Abstract

This paper examines how the nature of the technological regime governing innovative activities and the structure of demand interact in determining market structure, with specific reference to the pharmaceutical industry. The key question concerns the observation that—despite high degrees of R&D and marketing-intensity—concentration has been consistently low during the whole evolution of the industry. Standard explanations of this phenomenon refer to the random nature of the innovative process, the patterns of imitation, and the fragmented nature of the market into multiple, independent submarkets. We delve deeper into this issue by using an improved version of our previous “history-friendly” model of the evolution of pharmaceuticals. Thus, we explore the way in which changes in the technological regime and/or in the structure of demand may generate or not substantially higher degrees of concentration. The main results are that, while technological regimes remain fundamental determinants of the patterns of innovation, the demand structure plays a crucial role in preventing the emergence of concentration through a partially endogenous process of discovery of new submarkets. However, it is not simply market fragmentation as such that produces this result, but rather the entity of the “prize” that innovators can gain relative to the overall size of the market. Further, the model shows that emerging industry leaders are innovative early entrants in large submarkets.

Reprinted from Journal of Evolutionary Economics 22(4), 677-709, Springer (2012)

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Pharmaceuticals are traditionally a high R&D and marketing intensive sector. Both factors would suggest that—as a first approximation—the industry should be characterized by high degrees of concentration. However, concentration has been consistently low over the whole history of the industry. Yet, adding to the puzzle, competition does not occur among many small (relative to the market) firms of approximately similar size. Rather, the industry is largely dominated by a core of innovative firms which has remained quite small and stable for a very long period of time.

Standard explanations of these patterns refer essentially to the following main factors (e.g. Schwartzman 1976; Comanor 1986; Sutton 1998; Scherer 2000; Malerba and Orsenigo 2002):

-

a)

the patterns of imitation;

-

b)

the random nature of the processes of drug discovery;

-

c)

the fragmented nature of the market.

The first two factors are key features defining a “technological regime” (Nelson and Winter 1982; Winter 1984; Pavitt 1984; Breschi et al. 2000). A research tradition, nested in the tradition of innovation studies and evolutionary economics, suggests that the patterns of innovation and market structure are essentially determined by the nature of the relevant technological regime, described in terms of opportunity and appropriability conditions and cumulativeness of technological advances. In this context, the role played by the structure of demand has been less well explored, at least in formal terms. Here, using an updated version of a “history-friendly” model of the evolution of pharmaceuticals (Malerba and Orsenigo 2002), we address this issue directly and ask how the properties of the technological regime interact with market fragmentation (and size) in influencing the patterns of innovation and the evolution of market structure. In a nutshell: how do the relevant variables interact in producing the observed outcomes?

Our analysis links closely with other recent contributions, mainly Sutton (1998), Klepper (1996, 1997) and Klepper and ????Thompson (2006) which explicitly identify in market fragmentation a main limit to concentration. In this paper, we relate our results to this literature, but we depart from it in many respects. First, coherently with an evolutionary approach, we do not assume full rationality on the part of the agents and pre-impose equilibrium conditions. Second, we do not assume that the number of submarkets is fixed or exogenously generated, nor that any potentially profitable submarket is actually occupied (the “arbitrage principle”, see Sutton 1998). Rather, although there is a fixed number of “potential” submarkets, only some of them are actually discovered through R&D efforts. Third, our analysis is cast in an explicit dynamic setting. Fourth, we suggest that the variables that define a technological regime are indeed fundamental determinants of the mechanism governing the relationship between market structure and innovation.

In previous papers (Malerba and Orsenigo 2002; Garavaglia et al. 2010), we began to explore these issues through a history-friendly model of the evolution of the pharmaceutical industry and biotechnology. The model did a good job in replicating the main patterns of evolution of the industry. In this paper, we develop an updated version of the model, which introduces significant improvements compared to Malerba and Orsenigo (2002), and we expand significantly the analysis by examining systematically the manner in which the properties of the technological and demand regimes interact in determining concentration. It must be stressed that, although this paper is based on a history-friendly model, the analysis developed here is not strictly a history-friendly exercise. Rather, we use the history-friendly model to investigate a set of more general questions which might be relevant also for other industries and contexts. (For a discussion of this procedure, see Malerba et al. 2007 and Garavaglia 2010).

The paper is organized as follows: Section 2 discusses the interpretations of the features of market structure in pharmaceuticals provided by the literature. Section 3 presents the model, and Section 4 discusses the standard simulation results. Section 5 investigates the effects of technological regimes and demand structure on concentration. Section 6 concludes.

2 Innovation and Market Structure

2.1 Suggested Interpretations for the Case of Pharmaceuticals

The essential features of the pharmaceutical industry and of its history are rather well known and we shall not recount them here.Footnote 1 The central question raised in this paper is the following: why such a high R&D (and marketing) intensive industry such as pharmaceuticals has never been and it is still not highly concentrated? And why, at the same time, is this sector largely dominated by a handful of large firms, which entered early in the history of the sector and which have maintained their leadership for decades? The literature is almost unanimous in suggesting three factors which may explain the patterns observed in pharmaceuticals.

-

a)

Imitation

First, it is noted that imitation plays a crucial role. Innovation and the introduction of really new drugs is only part of the competitive story in pharmaceuticals. “Inventing-around” existing molecules, or introducing new combinations among them, or new ways of delivering them, etc., constitute a major component of firms’ innovative activities broadly defined. Thus, while market competition centers around new product introductions, firms also compete through incremental refinements of existing drugs over time, as well as through imitation after (and not infrequently even before) patent protection has expired. This latter in particular allows a large “fringe” of firms to thrive through commodity production and development of licensed products. Thus, many firms do not specialize in R&D and innovation, but rather in imitation/inventing around, as well as in the production and marketing of products often invented elsewhere. Additionally, generic competition after patent expiration is becoming increasingly strong.

-

b)

The properties of the innovation process

Second, it is emphasized that, in this industry, the innovative process is characterized by extreme uncertainty and, above all, by the difficulty of leveraging the results of past innovative efforts into new products. In other words, economies of scope and cumulativeness of technological advances are limited. In fact, the process of discovery and development of new drugs has been based for a long time on an approach customarily labelled “random screening”. Lacking a precise knowledge of the causes of the diseases and of the mechanisms of action of drugs, researchers screened randomly thousands of natural and chemically derived compounds in test tube experiments and in testing on laboratory animals for therapeutic activity. Unsurprisingly, only a very small fraction of them showed promising potential. Hence, innovative firms have only limited room for establishing dominant positions. Market leadership can be easily contested by new innovators. Concentration can arise through success-breeds-success processes: an innovative firm enjoying high profits may have more resources to invest in R&D and therefore higher probabilities to innovate again as compared to non-innovators. However, to the extent that the probability of the success of any one project is independent from past history, the tendency toward rising concentration is weakened. Thus, the process of discovery and development of a drug closely resembles a lottery (Sutton 1998).Footnote 2

-

c)

Market fragmentation

A third crucial factor limiting concentration is the fragmented nature of the pharmaceutical market. The pharmaceutical market results from the aggregation of many independent submarkets—corresponding to different therapeutic categories (TCs)—with little or no substitution between products. Thus, even monopolistic positions in one submarket do not translate into overall concentration, if the number of submarkets is large and their size (relative to the overall market) is not too skewed. As the number of submarkets increases, it becomes more difficult for one firm to dominate a larger, fragmented market. Pharmaceuticals fits this picture rather well. The industry is actually composed by a series of fragmented, independent markets, such as, e.g. cardiovascular, diuretics, tranquilizers, etc. The largest firms hold dominant positions in individual TCs.

