Abstract

Initial public offerings (IPOs) are a crucial step for entrepreneurial firms. Despite the growing popularity of social media among a variety of audiences including potential investors, limited studies have been conducted to investigate how firms can utilize social media to attract financial capitals during the IPO process. We attempt to shed light on this area through the signaling theoretical lens as well as the prior literature on electronic word of mouth (eWOM). Our study, based on Twitter and other data on 423 firms that went public in the US market from 2014 to 2015, provides significant evidence in support of a positive relationship between social media use by a firm and its IPO value. Furthermore, the effectiveness of a firm’s tweets is mediated by public responses to its tweets, and such effectiveness is also found to be stronger for B2C firms.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

- Initial Public Offering (IPO)

- Social Media Participation

- Tweets

- Internet-related Products

- Twitter Account

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

Relatively small or startup organizations may choose to pursue growth strategies by transforming their entity status from privately held to public (Certo, 2003; Chang, 2004). The process provides startup organizations with more equity capital and enhances the founder’s cash liquidity (Ritter & Welch, 2002). However, with limited information on startups’ prior information, it is risky for public investors to put their capital into these small firms (Certo, 2003). To alleviate this issue of information asymmetry, public investors tend to collect various types of information on the IPO firm before they make their investment decisions. Prior studies in finance and entrepreneurship have investigated several types of information that may influence the amount of capital raised at IPO (e.g., Booth & Chua, 1996; Mousa, Wales, & Harper, 2015; Schenone, 2004). For example, scholars reveal that a firm’s corporate governance (Bell, Filatotchev, & Aguilera, 2014), ownership structure (Booth & Chua, 1996), partnerships (Schenone, 2004), and entrepreneurial orientation (Mousa et al., 2015) can explain the variation in invested capital at IPO. Furthermore, certain kinds of narratives or symbolic communications, such as IPO prospectuses (Martens, Jennings & Jennings, 2007) and press releases (Navis & Glynn, 2010), may help reduce public investors’ uncertainty. Since 2005, the Securities and Exchange Commission (SEC) has updated regulations regarding the quiet period in which a firm’s public announcement was highly restricted during registration filing and the declaration of registration statement. The new rule is more flexible and allows firms to publicly communicate with their choices of media channels (Borah, Park, & Pahnke, 2015). Therefore, it becomes easier for firms to strategically manage their pre-IPO communication to reduce uncertainty perceived by investors.

Although the literature has suggested that firms’ communication efforts help alleviate public investor’s concerns over the issue of information asymmetry and related investment uncertainty, there is a limited understanding regarding the types of communications firms can effectively use (Fischer & Reuber, 2014). This is an important issue facing many IPO firms. Especially nowadays, IPO firms have many different media options that they can choose from, ranging from the traditional media, such as television, radio, and newspaper, to online social media, such as Twitter, Facebook, and LinkedIn. As research scholars, it is important for us to provide a better understanding of which media could be beneficial for firms that are in the process of an IPO. This study is inspired by how people can rapidly exchange information on social media in a manner not previously possible. Being among the few social media studies in entrepreneurship, we attempt to investigate the influence of the emerging social media phenomenon on IPOs as social media activity may play an important role in a firm’s strategy to increase interest and investment during their IPO processes.

Social media has been a topic of interest to managers and scholars because it enhances people’s interaction and connectivity (Hanna, Rohm, & Crittenden, 2011). Social media refers to “a group of Internet-based applications that build on the ideological and technological foundation of Web 2.0 and allow the creation and exchange of user-generated content” (Kaplan & Haenlein, 2010: page 61). The advancement of social media substantially changes the communication between people, communities, and organizations. Particularly, organizations have recognized social media as a new set of business processes and operations (Hanna, Rohm, & Crittenden, 2011). Despite the enormous interest in this phenomenon, the current literature provides a limited understanding of whether social media can be used to stimulate public attention during IPOs.

