Abstract

In the aviation industry, maintenance and inventory holding costs of spare parts give managers an opportunity to decrease their operational costs. Therefore, highly accurate demand forecasting is an indispensable entity in spare-parts inventory management. In the literature, traditional demand forecasting methods and measures are insufficient due to the variability of demand quantity and the uncertainty of demand occurrence times. When comparing the demand forecasting methods, MAPE and RMSE measures are usually preferred and these methods often give misleading results when inventory cost minimization is considered. In this paper, a cost-based performance measure and a newly generated joint performance measure, GMEIC, are employed to compare the traditional forecasting methods with the methods generated for non-smooth demand. The methodology applied in this paper consists of data classification, parameter tuning, and ordering decisions based on (Q, R) inventory policy and inventory cost evaluations. In order to measure the performances of the employed forecasting methods for non-smooth demand data, 632 different items were selected from the inventory of Turkish Airlines Technic MRO. It was observed that traditional forecasting methods did not perform better than the forecasting methods developed for non-smooth demand data when the inventory costs were taken into account as the performance measure.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

Irregular demand patterns make demand forecasting challenging and forecast errors can lead to substantial costs because of unfulfilled demand or obsolescent stock. A common problem in the case of irregular demand patterns is the need to forecast demand with the highest possible degree of accuracy and to set the inventory policy parameters based on that information. The accuracy of forecasting methods is closely related to the characteristic of demand data (Boylan et al. 2008). The need to produce more accurate time series forecasts remains an issue in both conventional and soft computing techniques; therefore, innovative methods have been developed in the literature for intermittent demand. Exponential smoothing methods and variations are often used for smooth demand patterns as well as to forecast spare parts requirements (Snyder et al. 2002). However, variability and the uncertainty of occurrence of these parts raise challenges when traditional forecasting methods are used. Exponential smoothing methods, however, place some weight on the most recent data regardless of whether there is zero or nonzero demand. As such, it underestimates the size of the demand when it occurs and overestimates the long-term average demand. Consequently, biased forecasting methods cause unreasonably high stocks.

Typical high-performance companies such as Turkish Airlines tend to improve robust demand forecasting techniques and processes, leading to smaller inventories and better customer satisfaction. There is scope to increase the performance of inventory planning systems, and modifications are required for the interaction between forecasting and stock control in terms of their effects on system performance.

In the literature, non-smooth demand data are categorized into three types: erratic, lumpy, and intermittent. When demand data contain a large percentage of zero values with random nonzero demand data with small variation, the demand is referred to as intermittent. If the variability of demand size is high but there are only a few zero values, it is called erratic demand. If both the variability of demand size and the time periods between two successive nonzero demands are high, it is called lumpy demand. The demand data type is smooth when both variability and time periods between two successive nonzero demands are low.

The categorization scheme is based on the characteristics of demand data that are derived from two parameters: the average inter-demand interval (ADI) and the squared coefficient of variation (CV2). ADI is defined as the average number of time periods between two successive demands, which indicates the intermittence of demand,

where N indicates the number of periods with nonzero demand and \({\text{t}}_{\text{i}}\) is the interval between two consecutive demands. CV2 is defined as the ratio of the variance of the demand data divided by the square of average demand, which standardizes the variability of demand.

where n is the number of periods, and \({\text{D}}_{\text{i}}\) and \(\overline{\text{D}}\) are the actual demand in period i and average demand, respectively. Cut-off values for Syntetos and Boylan’s categorization scheme are given in Fig. 1 (Syntetos and Boylan 2005a). The cut-off values are ADI = 1.32 and CV2 = 0.49.

Due to excessive stocks and low customer service levels, lumpy demand presents the biggest challenge with regard to spare parts in forecasting and inventory management (Altay and Litteral 2011).

As far as intermittent demand forecasting is concerned, stock control does not determine the consequences of employing specific estimators. A limited number of researchers considering forecast accuracy that it is to be differentiated from the stock control performance of the utilized estimators (Eaves and Kingsman 2004; Strijbosch et al. 2000).

Recent empirical research on the performance of various intermittent demand forecasting approaches was conducted by Willemain et al. (2004) and Syntetos and Boylan (2005b). Thus, stock-holding cost and service level measures are of utmost importance in evaluating the performance of an inventory management system. Since the inspirational work of Croston in the area of forecasting for intermittent demand (Croston 1972), more than a few researches have been conducted on forecasting implication to inventory management, although these items comprise a substantial portion of the inventory population in parts (Porras and Dekker 2008).

