Abstract

Knowledge is unequivocally one of the new sources of economic growth, though its use is not a new phenomenon from the economic perspective. The role of knowledge, along with its connection to innovation and economic performance, is a topic of interest for a growing number of researchers. Thus, many studies have been investigating not only the relationship between creating knowledge and innovation, but also the relationship between knowledge, creating innovation, and company performance—as well as economic growth. The collaboration plays in this process very important role. Participation in cooperation has thus become an important company tool, thanks to which the given participants are able to mutually support creation of knowledge, acquisition, transfer knowledge spillovers. The process of knowledge spillover is becoming increasingly important—primarily due to the potential it has for bringing value added to production processes. However, it is a process that is difficult to record and analyze; moreover, its results can be seen only over the long term. The goal of this theoretical overview chapter is to define spillover effects, describe their emergence and relationship to innovative activities, and subsequently depict their diverse influence as they operate in individual countries. The last section is devoted to the problem of measuring spillover effects, because it has not yet been possible to record and measure knowledge spillovers, and there is still the problem of which method to use when measuring them.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

- Spill-over Effects

- Regional Innovation Systems (RISs)

- Individual Economic Entities

- Knowledge Inflows

- Asheim

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Knowledge in Globalized Economic System

1.1 From Traditional Resources to the Knowledge Economy

In recent years, the concept of the knowledge economy has been gaining in importance. This concept describes the knowledge that supplements and sometimes even entirely replaces the “original” production factors for ensuring increasing competitiveness and overall economic growth. In fact, it is apparent—and a number of international studies confirm this (e.g., Kim 2015; Snieška and Drakšaitė 2015; Magnier-Watanabe 2015; Verba 2016)—that there is currently a shift from traditional resources, such as work, land, and capital towards knowledge and its use, i.e., from hard factors (e.g., infrastructure) towards soft (intangible) factors such as local atmosphere, synergetic effects, human capital, and knowledge assets (Becattini 1990; Camagni 1991; Camagni and Capello 2009). It has been demonstrated that the most important of these are knowledge and the ability to learn. Heng et al. (2012) state that knowledge

-

influences the economic growth of individual countries and regions,

-

represents an important production factor, and

-

causes differences in the productivity of countries and regions.

Today, the growth of a national economy is therefore much less dependent on quantities of natural resources, as was previously the case; rather, it is being increasingly influenced by intellectual capacity, the quality of human resources, and social and human capital, i.e., potential. Westlund (2006) stated that human capital is the individual-related resource (in the human nodes), while social capital is to be found in the links (relations) between individuals/actors and analysed that production and the exchange of knowledge in research, education and commercial R&D processes is promoted by the social capital. It refers to features of social organization, such as networks, norms, and trust, that facilitate coordination and cooperation for mutual benefit. Social capital plays an increasingly important role in the knowledge-based society and economy as it facilitates and speeds up economic actors’ acquisition of information and knowledge. In the following parts, we continue analysing issues that have been dealt with in the earlier Springer series Advances in Spatial Science (see Westlund 2006) with focus on the role of knowledge and its spillovers because individual economic actors are more frequently being forced to seek new resources—usually knowledge to help secure competitive advantage and sufficiently set them apart from the competition. As a result, the production of knowledge and information has been continuously growing, just as automobile or steel production saw growth in previous years (Stiglitz 1999). These changes have happened gradually alongside technological development, which started up half way through the twentieth century. The first visible impulse was the proliferation of personal computers, but the biggest boom happened with the mass use of the internet. Over time, developed countries have gradually become more dependent on the production and spread of knowledge (Powell and Snellman 2004) in connection with technological advancement. This has resulted in a shift from creating materially based prosperity to prosperity that is knowledge-based and better recognition of the role that knowledge and technology play within economic growth. Today, the individual economies of the OECD are strongly dependent on the production, distribution, and use of knowledge—more than in any previous time, because production/output and employment are expanding and growing most rapidly in technologically advanced sectors, such as computers, electronics, or aerospace technology (OECD 1996).

Smith (2000) states that knowledge alone is a more significant output than it has been in the past—both quantitatively and, to a degree, qualitatively; he lists a number of reasons for this:

-

Knowledge is now becoming a production factor that is displacing capital and work (this statement relies primarily on the implicit idea that the accumulation of knowledge and its related technological advancement can be separated from the accumulation of capital);

-

In comparison with natural resources, physical capital, and an unqualified labor force, the role of knowledge has acquired greater importance, and all the OECD economies are gradually becoming (at different paces) knowledge based;

-

In a certain way, knowledge is a much more important product than it has been up to now—because it is possible to see an increase in new types of activities based on trade in knowledge products.

Thus, knowledge is unequivocally one of the new sources of economic growth, though its use is not a new phenomenon from the economic perspective (Snieška and Bruneckienė 2009). It was Schumpeter who, around the year 1911, came up with the idea of using knowledge and its combinations as the basis for innovative activities and business undertakings (Cooke and Leydesdorff 2006). This lead to a gradual increase in the importance of creating innovation as a key driver of regional growth, living standards, and international competitiveness (Acs et al. 2002). The role of knowledge, along with its connection to innovation and economic performance, is a topic of interest for a growing number of researchers. Thus, many studies have been investigating not only the relationship between creating knowledge and innovation (e.g., Shapira et al. 2006; Martín-de Castro 2015; Osoro et al. 2015) but also the relationship between knowledge, creating innovation, and company performance—as well as economic growth (e.g., Capello and Lenzi 2015; Rodríguez-Pose and Villarreal Peralta 2015; Aghion and Jaravel 2015; Fidel et al. 2015). It is clear that economic growth cannot be achieved in the same ways as it has been in the past, i.e., by employing an ever greater number of workers as a source of input or by increasing consumer demand (Pulic 1998; Chen et al. 2004). The historical development of economic theories that deal with sources of competitive advantage shows that economic entities must always seek further (new) ways to achieve their company strategy and cope with the pace of rapid change (Stejskal and Hajek 2015).

1.2 The Role of Knowledge in Economic Theory

Just as economic thinking has evolved over the years, theories and approaches have evolved concerning (long-term) economic growth (including regional growth) and the role of knowledge. In this way, the sources of competitiveness as well as of company and regional growth (and of national economies) have come to be generally acknowledged in the present day. Economists have been studying economic growth at the national (or regional) level for more than 200 years (Klenow and Rodriguez-Clare 1997), but it is only in the last 30 years that there has been a sharp increase in interest in this problem as well as in the role of soft factors (knowledge, local atmosphere, synergetic effects, etc.), which has subsequently led to the creation of a number of new theories. The reasons why they have been and are continuing to be developed are numerous. Some of these reasons are (Volejníková 2005)

-

The polarization of wealth and poverty at the individual and country levels;

-

A change in how individual sectors are represented within the national economy;

-

Globalization;

-

Innovations in banking and the financial markets; and

-

Information technology, science, and research.

At the same time, the existence of these factors results in the fact that contemporary economic theory is not able to explain some of these problems, and if it can, it does so with difficulty or perhaps only incompletely.