Prior studies support the benefits of social media for a firm’s public investment (Luo & Zhang, 2013; Luo et al., 2013). For example, Luo et al. (2013) argue that social media activities have a positive relationship with a firm’s stock return, that is, a firm’s use of social media can influence public investment. This argument leads to the belief that social media could potentially be used to improve a firm’s communication strategy and, therefore, to attract public capital during the IPO process. However, another study provides evidence in arguing that firms should refrain from using social media during their IPO especially when potential investors use social media to express uncertainty about their firms (Borah, Park, & Pahnke, 2015). Thus, existing literature diverges on the appropriate role for social media usage during the IPO process. In this study, we investigate these inconsistent arguments through the theoretical lens of signaling theory (Spence, 2002) and the literature on word of mouth (Day, 1971; Dichter, 1966) by specifically seeking answers to the research questions: Does social media participation by firms increase the positive investment during their IPO processes? If so, how does it contribute to IPO values? Based on a sample of 423 firms that went IPO in the US stock market in the years of 2014 and 2015, we provide empirical evidence in support of the benefits of social media usage for IPO firms. The analysis from activities on Twitter demonstrates that a firm’s messages on social media can influence the invested monetary capital at IPO. Our findings reveal that the impact of a firm’s social media message is mediated by the level of audience responses. In addition, we explore whether the effect of social media is greater for B2C firms or firms with Internet-related products as their target customers might participate more on social media networks.

Theories and Hypotheses

Going IPO is a crucial step in the transformation of a new, private venture as it begins to offer stock that can be publicly purchased or traded (Certo, 2003). However, the lack of sufficient historical performance information during a firm’s private status may create uncertainty for investors. Thus, IPO firms are riskier compared to the established public firms that already have a record of stock prices and operation history (Nelson, 2003; Welbourne & Andrews, 1996). Various theoretical perspectives have been used to understand the phenomena of IPOs and related processes including agency theory, resource dependency theory, and signaling theory (Zimmerman, 2008). In particular, extensive research has used signaling theory to study the issue of information asymmetry at IPOs that could lead to the variation in capital raised during the IPO process (Certo, 2003). Specifically, prior research has shown that firms signal their specific characteristics – firm size, venture capital equity invested in IPO firms, underwriter’s reputation, equity retained in the firm, and the qualifications of the top management team – to gain legitimacy (Certo, 2003).

While various firm characteristics could be used as signals, the exchange of communication between firms, customers, and potential investors may be seen as a firm’s signaling strategy. With the emergence of social media in recent years, we posit that firms may use social media to show its social commitments and to develop customer relationship, such as broadcasting their socially related activities, announcing new products or services, or responding to customers’ concerns. During the IPO process, firms may utilize the rapid information diffused through social media to reduce information asymmetry about their legitimacy and to attract more investors. In the long run, legitimacy would provide IPO firms with the access to important resources such as financial capital or partnership for their future growth and survival (Zimmerman, 2008). However, the utilization of social media services as signaling tools may be challenging as firms likely would not have complete control over the diffusion of information (Kaplan & Haenlein, 2010). Kumar et al. (2013) note that a firm’s generated information on social media will eventually be leveraged by other users’ word of mouth, thus taking the control of that information away from the firm. We attempt to understand the impact of signaling and word-of-mouth effects within the social media context as they potentially influence the amounts of invested capital during IPOs. The next section explains the signaling theory in general before connecting to social media. Then, we elaborate and discuss the effects of word-of-mouth happening on social media as the mediating effects derived from a firm’s social media strategy.

Signaling Theory: Corporate Legitimacy Through Social Media

Signaling theory refers to the event where a sender communicates (signal) information to a receiver as well as how the receiver interprets that information (Connelly, Certo, Ireland, & Reutzel, 2011). Because people have access to different sets of information that might not be perfectly symmetric, imperfections or asymmetries of information occur among receivers (Stiglitz, 2002). Thus, scholars in many disciplines leverage signaling theory in explaining how two parties (sender and receiver) reduce information asymmetry (Spence, 2002). The classic example of how the signal is sent is from the Spence’s (1973) seminal work that investigates how job applicants reduce information asymmetry to potential employers, such as sending the signal of themselves as high-quality employees through higher education disclosure information. Moreover, signaling theory helps to shed light on the entrepreneurship literature by, for example, examining the value of venture capitalist presence and/or angel investor presence and founder involvement (Elitzur & Gavious, 2003). Although signaling theory explains various phenomena in organizational contexts, to the best of our knowledge, no prior study has applied signaling theory to explain a soon-to-be public firm’s communications with the general audience, including potential investors, in a social media context. The investigation into this area is necessary as people have rapidly adopted social media for their communications, and thereby, organizations may benefit from utilizing these tools for their signaling strategies.