Forecasts are used to determine inventory control parameters and to compare the average inventory or service levels (Syntetos and Boylan 2008). This type of performance measure sometimes hurts comparison but reveals that Croston-type methods outperform traditional methods. No studies have found consistent superior performance from either Croston-type or traditional methods. Most studies show that Croston-type methods perform better on average (Willemain et al. 1994; Ghobbar and Friend 2003; Regattieri et al. 2005), but some findings show that the traditional methods can still provide better results (Eaves 2002).

(Q, R) Policy with Non-smooth Demand

In maintaining the operational sustainability of airline companies and their Maintenance and Repair Operations (MRO), which are rigidly tied to the available spare parts, stock control and ordering policies for those spare parts have great importance. When one considers the minimization of inventory costs of spare parts, forecasting with high accuracy is a challenging task since demand data for spare parts generally show a non-smooth pattern. Croston’s method and Syntetos’ method, which were developed for non-smooth demand data, are employed in this study in order to provide comparisons of their cost performances with exponential smoothing and a naive approach.

Croston’s Method

Croston’s (1972) paper on intermittent demand is the pioneering paper that addressed sporadic demand forecasting. He proposed a forecasting procedure that independently updates the demand interval between two nonzero demand values and also the demand size. The forecast for the demand per period is then calculated as the ratio of the forecasts of demand size and demand interval. Croston’s method forecasts the nonzero demand size and the inter-arrival time between successive demands using exponential smoothing individually. Both forecasts are updated only after demand occurrences. The following notation is employed:

-

Y(t) is the estimate of nonzero demand size at time t,

-

P(t) is the estimate of the mean interval between nonzero demands at time t,

-

X(t) is the actual demand at time t, and Q is the time interval since the last nonzero demand,

-

α is the smoothing constant and F(t) is the estimate of demand per period at time t.

Croston’s forecasting method updates values of Y(t) and P(t) according to the procedure shown in Fig. 2.

Croston’s method finds the forecast of the demand for the period t as follows:

Syntetos’ Method

Modifications to Croston’s method were later developed by other researchers. Syntetos and Boylan showed that the initial Croston technique is biased (Syntetos and Boylan 2001). They corrected the biasness by multiplying the forecast for the demand per period by (\(1 - \alpha /2\)), which is defined as the correction factor. If the demand occurs, estimates are updated as in Croston’s method. Otherwise, the estimates remain the same. Their forecast of the demand for the period t is:

(Q, R) Policy Basics

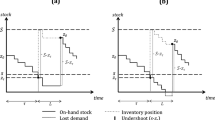

When the level of on-hand inventory decreases to point R, an order amount Q is supposed to be placed. Q is the order quantity that is added to the inventory and R is the reorder level in units of inventory.

The ordering policy in this inventory system is given as below:

- Q :

-

Order amount

- R :

-

Reorder point

- K :

-

Ordering cost per order

- h :

-

Holding cost ($h per unit held per year)

- p :

-

Penalty cost ($p per unit of unsatisfied demand)

- λ :

-

Mean demand unit per year

- \(\tau\) :

-

Lead time

Therefore:

- \(\uplambda\tau\) :

-

Expected demand over lead time

The expected average annual inventory costs by employing optimal values of (Q, R) decision variables are minimized (Fig. 3).

Inventory costs:

Let “D” be the observed demand over lead time. The expected number of shortages occurring in one cycle is:

The expected number of stock-outs incurred per unit of time (per year) is:

G(Q, R) is the total expected cost of holding, ordering, and stock-out costs.

Solving Q and R Iteratively

In order to minimize G(Q, R) for each item in the stock, the derivative of the cost function with respect to Q and R individually should be equalized to zero to satisfy the necessary conditions for minimization.

By solving two equations simultaneously, Q and R can be expressed as follows:

To solve Q, n(R) is needed. To solve R, the order quantity Q is needed. Since both Q and R require the other parameter, the iterative procedure will help to obtain the solutions. Arbitrarily selecting a Q value or an R value can start the iteration. Then a check should be performed to determine whether the solutions converge to meaningful results.

For the initial Q 0 value, the Economic Order Quantity (EOQ), which is the most convenient starting point, can be selected.

If the demand during the lead time is assumed to be normally distributed with mean µ and standard deviation σ, then the value of R 0 can be found from Eq. (13) by using a Z table (cumulative standard normal probability table).

Once R has been obtained, n(R) can be calculated by using the standardized loss function L(z) as follows:

where L(z) is

ϕ(z) is the standard normal probability density function and Φ(z) is the standard normal probability cumulative density function.

