Abstract

Please provide e-mail ID for the corresponding author and also check whether affiliation details are appropriate.

This chapter was previously published in Capello R., Camagni R., Fratesi U., Chizzolini B. (eds.) (2008), Modelling regional scenarios for the enlarged Europe, Springer Verlag, Berlin, 33–48.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 The Resurgence of Supply-Oriented Approaches

We may argue that, in the long term, theoretical supply-oriented approaches have outperformed strictly demand-oriented ones, of a Keynesian nature, in the interpretation of regional development processes.

In fact, on the one hand, regional internal demand is not relevant, even in the short run, to drive regional growth, given the huge interregional integration and ever-increasing international division of labour. On the other hand, national demand growth is certainly more relevant to internal regional performances, but it is so on a ‘on-average’ basis: single regions may outperform (or under-perform) the national average at the expense (in favour of) other regions,Footnote 1 either because of a more appropriate (poorer) sectoral mix or because of a favourable (unfavourable) competitive differential.

International demand growth, too, in particular as regards specific productions, may be highly favourable to the development of specific regions specialised in high-growth demand sectors. But this relationship may probably work well in a first approximation and in the short run; in a more precise and longer-term perspective, there is no necessary reason why different regions should benefit equally from the (aggregate or sectoral) expansion of international trade. Textiles, shipbuilding or car production were for long considered slow-growing industries, but this fact did not prevent the emergence of regional/national success stories such as, respectively, Tuscany, Korea or Japan, areas that proved able to acquire rapidly-increasing shares of an even stagnant international market.

From an ex-ante and logical point of view, it is exactly this regional differential growth capability that must be interpreted, and possibly forecasted, on the basis of supply-side elements.

Integrated demand-supply approaches based on complex feed-back effects between demand-driven shoves and increasing returns effects have for long shown good explanatory capacity, especially when strong cumulative effects, either virtuous or vicious, have been widely apparent and pervasively affecting broad typologies of winner and loser regions.

Today, a more selective pattern of regional growth is emerging. It differentiates among the development paths of single regions and produces a varied mosaic of development stories. This phenomenon calls for more stringent and selective interpretations of the different regional development paths. Perhaps, scholars themselves are becoming more demanding in terms of the specific interpretation of region-specific growth paths, and more sensitive to the consequent need to build tailor-made growth strategies for each territory.

This awareness is today strengthened by a new crucial theoretical argument: in a context of globalisation and the creation of broad single-currency areas, regions (and also nations) must closely concern themselves with the competitiveness of their production systems because no spontaneous or automatic adjustment mechanism is still at work to counterbalance a lack (or an insufficient growth rate) of productivity. Currency devaluation is no longer viable (by definition in the case of regions), nor are international monetary agreements; and wage/price flexibility is not sufficient or rapid enough to restore equilibrium once it has been perturbed, mainly because wages and prices are not determined on a regional base. In terms of international/interregional trade theory, regions do not compete with each other on the basis of a Ricardian ‘comparative advantage’ principle—which guarantees each region a role in the international division of labourFootnote 2—but rather on a Smithian ‘absolute advantage’, principle similar in nature to Porter’s concept of ‘competitive advantage’ (Camagni 2002).

Therefore, regional and local governments must address the issue of the competitiveness and attractiveness of external firms. Definition of possible growth strategies for each region, city or territory must necessarily rely on local assets and potentials and their full—and wise—exploitation: in short, on what is increasingly called ‘territorial capital’.

2 Towards a Cognitive Approach to Territorial Development: The Concept of Territorial Capital

Does the above signify that, in terms of interpretive theoretical tools, we are back with traditional, supply-side neoclassical models? In a sense ‘yes’, as local competitiveness cannot but be linked to local supply conditions. But these supply conditions must perforce refer to factors completely different from the traditional ones—namely capital and labour, local resources, and infrastructure endowment. The huge theoretical heritage of the endogenous development literature—industrial districts, milieux innovateurs, production clusters—has long directed regional scholars’ attention to intangible, atmosphere-type, local synergy and governance factors: what in the last decade were re-interpreted in the form of social capital (Putnam 1993), relational capital (Camagni 1999; Camagni and Capello 2002) or, in a slightly different context, as knowledge assets (Foray 2000; Storper 2003; Camagni 2004).

