Abstract

This article identifies determinants of entrepreneurial ecosystem and their effects of them on the entrepreneurial performance in Iran. After reviewing the recent literature on entrepreneurial ecosystem, eight factors were identified including R&D, financial resources, market, support services, infrastructure, culture, policies, and human capital that affect the entrepreneurial performance. The data has been collected by a survey method through questionnaires. Experts and entrepreneurs have participated in assessing the entrepreneurial ecosystem. The results of data analysis demonstrate that factors such as R&D, financial resources, market, support services, infrastructure, culture, policies, and human capital have a positive impact on entrepreneurial performance. Meanwhile, the results imply inefficiency in the entrepreneurial ecosystem of Iran. Moreover, the shortfalls of some factors cause to neutralize the effect of other determinants on the entrepreneurial performance.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Nowadays, the role of entrepreneurship in the development of the knowledge-based economy has been accepted. Governments use entrepreneurship as a tool for achieving sustainable development (Prieger et al. 2016). International organizations such as the OECD and the European Union have strongly highlighted the role of innovation and entrepreneurship as the engine of economic growth (OECD 2014). According to the Global Entrepreneurship Monitor (GEM), entrepreneurship is an individual’s effort to launch a new venture and self-employment in order to develop the entrepreneurial performance (wealth, business creation or development) (Angulo-Guerrero et al. 2017). Notably, some countries have formulated the entrepreneurship policies for more business creation and self-employment.

Over time, the entrepreneurship policies have been changed and directed from the quantitative development of entrepreneurship toward the qualitative development of entrepreneurship. Thus, Governments have considered a policy to develop entrepreneurial ecosystems. Entrepreneurial ecosystem is a new framework for this transition. This approach focuses on entrepreneurial efficiency. Entrepreneurs are not only the output of the entrepreneurial ecosystems, but also the main actors who create and keep a healthy ecosystem (Stam 2015).

Entrepreneurial ecosystem is gradually shaped over time by a series of interdependent components which interact with each other to create new businesses or ventures and then to improve the entrepreneurial performance (Cohen 2006). The success of entrepreneurial ecosystem has an impact on people’s welfare and economic performance. However, the advancement in entrepreneurial ecosystem needs a change in the traditional views on innovation and entrepreneurship (Zahra and Nambisan 2011). According to Isenberg (2010) “there is no single formula for creating an entrepreneurial economy and the use of a roadmap is an imperfect practical way”. In other words it is impossible to create a new Silicon Valley through replicating the features of its entrepreneurial ecosystem. Thus, every country must make a benchmark of best practices and develop its entrepreneurial ecosystem based on its own social, cultural and economic context (Arruda et al. 2015).

A review of the theoretical foundations of entrepreneurial ecosystems suggests that the entrepreneurial ecosystem provides a growth model for entrepreneurs and the new business creation. It determines the relevant components to prepare the development of entrepreneurial activities and performance. Studies in this field, aim to identify entrepreneurial opportunities in different regions of a country. As stated above, depending on the conditions of each country, regional ecosystems have their own characteristics and there is no single formula for creating a successful entrepreneurial ecosystem.

Iran is one of the developing countries in the Middle East. The Iranian Governments have implemented some programs to promote entrepreneurship and business growth since a decade ago. But there are many barriers to the entrepreneurship ecosystem in Iran. Despite the policy formulation, the international reports did not show any upper rank among other countries. Based on the Global Entrepreneurship Index (GEI) report, Iran has been ranked 80 among 132 countries (Ács et al. 2016). So, assessing the entrepreneurial ecosystem of Iran will give a better explanation for entrepreneurship development in the developing countries. Therefore, the present study aims at identifying the entrepreneurial ecosystem factors or constructs and assessing the quality of constructs based on the experts’ attitudes, testing the hypothesis based on the entrepreneurs’ attitudes.

2 Literature Review

2.1 Entrepreneurial Ecosystem

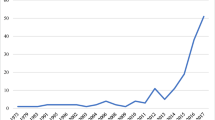

The term “ecosystem” was first coined 20 years ago and since then this word has been increasingly used in the literature of entrepreneurship and strategy (Autio and Thomas 2014; Adner and Kapoor 2010). The term of ecosystem often demonstrates a network of dependent structure and flows of resources with specific goals to create shared values (Overholm 2015). Entrepreneurial ecosystem is defined as a system that creates successful entrepreneurs and ventures. When entrepreneurship is successful in a country, it is said that its entrepreneurial ecosystem is efficient (e.g. Estonia’s and South Korea’s entrepreneurial ecosystems) Entrepreneurial ecosystem is a set of cause- and -effect elements that have mutual effects on entrepreneurship (Stam 2015).

