Abstract

The use of modern technologies in logistics was described in this publication. The logistics services of the e-commerce market necessitated an adaptation of the infrastructure to the requirements of customers as regards shipment and collection. The purpose of the study is a presentation of new technologies offered on the territories of Poland and Ukraine as well as their comparison. A literature analysis and a comparative analysis method of the services offered by the largest logistics operator and national mailing services for e-commerce were used in the article. A historical outline and the current development of the e-commerce market in both countries were presented. The sustainable development of the market has resulted in tendencies connected with information technology, ecology and changes in supply chains. The comparative analysis presents the similarity and differences in the logistics services offered by DHL to Polish and Ukrainian customers as well as in the logistics offer of national mailing companies. The direction of changes on the market of logistics services, such as automation of processes, reduction of costs and eco-logistics was indicated in the conclusions, changes to smart supply channel (SSC). The dynamics of the e-commerce market contributed to increased awareness on the part of all the participants of the supply chain and an implementation of changes to improve logistics services provided at each stage of the execution of the order, the results are smart supply network. Nevertheless, there occur differences within the same logistics operator that operates on the Polish and Ukrainian markets. Greater differences in the use of modern technologies can be observed with national mail operators.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- E-commerce

- Logistics

- Logistics service

- Operator

- E-logistics

- Ecologistics

- Internet of things (IoT)

- Smart supply channel (SSC)

- Smart supply network (SSN)

1 Introduction

Professional logistics services on the e-commerce market are most frequently connected with an adaptation of the infrastructure available to customer requirements. A comprehensive management of the supply chain necessitates the creation of shipping and receiving points, an advanced storage system as well as appropriate technological and IT facilities. Logistics operators invest not only in modern technology but also in the training of their own personnel, which guarantees long-term cooperation with customers. The e-commerce branch is reporting the largest growth on the Polish market and yet it still has a huge potential.

The purpose of the study is a presentation of new technologies offered by logistics operators on the territories of Poland and Ukraine. A comparative analysis method of the services offered by logistics operators and national mailing companies to e-commerce and a literature analysis were used in this article. The chief change in e-commerce consists in an acceleration and dissemination of technological progress, which reduces the life cycles of services, such as same-day delivery, and it forces those companies that sell via the Internet to make changes concerning the scope of logistics services. The internationalization of the world economy caused an increase of shipments on the territory of the country and Europe as well as a high demand for shipments from Asia with a particular consideration of the Chinese market. There appear new social needs which are reflected in consumerism (e-commerce) and ecology (social responsibility of logistics operators), as well as the emergence of smart supply networks.

The following hypotheses were put forward:

-

H1.

E-commerce is positively associated with the activities of the logistics operator.

-

H2.

Logistics operators implement new technologies in the field of ecology and smart supply channel (SSC).

-

H3.

There are differences in the application of modern technologies in logistics and national postal operators in Poland and Ukraine.

2 E-Commerce in Poland and Ukraine

Today, it is the Internet that dominates in e-commerce where, obviously enough, it is not the only one network of data transmission used for this purpose [22, p. 16]. A dynamic increase of the number of e-customers has resulted in logistics operators becoming interested in this market. Specialized companies emerged on the market that deal with the administration of e-shops and cooperate with carriers [20, p. 37]. The first techniques connected with the exchange of trade documents were based on the mechanisms of Electronic Data Interchange (EDI). These mechanisms enable the transfer of business transaction information between the information systems of companies including invoices, order forms and delivery notes [39]. EDI has been evolving till this day by adapting itself to new networks and data transmission techniques. Initially, electronic commerce would come down to an electronic exchange of data between large companies (e.g. banks, logistics operators) that possessed resources required to build a computer infrastructure to cover their own needs that used EDI. At present, EDI is commonly available and it is used by production, trade and service companies.

E-commerce offers a possibility to pace up business processes, reduce the costs of distribution, to gain new customers and draw up new business models and enter new markets. General agreement in the case of e-commerce is an implementation of electronic markets and digitization of products, where there is an impact on the flow of materials. No clear-cut identification of the scope and directions of effects has been reached as yet, and these questions still remain controversial. Data related to the environmental impact of e-commerce through the use of the Internet is limited. However, the available investigations and examples of e-commerce environmental impact ensure a diversified image of a positive, neutral and negative environmental impact [7]. E-commerce involves a wide array of interactive methods for conducting consumer goods and services. Furthermore, electronic commerce is understood any forms of business operations where parties interact through electronic technologies, and not in the process of a physical exchange or contact [25, p. 256]. M. V. Makarova defines the concept of “e-commerce” as “a kind of business activity in which the interaction of business entities in the sale and purchase of goods and services (both material and informational) is carried out with the help of the global computer network of the Internet or any other information network” [28, p. 272]. A. M. Bereza, I. A. Kozak et al. understand “e-commerce” as the “purchase or sale of goods by electronic means or through a network similar to the Internet”. This concept may include orders, payment and delivery of goods or services [6, p. 326].

In 2015, the global population amounted to around 7.3 billion people, of which 1.4 billion people purchased goods and/or services online at least once. In total, they spent $2272.7 bn online, which results in an average spending per e-shopper of $1582. Just like in 2014, Asia-Pacific was the strongest B2C e-commerce region in the world last year. With a B2C e-commerce turn over of $1056.8 bn, it ranked ahead of North America ($664.0 bn) and Europe ($505.1 bn). Latin America and Middle East and North Africa (MENA) were the smallest B2C e-commerce markets in 2015. They achieved B2C e-commerce sales of $33.0 bn and $25.8 bn, respectively. China increased its lead on the United States of America as the country with the highest B2C e-commerce turn over last year. With $766.5 bn, it ranked above the US ($595.1 bn) and the UK ($174.5 bn). Together, these three countries account for 68% of the total global B2C e-commerce turnover. Ranking Europe in turnover (in million of USD): United Kingdom $174.357, France $72.007, Germany $66.237, Russia $22.785, Spain $20.137 and others $149.604 [9].