The shift is not at all merely terminological: a cognitive approach is increasingly superseding the traditional functional approach to show that cause-effect, deterministic relationships should give way to other kinds of complex, inter-subjective relationships which impinge on the way economic agents perceive economic reality, are receptive to external stimuli, can react creatively, and are able to co-operate and work synergetically. Local competitiveness is interpreted as residing in local trust and a sense of belonging rather than in pure availability of capital; in creativity rather than in the pure presence of skilled labour; in connectivity and relationality more than in pure accessibility; in local identity besides local efficiency and quality of life.

The theoretical elements that support the new methodological approach may be found in the following:

-

the theory of bounded rationality and decision-making under conditions of uncertainty, from the seminal contributions of Malmgren and Simon (Malmgren 1961; Simon 1972) to their application to industrial innovation (Nelson and Winter 1982; Dosi 1982);

-

the institutional approach to economic theory based on a ‘theory of contracts’ which emphasizes the importance of rules and behavioural codes, and of institutions that “embed transactions in more protective governance structures” (Williamson 2002, p. 439), reducing conflicts and allowing mutual advantages to be gained from exchange;

-

the cognitive approach to district economies and synergies, which comprises the Italian school (Becattini 1990), the French ‘proximity’ approach (Gilly and Torre 2000), the GREMI approach to local innovative environments (Camagni 1991; Camagni and Maillat 2006),Footnote 3 and Michael Storper’s concept of ‘untraded interdependencies’ (Storper 1995). The GREMI group conceives proximity space or the local ‘milieu’ as an uncertainty-reducing operator which works through the socialised transcoding of information, cooperation enhancing, and the supply of the cognitive substrate—represented mainly by the local labour market—in which processes of collective learning are embedded (Camagni 1991; Capello 2001).

All the above elements—which add to, and do not substitute for, more traditional, material and functional approaches—may be encompassed and summarized by a concept that, strangely enough, has only recently made its appearance, and has done so outside a strictly scientific context: the concept of territorial capital. This was first proposed in a regional policy context by the OECD in its Territorial Outlook (OECD 2001), and it has been recently reiterated by DG Regio of the Commission of the European Union: “Each Region has a specific ‘territorial capital’ that is distinct from that of other areas and generates a higher return for specific kinds of investments than for others, since these are better suited to the area and use its assets and potential more effectively. Territorial development policies (policies with a territorial approach to development) should first and foremost help areas to develop their territorial capital” (CEC 2005, p. 1).

As is widely apparent from this research work, ‘territory’ is a better term than (abstract) ‘space’ when referring to the following elements:

-

a system of localised externalities, both pecuniary (where their advantages are appropriated through market transactions) and technological (when advantages are exploited by simple proximity to the source);

-

a system of localised production activities, traditions, skills and know-hows;

-

a system of localised proximity relationships which constitute a ‘capital’—of a social psychological and political nature—in that they enhance the static and dynamic productivity of local factors,

-

a system of cultural elements and values which attribute sense and meaning to local practices and structures and define local identities; they acquire an economic value whenever they can be transformed into marketable products—goods, services and assets—or they boost the internal capacity to exploit local potentials;

-

a system of rules and practices defining a local governance model.

Accordingly, the OECD has rightly drawn up a long, sometimes plethoric but well-structured, list of factors acting as the determinants of territorial capital, and which range from traditional material assets to more recent immaterial ones. “These factors may include the area’s geographical location, size, factor of production endowment, climate, traditions, natural resources, quality of life or the agglomeration economies provided by its cities, but may also include its business incubators and industrial districts or other business networks that reduce transaction costs. Other factors may be ‘untraded interdependencies’ such as understandings, customs and informal rules that enable economic actors to work together under conditions of uncertainty, or the solidarity, mutual assistance and co-opting of ideas that often develop in clusters of small and medium-sized enterprises working in the same sector (social capital). Lastly, according to Marshall, there is an intangible factor, ‘something in the air’, called the ‘environment’ and which is the outcome of a combination of institutions, rules, practices, producers, researchers and policy makers that make a certain creativity and innovation possible” (OECD 2001, p. 15).

Given these premises, the new concept of territorial capital deserves closer inspection, and mainly in regard to its components and economic meaning. On the one hand, it is clear that some items in the above list belong to the same abstract factor class and differ only in terms of the theoretical approach of their proponents, while some others are lacking. On the other hand, whether the notion of ‘capital’ can be applied to many of these factors is questionable, because they do not imply an investment, an asset requiring a remuneration, or a production factor expressed in quantitative terms.

The next section proposes a possible theoretical taxonomy.

