Abstract

Coal resources development projects have many characteristics of large investment, irreversibility, long cycle and uncertainty and so on, due to the inherent defects of the traditional NPV method, which can’t effectively deal with the uncertainty faced by the coal resources development investment, thus, the real value of the coal development investment projects are hardly assessed scientifically and rationally. Using the real options method, the paper builds a evaluation model on coal resources development investment project. The results show that using the model to assess the project value of coal resources development investment will be more scientific and rational, parameter analysis leads to the result that interest rates and convenience yields have a negative effect on the critical investment value of the projects, and the high jump frequency will reduce the critical investment value of the projects, while positive changes on jump range can increase.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

Based on China’s energy structure, coal resources plays a decisive role in China’s energy strategy, thus, rational development and utilization of coal resources is very essential to make the national economy maintain steady and rapid growth. Coal resources development projects have many characteristics of large investment, irreversibility, long cycle and uncertainty and so on, thus, how to scientifically and rationally assess the value of the projects has been a hot issue to be solved. Based on rigidity in decision-making, traditional NPV method fails to consider flexible decision-making changing the value of a project under uncertainty factors, which leads to the result that the real value of the projects are hardly assessed scientifically and rationally. The real option method is a thinking mode which applies the financial option theory to strategic decision-making. Using this method, decision-makers are able to adjust their strategies timely according to development and changes of the uncertain factors and projects. It will improve management flexibility to maximize project value.

The real option method, which evolved from Black, Scholes and Merton’s option pricing theory, was first proposed by Myers (1977). Brenman and Schwartz (1985) had combined real option pricing with asset pricing methods for the first time, they established a valuation model of mining investment value, which calculated the impact of management flexibility on project value, afterwards, Domestic and foreign scholars including Frimpong, Abdel, Amram, Paddock, Trigocgric, Pindyck, Copeland, Slade, Saito, Jin-suo Zhang, Neng-fu Zhang, Lei Zhu, Yong-feng Zhang etc. (Frimpong and Whiting 1997; Abdel Sabour 2001; Amrma and Kulatilaka 1998; Paddock et al. 1988; Trigeorgis 1996; Pindyck 1999; Copeland and Antikarov 2001; Slade 2001; Saito et al. 2001; Jin-suo Zhang 2002; Jin-suo Zhang and Shao-hui Zou 2006, 2009; Neng-fu Zhang et al. 2002, 2003; Lei Zhu et al. 2009; Yong-feng Zhang et al. 2006), who studied investment decision approach in the field of mineral resources based on the real option method. In field of investment for dedicated coal resources, Jin-suo Zhang and Shao-hui Zhou (Jin-suo Zhang et al. 2012) conducted a research on the formation mechanism of coal mining option value, then developed the investment decision method of coal resources on the basis of the real options method. Tao Wang (Tao Wang et al. 2012) discussed the option characteristics of coal resources exploration and investment using the real option method, they founded a project evaluation model under the coal exploration results if the prices change in a random manner. From the above, we can see that there are abundant studies on the oil and gas resources investment, which lacks dedicated coal resources investment. Therefore, based on related research, the paper builds a evaluation model of coal resources development investment project, in order to make rational decisions of coal resources development investment.

Risk Characteristics and Option Characteristics

There are many risk factors that impact coal resources development investment projects, in general, we can divide into the following aspects, in the first place, we call it market risk factors which mainly reflect the volatility of coal prices, due to the substitutability between coal and oil, fluctuations in oil prices caused by International incident would inevitably lead to changes in domestic coal prices, moreover, fluctuations in coal prices is also affected by the supply and demand of the domestic coal market situation. Secondly, risk factors on resource endowments, which are peculiar to mineral resources investment projects, with no exception for coal resources investment projects. Resources endowments mainly refers to the resource reserves, coal types, geological structure etc., rich resource endowments will not only get more recoverable reserves but also reduce development costs, and increase the project value, however, poor resource endowments have the opposite effects. Last but not least, we consider risk factors on policies and regulations. Related environmental policies will have an impact on investment projects when the coal resource development investment will inevitably cause damage, such as vegetation destruction, soil erosion and so on, in addition, technical and managerial aspects of risk factors can also lead to changes in the value of coal resource development investment projects, these risks are controllable, so we don’t explore them in the paper.

The above-mentioned risks what coal resources deep processing project equipped with risk factors bring to the project value, because of uncertainty about these risk factors, policymakers should make investment decisions according to its changing. In the project preparation stage. policymakers can delay investment if policy guidance is not clear, or relevant taxes and interest rate are higher than what it would to be. In the project production stage, policymakers can expand production when the coal prices are high. While the coal prices are low, then policymakers will suspend production, waiting for market conditions to improve, and they may abandon the project if the market continued to fall. The risks from the option to delay investment, expand production, suspend production and abandon the project are avoided, which add value to the project.