The number of Polish Internet users who buy on the Internet has been systematically increasing for several years now. Today, the value of the e-commerce market in Poland is estimated to amount to 36–40 bn zloty ($10.140–11.260 in million), and according to the latest report of “E-commerce in Poland 2017. Gemius for e-Commerce Poland”, 54% of Polish Internet users buy online. At present, 26.5 m. of 38.5 m. of the residents of Poland use the Internet. Over a half, that is 54%, have already done shopping online, 53% of the Internet users buy from Polish shops and 16% from shops abroad [44]. Almost half of all the Internet users examined (48%) have declared doing online shopping in the future, 10% of the Internet users buy from foreign e-shops, and the Chinese Aliexpress enjoys the largest success. Looking at the structure of e-shopping users from this group, respondents aged up to 34 with secondary or higher education residing in urban centers and also those who declare good material status of their households constitute the greatest percentage.

Those who do shopping online declare that it is above all convenience, saving time and money and a greater selection of products available than in the case of traditional shops that are the reasons why they use this form of shopping. Those who buy online perceive purchases of this type as little complicated and safe. Having selected products in online shops and websites, the respondents definitely prefer quick transfers via payment services such as Dotpay and PayU as regards payments for products. The users of e-commerce websites, apart from buying on the Internet, very frequently declare searching and comparing the prices of online products via portals such as www.ceneo.pl or www.skapiec.pl. While shopping, they most willingly look for such product categories as clothes (72%), books, records (68%), computer hardware and mobile devices (telephones, smart-phones or tablets) (56%), audio/video devices and household appliances (55%), cinema and theatre tickets (54%), cosmetics and perfumes (51%) as well as shoes (49%). About half of those respondents who do online shopping declare the ROPO effect (research online, purchase offline, which consists in buying products in traditional shops once the shopper has viewed them online). The strength of the effect varies between categories. This effect is the strongest in the case of such products as audio/video devices and household appliances, while it is the weakest in the category of multimedia, computer games and jewelers [40]. Saving of money in the form of lower costs of the purchase of products, special price offers or lower delivery costs of the goods purchased prove to be the most important factor to encourage one to start shopping on the Internet.

Until recently, there was no definition of “electronic commerce” in Ukraine, but Law of Ukraine No. 675-VIII eliminated this gap. Thus, in accordance with this Law, e-commerce is profit-sharing relations that arise in the course of committing transactions relating to the acquisition, change or termination of civil rights and obligations carried out remotely with the use of information and telecommunication systems, resulting in participants in such relations that there are rights and obligations of a property nature [43].

Summary of online purchases of products for Poland and Ukraine (Table 1).

In 2016, almost two thirds of Ukrainian e-consumers (59%), that is less than in the case Polish purchasers, decided to purchase clothes on the Internet. The next positions among the top most willingly purchased products were as follows: household appliances (57%), smart-phones and tablets (57%), transport tickets (54%) and computer hardware (51%) (Table 2).

The Ukrainian e-commerce market is only at the stage of formation, at the same time it has a significant potential for development. According to Kreditprombank (which in turn used materials from Morgan Stanley Research, Fintime, Forbes.ua, Gemius Ukraine, InMind, UIA), the e-commerce market in Ukraine in 2016 amounted to 5.65 billion dollars. However, according to forecasts in 2020, the volume of e-commerce market in dollars will increase more than by twice to reach 14 billion.

As we can see from the table, the growth rates of both penetration of Internet trade into the economy and actual volumes in monetary terms are growing rapidly; however, we are still far away from the level of the TOP-10 countries. It is safe to say that e-commerce has every chance to take up to 80–90% of the share of classical retailing. Moreover, quite a lot will change in other areas: logistics, the market of cashless payment systems, advertising business. Ukraine’s trend, which occurred a long time ago in developed economies, is the development of non-cash payments. Now all large platforms work with leading payment systems, which a few years ago was a rare phenomenon. The omnicality in retail is actively developing. To facilitate the development of e-commerce in Ukraine, the network of logistics companies and the development of payment systems and payment methods for buyers can expand. The development of the global Internet, social networks and mobile communications increasingly stimulates the development of e-business. The level of Internet coverage in Ukraine is estimated at 50%, and it is increasing year by year.

3 Ecologistics in Poland and Ukraine

Irresponsible economic activity of people and their exploitative attitude towards nature led to a violation of the ecological balance and gave rise to a number of environmental problems. Logistics as one of the directions of economic activity contributes to the deterioration of the environmental situation, therefore, logistics as a scientific and practical discipline within its activities must take into account environmental aspects in order to minimize the eco-destructive consequences of logistics operations. Ecological logistics is a kind of logistics, the scientific and practical activity of which is aimed at taking into account environmental aspects at all stages of the flow of material and other associated flows in order to optimize resource consumption and minimize destructive environmental impacts [32]. The tendencies of changes on the market of TSL services demonstrate changes in the actions undertaken by logistics operators towards environmental protection. In the formation of the transport and logistic systems of regions or states, an essential role is played by finding a certain optimum between efforts aimed at a reduction of costs in the scale of these systems and efforts aimed at an appropriate level of the service provided and the end customer service. Such an analysis covers an examination not just of the partial elements of the system but rather the provision of comprehensive solutions that offer the possibility of the streamlining of costs. The presented definitions highlight three key characteristics of a SSC (sustainable supply chains). Firstly, more than one entity must be involved in the management of resources, information, and processes that may be beyond a particular company’s control. Consequently, the decision-making process includes a number of decision-makers. Secondly, entities partaking in the chain might be working towards contradictory goals, i.e. profit maximisation, carbon footprint reduction, or welfare improvement. The third characteristic aspect is the fact that the environmental impact must be considered in the decision-making process. The carbon footprint of the entire span of the chain must be considered, including suppliers, partners, and clients. Moreover, sustainable development requires adopting an interdisciplinary approach as it necessitates integration of issues and solutions irrespective of functional divisions [24]. The concept of environmental protection in the activities of enterprises connected with transport, shipping and logistics (TSL) is currently acquiring a special significance; this is referred to as eco-logistics or “green logistics”. This is testified by an increase of its importance not only in scientific circles but first of all in any work undertaken by logistics operators aimed at environmental protection. Operationalizing green logistics -Green logistics (GL) is measured using a two-item scale based on Murphy and Poist [34] and McKinnon [31], which covers two items: item one refers to choosing the location of the warehouse/distribution center while accounting for emission reduction and renewable energy usage in the center (GL_1). This is related to the second item, that is, using renewable energy efficient lightning, such as sensor lamps and energy-saving lamps, solar power on the roofs, etc.) in the warehouse distribution center (GL_2). In this context, carbon dioxide emissions are frequently cited as a detrimental effect of logistical activities [1, 46]. While the first indicator is more strategic in nature and points to the impact of logistics on the environment, the second is operational and relates to day-to-day operations. Together, they allow a meaningful assessment of green logistics constructs. The results obtained from green supply chain management depend on the level of intellectual capital development of companies. A developed IT system, an effective knowledge diffusion inside and outside of the organization, having certificates supporting supply chain management, a developed motivation system, long-term contracts with clients, a loyalty of suppliers and many more elements contributing to intellectual capital, probably facilitate the green supply management and simultaneously allows for obtaining better results in this area [29]. Therefore, the organizational objectives identified for the implementation of an individual firm’s supply chain structure lead to effective conduct that in turn leads to potential achievement of operational and financial goals [5]. Applying the SCP paradigm to sustainable SCM, successful reverse logistics programs have been associated with positive performance measures (e.g. logistics performance [33], economic performance and environmental performance [19].

