Abstract

In addition to risks originating from the economic system, the stability of financial markets and institutions is exposed to adverse conditions in the surrounding social and ecological system. The exposure from unfavorable socio-ecological conditions (sustainability risks) affects the financial markets from multiple perspectives. A way to assess the financial system’s exposure to these risks and also to explore risk mitigation strategies is to incorporate sustainability risks into the framework of stress test ing the financial system.

This contribution emphasizes directions for the design of sustainability stress test (SST) models for the financial system. The major challenges for conceptualizing an SST framework are related to modeling the sustainability stress factors, their propagation within the financial system and the system’s response. It is argued specifically that the structural pattern of the financial system and its behavioral dynamics have to be considered in a forward-looking way in order to adequately model the SST framework.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 An Extended Dimension of Systemic Financial Risk and Return

Stress testing has been widely used in economics and other disciplines as a technique to simulate the impact from worsening operating conditions on a target variable (Demekas 2015, p. 4). Its main objective is to explore the consequences from adverse developments (stress factors) on a system or a system’s element, thereby assessing its sensitivity and resiliency (“what if” analysis). Stress testing in finance assumes negative variations of parameters in the financial and real markets—for example, an increase in risk spreads or a decrease in gross domestic product (GDP)—and searches for the effects from these variations on the stability of the system as a whole (macro approach) or the financial system’s single institutions (micro approach) (Batten et al. 2016, p. 19). Whereas stress test ing approaches (stress models) usually first assign negative variations and then model the resulting effects, inverse stress tests first fix an outcome considered as critical and then ask for the adverse conditions which may induce this outcome.

Even while adverse scenarios for financial stress test ing should be constructed to be both challenging and plausible (Anand et al. 2014, p. 62), they mostly remain within the financial or the real economic system’s boundaries. The assumptions thereby are that shocks emanate from inside the financial or real markets (economic markets) and that the effects from stress factors can be sufficiently measured within the scope of the economic system. In this regard, the stress tests conducted more recently by major central banks and supervisory authorities (Anand et al. 2014; Board of Governors 2016; ESRB 2016a) are based solely on sets of economic conditions that differ in the number and severity of assumptions and in the way they are interpreted.

In light of evolving ecological and societal changes and their effects on financial markets, the limitation of financial stress test ing models to the economic system has recently been criticized. Central banks have been asked by governments to comment on the possible effects from climate change on the stability of financial markets (ESRB 2016b). Regulatory authorities have been blamed for not sufficiently incorporating risk factors into the supervisory frameworks that emerge from outside the economic system (CISL and UNEP FI 2014; King et al. 2015, p. 146). Several external factors are missing in existing stress models: The scarcity of resources threats economic and financial stability as well as health-related risks from pollution and extreme weather events. As societies expand on a global scale, issues of social unrest and political dissent become more frequent and manifest in violations and the destruction of economic value (Bowman et al. 2014, pp. 10–12).

Mostly, the critical values for scenarios are obtained from looking at extreme values in the economic markets from the past. Even while this strengthens the empirical evidence of the stress test s, the underlying assumption is that future challenges may be replicated as a function of past experiences (assumption of stationarity ). In the case of increasing dynamics in the financial markets as well as almost unprecedented changes in ecology and society, this assumption is more than critical. Stress models usually assess the direct or first-round effects on financial assets and markets. However, as the most recent crises show, the effects from financial parameters may unfold in multiple dimensions and feed back in multi-step processes: When the bubble in the housing market burst, it manifested in worldwide cascades of decreasing asset prices and higher default risk s, along with the over-indebtedness and social problems of the borrowers.

In the past, stress test ing in finance was mainly focusing on individual institutions. In order to get an indication for systemic risk, the results from these micro stress tests have mostly been summed up (Demekas 2015, p. 17) showing thereby how many institutions have been hit and how much equity or liquidity was missing in the system. Yet, simply adding together the results from individual institutions may not provide an authentic picture of the system’s overall resiliency. As has been evidenced from financial crises, the interaction of institutions and their joint behavior differ largely from the sum of individual actions (Helbing 2010, p. 12; Gramlich and Oet 2017). More appropriate macro approaches specifically account for the connectivity and interactions of institutions. This applies both to their joint sensitivity to individual stress factors (correlation, common exposure ) and to dependencies in their responses where the failure of one institution may induce a series of follow-up problems (risk cascades, risk contagion ). Further, due to behavioral characteristics of the market such as amplification, exaggerating and herding (Krishnamurthy 2010), the effects from single events propagate exponentially to much higher levels in a systemic dimension (non-linearity ). Similarly, in the context of extended stress factors, the impact from financial investors ’ collective behavior on the overall economic, environmental and social system has to be taken into account (Lydenberg 2016, pp. 57–58).

In the light of these considerations, this contribution addresses in more detail the challenges and approaches related to the integration of adverse conditions from the natural and social environment into models of financial stress test ing. The extension of current stress testing in finance both by accounting for ecological and societal stress factors, the structural and behavioral complexity of the financial system and also with respect to possible feedback between the financial system and the socio-ecological system is referred to as sustainability stress testing the financial system. Existing and potential sustainability stress test (SST) approaches as a more comprehensive modeling framework is investigated. This allows for recognizing challenges to financial stability and profitability and also for the responsibility of the financial system in regard to the socio-ecological environment, thereby providing incentives for a better risk and return management.Footnote 1 The objective is to emphasize directions for the design of SST models in financial markets.

