Abstract

This chapter develops an application of a CGE model to analyze some important economic features and policy problems for Kenya, one of the most dynamic African countries. The CGE model developed reflects the basic structure of the Kenya’s economy and captures some of the key trade-offs affecting its policy choices, especially for what concerns aggregate growth, sustainability and inclusiveness. The results suggest that a policy strategy aimed to boost agricultural productivity and infrastructure investment would be the best choice for the long run development of the country.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

JEL Codes

1 Introduction

Compared with structural econometric as well as simulation models used in economic policy analysis, computable general equilibrium (CGE) solve numerically abstract general equilibrium structure a la Arrow and Debreu with real data to find the equilibrium levels of supply, demand and price for specified markets. According to Wing (2004), CGE models are useful but they are nonetheless viewed with suspicion by some in the economics and policy analysis communities as “black boxes” (Panagariya and Duttagupta 2001), whose results cannot be meaningfully traced to any particular feature of their data base or input parameters, algebraic structure, or method of solution. Such criticism, mainly due to the lack of communication and information across broader economics and policy community, typically rests on the presumptions that CGE models contain a large number of variables and parameters and are structurally complex, both characteristics allowing questionable assumptions to be hidden within them that end up driving their results. Descriptions of models’ underlying structure, calibration and solution methods abound, but tend to be spread across a broad cross section of materials, each subset of which focuses on a different aspect of the subject.

As explained in the introduction to this volume (Chap. 1), a recent revival of CGE models is based on several new facts and advancements of both theory and practice. CGEs have become the only point of encounter of macroeconomic policies with project evaluation, where they promise to perform a critical function to connect two frameworks that typically don’t mingle and often risk to contradict each other. In a series of important research attempts, in large part conducted at the World Bank, several generations of computable general equilibrium models (CGE) since the late 70s were developed and gradually became important and useful tools for policy analysis. In these models, social accounting matrices (SAM) became the core of the representation of general equilibrium as a circular flow of production, consumption and incomes, with prices in all markets as the equilibrating variables. Solving algorithms started with fixed point (Scarf and Hansen 1973) and mathematical programming procedures (Norton and Scandizzo 1981; Walbroeck and Ginsburg 1981) and gradually developed into nonlinear equation systems and local or global search solution methods (Devarajan et al. 1997). At present, while the macro-econometric models prevailing in the 1970s have all but disappeared from the economic practice, CGEs are increasingly used around the world, both in their static and dynamic versions, as tools to analyze economic policy options.

In this Chapter we develop an application of a CGE to analyze some important economic features and policy problems for Kenya, one of the most dynamic African countries. We try to build a model that reflects the basic structure of the Kenya’s economy and captures some of the key trade-offs affecting its policy choices, especially for what concerns aggregate growth, sustainability and inclusiveness. The plan of the Chapter is as follows: Sect. 2 provides a brief description of the Kenya economy and its recent trends and major development problems. Section 3 presents the mathematical structure of the CGE model and discusses its main assumptions and related characteristics. Section 4 reports and briefly discusses the estimates of Kenya’s social accounting matrix (SAM). Section 5 presents the model simulations and discusses their implications from the point of view of the economic policy problems examined. Section 6 finally develops some conclusions and policy recommendations.

2 The Kenya’s Economy

Kenya is a sizable country (580.400 km2 with a population of 44 million) and an income per capita of about 1,400 US$ at the official exchange rate. According to the Kenya Economic Update (World Bank 2017), for the third consecutive year, economic activity gave rise to sustained economic growth. Kenya’s economy expanded by 5.8% in 2016, 0.1% points higher than the previous year, in spite of a background of weaknesses in several emerging markets and Sub-Saharan economies where GDP growth decelerated. Unlike oil exporting countries, Kenya, being an oil importer, benefitted from the slump in oil prices, particularly in the first half of 2016. Similarly, earlier good rains supported favorable harvests in 2016, particularly in the first half of the year. Further the tourism sector, which had slowed down since the 2013 terrorist attacks, rebounded in 2016. Finally a positive role was played by domestic developments such as the government’s infrastructure drive aimed at easing supply side constraints and a stable macroeconomic environment, supported economic activity in 2016. These favorable compensated for the weakness in external demand and the sharp deceleration in credit growth to the private sector.

The service sector contributed 3.2% points to Kenya’s GDP growth for the first three quarters of 2016; in other terms, some 54% of Kenya’s growth in 2016 derived from the strength of the service sector. Performance among various service sub-sectors was, however, mixed. For examples thanks to the rebound in the tourism sector, accommodation and restaurant sub sector contributed to some 0.41% points to GDP growth; transport and storage also accelerated, as they benefitted from lower fuel prices. In contrast, Kenya’s real estate sector presented a deceleration in 2016, that could be reflective of the slowing private sector credit growth. Similarly, in 2016, the financial sector contributed only 0.3% points to GDP growth compared to its contribution to GDP of some 0.6% points in 2015. The decline in the contribution of the financial services is consistent with tougher environment faced by Kenyan banks in 2016 as a tighter regulatory condition for the provisioning of bad debts and lower interest margins resulting from the Banking Amendment Act.

