Abstract

Credit risk is the most important risk for banks which means that it is one of the most important factors for banks’ stability. The source of credit risk is the weakness of credit ability of a client which leads to bank’s losses. Losses are daily reality of every bank and according to that should be recognized, measured and implemented in credit risk managing models. The aim of this paper is to investigate how banks in Croatia are using internal rating system in their business on a daily basis, i.e. is the application of rating included in all phases of credit process. Data that will be presented in the paper will be collected through a questionnaire. The application of ratings in daily business of a bank is one of the most important minimal requirements for internal rating based approach application. Internal rating based approach is a significant in the process of validation and measurement of credit risk after Basel I approach.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The main precondition of credit risk management on the portfolio level is to be aware of the fact that all credits potentially can become “bad” during the time (Maskara and Aggarwal 2009). According to that banks should maximize banks risk-adjusted rate of return. Because credit risk is one of the largest problems n bank performance they should maintain credit risk exposure within acceptable parameters, i.e. long-term success of all credit institutions depends on effective credit risk management (Vašiček et al. 2013). Banks should identify and analyze existing and potential risks in certain product in order to perform efficient credit risk management (Broz Tominac and Posavec 2012). If banks apply standardized approach all parameters needed for credit risk estimation are provided by external rating agencies and if they apply internal ratings based approach they measure those parameters on their own (Vašiček et al. 2013). Key characteristics of credit capacity of debtors when determining capital requirements can be quantified. IRB approach is the main news from Basel II standard.

2 Definition and Coverage of Credit Risk

Credit risk is significant for banking and old as the banking itself (Bodla and Verma 2009). Credit risk arises from probability that the debtor will not be able to settle its obligations. Any nonpayment or rescheduling of any promised payments or from credit migrations of a loan gives rise to an economic loss to the bank (Schroeck 2002). The significance of credit risk as one of the largest risks in banks arises from the fact that in banks balance sheets dominate deposit-credit form of bank financial intermediation (Lastra 2004). There are different definitions of default but most internationally active credit institutions and credit institutions in European Union apply Basel definition (Bank for international settlements 2016):

-

Material exposures that are more than 90 days past due, or

-

Where there is evidence that full repayment of principal and interest without realization of collateral is unlikely, regardless of the number of days past due.

The source of credit risk is the weakening of debtor’s credit ability which leads to delay in obligation settlement or total failure in obligation settlement. That means a loss for a bank and is calculated as a product of the due amount, number of days of delay and market interest rate. Banks are dealing with losses on daily basis and that is the reason why losses should be recognized, measured and implemented in credit risk management models.

Since the credit risk is the most important for the most of credit institutions the goal of credit risk management is to maintain banks’ exposure to credit risk according to bank’s management parameters and adequate capital which leads to stability of bank and financial system on the whole. An identification and analysis of existing and potential risks that are present in certain product or activity are the basis for efficient credit risk management.

More than 80% of capital requirements of European banks are for credit risk (Jakovčević and Jolić 2013). For many banks loans are the highest source of credit risk and other sources of credit risk derive from other bank’s activities. According to that banks affront with credit risk in different financial instruments including futures, swaps, bonds, options etc. In credit risk management banks are encouraged to use internal systems for credit risk estimation.

3 Approaches to Credit Risk Management

3.1 Standardized Approach

Standardized Approach is a first phase of adjustment to Basel II standard and to acquirement of conditions for IRB approach application. It is very similar to Basel I standard in terms of capital requirements calculation, classification of positions of risk weighted assets and application of fixed factors prescribed by supervisor. This approach is simple and suitable for those banks which want such a system of capital adequacy. The characteristic of this approach is that all the components are prescribed by supervisor, i.e. banks allocate prescribed risk factors depending on placement characteristics.

Elements that are equal at Basel I agreement and standardized approach of Basel II are based on fixed risk factors that are determined according to claim category and are prescribed by supervisor. Banks are obliged to apply those factors when calculating capital adequacy. Categories of claims that are defined in standardized approach comprise claims from state institutions, banks, companies, inhabitants and claims that are insured by real estate.

Novelty of Basel II approach is the possibility of risk factors determination on a basis of external institutions‘ rating for credit risk estimation. This capital standard allows and encourages application of credit rating from external institution such as Moody’s and Standard & Poor’s. Those institutions are chosen from national supervisor. Banks have to disclose what agencies are used and apply them consistently for all claim categories.

