Abstract

Financing efficiency in Public-Private Partnership (PPP) projects is a vital but impressionable aspect, whose likely consequence always influenced by inevitable uncertainties and confused the stakeholders. This study aims to investigate the methods for evaluating and predicting the relative efficiency of current financing scheme in PPP project, which surrounding with various uncertainties. The current study proposed a new algorithm for assessing the inancing efficiency and simulating the flexibilities in PPP projects simultaneously. Furthermore, it integrates DEA and Monte Carlo to provide the possible probability distribution of financing efficiency which takes the uncertainties in PPP. A case study is given to show its feasibility and practicability. It shows uncertainties in PPP projects considerably count for its deviation from the optimum value. This innovative model provides an avenue to predict the effects and possible outcome of an optimal scheme, which is important for financing scheme decision making.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Infrastructure constructions are essential to support the world economic development. Both in developed and developing countries, governments have dedicated a significant share of the public budget to develop and refurbish infrastructures [10]. While, with the global economy slows, the lack of economic resource can prevent further economic growth and the development of already planned infrastructure projects [5]. Infrastructure builders (always public sectors) are driven to attract private investment to take part in infrastructure constructions. This idea has elicited the generation of Public-Private Partnerships (PPP) mode. The development and popularization of PPP well bridge the gap between a need of infrastructures and a lack of budget. Worldwide, PPP grows into one of the most important procurement mechanisms of project development.

PPP mode holds numerable advantages, among which the financial efficiency is one of the main superiority. The British government directly name PPP projects as “Private Finance Initiative”, therefore its effect on financing is evidently reflected. The Asian Development Bank strong introduced PPP for constructing infrastructures at the beginning of its establishment, in order to reach the value of money and promote the efficiency of financing [1]. Many scholars studied the financing effects of PPP mode either from theoretical aspect or relating with practical application. Sastoque [12] concluded that it is one of the key characteristics of PPP to count private sector’s contribution on financial issues of public projects. Gatti indicated PPP is an efficient financing instrument acts through designing, structuring, and executing, as an important role in whole life cycle [6]. The high financing efficiency of PPP mode allows infrastructure projects obtain the best value for money.

However, stakeholders of PPP are in need of a benchmark to learn about the financing efficiency quantitatively; it is a necessary prerequisite for making a sensible decision before it simplement. Uncertainties implicated in PPP projects, like lengthy durations, high transaction costs and a lack of competition and transparency, always lead to inefficiencies and ineffectiveness [2], and further drag the financing efficiency down. Experts are trying to build a systematic model for the assessment of financing efficiency in PPP. While, PPP projects are multi-participation activities and multi-indicator processes which makes this work more complicated than traditional ones, let alone making predictions and selecting the optimal scheme.

Various methods have been proposed by scholars to settle this issue. The first family of methods universally used in the assessment of PPP projects is Fuzzy Synthetic Evaluation (FSE). Verweij [14] employed FSE to analysis satisfactory outcome of financing in 27 PPP road constructions in the Netherlands. FSE performs well in comparing existing options, however, fails to propose an optimum scheme and make prediction or simulation. The second family of methods for addressing the above problem is Analytic Hierarchy Process (AHP) analysis. Zhuang [21] applied AHP to research the fiscal control in PPP of city infrastructure. AHP suffered from the same limitation as FSE. Besides, it is easily influenced by the subjective rating of experts. Recently, an improved method had been proposed for achieving a comparison of the existing options, optimization of the inefficient ones, as well as eliminating subjective influence from human. It is Data Envelopment Analysis (DEA). In YuYuanchun’s study, DEA plays an important role in evaluating the technology transfer efficiency in industry-university-research institution [17]. Wang Hong investigated the efficiency of debt risk and fiscal expenditure of local government with an application of DEA [15]. Another strong point of DEA is that it supports target data of each indicator in relatively inefficient projects, which provides a reference for optimizing the original scheme. But it ignores the uncertainties and external influences in projects implement, which can be conducted by Monte Carlo (MC) approach.