Whereas the 1950s and 1960s, using Solow’s neoclassic model, saw long-term economic growth as determined exogenously, i.e., by external factors (human capital and technology), the 1980s saw the emergence of a new theory, in which these factors were considered endogenous and were thus incorporated into the economic growth model. The reason why this occurred was because economic growth began to be increasingly influenced by previously unexplained and undefined exogenous input, which now began to increase in importance (Capello and Nijkamp 2010). One of the first and most significant theories is thought to be the new theory of (endogenous) growth, whose main proponents are Romer and Lucas. This theory presents knowledge, technology, human capital, and innovation as the key drivers of growth, where countries and regions can show convergence or divergence over the course of their economic development. One of the primary mechanisms causing convergence or divergence is increasing profits from knowledge, i.e., the accumulation of knowledge and external savings, primarily in the field of creating and disseminating knowledge (Blažek and Uhlíř 2011). Thus, the primary causes of differences are the varying quality of human resources and different technological and behavioral parameters.

Other theories of economic thinking developed during the last two decades of the twentieth century. The focus of institutional and neo-institutional economics, which even began to develop in the Czech Republic in the 1990s (Volejníková 2005; Blažek and Uhlíř 2011), has been very helpful when clarifying both the origin and development of economic differences between countries and regions and the mechanisms of evolutionary change in the economy, as well as for understanding an economy’s dynamics. Institutional theories postulate the thesis that the traditional concept of economics includes problem areas that have not yet been given enough attention, which are nonetheless primary factors for understanding differing economic growth. These areas include (Blažek and Uhlíř 2011)

-

Technology and technological innovation, where innovation and the learning pr cess are essentially a process of constant disruption of the market equilibrium;

-

The concept of companies: Richard Nelson, one of the main representatives of Institutional economics, stated that economists have not yet attempted to understand the principles of how companies operate and their relationship to the competition, suppliers, or differences in the ways companies internally organize work; and

-

Institutions, such as formal institutions (e.g., trade unions, pro-export organizations, etc.), and especially informal institutions (institutionalized practices, routine behavior, habits, etc.).

The topics listed above also inspired the development of the so-called institutionalized theories of regional development, which deal with all or only some of the selected areas. Blažek and Uhlíř (2011) have created a summary of the individual institutional theories of regional development (Table 1).

From the preceding text, it is clear that, over time, there has been a shift in the economic understanding of economic growth as well as a different understanding of knowledge and the role of human capital. In the last 20 years, analysis of the problem of using knowledge and human capital has increased to playing a central role in the discussion on the growth and success of nations, regions, and businesses. This is primarily because advanced societies have increasingly begun to orient themselves towards a knowledge economy (Capello and Nijkamp 2010).

1.3 The Definition and Features of the Knowledge Economy

It is rather difficult to find a unifying definition of the knowledge economy in contemporary literature. Each author adds their own perspective and significance to the concept. Brinkley (2006) has tried to find a unifying definition of the knowledge economy, and he presents the following definitions:

-

It is an economy in which the creation and use of knowledge have a dominant role in creating prosperity. This type of economy is based on the most effective use of all types of knowledge within economic activities.

-

The main idea of the knowledge economy is based on the description of new sources of competitive advantage (knowledge) that can be used by all companies, in all regions, and all sectors—from agriculture to biotechnology.

-

Economic success is increasingly based on the effective use of immaterial assets such as knowledge, experience, and innovation potential. These assets are key elements for acquiring competitive advantage. The concept of the knowledge economy is then used to describe these emerging economic structures.

-

The knowledge economy and society’s knowledge represent a larger concept than merely paying more attention to research and development. It includes each aspect of the current economy, in which knowledge is the basis for value added—from high-tech industry and ICT to knowledge intensive sectors and even creative sectors, such as the media and architecture.

Brinkley et al. (2009) later add that the term “knowledge economy” is used in a number of cases, but it is rarely defined; therefore, they have also come up with their own concept. It is a transformed economy, in which investment into assets based on knowledge (research and development, design, software, and human and organizational capital) dominates in comparison with investment into physical assets (machinery, equipment, buildings, and vehicles). The knowledge economy thus describes an industrial structure, work methods, and a basis for organizations’ mutual competition that have gradually changed.

Hendarman and Tjakraatmadja (2012) suggest that the knowledge economy is an economy based on creating, evaluating, and trading in knowledge. Thus the knowledge economy means production and services based on activities that demand knowledge and contribute to the accelerated pace of technological and scientific advancement—as well as to their rapid obsolescence. Consequently, one of the key signs of the knowledge economy is greater dependency on intellectual capabilities than on physical inputs or natural resources, in combination with an attempt to integrate improvement into each phase of the production process—from the laboratory to research and development, from the factory through to communication with customers (Powell and Snellman 2004).

In the current information society, in which knowledge is one of the most important factors for achieving added value, there is a distinct shift in capabilities and their utilization (Mortazavi and Bahrami 2012). Therefore, the literature differentiates two terms, the knowledge economy and the knowledge-based economy, which are often incorrectly used as synonyms. The origins of the knowledge economy reach roughly back to the 1950s. Initially, the knowledge economy was focused primarily on the appropriate composition of a variously educated workforce, whereas the knowledge-based economy expands on the original term to include structural aspects of technological trajectories and regimes from the systems perspective. This perspective leads to discussion on international property rights as another form of capital, for example (Cooke and Leydesdorff 2006). More simply, it can be said that the knowledge economy is an economy producing products and services based on knowledge-intensive activities and contributing to both an accelerated pace of technical and scientific advancement as well as more rapid obsolescence. A key component of the knowledge economy is greater reliance on intellectual capability than on physical input or natural resources (Powell and Snellman 2004). On the other hand, an economy based on knowledge is an economy that is founded directly on the production, distribution, and use of knowledge and information (OECD 1996) and has four fundamental aspects, which are: (1) innovation, (2) education, (3) an economic and institutional regime, and (4) information infrastructure (Popovic et al. 2009). Knowledge-based (knowledge-driven) economy is therefore the economy (1) in which the generation and the exploitation of knowledge has come to play the predominant part in the creation of wealth and (2) which is about the more effective use and exploitation of all types of knowledge in all manner of activity (Peters 2001).

Brinkley (2006) adds a number of key features to the definition of the knowledge economy:

-

The knowledge economy manages an increasing intensity of use of information and communication technology on the part of educated knowledge workers (these are workers with a high level of experience, which can be seen in their diploma or equivalent qualification; these workers perform tasks requiring expert thinking and comprehensive communication abilities, often with the help of computers; and they are often workers at top-level positions—managers, experts, or professionals).

-

In the knowledge economy, there is a growing share of GDP devoted to intangible knowledge assets in comparison to physical capital.

-

The knowledge economy is composed of innovating organizations using new technologies to introduce new innovations (e.g., process, product, or organizational).

-

Companies in the knowledge economy reorganize work so that they can manipulate, store, and share information using knowledge management (knowledge management describes how an organization monitors, measures, shares, and uses intangible assets, such as an employee’s ability to think and react quickly in a crisis. Some of the key steps in knowledge management are (i) the creation of a knowledge-sharing culture, (ii) a motivational policy for retaining employees, (iii) an alliance for acquiring knowledge, and (iv) a written concept for managing knowledge).

-

The knowledge economy is present in all economic sectors—not only in knowledge-intensive ones.