In the next step, the nature of SST models is related in more detail to the context of current financial stress test ing models (Sect. 7.2). Within the SST modeling particularly, the challenges from the connectivity within and between economic and noneconomic systems (structural complexity ) and their dynamic behavior (behavioral complexity) are addressed (Sect. 7.3). The findings from this section further lead to directions in future SST modeling (Sect. 7.4).

2 Approaches to Stress Testing Systemic Financial Risk

2.1 Financial Stress Testing

As the background of stress test s in finance is mainly linked to financial crises and as the stress tests conducted by regulatory authorities and central banks are mainly aiming to discover potentially distressed institutions (ESRB 2016a, p. 1), their connotation is mostly negative. Yet, stress tests also provide a range of helpful insights into the risk and return profile of institutions and the system and may be looked at from a much more positive perspective. Knowing the causes of their vulnerability, financial institutions are incentivized to strengthen their risk mitigation capacities and work proactively with their clients in order to avoid potential failures (IFC 2010, p. XII; Mercer 2011, p. 98; UNEP FI 2016, p. 26). Recognizing the impact from different stress factors, regulatory authorities and central banks may concentrate their efforts in order to ex ante mitigate the most critical factors for the system (Onischka et al. 2012, p. 2; Schoenmaker and van Tilburg 2016a, p. 6).

Though stress test s of the financial system may be conducted in various ways (an overview is given from Demekas 2015, pp. 7–20; Haben and Friedrich 2015, pp. 264–266), they are based on three common elements:

-

A set of assumptions about the critical changes in the relevant environment of the investigated system or element (scenarios, shocks, stress factors).

-

A functional approach to model the propagation of stress factors with respect to the structure and behavior of the system or the element (stress functions).

-

A concept on how to measure the outcome from the combination of critical changes and propagation process (stress effects).

Existing stress test s in finance design scenarios based on critical conditions in the real and financial markets. For example, the European Banking Authority assumed in the adverse scenario 2016–2018 for the European Union stress test that real GDP decreases by 2–5%, unemployment rises by 2.5–11.5%, equity prices fall by 25% and housing prices by 10% (ESRB 2016a). The Board of Governors assumed in the severely adverse scenario for stress testing the United States financial system 2016–2017 that real GDP decreases by around 6%, unemployment rises by 5–10%, equity prices fall by 50% and housing prices by 25% (Board of Governors 2016, pp. 5–7).

At the core of stress test ing is the functional model reflecting the processes within the financial system that relate stress factors to the system and the system’s reaction. As the financial system is considered to be highly connected and at the same time highly sensitive (Helbing 2010, pp. 11–13; Krishnamurthy 2010, p. 1), the functional part of the stress testing framework is highly demanding and various approaches for modeling exist. Effects within the system can be modeled when looking at the behavior of individual institutions and then aggregating the processes to a systemic dimension (bottom-up approach). Alternatively, the overall response of the financial system can be assessed first and then attributed to single institutions (top-down approach). Bottom-up approaches are mainly linked to balance sheet information for individual banks. The stress effects are obtained with respect to the value of assets and liabilities and the results in the income statement. Top-down approaches refer to the aggregated value of assets, capital or liquidity in the system and investigate its sensitivity to changing stress factors mostly based on statistical analysis. It is then determined how much the overall risk is affected from the inclusion or exclusion of single institutions (incremental or marginal risk).

Finally, the outcome from stress factors and consecutive adjustments in the financial system may be measured in different ways.Footnote 2 Very often the effects on bank equity is referenced, other approaches target the liquidity of banks and the system and, more recently, combined approaches to measure solvency and liquidity effects have been presented (Haben and Friedrich 2015, p. 274). Though these advances are already highly demanding and comprehensive, the framework of stress modeling is basically restricted to the boundaries of the markets for capital and goods. However, this ignores the dependency of economic markets on the surrounding environmental and social system. Achieving optimal stress results within the financial system does not mean that this is also optimal with respect to the stability of the entire system. The connectivity between the different dimensions of human life together with their highly dynamic pattern of interactions may produce quite different effects in the overall system than just in the financial system alone.

2.2 Financial Versus Sustainability Stress Testing

Sustainability stress test ing the financial system thus first implies the integration of stress factors from the broader ecological and social context (socio-ecological system, external system) into the modeling of financial effects.Footnote 3 Stress factors can emerge with respect to damage from disasters (physical risks) and also from policy responses to disasters (transition risk) (Batten et al. 2016, pp. 12–17; ESRB 2016b, p. 2). Secondly, the modeling framework has to account for the various interactions between the markets for capital and goods (economic system, internal system) and the external system. Due to the different nature of socio-ecological stress factors as well as the mostly unknown interaction patterns (Lydenberg 2016, p. 58), SST modeling is not just to be conceived as a simple extension of stress factors into the existing framework but rather as a new conceptual approach for stress modeling.

This is also evidenced by the way the effects from sustainability stress factors can be measured (an overview is given from Stiglitz et al. 2009, pp. 61–82; Lydenberg 2016, pp. 58–60). There is a consensus that sustainability is difficult to assess in a single monetary number, given its complex and global nature. Instead, it has to be measured as a set of indicators referring to quantities and qualities of natural, human, social and physical capital (Stiglitz et al. 2009, p. 17). From an economic perspective, adverse conditions from society and ecology impact on conventional financial parameters such as equity and liquidity. In a broader perspective, the effects should be measured in terms of variations of a sustainability value including also social and ecological value components besides simply the financial ones.Footnote 4 For example, the United Nations (2015) have adopted 17 sustainable development goals for the economic, social and environmental dimension with 169 targets where specific indicators are still to be developed. The different patterns of conventional financial stress test ing and SST modeling are illustrated in Table 7.1.

