Abstract

This paper conjectures that equity supply is crucial for firms in order to maintain a smooth patenting profile through time. This hypothesis is tested on Swedish firm-level observations from 1997 to 2005. Patent applications growth in Sweden has been highly volatile in recent years. During the economic downturn, following the burst of the IT-bubble, applications dropped substantially, but results here show that the downturn had little effect on the patenting of high-equity firms. Instead, the entire decline in patent applications is confined to firms with lower levels of equity. This effect is consistent across sectors, firm-size, corporate-affiliation, and human-capital intensity.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

This paper explores the relationship between finance and innovation. There are a number of studies which have explored the link between finance and R&D investment (see Hall and Lerner 2010 for a review), but we instead consider how finance affects firm-level patenting.Footnote 1 Studying patents in this framework is of interest for a number of reasons. For instance, a considerable share of firms’ inventions stem from activities which fall outside formal R&D. Many firms do not even have an R&D department, while some firms use incentive structures to encourage non-R&D employees to be inventive, and so aim at stimulating patenting. Thus, exploring patents instead of R&D enables us to capture an important aspect of financing firm-level innovation, which is mostly overlooked in the literature.

Since innovation activity is equity dependent (see e.g. Hall 2002), we conjecture that it is crucial for firms to have a consistent supply of equity in order to maintain their patenting strategy over time. Our analysis tests how firm-level equity supply affects the number of patent applications. We show that firms with the best supply of equity, other things equal, can maintain their patenting strategy over time, whereas firms with less equity experience drops in the number of patent applications when internal equity wanes.

Firms’ access to finance is volatile and highly affected by both supply and demand of capital. Literature on innovative activity emphasizes firm-level innovation as preferably a stable activity, which may become problematic if firms need to cut research or other innovation-related activities due to shortages of funds caused by short-term drops of capital supply (see Aghion et al. 2005, 2008).Footnote 2 Schumpeter (1942) referred to recessions as temporary drops of overall demand and an opportunity for firms to regroup and innovate.Footnote 3 Business cycle effects matter in the context of access to finance because, during booms when overall demand is high, firms that otherwise are constrained financially can fund their operations and innovate due to the cash-flow generation caused by the high demand. Firms that are capable of being persistent innovators develop internal capabilities, which enable them to benefit from knowledge spillovers; they also tend to be less sensitive to adverse macroeconomic shocks (Geroski et al. 1997; Cohen and Levinthal 1990).

There are empirical studies suggesting financial effects on R&D investment, albeit supplying a mixed picture. Evidence of financing constraints for U.S. firms investing in R&D has been shown (Hall 1992; Himmelberg and Petersen 1994; Mulkaly et al. 2001), while studies for Europe typically find weak evidence (Bond et al. 2003b; Harhoff 1998). However, more recent studies for the U.S. and Europe, employing more recent and detailed data, indicate that equity supply (both internal and external) plays an important role for the financing of R&D of high-tech firms (see Brown et al. 2009; Martinsson 2010 for U.S. and European evidence, respectively). Brown et al. (2009) find significant effects of cash flows and external equity for young but not for mature firms.

Both patenting activity and R&D are difficult to finance with debt due to the high idiosyncratic risk of firm-level innovation, which forces firms to pledge collateral in order to obtain debt (see Berger and Udell 1990). Further, moral hazard problems and adverse selection are severe in terms of firm-specific innovation projects as well (e.g. Stiglitz 1985). Therefore, equity is preferably used to finance innovation.

There is a small but growing body of literature on finance and patents. Similar to our approach, Schroth and Szalay (2009) hypothesize that financing constraints affect firm-level patenting. Using a sample of publicly traded pharmaceutical firms, they show that access to finance greatly affects the probability of winning a patent race. Kortum and Lerner (2000) confirm the importance of venture capital (VC) funding for patenting rates in the U.S., and that increases in VC activity in an industry are associated with significantly higher patenting rates.Footnote 4 Geroski et al. (1995) document a positive relationship between cash-flow and patenting.

In this paper, we hypothesize that patenting is equity-dependent, similarly to R&D investment, and therefore it is important for innovative firms to have access to equity in order to maintain a smooth patenting strategy over time. This way, equity supply is crucial if firms are to innovate when overall demand is low as proposed by Schumpeter (1942).

The Swedish economy, in combination with very detailed firm-level data, provides a setting that enables us to empirically explore the hypothesis that equity supply is important for firm-level patenting. First of all, Statistics Sweden has audited register data of all firms in Sweden, thus enabling us to analyze not just publicly traded firms.Footnote 5 Using the EPO Worldwide Statistical Database (PATSTAT), we have matched the firm-level data with all patent applications filed by enterprises based in Sweden. Second, Sweden is a patent-intensive country, with 1,770 patent applications per million of population compared to the U.S. with 1,360.Footnote 6 Also, Sweden has had a rather volatile development of total patent applications in recent years, which provides time series variation in the data. Patent applications filed by Swedish firms experienced high growth during the mid and late 1990s, before contracting, following the IT-boom, and returning to high growth again in 2006.

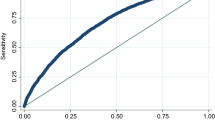

We separate our sample into quartiles based on firms’ average equity-ratio over the time period. Firms in the bottom quartile are referred to as low-equity firms, the second and third quartiles are middle-equity firms and the top quartile is denoted high-equity firms. The aggregate number of patent applications declined during our sample period. We show that the entire drop of patent applications took place in the middle equity group. Conversely, the top-equity firms exhibited a stable development. The remainder of the paper tries to understand this development. The fact that the low-equity firms account for a very small share of the patent applications corroborates our hypothesis that equity supply plays an important role for the number of patent applications.