We follow Zhu et al.’s [48] approach to measure operational performance by assessing the amount of improvement an individual firm achieves on such logistics outcomes as delivery time, inventory levels, and capacity utilization as a result of implementing a sustainable supply chain strategy. Remanufacturing and recycling often provide cost-effective alternatives when compared to the sourcing of new raw materials for use in the supply chain.

Eco-logistics as an integrated system can be described as follows:

-

It is based on the concept of the management of the re-circulatory flow of material streams in the economy and the flows of information related to them,

-

It guarantees the readiness and ability of an effective planning of segregation and processing as well as recycling of waste according to the accepted process rules and also technical and technological rules that fulfill the standardizing requirements and environmental protection rules,

-

It facilitates decision making on technical and organizational levels with the aim of a minimization of the negative effects of the environmental impact that accompany the realization of the processes of supply logistics, re-engineering production, the logistics distributions and servicing in the logistic chains of supplies.

Therefore, an assumption was adopted, that the current situation is connected with a low level of knowledge diffusion within the scope of GSCM [30]. In connection with the above, what seems just is to examine the level of knowledge diffusion within the area of these issues and indicate any troublesome elements connected with it also for logistics operators.

Environmental protection with Deutsche Post DHL—their green solutions are designed to help our customers reach their own environmental targets. Their range of climate-friendly products and services.

Green products and services

-

1.

Carbon Reporting—DHL produce reports on carbon emissions arising from products and services used by the customer, providing an account of the customer’s carbon footprint.

-

2.

Carbon Consultancy—DHL analyze their customer’s entire supply chain and offer strategies for optimizing transport routes and reducing carbon emissions.

-

3.

Carbon Reduction—DHL offer our customer measures for reducing emissions and saving costs.

-

4.

Carbon Offsetting—DHL offset carbon emissions by investing in officially recognized climate protection projects.

DHL acknowledge that their business has other impacts on the environment such as local air pollutants, their waste production as well as our use of water and paper. Unlike the global impact of carbon emissions, these environmental factors typically impact the environment at the local level. The DHL Group-wide energy efficiency program, together with our ongoing fleet renewal initiative, is helping to minimize our emissions of local air pollutants.

The firm are committed to improving the carbon efficiency of our own operations and those of their transportation subcontractors by 30% compared to our 2007 levels by the year 2020.

It is necessary to note such company as “Nova poshta” in Ukraine. Since 2016, the company has a sustainable development strategy. Over the past year, the company not only set new records in the number of deliveries, but also introduced quality internal changes. Also the company has been the official logistic partner of the eco-action “Let’s Make Ukraine Clean!” for several years now and uses its services, resources and the largest network of branches in different cities in Ukraine to help a good cause.

4 New Trends of Logistics Operators in Poland and Ukraine

Direct deliveries to work and home by post or courier services invariably constitute two definitely most willingly selected forms of the collection of products purchased online. The delivery of purchased goods via courier is the form that is most frequently chosen by the respondents: e-buyers. For the activities taken within Internet commerce to be effective and profitable, a lot of attention is to be given to the organization of the logistics process.

E-logistics as one of the forms of e-business focuses on the following issues:

-

supply of goods necessary for the proper functioning of the company;

-

warehousing and transportation;

-

distribution of finished products for certain traders and consumers;

-

promotion and offer of a certain range of products, service orders;

-

search for new suppliers and clients;

-

payment orders.

Advantages of e-logistics:

-

it allows to reduce enterprises costs. Thanks to the use of computers and the Internet as well as specialized software, most logistics processes can be implemented at significantly lower costs: related both to trading and communication activities as well as management. It promotes an optimal use of time: it shortens the time of implementation of logistics processes, as well as the preparation of order cycles; it improves the control of the processes;

-

it shortens supply chains: this is due to the exclusion of some intermediaries in distribution channels. In addition, it allows one to effectively explore the market and quickly use the results properly;

-

information available on the net about business partners helps the company reduce the risk of additional costs that could arise due to an improper choice of business partners.

Logistics in e-commerce can be described as having three aspects: product management including delivery forecasts, storing and delivery of goods to the customer [23, p. 52]. Smooth communication between the customer, the seller and the operator is usually mentioned when talking about those factors that decide about an effective logistics service of online shopping customers. Making information on the order status available to the customer has become a standard in this line of business. The customer may track their shipment either on dedicated websites or by receiving notifications from the operator by e-mail or SMS. When one understands e-logistics as a field of logistics that consists in the use of the Internet and information systems to coordinate and integrate the processes and activities leading to the delivery of products from producers or retailers to consumers, the thesis seems legitimate that online trade has an impact on the logistics industry causing it to change [2, p. 8].

