Abstract

Stochastic modeling of interest rates is expected to lead a better risk management in long-term investments due to the rapid changes and random fluctuations in the economies. Considering the fact that deterministic interest rate approach does not yield realistic future values, a country-specific stochastic model is aimed to fit the interest rates based on the United States Treasury Inflation Protected Securities (TIPS) at 10-year constant maturity by using time series techniques. Under the assumption that interest rate follows an ARMA(1, 1) model, the actuarial present value and its variance for a ten-year term life insurance policy are derived. Additionally, the stochastic mortality using Lee-Carter model for future mortality predictions is implemented to the U.S. Mortality tables over a period of 81 years. Based on these two stochastic patterns, the actuarial present value and the variance functions are calculated numerically for the years 2014 and forecasted for 2030. The accuracy of the proposed model is performed by assessing a comparative analysis with respect to a prespecified deterministic interest rate and mortality table.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

- Term-life insurance

- Stochastic interest rate

- Treasury securities

- ARMA(p, q)

- Lee-Carter model

- Actuarial present value

- Actuarial variance

1 Introduction

The long-term valuation of policyholders and insurers accumulation requires a precise financial planning in insurance sector. The actuarial analyses are commonly based on the deterministic assumptions on interest and mortality rates. However, these important factors in evaluating major indicators such as net single premium, reserves, technical gains and annuities, play an important role in the actuarial valuation. A realistic approach is to include the impact of stochasticity in formulating interest rate which enables the actuary to express the path to be followed for the future time value of the money.

Many studies are available in the literature on stochastic interest and mortality rate modeling. Many of those also employ time series models to understand the behavior of the rates. Boyle [1] assumes that the force of interest is generated by a white noise series and autoregressive models of order one are introduced to model interest rates. Panjer and Bellhouse [2, 3] developed a general theory for both continuous and discrete models by using AR(1) and AR(2) processes to compute moments of insurance and annuity functions. Giacotto [4] analyzed present value functions with stochastic interest rates when the spot rates are modeled discrete or continuous stochastic processes. He modeled the interest rates when actuarial functions are considered by using stationary and nonstationary \({ ARIMA}(p,0,q)\) and \({ ARIMA}(p,1,q)\) processes. Dhaene [5] developed the study of Giacotto (1986); the force of interest is modelled as an \({ ARIMA}(p,d,q)\) process. He used this model to compute the moments of present value functions. Frees [6, 7] examined the net premiums in life contingencies and extended the theory of life contingencies to a stochastic environment by using MA(1) model. Parker [8] presented a model combining random interest rate and random future lifetimes for portfolios of identical life insurances by using Ornstein-Uhlenbeck process. Lai and Frees [9] studied the potential short-term consequences of changes in the interest rate environment by using linear and nonlinear ARCH process. Zacks [10] investigated the accumulated value of some annuities-certain over a period of years with random interest rate. In Debicka’s [11] work, the cash value of discrete-time payment streams in insurance contracts are calculated where the interest rate and future-lifetime are random.

For the continuous modeling of interest rates Merton [12] (1973) used Ito process for the first time. Later Vasicek [13] employed Ornstein-Uhlenbeck type of short rate model with mean-reverting characteristics of the data. Cox, Ingersoll, and Ross (CIR) [14] (1985) introduced their original model to eliminate the shortcoming of previous models which was mainly based on the positive probability of negative interest rates.

Also another approach for modeling interest rate movements are the use of autoregressive conditional heteroskedasticity (ARCH) models, introduced by Engle [15]. These models are developed into generalized autoregressive conditional heteroskedasticity (GARCH) by Bollerslev [16], and to exponential GARCH (EGARCH) by Nelson [17]. The significant point for these models are that they indicated volatility persistence in high degrees, which was the shortcoming in the CIR model. These approaches are the most commonly interest rate modeling which takes into account the random volatility in the market.