3 Territorial Capital: A Theoretical Taxonomy

A three-by-three matrix, both theoretically sound and relatively exhaustive, can be proposed to classify all potential sources of territorial capital. It is built upon two main dimensions:

-

rivalry: public goods, private goods and an intermediate class of club goods and impure public goods; and

-

materiality: tangible goods, intangible goods and an intermediate class of mixed, hard-soft goods.

The four extreme classes—high and low rivalry, tangible and intangible goods—represent by and large the classes of sources of territorial capital usually cited by regional policy schemes. They can be called the ‘traditional square’. On the other hand, the four intermediate classes represent more interesting and innovative elements on which new attention should be focused; they can be called the ‘innovative cross’ (Fig. 6.1).

These latter components comprise, on the materiality axis, mixed goods characterized by an integration of hard and soft elements, material goods and services which indicate a capacity to translate virtual and intangible elements into effective action, cooperation, public/private partnership, supply of services: a capacity, that is, to convert potential relationality into effective relationality and linkages among economic agents. On the rivalry axis there is an intermediate class of goods encompassing two different relevant cases:

-

impure public goods in which, as in pure public goods, excludability is low, but rivalry is higher because, for example, of increasing congestion and scarcity. In this case, rivalry may also take the form of interest conflicts among different types of users or between the class of generic (and respectful) users and some specific free-riders whose action may endanger the consistency of the public territorial goods;

-

club goods, where the opposite condition holds, namely high excludability (with respect to non-members) and low rivalry.

A third intermediate class, likened here to the category of private goods, can be represented by ‘toll goods’: a typology of public goods whose use, because it is excludable, is subject to a toll levied by the public administration or by a concessionaire. The closer the price paid is to the production and maintenance cost, the less these public goods are distinguishable from ordinary private goods.

In all these intermediate cases, a crucial control function must be performed by public authorities in order to keep the potential benefit to the local community high and pervasive. Rules, regulations and authorities must be put in place, and they must maintain a well-balanced and wise position. But also new forms of local governance based on agreements, cooperation and private/public synergy can perform well, and even better than traditional ‘government’ interventions.

The various categories of territorial capital are set out in Table 6.1 and then described.

3.1 Public Goods and Resources

Traditional public goods are social overhead capital and infrastructure, natural and cultural public-owned resources, environmental resources. They are at the basis of the general attractiveness of the local territory, and they represent externalities which enhance the profitability of local activities. Two factors limiting the full exploitation of these resources may be pointed out: unsustainable exploitations and increasing land rents which appropriate a large share of potential profits. Counterbalancing elements and policies in these cases may be: enforced regulations—on resource or land use—and ‘polluter pays’ taxation in the case of environmental or landscape damage; taxation with earmarking for resource maintenance and accessibility in the case of land rents.

3.2 Intermediate, Mixed-Rivalry Tangible Goods

Intermediate mixed-rivalry goods, namely: proprietary networks in transport, communication and energy; public goods subject to congestion effects; collective goods made up of a mix of public and private-owned goods like the urban and rural landscape, or complementary assets defining a cultural heritage system. The first category is generally subject to a control authority guaranteeing fair access, the absence of monopoly pricing, sufficient maintenance and innovation of the network/good. The last two categories deserve closer inspection: they mainly comprise public or collective goods subject to congestion or free-rider effects that require a mix of control and incentive measures in order to maintain the potential beneficial externalities that they may supply.

In these cases, careful, far-sighted and sustainable private use (or complementary use) of the resource is necessary, and game theory does not allow us to exclude short-term, opportunistic behaviour by some users (or property owners) (Greffe 2004). In the case of the strict complementarity of single private goods (e.g., a historic city centre represented by multiple properties and a mix of private and public goods), the long-term advantage of cooperative behaviour is clear; but awareness of this fact depends on the cultural and economic homogeneity of the property owners. Here, a strong sense of belonging and territorial loyalty coupled with a far-sighted business perspective and the social stigmatisation of opportunistic behaviour—the ‘milieu’ effect—may result in favourable collective action, easy p/p agreements, and fruitful local synergies (Camagni et al. 2004). In this case, the milieu itself may be the true territorial capital allowing long-term efficiency in the economic exploitation of local resources (see typology e) in the taxonomy).Footnote 4

3.3 Private Fixed Capital and Toll Goods

Private fixed capital stock is, of course, a traditional component of territorial capital. In the short term it may be considered a territorial endowment which enables advantage to be taken of expansions in world trade demand; in the longer run it may be volatile and mobile, although it may be anchored to the local realm by softer but characteristically local and less mobile factors like skills, entrepreneurship and knowledge. In the same class one may also place pecuniary externalities, of a hard nature, encompassing high quality capital goods or intermediate goods produced in the local context and sold on the market.