Information about customers is of a key significance to the success of a business model, and it should be used to manage designing of the proposals of values, distribution channels, customer relations and earnings streams [35]. Collecting information about customers should go beyond the current customers to cover potential customers and other market segments, and it should take the external environment into consideration [21]. Understanding who the customer is and what are their values are is of a key significance [37]. For a company to deliver a value to the customer via its network regardless of the fact whether it has a direct contact with the final customer, it must extend its knowledge and understanding of the end customer. The challenge that faces logistics companies consists in gaining a competitive advantage with the aid of information technology to improve customer service and reduce costs at while simultaneously drawing up a new logistics offer. This causes IT to be an important part of the corporate plan of action and one of the grounds of the business potential of a carrier or a logistics operator and their competitive advantage as well as a fundamental part of their business model. Globalization, supply chain management and e-commerce are changing this industry. There is a tendency addressed to producers and distributors who place themselves as strategic partners in outsourcing. Logistics companies used to apply a relatively simple formula based on individual features or combinations of shipments for valuation. Now they had to pay for contracts where it was the service provided that was available and not transport. In many cases, they were asked about “an estimation of the value” by their customers: those prices which could demonstrate not only better performance but also an overall cost saving. In reality, it proved to be a benefit for many of these suppliers as they discovered that after their organization to provide services they can do it at a significantly lower cost than their customers; this not only owing to their knowledge and owing to the joint infrastructure of transport, storage and information systems, but also because their disciplines of quick relocation have allowed the customers to save significant sums as concerns avoiding out-of-date products, quality deterioration and theft as well as a reduction of stock financing costs. There was just a considerably smaller amount of awaiting stocks or stocks transferred between various distribution levels. Therefore, the price of the value was substantially more advantageous to both parties [42]. Although there is little data on the impact on production and provisions, there is some detailed research of the impact of e-commerce on logistics. The main problems connected with new electronic trade business models involve energy and packaging materials used by logistics networks for the realization and delivery of products.

Logistics operators must pay attention to the productivity, which has a direct impact on environmental protection depending on such parameters as shipping distances, freight value for return, allocations of purchases, population density, quantity of packagings and transport type. Simulations show that the deliveries of groceries home may reduce car traffic from 2 to 19%, electricity consumption from 5 to 35% and carbon dioxide emissions from 7 to 90% depending on the context and assumptions [10]. These investigations also emphasize that some direct effects of electronic food shopping contribute to a reduction of road traffic, and it is possible to identify indirect effects in relation to the natural environment. From the ecological perspective, the key question is whether e-commerce should be the first choice and what type of influence on environmental protection may improve the activity of the chain of values through better use of the capacity of vehicles, avoiding express delivery by air or minimization of packagings [3].

Quick and efficient delivery is one of the most important factors that influence the selection of an online shop. The “FlexDeliveryService” service is adapted to market tendencies, and recipients can make changes flexibly in the course of transport of consignments with the use of the latest technologies (the Internet, the smart-phone). It is a system solution owing to which consignees may freely decide about the date, place, method, delivery term of online consignments and information as to whether the company will deliver the consignment to them; this is without any need to contact the helpline, the courier or its branch. Offering flexible delivery of goods contributes to a greater probability of choosing the shop again by online shoppers. The “FlexDeliveryService” service offers many free options of delivery and changes in communication with the consignee. Logistics operators consider the “same day delivery”, i.e. the same day delivery to the customer who placed the order [49] to be the greatest challenge connected with the growing Internet commerce market. This requires fundamental adaptations in the current supply chain.

Logistics companies implement the Internet of things (IoT) technology, which was mainly used to enable communication between machines and to improve transport effectiveness. It is expected, however, that IoT will play a greater role in the future of logistics and it will increase speed, it will reduce waste volumes and it will lower overall costs. Many people believe that IoT will enable communication with other new technologies, such as AIDC (automatic identification and data capturing), RFID (radio frequency identification) or Bluetooth to identify those elements which need to be changed in accordance with requirements on the part of companies and customers. Designing of the supply chain and software for modelling is so important. Software for supply chain designing performs compound mapping and analyses based on unique requirements, and it calculates benefits for each scenario. It is predicted that the world’s industry of Semiconductor will exceed the threshold of USD 400 bn for the first time in the year 2017. There had been an increase of the market by +16.8% by the year 2016, mainly by developing the market of memory and a quick implementation of those devices that support IoT. DHL experts maintain that the IoT market will slow down the pace of annual income growth by the year 2019. Such a dynamic and unstable market in combination with a high activeness of fusions and takeovers as well as a complexity of electronic supply chain management requires logistics solutions for the whole industry.

5 Smart Supply Chain (SSC)

Logistics operators need to diversify their activities based on new levels of agility, precision and performance. Supply chains need to react to the environment that is becoming increasingly globalize, complex and multi-channeled. Under the pressure of profits, supply chains face the challenge of changes oriented onto customer needs; apart from this, they are oriented onto an increase of online sales and growing demand for prompt deliveries and accuracy. For example, one-hour delivery of products will soon become common in cities not only in Western Europe but in Poland, too. New markets, as well as changes in the models of operators’ activities, rely on changes in the processes of relations. Logistics operators perceive smart supply chains as a challenge or an opportunity to convert the supply chain into real competitive advantage. Those logistics companies that do so increase the value of their offers on the market. What is the key to this goal is an integration of various channels, efficient cooperation between participants and real-time smart management, use of the potential of new technologies that have an impact on and optimize integration, predictive intelligence and traceability. Transformation of the traditional supply chain into smart is unavoidable. Promptness, accuracy and efficiency of the service will decide about a competitive advantage. Any company that forms a part of the supply chain in any of its links will be affected by this change. This is in particular true of those logistics operators that provide services on the e-commerce market and companies in the B2B supply chain.

SSC is the approach that manages the movement of raw materials into an organization and it is deployed in both indoor and outdoor environments and the information updates about the goods are uploaded in the server with the help of IoT. IoT refers to the wireless communication between the objects and it can be controlled and monitored from anywhere, any place and at any time. SSC keeps the record of the movement of goods from the supplier to the manufacturer which moves along with the wholesaler to the retailer and finally to the customer. SSC is mainly used to benefit for the company and it links and collects the overall data collected by the warehouse management system, communication software and distribution management system as well. SSC is mainly used in order to increase the efficiency of the company and also to make sure that the materials reach to the customer [47].