The objective of this work is to propose a mathematical model to evaluate and predict the financing efficiency in PPP Projects. We apply DEA method to handle difficulties caused by multiple participators and factors, and integrate MC method to simulate uncertainties embraced in PPP projects. It is may offer a new insight and academic reference for related research.

2 Problem Statement

The motivation of the proposed method lies in the fact that the crude FSE and AHP method are limited in giving general evaluation and selecting the optimal scheme; moreover, they are vulnerable to anthropic rating [9]. These restrictions result in a series of dilemma in PPP projects, like hard to assess the potential influence of uncertainties, and lack of quantitative support for decision making of financing scheme. So, stakeholders in PPP projects are in an urgent need of a systematic model that offers data support for the decision of financing strategies, which should be uncertainties considering, optimum proposal providing, and free from artificial factors.

DEA is able to achieve all the mentioned goals except that it fails to take uncertainties in the implement and operation of PPP projects into account. The principle of Monte Carlo analysis is to run stochastic values of independent variable sand then simulate and identifies the possible distribution of outcomes [20]. A massive repetition of simulation processes counts the flexibility of changing environment, which supplement the flaw of DEA.

In this work, we try to propound an approach by exploiting Monte Carlo approach and integrating it with DEA. Monte Carlo works for simulating the uncertainties in PPP projects which facilitate the new method to systematically fulfill evaluation and optimization of financing efficiency in PPP Projects.

3 Monte Carlo and Its Application

Monte Carlo (MC) simulation is a computerized mathematical technique that allows people to simulate an approximate solution in quantitative analysis and decision making. The technique was first exploited by scientists who work in the nuclear technology field when they were facing with a 6-dimensional integral equation [20]. Calculating a result by repeated simulation was the only way to solve this complex multiple problem. Since then, MC was widely applied in the nuclear area, however, be confined to this area also because of the restriction of the capability of computing. As in projects, the related influence factor can be even more complex compared with in nuclear technology, a strong ability in computing and storage is needed [4]. With the booming development of computer in recent years, MC is widespread to various fields, for handling the simulation of multidimensional problems, especially in project decision making which constantly face with uncertainty, ambiguity, and variability. By using this method, the distribution of all possible outcome of an event is generated by running a model a large scale of times, and then prompts and assists the decision-making [11]. The main principle of MC is simulating the input of multiple independent variables, in accordance with their expected distributions, and drawing the proximate distribution and statistic data of dependent index. In the procedures of MC, it always involves determining the change rules of independent factors and exploring their interaction with dependent outcome. Then, the running of numerous simulations could identify the range and distribution of possible outcomes according to a number of scenarios. While managing a project, administrators always face up with difficulties when there is a list of alternatives for the project but lack of clues of their possible impact on the project. MC technique helps in forecasting the likely outcome of an event and thereby promotes making an informed decision. The method algorithm is shown in its succession interactive five steps [4, 11, 20]:

- Step 1.:

-

Clearly defining the target problem y, and creating a parametric model composed by its influence factors \(x_1,x_2,\cdots ,x_q\), the model is noted as Eq. (1):

$$\begin{aligned} y=f(x_1,x_2,\cdots ,x_q). \end{aligned}$$(1) - Step 2.:

-

On the basis of fitted or hypothetic distributions of influence factors, generating a random input set of data, \(x_1,x_2,\cdots ,x_q\);

- Step 3.:

-

Adding the random set which is generated from step 2 into the model in step 1, obtaining an effective calculation and recording results as \(y_i\);

- Step 4.:

-

According to the accuracy requirement of specific research, determining the simulation times n, and repeating steps 2 and 3 for \(i= 1\) to \(i=n~ (n=1000\) in this work);

- Step 5.:

-

Obtaining a distribution curve and analyzing the results by using statistic indicators generated from the simulation.