2.2 The Theoretical Background

Recent theoretical literature has emphasized the role of market fragmentation, coupled with high entry costs and the absence of economies of scope or cumulativeness in preventing the onset of concentration in innovative industries.

Sutton (1998) provides a simple and compact framework in a game theoretic setting for analyzing this question. In his approach, the key determinant is the “escalation parameter” alpha: how large is the profit that a firm outspending its current or potential competitors might gain? If such profit is large, then an escalation mechanism is set in motion which leads to high concentration. In Sutton’s approach, the degree of market fragmentation plays a crucial role: if the overall market is composed by many independent sub-markets, then the value of alpha is necessarily lower. When the overall market is composed of several independent product groups, firms may pursue alternative research trajectories which have different relevance for the various submarkets. At one extreme, the same trajectory might be applicable to a wide range of products. At the other extreme, each trajectory is applicable only to one specific submarket. Thus, the effectiveness of an escalation strategy depends on two factors. First, it depends on the effectiveness of R&D investment on any single trajectory in raising consumers’ willingness to pay for the firm product within the associated submarket. Second, it depends also on the strength of the linkages between different R&D trajectories and their associated submarkets, i.e. on the economies of scope characterizing any one trajectory and on the degree of substitutability among products in the eyes of the consumers (Matraves 1999). A further prediction of the model is that an increase of the size of the market should lead to higher concentration: as market size grows, so does the value of the profits achievable through higher R&D spending, and the stronger becomes the escalation mechanisms.

Klepper’s approach takes a different route. In the analysis of the life cycle patterns (Klepper 1996), the main engine is given by a process of dynamic increasing returns to R&D: larger firms benefit most from process R&D—and hence choose to invest more in R&D—because they apply the resulting unit cost reductions to the largest amounts of output. As entry and growth occur over time, industry output expands, causing price to fall. Over time, the requisite R&D capabilities to enter arise. Eventually, even the most capable potential entrants cannot profitably enter, and entry ceases. The convex costs of growth limit the ability of later entrants to catch up with earlier entrants in terms of size, and as price continues to fall, the smallest firms and least able innovators are forced to exit the industry. This leads to a shakeout of producers that continues until the entire output of the industry is taken over by the most capable early entrants.

This model assumes homogeneous demand. Klepper (1997) suggests that product differentiation and demand fragmentation into many niches may prevent shakeouts and the emergence of concentration. Generalizing this intuition, Klepper and Thompson (2006) develop a model in which the process of (exogenous) creation and destruction of submarkets drives industry evolution. Firms expand by exploiting new opportunities that arrive in the form of new submarkets, while they shrink when the submarkets in which they operate are destroyed. The model predicts that a shakeout occurs and concentration increases if the rate of creation of new submarkets slows down and/or a new very large submarket appears. The exploitation of economies of scale and especially economies of scope across different product varieties reinforces this tendency. The tire, laser, automobile and disk drive industries are examples (Buenstorf and Klepper 2010). The link between innovation, demand and market structure thus explains the patterns of industry evolution.

A third approach focuses attention on the nature of the relevant technological regime (Nelson and Winter 1982; Winter 1984; Pavitt 1984; Breschi et al. 2000) in determining the patterns of innovation and the evolution of market structure. In extreme summary, a technological regime is defined in terms of opportunity and appropriability conditions and the cumulativeness of technological advances. In particular, tight (weak) appropriability conditions and strong (weak) cumulativeness in innovation give big (small) and self-reinforcing advantages to (early) innovators. Thus, one would expect technologies characterized by these properties to be associated with high (low) levels of concentration and large (small) firm size, as in the so-called Schumpeter Mark II (Schumpeter Mark I) model. The role of opportunity conditions is less direct. In Schumpeter Mark II contexts, high opportunities may reinforce the tendency towards concentration or allow the survival and/or entry of new innovators. Moreover, under these conditions, “lucky” new innovators introducing major innovations can also end up displacing incumbents. Conversely, in Schumpeter Mark I technologies, ample innovative opportunities are likely to sustain competition, as innovation can come from every quarter and its advantages are transient.

In this paper, we suggest that the variables that define a technological regime are indeed fundamental determinants of the mechanism governing the relationship between market structure and innovation in Sutton’s approach (Sutton 1998). However, in the technological regimes approach, the role played by the structure of demand has been less well explored, at least in formal terms. A number of models have focused attention on differences in consumers’ preferences as an important factor influencing the industry life cycle (Saviotti 1996; Dalle 1997; Windrum and Birchenhall 1998), particularly by allowing for the emergence of multiple, distinct market niches. Other studies focus attention on the way in which heterogeneity in consumers preferences influences the conditions by which a new technology can survive and eventually displace the old one (Dalle 1997; Adner and Levinthal 2001; Adner 2002; Windrum and Birchenhall 2005; Malerba et al. 2007). Similarly, Malerba et al. (1999, 2008) show the manner in which the appearance of new market niches can (or fail to) lead to stronger competition. These models, however, were based on environments characterized by “Schumpeter Mark II” regimes, i.e. by strong appropriability conditions and cumulative technological advances. Here, we delve deeper into the analysis of the way the demand regime—defined in terms of market size and market fragmentation—interacts with the technological regime in shaping market structure and its evolution.

Specifically, we ask:

-

a)

how do changing opportunity, appropriability and cumulativeness conditions affect market concentration in a setting of fragmented market?

-

b)

are the same results obtained with more homogeneous markets?

-

c)

in other words: do the predictions of the technological regimes approach still hold under different demand regimes?

