Abstract

The combination of big data theory and supply chain management theory has brought the subversive change for the enterprise cooperation mode, the paper considered that when the big data suppliers to participate in the competition of the supply chain, the condition of overall profit of the supply chain in the two cases of cooperation and non-cooperation decision making. Firstly, the profit model of each member enterprise is established by the demand function theory, and the whole profit model of the supply chain is obtained in the case of decentralized decision-making, then, the profit model for common decision making of supply chain based on the maximization of supply chain is analyzed. After compared the two profit models, the conclusion was obtained that when big data suppliers join supply chain competition and one party gains the dominant position in the supply chain, collaborative decision-making is the key to enhancing the overall profitability of the supply chain.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

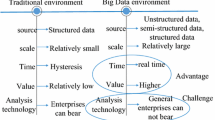

The method of supply chain management based on mutual cooperation between enterprises is one of the most effective business strategies adopted by enterprises in the fierce market competition, and the rise of big data industry is injected new blood on Supply Chain Management. Data analysis methods are applied to all aspects of supply chain management to effectively curb the procurement shortage, lag of logistics, production bottlenecks. There are some significant achievements in the area of big data supply chain management. Firstly, supply chain management has been intelligent, and a new generation of radio frequency identification technology can provide more reliable data for supply chains, these data flow in the supply chain nodes, so that enterprises can exchange information timely, the operating mechanism of the system can be optimized and the decision making become automated. In addition, big data has also brought disruptive changes for the supply chain logistics. At present, enterprises can already achieve real-time monitoring of logistics and route optimization in the use of big data technologies. Transport capacity and efficiency have been greatly improved than before. The focus of future research is to predict supply chain behavior rely on large data. Accurate forecasting is one of the effective measures to help enterprises save costs, and the accuracy of large data projections is not reached by other methods.

Current research on competition and cooperation model of the supply chain is very mature, Yang and Bai, who build up on the Hotelling model to analyze profit-sharing contracts between the supplier and the core firm, and study the impact of upward decentralization on the core firm and the whole supply chain under the assumption that the supplier does not have any advantage on production costs [12]. Wu and Han, who researched the optimal production decisions in closed-loop supply chains consisted of two competing manufactures and one retailer with remanufacturing costs disruptions [9]. Xu et al. [11] gave a literature review of supply chain contracts selection and coordination based on the supply chain under competing multi-manufactures. Shi, who studied in non-cooperative static game and Stackelberg game optimal advertising strategy in supply chain under master-slave, proves that relevance of the manufacturer and the retailer’s own ads level and cost and overall supply chain advertising level and costs [3]. Strategic of partner selection of supply chain model was constructed by Xin and others based on game theory, and get optimal strategies for select partners in the case of incomplete information [10]. Zhang, who thought the whole supply chain benefits and members of associated enterprise level knowledge sharing is very important, In light of this, he builds supply chain profit distribution model based on knowledge-sharing cost [14]. Chen et al. [1] proposed the question of how “big data analysis affects the value creation of the supply chain”, and it was answered through the use of dynamic capability theory as a unique information processing capability.

Research on supply chain based on the theory of large scale data, Wu [8] based on dynamic differential game theory constructed the dynamic corporation model of three-level supply chain under retailer paid contract, union pay contracts, with big data service providers to participate in, and discusses contract parameters on the profit impact of supply chain. Wang and Cong, [7] who studied the cloud computing service providers involved in two-stage supply chain coordination problem and introduced in the competition model of supply chain revenue-sharing contract and punished the contract so as to verify that the supply chain coordination and decision. Waller [5] established a matrix model to solve when it should be applied or avoid data analysis, theory of how to use predictive analytics improve issues such as promoting lower total logistics costs. Tan [4] through impedimented to data acquisition analysis, set up a corresponding data infrastructure framework, the framework of internal data, available through collection of deep mining, collection capacity required data to build a data network and helped provide supply chain optimal decision. A systematic framework for the SAM (Roadmap, Strategic Consolidation, and Assessment) roadmap was roadmap to help companies avoid getting caught in a mess of data by Sanders [2]. And the concept of supply chain analysis (SCA) driven by big data was proposed and the function, process-based, collaborative and agile SCA Maturity Mode was established by Wang and Angappa [6].