In the execution of PPP projects, forecasting the final financing efficiency is a complex and repeated issue. It always bewilders stakeholders because of its high degree of complexity and uncertainty. MC simulation assists in simulating likely scenarios and giving a probable distribution of objectives with taking the influence of risk factors and uncertainties into consider. In the model, we put forward in this study, DEA is applied to take the place of parametric model included in step 1. The key benefits and applicability of using the MC analysis in this research are listed below:

-

MC simulation settles the uncertainties caused by multiple participators and complex influence factors in PPP projects well. Differing from the crude traditional model, MC exempts the complex mathematical calculation, and directly obtains likely outcomes by simulating a series of possible scenarios, which make it more operable and practical.

-

MC overcomes the irreversibility involved in decision making, especially in significant determination as those in PPP projects. Simulation is a way to imitate results by running a large number of potential situations. MC simulation meets the need of foresight the possible outcome in advance.

-

With the advanced computing technology, Monte Carlo simulation is easier to operate. It gains the availability and feasibility in practical application of PPP projects.

4 Model Establishment

Scholars have explored a number of avenues to calculate and optimize the productivity and operational efficiency issues. However, it is noteworthy that DEA is one of the most popular approaches in this area. It is more recent in applications among studies and it also draws more effective conclusions in comparison with some other methodologies like Stochastic Frontier Analysis (SFA) [13]. With a popularization of the PPP mode, employing DEA as modeling method is becoming more and more popular in latest decade [19]. While in the specific financing efficiency field of PPP projects, only a few scholars have gone into and DEA is scarcely used.

In this research, we first adopt DEA to evaluate the financing efficiency of specific PPP projects and get the initially optimized data. Due to the limitation of theoretical mathematical models, DEA ignores the uncertainties and all possible scenarios in PPP projects. Therefore, Monte Carlo is designed to play a role for filling in the vacancy. The integrated algorithm can be used to both give an assessment and practically optimized scheme and its efficiency.

4.1 Evaluation and Optimization of Financing Efficiency in PPP Projects

In the projects area, the application of DEA always embodies three main parts: selecting input and output indexes, forming the decision-making unit set, and finally analyzing from calculated outcome. For the efficiency of financing in PPP projects, it involves two major areas: raising funds in low cost and using funds efficiently. In addition, franchise and public service of public infrastructure are two characteristics in PPP project. Accordingly, five indicators are selected to measure the financing efficiency of PPP projects in this study: the ratio of capital funds, the duration, and the franchise as input indexes; social influence and the turnover ratio of total capital as output indexes.

Five indicators refer to five aspects of financing efficiency in PPP projects. Their names, definitions, notations and formulas for indicators are listed in Table 1.

For making up an effective decision-making unit set, the number of decision-making units should be no less than twice the number of a sum of the input and output indicators; otherwise its ability to distinguish efficiency will decline [7]. So, when measures the relative efficiency of a PPP project, the data of the other nine projects is needed to compose the decision-making unit set. Then input all indexes into DEA model and results can be generated. The calculating model is as Eq. (2) [8].

Three indicators about efficiency can be obtained: technical efficiency \(\theta \), scale efficiency \(\theta _{SE}\) and pure technical efficiency \(\theta _{PE}\). \(\theta _{SE}\) and \(\theta _{PE}\) separately show the financing efficiency of PPP projects in aspects of scale and pure technique. Only when \(\theta _{PE}\) and \(\theta _{SE}\) equal 1 at the same time, it means that the targeted project is in a relatively efficient level among other projects in this decision-making units set. A particular relationship among the three indictors is shown in Eq. (3).

In addition, the input redundancy \(s^+\) and the output deficiency \(s^-\) stem from DEA model indicate targets of every independent indicator for reaching a relative efficiency state. They fail to count uncertainties embodied in PPP projects, while are important raw data for MC simulation.

4.2 Monte Carlo for Simulating Uncertainties

The Integration of MC and DEA is able to build an avenue for simultaneously fulfilling the assessment and prediction of financing efficiency in PPP. Although DEA model have generated an optimal target for each parameter, it is presented as theoretical and fixed data. During the practical development and construction of a PPP project, all the changes in policy, economics, natural environment and project itself generate flexibilities and fluctuations. They may result in a deviation from the expected optimal scheme. MC analysis is strong at simulating realistic uncertainties by randomly sampling the possible parameters set based on their fitted distribution.