In fact, social media could be an effective communication tool for firms to promote their reputations to potential investors during IPOs. As firms seek improved reputations, they may consistently send positive signals through social media about themselves to various stakeholders. As social media stimulates the wide spread of information to broad audiences, firms may recognize social media as the opportunity to build a good corporate reputation. For example, Rokka et al. (2014) explore how companies manage their reputations in social media by focusing on the role of employees in delivering brand promise to customers. Other studies also find that social media lead to a firm’s positive reputation by reaching out to different stakeholders directly (Lee, Hwang, & Lee, 2006). Aula (2010) suggests that a company’s reputation is determined in social media from their interactions and dialogue with other social media users and organizations. Therefore, social media can be beneficial for firms that look to have an overall positive evaluation over time.

In the IPO context, newly public firms usually lack prior reputation and record due to unavailable public information (Nelson, 2003). Prior studies instead focus on the impact of investment banking reputation on IPO value (Reuer, Tong, & Wu, 2012). We believe that IPO firms can also utilize social media to build up their reputations and signal their legitimacy to potential investors. Therefore, we argue in this study that firms would gain higher IPO values by diffusing more information using social media as their signaling strategy of reputation and legitimacy. Thus, we hypothesize:

Hypothesis 1

The amount of a firm’s generated content in social media is positively related to its IPO value.

Online Word of Mouth in Social Media

While signaling theory may be a logical fit in the social media context, the marketing literature has leaned more toward the understanding of online social media through word of mouth (WOM). Word-of-mouth communication refers to how information is transferred between noncommercial senders and receivers about a brand, product, or service (Dichter, 1966). According to Day (1971), WOM communication is very effective for firms to generate impacts on consumers compared with other forms of marketing communication. Recently, as the Internet has altered how people interact with each other, traditional WOM communication has been transformed into an electronic or online context, often referred to as electronic WOM (eWOM).

eWOM is defined as “any positive or negative statement made by potential, actual, or former customers about a product or company, which is made available to a multitude of people and institutions via the internet” (Hennig-Thurau, Gwinner, Walsh, & Gremler, 2004: p.39). Unlike the traditional WOM where communication happens face to face in exchanging private information, eWOM involves with a network of people in an online community where information can be publicly visible (Kozinets, Wojnicki, Wilner, & De Valck, 2010). A firm as communicator could utilize eWOM for various outcomes including social learning (Ellison & Fudenberg, 1995), enhancing the use of focal brand (Muniz & Schau, 2005), and impression management (Kozinets et al., 2010; Muniz & Schau, 2005). Although the impact of eWOM on reputation has been investigated dominantly at the individual level, an organization that is comprised of a group of individuals could also be influenced by eWOM. For example, organizations may utilize eWOM through social media in enhancing the firm’s reputation by diffusing the firm’s positive information. This argument is in line with a study by Rokka et al. (2014) that proposes that firms can manage their reputation through their employees’ use of social media with customers.

Various studies have broadened our understanding of social media through eWOM. For example, Kumar et al. (2013) show that social media can stimulate positive word of mouth among customers. Moreover, Goh et al. (2013) reveal that the existence of a social media brand community that has both marketer-generated and user-generated contents is positively related to consumers’ purchase expenditures. Prior evidence implies that a firm’s effective use of social media requires word-of-mouth phenomena from its social media audience. eWOM begins when an audience notices a firm’s social media messages and responds by spreading the information among their online networks. Therefore, the level of audience response toward social media messages is crucial for effective eWOM. Following Fischer and Reuber’s (2014) study, we define audience response toward social media as the user’s reaction via social media toward the sender’s social media massage such as Facebook’s like, share, and comment or Twitter’s favorite, retweet, and reply. We believe that the more audience responses toward a firm’s social media content, the more eWOM information will be diffused among different networks, thereby leading to a better reputation. In the IPO context, we believe that audience response mediates the effect of a firm’s social media activities on its IPO value. Accordingly, for IPO firms to effectively utilize their social media strategies for reputation improvement and legitimacy signaling to potential investors, they need to consider the amount of audience responses to their social media contents. Thus, we propose:

Hypothesis 2

Audience response to a firm’s social media messages mediates the relationship between a firm’s generated content in social media and its IPO value.