Agricultural output grew at 4.9% in first three quarters of 2016, the sector’s contribution to growth increasing by 0.2% points from that of the 2015. For the first three quarters of 2016, Kenya’s industrial sector expanded by 5.6% but the sector’s contribution to GDP growth decelerated to 1.6% points from 1.8% points over the same period in 2015. Much of this deceleration in growth can be attributed to sluggish/below par growth in the manufacturing sector and lower dynamism in the construction sector. A key question for the Kenyan economy thus appears to be the role of total factor productivity and the consequences of its increase in productivity agriculture versus the other sectors. Given the weight of agriculture and demographic pressures for Africa, this question appears important to identify goals for technological innovation and diffusion, as well as to suggest alternative strategies of growth.

The macroeconomic environment was stable in 2016; in particular inflation was moderate in 2016. However unfavorable weather has led to a surge in food inflation in recent months. The fiscal deficit declined from 8.4% of GDP in Financial Year (FY) 14/15–7.5% in FY 15/16. Kenya’s medium-term fiscal policy is anchored by its commitment to achieve convergence with the East African Community Monetary Union protocols. In recent years, the government has embarked on an ambitious infrastructure plan (roads, railways, ports and power projects) that drove the share of development spending to 8.8% of GDP in FY 14/15 from 6.3% a year earlier. However, in FY 15/16 development spending was moderate, thereby supporting the commencement of the fiscal consolidation. In contrast to development spending, recurrent spending increased to 15.6% of GDP in FY 15/16. Fiscal consolidation should help to: (i) anchor Kenya’s macro stability, (ii) reduce crowding out pressures, (iii) contain the pace of debt accumulation and (iv) contribute towards a more favorable sovereign debt credit rating.

However, in contrast to the consolidation that took place in FY15/16, the fiscal deficit is projected to rise to 8.9% of GDP in FY16/17. Given the projected increase in revenues (as a share of GDP), the increase in the deficit is being driven by an expansionary fiscal stance, with government expenditures increasing from 27.1% of GDP in FY15/16 to 30.0% in FY16/17. The significantly higher deficit, however, assumes that there will be a full execution of the development budget in FY16/17. Given the track record of 31% under-execution rate for development spending, deficit turnouts could be lower than current projections. There is a need to recreate fiscal space through reductions in the share of recurrent spending, and expansion of the revenue base in order to carry out the ambitious public investment drive without straining public finances.

From the point of view of development policy, the role of investment identifies a second policy question for the future of the Kenyan economy. This question concerns the trade-off between fiscal consolidation and growth faced by policy makers in the short run, even under the favorable assumption that the economy proceeds on a virtuous path of productivity improvement. While such an improvement may endogenously generate enough resources to fuel further growth, it is legitimate to ask whether an aggressive policy of investment in public goods, such as the one pursued by the government in recent years, might not be important to ensure stale support to a higher path of development for the country.

3 The Core CGE Model for Kenya

The CGE model is based on a social accounting matrix that provides a schematic portrayal of the circular flow of income in the economy: from activities and commodities, to factors of production, to institutions, and back to activities and commodities again. In particular, the equations of the core CGE model follows the same pattern of income generation of the SAM. These equations can be grouped in the following blocks: (1) equations which define the price system, (2) equations that describe production and value-added generation, (3) equations that describe the mapping of value added into institutional income, (4) equations which completed the circular flow, showing the balance between supply and demand for goods by the various actors, and (5) a number of “system constraints” that the model economy must satisfy; these include both market clearing conditions and the choice of macro “closure” for the model (Robinson et al. 1999).

The core of the model follows a standard structure (Robinson et al. 1999; Lofgren et al. 2002) based on CGE model specified in terms on non-linear algebraic equations and numerical solution techniques (Devris et al. 1982). While the model is designed as a neoclassical structure, different closure rules may be used to incorporate Keynesian hypotheses and mechanisms of income formation and to analyze differences in policy implementation (as explained later). In keeping with the private market orientation of the Kenyan economy, the core of the model is a process of maximization of profits by producers and utility by households. Labor is assumed to be mobile, markets are competitive within an open economy, and international trade and tourism.

Technology for producers and preferences for consumers are described by Cobb-Douglas functions and consumption demands are derived from the optimization process. Commodities are either sold in the domestic markets or exported to international markets. A constant elasticity of transformation function (CET) describe the relationship between the internal and external markets, with the determination of price ratios and elasticities of transformations to determine the level of output exported or sold domestically.

For imports, households and producers are assumed to utilize commodities based on Armington’s composite commodity function, which describes the substitutions between imports and domestic commodities through a constant elasticity of substitutions (CES) function. The government’s inflows are represented by taxes and transfers from other institutions and at the same time use the income to purchase commodities, make transfer to other institutions and savings. The commodities demanded by government are determined in fixed proportion and transfers from and to other institutions are also fixed in foreign currency. Enterprises are also included in the model as institutions, and receive inflows from factor of production and transfers from other institutions. As outflows, enterprises’ incomes are used to pay taxes, savings and transfers but not to consume commodities. International tourists are also represented as institutions, that receive as inflows incomes from the rest of the world and consumes commodities and savings domestically.

The CGE model incorporates all the flows from the Social Accounting Matrix (production, consumption, distribution etc.) and simulate the product and factor markets role in setting equilibrium relative prices. Depending on a number of factors and the purpose of which the model simulation is used, model closure consists of choosing a particular set of exogenous variables in a way that allows a consistent and possibly unique set of solutions. Because a problem of over-determination (Sen 1963; Ratso 1982) may arise when the number of equations implied by the model exceeds the number of endogenous variables, we refer to four basic closure rules: the neoclassical, the Keynesian, the Joansen and the neo-Keynesian. In the Neoclassical closure investment is endogenous and savings driven (i.e. saving determine the level of the endogenous investment that adjust consequently). The Keynesian closure is characterized by unemployment in equilibrium, hence the level of employment is not fixed and variation in the level of output and employment will clear the market of saving and investments. In the Joansen-closure, the model is investment-driven, hence the level of savings adjusts, differently from the neoclassical closure as Johansen considers the government as an important source of savings. Government consumption or tax rates become endogenous and savings depend on tax rate and adjust to ensure the saving-investment gap. Finally, in the neo-Keynesian closure, the real wage is not equal to marginal product of labor and the functional distribution of income ensures the equality between savings and investments.

