Abstract

First author “Camagni” has been considered as corresponding author. Please check and also provide e-mail ID for the corresponding author.

This chapter was previously published in Regional Science and Urban Economics, 16(1), 145–160.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Introduction

Traditional and modern approaches to urban development exhibit a natural tendency to cluster around a few consolidated theoretical ‘trajectories’, that are highly characterized in terms of methodology or field of inquiry. This tendency, which on the one hand facilitates the self-perpetuation of traditions or schools of thought and the progressive sophistication of theories and models, is responsible on the other hand for the paucity of new approaches to the problem and, above all, for the weakness of linkages among the different approaches.

Thus, in spite of the evident interdependence of spatial phenomena, diverse aspects of urban growth have been studied ‘per se’ and insufficient efforts have been devoted to integrating the different theories into a unified or even ‘eclectic’ model (Wilson 1983b).

We refer mainly to the central-place model of urban hierarchy, to the theoretical and empirical inquiries on optimal city size, to the export-base urban multiplier models and the spatial counterpart of the ‘product life-cycle’ and ‘filter-down’ hypotheses, to the theory of the inter-urban diffusion of innovation and the urban life-cycle model. All these approaches, taken separately, have almost exhausted their heuristic possibilities, but they may possibly supply new insights through the ‘cross-fertilization’ of their respective theoretical bases.

While based upon a dynamic approach and representing true methodological innovations, the most interesting recent models of urban growth, by Allen and Wilson (Allen and Sanglier 1981; Allen 1982; Wilson 1981; Diappi 1983), suffer from a disease similar to the above in terms of underlying economic theory.

The fascinating routes that they open reside mainly in the fact that they highlight the possible alternative paths of development for the urban system, thus adding ‘new perspective to historical geography’ and re-evaluating such concepts, previously banished from scientific research, as ‘historical accidents’ or ‘memory’. Now it becomes possible to ‘chart the particular path which is chosen, with reason why it is the case ... and to ask whether bundles of alternative paths can be grouped together in such a way that they constitute a type of city’ (Wilson 1983a).

But, from a theoretical point of view, these models do not identify any economic forces beyond the spatial interaction, the profit maximizing mechanism and the traditional, demand-oriented, urban multiplier effect to explain the structure and dynamic path of the urban hierarchy.

What is even more disappointing is that all recent approaches to urban development do not consider economic innovation, the truly dynamic element that, after Schumpeter, may be seen as the ‘primum mobile’ and the driving force in capitalist societies (Camagni 1984). Innovation does not only determine relative regional development, mainly in its form of technological progress in industry, but it also shapes relative urban growth, mainly through the creation of new producer or consumer services, the increasing sophistication of existing services, the improvement of tertiary functions within industry and their selective decentralization along the urban hierarchy (Andersson and Johansson 1984; Camagni and Cappellin 1984).

The present paper was written to address this widespread dissatisfaction with respect to the present state of the art of urban analysis. It builds upon some basic ideas developed in a previous study (Camagni et al. 1984) and presents a supply-oriented dynamic model that theoretically integrates three fundamental elements: innovation, urban hierarchy and spatial interaction. On the basis of this model, a computer simulation of the dynamics of an abstract urban system was run, in order to test the structural behaviour of the model and to ascertain the theoretical conditions for the emergence of an urban hierarchy.

2 The ‘Efficient’ Size of Urban Centers

The starting point of this work resides in the old standing question about the economic limits to urban growth. In fact, the idea of the existence of an ‘optimal’ city size, though fascinating, is contradicted by logical objections which limit its theoretical relevance and explain its poor empirical validation (Richardson 1972; Marelli 1981).

This last statement is confirmed by the fact that in the real world urban decline is taking place not just in large primate urban centers, but also in medium size cities and even in small towns. Indeed, in the last decade the urban system of Northern Italy’s Po plain has shown negative population growth rates not just for primary centers (7 out of 9), but also for secondary centers of 75,000–150,000 inhabitants (8 out of 19) and also for small centers of 20,000–75,000 inhabitants (27 out of 113) (Camagni et al. 1984).