A third category, already mentioned, comprises public but tolled goods, in particular when the tolls fully cover construction and maintenance costs.

3.4 Social Capital

To be found on the side of intangible goods, still of a public or collective nature, is social capital. The concept (Coleman 1990; Putnam 1993; Grootaert and van Bastelaer 2001) may be considered now sufficiently established, but its economic nature and its components still do not find sufficient consensus among scholars. Social capital can be defined as the set of norms and values which govern interactions between people, the institutions into which they are incorporated, the relational networks established among various social actors, and the overall cohesion of society. In a word, social capital is the ‘glue’ that holds societies together.

For economists it includes the capital represented by the rules, habits and relationships which facilitate exchange and innovation, with the consequence that it affects economic development. It is in fact almost unanimously accepted that if a market is to function properly, it needs shared norms as well as institutions and modes of behaviour which reduce the cost of transactions, which ensure that contracts are observed and implemented, and which can rapidly resolve disputes.Footnote 5

However the concept of social capital has difficulties and ambiguities of an analytical and linguistic nature which still obstruct its full acceptance. The term ‘capital’ denotes that it is an asset, or stock, accumulated over time which generates a flow of benefits, not just a set of values and social organizations. As a consequence, it should be possible to show that it is built up through a process involving costs or investments, at least in terms of individual and organisational time and effort.Footnote 6 On the other hand, social capital is created and accumulated through slow historical processes, and its original function is not directly linked to economic goals, namely an increase in economic efficiency. Therefore, it may be seen as “a by product of a pre-existent fabric of social relationships, oriented to other goals” (Bagnasco 2002, p. 274). Rather than being a measurable input to add to other factors of production, it can be considered a public good that produces externalities for the entire economic system, increasing the efficiency of the other factors. From this perspective it would be more appropriate to equate social capital with another well-known economic variable: the level of technological knowledge which, in a production function, moves ‘total productivity’ of production factors upwards (Camagni 2004).

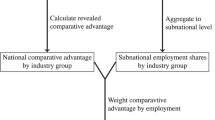

In order to avoid an excessively broad definition of social capital, and its use as a ‘catch-all’ term, it seems helpful to set out a classification of the different components of social capital according to two dimensions, or relevant dichotomies: the micro-macro dichotomy, which distinguishes elements directly involving single individuals from those of the system, and the dichotomy between the formal and the informal dimension, distinguishing elements expressed through observable objects (roles, networks, norms or social structures) from more abstract elements such as values, representations, attitudes and codes of behaviour (Fig. 6.2).

Dimensions, forms and roles of social capital. Source: Camagni 2004

The macro dimension comprises institutions and rules in the sense of Williamson and North: “the rules of the game in a society or, more formally, the humanly devised constraints that shape human interaction” (North 1990, p. 3). They may be formally expressed and objectively defined, or they may be informal, and here the reference is to conventions, codes of behaviour, values and representations. The micro dimension comprises—among the formal elements—social networks and associations, the ability to focus and organise within organised structures (even loose structures), a large range of interactions among social actors, as well as individual relationships, seen as the set of relations and contacts an individual possesses and which may be invested in economic and social activity. Among the informal elements, however, are trust and reputation and all the non-structured forms of individual participation in public or collective decisions.

There are many channels through which the different elements of social capital may affect local development. At the risk of oversimplifying the theoretical framework, we may state that each case has a more direct role in a specific direction, as indicated in the ovals of Fig. 6.2.

Institutions, rules and norms, in fact, fairly explicitly aim to reduce transaction costs, or the use costs of the market. They provide guarantees for contracts and obligations, efficiently manage problems of company law and governance, monitor for conflicts of interest and monopoly practice: in short, they create a favourable business climate which benefits local firms and enhances attractiveness for external firms. Social networks and associations aim to reduce the costs (and increase the availability) of information, particularly for current and potential commercial partners. They widen the potential market, make it easier to identify and sanction opportunistic behaviour, and accelerate the transmission of information on good practices, thereby facilitating their imitation and diffusion. Conventions and common values allow collective action among private parties to be undertaken more easily, i.e. the ex-ante coordination of individual decisions in order to achieve the advantages of economies of scale, purpose and complementarity. In many cases it is only if decisions are taken concurrently that costs can be reduced and complex projects made profitable and viable. Trust and reputation facilitate exchanges and repeated contracts, cooperation (covenants, strategic alliances, contracts—even incomplete—between customers and suppliers) or partnerships between public and private parties.