For an open economy with trade and international tourism the closure problem becomes more complex, with the introduction of a new equilibrium condition in the foreign exchange rate and new source of savings in the investment—savings balance (Ratso 1982; Delpiazzo 2011; Robinson 2006). In the case of the Neoclassical closure, foreign savings are assumed to be fixed and the real exchange rate is fluctuating to ensure the equilibrium on the foreign market. Investment is saving-driven and the model behaves in a way similar to the closed economy (Robinson 2006). In the Keynesian closure usually foreign savings is assumed to be fixed exogenously, while the exchange rate adjusts to clear the foreign exchange market. As the exchange rate varies, real prices (including the wage rate) will adjust, generating employment, income, production and savings to match fixed investments. Since foreign savings are fixed, they have no role in the adjustment and the multiplier is operating similarly to the closed economy case (Robinson 2006; Taylor and Lisy 1979). The Johansen closure in the open economy case is characterized by saving driven investment as in the closed economy, but foreign savings are endogenous and adjust to ensure investments—savings balance (and not the domestic savings as the closed economy case). A change in the level of investments will adjust the real exchange rate that is the equilibrating variable and generate changes in foreign savings. These in turn adjust to investment levels. Furthermore, the model assumes that the wage rate is free to vary and ensure equilibrium in the labor market. In the neo Keynesian closure, a fixed wage is the numeraire, while the exchange rate is exogenous and foreign savings adjust. Changes in the real wage provoke adjustments in price level and exchange rate. If for example the price level increases, the real wage decreases and employment, income and savings all increase. On the foreign market the real exchange rate appreciates, with a consequent deterioration of the balance of trade and increase in foreign savings. The increment in both foreign and domestic savings ensure macro equilibrium, so that the investments level end the effect of the Keynesian multiplier is lower than that of standard Keynesian closure.

4 Social Accounting Matrix and Computable General Equilibrium for Kenya

Several social accounting matrices are available for Kenya. The 2003 Kenya Social Accounting Matrix (SAM), estimated by the Kenya Institute for Public Policy Research and Analysis (KIPPRA) and the International Food Policy Research Institute (IFPRI), is the main example of a family of models both at national and regional level, built in the past decade. This matrix is a consistent data framework that captures the information contained in the national income and product accounts and the input-output table, as well as the monetary flows between households, government and other institutions. The Kenya SAM also used surveys to estimate the production technology underlying different sectors of the economy. By combining this information with the country’s household income and expenditure survey, the SAM provides a comprehensive picture of the structure of the Kenyan real economy built in 2003.

Using the 2003 KIPPRA-IFPRI SAM as a starting point, we updated the SAM for Kenya by applying the entropic methodology described in Scandizzo and Ferrarese (2015), to national and state account data and other statistics (Kiringai et al. 2006; KNBS 2014). These methods are based on the so called “maximum entropy econometrics” (Golan et al. 1996) and are able to handle the “ill-conditioned” estimation problems associated with the lack of the degrees of freedom typical of I-O matrices. The methods are very flexible in combining a variety of specific data with prior information and national accounts.

The matrix estimated contains detailed sector accounts for production, sales and purchase of goods and services. In total there are 35 production sectors, with primary activities including irrigated and non-irrigated agriculture as well as forestry and mining. Tourism is also detailed both from the point of view of various types of tourist demand and hotel and lodging supply. Three factors of production (labor, capital and land) are accounted for in connection with productive sectors and households. The latter are divided into four categories: namely rural poor, rural non-poor, urban poor and urban non-poor, using standard poverty level.

The SAM distinguishes between ‘activities’ (the entities that carry out production) and ‘commodities’ (representing goods and non-factor services exchanged on the market). SAM flows are valued at producers’ prices in the activity accounts and at market prices (including indirect commodity taxes and transactions costs) in the commodity accounts. The government is disaggregated into a core government account and different tax collection accounts, one for each tax type. Taxes are disaggregated into commodity, direct and trade taxes, plus a core government account. Enterprises institutions are also considered, as well as the capital account (savings—investments) that comprehends all formal and informal transactions concerning the various forms of credit in the economy, including transactions from the formal banking system and all financial transactions that play a crucial role to supply an outlet to savings and a source of credit to consumer-producer households. The rest of the world account represents trade flows between the national economy and rest of the world, such as imports and exports of goods and services.

Figure 1 and Table 1 shows the Rasmussen indexes of backward and forward linkages computed from the matrix. These indexes describe the direct and indirect connections between the different actors of the economy, whose accounts are represented in the SAM. Introduced by Hirschman and defined by Rasmussen (1957), the indexes of backward linkages are based on the average multipliers (from the columns of the SAM inverse) and can be interpreted as the increase in output of the entire system of industries needed to cope with an increase in the final demand for the products of one industry by one unit (Rasmussen 1957, pp. 133–134). The indexes of forward linkages are instead based on the row multipliers and quantify the extent to which the system of industries draws upon a given industry. They are indexes of sensitivity of dispersion, as they measure the increase in the production of an industry driven by a unit increase in the final demand for all industries in the system. Both indexes are normalized by dividing the average multiplier for each sector by the total average multiplier for all sectors.

