Abstract

Conventional approaches to estimating reserves, optimising mine planning and production forecasting result in single, often biased, forecasts. This is largely due to the non-linear propagation of errors in understanding orebodies throughout the chain of mining. A new mine planning paradigm is considered herein, integrating two elements: stochastic simulation and stochastic optimisation. These elements provide an extended mathematical framework that allows modelling and direct integration of orebody uncertainty to mine design, production planning, and valuation of mining projects and operations. This stochastic framework increases the value of production schedules by 25%. Case studies also show that stochastic optimal pit limits:

-

can be about 15% larger in terms of total tonnage when compared to the conventional optimal pit limits, while

-

adding about 10% of net present value (NPV) to that reported above for stochastic production scheduling within the conventionally optimal pit limits.

Results suggest a potential new contribution to the sustainable utilisation of natural resources.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Introduction

Optimisation is a key aspect of mine design and production scheduling for both open pit and underground mines. It deals with the forecasting, maximisation, and management of cash flows from a mining operation and is the key to the financial aspects of mining ventures. A starting point for optimisation in the above context is the representation of a mineral deposit in three-dimensional space through an orebody model and the mining blocks representing it; this is used to optimise designs and production schedules (e.g. Whittle 1999). Geostatistical estimation methods have long been used to model the spatial distribution of grades and other attributes of interest within the mining blocks representing a deposit (David 1988). The main drawback of estimation techniques, be they geostatistical or not, is that they are unable to reproduce the in situ variability of the deposit grades, as inferred from the available data. Ignoring such a consequential source of risk and uncertainty may lead to unrealistic production expectations (e.g. Dimitrakopoulos et al. 2002). Figure 1 shows an example of unrealistic expectations in a relatively small gold deposit. In this example (Dimitrakopoulos et al. 2002), the smoothing effect of estimation methods generates unrealistic expectations of net present value in the mine’s design, along with ore production performance, pit limits, and so on. The figure shows that if the conventionally constructed open pit design is tested against equally probable simulated scenarios of the orebody, its performance will probably not meet expectations. The conventionally expected NPV of the mine has a 2–4% chance to materialise, while it is expected to be about 25% less than forecasted. Note that in a different example, the opposite could be the case.

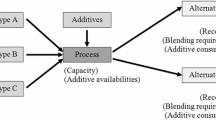

For over a decade now, a traditional framework has been used when dealing with uncertainty in the spatial distribution of attributes of a mineral deposit, as well as its implications to downstream studies, planning, valuation, and decision-making. Now, a different framework than the traditional has been suggested and is outlined in Fig. 2. Instead of a single orebody model as an input to optimisation for mine design and a ‘correct’ assessment of individual key project indicators, a set of models of the deposit can be used. These models are conditional to the same available data and their statistical characteristics, and all are constrained to reproduce all available information and represent equally probable models of the actual spatial distribution of grades (Journel 1994). The availability of multiple equally probable models of a deposit enables mine planners to assess the sensitivity of pit design and long-term production scheduling to geological uncertainty (e.g. Kent et al. 2007; Godoy 2010, in this volume) and, more importantly, empower mine planners to produce mine designs and production schedules with substantially higher NPV assessments through stochastic optimisation. Figure 3 shows an example from a major gold mine presented in Godoy and Dimitrakopoulos (2004), where a stochastic approach leads to a marked improvement of 28% in NPV over the life of the mine, compared to the standard best practices employed at the mine; note that the pit limits used are the same in both cases and are conventionally derived through commercial optimisers (Whittle 1999). The same study also shows that the stochastic approach leads to substantially lower potential deviation from production targets, that is, reduced risk. A key contributor to substantial differences is that the stochastic or risk-integrating approach can distinguish between the ‘upside potential’ of the metal content, and thus economic value of a mining block, from its ‘downside risk’, and then treat them accordingly, as further discussed herein.