This phenomenon is neither explained by recent approaches to urban growth, nor by the city life-cycle model (Klaassen et al. 1981; Van den Berg and Klaassen 1981). But a new fruitful and more relevant hypothesis may be put forward: namely, the hypothesis that an ‘efficient’ city-size interval exists separated for each hierarchical city rank, associated with its specific economic functions. In other words, for each economic function, characterized by a specific demand threshold and a minimum production size, a maximum city size also exists beyond which the urban location diseconomies overcome production benefits.

Let us assume that, for each localized economic function (F) or bundle of goods associated with a specific rank in the urban hierarchy, there exists:

-

(i)

a minimum efficient production size (A 0 , A 1, . . .in Fig. 9.1) and a supply or average cost curve that becomes perfectly horizontal above that size (TAC), as is currently assumed by most industrial economists;

-

(ii)

a traditional (Löeschian) demand curve (D) that is negatively shaped owing to the existence of spatial friction, for each income and population density level in the center and its surroundings; and consequently;

-

(iii)

a family of demand curves (D',D",...) as the demographic dimension of the single center increases (Fig. 9.1). These curves define the equilibrium market production for each size of the center (\( {A}_0^{\hbox{'}},{A}_0^{\hbox{'}\hbox{'}},{A}_0^{\hbox{'}\hbox{'}\hbox{'}},\dots \)), and the equilibrium average cost and revenue.

It is then possible for all functions (F 0 , F 1 , …) ranging from the lower to the upper, to define a curve of average production benefit (APB), associated with the dimension of the urban center and defined by the 'mark-up' over equilibrium direct costs (DAC) (Fig. 9.2). In this respect the city supplies both a spatially protected market that is not subject to distance decay, and broad availability and accessibility to qualified production factors.

Average profits may be assumed to increase as urban functions become of a higher order, due to (a) growing entry barriers, (b) decreasing elasticity of demand which allows extra profits to be gained in all market conditions far from the long-run equilibrium, and (c) increasing possibility of obtaining monopolistic revenues due to the use of scarce, qualified factors.

Moreover, we can directly compare this curve of average production benefits for each function with an Alonso type curve of average location costs (ALC), including land rent and congestion costs associated with urban size (Alonso 1971) (Fig. 9.2). Therefore, for each economic function and each associated urban rank, it is possible to define a minimum and a maximum efficient city size, which would increase with the level if the urban function and rank (A0–\( {A}_0^{\hbox{'}} \) for the function and the centre of rank 0, …).Footnote 1

As each center grows, it becomes potentially more suitable for the location of higher order functions, in terms of elements of both demand and supply. Lower order functions may be assumed to persist within higher order centers due to an intersectoral redistribution of the surplus attained by higher order functions.

In a dynamic setting, many elements may change the static picture presented hereto. Both growing per capita income which widens the market (holding population density constant) and fluctuations in income elasticity of demand and in relative physical productivity or terms-of-trade among the different functions may modify the efficiency interval for each city rank. These last two elements are particularly important from a theoretical point of view: in fact, they were shown to be directly linked to the k rate in Beckmann’s model of urban hierarchy and to be the economic determinants of the shape of the urban rank-size distribution (Beckmann 1957; Beguin 1983).

Another dynamic element is technical progress and in particular the application of microelectronics in industry, as it reduces minimum optimal production size in each sector or function. It may therefore generate, on the one hand, the spatial diffusion of higher order functions towards lower order centers (from A 1 to A 0 in Fig. 9.3); on the other hand, it may create in larger centers a condition of oversize with reference to the maximum efficient urban size interval for their respective production (from A’ 1 to A” 1 ).

3 Urban Dynamics

Within each single interval, each center should grow according to its distance from an ‘equilibrium’ size where production benefits equal location costs; its path follows a logistic curve, which theoretically fits neatly into Wilson’s ‘unified’ model of location and growth (Wilson 1983a).

Population increase in this case may take place mainly through migration, from other centers and from outside the urban system considered.

This spatial interdependence describes that form of the dynamic behaviour of a city system which has been called ‘constrained dynamics’. This form ‘refers to a system where the element of time plays an intrinsically important role in the evolution of state and/or control variables without, however, affecting the structure of the system itself’ (Nijkamp and Schubert 1983).

But another, more relevant, dynamic behaviour may be considered when ‘the system configuration exhibits an incremental or integral change’. This behaviour is termed ‘structural dynamics’. In this case, innovation and bifurcation play the dominant conceptual role.