This last point is tied into the Knowledge Economy Index Report (2014), which states that just as there is no one comprehensive definition of the knowledge economy, there are no precise sectors or activities singled out as belonging to it. In this study, the knowledge economy is defined as an economy composed of individuals, businesses, and sectors creating, developing, verifying, and commercializing new and emerging ideas, technologies, processes, and products that are then subsequently exported throughout the world. In the interest of trying to preserving competitive advantage, companies are always trying to remain at the forefront of their sector by (i) hiring highly qualified individuals, (ii) investing in research and development, (iii) implementing innovation, (iv) supporting creativity, (v) marketing, and (vi) seeking new markets. Therefore, the knowledge economy is an important element of all the advanced economies around the world, because it strengthens and contributes to increasing their global competitiveness, which results in economic growth. Some of the sectors belonging to the knowledge economy are

-

Pharmaceuticals and biotechnology;

-

Manufacturing medical equipment;

-

Software and digital content;

-

IT services;

-

Telecommunications;

-

Computational technology and advanced electronics;

-

Creative content and digital media;

-

Other technical services; and

-

Aviation and other forms of transport.

From the above, it is clear that the knowledge economy penetrates across the individual sectors of a national economy, and knowledge inputs and outputs are a main source of competitive advantage for companies and regions that are dependent on their capacity for using knowledge potential—their own or foreign in combination with investment in research and development. It is clear, however, that not all economic entities are able to use the given sources to the same degree or as effectively. Linked to this is the fact that all types of knowledge are not the same nor can they be applied to all sectors. Therefore, three types of knowledge bases have been distinguished: analytic, synthetic, and symbolic.

1.4 Knowledge Bases and Knowledge Assets

The importance of knowledge and its influence on business performance and economic growth was clarified in the previous section. However, international studies (e.g., Fitjar and Rodríguez-Pose 2015; Arvanitis et al. 2015; Woo et al. 2015) warn of the fact that the influence and impact of knowledge are different in connection with the different sectors of a national economy.

In general, it can be stated that, thanks to globalization, innovation is the main driver of companies for achieving and maintaining competitive advantage. This statement is underscored by the fact that creating innovation is linked to a company’s ability to absorb external information, knowledge, and technology (this fact is confirmed by a number of international authors, e.g., Negassi 2004; Segarra-Blasco and Arauzo-Carod 2008; Lichtenthaler 2011; Santos and Teixeira 2013).

However, Asheim and Coenen (2006) emphasize that innovative processes are becoming increasingly complicated. Namely, there is a wide spectrum of knowledge sources and inputs that companies and organizations are able to use. Generally, these are divided into three types of knowledge bases—analytic, synthetic, and symbolic. These knowledge bases incorporate various combinations of tacit and codified/explicitFootnote 1 knowledge, experience, competitive challenges, or implications for different sectors that can support companies’ innovation activities (Asheim and Coenen 2005).

Initially, Asheim and Coenen (2005) differentiated only the first two knowledge bases—the analytic or scientific, and the synthetic. The symbolic knowledge base was defined a while later. The typology of individual knowledge bases is depicted in Table 2. The problem of knowledge bases has been dealt with most extensively by Asheim in his own work and in collaboration with other authors (e.g., Asheim and Coenen 2005, 2006; Asheim and Hansen 2009; Asheim et al. 2011). On the basis of their studies, it is possible to define the individual types of bases as follows.

The analytical knowledge base relates to the industrial environment, in which scientific findings and knowledge are most important and where knowledge creation is often based on cognitive and rational processes or on formal models (e.g., genetics, biotechnology, or information technology). Basic and applied research are relevant activities as is the systematic development of products and processes. Even though companies have their own R&D division, they still rely/are dependent on the research results of universities and other research organizations for their innovation processes. Cooperation, ties, and networks at the “university-industry” level, i.e., between universities and companies in industry, are important and more frequent than for other types of knowledge bases. Codified knowledge (for inputs and outputs) occurs more frequently in the analytical knowledge base than in the other types of knowledge bases. This is for a number of reasons:

-

Knowledge inputs are often based on the evaluations of existing studies;

-

Knowledge generation is based on applying scientific principles and methods;

-

Knowledge processes are more formally organized (e.g., in R&D centers); and

-

Outputs have the tendency to be documented in reports/final evaluations, in electronic documents, or via patenting. Knowledge is applied in the form of new products or processes and results in much more radical innovation than for the other types of knowledge.

The synthetic knowledge base relates to the industrial environment in which innovation emerges primarily by applying existing knowledge or by combining knowledge in new ways. In most cases, it occurs as a reaction to the need for resolving concrete problems that arise from interaction with clients and suppliers. The most frequent examples of this type of field are plant engineering, specialized advanced production of industrial machinery and equipment, and ship construction. In most cases, the products that arise are “one-shot” or produced in small series. In this type of knowledge base, research and development does not gain in importance. If it is used, it tends to be used in the form of applied research, though more often in the form of product or process development. The ties between universities and industrial companies are important, but more in the case of applied rather than basic research. Knowledge is not created as often by the deductive method or using abstraction, but rather using the inductive process of testing, experiments, computer simulation, or practical work. The knowledge that is contained in the relevant technical solutions or engineering work often tends to be codified. Tacit knowledge appears to be more important, because that knowledge emerges from experience gained at the workplace as well as practical tasks utilizing mutual interaction. Afterward, the innovation process is most frequently focused on how effective and reliable the new solutions are or how practical and user-friendly the products are from the customer’s viewpoint. Overall, this results in innovation emerging in a somewhat cumulative way, with the prevailing idea being the modification of existing products and processes.

The symbolic knowledge base relates to the creation of products’ aesthetic aspects—the creation of design, imagery, and symbols as well as to the economic use of such types of cultural artifacts. The increasing importance of this type of knowledge is seen in the dynamic development of cultural production, such as media (film production, publishing, and music), advertising, design, brands, and fashion. This production demands a personal take on innovation. A fundamental portion of the work is devoted to creating new thoughts, ideas, and imagery, while the actual physical process has been pushed into the background. Competition has thus shifted further away from products’ utility value (tangible) to the visible value (intangible) of brands. Inputs thus tend to be aesthetic in nature rather than having cognitive quality. For this base, specialized characteristics and creativity are demanded over “mere” information processing; it is marked by a distinct level of tacit components.

Nonaka et al. (2000) state that so-called knowledge assets are another integral part of the successful process of creating and using knowledge in companies. These assets are defined as specific company resources necessary for creating a company’s value added. Generally, knowledge assets are divided into four main groups:

-

Experience knowledge assets—created with tacit knowledge that is spread using common experiences (e.g., the experience and know-how of individuals, care, trust, safety, energy, passion, or tension);

-

Conceptual knowledge assets—created by explicit knowledge articulated through imagery, symbols, language (e.g., design, brand value, or product concepts);

-

Routine knowledge assets—created by tacit knowledge that is routine and inserted to common actions and processes (know-how in daily operations, organizational routines, or organizational culture);

-

Systemic knowledge assets—explicit knowledge that is systematizing and packaged (documents, specifications, manuals, databases, patents, and licenses).