The magnitude of the multipliers depends on the number of the accounts considered exogenous and are lower the larger such a number, while the Rasmussen indexes, being normalized with the average multipliers, indicate only the relative importance of a sector linkage as compared to the mean. The multipliers used in the table correspond to the hypothesis that the capital formation account is exogenous. Under this hypothesis, as the table shows, the Rasmussen indexes of backward multipliers, which average 1 by construction, range from a minimum of 0.54 for metal and machines account to a maximum of more than 1.12 for sales taxes, indirect taxes and tariffs. This means that if the demand of one sector increases 100%, the average impact on the demand for the products of the other sectors is between a minimum of 54% and a maximum of 112% the average. The results show that the country enjoys a stronger than average backward connectivity for many sectors, like tourism, which are at the end of their value chain. The indexes of forward linkages, on the other hand, measure the degree of participation of each sector/institution to the overall economic activity, that is, on average, how much a sector demand increases in response to an equi-proportional increase in all sectors. They are much more diverse than the backward indexes, with especially large values for some sectors such as non-irrigated agriculture, transport and especially labor and capital. The lowest value of 0.06 is for poaching activity, while the highest value of 5.08 is for capital. Tourism activities have backward multipliers near to the average, but low forward multipliers. This suggests on the backward side that the local value chain, even though still weak, has already some depth, and, on the forward side, that the sector is not dependent on domestic economic activity and relies mostly on foreign demand.

5 Impact Analysis: Policy Simulations

Because of the importance of the agricultural sector in most developing economies, raising agricultural productivity appears a plausible and appealing choice for policy makers to promote economic growth. The literature provides abundant theoretical and empirical evidence that agricultural growth is essential to foster overall growth, especially in developing countries and identifies the diverse roles that agriculture plays in the process of growth and development as well. For example, for Johnston and Mellor (1961) agriculture contributes to economic development with food and raw materials, labor and capital, foreign exchange and markets for the outputs of other sectors. Agricultural productivity growth would generate increased demand not only for food but also for other industrial outputs and services via intermediate and final demand linkages (Adelman 1984; Mellor 1976). Bautista (1986) identifies increased agricultural production through productivity increase result in foreign exchange savings and reduction in food imports and increase the ability to export. Further, increased agricultural productivity may cause lower and more stable food prices making households better off (Adelman 1975; de Janvry and Sadoulet 2002).

It is important to underline the distinction between increases in output and productivity since these do not necessarily have similar impacts. In some cases, output and productivity increase together whereas in other cases they can vary inversely with differential consequences for poverty (Irz et al. 2001; Schneider and Gugerty 2011).

The effects of agricultural growth spread to the non-farm economy through different linkages; production, employment and incomes. Higher real incomes in the agricultural sector stimulate demands for the products of other sectors and labor within the sector, while higher agricultural outputs stimulate the creation of non-farm rural and urban employment opportunities through backward and forward linkages to manufacturing and services sector activities (Hanmer and Naschold 2000; Thirtle et al. 2001). Irz et al. (2001) summarize and review many possible arguments of effects of agricultural productivity growth on farm economy, rural economy as a whole and the national economy and the necessary conditions to achieve them. It is not clear that rural income will increase at all times with improvements in agricultural productivity, as a result of possible deterioration of agricultural terms of trade arising from price and income inelasticity of agricultural products (Bautista 1986). Arndt et al. (2000) suggest that price declines due to an increase in agricultural productivity would transmit most of the gains to urban households, to non-agricultural sectors and to non-agricultural factors of production. Rural households who mostly engage in agricultural activities gain from greater availability of food. Further, Thirtle et al. (2001) argue that productivity gains may not trigger poverty reduction if the decline in output prices outweighs the gain from increased productivity. These complex relationships between direct and indirect general equilibrium effects emphasize the linkages between agricultural productivity, growth and poverty reduction. While many studies of productivity or technical change in developing country agriculture have been conducted (Mellor 1999; Self and Grabowski 2007; Thirtle et al. 2003), linkages of the agricultural sector with the rest of the economy have been the object of only a limited number of studies.

Studies investigating the multiplier effects of agricultural growth on the other sectors of the economy (Arndt et al. 2000; Bautista 1986; Coxhead and Warr 1991, 1993, 1995; Dorosh et al. 2003) include social accounting matrices and CGE models. Arndtet al. (2000), for example, use a CGE model to analyze improvements in agricultural productivity and reductions in marketing costs in Mozambique. Their results suggest that that increasing agricultural productivity may be a priority for Mozambique with large potential gains. However, increasing agricultural output with very high marketing costs leads to significant fall in prices transmitting most of the gains in factor income to non-agricultural sectors. Bautista (1986) developed a CGE model to investigate the effects of productivity increases in Philippine agriculture. The study simulates the impacts of productivity increases in three agricultural sectors; food crops, export crops and livestock and fishing sectors and the food manufacturing sector on sectoral prices and outputs, rural and urban income, trade balance and national income. The simulations imply a 10% increase in total productivity separately in the four sectors and increased productivity in all sectors simultaneously. The cause of the productivity increase is assumed to be the result of technological change and/or improved infrastructure. Increased productivity in the food crops sector results in a fall in food prices but promotes the food processing sector. Productivity improvements in the crop sector results in a decline in sector prices while improving sector production. Increased productivity in the food manufacturing sector stimulates growth in production and in the food crop sector as well. Simultaneous productivity increases in all four sectors show moderate positive impacts on household income while there are significant impacts on macroeconomic variables. Based on those results, the author argues that increasing agricultural productivity does not necessary result in reduced rural income but is more likely to benefit urban households.