In order to meet the challenges facing today’s complex supply chains, new concepts for supply chain planning and control are emerging. Typical characteristics of such concepts are [2]:

-

Demand-driven control throughout supply chains, basing operations on pull rather than push principles

-

Integrated and automated operations

-

The use of unified supply chain control models

-

Intelligent and advanced information processing, data mining, visualisation and decision-support

-

Information sharing and transparent information flow.

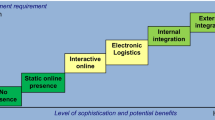

The smart supply chain will provide more value to companies and promote new collaboration models amongst actors, with complete end-to-end traceability. All the actors within the chain (from customers to the very last link) will be connected via smart platforms to establish new relationships and share processes and information, leading to optimized costs, delivery times and services (Fig. 1).

Source Author’s own based on [16]

The condition of the existence of SSN.

-

(1)

Collaborative integration—comprehensive visibility of the chain starting from the purchase of raw materials to the sale; it is possible owing to the integration of information between various links and use of the platform of cooperation. The customer is yet another link in the chain with a complete visibility of all the other stages (e.g. the order status). Fluctuations in the demand affect the management of the entire chain (e.g. automatic initiation of repeated supplementation of orders once products have been removed from the line).

-

(2)

Complete traceability—sensors and communication between all the elements and real time monitoring ensures comprehensive visibility of the SSC. This comprehensive traceability makes it possible to detect gaps and it leads to dynamic and continuous improvement, especially on the stages of transport. Traceability will close the chain and will radically reduce the time required to launch the product on the market, and it will adapt products to customer needs.

-

(3)

Logistics intelligence—by using huge real time information analysis, the organization is learning itself and establishes intelligent systems in the key areas of the chain: network planning, supplies and warehouse management. Complex scenarios and interactions will be dynamically simulated. The SSC model will be optimal all the time, and it will interpret the key parameters both of the environment and customers.

-

(4)

Agile models—predicting of trends in the behaviour and adaptability of an uncertain environment represents an exponential growth of the level of services. Advanced models of demand forecasting are defined, and adaptive models are used to promptly respond to information from the environment and to new demands (e.g. defining of flexible points of delivery: DPD and DHL: “predict and pickup point”). New sale channels and models are addressed to e-commerce customers in particular. Senders gain efficiency owing to continuous cost reduction, greater reliability and minimization of risk to the end customer.

-

(5)

Smart basset management—The assets in your logistics chain are monitored and managed through predictive intelligence algorithms to radically reduce downtimes, thus maximizing use and cutting maintenance costs. The customer will maximize the return on your investments by SSC.

The SSC consists of different streams whereby every stream provides particular information related to the entire contracting process. Underlying the principles of the SSC each stream stores its data on various servers to secure the inviolability of important process data. The extent of the permissions given to the contracting parties is defined by the business community and varies between full access on data, reading-permission only or the complete refusal of all information. This procedure ensures that only a verified party can add data or change status. It also simplifies the traceability in case of data abuse [45]. Apart from the payment cloud, further smart B2B service, such as financing or an insurance service, may be integrated within the confines of an SSC that is managed by a logistics operator, where the entire system is based on a cloud. Based on a comparative analysis in Poland in Ukraine, the customers of logistics operators gain the following [26]:

-

those companies that are served by logistics operators operate with greater flexibility while reducing the lead time up to 30% and dynamically adapting the chain to new operating models, new products, new intermediaries and new markets;

-

they manage operations more effectively by lowering logistics costs by as much as 20% per annum owing to sustainable planning, reduction of costs, optimization of stocks, simplification of processes and creation of the dynamics of constant improvement;

-

within the confines of SSC, logistics companies guarantee greater security and better services by obtaining entirely safe and reliable transport from end to end; by bringing the entire chain to the end customer; by increasing sales by as much as 10% owing to the improved reliability and level of services as well as a flexible response to the demand;

-

those companies that are served within the confines of SSC gain greater profitability by rationalizing the portfolio of their products, reducing products with low rotation by as much as 20% and optimizing current assets to maximum.

While logistics operators increasingly speak of the digitization and digitalization of logistics and supply chains with the IoT (enabling multiple logistics use cases and, along with other technologies such as cloud computing and edge computing or fog computing if you prefer, bringing intelligence to the edge across logistics) [25], digital supply chains and (semi-) autonomous decisions and logistical assets such as self-driving trucks and so forth, the role of people in supply chain management is far from over. Digital technologies are providing opportunities to better support the customers of logistics operators with proactive location and delivery information. They also give us better insight into the performance of the smart supply chain. The digital platform merges global transportation data and combines it with relevant weather data and news feeds from traditional sources as well as social media. This picture, which is much more comprehensive, enables our logistics and customer service teams to collaborate on events impacting the smart supply chain, resulting in more timely and accurate information for customers, creating the smart supply network in Europe.

This procedure ensures that only a verified party can add data or change the status. It also simplifies the traceability in the case of data abuse. When a contract component or requirement is fulfilled, the DCU (decentralized control units) transfer the information of completion to one of the related SSC. Subsequently, the smart contract triggers the determined payment. Logistics operators are included in the entire delivery, control and payment procedure. Changing the place of the delivery on the order of the parties.

The next key trend is a more prominent role of the Internet of Things (IoT) in extended smart supply chains. IoT can help logistics operators provide improved predictability of customer demand with real-time visibility of product and service demand signals. In a smart supply chain, strategic deployment of IoT technologies can improve asset utilization, customer service, working capital deployment, waste reduction and sustainability. Real time communication between machines, factories, logistic providers and suppliers provides improved visibility on the end-to-end SSC. IoT can address compliance, regulatory and quality reporting requirements such as parts traceability and product genealogy, emissions and country of origin. With IoT, organizations are better suited to track shipped products for warranties, returns and predictive support for maintenance. The real premise of IoT-enabled SSC is to delegate decision making on some of the operational aspects to smart objects and systems, based on real time analytics and machine learning algorithms. This brings us to a customer- and market-driven smart supply network (Fig. 2).