As defined by Prahalad (2005), the entrepreneurial ecosystem may empower individuals, businesses, and communities through a combination of factors that increase the economic performance and welfare. An entrepreneurial ecosystem provides a diverse set of interdependent factors in a geographic region that make profit and shape the economic performance (Iansiti and Levien 2004). The entrepreneurial ecosystem is not only a catalyst for the sustainable economy, but it is also the main advantage of an economy to face a market failure. Studies have shown that entrepreneurial ecosystem is increasingly used as a general tool for studying the geography of entrepreneurship. They consist of a set of cultural perspectives, social networks, financial supports, universities, and active economic policies which shape a supportive environment for the activity of the innovation-based business or ventures (Spigel 2015). Entrepreneurs can discover and exploit opportunities not only inside but also outside the efficient ecosystem (Nambisan and Baron 2013).

2.2 Entrepreneurial Performance

Entrepreneurial performance is one of the most important constructs in the entrepreneurship studies (Maltz et al. 2003). According to the reports by the Aspen Network of Development Entrepreneurs (ANDE 2013), the entrepreneurial performance refers to the specific activities performed by entrepreneurs and their impact on economic growth, venture creation, and poverty reduction.

Measuring the entrepreneurial performance is not easy and depends on the collection of detailed data (Beaton et al. 2009). According to Nordqvist and Zellweger (2010), the entrepreneurial performance consists of innovation, renewal, creation of a new business, and social success. According to Monteferrante and Pinango (2011), entrepreneurial performance includes not only the economic and monetary aspects (e.g. profit, return on investment, capital, etc.) but also the non-economic and non-financial aspects (e.g. business survival, number of employees). As stated by Grande et al. (2011) the entrepreneurial performance means acquiring a higher sales growth, a bigger market share, better market status, more employees, and better financial outcomes. According to Wielemaker and Gedajlovic (2011) the dimensions of the entrepreneurial performance are economic growth, innovative activities, high level of R&D, innovation, and intellectual property. Other authors have introduced the entrepreneurial performance as social contexts of entrepreneurship, motivation forces, knowledge and ability, environmental variables, and financial strength (Khanka 2009).

The indicators of the entrepreneurial performance are the following: creation of a new formal business, growth of business, increase in employment and the amount of human capital and profits.

2.3 Entrepreneurial Ecosystem and Entrepreneurial Performance

To advance the entrepreneurial performance at a higher level, it is necessary to introduce the factors that make an efficient entrepreneurial ecosystem (ANDE 2013). Despite the emphasis on creating entrepreneurial ecosystem, studies on the identification of the factors affecting ecosystem are limited. As Van de Ven (1993) states, the historical focus on individual entrepreneurs has resulted in a lack of proper attention to multiple factors (public and private) which are crucial for facilitating the creation of a successful entrepreneurial ecosystem. The significance of mutual transactions (or interactions) of the factors on each other in an entrepreneurial ecosystem cannot be overlooked. The framework of a proper ecosystem must inevitably include personality traits and individual behavior, policies, legal issues, social habits, and local culture of each region (Lee and Peterson 2000). Thus, to design an entrepreneurial ecosystem, we must act on the basis of the interconnected factors which are rooted in the social, cultural, and economic context of a country. According to the GEM 2015 report, entrepreneurial ecosystem is formed based on the cultural, social, economic, and political dimensions and the entrepreneurial activities are realized based on the personal characteristics and social values. The outcomes of entrepreneurial actions first emerge in the form of added value or job creation, and later they result in the social and economic development in the aggregate level.

Thus, in each region, the entrepreneurial ecosystem has special characteristics and different factors are involved in its development which must be identified. Studies have noted some of the factors which are summarized in Table 1.

As shown by the previous authors, several factors have been identified that have an effect on the formation of the entrepreneurial ecosystem. Based on the OECD, the eight important factors which play a major role in the formation of a promising entrepreneurial ecosystem and influence subsequently the entrepreneurial performance (ANDE 2013) are: research and development (R&D), financial resources (Finance), market, support services, infrastructure, culture, laws and policies, and human capital. These factors will be explained below.

1. Research and Development (R&D)

The firms that perform R&D, play an important role in the development of entrepreneurial ecosystem and performance. Because, they provide business training for their employees. Meanwhile R&D provides a source of new businesses. On the other hand, the internal R&D can create business opportunities for more innovations. Innovation is strongly associated with the sustainable entrepreneurial ecosystem and performance (GEM 2014; Cohen 2006; Isenberg 2011; Arruda et al. 2015; Zahra and Nambisan 2011; Oksanen and Hautamäki 2015). Prodan (2007) has stated that the entrepreneurial process often takes place based on R&D. The entrepreneurs utilize R&D to recognize opportunities that are often overlooked and not exploited by others. Exploration and exploitation of new opportunities through innovation in the market cause more competitive advantages. These arguments suggest the first hypothesis:

H1: R&D will have a positive effect on the entrepreneurial performance.