3 The Model

3.1 The Appreciative Model

The industry is composed of many submarkets, called therapeutic categories (TC). Firms compete to discover, develop and market new drugs for a large variety of diseases, which are then sold in one of the TCs. Consistent with an evolutionary approach, neither firms nor customers are assumed to be fully rational, in the sense that they do not completely understand the world in which they are living, and no equilibrium conditions are pre-imposed to the model. Firms are characterized by different propensities towards innovation, imitation and marketing. Thus, firms explore randomly the “space of molecules” until they find one or more promising compounds, i.e. one which might become a useful drug, and patent them. Reflecting the “random screening” procedure, the search process is by definition completely random. The patent provides protection from imitation for a certain period of time and over a given range of “similar” molecules. After discovery, firms begin to develop the drug, without knowing what the quality of the new drug will be. If successful, the drug is sold on the market, the size of which is defined by the number of potential patients. Marketing expenditures allow firms to increase the number of patients they can access. At the beginning, the new drug is the only product available on that particular TC. But other firms can discover competing drugs or—after patent expiry—imitate. Thus, over time, the innovator’s sales and profits will be eroded away.

The discovery of a drug in a TC does not entail any advantage in the discovery of another drug in a different TC—except for the volume of profits they can reinvest in research and development. As a consequence, diversification into different TCs is also purely random. Firms’ growth, then, depends on the number of drugs they have discovered, on the size and the growth of the submarkets in which they are present, on the number of competitors, on the relative quality and price of their drug vis-à-vis competitors. Given the large number of TCs and the absence of any form of cumulativeness in the search and development process, no firm can hope to be able to win a large market share of the overall market, but – if anything—only in specific TCs for a limited period of time. As a result, the degree of concentration in the whole market for pharmaceuticals will be low.

3.2 The Formal Model

In this section, we describe the basic structure of the model.Footnote 3

3.2.1 The Topography

The number of the submarkets (TCs) is given and equal to n. Each TC has a different number of patients (Pat TC ), which determines the potential demand for drugs in each TC. This number is set at the beginning of each simulation by drawing from a normal distribution truncated at 0 to avoid negative values, and it is known by firms. Patients of each TC are grouped according to their willingness to buy drugs characterized by different qualities. Some of them, for example, may be unwilling to buy low quality drugs at the current price because of the presence of side effects.

Other things being equal, TCs having a larger number of patients tend to be more attractive for firms. The economic value of each TC is endogenously determined by summing the revenues of each drug j sold at a given time-variable price (Price j,t ). Therefore, even if the number of patients is exogenously given, the economic value of the TC changes during the simulation according to the monopolistic power stemming from to patents and the degree of competition among firms.

Each TC is characterized by a given spectrum of opportunities, represented by the number of molecules Mol TC having a therapeutic and (therefore potential) commercial value (quality Q) which firms aim to discover. Q is randomly set, drawn from a normal distribution (Fig. 1). On average, the probability of finding a “zero quality” molecule is equal to ϕ.

When a molecule is discovered, a patent is granted and is stored in a firm-specific portfolio of molecules available for future development projects. Patents have a specific duration, PD, and width, PW. That is to say, a patent prevents competitors from developing similar molecules located in the neighborhood (spatial location represents the similarity) for PD simulation periods. Once the patent expires, the molecule becomes available to all firms, i.e. it is put it in a public portfolio shared by all the firms.

3.2.2 The Firms

The industry is populated by an exogenously given numberFootnote 4 of potential entrants, nF, which may possibly enter the market at any given time. Each potential entrant is endowed with a budget B start , equal for all firms. All firms engage in three activities: search, development (i.e. research activities) and marketing. In each simulation period, firms search for promising molecules and, if successful, start to develop the drug. If the process of drug development is successful, firms actually enter the market and start marketing and selling the new drug. Firms have a limited understanding of the environment in which they act and behave, and follow simple, firm-specific rules of thumb (routines).

Firms are heterogeneous: each firm is characterized by a different “strategy”, or propensity, with regard to research and marketing activities. This propensity is quantitatively represented by a parameter, h, extracted from a uniform distribution. Consequently, firms invest a different amount of resources to each activity, according to their propensity. Thus, the firm’s budget, B, is divided each period among search, development and marketing activities as follows:

where ω is invariant and firm-specific.

Firms are heterogeneous for another reason as well: they can behave as innovators or imitators. Innovators look for new molecules, randomly screening the market environment and incurring a search cost. Imitators select among the molecules the patents on which have expired and thus avoid the cost of search. Imitators also benefit from facing a lower cost of drug development.

3.2.3 Innovative and Imitative Activities

Innovators invest in a search process which involves the payment of a fixed cost, (C s ), in order to draw a molecule. Thus, the number of molecules drawn by a firm in each period (X t ) is determined by the ratio between the fraction of the budget allocated to search, B s,t, and the cost C s :

Firms do not know the “height” (quality) Q of the molecule that they have drawn: they only know whether Q is greater than zero or not. If the molecule has Q > 0 and it has not been patented by others, then a patent for that molecule is obtained. The patented molecules become part of an individual ‘portfolio’ that each firm maintains for potential drug development. When drug development ends, the quality of the molecule (the new drug) is revealed.

Imitative firms differ from innovative firms because they pick up an already discovered molecule the patent on which has expired,Footnote 5 without paying the cost of drawing.

3.2.4 Development Activities

Both innovator and imitator develop products from molecules by engaging in drug development activities. A firm starts a development project using the budget allocated to this kind of activity, B D,t, to pay for the cost of development. The time and the cost necessary to complete a development project are assumed—for sake of simplicity—to be fixed and equal for all molecules and firms, the only difference being that both the cost and the time spent for innovation are larger than for imitation. Products must have a minimum quality, indicated with ν Q , to be allowed to be sold in the marketplace. In other words, products are subject to a “quality check” by an external agency (e.g. the FDA). Below this value, the drug cannot be commercialized and the project fails.

When a product originates from a molecule which has never been used before, it is labelled as an innovative product; otherwise it is considered an imitative product.

In every simulation period, firms choose how many projects to start and which are the most promising molecules to develop: firms run parallel projects. The choice of how many projects to be conducted simultaneously and of the molecules to be developed is governed by routines. Firms consider two features of the molecules for choosing the molecules to be developed: the economic valueFootnote 6 of the TC to which the molecule belongs and the residual length of the molecule’s patent protection. Given the number of projects compatible with the budget constraint, the top ranked molecules are chosen and the related development projects are started.

3.2.5 Marketing Activities

If the quality check is successful, in order to get access to a larger number of patients, firms invest in marketing activities, which yield a certain level of “product image” for the consumers.

The marketing expenditure for a given product, M t , is borne entirely at the launch of the drug at time t. This level of “image” is eroded with time at a rate equal to eA in each subsequent period, according to:

3.2.6 Demand

Drugs are bought on the marketplace by groups of heterogeneous consumersFootnote 7 (patients). Their decision to buy a drug depends on several factors, which together yield a specific “merit” to each j-th drug at time t. Formally, the value of this “merit”, U j,t , is given by:

where: Q j is the quality of the drug, M t the level of marketing “image” at time t, Price j,t is the level of price of drug j at time t defined by the firm according to a mark-up rule,Footnote 8 exponents a, b and c are specific to each TC and drawn from uniform distributions (see Appendix 1).