Organizations would need not only to be aligned with the true customer demand but also to shape the demand using technology and analytical tools. SSN are extremely complex organisms, and no company has yet succeeded in building one that is truly digital. Today, smart supply chains are transforming into dynamic, interconnected systems: smart supply networks by logistics operators. These digital supply networks integrate information from many different sources to drive production and distribution, potentially altering manufacturer’s competitive landscape.

6 Comparative Analysis

Large shipping companies, such as DHL, UPS, DPD or GLS, extend their services of deliveries and returns to include new functionalities. They also extend the networks of partner points or devices where shipments can be directed to (immediately or after an unsuccessful attempt by the courier to deliver them), or where returns can be made. At the same time, smaller shipping companies are developing; they offer niche services that integrators are not interested in: for example, X-press Couriers has introduced nationwide same day deliveries [36, p. 92]. Those companies that specialize in other segments of logistics or mail markets joined in the battle for e-commerce customers, yet these are those companies that possess experience in logistics industry and suitable resources to handle e-commerce and have a vision of innovative services. Some of these have been introducing new innovative solutions for several years now. For example, InPost has developed a network of parcel stations, Ruch offers collection in retail points of sale; the Polish Post has decided to develop a network of collect and send systems in their post offices. Companies are developing which supply collect and send systems that are installed in shopping centers, petrol stations, in locations close to public transport nodes or office blocks. An example of these includes SwipBoxes manufactured by NoaTech (DHL is one of those that are introducing these).

DHL (13%), DPD (11%) and UPS, Polish Post, In-Post and GLS (3%) are the most preferred brands in Poland by on-line shoppers as regards courier services.

The largest player on this market, which functions on both markets: DHL (Table 3), and national postal operators: the Polish Post and UkrPost (Table 4) were accepted in the analysis.

Professional operators of the logistics market in Ukraine, which mainly serve parcels related to online sales, form a segment that is identified abroad as CEP (courier, expedition, post), even though today it is difficult to clearly assign packages to courier, postal or logistics services. These industries compete with each other, and the differences are increasingly smoothed out. Each of the operators offers their services. For example, courier operators, are expanding the service “from door to door”, offer: deliveries on the same day, deliveries for a certain hour; city parcels. Logistic operators, such as DHL, offer deliveries up to a certain hour (until 9:00, until 10:30, until 12:00, until 18:00) and by the end of the working day.

Also, logistic operators guarantee the refund of the tariff in the case of non-compliance with the delivery time, which indicates high standards of customer service. Another example is the Cargo Express company delivering door-to-airport and airport-to-airport services. Additional services include SMS messages about the arrival of the parcel to the destination, delivery of cargoes in non-working hours, at a specified hour, delivered to a specific person, etc. DHL Ukraine offers Time Definitive Delivery to certain specific destinations [4]. Processing several million customs entries is no easy task. DHL Express in Ukraine does that every day for its customers because it acts as a broker on their behalf.

Once thoroughly checked, your shipment information is handed over to the appropriate customs authority. They work with them to expedite the clearance and get your goods delivered quickly and efficiently. In the postal logistics market, Ukrposhta, the largest state logistics company, is still ranked first. According to the Ukrainian Association of Direct Marketing, it owns more than 30% of the market. Over the past 2 years, the company has bought new cars, launched express delivery and made an interface for integration with online stores.

Unlike a standard package, with a delivery period of three to six days, express mail promises delivery within 24 or 48 h, and costs of about 20% more. For sellers and online stores, Ukrposhta also gave an opportunity to manage international shipments through their personal office, and for their customers—to inspect the physical goods in the department before paying for them. To streamline the company’s navigation and improve customer communication, chat boots running on Facebook, Viber and Telegram platforms are launched [8].

Polish Post and Ukrposht do not perform those services that are offered by DHL in Poland, for example: comfort and flexibility of deliveries (last mile), market platform service (fulfillment) and supplies management. In addition, Ukrposht does not offer the following services: interactive messaging (predict), find a service point (pickup), personal collection at the facility (click and collect) and omnichannel. The service—common label SSCC (serial shipping container code) is offered by DHL in Germany and USA only.

7 Conclusions and Future Research

The chain of tomorrow’s deliveries will be more compact, faster and, what is important, environment friendly and self-implementing. This unprecedented pace of changes will be driven by several state-of-the-art technologies, which will be cautiously accepted by the members of the industry in the coming a dozen or so years. The chain of deliveries currently constitutes a key competitive advantage for online trading companies. Such companies as Amazon on the European market and Zalando on the Polish market, which established new industry standards for innovative logistics in the year 2016, testify about the role of the delivery chain in the company’s success. In the future, managers and financial teams will be putting more emphasis on the chain of deliveries and a reduction of costs. Approaches in the area of innovations are changing; micro-logistics is being introduced in the company with its impact on profits; macro-logistics is being introduced that has an impact on the growth of sale and customer loyalty. Those companies that sell on the Internet will have to evaluate their chains of deliveries and terminate obsolete and ineffective processes. Examples include everything: starting from the solutions of enterprise resource planning and electronic communication to forwarding agents and software for stock forecasting and management. Those IT companies that provide software focus on the transformation of efficiency, transparency and risk exposure to ensure advantage. Overall net savings can be measured by reduced data delays and faster response to changing trends. Retail chains will continue putting pressure on their suppliers to produce goods that are sold exclusively through their channels to be able to compete with and become different from such online sellers as Amazon. For those customers that show loyalty to these sellers, this will require greater specialization on the part of manufacturers without increasing shipping costs.