2. Financial Resources

The access to financial resources is crucial for business development and entrepreneurial performance (Stam 2015). Financial resources are provided by technology development funds, public and private investment associations, and entrepreneurial networks (Isenberg 2011; Arruda et al. 2015; Nacu and Avasilcăi 2014; Suresh and Ramraj 2012; Khalil and Olafsen 2010). According to the British Department for International Development (DfID) (2013), the financial indices involved in the development of entrepreneurial ecosystem are accessibility to venture capitals, loans, business angels, and the stock market. According to Prodan (2007), venture capital is one of the most popular financing methods for establishing new businesses. In addition, according to the OECD (2015), bank loans are another common source of financing for many small and medium-sized businesses and entrepreneurs (SMEs). The second hypothesis is as follows:

H2: Access to financial resources will have a positive effect on the entrepreneurial performance.

3. Market

Market refers to a place in which entrepreneurs receive feedbacks on their innovations and marketing of products and get information about many issues related to the market. The markets include local markets and foreign markets (World Economic Forum 2013; Isenberg 2011; Prodan 2007; Suresh and Ramraj 2012; Arruda et al. 2015). The access to local markets plays a key role in providing opportunities within an entrepreneurial ecosystem. According to Spilling (1996a, b) and the World Economic Forum (2013), the customers’ needs create opportunities for new business ventures. As Spigel (2015) says, customers’ needs lead to the formation of networks that support entrepreneurs to obtain technology and market knowledge, access to resources such as investments, access to customers and suppliers, and thereby to improve their own performance. This leads to our third hypothesis:

H3: Access to markets will have a positive effect on the entrepreneurial performance.

4. Support Services

Providing support services (technical and managerial) can sustainably overcome the barriers to entrepreneurial programs and reduce the time to enter the innovation market (Stam 2015). The formation of entrepreneurial ecosystem can be assisted through the following actions: accessing managerial and technical talents and skills in every sector, facilitating access to universities talents, professional services such as consulting, financial, and legal services, facilitating cooperation and communication between entrepreneurs and other communities (Feld 2012; Cohen 2006; Isenberg 2011; Neck et al. 2004; Nacu and Avasilcăi 2014; Khalil and Olafsen 2010). Consulting includes a network of skilled consultants and specialists (lawyers, accountants, experienced entrepreneurs, professors, and universities researchers) that work together to help entrepreneurs to access the skills and knowledge they need. We put forward the fourth hypothesis as follows:

H4: Support services will have a positive effect on the entrepreneurial performance.

5. Infrastructure

Infrastructure has two dimensions, hard and soft. The hard infrastructure results in ease of access to physical resources, communication, transportation, land and space at a low price without discrimination. The soft infrastructure includes information networks, databases, and innovation that lead to the development of entrepreneurial ecosystem and performance (DfID 2013; GEM 2014; Nacu and Avasilcăi 2014; Prodan 2007). The efficient infrastructure enables entrepreneurs to deliver their products to the market in a timely manner and it plays an important role in the cycle of the system. The literature leads us to the fifth hypothesis:

H5: Appropriate infrastructure will have a positive effect on the entrepreneurial performance.

6. Culture

Culture is one of the items required for the entrepreneurial ecosystem and improving the entrepreneurial performance (Audretsch and Belitski 2016). Culture comprises beliefs, norms, attitudes, symbols and stories. The two main features of the cultural characteristics of an entrepreneurial ecosystem are cultural attitudes and stories of entrepreneurship and business ownership in a culture (Stuetzer et al. 2014; Vaillant and Lafuente 2007). Aoyama (2009) argues that regional cultures affect the entrepreneurial activities through the development of acceptable entrepreneurial methods and norms. Saxenian (1994) has compared Silicon Valley and Boston and showed how cultural attitudes to entrepreneurship and risk taking have resulted in different entrepreneurial and economic approaches in the two studied regions. According to Feldman et al. (2005), the eminent background of entrepreneurial success stories makes an important part of the cultural attitudes. In general, culture consists of several factors such as the rate of failure and risk tolerance, encouraging self-employment and success stories, creating a positive impression of entrepreneurship, and celebrating the innovation. When these factors or culture encourage the creation of a new business or any self-employment, the rate of entrepreneurship and business ownership may increase (World Economic Forum 2013; Isenberg 2011; Prahalad 2005; Cohen 2006; Arruda et al. 2015). The sixth hypothesis is as follows:

H6: Supportive culture will have a positive effect on the entrepreneurial performance.