The quality of the drug impacts the diffusion among patients. Each patient is assumed to buy one unit of the drug. Patients of each TC are classified according to their sensitivity to drug’s quality. Low quality drugs will be in competition only for patients with the lowest request in terms of quality. Only high quality drugs are able to satisfy all the demand, even if there is only one firm in the TC. This stylized mechanism accounts the heterogeneity of the demand, where some patients face problems of side-effects and tolerability of the drugs.

Other things being equal, the higher the share of patients the higher will be firm’s sales and market share and, consequently, the higher will be the mark-up and price. The product’s price, the unit cost of manufacturing (assumed to be constant) and the number of patients determine the profits earned by a firm associated to a given product. Because a firm may have more than one product, total profits are given by the sum of profits obtained from all the products of the firm.

3.2.7 Exit Rules

There are three rules governing the firm’s exit. First, if the number of draws of potentially valuable molecules per period in the search process is 0 more than x times, the firm fails. This rule aims at reflecting research inefficiencies (obviously this rule does not work for those firms who follow an imitative strategy). The second rule states that, when a firm does not have the minimum budget needed to complete one project and is not selling or making other products, it fails. This rule reflects financial difficulties of the firm. Finally, firms exit when their overall market share is lower than χ. This reflects the unattractive position of the firm in the market. In the model, there is also an exit rule at the product level: firms consider marginal a product that is purchased by a share of consumers lower than 5 %, and consequently withdraw this product from the market.

4 Simulation Runs: “History-Friendly” Results

The “history-friendly” parameterization of the model (the “Standard Set”) reflects some fundamental theoretical hypotheses and, in a highly qualitative way, some empirical evidence, some strongly simplifying assumptions and, of course, our ignorance about the “true” values of some key parameters. Thus, for example, there are no economies of scale, no economies of scope and no processes of mergers and acquisitions, no exogenous advances in knowledge that allow firms to focus their search activities. As a consequence, the Standard Set is broadly considered as “history-friendly” and it serves the purpose to produce a benchmark for subsequent analyses.

The calibration of the model is the result of a process of repeated changes in the parameters and methods of the model in order to obtain a satisfactory specification. Some parameters are selected on the basis of the knowledge we have about their meanings and values as shown by the empirical literature and the evidence provided by industry’s specialists. The value of other parameters has been selected with the view to preserve coherence.

In our model, the landscape explored by firms is sufficiently rich in terms of opportunities of discovery to allow for the survival of the industry and the introduction of a large number of new drugs. However, search remains a very risky and most of the time unsuccessful activity: the parameter describing the probability of finding a “zero quality” molecule, ϕ, is set equal to 0.97: this means that only 3 % of the available molecules are potentially valuable. Moreover, the quality value of the molecules is highly skewed.

Search, development and marketing activities are expensive and take time. The development of a drug takes, respectively, eight and four periods (approximately, one period can be thought as corresponding to one year) for innovative and imitative products. The relative costs of search, development and marketing broadly reflect the costs currently observed in the industry (Di Masi et al. 2003). Patent duration is set equal to 20 periods. The number of submarkets (TCs) is also very high (200). Marketing expenditures have an important role in accessing a large number of customers and the sensitivity of demand to price is rather low.

The results of the “history friendly” analysis are described in detail in Garavaglia et al. (2010) and, for reasons of space, they will not be recounted here again. Suffice it to say that the so-called “Standard Set” succeeds in reproducing many of the stylized facts of the pharmaceutical industry: low and relatively stable concentration, strong competition between innovators and imitators, firms diversification in many submarkets, skewed size distribution of firms. In particular, it might just be worth remembering that, in each submarket, concentration (measured by the Herfindahl index, H TC ) tends to decrease quickly after an initial upsurge (Fig. 2): early entrants gain monopoly power in each TC but gradually, after the introduction of new competitive innovative and imitative products in the same TC, the degree of competition rises and concentration decreases.

Overall market concentration (measured by Herfindahl index in the overall market, H) is, however, always much lower than in individual TCs and it remains low throughout the simulation (Fig. 3). The reasons of this result are described and discussed in the following sections.

5 The Simulation Runs: Technological Regimes and Demand Regimes

The Standard Set is broadly considered as “history-friendly” and it serves the purpose to produce a benchmark for subsequent analyses.

In this section, we investigate the relationships between the variables defining the technological regime (appropriability, cumulativeness, opportunity) and the structure of demand (market fragmentation and market size). Results are averages over 100 runs.

5.1 Technological Regimes and Market Fragmentation

5.1.1 Appropriability

Imitation is the first candidate for explaining the low overall level of concentration. Figures 4 and 5 show how different appropriability regimes—defined in term of the duration of patent protection (PD)—affect concentration. In the Standard Set, unsurprisingly, H TC increases as patent protection becomes longer (Fig. 4). However, changes in PD induce somewhat unexpected outcomes in terms of overall concentration H (Fig. 5). First of all, changes are not drastic. Second, in a regime with basically no patent protection (PD= 1), H is actually higher in the earlier periods of the simulation: immediate imitation cuts the profits of both innovators and imitators and therefore the probability of discovering new products. Thus, entry becomes more difficult and the number of active firms is small. When the number of innovative products has grown enough, concentration begins to fall because firms are small and easy imitation starts to bite. At the end simulation, the value of H is halved as compared to the Standard Set.

However, H decreases also when patent duration is doubled, as compared to the Standard Set (PD= 40). The reason is that longer patent protection entails higher profits for innovators and hence higher probability to discover new drugs: while stronger patent protection extends the ability to maintain market power in each individual TC, innovative firms discover more TCs(about +30 %). Overall concentration declines accordingly because the number of active submarkets increases. Imitating firms also benefit from this scenario because there are now more products to imitate; both the number of innovative and imitative products increase (respectively, about +70 % and +23 %). As a result, H TC declines over time, reaching values only slightly superior to those obtained in Standard Set by the end of the simulation, and a larger number of active TCs allows more firms (innovators and imitators) to survive and prosper.Footnote 9

Let us now investigate the effects of shorter or longer PD in a less fragmented market. Figure 6 reports the value of H when the number of submarkets TCs is equal to 50, 10 and 1, for the cases of low, standard and high patent protection (respectively: PD = 1, 20 and 40). First, as the number of TCs decreases, the H index increases and, again, PD does not modify concentration substantially. More specifically, the effect of longer PD tends to decrease H with a large number of TCs. This effect becomes smaller as the number of TCs is reduced, but it never becomes positive. Conversely, low PD tends to increase slightly the H index (at least until period 40) with fewer TCs, i.e. TC = 50. When the number of submarkets becomes very low (i.e. TC = 10 or less), a shorter PD decreases again H (but still marginally), such that there is an inverted U effect of lower patent duration on H as the market becomes less fragmented. In the extreme case of a homogenous market (TC= 1), the industry converges quite rapidly towards monopoly, but even with no patent protection, concentration remains lower but still very high.

