VIKOR values

\(Q_i\) for \(i=1, 2, \cdots , m\), which are defined as\( Q_i = v\left[ {\frac{S_i - S^*}{S^--S^*}} \right] +(1-v)\left[ {\frac{R_i - R^*}{R^- - R^*}}\right] ,\) where \(S^- = \max _i S_i,~S^*= \min _i S_i,~R^ -= \max _i R_i,~R^*= \min _i R_i\) and \(v\) is the weight of the strategy of “the majority of criteria” (or “the maximum group utility”). \(\left[ {\frac{S_i - S^*}{S^--S^*}} \right] \) Represents the distance rate from the positive ideal solution of the \(i\)th alternative’s achievements. In other words, the majority agrees to use the rate of the \(i\)th. \(\left[ {\frac{R_i - R^*}{R^- - R^*}}\right] \) Represents the distance rate from the negative ideal solution of the \(i\)th alternative; this means the majority disagree with the rate of the \(i\)th alternative. Thus, when the \(v\) is larger \((> 0.5)\), the index of \(Q_i\) will tend to majority agreement; when \(v\) is less \((< 0.5)\), the index \(Q_i\) will indicate majority negative attitude; in general, \(v = 0.5\), i.e. compromise attitude of evaluation experts.

-

(5)

Rank the alternatives by \(Q_i\) values

According to the \(Q_i\) values calculated by Step 4, it can rank the alternatives and to make-decision.

6 Case Study

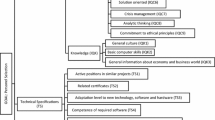

This part tries to establish proposed model in Agri bank. In this case, researchers try to rank the five branches of Agri bank in field of employee empowerment (Branch 1, Branch 2, Branch 3, Branch 4, and Branch 5) (Fig. 10.1).

-

(1)

Extract the most important criteria in case study and design the decision tree

In this step, it should be noted that according to case study, the important criteria should be extracted. Then the decision tree can be designed.

The most important employee empowerment criteria in Agri Bank are Personal development in career planning, Style of leadership, Environment and decentralization, Formality and transparency, Human resource’s problems, Attitude, Experience of other organizational changes, and Perceptions of empowerment. The decision tree of this case study as follow:

-

(2)

Measure the weight of each criterion by using FAHP technique.

To measure the weighting of criteria, should establish criterion paired comparison matrix according to experts of banking industry. It is better used the more than ten opinions of expert for receive more stable results. To establish criterion paired comparison matrix. To convert the fuzzy linguistic variables to fuzzy number can use the following Table 10.1.

After collecting the opinions of experts, using the arithmetic mean for construct the group paired comparison matrix (Tables 10.2, 10.3, 10.4, 10.5, 10.6, 10.7, 10.8, 10.9, 10.10 and 10.11).

- Step 1. :

-

by use the Eq. (10.8), \(S_i\) collected:

- Step 2. :

-

by use the Eq. (10.9), the degree of possibility matrix as

- Step 3. :

-

calculate the minimum of each row.

- Step 4. :

-

the weight can be calculated of the minimum values obtained in the previous step.

-

(3)

Design decision matrix by consider to the scores of each bank in each criteria

The decision matrix to rank the five banks is as follows. \(a_{ij}\)th are numbers in 1-10 scale that show the score of bank branch(\(i\)).

-

(4)

Rank the banks by attention to measured decision matrix and use VIKOR method.

- Step 1. :

-

Calculate the normalized decision matrix, use Eq. (10.1)

- Step 2. :

-

Determine the best and worst values in each column by use Eqs. (10.2), (10.3)

- Step 3. :

-

Compute the distance of alternatives to ideal solution by use Eq. (10.4), (10.5)

- Step 4. :

-

Calculate the VIKOR values \(Q_i\) by use Eq. (10.6).

- Step 5. :

-

Rank the alternatives

To rank the bank branch 1, \(\cdots \) bank branch 5, sort the \(Q_i\) ascending.

According to Table 10.12, Bank branch 4 is best one in field of employee empowerment.

7 Conclusions

In today’s competitive environment, recognizing some factors that help company to overcome with their competitors are important issue. Many recent papers have shown that human resource is the most important competitive advantage in today’s organizations. One of the major issues in HRM is employee empowerment, and for this reason some authors tried to find main factors that influence the empowerment.

This paper proposed a new model according to ranking bank branches in field of employee empowerment issues. This model is the combination of Fuzzy AHP and VIKOR methods and selects the best banks and their main criteria in field of employee empowerment based on evaluation of factors that have major impacts on quality of employee empowerment. Different from other studies in the literature, this study FAHP and VIKOR methods used together. FAHP used for determining the weights of the criteria and VIKOR method used for determining the ranking of the banks.