Knowledge bases and assets, i.e., knowledge and its ability to be transformed (into innovation, for example) are becoming the core of individual regions’ and countries’ economic systems. They often try to support their generation, acquisition, and transfer both financially and non-financially. Disseminating knowledge has thus become one of the knowledge economy’s key activities; this can happen in a number of ways, which are described in Sect. 1.5.

1.5 Creating and Disseminating Knowledge

In the present day, creating and disseminating knowledge are key activities that must be handled by most economic actors. Namely, there are many ways to create (new) and disseminate (new and existing) knowledge. Frenz and Ietto-Gillies (2009) present four sources of knowledge that can be used:

-

Generating original knowledge,

-

Purchasing knowledge,

-

Internal company sources (transfer of knowledge within a single company), and

-

Cooperation.

The latter, i.e., cooperation, has recently been becoming increasingly important (Miozzo et al. 2016; González-Benito et al. 2016). It can be said that, in the present day, cooperation is necessary for any given entity that wants to grow and compete on the market. It is clear that while non-cooperating businesses focus on their own sources and on developing key competences, knowledge is being updated at an ever more rapid pace, resulting in the obsolescence of technologies, which is linked to a necessary increase in investment and growing costs for knowledge creation. As a result of these factors, it is nearly impossible for a company to create and accumulate all the knowledge necessary for its survival and prosperity on its own. Participation in cooperation has thus become an important company tool, thanks to which the given participants are able to mutually support their knowledge and create new knowledge. Thus, companies bring both prior knowledge, primarily patents and know-how acquired before the given cooperation, to the collaboration as well as their current attempts at creating knowledge, which include financial capital and physical and human resources (Ding and Huang 2010).

Whereas explicit knowledge can be disseminated at the individual, company, or international level, tacit knowledge can only be acquired at the lowest, or individual, level. Transferring explicit knowledge can happen through the use of technologies, documents, products, and processes (at the company level)—or a multilateral agreement on the transfer of technologies, education, and professional training or the direct import and export of products (at the international level). On the other hand, the exchange of tacit knowledge at the individual level can be conducted by either deliberate transfer of knowledge or by unintentional spillover effects.Footnote 2 Fallah and Ibrahim (2004) list three levels of knowledge spillover effects:

-

Individual (between people). Here, knowledge is unintentionally exchanged between people. Individuals have control over their tacit knowledge and can share it with whomever they wish or need to share it with. Most frequently, knowledge spillover effects happen as a result of unawareness or ignorance—or when the tacit knowledge is externalized for use. Though individuals can use patents or copyrighting to protect knowledge, it nonetheless starts spilling over to others once the tacit knowledge has become explicit. For example, sharing knowledge as a member of a cooperating team (within a single company, through cooperation between companies, or as a part of the customer-supplier relationship) is not considered a spillover, because, in this case, the given team was created specifically with the goal of transferring knowledge. However, unintentional sharing of knowledge that was not specified for the given group in the first place or even sharing the group’s knowledge with people outside the group (outside the organization) is considered to be a knowledge spillover effect.

-

Company (between companies). In this case, knowledge exchange occurs between companies—between neighboring companies (often located in close proximity) or as part of joint business endeavors by connected companies. Just as in the previous example, this process is called knowledge sharing or transfer if it the knowledge exchange is intentional. Any information that is not intentionally shared is then a spillover effect.

-

Global (between countries). Knowledge spillover effects occur when there is unintentional knowledge sharing between individual countries. This sharing can happen both between neighboring countries as well as between countries that conduct trade with each other (e.g., an accompanying process during technology transfer).

There are other levels at which knowledge spillover effects between companies and other entities can occur; these are now coming into prominence:

-

University-industry. In this case, cooperation occurring between universities and companies increases in importance and is being investigated by an increasing number of researchers (e.g., Siegel et al. 2003; Ponds et al. 2010; Maietta 2015). Perkmann and Walsh (2007) list various ways this cooperation can happen (Table 3).

-

University-industry-government collaboration (or the Triple Helix). Similar to cooperation with universities alone, this type of collaboration between universities, companies, and government is also increasing in significance and is being investigated by a number of international authors (e.g., Etzkowitz and Leydesdorff 2000; Leydesdorff 2012; Zhang et al. 2014; Petersen et al. 2016). In recent years, the original Triple Helix concept has been expanded to include a fourth component, human society as those who use innovations; this model is called the Quadruple Helix.

Other studies are also appearing that deal with the influence of cooperation and its resulting knowledge spillover effects. Specifically, this means the relationships between competitors, suppliers, and customers (e.g., Dai Bin and Hongwei 2011; Classen et al. 2012; Belderbos et al. 2014).

The options that are described are then also discussed extensively as they relate to practical application. Individual companies are forced to decide whether they will implement their own research and development either (i) alone, (ii) as part of a research alliance with other companies (universities or government laboratories), (iii) contractually through specific research and development projects, or (iv) by contracting researchers from other companies or research centers (Mueller 2006). Research and development activities offer a number of other possibilities in addition to generating innovation; they increase the ability to identify, adapt, and use externally created knowledge—resulting in the opportunity to utilize research and development activities at a higher level, greater absorption capacity, and a larger pool of knowledge. The absorption capacity may become critical circumstance as for the final spillover effects because creation of spillover effects is depend considerably on the economic environment to which they are extended. Therefore, research specialization should be generally aligned with economic specialization. This is because of the fact that the close match between the regional knowledge base and the needs of industry is often not the case and the absorption capacity of local economy is hindered by number of factors (Gál and Ptaček 2011). These factors for example are (Varblane et al. 2010): discrepancies between the existing knowledge base and the needs of the economy, problems of cooperation between universities and businesses—lower innovation capability of enterprises on the one side and problems with the orientation of public sector research to the needs of the business.Footnote 3

Even despite the clear advantages that cooperation and disseminating knowledge bring, there are many companies that do not participate in cooperation or are not able to fully use its advantages. Iammarino and McCann (2006) refer to two differing perspectives on knowledge spillover effects, i.e., knowledge inflows and knowledge outflows. Knowledge inflows are looked upon positively by companies. On the other hand, unplanned knowledge outflows can have either a positive or negative impact on the company. For a company, one of the main negative unintentional knowledge outflows is the escape of valuable intellectual capital and intangible assets. Conversely, a potentially positive effect of an unintentional leak of knowledge is seen in the nature of knowledge as a public good. This outflow would be important in a situation where it helped strengthen the local knowledge base, and the given territory thus became more attractive for other innovative companies, which would result in a greater knowledge inflow in the future. Therefore, this primarily depends on individual evaluation of how knowledge spillovers benefit individual companies, i.e., the relative significance of these two effects. At the moment, such considerations appear to be quite complicated, because there is no single universal method that would provide companies the opportunity to measure the size of knowledge inflows and outflows as well as the effects linked to them.