We find that the most significant difference between these groups of firms is their equity supply. The equity groups are remarkably similar in terms of other firm characteristics such as size, human-capital intensity, and corporate affiliation.

We test the importance of equity-financing formally by adopting the pecking order approach behind investment-cash flow sensitivity analyses first introduced by Fazzari et al. (1988). The rationale is basically that a firm displaying sensitivity of investment to cash-flow over a period of time likely has worse access to external finance than a firm not displaying such sensitivity. The econometric analysis shows the following: firms in the low and middle equity group display large economically, as well as statistically, significant sensitivities of patent applications to cash-flow. The top equity firms display no such sensitivity, suggesting that the firms in the bottom three quartiles have relatively less access to external finance than firms in the top equity group.

The intuition behind our finding is that when firms face difficulties obtaining external finance, they become dependent on retaining earnings to fund operations. As cash-flow wanes, firms focus on tangible assets which generate cash-flow (Anderson and Prezas 1999). Thus, they are more likely to refrain from filing a patent application if finances are low since patenting inventions, which, by some stochastic probability, only stands to generate cash-flow sometime in the future. Enabling firms to stay innovative, and ultimately protecting their innovative efforts with patents, is important in order for firms to stay competitive in the future.Footnote 7

However, one might argue that recessions shake out the less viable inventions, leading to fewer patent applications by forcing firms to focus on their core operations in the spirit of Schumpeter’s (1942) notion of recessions as cleansing mechanisms. We find such an explanation implausible since it is highly unlikely that firms with lower equity-ratio (these firms are far from insolvent) have disproportionately many less patentable inventions.

This paper proceeds as follows. Section 1 presents the data. Section 2 highlights the Swedish case and discusses how equity supply affects patenting activity. Section 3 provides econometric evidence of how equity supply affects patent applications. Section 4 performs some robustness tests. Section 5 concludes and discusses some of the implications of the paper.

1 Data Description

The firm-level data used in this study was originally constructed from audited register information on firm characteristics based on annual reports on surviving and non-surviving firms in Sweden during 1997–2005. Using the EPO Worldwide Statistical Database (PATSTAT), we have merged this data with additional data on the educational level of each firm and national and international patent applications filed by enterprises in Sweden. In the merging process we have managed to match 76 % of the patent applications in PATSTAT with unique firms in Sweden. Analyzing the remaining 24 % of the patent applications shows that they mostly consist of micro firms with few or no employees.

The sample for this paper is focused on manufacturing firms exclusively. We do this for two particular reasons. Most of the patent applications in our sample are filed by manufacturing firms. Moreover, a majority of studies on finance and innovation involve manufacturing firms exclusively and we make extensive use of these previous studies in variable selection, for instance (e.g. Bond et al. 2003b; Brown et al. 2009; Mulkaly et al. 2001).

Since the data includes the entire population of Swedish firms, as defined above, we are confronted with some particular data management issues. First, we must exclude firms with obvious erroneous observations. In line with Brown et al. (2009), Fazzari et al. (1988) and Scellato (2007), all firms with negative sums of cash-flow-to-assets during the sample period are dropped. Since the original sample consists of all firms in Sweden there are some issues regarding the quality of the data for the smaller firms in particular. We therefore exclude firms with average number of workers below ten during the sample period, and we also eliminate implausible values such as negative debt and equity figures, etc.Footnote 8 Following the sample construction we end up with an unbalanced panel of about 3,400 firms for the period 1997–2005. About 15 % of the firms applied at least once for a patent during the sample period.

2 Patent Applications and Financial Factors: The Swedish Case

2.1 Background

The period after the burst of the IT-bubble in the beginning of 2000 is characterized by a dramatic decline in patent applications filed by Swedish manufacturing firms. The decrease in our sample is substantial, with a drop from about 5,000 filed patent applications in the late 1990s to about 3,000 in the early 2000s. This drop in patent applications was not driven by ICT and/or biotech firms alone; these sectors experienced similar drops to the overall sample. Instead we hypothesize that firms’ access to finance played a large part. Innovation is largely financed with equity (see Hall 2002; Hall and Lerner 2010 for surveys). Debt contracts are ill-suited for innovation activity. For instance, the uncertain and volatile returns of research and patent intensive firms (Carpenter and Petersen 2002; Stiglitz 1985), as well as adverse selection problems associated with R&D investment and patent-related activities, disqualify debt as a financial instrument (Jensen and Meckling 1976; Stiglitz and Weiss 1981). Creditors do not share the upside potential of innovation investments, but stand to lose, since they only receive a fixed income stream from interest payments while carrying too much of a down-side risk due to the highly stochastic nature of the return to innovation investments. Further, there is poor collateral quality in innovation-related investment, which disqualifies debt as a financial instrument (Berger and Udell 1990; Titman and Wessels 1988).

2.2 Equity Financing and Patent Applications: Pooled Evidence

We hypothesize that equity supply is important for firms in order to maintain a consistent patenting activity over time. We divide our sample into quartiles based on their average equity-ratio over the time period. Firms in the bottom quartile are referred to as low-equity firms, the second and third quartiles are middle-equity firms and the top quartile is denoted high-equity firms. In Fig. 1 we display the development of the number of patent applications for these three groups of firms.