In our urban setting, each center's long-term growth possibilities are tied to its ability to move to ever higher urban ranks, developing or attracting new and superior functions. This ability is by no means mechanically attained, and does not spring directly from a simple market dimension, as in most traditional demand-side, export-base models.

Urban size, which is, however, a proxy not only for market size but also for presence of qualified production factors, is nothing but a necessary precondition for acquiring a new function. The real acquisition of a new function (n), once the size of the center has overcome its appearance threshold (A n ), depends upon the innovativeness of the private and public urban sectors and may be treated as a stochastic variable within the model.

As in Allen’s model of urban dynamics (Allen 1982), each center’s growth path is subject to successive bifurcations which are linked to the appearance (within the correct intervals) of new economic functions as well as to the pace of general technical progress. The latter is responsible for sudden reductions in maximum efficient city size and for consequent urban decline in terms of population. Leaving aside the general spatial interaction among centers, the single center path may be described as in Fig. 9.4.

The probability of each center’s entering a new phase of development by capturing a new function depends on many endogenous elements:

-

(a)

the ability to overcome the minimum appearance threshold, which controls for the existence of appropriate production factors and of a minimum ‘sheltered’ local market;

-

(b)

the possibility of a spillover or diffusion process from centers of a higher rank, located in close proximity;

-

(c)

the diversification of local production, in terms of the presence of the entire range of activities or functions that characterize the single urban level (Chinitz 1961); indeed, a specialized oligopolistic urban structure is likely to be less innovative than a competitive, diversified one;

-

(d)

the general situation of spatial competition with respect to the single new function. In fact, the existence of a sufficient market share for each center when it acquires a higher function is a condition for its persistence in the higher rank of centers. Through this competitive mechanism, demand is introduced into our supply-oriented model; nevertheless, differently from most of the existing models, it is conceived as a minimum threshold, not as the driving force in the dynamics of the urban system.

4 The Model

The basic mechanisms of urban evolution may be expressed by two equations describing population growth at the single center j and the stochastic process of changing in rank.

Let K =(k 1 , ..., k j ,… k n ) represent the state vector of the rank of each center at time t. Then the differential equation of population growth in each center j of rank k within the interval of ‘efficient’ city size, a process we have labelled as ‘constrained dynamics’, may be defined as follows:

where P is population, a is the net migration rate from outside the urban system + the net natural growth rate, c is cost associated with distance, m is the inter-urban migration rate within the system, k denotes the urban rank and the associated economic function, C’s are the average location costs, an increasing function of urban size, and B k ’ s are the average production benefits for function k in center j, as defined in Fig. 9.2.

Moreover,

where q k is an attraction or accessibility coefficient and A k is the minimum appearance threshold for each function.

The equation describes essentially a logistic growth of population up to some limiting values which depend on the specific values of \( {B}_{k_j} \) and therefore on the rank of center j.

A second equation defines the ‘structural’ dynamics of the urban hierarchy, which come into play when each center captures new, higher functions and consequently moves to higher ranks in the urban hierarchy.

In this respect, the process of urban growth and decline may be described through a stochastic process where the single center j of rank k constitutes the system. The state vector defines the probability of belonging to the rank k. The transition probability matrix is markovian and non-homogeneous, since the probabilities, defined as functions of population size in j, change with time.

If Π k is the probability of belonging to rank k, its change in time may be defined as the sum of the probabilities of entry and exit, due to the gain or loss of functions k, k−1 and k+1,

GR k is defined as the rate of change of the rank k of the city to the rank (k+1) and expresses the ability of capturing new higher level functions.

The probability GR k can be considered as the product of the following events:

-

the overcoming of the appearance threshold A k+1 (in population terms) of the next higher level rank of economic activities;

-

the existence of externalities or spillover effects coming from centers of higher order (EX); and

-

the differentiation vs. specialization of local economic structure, representing a favourable condition for innovation and local creativeness; this element is expressed in terms of a Theil index of sectoral specialization (SP).

where

and

S jn is the economic dimension of the n sub-functions or sectors in center j, and h and l are normalizing factors. In its turn, DC k is the rate of change from rank k of the city to rank (k−1). This probability of losing function k (and to leave the corresponding urban rank k) depends on the overcoming of a demand constraint, given by the average market potential Φ of all centers which compete in the same function k,

where

and

5 The Dynamic Simulation

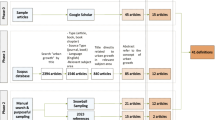

The temporal evolution of the stochastic process presented above has been studied through a random sampling simulation model based on a Monte Carlo procedure. This procedure is applied to the process of gain and loss of functions along the urban hierarchy; by this, the random character of the model and the importance attached to the innovation process are highly emphasized.