Moreover, certain companies are not able to entirely use the knowledge they have acquired (Mueller 2006). One of the possible reasons for this is the fact that many established companies are not willing to accept the risk linked to introducing new products and processes. These companies would rather focus on generating profit from their time-tested production program and are not interested in looking for or acting on new opportunities. For many companies, this is caused by management’s aversion to risk. Many companies do not have the ambition of becoming leaders in innovation or participating in cooperation. Other problems include insufficient funding, excessive bureaucracy connected to implementing public projects, unprofessional assessment of grant applications for research projects, and a large time lag between producing and commercializing knowledge (this is a significant barrier for industry-university cooperation on account of their dichotomous goals). Therefore, companies prefer to withdraw from many projects or wait until they are able to accomplish them with their own resources. If a company is not hindered for any of these reasons, there is another problem on the horizon: the availability of a sufficiently qualified work force. The availability of this type of labor is a problem encountered by an overwhelming majority of companies across sectors.Footnote 4

In order to analyze cooperative ties with the goal of creating innovation, it proves to be necessary to conduct detailed analysis of knowledge flows and spillover effects—as well as their causes and effects. These ties serve to disseminate and use knowledge in networks, which to a large degree has a positive influence on overall company performance. De Faria et al. (2010) discovered causal/significant relationships between the flow of external information and knowledge and the decision to cooperate on research and development activities. Companies that value the general availability of the incoming knowledge spillover effects as an important input into their innovation processes are the most likely to be involved in cooperation agreements on research and development activities. Likewise, companies that are more effective in adopting the results of their innovation processes are more often involved in cooperation in research and development. From this, we can see that managing incoming knowledge spillover effects and their adoption have significant effects; companies that are more able to acquire/absorb knowledge from external sources and are also better prepared to protect their own knowledge are more often (with higher likeliness) involved in research and development cooperation. Some of the primary factors that later influence company decision making on cooperation are

-

engagement in research and development,

-

the qualification of human resources (in relationship to absorption capacity and the ability to optimize spillover effects),

-

company size, and

-

competitiveness.

Companies that subsequently decide to cooperate look for the most varied ways of creating the most favorable environment for cooperation and for using knowledge spillover effects. One way to support their emergence and the positive influence on company research, development, and innovation linked to them is by creating regional innovation systems or industrial clusters and their initiatives, which are typically spatial concentration and sector specialization (Tsai 2005). An obvious fact that has been stated by a number of international authors, e.g., Baptista and Swann (1998), is that company research and development does not occur in isolation. In other words, it is much more effective if it is supported by external resources (in each of its phases). Actually, the geographical proximity of these resources very often plays an important role—this is determined by knowledge’s cumulative nature (knowledge generally spreads more easily over shorter distances). Therefore, faster growth, easier generation of new knowledge, and other innovative outputs will generally be recorded for companies with headquarters in a strongly innovative area. Another important determinant is regional policy, which helps create a favorable economic (business) environment for individual economic entities and significantly influences public financing systems in the present day. This has resulted in the emergence and increasing importance of functional regions, innovation systems, or supranational industrial clusters. However, judging the effectiveness of these steps is very difficult. Namely, there are no standardized methods for measuring the effects of implementing knowledge or its spillover effects (Kitson et al. 2004). Various studies argue about whether an economy’s knowledge base is measurable or how to measure the output of the knowledge economy, which is necessary for various types of economic analysis (e.g., Leydesdorff et al. 2006; Shapira et al. 2006).

1.6 Measuring the Effects of Applied Knowledge

It has been mentioned that there is a problem with the extent to which spillover effects from applying knowledge are measurable. Researchers in this area are increasingly facing questions of how it is possible to measure knowledge and knowledge inputs and output—and whether they are measurable at all. On one hand, the possibility of measuring knowledge is rejected for a number of reasons, e.g., because measuring would be a very complicated process, primarily at the regional level (Chen and Huang 2009), or because economic entities are unable to provide suitable data. On the other hand, a number of authors are tying to create systems and procedures would make it possible to measure knowledge and its effects, primarily using composite indicators (Nelson 2009; Méndez and Moral 2011; Dubina et al. 2012; Leydesdorff and Zhou 2014).

The OECD (1996) states that one of its primary problems when measuring knowledge is the fact that knowledge is not a traditional economic input. In agreement with traditional production functions, the previous account has made it clear that economic growth occurs when traditional inputs are added (e.g., adding units of labor results in GDP growth by the amount that was dependent on actual work productivity). On the other hand, new knowledge influences economic performance by changing the traditional production schemes; this change then results in product or process changes/possibilities that were formerly unavailable. While new knowledge generally increases potential economic output, the quality and quantity of this impact is not known in advance (the change that has been brought about generally depends on a number of factors: economic competition, business, competition, etc.). Consequently, it is difficult to find a production function encompassing the relationship between inputs, knowledge, and the resulting outputs. Therefore, four main reasons are generally listed for why knowledge indicators cannot approximate the systematic comprehensiveness of traditional economic indicators. These are primarily the following:

-

The absence of stable production schemes for transforming knowledge inputs into knowledge outputs,

-

Inputs for creating knowledge are very difficult to map,

-

There is lack of a systematic price system for knowledge, which would be used as the basis for aggregating findings that are essentially unique, and

-

The creation of knowledge need not always mean an increase in the base of findings, and the obsolescence of specific knowledge in this base has not been precisely documented.

The World Bank has offered its own possible solution, which provides a spectrum of knowledge economy factors that are used for analyzing its development: the Knowledge Assessment Methodology (KAM). This is an interactive comparative tool to help individual countries identify the challenges and opportunities they face when changing over to a knowledge economy. KAM provides a specific basic evaluation for countries and regions and their level of readiness for the knowledge economy; the uniqueness and strength of this method are due to the fact that it represents a wide range of factors describing the knowledge economy (Chen and Dahlman 2005). This method is composed of 148 structural and qualitative variables making it possible to measure the performance of a total of 146 countries using individual areas of the knowledge economy (World Bank 2015). These areas are divided into four parts: (i) economic incentive and institutional regime, (ii) educated and qualified workers, (iii) an effective innovation system, and (iv) corresponding information infrastructure (Chen and Dahlman 2005). KAM’s advantage lies in the fact that it is available in a total of six different forms: (i) a basic evaluative document, (ii) a personalized evaluative document, (iii) knowledge economy indexes, (iv) over-time comparison, (v) cross-country comparison, and (vi) a world map evaluating countries’ readiness for the knowledge economy.

A number of contemporary international studies list patent creation as a potential tool for measuring knowledge outputs and competitiveness as well as being an important indicator (e.g., Lam and Wattanapruttipaisan 2005; Olivo et al. 2011). The number of patents was also used for analyzing the relationship between regional competitiveness, the emergence of spillover effects, and innovative company behavior (Audretsch et al. 2012). Patents are also part of the previously mentioned set of indicators used by the World Bank. Even the OECD attaches a significant role to patents in their method—for evaluating innovative activities, outputs, and economies’ performance (OECD 2004). The number of patents is also used in a number of economic analyses; Nelson (2009) lists the reasons. It is because the number of patents is monitored by statistical offices, i.e., long-term statistics enabling international comparison thanks to harmonized procedures. They are often divided into categories and subcategories, they identify creators/developers (individuals and corporations), and they make it possible to observe public financing as well as, in certain specific cases, the emergence of a patent from first reference to registration. In their studies, Fontana et al. (2013) also confirm the significance of patents and their ability to measure the output of the innovation process. This works because patents are by definition connected to innovative activity; they are easily available; in this case, they make it possible to save time and effort when collecting data; they are available for a relatively long period of time; and they encompass essential and important information, e.g., the name and address of the inventor, the owner of the given innovation, a description of the innovation, and its relationship to previous innovations represented by patents.