Model Construction

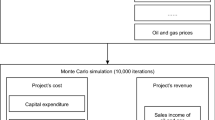

Market risk, resource endowments, policies and regulations are the main risk factors for coal resource development investment projects, changes in these factors may cause fluctuations in coal prices and the project value, even lead to jump the change, thence, on the basis of the literature references (Dixit and Pindyck 1994), the coal prices are assumed to be a mixed Brownian motion/jump process.

In the formula one, \( dz \) is the increment of a Wiener Process, \( dz={\epsilon_t}\sqrt{t} \), \( {\epsilon_t} \) is said to be normally distributed random variables, with a mean of zero and a standard deviation of 1, \( a \) is a drift parameter, \( \sigma \) is variance parameter, \( q \) is called a Poisson Jump Process.

In the formula two, coal prices will fluctuate as a geometric Brownian motion. For each time interval \( dt \), it will be \( (1+\varphi ) \) times its initial value by probability of \( \lambda dt \), then continue to fluctuate towards the occurrence of another event. We assume that \( \varphi \in (-1,+\infty ) \), the unexpected events have a negative effect on coal prices when \( \varphi \) is negative, In contrast, the events are positively correlated with coal prices while \( \varphi \) is positive.

According to the literature which is reviewed by Dixit and Pindyck, they consider that \( F(P) \) represents option value of coal resource development investment projects, and \( V(P) \) is representative of project value of coal resources development investment, then option value and project value are expressed as follows

In the formula three and four, \( \delta =r-a \), which stands for the convenience yield, \( r \) is used as the risk-free interest rate, the unit cost of the project of deep processing of coal resources, \( C \) represents the unit cost of coal resources deep-processing project.

The option pricing method had been brought forward by Dixit and Pindyck, project option value and project value can be expressed as follows.

\( {A_1} \), \( {K_1} \) and \( {B_2} \) are undetermined coefficient, \( {\beta_1} \) and \( {\beta_2} \) can be obtained by formula 60.7,

According to value-matching condition and smooth pasting condition

Solutions form of \( {A_1} \), \( {K_1} \), \( {B_2} \) are as follows

We can use the following formula 60.12 to obtain the value of \( {P^{*}} \)

Empirical Research

Basic Data of Coal Resource Development Projects

After obtaining exploitation rights of some mining areas in Jurassic coalfield, a mining company of Northwest had better analyze the next investment decisions based on survey report and market situation. The survey report shows that minefield area covers 31.6 km2, with recoverable reserves of 60 million tons, the main coal type is long flame coal with mid-ash, low-sulfur and high calorific value. According to the coal price data between 2001 and 2010 in the region, we conclude that annual volatility of coal price is around 15%, we set risk-free interest rate called \( r \) at 4%, based on interest rate of government bonds in 2011. Through past experiences and literature retrieval, the convenience yield of project \( \delta \) is set at 0.02 (Table 60.1).

Testing Results

Due of the presence of uncertain risk factors, it’s feasible for mine enterprises to invest on coal resource development projects, only when coal resources development investment projects worth more than the investment critical value. It can be seen that critical investment value is much larger than the project’s initial investment (Table 60.2).

Parameter Analysis

It can be seen from the evaluation results, the presence of uncertainty increases the critical value of the coal development investment projects, which impacts critical investment value of the projects that needs further analysis. According to influence of interest rates and convenience yield on critical investment value, from Fig. 60.1, we can find that interest rates and convenience yield have a negative effect on critical investment value of the projects. Increase of interest rates will reduce critical investment value of the projects, namely, it will lower the access threshold of investment projects. The convenience yield reflects the abundance of resources, the greater the convenience yield, the higher resource abundance. High convenience yield will facilitate completion of the project as soon as possible, also lower the access threshold of investment projects.

It can be seen from Fig. 60.2, when jump frequency level is fixed, critical investment value of the project is improving with the increase of coal price volatility, this means that the high volatility of coal prices will improve the access threshold of investment projects. In the case of fixed coal price volatility, the high jump frequency will reduce the critical investment value of the projects, namely, it lower the access threshold of investment projects, and facilitate completion of the project quickly.

By Table 60.3, we can find that jump-amplitude changes from the negative to the positive, the investment critical value of projects have increased, when other parameters are kept constant, it can be considered that adverse events will reduce investment value of projects, while favorable events contribute to the value of projects to a certain extent, which will lead to invest on projects by decision-maker in higher investment thresholds.