Figure 2 represents an extended mine planning framework that is stochastic (that is, integrates uncertainty) and encompasses the spatial stochastic model of geostatistics with that of stochastic optimisation for mine design and production scheduling. Simply put, in a stochastic mathematical programming model developed for mine optimisation, the related coefficients are correlated random variables that represent the economic value of each block being mined in a deposit, which are in turn generated from considering different realisations of metal content. Note that the second key element of the risk-integrating approaches is stochastic simulation; the reader is referred to Mustapha and Dimitrakopoulos (2010, in this volume) for the description of a new general method for high-order simulation of complex geological phenomena. The further integration of market uncertainties in terms of commodity prices and exchange rates is discussed elsewhere (Abdel et al. 2011; Meagher et al. 2010).

The key idea in production scheduling that accounts for grade uncertainty is relatively simple. A conventional optimiser (any one of them) is deterministic by construction and evaluates a cluster of blocks, such as that in Fig. 4a, so as to decide when to stop mining, which blocks to extract when, and so on, assuming that the economic values of the mining blocks considered (inputs to the optimiser) are the actual/real values. A stochastic optimiser, also by construction, evaluates a cluster of blocks, but as in Fig. 4b, by simultaneously using all possible combinations of economic values of the mining blocks in the cluster being considered. As a result, substantially more local information on joint local uncertainty is utilised, leading to much more robust schedules that also can maximise the upside potential of the deposit (e.g. higher NPV and metal production) and at the same time minimise downsides (e.g. not meeting production targets and related losses).

Production scheduling optimisation with conventional versus stochastic optimisers. a Single representation of a cluster of mining blocks in a mineral deposit as considered for scheduling by a conventional optimiser; b a set of models of the same cluster of blocks with multiple possible values considered simultaneously for scheduling by a stochastic optimiser

To elaborate on the above, the next sections examine a key element in the risk-integrating framework shown in Fig. 2, that of stochastic optimisation. The latter optimisation is presented in two approaches, one based on the technique of simulated annealing, and a second based on stochastic integer programming. Examples follow that demonstrate the practical aspects of stochastic mine modelling, including the monetary benefits.

Stochastic Optimisation in Mine Design and Production Scheduling

Mine design and production scheduling for open pit mines is an intricate, complex, and difficult problem to address due to its large-scale and uncertainty in the key parameters involved. The objective of the related optimisation process is to maximise the total net present value of the mine plan. One of the most significant parameters affecting the optimisation is the uncertainty in the mineralised materials (resources) available in the ground, which constitutes an uncertain supply for mine production scheduling. A set of simulated orebodies provides a quantified description of the uncertain supply. Two stochastic optimisation methods are summarised in this section. The first is based on simulated annealing (Godoy and Dimitrakopoulos 2004; Leite and Dimitrakopoulos 2007; Albor et al. 2009); and the second on stochastic integer programming (Ramazan and Dimitrakopoulos, in this volume, 2013; Menabde et al. 2017, in this volume); Leite and Dimitrakopoulos 2014; Montiel et al. 2016; Goodfellow and Dimitrakopoulos 2017a, b).

Production Scheduling with Simulated Annealing

Simulated annealing is a heuristic optimisation method that integrates the iterative improvement philosophy of the so-called Metropolis algorithm with an adaptive ‘divide and conquer’ strategy for problem solving (Geman and Geman 1984). When several mine production schedules are under study, there is always a set of blocks that are assigned to the same production period throughout all production schedules; these are referred to as the certain or 100% probability blocks. To handle the uncertainty in the blocks that do not have 100% probability, simulated annealing swaps these blocks between candidate production periods so as to minimise the average deviation from the production targets for N mining periods, and for a series of S simulated orebody models, that is:

where θ n (s) and ω n (s) are the ore and waste production targets, respectively, θ n (s) and ω n (s) represent the actual ore and waste production of the perturbed mining sequence. Each swap of a block is referred to as a perturbation.

The probability of acceptance or rejection of a perturbation is given by:

This implies all favourable perturbations (Onew ≤ Οold) are accepted with probability 1 and unfavourable perturbations are accepted based on an exponential probability distribution, where T represents the annealing temperature.

The steps of this approach, as depicted in Fig. 5 are as follows:

-

1.

define ore and waste mining rates;

-

2.

define a set of nested pits as per the Whittle implementation (Whittle 1999) of the Lerchs-Grossmann (1965) algorithm, or any pit parameterisation;

-

3.

use a commercial scheduler to schedule a number of where: simulated realisations of the orebody given 1 and 2;

-

4.

employ simulated annealing as in Eq. 1 using the results from 3 and a set of simulated orebodies; and

-

5.

quantify the risk in the resulting schedule and key project indicators using simulations of the related orebody.