Coxhead and Warr (1991) used a CGE model for Philippines to investigate the distributional effects of technical progress in Philippine agriculture. They show, in a small open economy, that technical improvements in farming are likely to benefit the poor, especially if the technical change is labor-using—land-saving. A technical change which substitutes capital for labor with no increase in output in irrigated agricultural sector triggers a reduction in real wage in the same sector. Households owning only labor lose while real incomes of households that do not depend on labor show a slight increase. Coxhead and Warr (1995) used the same model to trace the effects of differential rates of technical progress in the irrigated and non-irrigated agricultural sectors on income distribution of factor owning household groups, poverty and economic welfare within a small open economy with open agricultural trade and agricultural trade under restrictions. The results clearly showed that reduced poverty from technical progress is substantially greater when agricultural trade is unrestricted at constant world prices. Similar results are obtained by Coxhead and Warr (1993), who examine the distributional effects of technical change in Philippines’ agriculture using a CGE model. They show that technical change in Philippine agriculture may lead to increased incomes, reduced poverty and improved income distribution.

Given this background of past studies and results, we propose a series of simulation with the CGE model that combine increases in productivity of agriculture and, alternatively, in the industrial sector. with investment increases. These simulations aim to measure the potential growth spill overs of technical change in agriculture and industry. They also aim to quantify the link between investment and productivity increase, since one of the most important reasons to invest in infrastructure is precisely to induce productivity growth and, on the other hand, any exogenous increase in productivity needs to be accommodate by further investment to spread to the rest of the economy. More specifically, we simulate the following scenarios:

-

(a)

doubled agricultural total factor productivity (TFP) with a parallel increase in investment (50%) with a Keynesian closure;

-

(b)

increased investment (50%) with a Keynesian closure.

-

(c)

doubled agricultural TFP with a Neoclassical closure.

-

(d)

doubled industrial TFP with a parallel increase in investment (50%) under a Keynesian closure;

-

(e)

doubled industrial productivity with a Neoclassical closure.

The simulations are made with the GAMS (General Algebric Modelling System) software described in Brooke et al. (1996).

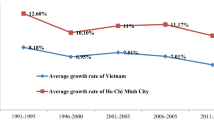

Tables 2 and 3 and Fig. 2 present a summary of the results obtained in the simulation scenarios mentioned above, in terms of real increases for the key economic variables of the model. The simulations representing a Keynesian scenario assume wage rigidity and exogenous investment, while in the neoclassical simulations wages are free to vary and investments are endogenized. In the former scenarios almost all variables are higher. The agricultural growth simulations also suggest that increases in agricultural TFP would be more beneficial, ceteris paribus, from the point of view of production, factor income and income redistribution. Furthermore, the impact of industrial TFP growth combined with the exogenous investment stimulus in the Keynesian scenario, would have rather modest effects and would display the greatest difference between relatively large benefits to factor remunerations and GDP increases, compared to rather low and uniform benefits to personal (disposable) incomes. These results are in line with empirical literature mentioned above where the authors found in a neoclassical economy a welfare gains from agricultural productivity increasing, but the differences of performance displayed between agriculture and industry TFP growth are a somewhat novel finding of our study. They suggest the intriguing hypothesis that a stage-wide pattern of growth may be mandated by the very structure of a developing economy.

In detail, simulations I, III, IV and V show the potential benefits of technical productivity change respectively in agriculture (scenarios I and III) and industry (scenarios IV and V). They also aim to detect the potential gains due to a combination of investment and productivity increases in these two different sectors (scenarios I, II and V). The simulations permit also to compare the results obtained with different closures of CGE models—neoclassical and Keynesian—which correspond to different hypotheses on the functioning of the economic system. The increase in productivity, both agricultural and industrial, effectively reduce marginal production costs and increase the level of production and GDP. The results show that agricultural production increases of 75 and 78% and industrial production increases of 51 and 43% with respect to the base case (respectively in the Keynesian and Neoclassical closure). The increase in real GDP drives up also Government income and both imports and exports in the foreign market.

Notably, in the first scenario the investment multiplier is higher than in the second one (3.47 vs. 2.61); however, the highest multiplier is in the third scenario (6.06), even though in this case it is the productivity increase that determines the surge of investment and some of the ensuing effects. In the first scenario almost all variables are higher with respect to the other simulations; for example the GDP increases around 33% respect to 21% in the second and 27% in the third (Fig. 3). This suggests that a mix of increasing productivity and investment is a better development vehicle as compared to just increasing investment demand. However in the third scenario the investment multiplier is greater, meaning that increasing agricultural productivity works well in a neoclassical economy when it is supported by a stimulus of endogenous demand.