These results suggest that concentration depends much more on the degree of fragmentation of the market than on the appropriability regime. Competition in the industry does not appear to be substantially determined by the ease of imitation. Rather, the effects of changes in patent protection are constrained by the structure of demand. In “homogeneous” markets, concentration tends to be high anyway and stronger patent protection has practically no effect, while weaker appropriability can only limit but not reverse the tendencies towards monopoly power. Vice versa, if the industry is competitive (as a result of market fragmentation), a stronger appropriability regime may even reduce (already low) concentration precisely because—through higher profits—it makes the discovery of new submarkets easier.

5.1.2 Cumulativeness

A second factor that induces low concentration in pharmaceuticals is customarily identified in the random nature of search and the low level of cumulativeness in innovation. Thus, firms are unable to exploit past research to improve their chances to innovate again in the future, both in each TC and even more so in different TCs.

In this simulation, we introduce a technical cumulative effect in the search process of firms by modifying Eq. 2: the number of draws in the search space in each period for a firm is now defined as an increasing function of the number of products owned by the firm (Pr t ):

where Pr t is the number of products already developed by the firm and cum and k are parameters.

In general, more cumulative search processes have no significant effects on H.Footnote 10 When k = 1, if anything, stronger cumulativeness tends to lower H. Why? An “equalizing effect” prevails: all firms benefit from the cumulative effect in the process of search,Footnote 11 so that they increase their probability to develop more innovative products. This also leads to a higher opportunity for imitative firms to survive and to prosper by imitating and introducing new products. On the other hand, big firms with rich budgets benefit relatively less than small firms from cumulativeness, since they have already access to a large number of draws. In any case, as new TCs are discovered, overall concentration is lowered and coherently average concentration in each TC increases. With higher values of the parameter k, concentration does indeed increase, but the effect is still small (from 0.22 to 0.26): higher cumulativeness increases concentration only when the parameter k is very high.

This result holds also when the number of submarkets is changed. Changes in the degree of cumulativeness have very small effects in all scenarios. Similar results are obtained if a different form of cumulativeness is introduced in the model, namely economies of scale and scope in product development rather than in drug discovery.

5.1.3 Innovative Opportunities

How would market structure and innovation evolve in “richer” and “poorer” environments in terms of innovative opportunities? The effect of these changes are ex-ante uncertain: on the one hand, higher opportunities might reduce concentration, making it easier for firms to find molecules and to introduce new products; imitation would becomes easier, too. On the other hand, higher opportunities might increase concentration to the extent that success-breeds-success processes favor the growth of the larger firms, even in the absence of cumulativeness in the search process (Nelson and Winter 1982).

In order to investigate this question, we focus on the properties of the search space in our model. We run simulations with different probabilities of finding a promising molecule in order to start a new project (probability 1 − ϕ in Section 3.2.1), comparing the Standard Set, where the probability of finding a “zero quality” molecule is ϕ = 0.97, with a simulation in which opportunities are “richer” (ϕ = 0.9) and with one where are “poorer” (ϕ = 0.99).

The results are similar to the case of patent protection: the higher the probability of finding promising molecules, the higher (but only slightly) is the H TC (Fig. 7), the lower is H (Fig. 8), the greater are the number of firms, the number of explored TCs, the number of innovative and imitative products, and the size of both innovative and imitative firms.

These patterns can be explained by the interaction of different processes. First, when discovery is easier (higher opportunities), more TCs are discovered: firms distribute their innovative and imitative activities over a wider spectrum of submarkets. Second, within each TC, innovators can maintain higher market shares simply because they face fewer competitors (who are active in different TCs). Larger firms can grow more, enjoy higher profits and higher further chances to discover new drugs. But again, successful efforts are distributed over many different submarkets.

Results are partially different under alternative scenarios of the demand structure. In situations of high market fragmentation, higher opportunities reduce concentration, making it easier for firms to introduce new products in new submarkets. As the number of submarkets shrinks, higher opportunities induce higher concentration both in individual submarkets and in the aggregate. Firms have still better chances to discover new products, but the scope for entering new submarkets is now more limited. Larger firms have still better chances to innovate, but in a smaller set of TCs. Competitors may well introduce new products, but the submarkets are more crowded, profits are lower and chances to innovate again are comparatively reduced. Thus, success-breeds success processes lead to comparatively higher H. However, the effect of higher opportunities on H is positive at a decreasing rate as the number of TCs decreases. As the number of submarkets becomes very small—the extreme case being a completely homogeneous market—a firm becomes quickly a (quasi)-monopolist; in this case, higher opportunities for innovation and additional profits bear only smaller additional advantages, also because new products cannibalize old ones.

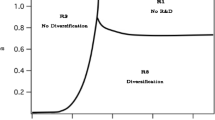

5.1.4 Schumpeter Mark I and Mark II

Finally, we summarize the results obtained so far by changing simultaneously the values of the parameters which define a technological regime. First, we create a “Schumpeter Mark I” context (SM1), with plenty of opportunities to innovate (ϕ = 0.9), low appropriability (\({\it PD} = 1\)) and no cumulativeness. Then, we construct a “Schumpeter Mark II” context (SM2), where ϕ = 0.99, \({\it PD} = 40\) and cumulativeness is high (k in Eq. 5 is equal to 3). We compare these two regimes with the Standard Set for different numbers of potential submarkets. We should expect, in principle, that concentration should decrease in the SM1 regime and increase in the SM2 regime.

In the SM1 regime (Figs. 9 and 10), both H TC and H are always lower than in the Standard Set for every given demand structure, although the effects are small and disappear by the end of the simulation. The fall in the indexes is more pronounced with a large number of submarkets. It becomes smaller as the number of TCs is reduced.

In the SM2 regime (Figs. 11 and 12), the effect is less obvious. On the one hand, concentration increases within individual submarkets up to a degree of market fragmentation equal to TC = 10, where, as we have discussed, the effect of low opportunities associated with the “Schumpeter Mark II” regime leads to lower average concentration levels. Moreover, overall concentration H decreases, contrary to our initial expectation. Our previous findings, however, explain this result. As appropriability and cumulativeness are stronger, firms gain larger profits in any one TC and have greater chances to discover new molecules and to open new submarkets. Thus, while concentration increases within each individual TC (H TC ), overall concentration H falls as the number of active TCs grows. As the number of potential submarkets is reduced, this effect becomes weaker. In the extreme case of a homogeneous market (TC = 1), the industry converges to monopoly.

5.2 Demand Regimes: Potential Submarkets and the Size of the Market

Previous results indicate that the variables defining the technological regime exert their effects on concentration—coherently with expectations—only within any given demand structure, but have limited effects when the demand structure changes. Indeed, one of the most important channels through which the technological regime influences market structure is through the discovery of new submarkets. The crucial questions, then, are: how and why do different degrees of market fragmentation affect concentration?