3.2 Internal Ratings Based Approach

Internal rating based approach is the main novelty of Basel II standard. Credit risk arises from the probability that the debtor will not be able to settle its liabilities. When applying internal rating based approach all exposures must be classified into different exposure classes such as corporate, sovereign, bank, retail and equity exposures (Saita 2007). Then for each of those classes following key components of credit risk should be defined:

-

1.

PD—probability default,

-

2.

LGD—loss given default,

-

3.

EAD—exposure at default,

-

4.

M—maturity.

The above components have direct impact on the capital requirements amount, i.e. the higher the components the higher capital requirements and vice versa.

3.2.1 Basic Internal Rating Based Approach

The most important novelty of Basel II is internal rating of placements. As it was already mentioned earlier at standardized approach all risk parameters are prescribed by regulatory body while at internal ratings based approach banks measure those risk parameters. In that way banks can quantify key characteristics of clients’ credit ability when determining capital requirements. Risk components, risk factors and minimum capital requirements should be determined for every type of assets under internal rating approach.

According to internal rating system (further, IRB approach) bank classify placements in five basic categories considering risk characteristics (Martinjak 2004):

-

Bank exposure to corporate;

-

Bank exposure to sovereign;

-

Bank exposure to other banks;

-

Bank exposure to retail and

-

Bank exposure to equity.

For every category bank determines key elements of IRB approach, i.e. risk components (internal or by supervisor), calculation of weighted assets (funds through risk components are transformed into risk weighted assets and tan into capital requirements) and minimum requirements (relating to standards which must be obtained by bank if they want to apply IRB approach).

By basic IRB approach it is important that bank gives its own estimation of just one parameter (probability default) while other parameters are prescribed by supervisor. For IRB approach credit institution has to procure the supervisor’s permission. According to that IRB approach can be implemented gradually through different exposure categories inside of credit institution. For every exposure type bank estimates a probability default parameter on the basis of historical data and statistic models. There is a possibility that supervisor defines minimum values of that risk parameters for certain exposure types. Except probability default all other risk parameters inside of basic IRB approach (LGD, EAD, maturity) is defined by supervisor.

3.2.2 Advanced Internal Rating Based Approach

By advanced IRB approach all risk components are estimated by bank. Advanced IRB approach can also serve as an early warning signal and ensure the base for flexible business politic (Chorofas 2007). It is important to mention that Basel II allows advanced IRB approach only if rigorous qualitative and quantitative requirements are satisfied (the accent is put on banks’ ability to rank and quantify risk on consistent and confident way).

It is necessary to ensure such a risk estimation system which will enable appropriate estimation of debtor’s characteristics and transactions, appropriate differentiation of risk and accurate and consistent quantitative risk estimation as well as the integrity of critical input data. Those inputs should arise from bank’s system which is used in everyday business not only for estimation of regulatory capital. A bank has to have unique system and use its results both for supervisor and for making business decision. Internal rating system must be approved from supervisor (Konovalova 2009).

In order to pass on advanced internal rating based approach banks have to prove that they understand the risk they are exposed to, that are familiar with approaches through which risk can be mitigated and how to manage it in whole. Some of the encouragements for implementation of IRB approach are profitability increase because better risk understanding enables better risk and capital management, then internal models of credit risk parameters which enable implementation risk based differentiated interest rates and on risk based efficiency measures which finally lead to improvement of external rating of a bank through available and cheaper capital.

All above mentioned contribute to increase of bank competition as well as to decrease of total level of systemic risk on the level of individual bank and banking system in a whole. However, by numerous advantages there are also some disadvantages of internal rating system. Prior that is a procyclicality of capital requirements and with deterioration of economic situation the client’s rating is deteriorated too. That leads to deterioration of risk parameters and increase in capital requirements. And all that in circumstances when capital is hardly achievable. It is necessary, therefore, to work on decrease of capital requirements procyclicality influence which is one of the tasks of Basel III standard. That means that bank creates reserves of capital in favorable economic conditions which can be used to certain level in unfavorable periods. In average bank can achieve stable capital adequacy adjusted with portfolio risk.

There are numerous benefits for banks that are going in direction of advanced internal rating system application because the efficient allocation of capital became a key comparative advantage for financial institutions (Tschemernjak 2004). Benefits are even higher when comprehensive and transparent decisions based on risk are implemented.