As in financial stress test ing, the SST framework is also based on the three basic model elements: stress factors, stress functions and stress effects. In addition, its profile as a separate class of modeling is evidenced by the fact that socio-ecological stress factors exhibit a higher degree of complexity , new transmission structures and dynamics and that SST models may also include specific target variables. Modeling based on observed patterns in financial markets in the past may be misleading as the emerging sustainability risks create patterns of vulnerability and connectivity of their own. Instead, the modeling framework has to invent new and forward-looking scenarios (IFC 2010, p. 7). This may include new types of exposures, correlations and amplifications, and the modeling of sustainability stress factors has to be adjusted accordingly.

3 A Framework for Sustainability Stress Testing the Financial System

3.1 Models of Sustainability Stress Testing the Financial System

SST models for financial systems account for the connectivity and interaction between the financial system and the social and ecological context. Though few modeling concepts for SST exist (EIU 2015, p. 33; Battiston et al. 2016, p. 2), these models have in common that they align the modeling components stress factors, stress transmission and stress effects alongside the objectives of a sustainability -related risk assessment framework. Existing approaches mainly concentrate on climate risk factors as a threat for loan and investment portfolios thereby assessing potential damages for financial assets and exploring ways how to mitigate them (CISL 2015; EIU 2015; Mercer 2015; UNEP FI 2016).

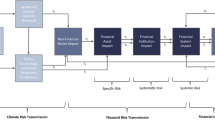

Given the complexity resulting from the extension of already very demanding financial stress test ing models by climate factors, the connectivity between climate and finance is basically modeled in a unidirectional way: The pattern investigated is how climate-related factors propagate into the financial markets and impact the value of assets. Feedback from the financial system to the external system is rarely included.Footnote 5 Further extensions of SST models may focus more on those responses as well as further social and environmental stress factors and also include target variables other than purely financial effects on equity and liquidity. Figure 7.1 illustrates the components of the SST framework.

First approaches to link developments from society and ecology to economics can be attributed to the work of The Club of Rome and the underlying modeling from System Dynamics in the 1970s (Meadows et al. 1972) and the follow-up reports (Meadows et al. 2004; Lietaer et al. 2012). Though not explicitly labeled as a stress test , the publication of The limits to growth and the follow-up reports express critical outcomes for economy and society from a negative environmental scenario . They are based on the simulation model World3 incorporating feedback loops and non-linearities and also provide evidence on how economic growth and structures themselves feed back on environmental and social frictions.

More recent SST frameworks have been developed as a consequence of extreme weather events at the beginning of the twenty-first century focusing primarily on the damage to corporates and insurers. One of the most well-known approaches is the investigation of climate change -related economic effects, the Stern review (Stern 2006, 2009). Similar to The limits to growth, the Stern review concludes that a transition into a sustainable system is possible. However, the cost of transition gets exponentially higher the more time is needed for actions. As in the approach from the Stern review, the modeling of Nordhaus (2010, 2014) and approaches from the Economist Intelligence Unit (EIU) and Mercer are designed as integrated assessment models (EIU 2015, p. 33; Mercer 2015, p. 9), thereby representing top-down approaches that integrate macroeconomic models with effects from climate change.

Existing models are still at the beginning of developing SST frameworks. Though they already provide valuable insight into the vulnerability of financial markets caused from external factors, the structural and dynamical complexity of the problem needs much more consideration. A major challenge is to model the multiple, direct and indirect and mostly non-linear transmission processes from sustainability stress factors into the financial markets. Particularly, assumptions about levels of future economic productivity, the associated climate sensitivity and the destruction potential (EIU 2015, p. 51) are considered to be critical.Footnote 6 Further challenges come from the interaction effects back and forth between the socio-ecological system and financial institutions (UNEP FI 2016, p. 26) and from the representation of the inherent complexity in a simple numeric way. As general obstacles for the development of SST models, it may be considered that the purely financial modeling of stress is difficult and not yet complete (Demekas 2015, p. 20). In addition, the awareness of socio-ecological risks currently is too weak to put sufficient pressure on rapidly expanding the SST framework (Onischka et al. 2012, pp. 12–13; Gramlich 2014, p. 233).

As a consequence, basic challenges in the modeling of SST frameworks are associated with the adequate representation of the underlying systems’ structural, dynamical and algorithmic complexity (Helbing 2010, p. 3; Haldane and May 2011, p. 351). Where structural and dynamic aspects are related to the systems’ elements, their connectivity and behavior, algorithmic complexity addresses more technical challenges in the functional implementation of the framework. The following sections are arranged along these modeling challenges.

3.2 Sustainability Stress Testing from a Structural Perspective

Structural aspects of SST models include the components of the stress test ing framework and how these components are connected. Further to economic stress conditions related to the markets for capital and goods in the financial stress testing models, SST approaches consider how adverse conditions in society and ecology and policy responses to them affect the financial markets’ efficiency and resiliency. Several new dimensions of connectivity have to be considered. Within the socio-ecological stress context, single factors such as climate change and migration can be modeled in isolation or in combination with eventually amplifying effects. The transmission of these factors into the financial markets can directly impact financial institutions, for example, pollution affecting the institutions’ staff, or indirectly via the institutions’ claims on exposed companies (UNEP FI 2016, pp. 24, 26). Effects from sustainability -related risk factors might have impacts on financial values and also on social values such as health and reputation.