On the other hand, there are studies that criticize this method of measurement primarily because not all innovations are patented. Naturally, how many innovative outputs are patented and how many of these outputs are not is only a matter of speculation. Fontana et al. (2013) put forth the opinion that there are three types of reasons why inventors decide not to patent their outputs:

-

The innovations are not patentable—the inventor is convinced that it is not necessary to patent the given output;

-

The innovation is patentable, but the creator assumes that the creative steps of their innovation process are not large enough for it to be suitable for a patent;

-

The inventor decides not to patent their output, because they prefer keeping the given information secret.

Arundel (2001) conducted a study in which he determined that a large percentage of companies conducting research and development activities find secrecy to be a much more practical and effective method than patenting. Moreover, researchers must take a number of other risks into account when using patents. Van Zeebroeck et al. (2006) list the source of patent data as one of the risks that must be considered when conducting research. Specifically, it is clear that globally there are a whole range of patent statistics that can be used. These include the United States Patent and Trademark Office (USPTO), the Japan Patent Office (JPO), the European Patent Office (EPO), the Triadic Patent Families, the World Intellectual Property Office (WIPO), and national patent offices. The topicality of this problem can be seen in Svensson’s study (2015), which states that the weakness of a number of patent databases is the fact that they are not able to determine which patents were used commercially, i.e., which patents were introduced in the market as innovations. Moreover, certain patents are introduced in the market only for competitive advantage so that companies can prevent the competition from using the given patent. In many cases, these patents do not encompass very much innovation. For certain inventions, it must be considered whether it may be more advantageous to use an alternative to patents, i.e., utility models.

Researchers have been investigating the ratio of patented to unpatented innovations for many years. For example, Moser (2012) conducted a study focused on innovation creation without patenting, in which she achieved the result that 89% of innovations from British exhibitions were not patented. In their study, Fontana et al. (2013) presented the results of Mansfield’s research from 1986, which dealt with the question of how many patentable innovations are actually patented. This research was conducted on a random sample of large American companies from various sectors. The results of this research showed that roughly 34% of the patentable inventions were not patented in sectors in which patenting is not considered a very effective mechanism (electronic equipment, tools, office supplies, motor vehicles, etc.). However, in sectors where patenting was considered practical and effective (the pharmaceutical, chemical, oil, machinery, metals, and metalworking industries), this percentage was lower—around 16% (Fontana et al. 2013). Further research was conducted by Arundel and Kabla (1998) and Arundel (2001). This research investigated the situation of companies in 19 industrial sectors and their tendency in percentages for making patent applications. The results showed that the average tendency towards patenting product innovations is 35.9% (this tendency ranges between 8.9% for the textile industry and 79.2% for the pharmaceutical industry). This tendency was somewhat lower for process innovation—roughly 24.8% (again ranging between 8.1% for the textile industry and 46.8% for the field of precision instruments). The given analyses also provided another interesting result—that this tendency for both types of innovation was >50% in only four sectors.

From the above, it can be seen that today knowledge (in combination with traditional production factors) is a key element for economic growth in most countries—despite the fact that there is still no unified, universally used method for measuring it. With the arrival of the knowledge and knowledge-based economies, the focus of individual analyses has shifted from technological change to a focus on innovation. Knowledge has thus officially become one of the most important strategic resources, and the learning process has become one of the most important processes in the present day (Tappeiner et al. 2008). Whereas the significance of knowledge in the new growth theory was connected to stimulating technological progress and the resulting growth in productivity, Romer and Lucas explained that economic growth occurs via the accumulation and spillover of technological knowledge (Mueller 2006). Blažek and Uhlíř (2011) created a framework for regional development theories, whose conclusion attempted to find a “miraculous formula” and practical guide for regional policy motivated by the attempt to create and strengthen regional competitiveness in the age of the knowledge economy. This framework includes a total of eight areas:

-

Excellent research and a top-notch interface between research and the business world;

-

Support for talent

-

Company culture and the role of models;

-

Smart money and qualified consulting;

-

Contacts, networks, and clusters;

-

Governance and a regulatory framework;

-

A region’s attractiveness and quality of living; and

-

Access to transportation.

In the present day, another factor has also been increasing in importance—knowledge spillover effects. Knowledge spillovers are a complicated process influencing the economic system both at the microeconomic level (inside individual companies and their outputs) and at the macroeconomic level (e.g., by acting on gross domestic product).

2 Knowledge Spillover Inside the Economic Environment

Previously, the issue of the knowledge economy and the role of knowledge in contemporary globalized society were described, with the new (endogenous) growth theory being one of the first theories considering knowledge, technology, human capital, and innovation to be key drivers for growth. Proponents of this theory dealt with two basic problems: whether technological change is the result of conscious economic investment and the explicit decision making of many varied economic entities and whether the existence of significant externalities, knowledge spillover effects, and other sources of increasing profits can lead to constant (sustained) economic growth (Griliches 1991). The first question was dealt with by a number of important economists in the 1960s, such as Schultz, Griliches (1957), and Mansfield (1968). The second question, i.e., the problem of knowledge spillovers, has primarily become more significant in the past 20 years, when a number of studies showed that the positive effects of disseminating knowledge and implementing innovation are used not only by the solitary actors involved in these processes but also by third parties who are not directly integrated into the given activities. This occurs precisely because of the emergence of knowledge spillover effects, which mainly exert significant influence over companies’ innovation processes and countries’ economic development (Mueller 2006). The creation, flow, and capitalization of knowledge spillovers contribute greatly to the varying speeds of growth in different regions (Fritsch and Franke 2004)—within countries as well as in international comparison. The goal of this chapter is to define spillover effects, describe their emergence and relationship to innovative activities, and subsequently depict their diverse influence as they operate in individual countries. The last section is devoted to the problem of measuring spillover effects, because it has not yet been possible to record and measure knowledge spillovers, and there is still the problem of which method to use when measuring them.

2.1 The Emergence of Spillover Effects

In the previous section, the problem of knowledge and knowledge-based economies was described, including four basic terms that have been distinguished over time (OECD 1996; Fallah and Ibrahim 2004):

-

Knowledge production, which is realized via research and development;

-

Knowledge transmission, which is achieved via education and vocational training;

-

Knowledge transfer, in which intentional knowledge exchange occurs between people or organizations; and

-

Knowledge spillover, the unintentional transmission of knowledge.

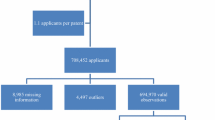

The path of knowledge from its owner to the recipient of this knowledge is recorded by Fallah and Ibrahim (2004) in Fig. 1, as is the difference between knowledge transfer and knowledge spillover. From this, it is clear that the first step in transmitting knowledge from the owner to the recipient is a process called externalization, i.e., when knowledge is articulated and transformed into explicit knowledge. In the next step, the owner of the knowledge decides with whom to share the given knowledge (transfer). Knowledge transfer can also occur unintentionally (via spillover). Thus, a situation can occur within this process where an individual who owns knowledge cannot control its dissemination. It is generally true that the more knowledge is codified, the less opportunity its owner has to control who will obtain and use the knowledge in the end, because the knowledge transfer can be influenced by other entities as well. Naturally, this does not mean that spillover effects do not emerge from non-codified knowledge. However, this type of transfer is much more complicated.