Number of patent applications across equity-ratio groups 1997–2005. Notes: Equity groups are based on the average equity to total assets ratio across the sample period. ‘Low’ comprises the bottom quartile of firms in terms of average equity ratio, ‘Middle’ the second and third quartiles and ‘High’ the top quartile

The low equity group comprises very few patent applications. In Fig. 1 it is clear that firms in the middle-equity group constitute the entire fall in the number of patent applications. The high-equity firms display some annual variation, but do not share the development of the middle-equity firms. Given the clear picture presented in Fig. 1 we carry this sample split of three groups based on equity-ratio throughout the paper. First, we need to examine whether we are capturing something other than access to equity.

Table 1 presents descriptive statistics for all firms divided into the three groups in the first three columns to the left, and only for the patenting firms in the three columns to the right. The choice of variables displayed in Table 1 follows the more developed finance and R&D investment literature (see Brown et al. 2009; Hall 1992; Himmelberg and Petersen 1994). The choice of variables is, of course, also restricted by data availability.

We start by scrutinizing the equity-ratio division based on the overall sample. The average number of patent applications per firm increases with the size of the equity-ratio. Not very surprisingly, the high equity-group comprises, on average, more profitable firms (we address this more in Sect. 2.3). We measure profitability by cash-flow (after-tax income plus depreciation and amortization). The long-term debt stocks mirror the equity stocks. The low-equity group uses lots of long-term debt and the high-equity group much less. We find interestingly that the average and median firm-size (measured as the log of employment) of the equity groups is more or less identical, so we are not capturing a size effect in Fig. 1.

Klette and Kortum (2004) argue that a firm’s innovation rate depends on its knowledge capital, which stands for all the skills and know-how that it possesses when it attempts to innovate. A large part of this knowledge capital is embodied in the workers in the firm. We try to capture this by how well-educated the firm’s workers are. We define the variable Human capital as number of workers with a university education longer than 3 years normalized by the total number of workers. We argue that this reflects a firm’s capacity to absorb, assimilate and develop new knowledge and technology (Bartel and Lichtenberg 1987; Cohen and Levinthal 1990).Footnote 9 We do not address the issue of persistent innovators, causing a potential omitted variable bias in our econometric approach (Blundell et al. 1995).Footnote 10 We argue that the inclusion of the Human capital variable, along with the control of firm fixed effects, in the econometric analysis reduces this problem. It is noteworthy that the three equity-groups display the same share of skilled employees, about 16 %.

The paper also includes a dummy variable, high-tech sector, enabling us to control for the degree of high-technology of each sector. This measure is based on the OECD classification of sector R&D-intensity. Since the decline in patent applications coincided with the burst of the IT-bubble, we want to make sure that the development in Fig. 1 is not driven by sector composition within each group. The middle equity-group has a slightly higher share of high-tech firms, albeit not large enough to be driving the results. Of the firms in the middle group, 7.2 % operate in high-tech industries, compared to 6.5 % and 6.4 % in the top and bottom groups, respectively (we examine patent applications in high-tech sectors versus non-high tech sectors in depth in Sect. 4).

As a final control variable we have access to information on corporate-affiliation, in Table 1 represented by a dummy indicating if the firm is a part of a multinational enterprise (MNE). Corporate-affiliation might very well be driving the results here. A firm affiliated to an MNE could either receive equity-injections directly from other parts of the MNE or enjoy lower costs of external finance because of its affiliation. In terms of corporate-affiliation of the three equity-groups we find no significant difference; about 35 % of the sample-firms are affiliated to an MNE.

The differences between patenting firms and the overall sample are consistent across the equity groups. Table 1 provides evidence of differences in terms of the average number of patent applications per firm, cash-flow and equity to total assets across the equity-groups. There is also a clear difference between all firms and the patenting firms across all three groups. Patenting firms are more profitable in terms of average cash-flow. Further, they are substantially larger, have relatively more skilled workers and, to a far larger extent, are a part of an MNE. One noteworthy aspect: the number of patent applications per firm is higher for the high-equity group but the share of patenting firms in the middle and high-equity groups is very similar.

Based on our control variables in Table 1 we conclude that we have variation among equity groups in terms of cash-flow and number of patent applications. Is it simply so that more profitable firms file for more and better patents?

2.3 Profitability, Equity Financing and Patent Applications: Time Series Evidence

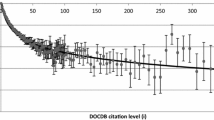

All three equity groups have stable equity ratios over the studied time period. Based on the descriptive analysis this far it appears as though we lack some information on firm-level access to equity. Given the high and stable level of equity of firms in the high-equity group, they should have high and stable cash-flows unless they can access equity finance elsewhere.

Pooling all firm-year observations, Table 1 reveals that the high-equity firms have on average higher cash-flows. However, breaking down the observations to annual averages Fig. 2 shows that the high-equity group also has the most volatile cash-flows. This suggests that we lack information on, for instance, external equity sources. Are the firms in the high-equity group publicly traded to a larger extent, are they backed up by VC or private equity investors, or any other external equity source? This is beyond what we see in our data. We address this in the econometric analysis in Sect. 3.

Average annual cash flow to total assets across equity-ratio groups 1997–2005. Notes: Equity groups are based on the average equity to total assets ratio across the sample period. ‘Low’ comprises the bottom quartile of firms in terms of average equity ratio, ‘Middle’ the second and third quartile and ‘High’ the top quartile. Cash flow is defined as after-tax income plus depreciation and amortization divided by the beginning of the period total assets

One potential driver of the results is that the equity-ratio sample division simply captures growth and non-growth firms (see Fig. 3). However, the groups follow the same pattern with growth (in terms of total assets) in excess of 10 % per annum in the late 1990s, around 2 % growth rates during the weak economic period following the burst of the IT-bubble, and then we see a return to high growth in the latter part of the sample period.