After adequate abilities are developed and form the side of banks and form the side of supervisor some banks will be enabled to switch on advanced internal rating based approach. However, small banks should direct their resources on understanding of basic approaches and identification of minimum requirements.

Because the fact that well established risk management system is a precondition for implementation of advanced approach, banks are asked for evaluating of different possibilities. Banks that perform on international level should strive to improvement their risk management systems and pass on advanced approaches because they will need to compete with international banks which already apply such systems. But an application of advanced approaches claim an application of superior technology and information systems which enables banks quality data collecting and detailed analysis of data. But, despite banks expect lower capital requirements when applying advanced approaches they should be ready to provide more information.

Possible impact on bank’s decision about pass on advanced internal rating approach is fact that implementation of advanced approaches when applying Basel II isn’t obligatory for small banks that perform on traditional means and perform on regional base; implementation of advanced approaches shouldn’t be understand as a trend and implementation of basic approaches shouldn’t be considered inferior; every bank’s decision about pass on advanced approach has to be well considerate, concise decision after taking into consideration bank’s capacity for capital requirements calculation and bank’s capacity when maintaining risk profile and consequently capital levels under impact of different scenarios (especially stress ones); preconditions for pass on advanced systems, well established, efficiency infrastructure of IT, cost-benefit analysis of advanced approaches, availability of appropriate acquirements and capacities and well established, efficient and independent mechanisms of internal control as a support to risk management system.

Law should demand minimum number of risk categories as well as minimum obligatory criteria which should be integrated in internal rating system from banks. Regulatory body should evaluate internal rating system, i.e. determine compatibility with the nature of bank performance and complexity.

4 Results of Empirical Research

In order to research how internal ratings system outputs should be used, where risk parameters are used and to investigate if Croatian banks have developed rating culture a questionnaire was sent to Croatian banks. The researched population is ten banks in Croatia.Footnote 1 There are three hypothesis of the impact of internal rating system application on credit risk management in banks. Z Test of Hypothesis for the proportion was carried out.

Hypothesis 1

Internal rating system outputs should be used only for capital requirements calculation.

Two out of ten banks responded positively while eight responded negatively. It is assumed that the majority of banks consider that the outputs of internal rating system outputs should be used only for capital requirements calculation. The test on assumed value of proportion in program PHStat2 is used. It is assumed that half of the banks are using internal rating system outputs only for capital requirements. Test hypothesis are following: H…p = 0.50 and H…p ≠ 0.50. According to the results of test hypothesis given in Table 1 zero hypothesis can’t be rejected with significance level of 5%. Concrete, with that level of significance the majority of banks consider that the outputs of internal rating system outputs should not be used only for capital requirements calculation.

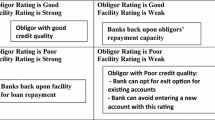

If outputs of internal rating system should be used only for capital requirements calculation it could happened that intention for capital requirements minimization influences on risk parameters estimation. The use of ratings in daily activities implicates its use in all phases of credit process. The use of internal ratings in the process of placement approval usually includes determination of authorization level for approval but in accordance with the placement risk. Placements of lower risk can be approved by lower authorization levels while placements of higher amount and risk should be approved by higher authorization levels.

Hypothesis 2

Risk parameters are used in credit products price calculation.

Four from ten banks have answered true and six banks not true.

It is assumed that the majority of banks use risk parameters in credit products price calculation. The test on assumed value of proportion in program PHStat2 is used. It is assumed that most banks use risk parameters in credit product price calculation. Test hypothesis are following: H…p ≤ 0.50 and H…p > 0.50. According to the results of test hypothesis given in Table 2 zero hypothesis can’t be rejected with significance level of 5%. Concrete, with that level of significance the majority of banks do not use risk parameters in credit products price calculation.

According to the results of test hypothesis given in Table 2 zero hypothesis can’t be rejected with significance level of 5%. Concrete, with that level of significance the majority of banks do not use risk parameters in credit products price calculation.

Risk parameters should be used for credit product price determination. That is the most important advantage of internal ratings. The price of credit products which depends on risk is fair because in terms when all debtors are paying the same interest rate, good debtors are actually subsidizing the bad ones (Jakovčević and Jolić 2013). Certain banks are determining prices by comparison with competition. But banks can have different affinity for risk taking and certain placement can lead to diversification in one bank but concentration of risk in other bank depending on portfolio structure.