5.2.1 Number of Potential Submarkets

Keeping unchanged the value of the other relevant parameters, we modify the number of potential submarkets. Holding the value of the overall market constant, the number of TCs is gradually reduced from 200 to one. Results are straightforward: concentration increases as market fragmentation decreases. In the extreme case of a homogeneous market (TC= 1), the H index converges progressively and rapidly towards monopoly. This result squares neatly with the simple intuition described in the Introduction and in Section 3 and, in particular, with Sutton’s model (1998).Footnote 12

With regard to the dynamics of concentration in individual submarkets, at the end of the simulations, average concentration is higher, the lower is fragmentation, as expected. However, at the beginning of the simulations, the reverse holds: in the early stages of the simulation, only a few TCs have been discovered. Hence, more firms enter the same TCs, fostering competition and lowering concentration (see Garavaglia et al. 2010 for details).

This result is in tune with theoretical expectations. In particular, Sutton’s model predicts that market fragmentation leads to lower concentration because the “escalation parameter”, alpha, is lower. When markets are fragmented, the additional profits obtainable by a firm outspending rivals are limited: concentration remains low. Our model confirms this intuition: the key variable is the size of the “prize” that innovators can gain relative to the value of the overall market (and hence also the distribution of these prizes across submarkets): in pharmaceuticals, firm growth and changes in concentration are strongly dependent on the discovery of few blockbusters. However, the mechanism linking market fragmentation and concentration is somewhat different: it has to do essentially with success-breeds-success processes and first mover advantages.

When the market is fragmented, the prize accruing to an innovator is limited. An early innovator gains only a modest advantage vis-a-vis competitors, who maintain their chances to discover a molecule, mainly by opening new TCs. In an extreme case, one can think of many firms holding monopoly power in a single submarket and few early innovators being present in different TCs. This process increases concentration within each therapeutic category, but decreases it overall. Conversely, when the “prize” is big—because there are few TCs—early innovators gain a disproportionate advantage vis-a-vis competitors. Through their large profits, they gain further chances of discovering new molecules, while competitors are left with little possibilities to invest and find new drugs. Early innovators gradually end up dominating individual submarkets and—through diversification—the overall market.

More generally, it is the distribution of the “prizes” accruing to innovators that matters. Results (not reported here) show clearly that, holding constant the number of TCs and the value of the overall market, changes in the variance and in the skewness of the values of individual submarkets have a substantial impact on concentration (Garavaglia et al. 2010). The explanation is that, if the overall market is composed by very few extremely rich TCs and many poor ones, concentration increases drastically: the firm discovering the large submarket gains also a large fraction of the overall market; the “size of the prize” matters. In dynamic terms, this observation implies also that the discovery of a rich submarket will raise abruptly concentration, as in Buenstorf and Klepper (2010).

5.2.2 The Size of the Market

We now explore the behavior of the model for varying size of the markets. Holding the number of submarkets fixed, we change the number of patients and (as a consequence) the economic value of the market. Figure 13 shows an inverted U effect.

In the Standard Set, concentration declines (slightly) as the size of the market shrinks: the value of the prize is lower and the first mover advantage is smaller. However, larger markets do not induce substantially higher concentration because additional profits lead primarily to the discovery of new submarkets, keeping thus the level of concentration low. That is to say, irrespective of market size, fragmented markets are clearly related to low concentration and changes in the size of the market do not lead to substantially different results when the number of submarkets is high.

Next, we examine the effects of changes in market size in a different scenario of market fragmentation (\({\it TC} = 10\)), as reported in Fig. 14. The results confirm the previous intuition. As the number of submarket declines, poorer markets induce lower concentration and larger markets increase it, although at decreasing rates: when the market is sufficiently large (twice as much as compared to the Standard Set), further increases in market size do not bear any significant change. This is consistent with our previous finding: even if larger markets imply richer firms and consequently higher probabilities of discovering new TCs, with little market fragmentation, the negative effect of discovering new TCs on concentration vanishes: the degree of concentration shows a lower bound and remains relatively high.

In other words, the size of the “prize” matters: but it is its relative size rather than its absolute value that matters more.

5.2.3 Market Leaders

Both empirical evidence for pharmaceuticals and Klepper’s models (Klepper 1996; Klepper and Simons 2000a, b) suggest the relevance of innovative strategies and first-mover advantages in the evolution of the industry. Simulation results obtained so far suggest also that the size of the market (of the “prize” for innovators) should provide a strong advantage to innovators. To explore these issues, we implement a simple econometric analysis with simulated data. We define two different specifications of the model in order to test whether firms that dominate the market at the end of simulation are innovators and early entrants in large markets. We run 100 simulations and register data about 50 firms per simulation,Footnote 13 at the end of simulation, for the following variables: share (firms’ market share), size (firms’ profit), alive (status of firms), nTC (firms’ diversification, i.e. number of submarkets explored by each firm). Moreover:

-

we construct three dummies relating to the period of entry of firms; cohort1 if the firm enters in periods [1–3], cohort2 if the firm enters in periods [4–8], cohort3 if the firm enters after period 8;

-

we register market_size: size of the market, in terms of patients, in which firms enter first;

-

we define four dummies for the propensity of firms to invest in research in comparison to marketing, equal to (1–h), as defined in Section 3.2.2: high_propensity, medium_ propensity, weak_propensity, low_ propensity, respectively if h < 0.25, 0.25 ≤ h < 0.5, 0.5 ≤ h < 0.75, h ≥ 0.75.

We estimate a Probit model (column 1 of Table 1) with alive as the dependent variable. The results show that the earlier the entry period and the larger the first market entered, the higher the probability of being still alive at the end of the simulation period. The variables indicating the propensity to invest in research are not significant.

In another specification (column 2 of Table 1), we estimate an OLS on the subsample of firms conditional on being active in the end of the simulation. The dependent variable is the logarithm of share. Results are reported in column 2 of Table 1. Firms entering during the first cohort have a share 18 % larger at the end of the simulation. The same does not apply for the firms entering during the second cohort, while the difference is not statistically significant if compared to the firms that entered later. These results confirm that the first mover advantage is crucial and its effect is stronger at the very beginning of the simulation and disappears quickly. The size of the first TC explored by the firm affect positively the market share at the end of the simulation: a 1 % larger TC grants, on average, a 0.35 % larger share. Further, firms having a high propensity to innovate reach on average a market share 147 % larger then low propensity firms. To conclude, the model predicts that industry leaders are the early innovative entrants in large submarkets.

6 Conclusions

The history-friendly model of the pharmaceutical industry is able to reproduce the main stylized facts of the evolution of that industry. Moreover, our more theoretically oriented exploration provides results which might have a broader interest for the dynamic analysis of the relationships between innovation, demand and market structure.