Average annual total assets growth across equity-ratio groups 1997–2005. Notes: Equity groups are based on the average equity to total assets ratio across the sample period. ‘Low’ comprises the bottom quartile of firms in terms of average equity ratio, ‘Middle’ the second and third quartiles and ‘High’ the top quartile. Total assets growth is defined as the year on year percentage change of the natural log of total assets

Based on the descriptive statistics it appears as if access to equity is a key factor, explaining the decline of patent applications over the observed time period. Intuitively, this makes sense. When overall demand (measured as GDP) wanes, as it did following the burst of the IT-bubble, it is likely that the supply of cash-flow declines. Investments in intangibles, which patent applications represent, do not generate any cash-flow in the near future (see Anderson and Prezas 1999). If the firm is unable to access external finance, it might be forced to reduce intangible investment in favor of tangible assets that do generate cash-flow streams today. In the descriptive analysis we show that the entire drop in patent applications is concentrated to the middle-equity group. The low-equity group constitutes a very small fraction of overall patent applications and the high-equity group displays a stable development of patent applications. We now proceed with econometric analysis. This enables us to explore how financial factors affect patent applications, while simultaneously controlling for the non-financial determinants of firm-level patenting.

3 Econometric Analysis

3.1 Theory and Empirical Predictions

In order to investigate the importance of equity-financing for persistent patent activity, we adopt a pecking-order approach (Myers and Majluf 1984; Stiglitz and Weiss 1981) inspired by Fazzari et al. (1988), who explore the sensitivity of fixed investment to cash-flow and conjecture that if a firm’s investments are associated with cash-flow over time, it can be interpreted as a sign of financing constraints.Footnote 11 There are plenty of examples of studies applying the Fazzari et al. (1988) approach to R&D investment (see e.g. Brown et al. 2009; Himmelberg and Petersen 1994; Mulkaly et al. 2001). Our approach is to test the sensitivity of the number of patent applications to cash-flow.

Sensitivity of investment to cash-flow is an indication that the firm lacks access to external finance and thus is likely to be financially constrained. With this methodology we can analyze the relationship between patent applications and cash-flow across the three equity-groups while simultaneously controlling for the key determinants of patenting presented in Table 1. This way we can also gain some information on the external finance access of the high-equity group, which we suspect is better than for the other groups.

The high and stable level of equity across the different phases of the business cycle, in combination with the highly volatile cash-flow development, suggests that the high-equity firms might have better access to external sources of equity than firms in the middle- and low-equity groups.

We hypothesize that firms in the high-equity group do not display sensitivity of patent applications to cash-flow, while the other two groups do. This way we might implicitly observe the external finance access of the three sub-groups. The degree to which the low and middle groups differ is difficult to foresee given the few patent applications made by low-equity firms.

3.2 Estimation Method

Only about 15 % of the firms in our sample are patenting firms, implying that the patent filings variable has an excess of zero observations and is also over-dispersed. We apply the negative binomial model, since it is robust to excess numbers of zero observations and to over-dispersion while also controlling for unobserved firm-specific effects (Cameron and Trivedi 2008; Lerner et al. 2008).

In our model specification number of patent applications is the dependent variable and cash-flow is the key explanatory variable of each of the three sub-groups based on equity-ratio. Further, we also include sales and long-term debt as “financial” control variables. Omitting sales may lead to an upward bias of the cash-flow estimate due to the high correlation of sales and cash-flow. Sales constitute a control for firm demand which enables us to view the cash-flow estimate more as a sign of internal finance access rather than a sign of high firm demand (Brown et al. 2009, p. 163). As discussed in Sect. 2, we include the log of employment as a control for firm-size, human-capital intensity as a control for the knowledge base within the firm, sector dummies to control for the high-tech intensity of the industry, and also corporate-affiliation indicating if the firm is a part of a domestic or foreign-owned multinational enterprise (MNE).

3.3 Results

Table 2 shows the relationship of patent applications with respect to its determinants. The first column comprises the coefficient estimates for the whole sample. All variables enter significantly and with the expected signs. However, cash-flow provides the weakest estimate, significant only at about 5 %. As expected, the size estimate indicates that, other things equal, larger firms file for more patents. Human-capital intensity is quantitatively large and highly important to the number of patent applications, in line with the descriptive statistics and existing literature. Also, both foreign as well as domestic MNE-affiliated firms are associated with higher levels of patent applications, corroborating Table 1.

In columns 2–4 we examine the sensitivity of patent applications to cash-flow for the three different subgroups classified by their equity-ratio; Low, Middle and High. Columns 2 and 3 show positive, significant and quite sizeable coefficients associated with changes in cash-flow for firms with a low- or middle-equity ratio. In contrast, the cash-flow coefficient is very small and nonsignificant for high-equity firms. This result confirms the predictions of Sect. 3.1. Following the rationale of cash-flow sensitivity, we argue that this is a sign that low-equity firms have less external finance access than firms with a higher equity-ratio. The cash-flow estimates suggest that the high-equity firms might have better access to outside financing compared to the middle- and low-equity firms. This could be an explanation of why low and especially middle-equity firms reduce their patent applications as a consequence of falling internal equity supply following lower overall demand.