Geometric Mean of the Expected Inventory Costs (GMEIC)

Since there are multiple items in the stock, a performance measure that will collectively calculate the performances of the forecasting methods is needed. Regardless of the variability of the items in the stock, the geometric mean (based on products) of the expected costs (based on time) may be employed by using the expected costs as follows:

Methodology

The following steps are taken when determining the best strategy in order to lower the inventory costs:

-

The spare parts demand data are categorized.

-

24 months’ data are used for initialization.

-

The last 36 months’ data are used for validation purposes.

-

Demand forecasting methods are selected (naïve, exponential smoothing, Croston and Syntetos; a constant smoothing factor α of 0.2 is used).

-

The future (hidden) demand is forecasted.

-

Ordering times and amounts are determined.

-

Inventory holding costs, ordering costs, and stock-outs are calculated.

-

The results of the naïve, exponential smoothing, and Croston and Syntetos methods are compared.

-

The results are compared to select the most appropriate method.

The following steps are followed to obtain the Q and R values and compare the inventory costs of the forecasting methods employed.

-

1.

Calculate the Q0 (EOQ) using Eq. (14).

- 2.

-

3.

Find the corresponding z value.

-

4.

Find the loss function value for the corresponding z using Eq. (17).

-

5.

Calculate n(R) using Eq. (16).

-

6.

Calculate Qi using Eq. (12).

-

7.

Repeat Steps 2–6 until Q and R converge to Q* and R* respectively.

-

8.

The last Q* value is taken to define the order amount for the month considered.

-

9.

F(R*) is employed to calculate the reorder point (R*) value.

Case Study

In this study, a spare parts demand dataset is employed to perform comparisons of forecasting methods in the light of the inventory costs of Turkish Airlines Technic MRO. Accurate demand forecasting for stock-keeping units has a high importance in the aviation industry as the absence of any small part can lead to very high downtime costs. The minimization of inventory costs by keeping the availability of service parts as high as possible is a fundamental dilemma that needs to be investigated with new approaches.

Turkish Airlines Technic MRO is a notable aircraft maintenance, repair, and overhaul services company in the region. Turkish Airlines Technic MRO provides maintenance operations to its customers (business partners, airlines, etc.) for approximately all aircraft components (4,000 Boeing and 4,000 Airbus parts) from two wide- and narrow-body hangars and one VIP and light-aircraft hangar in Istanbul.

In this study, real datasets for spare parts that belong to the Turkish Airlines Technic MRO inventory are employed. These spare parts (except for one) were selected from non-smooth demands that have ADIs greater than 1.32 or CV2 values above 0.49. The data cover 106 monthly periods from 2008 to 2013. Descriptive statistics of the non-smooth demand dataset are given in Table 1.

Examples of non-smooth demand data from each demand category are given in Fig. 4. Data are taken from the MRO inventory of service parts of Turkish Airlines are given in monthly form for the last two years.

In our case, 632 demand data from the Turkish Airlines Technic MRO inventory are selected for the purpose of classification (Table 2).

In this section, the inventory cost performances of the forecasting methods are investigated. Cost-based inventory performance results are given with the application of (Q, R) policy based on the exponential smoothing, Croston, Syntetos, and naive forecasting methods. The following assumptions are made:

-

1.

The lead time is fixed as 1 month.

-

2.

Demand is random and the system is continuously reviewed.

-

3.

The penalty cost is taken as five times the part price.

-

4.

The holding cost is taken as 0.2* part price.

-

5.

The ordering cost is taken from the Turkish Airlines Technic MRO inventory cost system.

-

6.

The demand during the lead time is a continuous random variable D with a probability density function. Let µ = E(D) and \(\sigma = \sqrt {var(D)}\) be the mean and standard deviation of the demand during the lead time.

The iterative methodology given in Section “Methodology” is applied to obtain results. The inventory costs and GMEIC are the performance measures used to compare the intermittent demand forecasting methods.

Cost Results

Comparative results are given in Table 3 for the demand data for 632 spare parts. Of the 631 data, 278 had intermittent characteristics. Of these 278 intermittent data, 119 (43%) are best forecasted by Syntetos’ method. Even with the smoothed data, 44% of the time, the performance of the Syntetos method is better than that of the other methods. The smoothing parameter (α) is selected as 0.2 for the exponential smoothing, Croston, and Syntetos methods.

Looking at the best performance is insufficient to help us compare the performance of non-winning methods. In this case, the GMEIC can be employed. The GMEIC results obtained from 632 different items are given in Table 4.