The simulation process is the vital part in Monte Carlo analysis. It contains defining distributions of independent parameter, inputting random sampling data set, and gathering results to generate a fitted distribution of dependent indicators. When integrates with DEA model, the sampled random date set need to be put in DEA model for running and giving the results of efficiency indicators, provided that the simulation times does not reach 1000 yet. An aggregation of all the results obtained from every simulation forms a possible financing efficiency distribution. Consequently, uncertainty is considered in the majorization. The flowchart of simulation process of the new model is shown in Fig. 1.

The innovative algorithm combines data processes of MC and DEA, which contribute to a complement of both methods. DEA creates raw data and algorithm for simulation in MC, and MC simulation bridge the gap between reality and theoretical values given by DEA. With the integrated algorithm, a probability distribution of financing efficiency with potential changes in implement will be drawn. It offers a quantitative reference for managers of PPP projects to analyze the feasibility and risk of the optimum proposal, and then make more evidence-based and financing efficient decision.

5 Case Study

5.1 Project Introduction

Australia Adelaide Water Utility project was developed to mitigate the water threat. PPP mode was applied to ally the public and private sector for supporting more efficient and quality service. The United Water Corporation (private sector) cooperated with the Water Company in South Australia (public sector) to construct the PPP project. The overall budget was 4.3 billion included 1.6 billion capital investments, which was raised from both main stakeholders and the others investment from banks and other social capital. During the negotiation stage, the government committed a 27 year franchise right. The completed water utility was expected to serve 5 million citizens and get 521 million’s annual operating incomes.

5.2 Simulation and Optimization Analysis

In order to composing an effective decision-making unit, set for DEA analysis, we collected the related data of nine other PPP projects include Bird Nest and the Sydney Olympic Games Stadium. In order to guarantee their comparability, these projects shared similar scale and age of building; further, all the data is transform into the form of ratio of capital funds, duration, franchise rights, social influence and turnover ratio of total capital. The results of relative financing efficiency: pure technical efficiency \(\theta _{PE}\), scale efficiency \(\theta _{SE}\) and technical efficiency \(\theta \) are calculated with the application of DEA as listed in Table 2.

From the Table 2, a conclusion is drawn that, the financing efficiency is far away from relatively efficient state compared with the other projects in this decision-making unit set. When other projects almost reached 1, a relative efficient state, the pure technical efficiency, scale efficiency and technical efficiency of financing for Australia Adelaide Water Utility are separate to be 0.667, 0.454 and 0.303. Thus, an optimal scheme is in an urge need to improve the situation of relative inefficiency in Australia Adelaide Water Utility PPP project.

DEA model delivers an improvement strategy for relative inefficient units to reach an ideal level, namely a relative efficient financing efficiency state. For Australia Adelaide Water Utility, the initial input and final target given by DEA model are shown in Table 3.

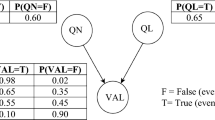

The target values are more theoretical, rather than feasible and practical. For in the actual construction, it is surrounded by a changing environment all the time, any uncertainty can result in a deviation from the optimal target. If we predict and simulate all the possibility value of independent parameters, the possible value of dependent parameters can be obtained. MC is created to imitate this process. Ratio of capital funds, duration, franchise rights, social influence and turnover ratio of total capital are five independent parameters in this algorithm, we collect data from over hundred PPP projects so as to generate a fitting probability distribution for each parameter, and they are hypothesized as show in Fig. 2.