Up to date, mostly climate -related issues are taken into account. Climate factors already unfold to a broad spectrum of subsequent effects and are particularly addressed in the report of the Intergovernmental Panel on Climate Change (IPCC) including (IPCC 2014, pp. 58–64):

-

Rising air temperature with more frequent hot and fewer cold temperature extremes.

-

Water cycle and extreme precipitation events (floods, droughts, storms, blizzards).

-

Sea level rise and reduction of Arctic sea ice.

-

Carbon cycle changes and ocean uptake of anthropogenic carbon dioxide.

Potential dimensions of climate change may affect the markets in various ways (IPCC 2014, pp. 64–74; CISL 2015, pp. 36–40). Institutions are immediately hit as their staff and their infrastructure are directly exposed to the consequences of climate change: Heat waves cause productivity and health problems among employees (King et al. 2015, pp. 57–64), and rising sea water levels and flooding jeopardize the institutions’ infrastructure in coastal areas. At the same time, private and corporate customers are hit by the same effects, which then may induce multiple consequences for the value of financial assets and collateral, default rates and cash flows (Gramlich and Finster 2013, pp. 636–639). Batten et al. (2016) and ESRB (2016b) also address potential threats that emerge from climate change policies where new legislation requirements impact the markets.

Where in financial stress test ing concepts mainly banks are assessed, SST frameworks must comprise a larger range of institutions. Sustainability stress factors threaten the system as a whole, and the assets held by all types of financial institutions are exposed (Klomp 2014, p. 180): Losses from environmental damage hit at the same time banks, near-banks (specific types of funds), investment funds and also insurers. Institutions are hit directly through assets in exposed sectors or indirectly via stakes in other financial institutions that are threatened themselves (Battiston et al. 2016, p. 4). In particular, insurance companies have to be included as they are exposed both by their asset holdings and from insuring natural damage.Footnote 7 Given the broader range of affected institutions and their exposure, the impact from sustainability stress factors is to be estimated as being higher than from simply financial stress factors.

Though climate -related issues already expand to a broad range of effects, changes in the natural environment involve further consequences. The scarcity of resources, particularly when considering fossil fuel resources such as oil and gas, will impose restrictions on particular industries and also affect the mobility of people. Water will become an even more scarce resource due to increasing demand from a rising population, changing meteorological conditions and contamination of ground water in industrialized areas (King et al. 2015, pp. 74–83). Last but not least, increasing pollution is a threat for the health of people and ecological systems and further affects the productivity of companies, the creditworthiness of borrowers and the stability of social security systems. As a consequence, the approaches for stress test ing must be adjusted:

-

Environmental factors are a global phenomenon (CISL 2015, p. 36) and materialize through multiple channels.Footnote 8 Thereby, they affect companies and households from various sides and create new patterns of common exposure s and risk concentrations. As a consequence, the traditional pattern of correlation and diversification with respect to customers has to be rethought (Batten et al. 2016, p. 8): Currently, the loan portfolio of a bank seems to be well diversified if it includes loans to different industries, for example, to the agriculture and to the energy sector. However, in future both types of customers may suffer simultaneously from rising temperatures—reduced harvest for the farmer and problems from cooling down the power stations—and the bank may thus be exposed to a temperature concentration risk.

-

Similarly, an SST of the financial system can show the common exposure of multiple institutions from sustainability stress factors and incentivize regulatory limits (Schoenmaker and van Tilburg 2016a, p. 6).

-

Climate change as a systemic risk factor is not limited to political boundaries and affects various regions, countries and even continents simultaneously. As a consequence, the concept of geographical diversification has to be rethought. Particularly, global investment funds diversifying their assets based on regional criteria have to reexamine their allocation strategy.

An outcome of the yearly meetings of global leaders in economy and politics at the World Economic Forum (WEF) in Davos is the Global risk report. The report includes estimations of major challenges to the world obtained from a survey among the Forum’s participants. The challenges comprise threats from economy, ecology, technology and society. Among the various stress factors arising from social changes particularly, the risks from higher polarization of societies, wealth disparity and migration are addressed (WEF 2017, p. 11). Similar to ecological factors, the effects from social risks are diverse and unfold into multiple dimensions.Footnote 9 Destruction in the course of aggressive conflicts, the costs of restoring peace and the impact on social security systems due to global migration affect further the value of financial assets and stress mitigation policies (further examples of social unrest are given from Bowman et al. 2014, pp. 10–15). Furthermore, the amplifying connectivity between these aspects must be taken into account; for example, rising temperatures will decrease water availability and thus increase migration (further examples are given from WEF 2017, p. 16).

SST approaches on the other hand are not only designed to trace solely the negative outcomes from changing scenarios. Inherent to transformations in ecology and society there are also new opportunities for mitigating damage and even for creating value (Gramlich and Finster 2013, p. 633). Where some companies and regions are affected from sustainability stress factors, others may benefit from a warmer climate and the immigration of citizens. Similarly, where some industries suffer from scarce and expensive resources, other companies involved in decarbonization , renewable energy and recycling may take advantage of the sustainability-related opportunities.