Table 3 presents scenarios IV and V—concerning the industrial sector productivity increases—with the results obtained significantly lower than those in scenario I and III. For example the GDP increases by 21% in the fourth scenario and by 15% in the fifth one, with lower investment multipliers (respectively 1.61 and 1.99). This suggests that the combination in increasing industrial productivity and investment demand (scenario V) does not determine the best development path of the economy either from the production side or from the income one. The stimulus of domestic demand, in fact, is higher in simulation IV (neoclassical closure), where the increase in real GDP drives up the Government income by about 18% while real growth os much lower in the last scenario. Furthermore, private consumption is higher and in the IV scenario increases of 13% with respect to the base case, against an increment of only 9% in the last scenario.

6 Conclusions

In this chapter we have presented an application of a CGE model, estimated for Kenya on the basis of a recent estimate of a SAM matrix, to the analysis of the country economic structure and to some basic policy choices confronting the government. These choices concern the weight to give to agriculture in the development strategy of the country, and how to combine an infrastructure-centered policy of public investment with a drive for diversification and industrial growth.

The results of the analysis present us with a picture of Kenya as a country that, though still dominated by agriculture, may develop at a fast rate and diversify in multiple industries and services, including a very dynamic tourism sector. At the same time, the CGE simulation results suggest that agricultural growth may be the most important driver of the country economic development. This result appears to depend not only on the weight of agriculture on the economy (70% of Kenyans are still estimated to take their livelihood from agriculture), but also on its multiple connections, through backward and forward linkages, with the rest of the economy.

More intriguingly, the CGE simulations appear to indicate that a bias in favor of policies directed to industrial development may not only display an inferior performance, with respect to policies oriented towards increasing agricultural TFP, but may even be counterproductive. In particular, the combination of industrial TFP and investment increases may cause producer and consumer prices to diverge, and ultimately bring about a major gap between aggregate growth results and the improvement of living conditions by boosting disposable incomes. This is a phenomenon that has been experienced also by several advanced countries in the course of the past 30 years, and is at the root of the perceived inability of aggregate growth to create employment and lift people from poverty.

Abbreviations

- ada:

-

Production function efficiency parameter

- aqa:

-

Shift parameter for composite supply (Armington) function

- atc:

-

Shift parameter for output transformation (CET) function

- cwtsc:

-

Weight of commodity c in the CPI

- icaca:

-

Quantity of c as intermediate input per unit of activity a

- intaa:

-

Quantity of aggregate intermediate input per activity unit

- ivaa:

-

Quantity of value-added per activity unit

- mpsh:

-

Share of disposable household income to savings

- pwec:

-

Export price (foreign currency)

- pwmc:

-

Import price (foreign currency)

- qdtstc:

-

Quantity of stock change

- qbarinv(C):

-

Exogenous (unscaled) investment demand

- qinvc:

-

Base-year quantity of private investment demand

- shryif:

-

Share for domestic institution i in income of factor f

- tec:

-

Export tax rate

- tmc:

-

Import tariff rate

- tqc:

-

Rate of sales tax

- trii:

-

Transfer from institution i’ to institution i

- tva:

-

Value added tax

- tyi:

-

Rate of nongovernmental institution income tax

- \( \alpha_{a}^{a } \) :

-

Efficiency parameter in CES function

- \( \alpha_{a}^{va } \) :

-

Efficiency parameter in CES function for value added

- βch:

-

Share of commodity c in the consumption of household h

- βtouc:

-

Share of commodity c in tourism consumption

- \( \delta_{a}^{a} \) :

-

Share parameter in CES function

- \( \delta_{fa}^{va} \) :

-

Share parameter for factor fin activity a, in value added CES function

- δ qc :

-

Share parameter for composite commodity supply (Armington) function

- δ tc :

-

Share parameter for output transformation (CET) function

- θac:

-

Yield of commodity c per unit of activity a

- \( \rho_{a}^{a} \) :

-

CES function exponent

- ρ qc :

-

Armington function exponent

- ρ tc :

-

CET function exponent

- ψ:

-

Per capita consumption of tourist

- σ tc :

-

Elasticity of substitution for composite supply (Armington) function

- σ tc :

-

Elasticity of transformation for output transformation (CET) function

- CPI:

-

Consumer price index

- CDTOUR c :

-

Tourists’ consumption

- EG:

-

Government expenditures

- EXR:

-

Exchange rate

- FSAV:

-

Foreign savings

- GSAV:

-

Government savings

- IADJ:

-

Investment adjustment factor

- PAa:

-

Activity price

- PDc:

-

Domestic price of domestic output

- PEc:

-

Export price (domestic currency)

- PMc:

-

Import price (domestic currency)

- PQc:

-

Composite commodity price

- PVAa:

-

Value-added price (factor income per unit of activity)

- PXc:

-

Aggregate producer price for commodity

- QAa:

-

Quantity (level) of activity

- QDc:

-

Quantity sold domestically of domestic output

- QEc:

-

Quantity of exports

- QFfa:

-

Quantity demanded of factor f from activity a

- QFSf:

-

Supply of factor f

- QGc:

-

Government demand

- QHch:

-

Quantity consumed of commodity c by household h

- QINTca:

-

Quantity of commodity c as intermediate input to activity a

- QINVc:

-

Quantity of investment demand for commodity

- QMc:

-

Quantity of imports of commodity

- QQc:

-

Quantity of goods supplied to domestic market (composite supply)

- QVA:

-

Quantity of value added

- QXc:

-

Aggregated marketed quantity of domestic output of commodity

- –:

-

Walras dummy variable

- WFf:

-

Average price of factor f

- WFDISTf:

-

Wage distortion factor for factor f in activity a

- YFif:

-

Transfer of income to institution I from factor f

- YG:

-

Government revenue

- YIi:

-

Income of domestic nongovernment institution

- YTtt:

-

Tourists’ income

- OBJ:

-

Object function (to maximize)

References

Adelman, I. (1975). Growth, income distribution and equity-oriented development strategies. World Development, 3(2–3), 67–76.