After sampling 1000 times in Monte Carlo simulation and running extracted data in DEA model, the crossover process finally generates the probability distribution of pure technical efficiency \(\theta _{PE}\), scale efficiency \(\theta _{SE}\) and technical efficiency \(\theta \) (Fig. 3). It shows the fitted probability curve for scale efficiency and technical efficiency are lognormal distribution; while for pure technical efficiency is beta distribution. With setting the optimal scheme as a target, the expected value for the pure technical efficiency reaches 0.8, has a promotion over 20% than the initial value; for the scale efficiency reaches 0.68, get a considerable 50% improvement; for the technical efficiency meets 0.54, improves 80%. The blue area highlighted in graphs reveals the most probable range of financing efficiency value with a boundary set at the half of the maximum value.

Finally, we can make a conclusion that the practical implementation of an optimal scheme hardly fulfills the relative efficient state in the end, because of all the uncertainties and change of environment related with PPP projects. While the innovative algorithm proposed in this research offers an approach to predict possible outcomes and distribution of financing efficiency. It enables stakeholders make a better decision among financing strategies and prepare for probable consequences.

6 Conclusions

In this work, we propose an efficient and practical model for estimating and predicting financing efficiency in PPP projects. It integrates DEA and Monte Carlo approach to measure financing efficiency scientifically and objectively, as well as take the uncertainties embodied in PPP project into consider. The innovative model designs a crossover running between DEA and MC, which enable them to compensate for each other’s weaknesses. DEA is an effective approach to measure the relative efficiency and delivered an optimal target to reach the relative efficiency state [19]. Wanke, Peter F also applied DEA to analyze scale efficiency of PPP projects in Brazilian ports [16]. While PPP projects are full of risks and uncertainties which will result in a fluctuation from the optimal target, the intrinsic restrictions of DEA fail to take it into consider. A number of scholars, like DijunTan and Yuzba Bahadr, use the features of Monte Carlo to quantify and visualize volatility and flexibility [3, 18]. In this manuscript, the MC method is combined with DEA to handle uncertainties through a series of simulation. The proposed algorithm offers a comprehensive method to assess and forecast the financing efficiency in PPP projects.

In the case study of Australia Adelaide Water Utility project, one- thousand-time simulation forms the possible probability distribution of final pure technical efficiency, scale efficiency and technical efficiency of financing. It reveals the possible outcome of financing efficiency in this PPP project when set the optimal value derived from DEA as the target. It shows that, although uncertainties make the relative efficiency hardly to meet a perfectly financing efficient state, while the three efficiency parameters promoted 20%–80% than the initial financing scheme. This result enables the stakeholders to have a full preparation for the probable consequence.

The application of the new method which integrates MC and DEA is not limited in the financing efficiency of PPP projects. It can be extended to various fields whose assessment and simulation process involve multiple indicators and uncertainties. After making corresponding changes in input and output indexes and fit their possibility distribution, the innovative algorithm can be widely used in different areas.

7 Summary of Research Results and Future Study

This study proposed a new model to predict the financing efficiency with fluctuation caused by uncertainties in PPP projects, based on integration of DEA and MC. The case study of Australia Adelaide Water Utility project shows that this innovative method is capable to evaluate and predict flexibilities quantitatively and visually. It also indicates that the uncertainties in PPP projects make the target values in optimal scheme hard to reach, while in this specific project, it also realizes a considerable promotion in all three efficiency indicators.

Further research, such as a more comprehensive indexes system of DEA and subdivide uncertainties in to different categories, is necessary to delve more in-depth and practical in this topic. A more comprehensive and thorough investigation of related factors in DEA method will contribute to a more accurate outcome. Considering that the implementation of PPPs would be affected by economic, social and environmental conditions, sorted uncertainties can facilitate a more accurate calculation. Alternatively, a series of diversified case study need to be carried out in the future to verify and enrich the reliability and feasibility of this new model.