In all cases, the importance of social capital for economic activity is entirely evident.

3.5 Relational Capital

Social capital may be given either a ‘systemic’ or a ‘relational’ interpretation according to the generality of the approach, the emphasis on a ‘general purpose’ vs. a ‘selective’ interpretation of its economic role, and the attention paid to economic potential vs. actual economic outcome. While it may be argued that a social capital exists wherever a society exists, ‘relational’ capital may be interpreted as the set of bilateral/multilateral linkages that local actors have developed, both inside and outside the local territory, facilitated in doing so by an atmosphere of easy interaction, trust, shared behavioural models and values. In this sense, relational capital is equated with the concept of local milieu, meaning a set of proximity relations which bring together and integrate a local production system, a system of actors and representations and an industrial culture, and which generates a localised dynamic process of collective learning (Camagni 1991). Geographic proximity is associated with socio-cultural proximity—the presence of shared models of behaviour, mutual trust, common language and representations, common moral and cognitive codes.

The role of the local milieu, and consequently of relational capital, in terms of economic theory is linked to three types of cognitive outcome which support and complete the normal mechanisms of information circulation and coordination of agents performed through the market: namely, reduction of uncertainty in decisional and innovative processes through socialised processes of information transcoding and imitation/control among potential competitors; ex-ante coordination among economic actors facilitating collective action; and collective learning, a process occurring within the local labour market and which enhances competencies, knowledge and skills.Footnote 7

In public/private terms, relational capital and milieu effects belong to an intermediate class where ‘collective’ rather than public efforts and investments give rise to beneficial effects that can be exploited only by selectively chosen partners located in particular territories with specific identities, and sharing similar interests and values. The concept of club goods seems best suited to interpreting this condition.

3.6 Human Capital

The presence of human capital is today constantly cited as a fundamental capital asset available to territories so that they can compete in the international arena by both strengthening local activities and attracting foreign ones. Endogenous growth theories long since developed the concept into formalised growth models (Lucas 1988; Romer 1990), thereby starting a significant and fruitful process of convergence between stylised approaches and qualitative, bottom-up development theories (Capello 2016). In parallel, the concept of territorial capital, once it has been duly developed and analytically structured, could become the attractor and the interlocking element between the two theoretical trajectories—endogenous growth and endogenous development theories.

Besides human capital, this class also comprises the pecuniary externalities supplied by the territorial context in terms of advanced private services in the fields of finance, technological and marketing consultancy, customized software packages, and so on.

3.7 Agglomeration Economies, Connectivity and Receptivity

Again belonging to the class of public or collective goods of a mixed—hard and soft—nature are those elements of territorial capital that concern:

-

agglomeration economies or—in different territorial contexts characterised by specialisation in some sectors, technologies or filières—district economies. Cities and industrial districts, viewed as archetypes of the territorial organisation of production and social interaction, exhibit clear similarities in theoretical terms in spite of their geographical and economic differences (proximity and high density of activities, concentration of social overhead capital, density of interaction, high cohesion and sense of belonging) (Camagni 2004). These similarities give rise to economic advantages like the reduction in transaction costs, cross-externalities, division of labour and scale economies that constitute a large part of territorial capital;

-

connectivity, by which is meant the condition in which pure physical accessibility is utilised in a targeted and purposeful way by the single actors in order to collect information, organise transactions, and exchange messages in an effective way;

-

receptivity, or the ability to extract the highest benefit from access to places, services or information;

-

transcoding devices operating in the field of knowledge accumulation and diffusion, mainly in the form of public agencies facilitating interaction among research facilities, universities and firms and whose mission is to create a common language and shared understanding among the above-mentioned bodies.

3.8 Cooperation Networks

This category of territorial capital lies at the centre of the ‘innovative cross’. It integrates tangible and intangible assets and yields goods and services traditionally supplied through public/private or private/private cooperation networks. Strategic alliances for R&D and knowledge creation supported by (or partially supporting) public agencies for the dissemination and diffusion of knowledge, operating on the open market with some public support, are the key tools for a fair and fast implementation of the knowledge society.