Adelman, I. (1984). Beyond export-led growth. World Development, 12(9), 937–949.

Arndt, C., Jensen, H. T., Robinson, S., & Tarp, F. (2000). Marketing margins and agricultural technology in Mozambique. Journal of Development Studies, 37(1), 121–137.

Bautista, R. M. (1986). Effects of increasing agricultural productivity in a multisectoral model for the Philippines. Agricultural Economics, 1(1), 67–85.

Brooke, A., Kendrick, D., Meeraus, A., & Raman, R. (1996). GAMS, A user’s guide, 1998. Washington, DC: GAMS Development Corp.

Coxhead, I., & Warr, P. G. (1995). Does technical progress in agriculture alleviate poverty? A Philippine case study. Australian journal of agricultural economics, 39(1), 25–54.

Coxhead, I. A., & Warr, P. G. (1991). Technical change, land quality and income distribution: A general equilibrium analysis. American Journal of Agricultural Economics, 73(2), 360–435.

Coxhead, I. A., & Warr, P. G. (1993). The distributional impact of technical change in Philippine agriculture: A general equilibrium analysis. Food research institute studies, 22(3), 253–274.

de Janvry, A., & Sadoulet, E. (2002). World poverty and the role of agricultural trchnology: Direct and indirect effects. Journal of Development Studies, 38(4), 1–26.

Delpiazzo, E. (2011). The mozambican participation in SADC. A liberalization process through different models and different closures. Ph.D. Dissertation.

Dervis, K., de Melo, J., & Robinson, S. (1982). Planning models and development policy. London: Cambridge University Press.

Devarajan, S., Go, D. S., Lewis, J. D., Robinson, S., & Sinko, P. (1997). Simple general equilibrium modeling. In J. F. Francois & K. A. Reinert (Eds.), Applied methods for trade policy analysis: A handbook. Cambridge: Cambridge University Press.

Dorosh, P., El-Said, M., & Lofgren, H. (2003). Technical change, market incentives and rural incomes: A CGE analysis of Uganda’s agriculture. Paper Presented at the 25th International Conference of Agricultural Economics. Durban, South Africa.

Golan, A., Judge, G., & Miller, D. (1996). Maximum entropy econometrics: Robust estimation with limited data. Chichester, England: Wiley.

Hanmer, L., & Naschold, F. (2000). Attaining the international development targets: Will growth be enough? Development Policy Review, 18, 11–36.

Irz, X., Lin, L., Thirtle, C., & Wiggins, S. (2001). Agricultural productivity growth and poverty alleviation. Development Policy Review, 19(4), 449–466.

Johnston, B. F., & Mellor, J. W. (1961). The role of agriculture in economic development. The American Economic Review, 51(4), 566–593.

Kiringai, J., Thurlow, J., & Wananjala, B. (2006). “A 2003 Social Accounting Matrix (SAM) for Kenya”, Kenya Institute for Public Policy Research and Analysis, Nairobi, and International Food Policy Research Institute, Washington, D.C.

KNBS Kenya National Bureau of Statistic (2014), Statistical abstract.

Lofgren, H., Harris, R. L., & Robinson, S. (2002). A standard computable general equilibrium (CGE) model in GAMS (Vol. 5). Intl Food Policy Res Inst.

Mellor, J. W. (1976). The new economics of growth: A strategy for India and the developing world. London: Cornell University Press.

Mellor, J. W. (1999). Faster, more equitable agricultural—the relation between growth in agriculture and poverty reduction. Agricultural policy development project research project research report no.4. Cambridge.

Norton, R. D., & Scandizzo, P. L. (1981). Market equilibrium computations in activity analysis models. Operations Research, 29(2), 243–262.

Panagariya, A., & Duttagupta, R. (2001). The ‘Gains’ from preferential trade liberalization in the CGEs: Where do they come from? In S. Lahiri (Ed.), Regionalism and globalization: Theory and practice (pp. 39–60). London: Routledge.

Rasmussen, P. N. (1957). Studies in inter-sectoral relations. Amsterdam: North-Holland.

Rattso, J. (1982). Different macroclosures of the original Johansen Model and their importance in policy evaluation. Journal of Policy Modelling, 4, 85–98.

Robinson, S. (2006). Macro models and multipliers: Leontief, Stone, Keynes, and CGE models. In Poverty, Inequality and Development (pp. 205–232). Boston, MA: Springer

Robinson, S., Naude, A. Y., Ojeda, R. H., Lewis, J. D., & Devarajan, S. (1999). From stylised models: Building multisector CGE models for policy analysis. The North American Journal of Economics and Finance, 10, 5–38.

Scandizzo, P. L., & Ferrarese, C. (2015). Social accounting matrix: A new estimation methodology. Journal of Policy Modeling, 37(1), 14–34.

Scarf, H. E., & Hansen, T. (1973). The Computation of economic equilibria. New Haven, CT: Yale University Press.

Schneider, K., & Gugerty, M. K. (2011). Agricultural productivity and poverty reduction: Linkages and pathways. The Evans School Review, 1(1), 56–74.

Self, S., & Grabowski, R. (2007). Economic development and the role of agricultural technology. Agricultural Economics, 36, 395–404.