As a consequence of looking at structural aspects of sustainability scenarios, the following aspects for modeling SST approaches for financial markets should be considered:

-

Structural effects for industries and countries arising from ecological and societal transformations will overlay the traditional purely economic structures and become more important in the future.

-

As a consequence of the structural overlay from sustainability -related factors, new patterns of connectivity between companies, industries and regions will emerge and thus imply new patterns of correlations and common exposure s.

-

As far as responses within SST models to these structural changes are considered, new stress mitigation directions for stress assessment (e.g., rating concepts including the exposure to scarce resources) and stress mitigation (e.g., diversification approaches based on the exposure to climate change ) and therefore new stress modeling functions are needed.

3.3 Sustainability Stress Testing from a Dynamic Perspective

Whereas the buildup of stress is mostly ignored at first, the financial system tends to react to perceived stress in a more immediate and very sensitive way. Depending on tipping point s or thresholds of financial stress, the markets adjust dynamically in a series of amplifications and feedbacks (Krishnamurthy 2010). Usually, after a time of exaggeration, the system gets back to a new equilibrium (mean reversion).

In comparison, stress factors from the socio-ecological environment at first tend to develop gradually in a mid- and long-term dimension. In this regard, projections about the rise in temperature or the scarcity of fossil fuel resources often extend to the end of the century (Meadows et al. 2004; Vivid Economics 2013, p. 68). However, socio-ecological stress factors then may reach tipping point s of their own, and exceeding these thresholds —unlike in finance—is expected to lead to non-reversible consequences:

-

In case the Gulfstream ceases to circulate, it cannot be reactivated with subsequent tremendous effects on the climate of the northern hemisphere.

-

In the case of crops and water, the rise in temperature may imply a sharp, sudden and mostly irreversible loss (King et al. 2015, pp. 8–9).

Also, measures to mitigate socio-ecological stress cannot be applied with immediate effects as in the financial markets where lowering interest rates or the expansion of liquidity supply from the central bank may have an almost instantaneous impact. In contrast, adaptation policies for socio-ecological stress must be incorporated much earlier. On the other hand, policy responses for the mitigation of expected sustainability risks (Gramlich 2014, pp. 230–233; Schoenmaker and van Tilburg 2016b) may occur suddenly and define a higher burden for the institutions.Footnote 10

SST approaches may consider reactions from the financial system in different ways. As the awareness of financial risks through ecology and society increases, investors are supposed to switch into less-exposed assets (CISL 2015). However, this is more a short-term reaction to the effects rather than a response to the long-term causes of the problem (King et al. 2015, p. 146). Alternatively, SST approaches have to consider the extent financial institutions may proactively contribute to the ex ante mitigation of stress. This may happen through the extension of activities into decarbonization , renewable energy and recycling technologies. CISL (2015) models the temporal interaction between future physical damages from climate change and present adaptation from the markets: It is assumed that today’s expectations of investors about future sustainability stress “provide a bridge” (CISL 2015, p. 8) between the two time dimensions. The impact of scenario -dependent behavior of investors is then quantified for different types of financial portfolios. Figure 7.2 illustrates possible interactions within the SST framework.

In a similar way, the effects from sustainability -related stress factors are supposed to propagate with different dynamics. A first phase may assume that the institutions successively become aware of the damages from sustainability stress factors and shift away from potentially risky financial assets (CISL 2015). It may also assume that with higher public awareness of sustainability risks and changes in their customers’ investment behavior, financial institutions involved in critical sectors may be exposed to reputational problems and therefore be constrained to change their investment policy.

A second phase may assume higher public sensitivity and higher legal requirements. Government s may impose restrictions on companies engaged in critical activities and therefore indirectly also impact the profitability of financial stakes in these companies. Financial regulation may estimate a higher default risk from funding environmentally and socially critical investments and therefore require a higher capital ratio of the institutions (Schoenmaker and van Tilburg 2016b, p. 326).Footnote 11 In a third phase, the sudden awareness of sustainability risks from private investors and their following some leading investors (herding) may lead to a financial tipping point and imply crashes in the financial markets. Finally, as sustainability stress factors materialize more and more across the economy and society, in a fourth phase the financial institutions may fail because of overall unsustainable conditions.

Main challenges for conceptualizing SST frameworks from a dynamic perspective are related to these points:

-

Sustainability stress factors exhibit a different time pattern than purely economic factors with a longer period of gradually increasing stress levels, however, with final tipping point s that are assumed to be irreversible.

-

Stress reactions from the financial system may occur in different phases including the reallocation of financial assets based on different perceptions of sustainability risks as well as bank runs with presumably non-linear effects.

-

SST frameworks should incorporate possible positive feedback on the sustainability stress environment that comes from adjusted investment and funding strategies on financial markets.

-

Basically, the time pattern of financial stress is to relate to the time pattern of sustainability stress and their potential interactions (ESRB 2016b, p. 9) where in an extreme scenario tipping point s in financial and the socio-ecological systems may coincide.

3.4 Techniques of Sustainability Stress Test Models

At the core of SST modeling are the functional relationships that connect the different elements of the framework. This functionality is needed to link the external sustainability stress factors with the internal economic framework, model transmission pathways within the real and financial markets, design feedbacks within the economic system and between economy and the external system as well as finally deriving the quantitative outcome from the SST framework.