Social Media Strategy for Different Businesses and Products

Prior eWOM studies demonstrate that the effective use of social media could encourage customers to exchange information and stimulate sales (Gopinath, Chintagunta, & Venkataraman, 2013). The benefits of social media activities may have a higher impact on firms that focus on individual consumers rather than business customers as individual customers can be more easily influenced by online reviews on social media (Sen & Lerman, 2007). Wang et al. (2012) also note that peer communications in a social media setting affect product attitude and purchase intentions among individuals. These studies support the importance of social media in influencing individual customers on their purchasing decisions. Consequently, it is necessary for firms who distribute their products or services focusing on individual consumers to realize the importance of social media. In contrast, a business customer may be more skeptical of information from online reviews which usually come from strangers. Making a purchase decision in a B2B setting may be more complex as it involves factors such as a seller’s reputation, prior transaction experience, or whether or not the sellers and buyers are strategic partnerships. It would be harder for a business customer to rely on information from just online reviews for decision-making. Thus, companies that are dealing with individual consumers may yield more results from a strong social media strategy than firms focusing on business customers. Individual buyers are specifically searching for positive consensus from other customers prior to purchase, which can be found via social media, while business buyers are more focused on a complex set of variables, as noted above (Qiu, Pang, & Lim, 2012). Thus, a strong social media strategy for IPO firms should be more effective if their main products or services are considered to be business to consumer (B2C). Following this logic, we reckon that the type of business (i.e., B2C or B2B) may influence how potential investors evaluate the legitimacy of the IPO firms from their social media strategy. Type of business is defined as characteristics of the market that differ from consumer markets and business markets, leading to different marketing and management approaches (Homburg & Fürst, 2005). Thereby, we posit our next hypothesis as follows:

Hypothesis 3

Type of business moderates the positive relationship between IPO firm-generated content in social media and IPO value; that is, IPO firm-generated content will have a higher effect on IPO value for B2C companies.

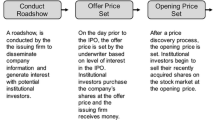

Finally, we posit that the type of product offered by an IPO firm is likely to affect how investors assess the firm’s legitimacy through social media. For example, the rapid development and diffusion of social media have been driven by the advancement of the Internet; thus, it is more likely that Internet-related products or services will receive more attention from social media communities. Indeed, Chevalier and Mayzlin (2006), based on data from 2387 reviews posted at Amazon.com and bn.com, show that online reviews and other social media activities influence the sales of online products. Furthermore, an empirical investigation from 751 social media campaigns reveals that social media can be effectively used in supporting online gaming products but not for utilitarian products (Schulze, Schöler, & Skiera, 2014). Prior studies provide significant evidence that the consumer information exchange taking place on social media platforms can improve Internet-related product performance. As consequences, we believe that IPO firms focusing on Internet-related products or services may benefit more from social media use and may be able to attract more investment from potential investors. Thus, we position our last hypothesis as follows (Fig. 1):

Hypothesis 4

Type of product moderates the relationship between IPO firm-generated content in social media and IPO value; that is, IPO firm-generated content will have a higher effect on IPO value for firms producing Internet-related products/services.

Methods

Data Collection

To test our hypotheses, we collected data from multiple sources. IPO investment data were collected from Global Public Finance database in SDC. The SDC database is well known for its richness and reliability. Thus, it has been widely used for IPO research (e.g., Reuter 2006). We utilized Twitter data, as approximately 78% of Fortune 500 firms use Twitter as media for communications (Barnes, Lescault, & Andonian, 2012). The firms’ Twitter account information was manually collected from each firm’s corporate website. We further collected each applicable firm’s tweets and other activities through a third-party data crawling website. From each IPO firm’s Twitter account, we collected Twitter’s data such as firm tweets, firm reply tweets, and firm retweets. Moreover, we collected the interaction data from followers if they retweeted the firms’ original tweets. The data on types of business and product were from another SDC database – VentureXpert. If the data on business and product types are missing for an IPO firm in VentureXpert, we further manually coded the types based on information collected from the firm’s official website.

The data collection process reveals the challenges to access Twitter data due to various restrictions. The historical data from Twitter can only be acquired up to 3200 total tweets by the focal account (tweets, replies, retweets) at the time of accessing the database. This limitation makes it difficult to collect Twitter data prior to a firm’s IPO date. To alleviate this issue, we focused only firms that went IPO in 2014 and 2015. The collection of Twitter data started in December 2014 and ended in January 2016. We were able to obtain the data of Twitter activities 1 year before the IPO events. Our initial sample consists of 647 firms that went IPO in 2014 and 2015. We further excluded firms that went IPO in foreign stock exchange markets due to the inaccessibility of investment data. Our final sample consists of 423 firms that went IPO in the US stock market: 200 firms went IPO in 2014 and 223 firms in 2015.