Knowledge transfer versus spillover. Source: Adopted from Fallah and Ibrahim (2004)

It is therefore clear that the process of knowledge spillover is becoming increasingly important—primarily due to the potential it has for bringing value added to production processes. However, it is a process that is difficult to record and analyze; moreover, its results can be seen only over the long term. Examples of this include student experience at professional workplaces or the process of preparing doctors for accreditation, with this type of learning very closely relating to the capacity (ability) of individual economic entities for absorbing knowledge. Companies’ ability to absorb knowledge thus depends primarily on their employees’ experience and professional training. For individuals, absorption capacity is influenced by their sagacious knowledge. Mueller (2006) describes a company’s absorptive capacity as the ability to produce, identify, and use knowledge; this ability depends on existing knowledge stock and the entities’ (employees in companies or researchers at universities or research institutes) absorptive capacity. Therefore, it is clear that when the same new information is obtained by two different entities, one of them can connect this information with previously obtained knowledge and learning and use it in an innovative way. Conversely, the other individual may not notice the emergence of this knowledge and put it to further use. Sagacious knowledge and the use of tacit knowledge thus influence the way knowledge is acquired and internalized.

2.2 Defining, Classifying, and Disseminating Spillover Effects

The issue of knowledge spillover and its resulting effects are perceived differently by many authors; in consequence, there is no one fixed definition. Gilbert et al. (2008) define knowledge spillover effects as the direct or indirect transfer of knowledge from one party to the next, i.e., from one economic entity to the next. This knowledge tends to be generated by companies engaging in innovative activity and is very valuable, because it provides knowledge and findings that are completely new to the company that embraces it (i.e., the company that uses these positive externalities). When there are technological effects from knowledge spillovers, companies are equipped with specific industrial knowledge that helps them know (i) what technological activities have been conducted by others, (ii) what activities are currently being conducted, and (iii) what level of success was achieved by companies as part of these activities. It is assumed that technological spillover effects help companies utilize the latest technology and compete on the most attractive markets.

Kesidou and Romijn (2008) state that knowledge spillover has been defined by economists as knowledge flows that emerge and provide an altogether spontaneous source of knowledge that does not require any type of compensation. The authors naturally add that, to a degree, knowledge spillover can also occur intentionally via the mutual interaction of the participating parties (companies, universities, development centers, etc.). The important feature of these effects (externalities) is the fact that they emerge outside the market and directly influence companies’ production function—in contrast to financial externalities that exert indirect influence via price change.

Fallah and Ibrahim (2004) describe spillover effects as the unintentional transfer of knowledge across the boundary of what was intended; they see potential for knowledge exchange within every possible interaction. The authors differentiate between knowledge transfer, which encompasses knowledge exchange between select people or organizations, and spillover effects, which include any type of knowledge that is exchanged outside the boundaries of what was intended. The unintentional use of knowledge exchanged in this way is then called a knowledge externality.

Many authors use various approaches for distinguishing the types of spillover effects. Lee (2006) distinguishes between rent spillovers and knowledge spillovers. Typically, rent spillovers emerge exclusively within economic transactions, whereas real knowledge spillovers may not always emerge exclusively within economic transactions. Fischer et al. (2009) distinguish between different types of knowledge spillovers called pecuniary and non-pecuniary knowledge spillovers. The first type designates spillover effects embodied in traded capital or intermediate products and component services (so-called pecuniary externalities). The second type describes intangible spillovers (non-pecuniary externalities), which emerge because the production of knowledge is a public good and limits companies’ ability to prevent other companies or individuals from investigating and acquiring this knowledge. Sun et al. (2015) define spatial spillover effects as the influence regional economic development has on (less developed) neighboring regions. De Jong and von Hippel (2009) describe intentional and voluntary spillovers, which primarily result when a company (the inventor) intentionally reveals their own innovative outputs because they believe that they will receive valuable feedback and suggestions for improvement from other economic entities.

Another way of categorizing spillover effects is into vertical and horizontal (De Faria et al. 2010). Vertical spillover is linked to the interaction between suppliers and customers and influences research and development activities more significantly. Horizontal spillover happens within interactions between universities, research institutes, and competitors. Cooperation with different types of partners is increasing in significance and, according to numerous international studies, positively influences innovative activities and overall company performance. Thus, the choice of partners is a key process for achieving a company’s strategic objectives, primarily when creating innovation. De Faria et al. (2010) determined that it is always necessary to choose a suitable partner for cooperation in order to be successful when implementing various types of innovation. Whereas the key to success when implementing product innovation is to have customers and public sector institutions as the primary partners for cooperation, suppliers and universities positively influence the success of process innovations. Cooperation with suppliers and competitors distinctly influences the growth of work productivity, whereas cooperation with universities, research institutes, and competitors positively influences growth of sales from products and services that are new in the market per employee.

Cantù (2016) demonstrates that spillover effects can also emerge at specific economic levels (micro-, mezo-, and macro-) and at differing geographic distances (Fig. 2), where strong ties are created between the given entities at each of the levels.

Network spaces in place perspective. Legend: Numbered cells represent economic actors. Source: Adopted from Cantù (2016)

It is thus clear that when achieving strategic company objectives and creating innovation, knowledge spillovers are becoming more important: (i) at the individual economic levels and (ii) within cooperation between various partners. Nevertheless, innovative activities are currently perceived as one of the key elements helping individual economic entities achieve competitive advantage, create value added, and even achieve economic growth. Nonetheless, the process of implementing innovation is complicated on its own and encompasses many elements that need to be managed in order to apply the final innovation—within companies though primarily on the (often international) market. There have been a number of studies (Maidique and Zirger 1984; Martin and Horne 1993; Lengyel and Leydesdorff 2011; Scarbrough et al. 2015) proving that just as not all economies using knowledge are knowledge economies, not all companies that innovate are innovative companies reinforcing their competitive advantage or another strategic goal—rather, they are failing at their innovative activities. The following section consequently focuses on the significance of knowledge spillover effects in relationship to innovation activities.

2.3 The Growing Influence of Spillovers on Creating Innovation

The effect of spillovers in today’s most advanced economies has become a key question for many scientists (e.g., Coe and Helpman 1995; Baicker 2005; Sun et al. 2015) investigating their influence on economic growth, company productivity, supply and demand, and innovation. Namely, innovation is a driver for both companies and entire economies, and it increases competitiveness and economic performance. Innovation policy is continuing to become more significant and is considered key in today’s dynamic market environment (Tödtling and Trippl 2005; Seidler-de Alwis and Hartmann 2008).Footnote 5 Thus, the creation, dissemination, use, and especially spillover of knowledge are key processes that help companies with their innovative activities. For companies, creating innovation makes it possible for them subsequently to create value added, set themselves apart from the competition, and occupy a very strong position on the national or international market. Innovation thus appears at the forefront of political programs both in industrial fields as well as in regional policy; no driver of economic growth has gained as much attention as innovation—the basic driving force of economic growth, prosperity, and competitiveness (Matatkova and Stejskal 2012; Hudson and Minea 2013; Sleuwaegen and Boiardi 2014).