Existing SST concepts mainly focus on the effects from climate change , and climate-related functions are primarily based on the IPCC (2014) trajectories for temperature. The trajectories are then transformed into macroeconomic effects on production and consumption where on the one hand, damage functions demonstrate the system’s vulnerability and on the other hand, transition functions the system’s adaptability to a changing sustainability environment. Stress testing approaches in this regard usually design scenarios as a consistent set of combinations from stress factors and the economic system’s responses. For example, Mercer (2015) considers four risk dimensions—progress of technology, resource availability, physical impact, policy targets—that are combined with four adaptive responses to climate change: strong mitigation, coordinated mitigation, limited mitigation with low damages, limited mitigation with high damages.

Existing SST modeling techniques provide different directions how to comply with the multiple modeling challenges (Bowman et al. 2014, pp. 30–31). As mentioned, these approaches may include micro and macro concepts or top-down and bottom-up approaches. Models for public use include modeling from the perspective of monetary policy (Batten et al. 2016) or macroprudential regulation (ESRB 2016b) whereby models for private use primarily focus on the effects for financial portfolios of investors . An overview is given in Table 7.2. In a comprehensive discussion of modeling approaches, Vivid Economics (2013, pp. 64–69) distinguishes five techniques relative to the extent of issues addressed: Bottom-up studies investigate impacts on specific sectors, integrated assessment models link single models, adaptation integrative assessment models explore effects of adaption to climate change , multi-asset models assess cross-sectional interactions and extreme weather event studies consider the impact of all kinds of extreme weather simultaneously.

Among the integrated assessment models the most advanced functional approaches are the DICE/RICE, PAGE, FUND and WITCH models (an overview is given from Gillingham et al. 2015; Nordhaus 2014).Footnote 12 The concepts basically differ in the way they model the range of climate effects and the effects from climate policy. A classification suggested from Demekas (2015) for macroprudential stress test s can similarly be applied for SST frameworks. Here, partial equilibrium models focus on specific market institutions but do not account for connectivity . General equilibrium models aggregate specific sectors or institutions and their connectivity and mostly rely on balance sheet or market price data. More technically, connectivity is assessed based on multivariate density functions or Merton-type models. Finally, stress test models for the financial system as a whole (top-down) are distinguished.

From a similar technical point of view, EIU (2015, p. 35) suggests for the calculation of future losses from climate change first a dividend approach where potential damages are assessed as discounted cash flows from reduced dividends. Alternatively, the capital approach estimates the value of physical stocks after damages and links this estimate to the value of financial stocks. Depending on the propagation and effects of shocks within the economic system, on the one hand physical risks are modeled on the damage from the deteriorating human and natural environment. On the other hand, the effects from transition risks are assessed, here the effects from adjusting to new regulation and technology during the transfer into a low-carbon economy (Battiston et al. 2016).

The multiple patterns of connectivity and behavior in the financial system have to be captured appropriately as an essential and specific component in the overall SST framework. Up to now, only few approaches exist to model explicitly the structural and dynamic characteristics of financial markets. For example, CISL (2015) emphasize behavioral effects and non-linearities, Batten et al. (2016) explore the connectivity among financial institutions and the ESRB (2016b) includes potential amplifiers such as the leverage ratio and linkages among banks and insurers.

While there are some similarities among the different technical approaches, a clear and consistent framework for functional modeling is lacking. However, this may also be conceived as an advantage as principally complex phenomena should be assessed from multiple perspectives (Vivid Economics 2013, p. 5) and their results be integrated. The SST functional modeling can thus be commented as follows:

-

Among the core elements in the functional SST modeling are damage and transition functions for the real markets and functions to translate their effects into the financial markets’ parameters of solvency and liquidity.

-

In particular, the specific pattern in the financial markets’ responses to the real markets and the external system and thus the effects from amplification, feedback and herding have to be functionalized.

-

Given the complexity of the phenomena to be modeled, the functional modeling cannot be executed in an exact mathematical way, yet it should be based on flexible, modular approaches as for example multiple scenarios or simulations based on distributions.

-

Besides the effects from climate change , other ecological and social stress factors must be functionalized as well as their interdependence.

4 Challenges of Sustainability Stress Testing

The basic challenge of SST models for financial systems is to cope with the complexity of socio-ecological and economic systems and their interaction . In particular, the structural pattern of the systems, their behavioral dynamics and the resulting challenges for the model functions must be addressed. Specific problems are related to the long-term nature of sustainability stress factors in combination with the short-term behavior of economic, particularly financial markets affecting the trade-off between the costs of present investments into sustainability against their future benefits. Given these challenges, a SST framework cannot only be conceived as an extension of existing systemic stress models, but as a modeling class of its own.

A basic response to complexity is to model the SST framework from different perspectives, with different objectives and different functional techniques.Footnote 13 Ideally, the single models are designed in a modular fashion and can be integrated. As a consequence of the multiple dimensions, a joint effort from experts in economic and natural sciences is necessary (ESRB 2016b, p. 2). Although the measurement of impacts from sustainability stress factors on the real and financial markets is predominant, the effects from deteriorating environmental systems cannot be measured solely as a financial number, but must include elements of a social and ethical value. Up to now the climate -related effects on financial portfolios have been the focus of SSTs. However, there are many more environmental challenges besides climate change to consider. Also, critical aspects from societal transformation are still lacking in the SST framework.