Automation and implementation of new technologies will help logistics enterprises ship goods to customers faster, at lower costs and with great precision; at the same time, however, the demand for warehouse workers will be diminishing. One of the best ways of achieving a significant reduction of shipping costs may be re-thinking of the design of the delivery chain as sustainable development. An expansion of the network of distribution and logistics centers makes it possible to position key resources closer to customers and shipping destinations. Placing the centres in adequate locations may reduce indirect shipping routes and zones, and this will finally contribute to reduced shipping costs and better environment protection. Owing to the delivery chain modelling, it is possible to find an adequate delivery chain design for the operator and postal services by experimenting with various scenarios and thereby reduce shipping costs. Changes in IoT will have a strong impact on the overall development of the network market (Networks), at the same time having an influence on solutions in the chain of deliveries. There will be an increased demand for comprehensive solutions in the chain of deliveries for mobile infrastructure networks including light assembly, local deliveries and spare parts management. At the same time, global level investments will differ as regards requirements related to the delivery chain, and emerging markets will require new network infrastructures and mature markets while focusing on an improvement of the network, thereby having an impact on their solutions as regards the delivery chain and sustainable development.

Polish Post and Ukrposht do not perform those services that are offered by DHL in Poland, for example: comfort and flexibility of deliveries (last mile), market platform service (fulfillment) and supplies management. In addition, Ukrposht does not offer the following services: interactive messaging (predict), find a service point (pickup), personal collection at the facility (click and collect) and omnichannel. The service—common label SSCC (serial shipping container code) is offered by DHL in Germany and USA only.

These days, logistics operators adapt their supply chains to suppliers and recipients to help them gain a competitive advantage. They form a SSN with them that is subject to constant changes. Smart supply chains play a key role in helping e-commerce companies to obtain the objectives of growth. On the present day markets, companies pose more and more frequently challenges to their supply chains on many levels, including flexibility, cost reduction, predictable risk management and customer service level, which is possible owing to the implementation of new technologies by logistics operators and also owing to a slow adaptation of national postal services.

The following research should be undertaken in the field of:

-

whether and to what extent the new solutions affect customer service by the logistics operator?

-

what pro-ecological elements influence the choice of a logistics operator in selected countries?

-

whether the introduced elements of environmental policy influence the improvement of quality?

On the grounds of the analysis of data and the research in e-commerce market carried out, it can be stated that TSL companies demonstrate a sensitivity to activities connected with environmental protection, and they take responsibility for the effects of their negative impact. From the perspective of obtaining a competitive advantage, logistic operators are based on the creation of a positive image and an involvement not only as a company but also as its employees in social and eco-friendly activities. The introduction of ISO 14001 in logistics corporations resulted in procedural changes and having those subcontractors that realize transport within the framework of the logistic chain replace the means of transport with new and more eco-friendly means of transport.

References

Abukhader, S. M., & Jönson, G. (2004). Logistics and the environment: Is it an established subject? International Journal of Logistics Research and Applications, 7(2), 137–149.

Antonowicz, A. (2016). Handel internetowy—Implikacje dla logistyki (Internet commerce—Implications for logistics). Handel Wewnętrzny, 2(361), 8.

Bjartnes, R., Strandhagen, J. O., Dreyer, H., & Solem, K. (2008). Intelligent and demand driven manufacturing network control concepts. In Proceedings of EurOMA/POMS Tokyo, 5. October 8, 2008.

Chornopyska, N.V. (2012). Development of the express delivery market in Ukraine [Text]. In N. V. Chornopyska, N. R. Kubrak, & R. S. Chornopysky (Eds.), Bulletin of the National University “Lviv Polytechnic”. Logistics (No. 749. pp. 310–315).

Defee, C. C., & Stank, T. P. (2005). Applying the strategy-structure-performance paradigm to the supply chain environment. The International Journal of Logistics Management, 16(1), 28–50.

Bereza, A. M., Kozak, I. A., Shevchenko, F. A., et al. (2002). E-commerce: Tutorial manual (p. 326). Кiev: КNEU.

Fichter, K. (2003). E-commerce. Sorting out of the environmental consequences. Journal of Industrial Ecology, 6(2), 29–30.

Grebenyk, K. (2017). The future of postal logistics in Ukraine and in the world: What market leaders are introducing today. Online https://mind.ua/publications/20177428-majbutne-poshtovoyi-logistiki-v-ukrayini-ta-sviti-shcho-lideri-rinku-vprovadzhuyut-uzhe-sogodni. Access: November 12, 2017.

Global B2C E-commerce Report. (2016). E-commerce foundation. Amsterdam, 2017, 11.

Heiskanen, E., Halme, M., Jalas, M., Karna, A., & Lovio, R. (2001). Dematerilization: The potential of ICT and services. The Finnish Environment 533. Helsinki: Finish Ministry of the Environment.

https://www.minsait.com/en/what-we-do/empower/smart-supply-chain

Huang, Y. C., & Yang, M. L. (2014). Reverse logistics innovation, institutional pressures and performance. Management Research Review, 37(7), 615–641.

Kawa, A. (2014). Logistyka w obsłudze handlu elektronicznego (Logistics in the sernice of e-commerce). Logistyka No, 4(2014), 37.

Kim, W., & Mauborgne, R. (2015). Blue ocean strategy: How to create uncontested market space and make the competition irrelevant (Expanded ed.). Boston, MA: Harvard Business School.

Konopielka, Ł., Wołoszyn, M., & Wytrębowicz, J. (2016). Handel elektroniczny. Ewolucja i perspektywy (E-commerce. Evolution and perspectives) (p. 16). Oficyna Wydawnicza Uczelni Łazarskiego, Warszawa.

Kozerska, M. (2014). Obsługa logistyczna obszaru e-commerce (Logistic services for e-commerce area). Zeszyty Naukowe Politechniki Śląskiej, seria Organizacja i Zarządzanie z., 68(1905), 52.

Leszczyńska, A., & Maryniak, A. (2017). Sustainable supply chain—A review of research fields and a proposition of future exploration. International Journal Sustainable Economy, 9(2), 159–179.

Logistics 4.0 and smart supply chain management in Industry 4.0. https://www.i-scoop.eu/industry-4-0/supply-chain-management-scm-logistics/. Access January 31, 2018.

Macauley J., Buckalew, L., & Chung, G. (2015). Internet Things in Logistics. DHL Trend Research, Troisdorf, Germany, https://www.dpdhl.com/content/dam/dpdhl/presse/pdf/2015/DHLTrendReport_Internet_of_things.pdf. Access January 31, 2018.