7. Policies

Laws and policies provide obligations to encourage entrepreneurship and decrease barriers to entry. Political and legal factors are key parts of economic and political context in which entrepreneurship is emerging. The context may also consider legal barriers to business formation and develop effective tax systems or publicly funded systems to implement entrepreneurship support programs, make local networks, or launch development programs (Huggins and Williams 2011; Mason and Brown 2013; Spigel 2015). As Isenberg (2010) says many governments adopt some misleading rules to create an entrepreneurial ecosystem. Governments alone are not able to build an ecosystem and should involve the private sector through a deregulations process. Therefore, governments improve the business environment and reduce some laws or deregulation for more private sector participation. Because, the private sector has been motivated for developing in profit-oriented markets, therefore the government should allow the private sector to participate and make a significant contribution to the success of the ecosystem. In general, laws and policies include tax rates, tax incentives, ease of starting businesses and making more transparency to encourage entrepreneurship. Some studies also indicate that governments and national laws must accelerate and facilitate the growth of companies and provide a supportive environment for incorporating activities so that they improve the entrepreneurial performance (Prodan 2007; Feld 2012; Nacu and Avasilcăi 2014; Isenberg 2011; Suresh and Ramraj 2012). The seventh hypothesis is as follows:

H7: Policies will have a positive effect on the entrepreneurial performance.

8. Human Capital

According to some researchers such as Audretsch et al. (2012) and Qian et al. (2013), the access to human capital is the essential precursor to have a success in an advanced knowledge based economy and skilled manpower is the key component of competitiveness for new business ventures. Universities play an important role in the completion of the ecosystem cycle through training skilled manpower. Universities nurture expert manpower through the provision of proper training. Thus, human capital is a key factor in forming and developing business and its performance. The human capital includes managerial talent, technical talent, entrepreneurial companies, outsourcing capabilities, and immigrant workforce. This factor determines the homogeneity of human capital which can be effective in the speed and volume of entrepreneurship growth in a country (World Economic Forum 2013; DfID 2013; Isenberg 2011; Stam 2015; Feld 2012; Khalil and Olafsen 2010). We develop the eighth hypothesis as follows:

H8: Human capital will have a positive effect on the entrepreneurial performance.

Accordingly, the conceptual model is formulated as presented in Fig. 1.

3 Methods

Several methods may be used to measure entrepreneurship. One of the favorite methods is using the questionnaire to assess the view of entrepreneurs and experts such as the GEM (Ács et al. 2014). Therefore, the questionnaire has been extracted based on the ecosystem studies in this article. Thus, the study has been done by a survey method.

The study has been conducted in two steps. The first step is to test the quality of questionnaire through the experts’ opinions. In this step, the questionnaires have been gathered from the experts in the field of entrepreneurship (n = 71). In order to test the quality of measures, we run the Smart PLS software and statistics such as the factor loading, significant t-value, composite reliability or CR, Cronbach’s alpha or Alpha (both of them for internal reliability), average variance extracted or AVE.

In the second step, we have collected the views of the entrepreneurs in order to evaluate the hypotheses and assess the current status of the entrepreneurial ecosystem in Iran.

Therefore, the questionnaire has been used to collect data from 156 entrepreneurs. In order to analyze the data in the second step, we have used the SPSS software and the descriptive statistics (e.g. mean, standard deviation, coefficient of variation) and inferential statistics (e.g. simple linear regression and multiple linear regression).

4 Data Analysis

Step (1) Identifying and Assessing the Quality of Constructs

Reliable and valid measurement show the quality of the research or constructs. Because of having confidence in the findings of study, we must first have confidence in the quality of measurement (Noar 2003).

In the first step, 71 experts’ questionnaires are collected. Then, we run the Smart PLS software to measure reliability and validity coefficients of the instruments. The calculation coefficients are CR, Alpha (both of them for internal reliability), AVE, factor loadings, t-value, and Goodness of Fit or GoF measure. The results are presented in Table 2.

As seen above, Alpha scores and CR scores of the instruments are acceptable. When Alpha scores and CR scores are more than 0.7, the reliability of the tools will be verified. Meanwhile, when AVE scores of all constructs are higher than 0.5, Convergent validity will be acceptable and strong.

Based on the analysis presented in Table 3, we compare the correlation coefficients between the paired variables.

Factor loadings, significant t-value (t-test), and GoF measure are the indicators for the items of questionnaire validity which have been analyzed by Smart PLS. The factor loadings of all items must be upper than 4.0. When the factor loading of an item is lower than 0.4, the item must be deleted or changed and the model must be run again. The analysis of factor loadings and significant t-value tests are presented in Table 4. As shown, factor loadings of all items are upper than 0.4 and it is not necessary to delete any item. Then, the t-value coefficients are calculated; T-value must be upper than 1.96 to reach the satisfactory level of validity. As shown in Table 4, all the items have high t coefficients (t ≥ 1.96).