But the advantages of a public/private partnership strategy do not reside only in management of the knowledge filière. The strategy also allows crucial potential results to be achieved by urban schemes for the development of large urban functions and services (where ex-ante coordination among partners enhances private profitability and public efficiency in the investment phase).

A third area in which this class of territorial capital is manifest consists of new forms of governance in spatial planning and land-use, a field characterised by both market failures and government failures, but also by huge risks of contradictory strategies and undesirable outcomes if individual, piecemeal, non-cooperative private decisions are not controlled (OECD 2001).

In all the cases mentioned above, the term ‘capital’ can be used on sound economic bases: the construction of relational networks and cooperation agreements involves real and costly investments which are usually overlooked owing to their nature as implicit or sunk costs (management time, organisational costs, risk of failure or of opportunistic behaviour by potential partners) (Camagni 1993).

3.9 Relational Private Services

Of course, in many cases certain crucial services of a relational nature may be supplied entirely by the market: for example, when firms search for external partners and suppliers (through financial institutions or specialised consultancy agencies), or in the cases of technological transfer, partnership and diffusion. University spin-offs also belong to the class of potential territorial assets to be supported by internal rules and public incentives—financial or ‘real’.

4 Conclusions

It appears from the foregoing discussion that territorial capital is a new and fruitful concept which enables direct consideration to be made of a wide variety of territorial assets, both tangible and intangible, and of a private, public or mixed nature.

These assets may be physically produced (public and private goods), supplied by history or God (cultural and natural resources, both implying maintenance and control costs), intentionally produced despite their immaterial nature (coordination or governance networks) or unintentionally produced by social interaction undertaken for goals wider than direct production. In all cases, a repeated use in successive production cycles of these assets is implied, and the usual accumulation-depreciation processes take place—as in the case of physical capital assets. In most cases, the accumulation process is costly, except when socialised processes taking place within the territorial context are responsible for the cumulative creation and value of an immaterial asset.Footnote 8

The economic role of territorial capital is to enhance the efficiency and productivity of local activities. A stylised, potential treatment of the single elements of territorial capital should address its efforts towards finding a way to measure each of them quantitatively. The impossibility of direct measurement implies equating the effects of territorial capital with ‘technological progress’ in a production function—but this would only be a measure of our ‘ignorance’.

This chapter has proposed a preliminary taxonomy of the various components of territorial capital. Based on the two dimensions of rivalry and materiality, this taxonomy has gone beyond the traditional ‘square’ encompassing pure private and pure public goods, human capital and social capital. An intermediate class of club-goods or impure public goods has emerged which implies, or requires, strong relationality and seems of great relevance to the governance of local development processes. On the one hand stand proprietary networks—of a hard nature when they are physical, or a soft one when they concern cooperation agreements and the supply of common services; on the other, there are public goods subject to congestion or to opportunistic, free-rider or endangering behaviour. In both cases, new forms of governance, participatory and inclusive, should be developed in order to accomplish the maximum benefit for the members of the ‘club’—the local community. The presence of social or relational capital in the form of trust and cooperative attitudes is highly beneficial in this respect.

Generally, tangible assets are subject to traditional supply processes, while intangible assets operate in the sphere of ‘potentials’. The ‘mixed’ category, which merges the two components together, translates abstract potentials into actual assets by defining shared action strategies, complex relational services, and concrete cooperation agreements between private and public partners.

The ‘mixed’ category of hard+soft goods has the further advantage of highlighting the relevance of such complex territorial organisations as cities or ‘districts’. These are sorts of collective goods built through the spontaneous, un-organised action of a multitude of local actors, private and public, and which thus generate wide externalities for the entire community. Once again, wise control policies should be implemented in order to avert the implicit risk of rent-seeking behaviour: the localised nature of these public goods automatically generates increases in land rents which, on the one hand, may be beneficial in that they trigger a continuous upward selection process in the quality of local activities and a ‘filtering down’ process of lower order functions along the urban hierarchy, but on the other hand subtract potential profits from productive (social classes and) uses.

All the above considerations have significant implications for new spatial development policies (OECD 2001; Camagni 2001) which introduce governance styles addressed to cooperation and relationality. A telling example of the style required is provided by the new strategies necessary to cope with the issue of the knowledge society: instead of (or besides) injecting public money directly into the system of firms, universities and research centres, which by and large are self-referential systems with their own specific goals, public policy should support ‘relational’ actions, such as common schemes and production projects built through cooperation among the above-mentioned actors operating on the local or regional scale; or it should support ‘transcoding’ services linking scientific output and business needs/ideas, such as transfer of R&D, development of a science-based entrepreneurship or university spin-offs. More generally, the approach suggests a new role for local or regional policy-makers as the ‘facilitators’ of linkages and cooperation among actors, both at the regional and the inter-regional/inter-national scale.