Sen, A. K. (1963). Neo-classical and neo-Keynesian theories of distribution. Economic Record, 39, 54–64.

Taylor, L., & Lisy, F. (1979). Vanishing income redistributions. Keynesian clues about model surprises in the short run. Journal of Development Economics, 6, 11–29.

Thirtle, C., Irz, X., Lin, L., McKenzie-Hill, V., & Wiggins, S. (2001). Relationship between changes in agricultural productivity and the incidence of poverty in developing countires.

Thirtle, C., Lin, L., & Piesse, J. (2003). The impact of research-led agricultural productivity growth on poverty reduction in Africa, Asia and latin America. World Development, 31(2), 1959–1975.

Waelbroeck, J. and Ginsburgh, V. (1981). Activity analysis and general equilibrium modelling.

Wanjala, B. M., & Were, M. (2009). Gender disparities and economic growth in Kenya: A social accounting matrix approach. Feminist Economics, 15(3), 227–251.

Wing, I. S. (2004). Computable general equilibrium models and their use in economy-wide policy analysis: Everything you ever wanted to know (But were afraid to ask), The MIT Joint Program on the Science and Policy of Global Change, Technical Note, no. 6.

World Bank Group. (2017). Housing—Unavailable and Unaffordable. Kenya Economic Update, 15. World Bank, Washington, DC (April 2017). ©World Bank. https://openknowledge.worldbank.org/handle/10986/26392, License: CC BY 3.0 IGO.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix: Model Specification

Appendix: Model Specification

Core Equations of the Model

Price Block

Import Price

Export price

Absorption

Market output value

Activity price

Value-added price

In the price Block, PE and PM are the international prices for commodities traded with foreign economies. The prices are respectively export and import prices, which are reduced by governmental subsidies in the first case (te) and incremented by tariffs in the second case (tm). PQ is the price paid into the domestic market for the commodity demand and represents the composite price. PX is the producer’s price, which is the combination of commodities sold domestically and exports. PA is the price received by each activity from commodities selling, that allows a multiple commodity production by each activity. PVA is the value-added price which reflect the price of activities net the price of output, thus reflecting the price of production factors.

Production Equation

Production function

Value added and factor demand

Factor demand

Intermediate demand

Output function

Composite supply

Import-domestic demand ratio

Output transformation function

Export-domestic supply ratio

In the production block QA represents the value of activity production, modeled as a CES function but put in its simplest version as cob-douglass production function where alpha is the efficient parameter and rho is the share parameter (Eq. 7). Equation (8) states represents the quantity of value-added that is a CES function of disaggregated factor quantities. The optimality condition brings to factor demand (Eq. 9) that is in function of relative factor prices. The demand of intermediate inputs in Eq. (10) is fixed in proportion if intermediate input coefficients. Equation (12) reflects the Armington specification of the composite supply, where the supply is divided for domestic and international markets defined by share parameters of market supply. Equation (13) is the optimality condition for the Armington specification. The Output transformation function (Eq. 14) defines the substitution between output produces for domestic market and output produced for foreign market. Also in this case the optimality mix in in function of share parameters and production elasticities. Equation (15) represents the optimality condition.

Institution Block

Factor income

Household demand function

Investment demand function

Government consumption function

Government revenues

Government expenditure

Tourist demand

Objective function

The first equation of the institution block represents the factor income, which is the sum for each activity of the quantity demanded for the respective factor price. The household demand function, (Eq. 16), is a liner expenditure function of commodities demanded by households. In its simplest form (like in this case) the function can be stated as cobb-douglass demand function, where households demand commodities in function of their disposable income, after paying taxes, other transfers and savings. The demand for investments in Eq. (17) is fixed according to fixed investment coefficients and multiplied by an adjustment factor IADJ. The same specification is stated for Government demand of commodities according to fixed demand coefficients. The Government total revenue is the sum of taxes, tariffs and transfers from the rest of the World, while the spending are the sum of commodity consumption and transfers to other institutions. Tourist demand in Eq. (21) is stated as in function of an exogenous tourist income and enterprise revenue is the sum of capital shares and transfers from other institutions such as government and rest of the world.

System of constraint block

Factor market

Composite commodity market

Current Account balance

Savings-Investment balance

Price Index

The system of constraints is very important for the specification of the CGE model and represents the conditions for model equilibrium. The first Eq. (24) represents the equality between factor demand and supply. In the Neoclassical specification, factor supply is fixed, reflecting the fact of full employment, while in Keynesian specification this hypothesis can be relaxed. Equation (25) stated the equality between commodity supply and composite demand, where the supply is equal to demand from institutions (households, government), investment demands and demand for intermediate inputs.

Equation (26) states the current account constraint, where imports equal exports plus the foreign deficit and everything is expressed in foreign currency. Finally, Eq. (27) is the saving—investment balance, where savings from domestic institutions and the rest of the world, equals the total capital formation.

Changing the specification of the closure equations (i.e. allowing some variables to vary and fix others), changes the model closures, according to policies and hypothesis that we want to analyze with the study.

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Scandizzo, P.L., Pierleoni, M.R., Cufari, D. (2018). A CGE Model for Productivity and Investment in Kenya. In: Perali, F., Scandizzo, P. (eds) The New Generation of Computable General Equilibrium Models. Springer, Cham. https://doi.org/10.1007/978-3-319-58533-8_6

Download citation

DOI: https://doi.org/10.1007/978-3-319-58533-8_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-58532-1

Online ISBN: 978-3-319-58533-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)