This paper analyzes the overall profitability of the supply chain under different decision-making situations when the big data suppliers participate in the supply chain competition. The supplier and manufacturer’s demand curve is taken as the input to construct the profit model of the supplier and the manufacturer when the manufacturer assumes the big data cost respectively. Through the analysis of the model, the profit model of the supplier and the manufacturer is obtained respectively in the decision - The overall profitability of the supply chain. After comparing the two profit models, we get the corresponding conclusion.

The rest of the paper is organized as follows. In Sect. 2, the problem of is described and some assumptions is proposed. In Sect. 3, the model of decentralized decision-making profit and common decision making are built. In the Sect. 4, two models are compared and analyzed. And there is a numerical analysis in Sect. 5. In Sect. 6, conclusions are given.

2 Problem Description and Model Assumptions

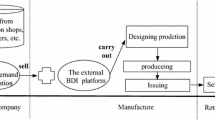

The paper considers the supply chain system as a kind of supply and demand relationship between a supplier and a manufacturer. The manufacturer produces a product with a fixed life cycle and mature market demand. The supplier provides raw materials. The input-output ratio of the raw material to the final product is 1: 1. In order to solve the problem of lagging information transmission among member firms and to improve the accuracy of market demand forecasting, the third-party big data enterprise is used to help the supply chain to build a big data decision platform. The cost is borne entirely by the manufacturer. Because of exists of the supply chain big data platform, the information on the supply chain is completely symmetrical. Assuming that the profit-sharing problem in cooperative decision-making has already reached a corresponding contract between supply and demand, the paper will not consider it.

Suppose that the manufacturer’s market demand function is \(D({p_A}) = a - b{P_A}\,+\,bK(t)\), then we can get the manufacturer’s price curve \({P_A} = \frac{a}{b} - \frac{1}{b}D\), for the convenience of calculation, let \(\frac{a}{b} = m\), \(\frac{1}{b} = \mathrm{{n}}\), then there is \({P_A} = m - nD + K(t)\). It is worth noting that, where m is the limit price that the market can afford [13], that is to say, at this price, the purchase rate of the commodity is 0; Suppose that the market demand function of the suppliers is \(D({p_B}) = \alpha - \beta {P_B}\), we can get \({P_B} = \frac{\alpha }{\beta } - \frac{1}{\beta }D\), let \(\frac{\alpha }{\beta } = s\), \(\frac{1}{\beta } = t\), then \({P_B} = s - tD\), empathy, s is the limit price that the market can afford.

The symbols involved in the article are described as follows:

- D :

-

: Market demand;

- \({P_A}\) :

-

: The price of the product produced by the manufacturer;

- \({P_B}\) :

-

: The price of the raw materials supplied by the supplier;

- \({G_B}\) :

-

: The prices of the raw materials supplied by the sub-suppliers;

- K(t):

-

: Big data horizontal curve;

- r :

-

: Big data cost coefficient;

- \({\varPhi _A}\) :

-

: The profits of the manufacturers;

- \({\varPhi _B}\) :

-

: The profits of the suppliers;

- \({\varPhi _{AB}}\) :

-

: The total profit of the supply chain when making decisions together.

Among them, the big data cost is \(F = {\frac{{rt}}{2}}D\), that is, the manufacturer’s output is positively correlated with the big data costs, the higher the output, the greater the cost of the big data.

3 Building of the Model

3.1 Decentralized Decision-Making Profit Model

In the case of decentralized decision making, the manufacturer’s profit depends on the market price of its own products and the price of raw materials from the suppliers, In addition, because of the cost of big data suppliers to join the supply chain is entirely borne by the manufacturer, so the profits are:

The profit of the suppliers depends on the price of the product to the manufacturer and the purchase price of the raw material. Therefore, the profit of the suppliers is:

It can be known from the supplier’s demand function that \(D = \frac{{s\,-\,{P_B}}}{t}\). Therefore, its profit is:

Find the partial derivative of \({P_B}\) in the supplier profit model and let it be equal to 0, and then the function of raw material price provided by the suppliers and cost is obtained:

The manufacturer’s profit formula can be known from formulas (3) and (1):