We also estimate the sample of all firms on a sub-sample of years with high economic activity (1997–2000) and lower economic activity (2001–2005).Footnote 12 This way we can gain additional understanding of how reliable the cash-flow sensitivity approach is in our context. In times of high economic activity the premium on external finance goes down following more risk appetite from investors, higher expected rates of return to investment etc. Cash-flow is also higher when demand is high, all else equal. Thus, we predict that there should be no or lower sensitivity of patent applications to cash-flow in the 1997–2000 sample and higher sensitivity in the 2001–2005 sample. In line with our predictions, the cash-flow is non-significant during the high economic activity period. Conversely, there is a large and highly statistically significant cash-flow estimate in the 2001–2005 sub-sample. The findings for the sample split on macroeconomic activity strengthen our belief in the usefulness of the cash-flow sensitivity approach here.

We thus argue that equity financing matters for a firm in order to maintain its patenting strategy over the course of the business cycle. And, as suggested by the econometric analysis, it is important to be able to access equity externally in order to maintain a consistently high equity-ratio. We draw this conclusion from implicitly observing access to outside finance via estimating the sensitivity of patent applications to cash-flow for the three equity groups.

4 Robustness Checks

4.1 High-Tech Patent Applications vs. Non-high Tech Patent Applications

Since the decline in patent applications coincided with the burst of the IT-bubble, we want to make sure that our results are not driven by the high-tech sectors.Footnote 13

In Fig. 4 we calculate the growth rate of patent applications and convert them into an index with 1997 set as reference year, across high-tech and non-high tech firms as well as high-equity and middle-equity firms. The high-equity group finishes above 100, at 110 to be specific. The middle-equity group index-value in 2005 is 46, implying that the number of patent applications of the middle group declined by 54 % from 1997 to 2005. Both high-tech and non-high tech firms experienced declines of about 40 % in the number of their patent applications during the sample period. This piece of evidence convinces us that we are not simply capturing a downturn in high-tech patent applications.

Development of the number of patent applications (1997–2005): High-tech sector division vs. equity split. Index with 1997 set as 100. Notes: The high-tech sectors are: Manufacture of basic pharmaceutical (SIC 24410), pharmaceutical preparations (24420), office machinery (30010), computers and other information processing equipment (30020), insulated wire and cable (31300), electronic valves and tubes and other electronic components (32100), television and radio transmitters and apparatus for line telephony and line telegraphy (32200), television and radio receivers, sound or video recording or reproducing apparatus and associated goods (32300), medical and surgical equipment and orthopedic appliances except artificial teeth, dentures, etc. (33101), instruments and appliances for measuring, checking, testing, navigating and other purposes, except industrial process control equipment (33200) and industrial process control equipment (33300) (source: Statistics Sweden). Equity groups are based on the average equity to total assets ratio across the sample period. ‘Low’ comprises the bottom quartile of firms in terms of average equity ratio, ‘Middle’ the second and third quartiles and ‘High’ the top quartile. Cash-flow is defined as after-tax income plus depreciation and amortization divided by the beginning of the period total assets

4.2 Are the Middle- and Low-Equity Firms Financially Constrained?

In Sect. 3 we tried to gain information on the external finance access of the different equity groups. Based on the investment-cash flow sensitivity approach, we argue that the low and middle equity-groups have poorer access to equity than firms in the high-equity group. In this section we address the potential problems of the investment-cash flow approach (the Kaplan and Zingales critique) by applying another test of firms’ financing constraint status. Almeida et al. (2004) develop a model for testing whether groups of firms are financially constrained. They test the cash-flow sensitivity of cash. Firms that experience problems obtaining funds in the external capital market buffer cash from their own cash-flow in order to smooth operations when cash-flow wanes. Almeida et al. (2004) find that financially constrained firms display such sensitivity whereas unconstrained firms do not.Footnote 14

We estimate a specification with changes in cash holdings (cash and equivalents) divided by beginning of the period total assets as the dependent variable and cash-flow as the main explanatory variable along with the same control variables as in Table 2 to evaluate the cash-flow sensitivity of cash for the high-equity group vs. the rest of the sample.Footnote 15 In line with the results in Sect. 3, the high-equity group displays no cash-flow sensitivity of changes in cash holdings, whereas the middle and low-equity groups do. These findings further strengthen our results that there are firm-level financial effects behind the fall in patent applications in Sweden from 1997 to 2005.

4.3 Change in Definition and Model Specification

In our final robustness check we make a substantial change of the observed data and the methodological framework in order to test the sensitivity of the result presented in Table 2. The alternative dataset is also based on PATSTAT, but we expend the period with three additional years. Moreover, our second data set has a higher match-rate between the firm-level data and the patent applications filed by enterprises based in Sweden. The second dataset also includes more outliers that were eliminated in Table 3. Thus, Tables 3 and 4 report results with the following changes. First, the time-span is 1997–2008. Second, we include sales growth in the model and drop the ownership variables. Third, we modify the cash-flow variable, which now is defined as after-tax income adjusted for depreciation and amortization, wage costs, a cost for intermediate products and costs for raw materials. Fourth, the firms are separated into only two equity groups. The first is low-medium consisting of firms within the bottom 2/3 of the average equity distribution over the period 1997–2008, and the second contains firms in the top 33 % of the distribution. Fifth, we include a lagged cash-flow variable, in Table 4. Sixth, finally, we compare different count-data models for panels, the Poisson model and the Negative binomial estimator.