The theoretical model proposed by this volume fully acknowledges the role of territorial capital, whose components are included, as far as possible, in the formalised econometric tools.

In general, territorial capital is at the base of the regional performance part of the model focusing on the differential-shift component of regional growth. Territorial assets are, in fact, found in the spheres of economy (R&D, human capital), economic geography and urban-territorial structure (presence of large agglomerations, accessibility and peripherality). Relationality is accounted for through spatial spillover effects differentiated by typology of regions; agglomeration economies through urban structure and polycentrism; accessibility and connectivity through market potential functions; governance and institutional effects through continental political barriers and Union accession processes.

Other classes of territorial capital—namely those of a soft nature like social capital—are impossible to manage quantitatively, given the present state of regional statistics, but they warrant closer inspection in the next phases of the research programme.

Notes

- 1.

We shall find that, on an ex-post base, the national aggregate growth rate and the weighted sum of regional growth rates are equal.

- 2.

Every country always has a ‘comparative advantage’ in some production sectors, even if it may be less efficient in absolute terms in all productions with respect to competitor countries: its advantage resides in those productions in which it is ‘comparatively’ less inefficient, and it is exactly in these productions that it will specialise within the international division of labour, to the mutual benefit of all countries. The Ricardian principle of comparative advantage was judged by Paul Samuelson as the only statement of economic theory that was at the same time true and not trivial. As argued here, it refers to countries, not to regions or territories (see also Camagni 2001).

- 3.

GREMI—Groupe de Recherce Européen sur les Milieux Innovateurs, headquartered in Paris at Université de Paris 1—Panthéon Sorbonne and active since the mid-1980s.

- 4.

Does all this mean that the local milieu is per se an ethical and environment-friendly subject or intermediate institution? The answer is ‘no’, of course: a lobbying and short-term strategy by local, situation-rent seeking actors is not excluded, if not probable, and a mix of regulations and incentives implemented by public bodies seems necessary. In the case of external challenges and threats to local business, the presence of a milieu guarantees a faster and more effective reaction capability (Camagni and Villa Veronelli 2004, describing the case of an apple-producing community in the Trento Valley, Italy, challenged by the anti-pesticide health regulations imposed in their major German market).

- 5.

If we add further factors—reciprocal trust, a sense of belonging to a community that shares values and behaviours, and participation in public decisions—then a climate is created which encourages responsibility, cooperation and synergy. Such a climate enhances productivity, stimulates creativity and ensures more the effective provision of public goods.

- 6.

- 7.

Also to be mentioned here is the function of promoting informal guarantees for the honouring of incomplete contracts, which the milieu can perform because of its networks of interpersonal relations. Models inspired by game theory have been used to show that, when there are interpersonal networks and effective mechanisms for punishment, social exclusion and reprisal, implying a reduction in the costs of monitoring and enforcement of contracts, it is possible not only to attain stable (cooperative) Nash equilibria which are not possible when costs are high, but also to achieve overall benefits for the partners which exceed the allocative costs of local contractual policies (or ‘parochialism’) (Bowles and Gintis 2000).

- 8.

This feature is also present in the case of physical, costly capital assets, e.g. the effects of increasing agglomeration externalities on the value of real estate assets.

References

Arrighetti A, Lasagni A, Seravalli G (2001) Capitale Sociale, Associazionismo Economico e Istituzioni: Indicatori Statistici di Sintesi, Working Papers n. 4, Dipartimento di Economia, Università di Parma

Bagnasco A (2002) Il Capitale Sociale nel Capitalismo che Cambia. Stato e Mercato 65(2):271–303

Becattini G (1990) The Marshallian industrial district as a socio-economic notion. In: Pyke F, Becattini G, Sengenberger W (eds) Industrial districts and inter-firm cooperation in Italy. ILO, Geneva

Bowles S, Gintis H (2000) Optimal parochialism: the dynamics of trust and exclusion in networks. Department of Economics, University of Massachusetts, mimeo, February 2000

Camagni R (1991) Technological change, uncertainty and innovation networks: towards a dynamic theory of economic space. In: Camagni R (ed) Innovation networks: spatial perspectives. Belhaven-Pinter, London, pp 121–144