References

Bank AD (2013) Public-private partnership operational plan 2012-2020: realizing the vision for strategy 2020: the transformational role of public-private partnerships in Asian development bank operations

Broadbent J, Gill J, Laughlin R (2008) Identifying and controlling risk: the problem of uncertainty in the private finance initiative in the UK’s national health service. Crit Perspect Account 19(1):40–78

Dijun T, Yixiang T (2007) Volatility modeling with conditional volatility and realized volatility. In: International Conference on Management Science and Engineering Management, pp 264–272

Dubi A (2000) Monte carlo applications in systems engineering. In: IEEE R&M symposium on a Dubi stochastic modeling of realistic systems topics in reliability & maintainability & statistics tutorial notes

Franke M, John F (2011) What comes next after recession? - airline industry scenarios and potential end games. J Air Transp Manage 17(1):19–26

Gatti S (2013) Project finance in theory and practice: designing, structuring, and financing private and public projects. Academic Press, Cambridge

Li G, Lei Q, Yang Y (2014) The efficiency evaluation of Chinese film and television industry listed companies based on DEA method. In: 2014 Proceedings of the eighth international conference on management science and engineering management. Springer, Heidelberg, pp 83–95

Lin Q (2013) Introduction of decision analysis. Tsinghua University Press, Beijing, pp 45–47

Liu J, Yang Y (2014) Efficiency evaluation of Chinese press and publication listed companies based on DEA model

Martins J, Rui CM, Cruz CO (2014) Maximizing the value for money of PPP arrangements through flexibility: an application to airports. J Air Transp Manage 39:72–80

Platon V, Constantinescu A (2014) Monte carlo method in risk analysis for investment projects. Procedia Econ Finance 15:393–400

Sastoque LM, Arboleda CA, Ponz JL (2016) A proposal for risk allocation in social infrastructure projects applying PPP in Colombia. Procedia Eng 145:1354–1361

Schøyen H, Odeck J (2013) The technical efficiency of Norwegian container ports: a comparison to some Nordic and UK container ports using data envelopment analysis (DEA). Marit Econ Logist 15(2):197–221

Verweij S (2015) Producing satisfactory outcomes in the implementation phase of PPP infrastructure projects: a fuzzy set qualitative comparative analysis of 27 road constructions in the Netherlands. Int J Project Manage 33(8):1877–1887

Wang H, Huang J, Li H (2017) Local government debt risk, fiscal expenditure efficiency and economic growth. Springer, Singapore

Wanke PF, Barros CP (2015) Public-private partnerships and scale efficiency in Brazilian ports: evidence from two-stage dea analysis. Socio-Econ Plann Sci 51:13–22

Yu Y, Gu X, Chen Y (2017) Research on the technology transfer efficiency evaluation in industry-university-research institution collaborative innovation and its affecting factors based on the two-stage DEA model. In: 2017 Proceedings of the tenth international conference on management science and engineering management. Springer, Singapore, pp 237–249

Yüzbaşı B, Ahmed SE (2015) Shrinkage ridge regression estimators in high-dimensional linear models. Springer, Heidelberg

Zhang S, Chan APC et al (2016) Critical review on PPP research - a search from the Chinese and international journals. Int J Project Manage 34(4):597–612

Zhongji X (1985) Monte Carlo Approach. Shanghai Science and Technology Press, Shanghai

Zhuang M (2012) Research on fiscal control in public-private partnerships of city infrastructure. In: Electronic system-integration technology conference, pp 1–4

Acknowledgement

The authors would like to thank the National Natural Science Foundation of China for financially supporting this research (Grant No.: 71502011). It is also supported by the Fundamental Funds for Humanities and Social Sciences of Beijing Jiaotong University (Grant No.: 2015jbwj013).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Qiu, Y., Akram, U., Lin, S., Nazam, M. (2018). How to Predict Financing Efficiency in Public-Private Partnerships–In an Aspect of Uncertainties. In: Xu, J., Gen, M., Hajiyev, A., Cooke, F. (eds) Proceedings of the Eleventh International Conference on Management Science and Engineering Management. ICMSEM 2017. Lecture Notes on Multidisciplinary Industrial Engineering. Springer, Cham. https://doi.org/10.1007/978-3-319-59280-0_20

Download citation

DOI: https://doi.org/10.1007/978-3-319-59280-0_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-59279-4

Online ISBN: 978-3-319-59280-0

eBook Packages: EngineeringEngineering (R0)