Hypothesis 3

Croatian banks have developed rating culture.

It is assumed that the majority of banks have developed rating culture. The test on assumed value of proportion in program PHStat2 is used. It is assumed that half of the banks have developed rating culture. Test hypothesis are following: H…p = 0.50 and H…p ≠ 0.50. According to the results of test hypothesis given in Table 3 zero hypothesis can’t be rejected with significance level of 5%. Concrete, with that level of significance half of banks consider that they have developed rating culture.

Rating allocation and internal rating system output application should be a part of business culture of credit institution. If employees understand outputs of internal rating systems, if rating is given to every debtor, if there is reporting about rating systems than there is a rating culture. But if ratings are just calculated and not used in business process which means that employees don’t recognize the importance of ratings than rating culture doesn’t exist.

5 Conclusion

According to research results about the impact of internal rating system application on credit risk management in banks majority of banks consider that the outputs of internal rating system outputs should not be used only for capital requirements calculation, majority of banks do not use risk parameters in credit products price calculation and the half of banks consider that they have rating culture. That means that majority of banks recognize the importance of internal ratings in daily business but are not using those in price determination. The main reason is because the most of Croatian banks doesn’t apply internal ratings yet. Also, employees should learn how internal ratings can improve daily business in order to develop rating culture in banks. In order to strengthen financial system on local and on global level banks need to use more sophisticated methods of credit risk estimation. With such methods the level of regulatory capital will be adjusted with its risk profile. In that sense there is a lot space for progress in Croatian banks in future.

Notes

- 1.

Because of data protection there aren’t any bank names in this paper.

References

Bank for International Settlements. (2016). Prudential treatment of problem assets – Definitions of non-performing exposures and forebearance. Basel: BIS.

Bodla, B. S., & Verma, R. (2009). Credit risk management framework at banks in India. The IUP Journal of Bank Management, 8(1), 47–72.

Broz Tominac, S., & Posavec, M. (2012). Managing credit risk on the basis of Basel regulation in building societies. International Conference Proceedings, 6th International conference – An Enterprise Odyssey: Corporate governance and public policy – path to sustainable future. Šibenik, Croatia, 13–16 June 2012. Šibenik: Faculty of Economics and Business Zagreb.

Chorofas, D. N. (2007). Risk accounting and risk management for accountants. Great Britain: CIMA Publishing.

Jakovčević, D., & Jolić, I. (2013). Kreditni rizik [Credit risk]. Zagreb: RRIF.

Konovalova, N. (2009). Problems of the evaluation of credit risk in commercial banks. Journal of Business Management, 1(2), 85–92.

Lastra, R. M. (2004). Risk-based capital requirements and their impact upon the banking industry: Basel II and CAD III. Journal of Financial Regulation and Compliance, 12(3), 225–239.

Martinjak, I. (2004). Rezultati upitnika o novom baselskom sporazumu o kapitalu (Basel II) [The results of questionnaire on new Basel agreement on capital (Basel II)] [online]. Accessed March 21, 2009, from http://www.hnb.hr/supervizija/implementaacija-dkz/basel2/h-rezultati-upitnika-o-novom-bazel-spozazumu.pdf

Maskara, P. K., & Aggarwal, R. (2009). Credit risk measurement models and their regulatory implications. Review of Business Research, 9(4), 58–65.

Saita, F. (2007). Value at risk and bank capital management. Burlington: Academic Press Advanced series.

Schroeck, G. (2002). Risk management and value creation in financial institutions. New York: Wiley.

Tschemernjak, R. (2004). Assessing the regulatory impact: Credit risk – Going beyond Basel II. The Journal of Risk Finance, 12(4), 37–41.

Vašiček, V., Broz Tominac, S., & Žmuk, B. (2013). Are Croatian banks ready for pass on AIRB approach? Journal of Economics Business and Management, 1(1), 81–84.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Tominac, S.B. (2018). The Impact of Internal Rating System Application on Credit Risk Management in Banks. In: Bilgin, M., Danis, H., Demir, E., Can, U. (eds) Eurasian Business Perspectives. Eurasian Studies in Business and Economics, vol 8/1. Springer, Cham. https://doi.org/10.1007/978-3-319-67913-6_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-67913-6_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-67912-9

Online ISBN: 978-3-319-67913-6

eBook Packages: Business and ManagementBusiness and Management (R0)