Finally, to calculate Goodness of Fit (GoF), we calculate the following formula:

The Goodness of Fit (GoF) index is defined as the geometric mean of the average communality and mean R2 for all the endogenous constructs of the model and its dimensions to determine the overall prediction power in PLS-SEM (Akter et al. 2011). As the GoF value exceeds 0.36, the overall validation of the model will be approved.

Step (2) Test Hypothesis and Assessment the Current Status of the Entrepreneurial Ecosystem in Iran

In this step, the first descriptive statistics have been calculated as basic features of the study in Table 4. The statistics comprise mean, standard deviation, and coefficient of variation. As shown, the mean score of the entrepreneurial ecosystem constructs has been calculated lower than 3 based on the five-point Likert scale. Only the infrastructure has a better status than other factors and finance has the lowest mean score. It means the financial support has not been strong for shaping an entrepreneurial ecosystem by the participants who are entrepreneurs.

Table 5 presents the analysis of simple linear regression for testing 8 hypotheses. As shown, all the hypotheses have been accepted, at a confidence interval of 95% (p < 0.05). Hence, all of the entrepreneurial ecosystem factors affect the entrepreneurial performance. The adjusted R Square coefficients show that support has 0.44 of variation in the entrepreneurial performance. It is respectively followed by the 7th model (finance, 0.35), the 6th model, and the 3rd model. Model 1 (with independent variable of R&D) has the least coefficient (0.28).

In the next step, all the factors are calculated by utilizing multiple linear regressions. We have chosen the method of stepwise. The analysis is presented in Table 6.

“In the stepwise method at each step, the independent variable will not be in the equation that has the smallest probability of F if that probability is sufficiently small. Variables in the regression equation are removed if their probability of F becomes sufficiently large. The method terminates when no more variables are eligible for inclusion or removal” (SPSS 23 2015). It means that the variables are respectively entered into the model based on their significance. So, after entering the eight independent variables of the entrepreneurial ecosystem, four models will be calculated. Support (with an Adjusted R Square value of 0.44) is entered into the first model. Finance is entered into the second model and together with support will have 0.52 of variance in the entrepreneurial performance (E.P.). Infrastructure is entered into the third model and the R Square or R2 of the model increases by 0.04. Policy is entered into the last model and the Adjusted R2 reaches 0.57. Totally, these four variables will have 57% of variance in the entrepreneurial performance. In addition, the other four variables (R&D, Market, Culture, and Human Capital) will be completely excluded from the model. The removal of these variables indicates that the mutual interactions between the independent variables will result in the neutralization of the effects of the four listed variables. This result will be discussed in Table 7.

5 Discussion

Based on the literature, countries or regions show a different entrepreneurial performance at a macro level that is affected by that different entrepreneurial ecosystem. In order to sustain the entrepreneurial activities or grow the business, policy makers must identify the causes and effects of an entrepreneurial ecosystem. So, this study has been formulated for assessing the entrepreneurial ecosystem of Iran.

In the present study, first we have identified the factors shaping an efficient entrepreneurial ecosystem. The first part of the study has been formulated to construct reliability and validity based on the experts’ opinions for testing the quality of measures. The analysis demonstrates the valid measures of the constructs based on reliability and validity.

In the second part of the research, the current status has been assessed and the hypotheses have been tested. In this step, we have used the opinions of entrepreneurs. The results obtained in this step show that the entrepreneurial ecosystem factors in Iran are not efficient due to the low mean. It should be noted that the results are consistent with the findings of the annual report by the Global Entrepreneurship Index or GEI (GEM 2016), in which it has been stated that the rank score of the entrepreneurial ecosystem in Iran is not high in the world (80th between132 Countries). Meanwhile, comparing the Middle East with North Africa or MENA based on the GEI report (GEM 2016) shows that the ecosystem of entrepreneurship in Iran has lower score than others. Iran has been ranked only ahead of Egypt in MENA. Also, the United Arab Emirates (19th), Qatar (24th) and Bahrain (29th) have been ranked upper than other countries in MENA.