Camagni R (1993) Inter-firm industrial networks: the costs and benefits of cooperative behaviour. J Ind Stud 1(1):1–15

Camagni R (1999) The city as a Milieu: applying GREMI’s approach to urban evolution. Revue d’Economie Régionale et Urbaine 3:591–606

Camagni R (2001) Policies for spatial development. In: OECD (ed) OECD territorial outlook. OECD, Paris, pp 147–169

Camagni R (2002) On the concept of territorial competitiveness: sound or misleading? Urban Stud 39(13):2395–2412

Camagni R (2004) Uncertainty, social capital and community governance: the city as a Milieu. In: Capello R, Nijkamp P (eds) Urban dynamics and growth: advances in urban economics. Elsevier, Amsterdam, pp 121–152

Camagni R, Capello R (2002) Milieux innovateurs and collective learning: from concepts to measurement. In: Acs Z, de Groot H, Nijkamp P (eds) The emergence of the knowledge economy: a regional perspective. Springer, Berlin, pp 15–45

Camagni R, Maillat D (eds) (2006) Milieux Innovateurs: Théorie et Politiques. Economica, Paris

Camagni R, Villa Veronelli D (2004) Natural resources, know-how and territorial innovation: the apple production system in val di Non, Trentino. In: Camagni R, Maillat D, Matteaccioli A (eds) Ressources Naturelles et Culturelles, Milieux et Développement Local. Editions EDES, Neuchâtel, pp 235–260

Camagni R, Maillat D, Matteaccioli A (eds) (2004) Ressources Naturelles et Culturelles, Milieux et Développement Local. Editions EDES, Neuchâtel

Capello R (2001) Urban innovation and collective learning: theory and evidence from five metropolitan cities in Europe. In: Fischer MM, Froehlich J (eds) Knowledge, complexity and innovation systems. Springer, Berlin, pp 181–208

Capello R (2016) Regional economics, 2nd edn, Routledge, London

Coleman JS (1990) Foundations of social theory. Harvard University Press, Cambridge, MA

Dosi G (1982) Technological paradigms and technological trajectories. Res Policy 11(3):147–162

EC – European Commission (2005) Territorial state and perspectives of the European union, scoping document and summary of political messages, May 2005

Foray D (2000) L’Economie de la Connaissance. La Découverte, Paris

Gilly JP, Torre A (eds) (2000) Dynamiques de Proximité. L’Harmattan, Paris

Greffe X (2004) Le Patrimoine Dans la Ville. In: Camagni R, Maillat D, Matteaccioli A (eds) Ressources Naturelles et Culturelles, Milieux et Développement Local. Editions EDES, Neuchâtel, pp 19–44

Grootaert C, van Bastelaer T (2001) Understanding and measuring social capital: a synthesis of findings and recommendations from the social capital initiative, World Bank, Social Capital Initiative Working Paper n. 24, April, Washington, DC

Lucas R (1988) On the mechanics of economic development. J Monet Econ 22:3–42

Malmgren HB (1961) Information expectation and the theory of the firm. Q J Econ 75:399–421

Nelson R, Winter S (1982) An evolutionary theory of economic change. Harvard University Press, Cambridge, MA

North D (1990) Institutions, institutional change and economic performance. Cambridge University Press, Cambridge

OECD (2001) OECD territorial outlook. OECD, Paris

Putnam RD (1993) Making democracy work. Princeton University Press, Princeton

Romer P (1990) Endogenous technological change. J Polit Econ 98:S71–S102

Simon H (1972) Theories of bounded rationality. In: Mc Guire CB, Radner R (eds) Decision and organization. North Holland, Amsterdam, pp 161–186

Storper M (1995) The resurgence of regional economies ten years later: the region of untraded interdependencies. Eur Urban Reg Stud 2:191–221

Storper M (2003) Le Economie Locali come Beni Relazionali. In: Garofoli G (ed) Impresa e Territorio. Il Mulino, Bologna, pp 169–207

Williamson O (2002) The lens of contract: private ordering. Am Econ Rev Pap Proc 92(2):438–453

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Camagni, R. (2017). Regional Competitiveness: Towards a Concept of Territorial Capital. In: Capello, R. (eds) Seminal Studies in Regional and Urban Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-57807-1_6

Download citation

DOI: https://doi.org/10.1007/978-3-319-57807-1_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-57806-4

Online ISBN: 978-3-319-57807-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)