First, the structure of demand matters in determining market structure. Fragmented markets are always less concentrated than homogeneous markets, irrespective of the relevant technological regime.

Second, technological regimes matter also, but their influence is modulated by the demand regime. Given a degree of market fragmentation, while in Schumpeter Mark I regimes, the nature of the technological regime influences market structure according to expectations (i.e. concentration tends to be lower as compared to the Standard Set), in a Schumpeter Mark II regime, overall concentration tends to be lower.

This seemingly negative result is explained by the third finding of this paper. Competition takes place in the model largely through the discovery of new submarkets. Within each submarket, the variables that define the technological regime produce indeed the expected results: stronger cumulativeness, richer opportunities to innovate and tighter appropriability conditions favor the emergence of market leaders. However, the opening of new submarkets reduces overall concentration.

Fourth, is not the number of submarkets as such that determines market structure, but rather the size of the “prize” that the innovators gain, both in absolute terms and relative to the value of the market. From this perspective, our result is in line with Sutton (1998) emphasis on the role played by the “escalation mechanism” in determining the relationship between market structure and innovation. However, our model reinterprets this finding in a dynamic, evolutionary context, where the value of the escalation parameter is crucially influenced by the nature of technological regime, the number of submarkets is partially endogenous and no assumption that profitable submarkets will be left unoccupied is required.

Moreover, the model embodies, at the same time, further results concerning the factors leading to industry leadership. Similarly with Klepper (1996), Klepper and Simons (2000a) and Klepper and Thompson (2006), but through different processes, and consistently with empirical evidence for pharmaceuticals, the model predicts that industry leaders will be early innovative entrants in large submarkets.

Fifth, the emergence of concentration (or lack of it) is explained in our model by the working of dynamic processes such as success-breeds-success, and increasing returns and strong cumulativeness, bandwagon effects in the demand side, as well as by the (partially endogenous) process of the creation of new submarkets.

We believe that these results increase our understanding of the factors affecting the relationship between market structure and innovation in an evolutionary and Schumpeterian approach. We believe also that they can foster dialogue and cross-fertilization between different approaches, identifying not only differences but also similarities, beyond fundamental diversity in basic methodological commitments.

Notes

- 1.

- 2.

From the mid 1970s, basic scientific progress led to a deeper understanding of the causes of the diseases as well as of the mechanisms of the action of drugs. This advance opened up the way for new techniques of searching, that have been named “guided search” and “rational drug design”. It is not the aim of this paper to study the advent and the consequences of biotechnology: a preliminary attempt in this direction can be found in Malerba and Orsenigo (2002). For the purposes of the present, suffice it to mention here that the “biotechnological revolution” and genomics have not yet substantially modified the intrinsically uncertain nature of the process of drug discovery and development.

- 3.

As compared to the previous version (Malerba and Orsenigo 2002), the model has been modified in many respects. The main change concerns the possibility of running parallel projects. Also, the development process, the demand equation, the pricing rule and the marketing module have been considerably modified. For a more detailed presentation of the model, see Garavaglia et al. (2010).

- 4.

The choice of parameters nF, n and time has been taken according to a process of calibration of the model in order to avoid meaningless outcomes.

- 5.

The portfolio of molecules includes not only the molecules from which other firms generated a drug, but also molecules not developed because firms fail or the molecules was not economically attractive.

- 6.

This value depends on the degree of competition among firms in the TC.

- 7.

For reasons of simplicity, we do not distinguish between patients who use the drug and physicians who prescribe it.

- 8.

The mark-up is structured in order to take into account the competitive pressure in the market TC. See Garavaglia et al. (2010).

- 9.

In this paper, we do not discuss the effects of patent protection on prices. In general, though, lower patent protection implies lower prices, as expected.

- 10.

See Figures in Garavaglia et al. (2010) regarding results with different values of the parameters cum and k, not included here for reasons of space.

- 11.

- 12.

See the robustness of these results in Appendix 2.

- 13.

The number of firms included in the regression should be 5000 (50 firms for 100 simulations). Among the 5000 firms, 20 do not enter the market (i.e. they do not discover and sell any drug). These firms are not included in the regression sample.

References

Adner R (2002)1 When are technologies disruptive: a demand-based view of the emergence of competition. Strat Manag J 23:667–688

Adner R, Levinthal D (2001) Demand heterogeneity and technology evolution: implications for product and process innovation. Manag Sci 47(5):611–628

Bottazzi G, Dosi G, Lippi M, Pammolli F, Riccaboni M (2001) Innovation and corporate growth in the evolution of the drug industry. Int J Ind Organ 19(7):1161–1187

Breschi S, Malerba F, Orsenigo L (2000) Technological regimes and schumpeterian patterns of innovation. Econ J 110:388–410

Buenstorf G, Klepper S (2010) Submarket dynamics and innovation: the case of the U.S. tire industry. Ind Corp Change 19(5):1563–1587

Chandler AD (2005) Shaping the industrial century: the remarkable story of the modern chemical and pharmaceutical industries (Harv Stud Bus Hist), Harvard University Press, Cambridge, MA

Comanor WS (1986) The political economy of the pharmaceutical industry. J Econ Lit 24:1178–1217

Dalle J-M (1997) Heterogeneity vs. externalities in technological competition: a tale of possible technological landscapes. J Evol Econ 7:395–413

Di Masi J, Hansen R, Grabowski H (2003) The price of innovation: new estimates of drug development costs. J Health Econ 22(2):151–185

Galambos L, Sturchio J (1996) The pharmaceutical industry in the twentieth century: a reappraisal of the sources of innovation. Hist Technol 13(2):83–100

Gambardella A (1995) Science and innovation in the US pharmaceutical industry. Cambridge University Press, Cambridge

Garavaglia C (2010) Modelling industrial dynamics with ‘history-friendly’ simulations. Struct Chang Econ Dyn 21(4):258–275

Garavaglia C, Malerba F, Orsenigo L, Pezzoni M (2010) A history-friendly model of the evolution of the pharmaceutical industry: technological regimes and demand structure, KITeS Working Paper

Grabowski H, Vernon J (1994) Innovation and structural change in pharmaceuticals and biotechnology. Ind Corp Change 3(2):435‒449

Henderson R, Orsenigo L, Pisano GP (1999) The pharmaceutical industry and the revolution in molecular biology: exploring the interactions between scientific, institutional and organizational change. In: Mowery DC, Nelson RR (eds) The sources of industrial leadership. Cambridge University Press, Cambridge

Klepper S (1996) Entry, exit, growth and innovation over the product life cycle. Am Econ Rev 86:562–583

Klepper S (1997) Industry life cycles. Ind Corp Change 6(8):145–181

Klepper S, Simons K (2000a) Dominance by birthright: entry of prior radio producers and competitive ramifications in the US television receiver industry. Strateg Manag J 21:997–1016