The simulation model allows us not only to analyse and compare the behaviour of the system under different parameter values, but also to evaluate the impact of different initial conditions upon the final asymptotic state of the system.

Particularly interesting initial conditions may be found (1) in some homogeneous spatial configuration describing an abstract early stage of urban development, and (2) in some theoretical equilibrium state of the hierarchical system, such as a 45° negatively sloped Zipf curve or a Christaller type spatial pattern of centers distribution.

To provide the basis for numerical experiments, an idealized geometrical zoning system is employed, in which the centers are arranged on a regular (triangular, quadratic or hexagonal) grid and where the distance among them is a parameter of the simulation (see appendix for details on the simulation procedures and parameters employed).

With respect to other similar dynamic simulation models, which are mainly concerned with sensitivity analysis and with the stability analysis of the asymptotic behaviour of the system, the major emphasis in our case is devoted to the simulation of different abstract processes bearing a precise theoretical interest.

The theoretical problems which the model has actually been used to deal with are the following:

-

(1)

the effect of technical progress, represented by continuous shift in the appearance thresholds of urban functions, on the spatial and size distribution of centers;

-

(2)

the effect of different forms of the net benefits function (B–C: production benefits less location costs), and in particular the effect of different hypotheses concerning the average net returns to urban scale; in our specific case, we are referring to constant, decreasing and increasing returns to urban rank, as net benefits are steadily diminishing within each interval of ‘efficient urban size’ and only an innovation or a jump over a higher rank may increase them;

-

(3)

the effect of different spatial deterrence parameters, with reference to both the general internal accessibility of the system and the relative spatial friction for different economic functions.

Two initial states of the system were chosen: an abstract state of uniform city rank distribution (with all, small-sized, centers randomly lying within the size interval of the second rank), and an equally random Zipf-type distribution of centers, ranging from the lowest (<12,500 inhabitants) to the highest (>800,000) of seven city ranks.

Starting from a set of parameter values taken from the real world experience of the Lombardy urban system, viz. birth, deaths and migration rates, general and relative spatial friction parameters, simulations were run in these alternative cases:

-

high general spatial impedence, not presented here in detail, vs. a rapidly smoothing-down impedence with rising urban functions;

-

constant, linearly increasing and exponentially increasing net returns to urban rank;

-

fixed vs. variable appearance thresholds of the different functions, in order to simulate absence or presence of technical progress.

Nine cases are presented and discussed here in detail.

Case 1A.

Homogeneous initial distribution and absence of technical progress; constant returns to urban scale.

Case 1B.

The same conditions as before, but linearly increasing returns.

Case 1C.

The same conditions as before, but exponentially increasing returns.

Case 2A.

Zipf-type initial distribution and absence of technical progress; constant returns to urban scale.

Case 2B.

The same conditions as before, but linearly increasing returns.

Case 2C.

The same conditions as before, but exponentially increasing returns.

Case 3A.

Zipf-type initial distribution and diminishing appearance thresholds (50% in the first 50 years); constant returns to scale.

Case 3B.

The same conditions as before, but linearly increasing returns.

Case 3C.

The same conditions as before but exponentially increasing returns.

6 Main Results

The main results of the simulation may be summarized as follows.