Innovation can take a number of forms (product, process, service, or marketing) and is a complicated process that is influenced by numerous determinants and factors (internal and external). According to Maier (1998), these are as follows:

-

Market structure and potential (e.g., monopolistic or oligopolistic markets as well as markets that are changing from a monopolistic to a competitive structure);

-

Factors directly influenced by managerial decision making (such as price setting and advertising, product quality as influenced by the quality of the production process, technical know-how incorporated into a product via research and development, etc.); and

-

Other aspects of the innovation diffusion process (e.g., spillover effects).

Here, the interaction between innovation activity’s various determinants (internal and external), company creativity, learning, and innovation are bi-directional, synergetic, and lead to creating spillovers (Huber 1998; Stejskal and Hajek 2015). As described above, not every economic entity is always able to use their innovation potential and transform it into a successful innovation that can be put on the market. The individual actors within innovative processes encounter a whole range of barriers and limitations. Hadjimanolis (1999) has divided these barriers into internal and external (Table 4).

One of the initial problems faced by a specific innovating entity is the fact that many innovative plans fail in their beginning phase, and only a small percentage of the initial innovations are realized. The problem of implementing innovation has been dealt with by Maier (1998), who stated that innovation (or constantly updating and improving company products and activities) is of key importance for company survival in a competitive environment, where questions (and problems) concerning innovation processes are currently becoming more complicated and dynamic. Thus, the innovation management of individual enterprises must have an ever more rapid reaction to the most varied of needs (primarily the market’s), and technically complicated products must be developed at an increasingly rapid pace. Likewise, individual financial resources must be utilized and distributed among research and development projects in the most effective way possible—in order to achieve economically successful results, i.e., a quick and easily commercialized innovation. In most cases, new products are introduced in global markets and thus face strong international competition. Therefore, companies—primarily their innovation management—must first comprehensively understand the innovation process and manage its individual phases (Maier 1998):

-

Developing a new product (invention),

-

Implementing a new product or process (innovation), and

-

Disseminating innovation (diffusion).

The first phase, developing a new product, is a very dynamic and complicated process; nonetheless, the processes of implementing and disseminating the innovation are just as important, if not more so. The importance of a company managing these phases properly is depicted in Fig. 3, which expresses a hierarchical process for innovative activities and their associated costs.

Cascading outcome of innovation activity. Source: Adopted from Maier (1998)

Here, Maier (1998) demonstrates that even though roughly 40% of all research projects are successful from the technical perspective, only 22% have a chance of being economically successful and a remaining 18% have been terminated because they do not have the potential to be successful in a market environment. Therefore, roughly 22% of research projects are introduced in the market though only 40% of those are truly successful. On the other hand, more than 50% of all the costs for innovation are invested in the second and third phases of the innovation process, which underscores the importance of these phases.

Thus, the approach to innovations and their successful implementation has undergone a number of changes over time with the use of the most varied innovation models; the first innovation models were created as early as the 1950s and 1960s. Kotsemir and Meissner (2013) recorded seven phases for the development of approaches to innovation models, which are listed in Table 5.

However, the problem that most of the proposed models face are systemic deficiencies and failure (Tödtling and Trippl 2005; Hudec 2007; Blažek et al. 2014) leading to low levels of research and innovative activity (primarily at the regional level):

-

Organizationally thin regional innovation systems, in which certain of the basic elements are missing or poorly developed—not enough innovative companies or other key institutions and organizations and a low level of clustering;

-

Locked-in regional innovation systems, which typically have above-average anchoring and above-average specialization on traditional, declining sectors with outdated technology;

-

Fragmented regional innovation systems, which suffer from insufficient networks and knowledge exchange between system participants, resulting in insufficient collective learning and systemic innovation activities.

From the above, it is apparent that the innovation process is complex and that there has not yet been a suitable proposal for a single model of innovation. Individual economic entities are therefore faced with the decision of which approach and which determinants to use as part of their innovation process. Moulaert and Sekia (2003) created the territorial innovation model, which includes international authors’ approaches to innovation models and which demonstrates that the given models have common elements despite the diversity of approaches (see below). Some of the models mentioned are the innovative milieu, industrial districts, regional innovation systems, local production systems, and learning regions; all of these models are based on the concept of local production systems.

Individual theories and approaches dealing with the problem of creating innovation are depicted in Fig. 4. The individual models demonstrate a noticeable shift in the authors’ approaches and opinions; these models’ common elements are companies, knowledge, and public institutions (or the government) as well as the assumption of cooperation by individual entities and creating a favorable innovation environment in which public authorities have their role and tasks (even if often only marginal). The individual approaches agree on the following common determinants:

-

Networking—suppliers and producers, subcontractors, etc. (Hansen 1992);

-

Cooperation (Abramovsky et al. 2009);

-

An innovative milieu (Moulaert and Sekia 2003);

-

Knowledge (primarily tacit), the ability to learn, and creativity (Cassiman and Veugelers 2002); and

-

Knowledge transfer and spillover effects.

Territorial innovation models. Source: Moulaert and Sekia (2003)

These determinants of the innovative environment can then be found within cooperative chains or knowledge networks (e.g., the triple helix) and are able to effect them. It is thus clear that innovation and its creation, dissemination, and application in a market environment are linked to and influenced by knowledge and knowledge spillover effects, i.e., the static transfer of knowledge based on informal (non-business) relations within the innovation process of knowledge exchange (Table 6).

It is clear that knowledge spillovers function differently in individual sectors or countries (or regions) and that individual economic entities achieve different results from implementing innovation. These differences and their causes are described in the next section of this paper.

2.4 Measuring Spillovers

In recent years, there have been a number of attempts at measuring knowledge flows and their related knowledge spillovers—both at the microeconomic and the macroeconomic levels (Fischer et al. 2009). However, the impacts of spillovers are usually identified in terms of quality whereas their scope and intensity is often only estimated because merely part of them can be duly assessed. The following effects have been successively investigated:

-

Between individual companies (e.g., Mairesse and Sassenou 1991; Los and Verspagen 2000);

-

Between the individual sectors of a national economy (e.g., Scherer 1994; Branstetter 2001); and

-

Between individual countries (e.g., Park 1995).

The entire process of spillover effect emergence is naturally influenced by a number of factors; therefore, it is difficult to find one universal method for measurement. For this reason, it is possible to encounter various studies investigating different factors and their influence on spillover creation, the resulting innovation creation, improving company performance, and economic growth. Examples of some of the most frequently investigated factors are:

-

Cooperation with diverse partners—universities, companies, customers, suppliers, or competitors (López et al. 2014),

-

Providing public funding from national and/or European funds (Rodríguez-Pose and Di Cataldo 2014), and

-

Investment into research and development (Hall et al. 2013).

Here, the relationships between the various determinants are mutual and synergetic and therefore cannot be investigated separately (Huber 1998). Researchers thus face a number of problems and risks (primarily the choice of data and the selection of variables) when they conduct individual measurements. The factors listed above are the ones most commonly selected to be input (independent) variables. The choice of suitable output (dependent) variables is more difficult. Nieto and Quevedo (2005) created an overview of studies that focuses on analyses that measured spillover effects between the years 1984 and 1999.