Klepper S, Simons K (2000b) The making of an oligopoly: firm survival and techniological change in the evolution of the U.S. tire industry. J Polit Econ 108:728–760

Klepper S, Thompson P (2006) Submarkets and the evolution of market structure. RAND J Econ 37(4):861–886

Malerba F, Nelson R, Orsenigo L, Winter S (1999) History-friendly models of industry evolution: the computer industry. Ind Corp Change 8(1):3‒40

Malerba F, Nelson R, Orsenigo L, Winter S (2007) Demand, innovation, and the dynamics of market structure: the role of experimental users and diverse preferences. J Evol Econ 17:371–399

Malerba F, Nelson RR, Orsenigo L, Winter SG (2008) Vertical integration and disintegration of computer firms: a history-friendly model of the co-evolution of the computer and semiconductor industries. Ind Corp Change 17:197–231

Malerba F, Orsenigo L (2002) Innovation and market structure in the dynamics of the pharmaceutical industry and biotechnology: towards a history-friendly model. Ind Corp Change 11(4):667–703

Matraves C (1999) Market structure, R&D and advertising in the pharmaceutical industry. J Ind Econ 47(2):169–194

Nelson R, Winter S (1982) An evolutionary theory of economic change. The Belknapp Press of Harvard University Press, Cambridge

Pammolli F (1996) Innovazione, Concorrenza a Strategie di Sviluppo nell’Industria Farmaceutica, Guerini Scientifica

Pavitt K (1984) Sectoral patterns of technical change: towards a taxonomy and a theory. Res Policy 13(6):343–373

Pisano G (1996) The development factory: unlocking the potential of process innovation. Harvard Business School Press

Saviotti P (1996) Technological evolution. Variety and the economy. Edward Elgar, Cheltenham

Scherer FM (2000) The pharmaceutical industry. In: Culyer AJ, Newhouse JP (eds) Handbook of health economics, I. Elsevier, Amsterdam, pp 1297–1336

Schwartzman D (1976) Innovation in the pharmaceutical industry. John Hopkins University Press, Baltimore

Sutton J (1998) Technology and market structure: theory and history. MIT Press, Cambridge

Windrum P, Birchenhall C (1998) Is product life cycle theory a special case? Dominant designs and the emergence of market niches through coevolutionary-learning. Struct Chang Econ Dyn 9:109–134

Windrum P, Birchenhall C (2005) Structural change in presence of network externalities: a co-evolutionary model of technological successions. J Evol Econ 15:123–148

Winter S (1984) Schumpeterian competition in alternative technological regimes. J Econ Behav Organ 5(3‒4):287‒320

Acknowledgements

The authors acknowledge the financial support of the Italian Ministry for Education, Universities and Research (FIRB, Project RISC - RBNE039XKA: “Research and entrepreneurship in the knowledge-based economy: the effects on the competitiveness of Italy in the European Union”). Christian Garavaglia would like to thank the participants of the 13th Conference of the International Schumpeter Society (Aalborg, 21–24 June 2010). The authors thank two anonymous referees for their useful suggestions. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: Parameters and variables reported in the text

- f :

-

index for firms

- t :

-

index for time

- TC :

-

index for therapeutic categories

General model parameters

- \({\it nF = 50}\) :

-

Initial number of possible entrants (firms)

- n = 200:

-

Number of TCs

- time = 100:

-

Periods of simulation

Exogenous industry characteristics

- a = U(0.5,0.6):

-

Exponent of product quality (PQ)

- b = U(0.15,0.20):

-

Exponent of inverse of price 1/Pricej,t

- c = U(0.35,0.4):

-

Exponent of launch marketing expenditures M

- \({\it eA} = 0.01\) :

-

Erosion coefficient of launch marketing expenditure

- \({\it Mol}_{TC} = 400\) :

-

Number of molecules per TC

- \({\it PD} = 20\) :

-

Patent duration

- \({\it PW}= 5\) :

-

Patent width

- ϕ = 0.97:

-

Probability of drawing a zero-quality molecule

- \({\it Pat}_{TC}\sim N(\mu _{p},\sigma_{p})\) :

-

Number of patients per TC

- μ p = 600:

-

Mean of normal distribution of number of patients per TC

- σ p = 200:

-

Standard deviation of normal distribution of the number of patients per TC

- Q~N(μ Q ,σ Q ):

-

Quality of the molecule

- μ Q :

-

Mean of normal distribution of positive quality molecules

- σ Q :

-

Standard deviation of normal distribution of positive quality molecules

- ν Q = 30:

-

Minimum quality of the product to be sold on the market

- ε = 1.5:

-

Price sensitivity of demand

Endogenous industry characteristic

- H TC :

-

Average Herfindahl index in submarkets (TCs)

- H :

-

Herfindahl index in the overall market

Exogenous firm characteristics

- B start = 4500:

-

Starting budget given to each entrant

- h = U[0.25, 0.75]:

-

Firm’s strategy

- ω = U(0.05, 0.15):

-

Firm’s share of budget dedicated to search

- C s = 20:

-

Firm’s cost of draw new molecules

- x = 7:

-

blank periods of search that leads to exit the market

- χ = 0.4 %:

-

lower bound to exit the market

Endogenous firm characteristics

- B D,t :

-

Budget dedicated to development of products at time t

- B M,t :

-

Budget dedicated to marketing of products at time t

- B S,t :

-

Budget dedicated to search of molecules at time t

- X t :

-

Number of draws of a firm f at time t

- \({\it Pr}_{t}\) :

-

Number of products belonging to firm f at time t

- M t :

-

marketing expenditure at time t

- \({\it Price}_{j,t}\) :

-

Price of drug j at time t

Appendix 2: Robustness of results

We check the robustness of our results with a Monte Carlo exercise for different degrees of fragmentation of the market: TC = 1, 10 and 200. For each of these three cases, we draw 100 different parameterizations of the model from a uniform multinomial distribution. Each marginal distribution of the multinomial is the value of the parameter i for the parameterization n, where i is between 1 and 8, and n between 1 and 100. Table 2 reports the parameters of the robustness check. We exclude the parameters that are the center of our analysis in order to isolate the effects of the i.

Robustness check is successful (Figs. 15 and 16). In the three baseline cases (TC = 1, 10 and 200), the effect of market fragmentation on H TC and H is confirmed, according to the analyses in the text, even applying the random parameterization of the model.

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Garavaglia, C., Malerba, F., Orsenigo, L., Pezzoni, M. (2013). Technological Regimes and Demand Structure in the Evolution of the Pharmaceutical Industry. In: Pyka, A., Andersen, E. (eds) Long Term Economic Development. Economic Complexity and Evolution. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-35125-9_4

Download citation

DOI: https://doi.org/10.1007/978-3-642-35125-9_4

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-35124-2

Online ISBN: 978-3-642-35125-9

eBook Packages: Business and EconomicsEconomics and Finance (R0)