The following results have been observed based on the simple linear regressions for testing 8 hypotheses. Findings show that the R&D activities are affecting the entrepreneurial performance positively (H1). R&D facilitates knowledge and technology, generates innovative ideas and provides opportunities for new entrepreneurial activities. They can improve the performance of the entrepreneurial companies (Arruda et al. 2015; Oksanen and Hautamäki 2015; Zahra and Nambisan 2011). Analysis shows that financial resources can also influence the entrepreneurial performance positively (H2) (Isenberg 2011; Spigel 2015). The access to financial resources is critical for investment in uncertain entrepreneurial projects with long-term horizons (Stam 2015). Financing can be done through private institutions such as venture capital funds, banks and personal savings (Isenberg 2011). The markets consist of networks, customers and distributors. Statistical findings show that markets have a positive impact on the entrepreneurial performance (H3). The available local and international markets enable entrepreneurs to start or develop their businesses (Spigel 2015; Isenberg 2011; Autio and Thomas 2014; Nambisan and Baron 2013). Managerial and technical supports which are provided by the private sector and trade associations cause the development of businesses to affect the entrepreneurial performance positively based on the entrepreneurs opinions (H4) (Isenberg 2011; Spigel 2015). Infrastructures support entrepreneurs to send and receive their products or raw materials to or from the market in a timely manner; consequently, the analysis shows that the hard and soft infrastructures can reinforce firms and industries to improve their performance (H5) (Prodan 2007; Nacu and Avasilcăi 2014). Culture also affects the entrepreneurial performance positively (H6). The cultural programs are recognized as promotion activities such as introduction of role models and entrepreneurship events which result in business entry (Arruda et al. 2015; Feldman et al. 2005). The political and legal factors are the key parts of the economic and political context in which entrepreneurship occurs (Spigel 2015). Regulatory environment affects the positive and negative business entry, development or exit in the entrepreneurial ecosystem (H7). The results show that policies have a positive effect on the performance of entrepreneurial businesses (Feld 2012; Spigel 2015; Arruda et al. 2015; Isenberg 2011). Finally, human capital, as an important factor will affect the entrepreneurial ecosystem and has a positive effect on it (H8). This construct includes staffing, the activities of education and etc. It includes professionals and skilled human resources who are employed to produce goods and provide services in the entrepreneurial firms (Spigel 2015; Isenberg 2011; Arruda et al. 2015).

Totally, the factors of the entrepreneurial ecosystem individually or one by one have a positive impact on the entrepreneurial performance. Thus, the eight hypotheses are accepted (sig < 0.05). However, when we analyze the multiple linear regression by the stepwise method in order to identify more important independent variables, we will observe some independent variables removed from regression equation.

The calculations prove that support, finance, infrastructure and policies in sequence have entered and explained the entrepreneurial performance. Other factors (R&D, Market, culture and human capital) have been excluded due to the lower importance in equations. The results imply some interactions between the factors of entrepreneurship ecosystem. This finding is consistent with the report by the Ministry of Labor in Iran based on the GEI Report (GEM 2016) about our country.

According to the report, the factors in the ecosystem influence each other; therefore, the weakness in the ecosystem factors of Iran may undermine the strong ones. Meanwhile, the elements of an ecosystem complete each other and the weakness of a factor may have some adverse effects on other factors. In summary, some Iranian ecosystem factors neutralize the effects of the other strong factors and consequently make barriers to the entrepreneurial performance.

Therefore, the entrepreneurship programs must be integrated as different factors for making a better performance. The programs should be supported by the government, private sectors, and other actors. In addition, it is necessary to adopt a comprehensive, holistic, and sustainable approach for developing the entrepreneurial ecosystem. Consequently, in addition to a variety of factors discussed in this study, other factors such as institutions, business environment, and competitiveness must be simultaneously improved.

5.1 Theoretical and Managerial Implications

Policy makers should consider a long term approach in the field of the entrepreneurship development. Because the entrepreneurship development is not simply shaped by the formulation of short-term programs without a systemic view and lack of balanced development of the financial system, the market, human capital, cultural promotion and all kinds of support. Also, the participation of the private sector and other actors is required. Hence, the attention to the factors of entrepreneurial ecosystems in creating the appropriate environment should be considered as an important condition in the cooperation of the public and private sectors.

5.2 Limitation and Direction for Future Research

Despite the efforts, problems such as changes in policies, action plans, and inefficiency of economic environment have led to a lack of growth of the entrepreneurship in Iran. Some of the factors introduced in Iranian entrepreneurial ecosystem are facing major challenges which sometimes cause a contradictory performance. For example, governmental financial supports to businesses in order to shape a productive entrepreneurship have sometimes led to an unproductive entrepreneurship in Iran. So, assessing the inefficiencies in the entrepreneurial performance may develop a better understanding of the effect of contradictory policies.

Another limitation of the research relate to the use of questionnaire. The questionnaire is based on the respondent’s attitudes. Therefore, we suggest that future researchers use factual and authorized data. The other limitation relates to the lack of comparison of the ecosystems between regions or countries, so a comparison between countries and regions based on the official and comparable data is recommended. Considering that Iran is located in the Middle East, it is better to compare Iran’s data with other countries in the Middle East, North Africa or MENA region. The type of industry is also one of the factors affecting the business ecosystem, So, We think that the different dimensions of the entrepreneurship ecosystem in various industries will be investigated. Finally, since the formation of entrepreneurship ecosystems is influenced by various factors, we suggest studying moderating variables such as business environment and institutional environment in the formation of entrepreneurship ecosystems.