Measures

IPO Value

IPO value reflects market valuation toward a firm during its initial public offering (Gulati & Higgins, 2003; Zimmerman, 2008). In line with the literature, we measured IPO value by the net capital raised at IPO, which was calculated by the total capital raised during a firm’s IPO minus the underwriters’ fees (Gulati & Higgins, 2003; Zimmerman, 2008). Following the prior studies (e.g., Mousa et al., 2015), we also took the log-transformation on IPO value to reconcile with the possible skewness issues.

Firm with Twitter

To distinguish firms with active Twitter account from those without Twitter account, we created a dichotomous variable. This is consistent with prior studies that utilized the binary data to capture whether the firm has an active Facebook account or not (Miller & Tucker, 2013).

Firm’s Generated Content in Social Media

Although there is no universal consensus on how to capture the various dimensions of a firm’s social media usage, we followed prior studies that used the number of tweets as direct measures of social media activities (Borah et al., 2015). We also log-transformed the data to avoid possible normality issues.

Audience Response

We operationalized audience response as the number of audience interactions with a firm’s tweets. We captured the number of audience “retweets” of firm’s original tweets. This measurement is consistent with the prior literature that captured consumer’s engagement on Twitter by measuring online word-of-mouth activities from consumers (Zhang, Jansen, & Chowdhury, 2011). We also log-transformed the retweet data.

Type of Business

We relied on the data from SDC (VentureXpert) on firm’s primary business type and coded it into a dichotomous variable. The value of “1” is assigned if a firm is a B2C company; otherwise, the value of “0” is assigned.

Type of Product

Furthermore, we operationalized the type of product using a dichotomous variable. The value of “1” is assigned if a firm produces Internet-related products/services; otherwise, the value of “0” is assigned. The examples of the Internet-related product include computer software or goods and services through e-commerce. The data were also collected from SDC (VentureXpert).

Control Variables

In our study, we controlled for potential confounding factors in line with the literature. First, we controlled for firm age measured by the number of years since firm’s founding year up to the IPO year. Firm age was commonly used as a control variable in the prior studies (Zimmerman, 2008) as younger firms might have limited resources and less external relationships with potential investors. Second, the national cultural difference was found to influence the variation of IPO value (Costa, Crawford, & Jakob, 2013). Thus, we accounted for firm’s culture in which we coded a dichotomous variable whether IPO firm is originally from the USA or elsewhere. Third, we controlled for whether IPO firms were spin-off companies. Although the prior literature shows inconsistent results regarding a spin-off firm’s advantages, a study by Sapienza et al. (2004) finds that partial knowledge overlap between parent and spin-off firms influences spin-off performance. Thus, public investors may perceive spin-off companies as having more legitimacy compared to non-spin-offs. Fourth, previous research suggests that venture capital (VC) backing is an influential factor toward the success of an IPO (Sanders & Boivie, 2004). Therefore, we controlled for VC-backed IPO firms by collecting dichotomous information. Fifth, we controlled for IPO years to capture the possible time-difference effects. Last, a set of dummy variable were generated to indicate whether IPO firms were in manufacturing, transportation/communication, retail/wholesale, finance, or service industries based on SIC codes.

Results

We tested our hypotheses using ordinary least square (OLS) regression analyses with the adjustment for robust standard errors. We also employed the bootstrapping method (Baron & Kenny, 1986) in testing the mediating relationship and regression with interaction terms in testing the moderators. In this study, we used STATA version 14 to help generate the results. For the 423 IPO firms in our sample, 195 firms had Twitter accounts, which accounts for 46% of the total sample. Furthermore, 17% of these IPO firms were B2C companies, and 26% produced Internet-related products/services.

Comparison of IPO Value

We conducted regression analyses in comparing the IPO value of firms with and without Twitter account. After adding firm with Twitter into the regression with control variables, the R-squared is increased by 2% and the coefficient of firm with Twitter is significant and positive (b = 0.394, p < 0.01). The results preliminarily exhibit that participation in social media such as Twitter can positively influence IPO value.