Stochastic Integer Programming for Mine Production Scheduling

Stochastic integer programming (SIP) provides a framework for optimising mine production scheduling considering uncertainty (Dimitrakopoulos and Ramazan 2008). A specific SIP formulation is briefly shown here that generates the optimal production schedule using equally probable simulated orebody models as input, without averaging the related grades. The optimal production schedule is then the schedule that can produce the maximum achievable discounted total value from the project, given the available orebody uncertainty described through a set of stochastically simulated orebody models. The proposed SIP model allows the management of geological risk in terms of not meeting planned targets during actual operation. This is unlike the traditional scheduling methods that use a single orebody model, and where risk is randomly distributed between production periods while there is no control over the magnitude of the risks on the schedule.

The general form of the objective function is expressed as:

where:

- p:

-

is the total production periods

- n:

-

is the number of blocks

- b ti :

-

is the decision variable for when to mine block i (if mined in period t, \( {\text{b}}_{{\text{t}}}^{{\text{i}}} \) is 1 and otherwise \( {\text{b}}_{{\text{t}}}^{{\text{i}}} \) is 0)

The c variables are the unit costs of deviation (represented by the d variables) from production targets for grades and ore tonnes. The subscripts u and l correspond to the deviations and costs from excess production (upper bound) and shortage in production (lower bound), respectively, while s is the simulated orebody model number, and g and o are grade and ore production targets. Figure 6 graphically shows the second term in Eq. 2.

Graphic representation of the way the second component of the objective function in Eq. 2 minimizes the deviations from production targets while optimizing scheduling. This leads to schedules where the potential deviations from production targets are minimized, leading to schedules that seek to mine first not only for high grade mining blocks, but also with high probability to be ore

Note that the cost parameters in Eq. 2 are discounted by time using the geological risk discount factor developed in Dimitrakopoulos and Ramazan (2004). The geological risk discount rate (GRD) allows the management of risk to be distributed between periods. If a very high GRD is used, the lowest risk areas in terms of meeting production targets will be mined earlier and the most risky parts will be left for later periods. If a very small GRD or a GRD of zero is used, the risk will be distributed at a more balanced rate among production periods depending on the distribution of uncertainty within the mineralised deposit. The ‘c’ variables in the objective function (Eq. 2) are used to define a risk profile for the production, and NPV produced is the optimum for the defined risk profile. It is considered that if the expected deviations from the planned amount of ore tonnage having planned grade and quality in a schedule are high in actual mining operations, it is unlikely to achieve the resultant NPV of the planned schedule. Therefore, the SIP model contains the minimisation of the deviations together with the NPV maximisation to generate practical and feasible schedules and achievable cash flows. For details, please see Ramazan and Dimitrakopoulos (2008) and Dimitrakopoulos and Ramazan (2008) .

Examples and Value of the Stochastic Framework

The example discussed herein shows long-range production scheduling with both the simulating annealing approach in Sect. “Simulated annealing and production schedules” and SIP model in Sect. “Stochastic integer programming and production schedules”. Section “Stochastically optimal pit limits” focuses on the topic of stochastically optimal pit limits. The application used is at a copper deposit comprising 14,480 mining blocks. The scheduling considers an ore capacity of 7.5 M tonnes per year and a maximum mining capacity of 28 M tonnes. All results are compared to the industry’s ‘best practice’: a conventional schedule using a single estimated orebody model and Whittle’s approach (Whittle 1999).

Simulated Annealing and Production Schedules

The results for simulated annealing and the method in Eq. 1 are summarised in Figs. 7, 8, 9 and 10. The risk profiles for NPV, ore tonnages, and waste production are respectively shown in Figs. 7, 8, and 9. Figure 10 compares with the equivalent best conventional practice and reports a difference of 25% in terms of higher NPV for the stochastic approach.