References

Ács ZJ, Autio E, Szerb L (2014) National systems of entrepreneurship: measurement issues and policy implications. Res Policy 43(3):476–494

Ács ZJ, Szerb L, Autio E (2016) Global entrepreneurship index 2016. The Global Entrepreneurship and Development Institute, Washington

Adner R, Kapoor R (2010) Value creation in innovation ecosystems: how the structure of technological interdependence affects firm performance in new technology generations. Strateg Manag J 31(3):306–333

Akter S, D’Ambra J, Ray P (2011) An evaluation of PLS based complex models: the roles of power analysis, predictive relevance and GoF index. In: Proceedings of the 17th Americas conference on information systems (AMCIS 2011). Association for Information Systems, Detroit, USA, pp 1–7

Angulo-Guerrero MJ, Pérez-Moreno S, Abad-Guerrero IM (2017) How economic freedom affects opportunity and necessity entrepreneurship in the OECD countries. J Bus Res 73:30–37

Aoyama Y (2009) Entrepreneurship and regional culture: the case of Hamamatsu and Kyoto, Japan. Reg Stud 43(3):495–512

Arruda C, Nogueira VS, Cozzi A, Costa V (2015) The Brazilian entrepreneurial ecosystem of startups: an analysis of entrepreneurship determinants in Brazil and the perceptions around the Brazilian regulatory framework. In: La Rovere RL, de Magalhães Ozório L, de Jesus Melo L (eds) Entrepreneurship in BRICS. Springer, Cham, pp 9–26

Aspen Network of Development Entrepreneurs or ANDE (2013) Entrepreneurial ecosystem diagnostic toolkit. Aspen Institute, London

Audretsch DB, Belitski M (2016) Entrepreneurial ecosystems in cities: establishing the framework conditions. J Technol Transf 41:1–22

Audretsch DB, Falck O, Feldman MP, Heblich S (2012) Local entrepreneurship in context. Reg Stud 46(3):379–389

Autio E, Thomas L (2014) Innovation ecosystems. In: Dodgson M, Gann DM, Phillips N (eds) The Oxford handbook of innovation management. Oxford University Press, Oxford, pp 204–288

Beaton D, Bombardier C, Escorpizo R, Zhang W, Lacaille D, Boonen A, Tugwell PS (2009) Measuring worker productivity: frameworks and measures. J Rheumatol 36(9):2100–2109

Cohen B (2006) Sustainable valley entrepreneurial ecosystems. Bus Strateg Environ 15(1):1–14

Department for International Development (DfID) (2013) Entrepreneurial ecosystem diagnostic toolkit report

Feld B (2012) Startup communities: building an entrepreneurial ecosystem in your city. Wiley, Hoboken

Feldman M, Francis J, Bercovitz J (2005) Creating a cluster while building a firm: entrepreneurs and the formation of industrial clusters. Reg Stud 39(1):129–141

GEM (2014) Global entrepreneurship monitor report

GEM or Global Entrepreneurship Monitor (2016) 2015/16 Global report. http://www.gemconsortium.org

Grande J, Madsen EL, Borch OJ (2011) The relationship between resources, entrepreneurial orientation and performance in farm-based ventures. Entrep Reg Dev 23(3–4):89–111

Huggins R, Williams N (2011) Entrepreneurship and regional competitiveness: the role and progression of policy. Entrep Reg Dev 23(9–10):907–932

Iansiti M, Levien R (2004) Strategy as ecology. Harv Bus Rev 82(3):68–81

Isenberg DJ (2010) How to start an entrepreneurial revolution. Harv Bus Rev 88(6):40–50

Isenberg D (2011) The entrepreneurship ecosystem strategy as a new paradigm for economic policy: principles for cultivating entrepreneurship. Presentation at the Institute of International and European Affairs, Dublin Ireland, May 12 2011. http://entrepreneurial-revolution.com. Accessed 27 Jan 2012

Khalil MA, Olafsen E (2010) Enabling innovative entrepreneurship through business incubation. In: The innovation for development report 2009–2010. Palgrave Macmillan, Basingstoke, pp 69–84

Khanka SS (2009) Correlates of entrepreneurial performance in a less developed region: evidence from Assam. Vision 13(4):25–34

Kshetri N (2014) Developing successful entrepreneurial ecosystems: lessons from a comparison of an Asian tiger and a Baltic tiger. Balt J Manag 9(3):330–356

Lee SM, Peterson SJ (2000) Culture, entrepreneurial orientation, and global competitiveness. J World Bus 35(4):401–416

Maltz AC, Shenhar AJ, Reilly RR (2003) Beyond the balanced scorecard: refining the search for organizational success measures. Long Range Plan 36(2):187–204

Mason C, Brown R (2013) Entrepreneurial ecosystems and growth oriented entrepreneurship. Background paper for the international workshop on entrepreneurial ecosystems and growth oriented entrepreneurship