This study evaluated eight main factors in five bank branches of Agri bank. Other banks can use these methods in their branches before evaluating whole banks; it could help them to recognize that what exactly the main factors in each bank branch that influence its employee empowerment are.

References

Bojadziev G, Bojadziev M (1995) Fuzzy sets, fuzzy logic, applications, vol 5. World Scientific, Hong Kong

Bowen D, Lawler E (1994) The empowerment of service workers. The Training and Development Sourcebook 413

Buckley J (1985) Fuzzy hierarchical analysis. Fuzzy Sets Syst 17(3):233–247

Carless S (2004) Does psychological empowerment mediate the relationship between psychological climate and job satisfaction? J Bus Psychol 18(4):405–425

Chang D (1996) Applications of the extent analysis method on fuzzy AHP. Eur J Oper Res 95(3):649–655

Conger J, Kanungo R (1988) The empowerment process: integrating theory and practice. Acad Manag Rev 13(3):471–482

Deng H (1999) Multicriteria analysis with fuzzy pairwise comparison. Int J Approximate Reasoning 21(3):215–231

Ertugrul I, Karakasoglu N (2006) The fuzzy analytic hierarchy process for supplier selection and an application in a textile company. In: Proceedings of 5th international symposium on intelligent manufacturing systems, pp 195–207

Ertuğrul I, Tuş A (2007) Interactive fuzzy linear programming and an application sample at a textile firm. Fuzzy Optim Decis Making 6(1):29–49

Humborstad S, Perry C (2011) Employee empowerment, job satisfaction and organizational commitment: an in-depth empirical investigation. Chin Manag Stud 5(3):325–344

Kahraman C, Cebeci U, Ulukan Z (2003) Multi-criteria supplier selection using fuzzy AHP. Logistics Inf Manag 16(6):382–394

Kuo T, Ho L et al (2010) Employee empowerment in a technology advanced work environment. Ind Manag Data Syst 110(1):24–42

Laarhoven PV, Pedrycz W (1983) A fuzzy extension of saaty’s priority theory. Fuzzy Sets Syst 11(1):199–227

Men L (2011) How employee empowerment influences organization-employee relationship in China. Publ Relat Rev 37(4):435–437

NasreEsfahani A (2007) Employee empowerment in organizations. J Sheikh Bahaei 5:71–78

Ogden S, Glaister K, Marginson D (2006) Empowerment and accountability: Evidence from the UK privatized water industry. J Manag Stud 43(3):521–555

Opricovic S (1998) Multi-criteria optimization of civil engineering systems. Technical report, Faculty of Civil Engineering, Belgrade

Opricovic S, Tzeng G (2002) Multicriteria planning of post-earthquake sustainable reconstruction. Comput-Aided Civil Infrastruct Eng 17(3):211–220

Opricovic S, Tzeng G (2004) Compromise solution by MCDM methods: a comparative analysis of vikor and topsis. Eur J Oper Res 156(2):445–455

Pelit E, Öztürk Y, Arslantürk Y (2011) The effects of employee empowerment on employee job satisfaction: a study on hotels in Turkey. Int J Contemp Hosp Manag 23(6):784–802

Saaty T (1988) What is the analytic hierarchy process? Springer, Berlin

Seyyedjavadin R, Heidari H, ShahbazMoradi S (2009) Study of effective factors on empowerment of human resource in services. J Iran Publ Adm 1(2):75–88

Vaidya O, Kumar S (2006) Analytic hierarchy process: an overview of applications. Eur J Oper Res 169(1):1–29

Wang Y, Chin K, Yang J (2007) Three new models for preference voting and aggregation. J Oper Res Soc 58(10):1389–1393

Zadeh L (1965) Fuzzy sets. Inf Control 8(3):338–353

Zimmermann H (1992) Fuzzy set theory and its applications. Springer, Berlin

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Safari, H., Cruz-Machado, V.A., Faghih, A., Heidari, M., Rabor, F.M. (2014). Assessment Employee Empowerment Through Combination of FAHP and VIKOR Methods. In: Xu, J., Cruz-Machado, V., Lev, B., Nickel, S. (eds) Proceedings of the Eighth International Conference on Management Science and Engineering Management. Advances in Intelligent Systems and Computing, vol 280. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-55182-6_10

Download citation

DOI: https://doi.org/10.1007/978-3-642-55182-6_10

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-55181-9

Online ISBN: 978-3-642-55182-6

eBook Packages: EngineeringEngineering (R0)