Conclusion

Coal is China’s major energy resource. In recent years, with the rapid growth of coal consumption, coal resource development investment projects are gradually gaining mass attention, how to scientifically and rationally assess the value of coal resource development investment projects has important significance. Using the real options method, the paper builds a evaluation model of coal resources development investment project, and uses the model through empirical research, the results show that interest rates and convenience yield have a negative effect on critical investment value of the projects, the high interest rates and convenience yield will lower the access threshold of investment projects, and increase the attractiveness of projects. The high jump frequency will reduce the critical investment value of the projects, namely, it lower the access threshold of investment projects, and facilitate completion of the project quickly. Jump-amplitude changes from the negative to the positive, the investment critical value of projects will increase, but adverse events can reduce it. Favorable events contribute to the value of projects to a certain extent, which will lead to invest on projects by decision-maker in higher investment thresholds.

References

Abdel Sabour SA (2001) Dynamics of threshold prices for optimal switches: the case of mining [J]. Resour Policy 27(3):209–214

Amrma M, Kulatilaka N (1998) Real options: managing strategic investment in an uncertain world [M]. Harvard Business School Press, Boston, pp 87–98

Brennan M, Schwrts ES (1985) Evaluation natural investments [J]. J Bus 57:135–157

Copeland T, Antikarov V (2001) Real options [M]. Texere, New York, pp 121–136

Dixit A, Pindyck RS (1994) Investment under uncertainty [M]. Princeton University Press, Princeton, pp 56–65

Frimpong S, Whiting JM (1997) Derivative mine valuation: strategic investment decisions in competitive markets [J]. Resour Policy 23(4):163–171

Jin-suo Zhang (2002) Study on evaluation methods of mineral resources assets [D]. Xi’an Jiaotong University, Xi’an, pp 36–56 (In Chinese)

Jin-suo Zhang, Shao-hui Zou (2006) Study on mechanism of coal mining option [J]. J Xi’an Univ Sci Technol 26(1):121–124 (In Chinese)

Jin-suo Zhang, Shao-hui Zou (2009) Study on methods of the coal resources investment decision based on real option [J]. China Min Mag 18(9):21–26 (In Chinese)

Jin-suo Zhang, Shao-hui Zou, Tao Wang (2012) An investment decision model for coal resource development based on multiple real option. J Xi’an Univ Sci Technol 32(1):19–24 (In Chinese)

Lei Zhu, Fan, Yi-ming Wei (2009) An optimal investment model for mineral resources based on real option theory [J]. Chin J Manag Sci 17(2):36–41 (In Chinese)

Myers SC (1977) Determinants of corporate borrowing [J]. J Financ Econ 5:147–175

Neng-fu Zhang, Si-jing Cai, Chao-ma Liu (2002) Application of option pricing theory to decision-making on mining projects [J]. J Univ SciTechnol Beijing 24(1):5–7 (In Chinese)

Neng-fu Zhang, Si-jing Cai, Chao-ma Liu (2003) Real option evaluation method of investment value of mining projects. J China Univ Min Technol 32(4):455–458 (In Chinese)

Paddock J, Siegel D, Smith J (1988) Options valuation of claims on physical assets: the case of offshore petroleum lease [J]. Q J Econ 103(3):479–508

Pindyck RS (1999) The long-run evolution of energy prices [J]. Energy J 20(2):1–27

Saito R, de Castro GN, Mezzomo C, Schiozer DJ (2001) Value assessment for reservoir recovery optimization [J]. J Pet Sci Eng 32:151–158

Slade M (2001) Valuing managerial flexibility: an application of real-option theory to mining investments [J]. J Environ Econ Manag 40:193–233

Tao Wang, Jin-suo Zhang, Shao-hui Zou (2012) An evaluation model for coal mining exploration and investment projects based on real option. J Xi’an Univ Sci Technol 32(1):13–18 (In Chinese)

Trigeorgis L (1996) Real options: management flexibility and strategy in resource allocation [M]. MIT Press, Cambridge, pp 98–102

Yong-feng Zhang et al (2006) Study on strategic economic evaluation of oil & gas exploration projects based on compound real options [J]. Nation Gas Ind 26(3):138–141 (In Chinese)

Acknowledgment

This work was financially supported by the National Natural Science Foundation of China (No. 70873094).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Wang, T., Zhang, Js., Zou, Sh. (2013). Based on the Jump-Diffusion Process of the Coal Resources Development Investment Project Evaluation Model. In: Dou, R. (eds) Proceedings of 2012 3rd International Asia Conference on Industrial Engineering and Management Innovation (IEMI2012). Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-33012-4_60

Download citation

DOI: https://doi.org/10.1007/978-3-642-33012-4_60

Published:

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-33011-7

Online ISBN: 978-3-642-33012-4

eBook Packages: Business and EconomicsBusiness and Management (R0)