Conclusion

Service parts inventory management is a challenging task when it comes to considering costs. Selection of a forecasting method with high accuracy is crucial, since the data are in a very unusual form. Traditional time series forecasting methods generally perform poorly when applied to non-smooth demand. In this study, we investigated the implications of forecasting methods for inventory costs. It can be concluded that the choice of forecasting method has an impact on the decisions regarding inventory costs and thus on the performance of the system.

Initially, historical demand data of Turkish Airlines Technic MRO spare parts are classified according to their properties such as the average inter-demand interval (ADI) and the coefficient of variation based on the Syntetos scheme. Four different groups of spare parts were determined based on that classification, namely intermittent, lumpy, smooth, and erratic. Then, spare parts demand forecasting models and a (Q, R) ordering policy for stochastic demand during lead time were applied. The comparison was executed on 607 non-smooth and 25 smooth real demand data series. In order to compare the forecasting methods while considering inventory costs, a newly generated accuracy measure (GMEIC) was employed. It was observed that the Syntetos method outperformed the other methods.

In a supply chain, random occurrences of demand are studied to manage the inventory system and the planned customer service at minimum cost. The inventory of a product may experience stock-out or over-stocking if the actual demand does not match the demand forecast. If the inventory quantity is determined based on the improved forecast, the inventory cost of a product may be reduced. The focus of this research is on demonstrating the inventory cost reductions that can be achieved through the application of an appropriate demand forecast. The best forecast for the product may be selected by comparing the inventory costs derived from several forecasts.

References

Altay N, Litteral LA (2011) Service parts management, demand forecasting and inventory control, 1st edn. XIV

Boylan JE, Syntetos AA, Karakostas GC (2008) Classification for forecasting and stock control: a case study. J Oper Res Soc 59:473–481

Croston JF (1972) Forecasting and stock control for intermittent demands. Oper Res Q 23:289–304

Eaves AHC (2002) Forecasting for the ordering and stock-holding of consumable spare parts. Ph.D. thesis, University of Lancaster, UK

Eaves AHC, Kingsman BG (2004) Forecasting for the ordering and stock-holding of spare parts. J Oper Res Soc 50:431–437

Ghobbar AA, Friend CH (2003) Evaluation of forecasting methods for intermittent parts demand in the field of aviation: a predictive model. Comput Oper Res 30:2097–2114

Porras E, Dekker R (2008) An inventory control system for spare parts at a refinery: An empirical comparison of different re-order point methods. Eur J Oper Res 184:101–132

Regattieri A, Gamberi M, Gamberini R, Manzini R (2005) Managing lumpy demand for aircraft spare parts. J Air Transp Manag 11(6):426

Snyder R, Koehler A, Ord J (2002) Forecasting for inventory control with exponential Smoothing. J Forecast 18:5–18

Strijbosch LWG, Heuts RMJ, Schoot EHM (2000) A combined forecast-inventory control procedure for spare parts. J Oper Res Soc 51:1184–1192

Syntetos AA, Boylan JE (2001) On the bias of intermittent demand estimates. Int J Prod Econ 71:457–466

Syntetos AA, Boylan JE (2005a) On the categorization of demand patterns. J Oper Res Soc 56:495–503

Syntetos AA, Boylan JE (2005b) The accuracy of intermittent demand estimates. Int J Forecast 21:303–314

Syntetos AA, Boylan JE (2008) Forecasting for inventory management of service parts (Chap. 20). In: Kobbacy KAH, Murthy DNP (eds) Complex system maintenance handbook. Springer, World Academy of Science, Engineering and Technology (To appear in 2007)

Willemain TR, Smart CN, Shockor JH, DeSautels PA (1994) Forecasting intermittent demand in manufacturing: a comparative evaluation of Croston’s method. Int J Forecast 10:529–538

Willemain TR, Smart CN, Schwarz HF (2004) A new approach to forecasting intermittent demand for service parts inventories. Int J Forecast 20:375–387

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Sahin, M., Eldemir, F. (2018). Application of Q-R Policy for Non-smooth Demand in the Aviation Industry. In: Calisir, F., Camgoz Akdag, H. (eds) Industrial Engineering in the Industry 4.0 Era. Lecture Notes in Management and Industrial Engineering. Springer, Cham. https://doi.org/10.1007/978-3-319-71225-3_14

Download citation

DOI: https://doi.org/10.1007/978-3-319-71225-3_14

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-71224-6

Online ISBN: 978-3-319-71225-3

eBook Packages: EngineeringEngineering (R0)