Stochastic Integer Programming and Production Schedules

The application of the SIP model in Eq. 2, using pit limits derived from the conventional optimisation approach, forecasts an expected NPV at about $238 M. When compared to the equivalent traditional approach and related forecast, the value of the stochastic framework is $60 M, or a contribution of about 25% additional NPV to the project. Note that unlike simulated annealing, the scheduler decides the optimal waste removal strategy, which is the same as the one used in the conventional optimisation with which we compare.

Figure 11 shows a cross-section of the two schedules from the copper deposit: one obtained using the SIP model (bottom) and the other generated by a traditional method (top) using a single estimated orebody model. Both schedules shown are the raw outputs and need to be smoothed to become practical. It is important to note that:

-

the results in the second case study are similar in a percentage improvement when compared to other stochastic approaches such as simulated annealing; and

-

although the schedules compared in the studies herein are not smoothed out, other existing SIP applications show that the effect of generating smooth and practical schedules has marginal impact on the forecasted performance of the related schedules, thus the order of improvements in SIP schedules reported here remains.

Stochastically Optimal Pit Limits

The previous comparisons were based on the same pit limits deemed optimal using best industry practice (Whittle 1999). This section focuses on the value of the proposed approaches with respect to stochastically optimal pit limits. Both methods described above consider larger pit limits and stop when discounted cash flows are no longer positive. Figures 12 and 13 show some of the results. The stochastically generated optimal pit limits contain an additional 15% of tonnage when compared to the traditional (deterministic) ‘optimal’ pit limits, add about 10% in NPV to the NPV reported above from stochastic production scheduling within the conventionally optimal pit limits, and extend the life-of-mine. These are substantial differences for a mine of a relatively small size and short life-of-mine. Further work shows that there are additional improvements on all aspects when a stochastic framework is used for mine design and production scheduling.

The new approach yielded an increment of ~30% in the NPV when compared to the conventional approach. The differences reported are due to the different scheduling patterns, the waste mining rate, and an extension of the pit limits which yielded an additional ~5.5 thousand tonnes of metal.

Conclusions

Starting from the limits of the current orebody modelling and life-of-mine planning optimisation paradigm, an integrated risk-based framework has been presented. This framework extends the common approaches in order to integrate both stochastic modelling of orebodies and stochastic optimisation in a complementary manner. The main drawback of estimation techniques and traditional approaches to planning is that they are unable to account for the in situ spatial variability of the deposit grades; in fact, conventional optimisers assume perfect knowledge of the orebody being considered. Ignoring this key source of risk and uncertainty can lead to unrealistic production expectations as well as suboptimal mine designs.

The work presented herein shows that the stochastic framework adds higher value in production schedules in the order of 25%, and will be achieved regardless of which method from the two presented is used. Furthermore, stochastic optimal pit limits are shown to be about 15% larger in terms of total tonnage, compared to the traditional (deterministic) optimal pit limits. This difference extends the life-of-mine and adds approximately 10% of net present value (NPV) to the NPV reported above from stochastic production scheduling within the conventionally optimal pit limits.

References

Abdel Sabour SA, Dimitrakopoulos R (2011) Accounting for joint ore supply, metal price and exchange rate uncertainties in mine design. J Mining Science 86(2):191–201 (The Australasian Institute of Mining and Metallurgy: Melbourne)

Albor Consquega F, Dimitrakopoulos R (2009) Stochastic mine design optimization based on simulated annealing: pit limits, production schedules, multiple orebody scenarios and sensitivity analysis. Trans Inst Min Metall Min Technol 118(2):A80–A91

David M (1988) Handbook of applied advanced geostatistical ore reserve estimation. Amsterdam, Elsevier Science, p 216

Dimitrakopoulos R, Ramazan S (2004) Uncertainty based production scheduling in open pit mining. SME Trans 316:106–112

Dimitrakopoulos R, Ramazan S (2008) Stochastic integer programming for optimizing long term production schedules of open pit mines: methods, application and value of stochastic solutions. Trans Inst Min Metall Min Technol 117(4):A155–A167

Dimitrakopoulos R, Farrelly CT, Godoy M (2002) Moving forward from traditional optimization: grade uncertainty and risk effects in open-pit design. Trans Inst Min Metall Min Technol 111:A82–A88