Multivariate Regression

To further test our hypotheses, we ran regression analysis using the subsample of firms with active Twitter account. In our analysis, we excluded the 21 outlier firms that tweet more than 3200 messages during 1 year prior to the IPO date because of the inaccessible tweets beyond 3200. Finally, there were 153 IPO firms with a Twitter account in the analysis (Table 1). Robust variance provides accurate assessment of the sample’s variability and helps reconcile the possible heteroscedasticity issue (White, 1980). The result shows that the number of firm’s tweets is positively related to IPO value (b = 0.137, p < 0.05), which provides evidence in support of Hypothesis 1 . The results suggest that if a firm increases its tweets by 10% prior to its IPO, the IPO value will be expected to increase by 1.37%.

We followed Baron and Kenny’s (1986) method to test the mediation relationship as proposed in Hypothesis 2. As aforementioned, model 1 exhibits that the number of a firm’s tweets is significantly related to its IPO value (b = 0.137, p < 0.05) (step 1). Furthermore, we regressed our mediator variable, audience response, on firm’s tweets and found a significant and positive relationship between two variables (b = 1.09, p < 0.01) (step 2). We regressed IPO value on both the firm’s tweets and audience response variables. The result shows that audience response has a positive relationship with IPO value (b = 0.246, p < 0.01), while the significant coefficient of firm’s tweets became insignificant. Such findings indicate that audience response fully mediates the relationship between firm’s tweets and IPO value. Thus, Hypothesis 2 is supported.

Models 3 and 4 are used to test the moderating effects of the B2C and Internet-related product variables on the relationship between firm’s tweets and IPO value. We find evidence in support of Hypothesis 3 for type of business (B2C) as a moderator between firm’s tweets and IPO value (b = 0.602, p < 0.05). However, the interaction of Internet-related product and firm’s tweets is not significant; thus Hypothesis 4 is not supported.

Discussion

This study attempts to advance our understanding of how entrepreneurs could utilize social media in the critical IPO process. Despite the ongoing debate about whether social media can help stimulate financial resources at IPO, our results provide evidence in support of the benefits of social media for IPO firms. Our findings are consistent with prior studies that have revealed the positive impact of social media participation on obtaining other financial resources (Luo et al., 2013). As expected, we found statistical evidence that the number of a firm’s tweets can influence positive financial capital raised at IPO. In addition, the finding implies that entrepreneurs should utilize social media to signal the firm’s legitimacy toward potential investors when firms are about to go public. The various uses of social media – such as interacting with potential customers or investors, promoting the firm’s products or services, and spreading firm information to public audience – can yield significant benefits for businesses.

We also found that the impact of a firm’s use of social media relies on the engagement of the public audience as audience response mediates the impact of firm’s tweets onto IPO value. This is consistent with Goh et al. (2013), who emphasize that social media engagement by a variety of users can positively impact marketing outcomes. From the results, we suggest that entrepreneurs carefully consider the responses from the public audience when they are broadcasting their statements through social media. Tweets and other social media activities must encourage audience responses in order to truly be effective. Thus, firms should track audience responses and gain a better understanding of what type of content encourages audience engagement.

Furthermore, our results provide evidence that IPO firms targeting consumers (B2C) will realize more of an advantage from using social media compared to IPO firms that focus on other types of customers (i.e., B2B). We specifically recommend that B2C firms should regularly manage their social media accounts to encourage IPO value growth. More specifically, B2C firms that are about to go IPO should consider providing more information or interacting more with general stakeholders using social media as intermediary tools. According to our results, potential investors tend to take the volume and effectiveness of social media massages generated by IPO firms into consideration when deciding whether to invest in a company. Additionally, social media activity does not appear to have as much impact for non-B2C firms, as we expected.

We also found no evidence that supports the greater effects of social media participation for IPO firms that produce Internet-related products and services. The possible reason could draw from the notion that potential investors might assume that IPO firms with social media activities should already be related to the Internet. Without considering a firm’s product type, potential investors perceive no difference between firms with Internet-related products and others, especially on their social media activities. Ultimately, it appears that the type of business is a more important consideration than the product type.

In this study, we mainly focused on one particular type of social media – Twitter. Although the generalizability is limited, we put forward this initial evidence of the advantages of social media participation by IPO firms, especially those within B2C, in hoping this study can encourage further investigation.

References

Aula, P. (2010). Social media, reputation risk and ambient publicity management. Strategy & Leadership, 38(6), 43–49.

Barnes, N.G., Lescault, A.M. and Andonian, J. (2012), Social media surge by the 2012 Fortune 500: increase use of blogs, Facebook, Twitter and more, Charlton College of Business Center for Marketing Research, University of Massachusetts Dartmouth, North Dartmouth, MA, available at: www.umassd.edu/cmr/socialmedia/2012fortune500/.