The focus of this contribution is on the importance of connectivity and behavioral patterns inherent to financial markets for SST modeling. It is argued that the particularities of the financial system imply specific responses with regard to the sustainability stress factors. Therefore, the modeling concept for financial patterns needs to be conceived as an elementary sub-model within the overall framework. Otherwise, the SST framework would not comply with the specific challenges of a systemic (macro) stress test . In addition, the expected changes of correlation structures, common exposure s and contagion need to be assessed in a forward-looking way and incorporated into the overall SST modeling as well as effects from sustainability driven changes in regulation and the institutions’ business models.

A particular challenge is related to the different trajectories for sustainability stress factors and stress reactions within the financial system. Where sustainability stress is supposed to expand gradually over a long-term horizon, financial markets display much more frequent series of stress. The resulting question is, if rising concerns about sustainability might trigger a tipping point on the financial markets where the consequences may be negative on the one hand but lead to increased adaptation on the other. Alternatively, it may be asked if the absence of support for adaptation from the financial markets will lead to a collapse in the external socio-ecological system with a simultaneous collapse of the financial markets, hence a double threshold exceedance or a tipping point squared.

New functional modeling concepts might be suitable, thereby emphasizing the integrated and behavior-related assessment of the sustainability stress context. This refers also to modeling the potential differences in the behavior of the different types of financial institutions included and their customers. In addition to the predominant approaches from econometrics, further concepts from agent-based modeling, network theory, system dynamics and econophysics have to be explored (Helbing 2010, pp. 14–17; Haldane and May 2011; Gramlich and Oet 2017). Furthermore, the extension of SST frameworks toward early warning systems has to be considered with an expected higher sensitivity of the financial system’s responsibility for sustainability.

Notes

- 1.

For simplicity, the term risk management will be used hereafter thereby including risk and return management.

- 2.

In his investigation of the effects from natural disasters on financial fragility, Klomp (2014, pp. 181–182) refers to capital adequacy, asset quality, managerial quality, profitability, liquidity and reputation.

- 3.

Basically, the concept of sustainability refers to an overall balance in economy, ecology and society and includes also sustainability stress factors within the financial markets (Gramlich 2014, pp. 224–227).

- 4.

In this regard, Mercer (2015, p. 9) distinguishes the concepts of welfare (monetary concept) versus well-being (extended concept). Schoenmaker and van Tilburg (2016b, p. 330) suggest to incorporate long-term value creation into the corporate governance code of institutions. Lydenberg (2016, p. 60) refers to “jobs created, energy saved, health outcomes achieved” as possible elements.

- 5.

- 6.

Similarly, the ESRB (2016b, p. 2) refers to macroeconomic conditions, the value of carbon-intensive assets and insurers’ liabilities from natural catastrophes.

- 7.

An advanced concept to represent the diverse institutions in financial markets and their connectivity is suggested from Batten et al. (2016).

- 8.

- 9.

Helbing (2010, p. 2) states that “many major disasters affecting human societies relate to social problems.”

- 10.

As an example, CISL (2016, p. 21) refers to the sudden policy intervention from the German government toward nuclear energy after the earthquake in Japan and the damages in nuclear power plants.

- 11.

- 12.

DICE/RICE stands for Dynamic/Regional Integrated model of Climate and the Economy, PAGE for Policy Analysis of the Greenhouse Effect, FUND for Climate Framework for Uncertainty, Negotiation and Distribution and WITCH for World Induced Technical Change Hybrid model.

- 13.

References

Anand, K., Bédard-Pagé, G., & Traclet, V. (2014, June). Stress testing the Canadian banking system: A system-wide approach. Bank of Canada Financial System Review, 61–68.

Batten, S., Sowerbutts, R., & Tanaka, M. (2016). Let’s talk about the weather: The impact of climate change on central banks. Bank of England Staff Working Paper, No. 603, London.

Battiston, S., Mandel, A., Monasterolo, I., Schuetze, F., & Visentin, G. (2016). A climate stress-test of the EU financial system. University of Zurich Working Paper, Zurich.

Board of Governors of the Federal Reserve System. (2016). Dodd-Frank Act stress test 2016: Supervisory stress test methodology and results. Washington, DC: Board of Governors of the Federal Reserve System.

Bowman, G., Caccioli, F., Coburn, A. W., Hartley, R., Kelly, S., Ralph, D., Ruffle, S. J., & Wallace, J. (2014). Stress test scenario: Millennial uprising social unrest scenario. University of Cambridge Centre for Risk Studies – Cambridge Risk Framework series, Cambridge, UK.

CISL – Cambridge Institute for Sustainability Leadership. (Ed.). (2015). Unhedgeable risk: How climate change sentiment impacts investment. University of Cambridge CISL Working Paper, Cambridge, UK.

CISL – Cambridge Institute for Sustainability Leadership. (Ed.). (2016). Environmental risk analysis by financial institutions – A review of global practice. Cambridge, UK.

CISL & UNEP FI – Cambridge Institute for Sustainability Leadership, & United Nations Environment Programme – Finance Initiative. (Ed.). (2014). Stability and sustainability in banking reform: Are environmental risks missing in Basel III? Cambridge, UK/Geneva.

Demekas, D. G. (2015). Designing effective macroprudential stress tests: Progress so far and the way forward. IMF – International Monetary Fund Working Paper, No. 15/146, Washington, DC.

EIU – The Economist Intelligence Unit. (Ed.). (2015). The cost of inaction: Recognising the value at risk from climate change. London.

ESRB – European Systemic Risk Board. (2016a). Adverse macro-financial scenario for the EBA 2016 EU-wide bank stress testing exercise. Frankfurt.