Geman S, Geman D (1984) Stochastic relaxation, Gibbs distribution, and the Bayesian restoration of images. IEEE Trans Pattern Anal Mach Intell PAMI 6(6):721–741

Godoy M (2017) A risk analysis based framework for strategic mine planning and design—Method and application. (in this volume)

Godoy MC, Dimitrakopoulos R (2004) Managing risk and waste mining in long-term production scheduling. SME Trans 316:43–50

Goodfellow R, Dimitrakopoulos R (2017a) Simultaneous stochastic optimization of mining complexes and mineral value chains. Math Geosci. doi:10.1007/s11004-017-9680-3

Goodfellow R, Dimitrakopoulos R (2017b) Simultaneous stochastic optimization of mining complexes and mineral value chains. Math Geosci. doi:10.1007/s11004-017-9680-3

Journel AG (1994) Modelling uncertainty: some conceptual thoughts. In: Dimitrakopoulos R (ed) Geostatistics for the next century. Kluwer Academic, Dordrecht

Kent M, Peattie R Chamberlain V (2007) Incorporating grade uncertainty in the decision to expand the main pit at the Navachab gold mine, Namibia, through the use of stochastic simulation. In: Dimitrakopoulos R (ed) Orebody modelling and strategic mine planning, 2nd edn. The Australasian Institute of Mining and Metallurgy, Melbourne, pp 207–216

Leite A, Dimitrakopoulos R (2007) A stochastic optimization model for open pit mine planning: Application and risk analysis at a copper deposit. Trans Inst Min Metall Min Technol 116(3):A109–A118

Leite A, Dimitrakopoulos R (2014) Mine scheduling with stochastic programming in a copper deposit: Application and value of the stochastic solution. Min Sci Technol 24(6):55–72

Lerchs H, Grossmann IF (1965) Optimum design of open-pit mines. Trans Canadian Inst Min Metall LXVII:47–54

Meagher C, Abdel Sabour SA, Dimitrakopoulos R (2010) Pushback design of open pit mines under geological and market uncertainties. In Dimitrakopoulos R (ed) Advances in orebody modelling and strategic mine planning I. The Australasian Institute of Mining and Metallurgy, Melbourne, pp 291–298

Menabde M, Froyland G, Stone P, Yeates G (2017) Mining schedule optimisation for conditionally simulated orebodies. (in this volume)

Montiel L, Dimitrakopoulos R, Kawahata K (2016) Globally optimising open-pit and underground mining operations under geological uncertainty. Min Technol 125(1):2–14

Mustapha H, Dimitrakopoulos R (2010) High-order stochastic simulations for complex non-Gaussian and non-linear geological patterns. Math Geosci 42(5):455–473

Ramazan S, Dimitrakopoulos R (2013) Production scheduling with uncertain supply: a new solution to the open pit mining problem. Optimi Eng 14:361–380

Ramazan S, Dimitrakopoulos R (2018) Stochastic optimisation of long-term production scheduling for open pit mines with a new integer programming formulation. (in this volume)

Whittle J (1999) A decade of open pit mine planning and optimisation—The craft of turning algorithms into packages, in Proceedings APCOM’99, Computer Applications in the Minerals Industries: 28 International Symposium. Golden, Colorado School of Mines, pp 15–24

Acknowledgements

Thanks are in order to the International Association of Mathematical Geosciences for the opportunity to present this work as their distinguished lecturer. The support of the COSMO Laboratory and its industry members AngloGold Ashanti, Barrick, BHP Billiton, De Beers, Newmont, Vale and Vale Inco, as well as NSERC, the Canada Research Chairs Program and CFI is gratefully acknowledged. Thanks to R Goodfellow for editorial assistance.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Australasian Institute of Mining and Metallurgy

About this chapter

Cite this chapter

Dimitrakopoulos, R. (2018). Stochastic Mine Planning—Methods, Examples and Value in an Uncertain World. In: Dimitrakopoulos, R. (eds) Advances in Applied Strategic Mine Planning. Springer, Cham. https://doi.org/10.1007/978-3-319-69320-0_9

Download citation

DOI: https://doi.org/10.1007/978-3-319-69320-0_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-69319-4

Online ISBN: 978-3-319-69320-0

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)