Find the partial derivative of D and make it equal to 0, the manufacturer’s optimal production decision can be obtained:

The manufacturer’s profit under the optimal production decision can be known through formulas (3), (4) and (1):

It can be known after finishing:

Because of the existence of the big data platform, the information on the supply chain is completely symmetric. Therefore, the production decision of the supplier is based on the optimal production decision determined by the manufacturer. Then, the profit of the supplier under the manufacturer’s optimal production decision can be obtained through formulas (3) and (4):

It can be known after finishing:

According to the big data platform of the supply chain, in the case of decentralized decision-making, the manufacturer preferentially determines its own production decision and puts its own decision data on the big data platform. Based on the information obtained through the big data platform, the supplier produces the corresponding number of parts, and then the total profit of the supply chain at this time is:

It can be known after finishing:

3.2 Common Decision-Making Profit Model

In the model of collaborative decision-making, suppliers and manufacturers rely on the big data platform for effective correlation, considering the overall interests of the supply chain to jointly determine the optimal production decision. Therefore, the function of the collaborative decision-making profit is expressed by the original profit function of the supplier and the manufacturer:

It can be known after finishing:

Find the partial derivative of D and make it equal to 0, it can be known that the optimal number of producers and suppliers at the time of collaborative decision-making is:

The total profit model of supply chain can be known when the optimal production quantity has been determined under the condition of common decision through formula (8) and formula (9):

It can be known after finishing:

4 Comparative Analysis

Through the above analysis, it obtains the profit model of the supplier and the manufacturer in the case of decentralized decision-making and collaborative decision-making when the manufacturer is fully committed to the big data cost.

In the case of decentralized decision-making, suppliers and manufacturers do not take into account the overall interests of the supply chain to maximize, but entirely from the perspective of their own interests to make decisions. Because of the existence of big data platform, although the suppliers and manufacturers make decisions discretely, the transmission of information flow is transparent. The manufacturer makes the decision first, and the supplier makes its own production decision according to manufacturer’s production plan.

In the case of collaborative decision-making, to achieve the overall profit maximization of the supply chain is the premise of cooperation between suppliers and manufacturers, manufacturers take into account the supplier’s production capacity constraints, logistics conditions and other objective factors, and then the two sides can achieve collaborative decision-making. The overall profit model of the supply chain is determined according to the market demand function of both parties, so that the production decision can be made with the maximum profit of the supply chain.

The profit model of the two cases is compared and analyzed, and then:

for the convenience of calculation, let \(e = m + k(t) - G - \frac{{rt}}{2}\), then there is

According to the above it can be known that s is the limit price that the market can afford, so there must be \(G{}_B\;\langle s\), so, \({(e - G{}_B)^2} - {(e - s)^2}\rangle \;0\), and easy to proof that \(\varDelta \varPhi \;\rangle \;0\), that is to say the profit in cooperative decision-making is higher than that in decentralized decision-making.

It can be known that manufacturers dominate the entire supply chain and completely control the supply chain’s big data platform by analyzes and contrasts the two models, but it does not mean that the manufacturer can control the information flow entirely. Because in the case of decentralized decision-making, manufacturers do not take into account the conditions of suppliers when making decisions, so the interests of suppliers are damaged and lead to supply chain breaks. In the case of cooperative decision-making, manufacturers and suppliers, under the condition of ensure their own interests, determine the optimal number of production according to the conditions of both factors. After reaching the corresponding contract, the cooperation tends to be stable, which is to make the overall profit maximization of the supply chain as a prerequisite.

The above analysis can also prove that only cooperation can make the supply chain system to achieve the maximum profit, the joining of big data suppliers does not change the competition pattern of supply chain. Although manufacturers dominate the supply chain, choose to cooperate with suppliers will achieve a win-win situation.

5 Numerical Analysis

In this secondary supply chain, the overall profit of the supply chain with the raw material prices and market demand changes, Suppose that \(K(t)=\frac{{{t^2}}}{2}\) and large data cost coefficient \(r = 0.5\), consider the profit situation of supply chain when \(t = 10\), raw material price and market limit price change, the concrete numerical analysis is shown in Table 1.