-

(1)

the simulation model shows a strong internal consistency, due to the high interdependence of its parts (Eq. 9.1), and a strong stability in time. Indeed 200 years were necessary to create the entire urban hierarchy in the case of homogeneous initial distribution (Fig. 9.5);

-

(2)

higher probabilities of decline are found at the periphery of the system, where it is difficult to overcome the minimum demand threshold;

-

(3)

a general condition for the creation of an urban hierarchy seems to reside in the presence of increasing returns to urban scale (or rank). In fact, starting from a homogeneous initial condition, a very flat hierarchy organized over only four ranks was apparent after 200 runs in the constant returns hypothesis (Tables 9.1 and 9.2); moreover, in the Zipf-type initial distribution of centers, the hierarchical structure is hardly maintained under constant returns (case 2A), as it is shown by the flattening of the slope of the Zipf curve (from 1.075 at t = 0 to 1.028 at t = 100), the diminishing importance of the prime center (from 20% to 18% of total population) and the general shift towards lower order centers. This is in our view one of the most interesting results of the simulation model, as it adds to Christaller’s key concepts of ‘demand threshold’ and ‘range’ a further economic condition for hierarchization of centers, along theoretical lines similar to those recently highlighted by Beguin (1983);

Table 9.1 Rank-size distribution of centers in the final state Table 9.2 Frequency of centers in each rank of the urban hierarchy -

(4)

the absence of a high generalized spatial impedence was proved to be another, expected, condition for the creation of an urban hierarchy. In fact the simulations run under homogeneous spatial deterrence functions for the different rank-dependent bundles, omitted here, showed a marked difficulty of the higher centers to stabilize and even reach a sufficient market and population size;

-

(5)

in the Zipf-type initial distribution of centers, the hypothesis of linearly increasing returns with urban rank (case 2B) allows the persistence of the urban hierarchy in its initial shape and spatial pattern (Fig. 9.6): a sort of steady-state in which population increases due to natural growth and migration from outside the system, leaving the relative size of centers almost untouched;

Fig. 9.6 The spatial structure of the urban hierarchy (rank 5, 6, 7) in case 2B, i.e., Zipf-type initial distribution, no Technical progress, and linearly increasing returns to urban scale

-

(6)

the hypothesis of exponentially increasing returns, which strongly favours the innovative centers of the highest ranks, creates a steeper distribution of centers and a wider number of top cities (3 vs. 1 in the 2C case: see Tables 9.1 and 9.2). These cities are not necessarily the ‘historical’ ones: an innovative center with a favourable position in the entire system may overcome initially higher ranked cities in this case (Fig. 9.7);

Fig. 9.7 The spatial structure of the urban hierarchy (rank 5, 6, 7) in case 2C, i.e., Zipf-type initial distribution, no technical progress, and exponentially increasing returns to urban scale

-

(7)

the previous tendency towards a policentric urban structure is strongly emphasized in case technical progress was taken into account: six centers are found in the sixth and seventh rank in the 3B case (against two in the 2B case) and 18 in the 3C case (against nine in the 2C case) (see Fig. 9.8). In fact, due to the shifting down of appearance thresholds of the different functions, higher functions may be easily captured by smaller centers and the 'prime' urban role almost disappears: the biggest city accounts for only 11 and 5% of total population in the 3B and 3C case respectively. Only in the constant returns case (3A) a traditional hierarchy persists, though at lower population levels, as the shifting down of the appearance thresholds goes in parallel with the shifting down of the entire urban system, as seen before.

Fig. 9.8 The spatial structure of the urban hierarchy (rank 5, 6, 7) in case 3C, i.e., Zipf-type initial distribution, no technical progress, and exponentially increasing returns to urban scale

7 Conclusions

In this paper a dynamic simulation model of urban growth and decline is presented, where innovation at the urban scale is crucial. The model is deeply characterized in terms of supply conditions of the different functions or bundles of goods produced at the different ranks of the urban hierarchy. Urban dynamics depends on the form of the net location benefits curve, in relation to urban size and rank, and it is constrained by demand or market size conditions.

Both urban growth and decline are linked to two kinds of elements: the presence of positive location benefits in the actual production activities, and the appearance of innovations or new production, which generate bifurcations in the historical path of the single centers.

Different spatial configurations of the urban hierarchy are the outcome of different hypotheses concerning the initial state of the system, the presence of technical progress and the presence of increasing net returns to urban scale. The latter condition is proved to be crucial for the formation of an urban hierarchy.

Notes

- 1.

All curves presented in Figs. 9.1, 9.2 and 9.3 are ‘average’ and not ‘marginal’ curves as they refer to demand and supply conditions of the entire competitive market and not of a specific firm. In Fig. 9.1, the spatial market of functions 1, 2, ... is illustrated; in Figs. 9.2 and 9.3, on the other hand, a sort of aggregated urban land market is presented, with a supply curve which includes rent and congestion costs, and demand curves coming from the different urban functions.