Maevska, A. A. (2010). Electronic commerce and law: Teaching methodical manual (p. 256). Kharkiv.

Makarova, M. V. (2002). E-commerce: A guide for students at Higher Educational Institutions (p. 272). Kiev: Publishing Center “Academy”.

Maryniak, A. (2017). Economic, environmental, marketing and logistic effects of intellectual capital resulting from the implementation of green supply chains, Bicник Haцioнaльнoгo yнiвepcитeтy “Львiвcькa пoлiтexнiкa”. Лoгicтикa, 863, 285–294.

Maryniak, A., & Strąk, Ł. (2017). Analyses of aspects of knowledge diffusion based on the example of the green supply chain. In N. T Nguyen, S. Tojo, L. M. Nguyen, & B. Trawiński (Eds.), Intelligent Information and Database Systems, 9th Asian Conference, ACIIDS 2017, Proceedings, eBook, Kanazawa, Japan (Part I, pp. 335–344), April 3–5, 2017.

McKinnon, A. (2010). Environmental sustainability: A new priority for logistics managers. In A. McKinnon, S. Cullinae, M. Browne, & A. Whiteing (Eds.), Green logistics: Improving the environmental sustainability of logistics (pp. 3–30). London: Kogan Page Limited.

Mgebrishvili Kh. A. (2016). Ecological aspects in logistics. In Kh. A. Mgebrishvili, N. V. Wutkhuzi, & H. A. Kvabelashvili (Eds.), Modern technologies in engineering and transport (Vol. 2, pp. 105–109).

Morgan, T. R., Richey, R. G., & Autry, C. W. (2016). Developing a reverse logistics competency the influence of collaboration and information technology. International Journal of Physical Distribution & Logistics Management, 46(3), 293–315.

Murphy, P. R., & Poist, R. F. (2000). Green logistics strategies: An analysis of usage patterns. Transportation Journal, 40(2), 5–16.

Osterwalder, A., Pigneur, Y., & Tucci, C. L. (2005). Clarifying business models: Origins, present and future of the concept. Communications of the Association for Information Systems, 16(1), 1–25.

Pluta-Zaremba, A. (2017). Rozwój usług logistycznych implikowany dynamicznym wzrostem rynku e-commerce (Development of logistic services implied by the dynamic growth of the e-commerce market). Studia Ekonomiczne, Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach, No., 321, 92.

Porter, M. E., & Millar, V. E. (1985). How information gives you competitive advantage. Harvard Business Review, 63, 149–160.

Report about e-commerce in Poland and East Europe. (2017). https://www.gemius.pl. Access December 27, 2017.

Roos, D. (2015). The History of E-commerce. HowStuffWorks.com. http://money.howstuffworks.com/history-e-commerce1.htm. Access April 26, 2015.

Sass-Staniszewska, P., & Binert, K. (2017). E-commerce w Polsce 2016. Gemius dla e-commerce Polska (E-commerce in Poland 2016. Gemius for Poland e-commerce). https://www.gemius.pl/wszystkie-artykuly-aktualnosci/nowy-raport-o-polskim-e-commerce-juz-dostepny.html. Access December 16, 2017.

Sokolenko, P. (2018). Electronic commerce (e-commerce): trends and the forecast of development in Ukraine for 2017–2018. https://www.web-mashina.com/web-blog/ecommerce-prognoz-elektronnoi-kommercii-ukrainy-2017-2018. Access January 10, 2018.

Stott, R. N., Stone, M., & Fae, J. (2016). Business models in the business-to-business and business-to-consumer worlds—What can each world learn from the other? Journal of Business & Industrial Marketing, 31(8), 949–950.

The Law of Ukraine “About e-commerce” on September 3, 2015, No. 675-VIII, as amended by the Law No. 1977-VIII of March 23, 2017, Data of Supreme Council of Ukraine, 2017, No. 20, p. 240.

Ułan, G. (2017). Raport E-commerce w Polsce 2017—Prawie połowa polskich internautów nie kupuje online (Ecommerce Report in Poland 2017— Almost half of Polish Internet users do not buy online). http://antyweb.pl/e-commerce-w-polsce-2017/. Access September 21, 2017.

Witthaut, M., Henning, D., Sprenger, P., Gadzhanov, & P., Dawid, M. (2017). Smart object and smart finance for supply chain management. Logistics Journal. https://www.logistics-journal.de/not-reviewed/2017/10/4610/witthaut_en_2017.pdf. Access January 31, 2018.

Wong, C. Y., Wong, C. W. Y., & Boon-itt, S. (2015). Integrating environmental management into supply chains. International Journal of Physical Distribution & Logistics Management, 45(1/2), 43–68.

Yuvaraj, S., & Sangeetha, M. (2016). Smart supply chain management using internet if things (IoT) and low power wireless communication systems. Wireless Communications Signal Processing and Networking (WiSPNET), International Conference, Chennai, Indie, March 23–25, 2016.

Zhu, Q., Sarkis, J., Lai, K. H., & Geng, Y. (2008). The role of organizational size in the adoption of green supply chain management practice in China. Corporate Social Responsibility and Environmental Management, 15(6), 322–337.

Zombirt, J. J., Bartoszewicz-Wnuk, A., Tęsiorowska, M., & Sosef, D. (2017). Logistyka e-commerce w Polsce. Przetarte szlaki dla rozwoju sektora (Logistics e-commerce in Poland. Wasted routes for the development of the sektor) (p. 11). http://www.jll.pl/poland/pl-pl/Research/Logistyka_e_commerce_w_Polsce_przetarte_szlaki_dla_rozwoju_sektora_raport.pdf. Access December 16, 2017.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Dyczkowska, J., Reshetnikova, O. (2019). New Technological Solutions in Logistics on the Example of Logistics Operators in Poland and Ukraine. In: Kawa, A., Maryniak, A. (eds) SMART Supply Network. EcoProduction. Springer, Cham. https://doi.org/10.1007/978-3-319-91668-2_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-91668-2_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-91667-5

Online ISBN: 978-3-319-91668-2

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)