ESRB – European Systemic Risk Board. (2016b). Too late, too sudden: Transition to a low-carbon economy and systemic risk. Reports of the Advisory Scientific Committee, No. 6, Frankfurt.

Gillingham, K., Nordhaus, W., Anthoff, D., Blanford, G., Bosetti, V., Christensen, P., McJeon, H., Reilly, J., & Sztorc, P. (2015). Modeling uncertainty in climate change: A multi-model comparison. Cowles Foundation Discussion Paper, No. 2022, New Haven.

Gramlich, D. (2014). Sustainability, financial markets and systemic risk. In J. Hawley, A. Hoepner, K. Johnson, J. Sandberg, & E. Waitzer (Eds.), Handbook of institutional investment and fiduciary duty (pp. 222–238). Cambridge, UK: Cambridge University Press.

Gramlich, D., & Finster, N. (2013). Corporate sustainability and risk. JBE – Journal of Business Economics, 83(6), 631–664.

Gramlich, D., & Oet, M. V. (2017, forthcoming). Systemic financial feedbacks – Conceptual framework and modelling implications. Systems Research and Behavioral Science, wileyonlinelibrary.com. https://doi.org/10.1002/sres.2419

Haben, P., & Friedrich, B. (2015). Stress testing European banks: Lessons for risk managers. Journal of Risk Management in Financial Institutions, 8(3), 264–276.

Haldane, A. G., & May, R. M. (2011, January). Systemic risk in banking ecosystems. Nature, 469, 351–355.

Helbing, D. (2010). Systemic risks in society and economics. IRGC – International Risk Governance Council Paper, Geneva.

IFC – International Finance Corporation. (2010). Climate risk and financial institutions – Challenges and opportunities. Washington, DC: IFC Publication.

IPCC – Intergovernmental Panel on Climate Change. (2014). Climate change 2014: Synthesis report. Fifth assessment report, Geneva.

King, D., Schrag, D., Dadi, Z., Ye, Q., & Ghosh, A. (2015). Climate change: A risk assessment. CSaP – Centre for Science and Policy report, Cambridge, UK.

Klomp, J. (2014, August). Financial fragility and natural disasters: An empirical analysis. Journal of Financial Stability, 13, 180–192.

Krishnamurthy, A. (2010). Amplification mechanisms in liquidity crises. American Economic Journal: Macroeconomics, 2(3), 1–30.

Lietaer, B., Arnsperger, C., Goerner, S., & Brunnhuber, S. (2012). Money and sustainability – The missing link. A report from The Club of Rome – EU Chapter. Axminster: Triarchy Press.

Lydenberg, S. (2016). Integrating systemic risk into modern portfolio theory and practice. Journal of Applied Corporate Finance, 28(2), 56–61.

Meadows, D. H., Meadows, D. L., Randers, J., & Behrens, W. W., III. (1972). The limits to growth. New York: Universe Books.

Meadows, D. H., Randers, J., & Meadows, D. L. (2004). Limits to growth. The 30-year update. White River Junction: Chelsea Green Publishing Company.

Mercer (Mercer LLC). (2011). Climate change scenarios – Implications for strategic asset allocation. New York: Mercer LLC.

Mercer (Mercer LLC). (2015). Investing in a time of climate change. New York: Mercer LLC.

Nordhaus, W. D. (2010). Economic aspects of global warming in a post-Copenhagen environment. Proceedings of the National Academy of Sciences – PNAS, 107(26), 11721–11726.

Nordhaus, W. D. (2014). Estimates of the social cost of carbon: Concepts and results from the DICE-2013R model and alternative approaches. Journal of the Association of Environmental and Resource Economists, 1(1/2), 273–312.

Onischka, M., Liedtke, C., & Jordan, N. D. (2012). How to sensitize the financial industry to resource efficiency considerations and climate change related risks. Journal of Environmental Assessment Policy and Management, 14(3), 1–26.

Schoenmaker, D., & Van Tilburg, R. (2016a). Financial risks and opportunities in the time of climate change. Bruegel Policy Brief, iss. 2, Brussels.

Schoenmaker, D., & Van Tilburg, R. (2016b). What role for financial supervisors in addressing environmental risks? Comparative Economic Studies, 58(3), 317–334.

Stern, N. (2006). Stern review on the economics of climate change. London: HM Treasury.

Stern, N. (2009). Deciding our future in Copenhagen: Will the world rise to the challenge of climate change? Policy Brief, London.

Stiglitz, J. E., Sen, A., & Fitoussi, J.-P. (2009). Report by the commission on the measurement of economic performance and social progress. Paris.

UNEP FI – United Nations Environment Programme – Finance Initiative. (2016). Guide to banking and sustainability (2nd ed.). Geneva.

United Nations. (2015). Transforming our world: The 2030 agenda for sustainable development. New York.

Vivid Economics. (2013). The macroeconomics of climate change. Report prepared for Defra, London.

WEF – World Economic Forum. (2017). The global risks report 2017. Geneva.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Gramlich, D. (2018). Sustainability Stress Testing the Financial System: Challenges and Approaches. In: Walker, T., Kibsey, S.D., Crichton, R. (eds) Designing a Sustainable Financial System. Palgrave Studies in Sustainable Business In Association with Future Earth. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-66387-6_7

Download citation

DOI: https://doi.org/10.1007/978-3-319-66387-6_7

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-66386-9

Online ISBN: 978-3-319-66387-6

eBook Packages: Business and ManagementBusiness and Management (R0)