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173.

Bell, R. G., Filatotchev, I., & Aguilera, R. V. (2014). Corporate governance and investors' perceptions of foreign IPO value: An institutional perspective. Academy of Management Journal, 57(1), 301–320.

Booth, J. R., & Chua, L. (1996). Ownership dispersion, costly information, and IPO underpricing. Journal of Financial Economics, 41(2), 291–310.

Borah, A., Park, U. D., & Pahnke, E. C. (2015). Why silence is golden? firm participation in social media in an IPO context. Paper presented at Academy of Management Proceedings.

Certo, S. T. (2003). Influencing initial public offering investors with prestige: Signaling with board structures. Academy of Management Review, 28(3), 432–446.

Chang, S. J. (2004). Venture capital financing, strategic alliances, and the initial public offerings of internet startups. Journal of Business Venturing, 19(5), 721–741.

Chevalier, J. A., & Mayzlin, D. (2006). The effect of word of mouth on sales: Online book reviews. Journal of Marketing Research, 43(3), 345–354.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67.

Costa, B. A., Crawford, A., & Jakob, K. (2013). Does culture influence IPO underpricing? Journal of Multinational Financial Management, 23(1), 113–123.

Day, G. S. (1971). Attitude change, media and word of mouth. Journal of Advertising Research, 11(6), 31–40.

Dichter, E. (1966). How word-of-mouth advertising works. Harvard Business Review, 44(6), 147–160.

Elitzur, R., & Gavious, A. (2003). Contracting, signaling, and moral hazard: A model of entrepreneurs, “angels”,and venture capitalists. Journal of Business Venturing, 18(6), 709–725.

Ellison, G., & Fudenberg, D. (1995). Word-of-mouth communication and social learning. The Quarterly Journal of Economics, 110(1), 93–125.

Fischer, E., & Reuber, A. R. (2014). Online entrepreneurial communication: Mitigating uncertainty and increasing differentiation via twitter. Journal of Business Venturing., 29, 565–583.

Goh, K., Heng, C., & Lin, Z. (2013). Social media brand community and consumer behavior: Quantifying the relative impact of user-and marketer-generated content. Information Systems Research, 24(1), 88–107.

Gopinath, S., Chintagunta, P. K., & Venkataraman, S. (2013). Blogs, advertising, and local-market movie box office performance. Management Science, 59(12), 2635–2654.

Gulati, R., & Higgins, M. C. (2003). Which ties matter when? The contingent effects of interorganizational partnerships on IPO success. Strategic Management Journal, 24(2), 127–144.

Hanna, R., Rohm, A., & Crittenden, V. L. (2011). We’re all connected: The power of the social media ecosystem. Business Horizons, 54(3), 265–273.

Hennig-Thurau, T., Gwinner, K. P., Walsh, G., & Gremler, D. D. (2004). Electronic word-of-mouth via consumer-opinion platforms: What motivates consumers to articulate themselves on the internet? Journal of Interactive Marketing, 18(1), 38–52.

Homburg, C., & Fürst, A. (2005). How organizational complaint handling drives customer loyalty: An analysis of the mechanistic and the organic approach. Journal of Marketing, 69(3), 95–114.

Kaplan, A. M., & Haenlein, M. (2010). Users of the world, unite! The challenges and opportunities of social media. Business Horizons, 53(1), 59–68.

Kozinets, R., Wojnicki, A. C., Wilner, S. J., & De Valck, K. (2010). Networked narratives: Understanding word-of-mouth marketing in online communities. Journal of Marketing, 74 71–89.

Kumar, V., Bhaskaran, V., Mirchandani, R., & Shah, M. (2013). Practice prize winner-creating a measurable social media marketing strategy: Increasing the value and ROI of intangibles and tangibles for hokey pokey. Marketing Science, 32(2), 194–212.

Lee, S., Hwang, T., & Lee, H. (2006). Corporate blogging strategies of the fortune 500 companies. Management Decision, 44(3), 316–334.

Luo, X., & Zhang, J. (2013). How do consumer buzz and traffic in social media marketing predict the value of the firm? Journal of Management Information Systems, 30(2), 213–238.

Luo, X., Zhang, J., & Duan, W. (2013). Social media and firm equity value. Information Systems Research, 24(1), 146–163.