References

Allen PM (1982) Order by fluctuation and the urban system. In: Szegö GP (ed) New quantitative techniques for economic analysis. Academic Press, London

Allen PM, Sanglier M (1981) Urban evolution, self-organization and decision-making. Environ Plann A 13:167–183

Alonso W (1971) The economics of urban size. In: Papers and proceedings of the regional science association XXVI

Andersson AE, Johansson B (1984) Knowledge intensity and product cycles in metropolitan regions. Contributions to the Metropolitan Study 8, WP-84-13 IIASA, Laxenburg

Beckmann MJ (1957) City hierarchies and the distribution of city size. Econ Dev Cult Chang 6:243–248

Beguin H (1983) The shape of city-size distribution in a central place system. In: Paper presented at the 23rd European congress, RSA, Poitiers, 30 Aug–2 Sept 1983

Camagni RP (1984) Les modèles de restructuration économique des régions européennes pendant les années 70. In: Aydalot P (ed) Crise et espace. Economica, Paris

Camagni RP, Cappellin R (1984) Structural change and productivity growth in the European regions. In: Groes N, Peschel K (eds) Regional research in an interregional perspective. Florentz, München

Camagni RP, Curti F, Gibelli MC (1984) Ciclo urbano: Le città tra sviluppo e declino. Franco Angeli, Milan

Chinitz B (1961) Contrasts in agglomeration. Papers of the American economic review, New York and Pittsburg, May

Diappi L (1983) Processi di autoorganizzazione nei sistemi urbani. In: Proceedings of the 3rd Italian regional science conference, Firenze, Nov 1983

Klaassen LH, Molle WTM, Paelinck JHP (eds) (1981) Urban Europe: a study of growth and decline. Oxford, Pergamon

Marelli E (1981) Optimal city size, the productivity of cities and urban production function. Sistemi Urbani 1–2:149–163

Nijkamp P, Schubert U (1983) Structural change in urban systems. Contributions to the Metropolitan Study no. 5, IIASA, Laxenburg

Richardson HV (1972) Optimality in city size, Systems of cities and urban policy: a sceptic’s view. Urban Stud 9:29–47

Van den Berg L, Klaassen LH (1981) The contagiousness of urban decline. Netherlands Economics Institute, Rotterdam

Wilson AG (1981) Catastrophe theory and bifurcation: applications to urban and regional systems. Croom Helm, London

Wilson AG (1983a) Location theory: a unified approach. Working paper no. 355, School of Geography, University of Leeds, Leeds, May

Wilson AG (1983b) Making urban models more realistic: some strategies for future research. Working paper no. 358, School of Geography, University of Leeds, Leeds, Nov 1983

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix: Parameter Values of the Simulation Model

Appendix: Parameter Values of the Simulation Model

-

Number of centers: 72.

-

Number of ranks: 7.

-

Distance among centers: 20.

-

Minimum appearance thresholds for the different functions:

-

12.5 25 50 100 200 400 800 (thousands of inhabitants of the center).

-

Maximum efficient city size:

-

30 60 120 240 480 880 1600 (thousands of inhabitants of the center).

-

Frequency of centers in each rank in the initial state:

-

homogeneous case: 0 1.00 0 0 0 0 0,

-

Zipf-type case: 0.39 0.25 0.18 0.11 0.04 0.02 0.01.

-

-

Δt = 1 year.

-

b = birth rate = 0.003.

-

d = death + outmigration rate = 0.003.

-

a = intra-system migration rate = 0.08.

-

q = decay function coefficient for migration movements = 1/60.

-

Transportation cost coefficients for each function:

-

1/20 1/40 1/80 1/160 1/320 1/640 1/1280.

-

g = growth probability coefficient = 0.03.

-

r = decline probability coefficient = 0.03.

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Camagni, R., Diappi, L., Leonardi, G. (2017). Urban Growth and Decline in a Hierarchical System: A Supply-Oriented Dynamic Approach. In: Capello, R. (eds) Seminal Studies in Regional and Urban Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-57807-1_9

Download citation

DOI: https://doi.org/10.1007/978-3-319-57807-1_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-57806-4

Online ISBN: 978-3-319-57807-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)