The conclusion from Table 3 is that results confirm the main finding from Table 2 showing that the link between innovation (patenting) and economic fluctuations differ across groups of firms with different access to equity. In Table 3, both the Possison and Negative binomial estimates for cash flow are positive and highly significant. Presumably due to the different definition of the cash-flow variable, the order of magnitude of the coefficient estimates is lower than in Table 2. It can also be noted that the Poisson point estimate for cash-flow is negative and significant in Table 3, in accordance with the Schumpeterian hypothesis that R&D and patent filings are pro-cyclical. The corresponding Negative binomial estimate is non-significant.

Table 4 applies the same model as Table 3, but includes a lagged cash-flow variable. The results are almost identical to Table 3. The only exception is that the instantaneous effect if the cash-flow in the negative binomial regression only is significant at the 10 % level, while the lagged cash-flow coefficient is highly significant.

5 Conclusion and Implications

We argue that firm-level equity supply plays an important role for firms in maintaining their patenting strategy over the business cycle. We use a panel of 3,400 manufacturing firms in Sweden and find that their aggregate number of patent applications dropped by more than 40 % from the peak year in 2000.

We show that the entire drop of patent applications was concentrated among firms with moderate amounts of equity in relation to total assets, whereas patent applications of firms with high levels of equity were little affected. Firms with low levels of equity constitute a very small fraction of aggregate patent applications. This finding is not driven by firm-size, human-capital intensity, firm-affiliation, sector composition or asset-growth intensity.

Our results indicate that capital-market imperfections may have adverse impacts on firm-level patenting. Since we think it is highly unlikely for firms with moderate equity supply to have disproportionately many low-quality patent applications (even though we wish to incorporate the quality of the patents in future studies), we argue that improving equity supply could be a useful means to facilitate firm-level innovation.

Schumpeter (1942) argues that recessions are cleansing mechanisms that eliminate firms which are unable to re-organize and innovate. This notion about recessions assumes that firms can always obtain finance externally (see also Aghion et al. 2008). The Schumpeterian view on business cycles makes perfect sense in a world without capital-market imperfections; in a recession when demand is low, the opportunity cost to innovate for future growth is also low. Our results indicate that there are capital-market imperfections present that disturb this Schumpeterian view of business cycles. We think it is unlikely for high-equity firms to have such a disproportionately higher number of quality patent applications compared to middle-equity firms. Therefore, it is likely that firms in the middle-equity group actually dropped economically viable patent applications due to a lack of funds.

From a policy perspective it is possible to identify these firms, but is it desirable to intervene? Such policies are plagued with moral hazard and adverse selection issues.Footnote 16 And, as Heller and Eisenberg (1998) highlight, there is a downside to patents in that they potentially block technological development through enhancing incumbent market power.Footnote 17 However, there are fields where policy makers can intervene. Policies attempting to broadly improve both internal and external equity supply are favorable. Through the corporate tax rate it is possible to affect the supply of internal equity. External equity supply can be improved through efforts to improve accounting standards, removing obstacles in the financial market, creating stock exchanges for firms that wish to go public but during present conditions are unable to (which might also increase venture capital access from enhanced “exit possibilities”), etc.Footnote 18

Lev (2004, pp. 111–112) argues that due to disclosure problems, associated with intangible assets such as patents and R&D, intangibles-intensive public firms face an undervaluation problem which leads to higher costs of capital.Footnote 19 The patent-intensity of Sweden might partly be a result of the relatively transparent accounting standards reducing asymmetric information, which would otherwise deter investors. Sweden is classified as a country with high accounting standards (Levine 1999).Footnote 20 Therefore, it is not only firms with “deep pockets” that are able to be innovators. Ironically, this could be one of the reasons why Sweden’s patent-application growth is comparatively volatile. When external finance is plentiful, relatively many firms in Sweden can obtain adequate funds to be innovative, but when the external equity market dries up, these funds are no longer available.

Notes

- 1.

Klette and Kortum (2004) maintain that patents and R&D are related across firms. However, this relationship is the strongest for large firms. Smaller firms exhibit relatively many patents per dollar of formal R&D which Griliches (1990, p. 1676) interprets as “…small firms are likely to be doing relatively more informal R&D while reporting less of it and hence providing the appearance of more patents per R&D dollar”. There is a discrepancy between what constitutes innovation and what constitutes patents. Not all inventions are patentable and the inventions that actually are patented differ tremendously in quality. An economist wishes to isolate the patents that actually are economically significant. Patents have been found to be a good proxy for innovative output or indexes of inventive activity in the literature (see e.g. Griliches 1990; Lerner et al. 2008).

- 2.

Aghion et al. (2008) show that firms classified as credit constrained have a pro-cyclical R&D share out of total investment, whereas non-constrained firms have a counter-cyclical share. Thus, the non-constrained firms can innovate in recessions and increase their competitiveness.

- 3.

Geroski and Walters (1995, p. 918) make a similar point.

- 4.

Using a different perspective to Kortum and Lerner (2000), Haeussler et al. (2009) focus on firms seeking VC. They document the economic importance of patents as signaling instruments attracting VC financing for younger firms. However, some works find that firms with higher R&D intensity, more patents and lower share of tangible assets report more problems in accessing external finance. See for instance Westhead and Storey (1997), Freel (1997) for UK, Giudici and Paleari for Italy (2000).

- 5.