It can be seen from the numerical analysis that when the price of raw materials is kept constant, the market limit price of the supplier is unchanged and the increase of the market limit price of the manufacturer will increase the overall profit of the two supply chains; The limit price of manufacture does not change and the increase of the market limit price of supplier has no effect on the overall profit of the supply chain. In addition, from the table can clearly see the common decision-making big data supply chain profits than traditional supply chain profits increase of at least 50.5%.

6 Conclusion

Big data theory has spawned many new service and industry models, and it is challenging for traditional industries to use big data to change their supply chains operating. How big data can be used to implement change, what should be targeted to gain competition advantage is the first issue enterprise should consider.

The model constructed in the paper focuses on the competition problem brought by big data suppliers join to the supply chain, and examines the supply chain cooperation mode from the profit perspective. It is not sharing big data cost by manufacturers and suppliers in the model, which is a common phenomenon in practice. In order to gain a dominant position in the supply chain, one enterprise chooses to bear the cost of big data alone to achieve the control of big data platform. But it does not means that the enterprise will be able to achieve an increase in profits, partly because of the cost of containment, on the other hand the stability of cooperation could be impacted after enterprise obtaining a dominant position, and the overall profit of the supply chain maybe reduced in that condition. Therefore, the supply chain member companies choose to cooperate with each other and make decisions collaboratively is the key to improve the overall profit of supply chain through introducing the third-party big data providers. The analysis of the article is also just to verify this conclusion.

References

Chen DQ, Preston DS, Swink M (2015) How the use of big data analytics affects value creation in supply chain management. J Manage Inf Syst 32(4):4–39

Sanders NR (2016) How to use big data to drive your supply chain. Calif Manage Rev 58(3):26–48

Shi KR, He P, Xiao TJ (2011) A game approach to cooperative advertising in a two-stage supply chain. Ind Eng J 12:6–9

Tan KH, Zhan YZ et al (2015) Harvesting big data to enhance supply chain innovation capabilities: an analytic infrastructure based on deduction graph. Int J Prod Econ 165:223–233

Waller MA, Fawcett SE (2013) Click here for a data scientist: big data, predictive analytics, and theory development in the era of a maker movement supply chain. J Bus Logistics 34(4):249–252

Wang G, Gunasekaran A et al (2016) Big data analytics in logistics and supply chain management: certain investigations for research and applications. Int J Prod Econ 176:98–110

Wang HC, Cong JJ (2016) Study on coordination of cloud computation service supply chain under joint contracts. Logistics Technol 5:157–160

Wu C, Zhao DZ, Pan XY (2016) Comparison on dynamic cooperation strategies of a three-echelon supply chain involving big data service provider. Control Decis 7:1169–1171

Wu H, Han XH (2016) Production decisions in manufactures competing closed-loop supply chains under remanufacturing costs disruptions. Comput Integr Manuf Syst 4:1130–1140

Xin L, Jia Y (2011) Supply chain strategic partner selection based on game theory. Syst Eng 4:123–126

Xu L, Qi XU, Liu X (2015) A literature review on supply chain contracts under competing multi manufacturers. Technoeconomics Manage Res 7:3–7

Yang DJ, Bai Y (2015) Supply chain core firms competition and decentralization based on hotelling model. Proc Natl Acad Sci 102(4):1157–1162

Zhang A (2012) A comparative analysis of several demand function. J Jilin Province Inst Educ 10:153–154

Zhang TF, Zhang YM (2011) Analysis of knowledge sharing in supply chain node based on game theory. Stat Decis 17:184–186

Acknowledgements

This work was supported by the National Natural Science Foundation of China under Grant No. 61472027.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Liu, S., Wang, H. (2018). Analysis of Supply Chain Collaboration with Big Data Suppliers Participating in Competition. In: Xu, J., Gen, M., Hajiyev, A., Cooke, F. (eds) Proceedings of the Eleventh International Conference on Management Science and Engineering Management. ICMSEM 2017. Lecture Notes on Multidisciplinary Industrial Engineering. Springer, Cham. https://doi.org/10.1007/978-3-319-59280-0_82

Download citation

DOI: https://doi.org/10.1007/978-3-319-59280-0_82

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-59279-4

Online ISBN: 978-3-319-59280-0

eBook Packages: EngineeringEngineering (R0)