Martens, M., Jennings, J. E., & Jennings, D. (2007). Do the stories they tell get them the money they need? The role of entrepreneurial narratives in resource acquisitions. Academy of Management Journal, 50(5), 1107–1132.

Miller, A. R., & Tucker, C. (2013). Active social media management: The case of health care. Information Systems Research, 24(1), 52–70.

Mousa, F., Wales, W. J., & Harper, S. R. (2015). When less is more: EO's influence upon funds raised by young technology firms at IPO. Journal of Business Research, 68(2), 306–313.

Muniz, A. M., & Schau, H. J. (2005). Religiosity in the abandoned apple newton brand community. Journal of Consumer Research, 31(4), 737–747.

Navis, C., & Glynn, M. A. (2010). How new market categories emerge: Temporal dynamics of legitimacy, identity, and entrepreneurship in satellite radio, 1880-2005. Administrative Science Quarterly, 55(3), 439–471.

Nelson, T. (2003). The persistence of founder influence: Management, ownership, and performance effects at initial public offering. Strategic Management Journal, 24(8), 707–724.

Qiu, L., Pang, J., & Lim, K. H. (2012). Effects of conflicting aggregated rating on eWOM review credibility and diagnosticity: The moderating role of review valence. Decision Support Systems, 54(1), 631–643.

Reuter, J. (2006). Are IPO allocations for sale? Evidence from mutual funds. The Journal of Finance, 61(5), 2289–2324.

Reuer, J. J., Tong, T. W., & Wu, C. (2012). A signaling theory of acquisition premiums: Evidence from IPO targets. Academy of Management Journal, 55(3), 667–683.

Ritter, J., & Welch, I. (2002). A review of IPO activity, pricing, and allocations. The Journal of Finance, 57(4), 1795–1828.

Rokka, J., Karlsson, K., & Tienari, J. (2014). Balancing acts: Managing employees and reputation in social media. Journal of Marketing Management, 30(7–8), 802–827.

Sanders, W. G., & Boivie, S. (2004). Sorting things out: Valuation of new firms in uncertainty markets. Strategic Management Journal, 25(2), 167–186.

Sapienza, H. J., Parhankangas, A., & Autio, E. (2004). Knowledge relatedness and post-spin-off growth. Journal of Business Venturing, 19(6), 809–829.

Schenone, C. (2004). The effect of banking relationships on the firm's IPO underpricing. The Journal of Finance, 59(6), 2903–2958.

Schulze, C., Schöler, L., & Skiera, B. (2014). Not all fun and games: Viral marketing for utilitarian products. Journal of Marketing, 78(1), 1–19.

Sen, S., & Lerman, D. (2007). Why are you telling me this? An examination into negative consumer reviews on the web. Journal of Interactive Marketing, 21(4), 76–94.

Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355–374.

Spence, M. (2002). Signaling in retrospect and the informational structure of markets. American Economic Review, 92(3), 434–459.

Stiglitz, J. E. (2002). Information and the change in the paradigm in economics. American Economic Review, 92(3), 460–501.

Wang, X., Yu, C., & Wei, Y. (2012). Social media peer communication and impacts on purchase intentions: A consumer socialization framework. Journal of Interactive Marketing, 26(4), 198–208.

Welbourne, T. M., & Andrews, A. O. (1996). Predicting the performance of initial public offerings: Should human resource management be in the equation? Academy of Management Journal, 39(4), 891–919.

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica, 48, 817–830.

Zhang, M., Jansen, B. J., & Chowdhury, A. (2011). Business engagement on twitter: A path analysis. Electronic Markets, 21(3), 161–175.

Zimmerman, M. A. (2008). The influence of top management team heterogeneity on the capital raised through an initial public offering. Entrepreneurship Theory and Practice, 32(3), 391–414.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Academy of Marketing Science

About this paper

Cite this paper

Mumi, A., Obal, M., Yang, Y. (2018). Investigating Social Media Activity as a Firm’s Signaling Strategy Through an Initial Public Offering. In: Krey, N., Rossi, P. (eds) Back to the Future: Using Marketing Basics to Provide Customer Value. AMSAC 2017. Developments in Marketing Science: Proceedings of the Academy of Marketing Science. Springer, Cham. https://doi.org/10.1007/978-3-319-66023-3_85

Download citation

DOI: https://doi.org/10.1007/978-3-319-66023-3_85

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-66022-6

Online ISBN: 978-3-319-66023-3

eBook Packages: Business and ManagementBusiness and Management (R0)