The nature of our data enables us to draw inference from a more representative sample of firms. Griliches (1990) shows that U.S. studies on patents analyze publicly traded corporations, which is a highly disproportionate sample of firms. The firms in Bound et al.’s (1982) empirical study on R&D and patents have more than 1,000 employees. Compared to census data of all U.S. firms, only 4.6 % of the firms in the U.S. during the same time period had more than 1,000 employees.

- 6.

The patent application number is the 2007 number from WIPO divided by the most recent population figure for each country, which is approximately 301 million for the U.S. and 9 million for Sweden.

- 7.

Http://www.CNNMoney.com (December 11, 2009: 6:08 AM ET) cites an executive of a major software company: “The overall company reduced spending, and patent filings are a very controllable expense. We might have filed four patents, but we filed three and made sure they were strategically significant”.

- 8.

The results are robust to considering alternative cut-offs around ten employees.

- 9.

- 10.

We are unable to control for the effect of persistence in innovation as suggested in Blundell et al. (1995) since we do not have reliable measures of R&D or pre-sample history of the patent variable. Human capital is further useful since many small firms do not report official R&D expenditure.

- 11.

There are, however, caveats with the cash-flow sensitivity approach The approach of dividing a sample into sub-groups on the basis of different access to finance, and then testing the sensitivity of investment to cash-flow, has encountered criticism, most notably in Kaplan and Zingales (1997). However, Bond et al. (2003a, p. 154) argue that it “remains the case in the (Kaplan and Zingales) model that a firm facing no financial constraint… would display no excess sensitivity to cash-flow”, and in this case the Kaplan and Zingales critique does not apply.

- 12.

These estimation results are not presented due to space constraints, but they are available upon request.

- 13.

The following sectors are considered high technology: Manufacture of basic pharmaceutical (SIC 24410), pharmaceutical preparations (24420), office machinery (30010), computers and other information processing equipment (30020), insulated wire and cable (31300), electronic valves and tubes and other electronic components (32100), television and radio transmitters and apparatus for line telephony and line telegraphy (32200), television and radio receivers, sound or video recording or reproducing apparatus and associated goods (32300), medical and surgical equipment and orthopedic appliances except artificial teeth, dentures etc., (33101), instruments and appliances for measuring, checking, testing, navigating and other purposes, except industrial process control equipment (33200) and industrial process control equipment (33300) (source: Statistics Sweden).

- 14.

- 15.

We estimate this specification with within estimation firm-specific effects. Since we are only interested in comparing the two groups, we argue that potential endogeneity and simultaneity biases affect both groups of firms similarly.

- 16.

Svensson (2007) analyzes small firms and individuals and their access to external finance and the commercialization of their patents. He shows that the larger share of external funding from governmental programs the lower the probability of patents being commercialized, indicating the agency problems associated with non-private financial support.

- 17.

Hall and Ziedonis (2001) and Hall (2005) document the explosion of patents since the beginning of the 1980s. U.S. sources also document how the vast number of patent applications has become a serious public policy problem because patent offices are capacity constrained (see for instance National Research Council 2004).

- 18.

- 19.

See Hall et al. (2007) for recent evidence of the market valuation of patents.

- 20.

Based on an index (scale 0–90) of the comprehensiveness of corporate annual reports, referred to as accounting standards on scale, Sweden scores the highest of 83. For instance the U.S. has an index value of 71 and the second highest accounting standards are found in the UK with 78 (Levine 1999, pp. 14–15).

References

Aghion P, Angeletos G-M, Banerjee A, Manova K (2005) Volatility and growth: financial development and the cyclical composition of investment. Working Paper

Aghion P, Askenazy P, Berman N, Cette G, Eymard L (2008) Credit constraints and the cyclicality of R&D investment: evidence from France. Banque de France Working Paper 198

Almeida H, Campello M, Weisbach MS (2004) The cash-flow sensitivity of cash. J Finan 59:1777–1804

Anderson MH, Prezas AP (1999) Intangible investment debt financing and managerial incentives. J Econ Bus 51:3–19

Bartel AP, Lichtenberg FR (1987) The comparative advantage of educated workers in implementing new technology. Rev Econ Stat 69:1–11

Bates TW, Kahle KM, Stulz RM (2009) Why do U.S. firms hold so much more cash than they used to? J Finan 64:1985–2021

Baum CF, Schäfer D, Talavera O (2009) The impact of financial structure on firms’ financial constraints: a cross-country analysis. Working Paper

Berger AN, Udell GF (1990) Collateral, loan quality, and bank risk. J Monet Econ 25:21–42

Berman E, Bound J, Machin S (1998) Implications of skill biased technical change: international evidence. Quart J Econ 113:1245–1279

Black BS, Gilson RJ (1998) Venture capital and the structure of capital markets: bank versus stock markets. J Finan Econ 47:243–277

Blundell R, Griffith R, Van Reenen J (1995) Dynamic count data models of technological innovation. Econ J 105:333–344

Bond S, Elston J-A, Mairesse J, Mulkaly B (2003a) Financial factors and investment in Belgium, France, Germany, and the United Kingdom: a comparison using company panel data. Rev Econ Statis 85:153–165

Bond S, Harhoff D, Van Reenen J (2003b) Investment, R&D and financial constraints in Britain and Germany. LSE Research online http://eprints.lse.ac.uk/771/

Bound J, Cummins C, Griliches Z, Hall BH, Jaffe AB (1982) Who does R&D and who patents? NBER Working Paper 908

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash-flow, external equity, and the 1990s R&D boom. J Finan 64:151–185

Cameron AC, Trivedi PK (2008) Applied microeconometrics using STATA. STATA, New York