Monteferrante P, Piñango R (2011) Governance structures and entrepreneurial performance in family firms: an exploratory study of Latin American family firms. In: Understanding entrepreneurial family businesses in uncertain environments: opportunities and research in Latin America, vol 1. Edward Elgar, Cheltenham, p 91

Nacu CM, Avasilcăi S (2014) Environmental factors influencing technological entrepreneurship: research framework and results. Procedia Soc Behav Sci 109:1309–1315

Nambisan S, Baron RA (2013) Entrepreneurship in innovation ecosystems: Entrepreneurs’ self-regulatory processes and their implications for new venture success. Entrep Theory Pract 37(5):1071–1097

Neck HM, Meyer GD, Cohen B, Corbett AC (2004) An entrepreneurial system view of new venture creation. J Small Bus Manag 42(2):190–208

Noar SM (2003) The role of structural equation modeling in scale development. Struct Equ Model 10(4):622–647

Nordqvist M, Zellweger T (eds) (2010). Transgenerational entrepreneurship: exploring growth and performance in family firms across generations. Edward Elgar, Cheltenham

OECD (2014) Entrepreneurial ecosystems and growth oriented entrepreneurship. OECD, Paris

OECD (2015) New approaches to SME and entrepreneurship financing: broadening the range of instruments. OECD, Paris

Oksanen K, Hautamäki A (2015) Sustainable innovation: a competitive advantage for innovation ecosystems. Technol Innov Manag Rev 5(10):24–30

Overholm H (2015) Collectively created opportunities in emerging ecosystems: the case of solar service ventures. Technovation 39:14–25

Pinelli M, Cunningham J, Hiscock-Croft R, McLenithan M (2013) Entrepreneurial ecosystems around the globe and company growth dynamics. World Economic Forum, Cologny, pp 1–35

Prahalad CK (2005) The fortune at the bottom of the pyramid: eradicating poverty through profits. Wharton School Publishing, Saddle River

Prieger JE, Bampoky C, Blanco LR, Liu A (2016) Economic growth and the optimal level of entrepreneurship. World Dev 82:95–109

Prodan I (2007) A model of technological entrepreneurship, Handbook of research on techno-entrepreneurship. Edwars Elgar, Cheltenham

Qian H, Acs ZJ, Stough RR (2013) Regional systems of entrepreneurship: the nexus of human capital, knowledge and new firm formation. J Econ Geogr 13(4):559–587

Saxenian A (1994) Regional networks: industrial adaptation in Silicon Valley and route 128

Spigel B (2015) The relational organization of entrepreneurial ecosystems. Entrep Theory Pract 41(1):49–72. https://doi.org/10.1111/etap.12167

Spilling OR (1996a) The entrepreneurial system: on entrepreneurship in the context of a mega-event. J Bus Res 36(1):91–103

Spilling OR (1996b) Regional variation of new firm formation: the Norwegian case. Entrep Reg Dev 8(3):217–244

SPSS 23 (2015) Manual guide in software, USA

Stam E (2015) Entrepreneurial ecosystems and regional policy: a sympathetic critique. Eur Plan Stud 23(9):1759–1769

Stam E, Spigel B (2016) Entrepreneurial ecosystems and regional policy. In: Sage handbook for entrepreneurship and small business. Sage, London

Stuetzer M, Obschonka M, Brixy U, Sternberg R, Cantner U (2014) Regional characteristics, opportunity perception and entrepreneurial activities. Small Bus Econ 42(2):221–244

Suresh J, Ramraj R (2012) Entrepreneurial ecosystem: case study on the influence of environmental factors on entrepreneurial success. Eur J Bus Manag 4(16):95–101

Vaillant Y, Lafuente E (2007) Do different institutional frameworks condition the influence of local fear of failure and entrepreneurial examples over entrepreneurial activity? Entrep Reg Dev 19(4):313–337

Van de Ven H (1993) The development of an infrastructure for entrepreneurship. J Bus Ventur 8(3):211–230

Wielemaker M, Gedajlovic E (2011) Governance and capabilities: Asia’s entrepreneurial performance and stock of venture forms. Asia Pac J Manag 28(1):157–185

World Economic Forum (2013) Entrepreneurial ecosystems around the globe and company growth dynamics

Zahra SA, Nambisan S (2011) Entrepreneurship in global innovation ecosystems. AMS Rev 1(1):4

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Davari, A., Najmabadi, A.D. (2018). Entrepreneurial Ecosystem and Performance in Iran. In: Faghih, N., Zali, M. (eds) Entrepreneurship Ecosystem in the Middle East and North Africa (MENA). Contributions to Management Science. Springer, Cham. https://doi.org/10.1007/978-3-319-75913-5_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-75913-5_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-75912-8

Online ISBN: 978-3-319-75913-5

eBook Packages: Business and ManagementBusiness and Management (R0)