Carpenter RE, Petersen BC (2002) Capital market imperfections, high-tech investment, and new equity financing. Econ J 112:54–72

Cohen W, Levinthal DA (1990) Absorptive capacity – a new perspective on learning and innovation. Adm Sci Q 35:128–152

Fazzari SM, Hubbard RG, Petersen BC (1988) Financing constraints and corporate investment. Brookings Pap Econ Act 1:141–195

Francois P, Lloyd-Ellis H (2009) Schumpeterian cycles with pro-cyclical R&D. Rev Econ Dyn 12:567–591

Freel M (1997) Towards an evolutionary theory of small firm growth. Unpublished working paper, Paisley Enterprise Research Centre, Paisley

Geroski PA, Walters CF (1995) Innovative activity over the business cycle. Econ J 105:916–928

Geroski PA, Van Reenen J, Walters CF (1995) Innovations, patents and cash flow. Mimeo (London Business School), New York

Geroski PA, Van Reenen J, Walters CF (1997) How persistently do firms innovate? Res Policy 26:33–48

Giudic G, Paleri S (2000) The provision of finance to innovation: a survey conducted among Italian technology-based small firms. Small Bus Econ 14:37–53

Griliches Z (1990) Patent statistics as economic indicators: a survey. J Econ Lit 28:1661–1707

Groh AP, von Liechtenstein H, Lieser K (2010) The European venture capital and private equity country attractiveness indices. J Corp Finan 16(2). http://ssrn.com/abstract=1747662

Haeussler C, Harhoff D, Mueller E (2009) To be financed or not… – The role of patents for venture capital financing. Centre for European Economic Research Discussion Paper, No. 09–003

Hall BH (1992) Investment and research and development at the firm level: does the source of financing matter? NBER Working Paper 4096

Hall BH (2002) The financing of research and development. Oxf Rev Econ Policy 18:35–51

Hall BH (2005) Exploring the patent explosion. J Technol Transf 30:35–48

Hall BH, Lerner J (2010) The financing of R&D and innovation. In: Hall BH, Rosenberg N (eds) Handbook of the economics of innovation. Elsevier-North Holland, New York

Hall BH, Ziedonis RH (2001) The patent paradox revisited: and empirical study of patenting in the U.S. semiconductor industry, 1979–1995. RAND J Econ 32:101–128

Hall BH, Thoma G, Torrisi S (2007) The market valuation of patents and R&D: evidence from European firms. NBER Working Paper 13426

Harhoff D (1998) Are there financing constraints for innovation and investment in German manufacturing firms? Ann Econ Stat 49/50:421–456

Heller MA, Eisenberg RS (1998) Can patents deter innovation? The anticommons in biomedical research. Science 280:698–701

Himmelberg CP, Petersen BC (1994) R&D and internal finance: a panel study of small firms in high-tech industries. Rev Econ Stat 76:38–51

Jensen MC, Meckling W (1976) Theory of the firm managerial behavior, agency costs and ownership structure. J Finan Econ 4:305–360

Kaplan SN, Zingales L (1997) Do investment-cash flow sensitivities provide useful measures of financing constraints? Quart J Econ 112:169–215

Klette T, Kortum S (2004) Innovating firms and aggregate innovation. J Polit Econ 112:986–1018

Kortum S, Lerner J (2000) Assessing the contribution of venture capital to innovation. Rand J Econ 31:674–692

Lerner J, Sörensen M, Strömberg P (2008) Private equity and long-run investment: the case of innovation. NBER Working Paper 14623

Lev B (2004) Sharpening the intangibles edge. Harv Bus Rev 82:109–116

Levine R (1999) Law, finance and economic growth. J Finan Intermed 8:8–35

Machin S, Van Reenen J (1998) Technology and changes in skill structure: evidence from seven OECD countries. Quart J Econ 113:1215–1244

Martinsson G (2010) Equity financing and innovation: is Europe different from the United States? J Bank Finan 34(6):1215–1224

Mulkaly B, Hall BH, Mairesse J (2001) Firm level investment and R&D in France and the United States: a comparison. NBER Working Paper 8048

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Finan Econ 13:187–221

National Research Council (2004) Patent system for the 21st century, report of the board on science, technology, and economic policy. National Academic, Washington, DC

Scellato G (2007) Patents firm size and financial constraints: an empirical analysis for a panel of Italian manufacturing firms. Camb J Econ 31:55–76

Schroth E, Szalay D (2009) Cash breeds success: the role of financing constraints in patents races. Rev Finan 14:73–118

Schumpeter JA (1942) Capitalism, socialism and democracy. Harper and Brothers, New York (Harper Colophon edition, 1976)

Stiglitz JE (1985) Credit markets and the control of capital. J Mon Cred Bank 17:133–152

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71:393–410

Svensson R (2007) Commercialization of patents and external financing during the R&D phase. Res Policy 36:1052–1069

Titman S, Wessels R (1988) The determinants of capital structure choice. J Finan 43:1–19

Westhead P, Storey D (1997) Training provision and development of small and medium–sized enterprises, Research Report No. 26, London: DfEE

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Martinsson, G., Lööf, H. (2013). Financial Factors and Patents. In: Pyka, A., Andersen, E. (eds) Long Term Economic Development. Economic Complexity and Evolution. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-35125-9_17

Download citation

DOI: https://doi.org/10.1007/978-3-642-35125-9_17

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-35124-2

Online ISBN: 978-3-642-35125-9

eBook Packages: Business and EconomicsEconomics and Finance (R0)