This study aims to evaluate and derive the actuarial present value and its variance for a term life insurance under the assumption that interest rates follow ARMA(1, 1). The motivation is to observe the influence of stochastic interest and mortaliy rates on the net single premium and its variance. A developed market in life insurance is taken into account to illustrate the impact and efficiency of the proposed approach. To achieve the proposed approach, monthly United States TIPS at 10-year constant maturity are taken into account and an appropriate model is fitted. The implementation of the model is done on a mortality table whose stochastic pattern is predicted using Lee-Carter model. Sensitivity checks are done by comparing deterministic interest and mortality rates with stochastic ones. All computations are performed using Matlab R2013a, and Microsoft Excel 2010. The derivations of the actuarial present value and the variance modified based on [18] are presented with their proofs.

The organization of the chapter is as follows: The basic model proposed is presented in the next section. Market yields on United States TIPS at 10-year constant maturity are analyzed and modeled through ARMA(1, 1) model and actuarial present values and the variances are derived. The U.S. mortality rates between years 1933 and 2013 are used to estimate the future mortality rates for a period of next 16 years. A comparison of deterministic and stochastic approach on the present values is presented in the last section.

2 Stochastic Interest Rate Model

Treasury bills are the safest and highly demanded instruments in financial markets. Most of the life insurance regulations on the valuation of life insurance reserves require insurance companies to invest a portion of their accumulations on safe investments like treasury bills and government bonds. For this reason, to capture the behaviour of a risk free asset in a volatile market gains importance. As the first step in actuarial valuation under stochastic interest rate, we start defining a time dependent model using the U.S. TIPS at 10-year maturity. The data set is collected from the web page of Federal Reserve [19]. The nominal interest rates can be converted to their real equivalences as follows:

Here, \(i_t\), \(e_t\) and \(i_t'\) denote the monthly interest rate, the inflation rate and the real interest rate for the tth term, respectively. The monthly rates of a 12-year period starting from January 2003 to December 2015 are inflation adjusted. Therefore, a log-transformation of the real interest rates rates are employed to fit an appropriate model.

The real interest rates of the U.S. TIPS at 10-year maturity between 2003 and 2015 [19]

The interest rates, \(y_t\), plotted with respect to time in Fig. 1, illustrate the sharp decrease in years 2008 and 2013 and a declining trend over years. The preliminary descriptive analysis and frequency plot of returns yield a monthly average value of 0.0053; a median value of 0.0064; and a mode value of 0.0024. The standard deviation of the process is found to be 0.0040. The pattern of temporal dependence is analyzed through autocorrelated (ACF) and partial autocorrelated (PACF) functions which are presented in Fig. 2. It can be seen that the original series has a trend which require testing the existence of the unit root. ADF test statistics of the first differenced data (p value<0.01) assure the stationarity to proceed in model estimation.

The time series model, \({ ARIMA}(1,1)\) [20] is defined as

where \(\delta \), \(\varphi \) and \(\beta \) denote the parameters corresponding to the drift, AR and MA coefficients, respectively. The model estimation yields the values for the parameters which are illustrated in Table 1. The p-values of the test statistics show that the coefficients are significant validating the model at the main step of the time series modeling, except the constant term. Besides the statistical justification of the parameters, the best fit in time series require the diagnostic tests on the residuals. The residual analysis yields a mean value which is almost equal to zero, \(-5.6887\,\times \,10^{-6}\), and a standard deviation of \(7.9154\,\times \,10^{-4}\). As it can be seen in the Fig. 3, the ACF and PACF graphs of residuals support that they are white noise and Q–Q plot justifies that the normality in residuals is justified.

The stationarity in ARMA models presented in Eq. (2) leads us to represent the linear model in terms of its residuals as given below:

As it can be seen from Eq. (3), \(y_t\) could easily be estimated in terms of its residual terms (random error). Using this stationary linear model is convenient in the sense of deriving distribution of the series with respect to the moment generating functions, as the residuals follow normal distribution. Therefore, the moment generating function will be the basic term to derive the actuarial present value and its variance.

3 Actuarial Present Value and Its Variance Under ARMA (1,1)

Actuarial present value for a whole life insurance which pays a pre-determined benefit at the end of the year of death is a function of the interest and the mortality rates. Given \(V_t\) denotes the interest discount factor from the time of payment back to the time of policy issued, the present value, Z, of the amount of the payment, \(b_t\), is

whose probability distribution can be expressed as

Here, for a person aged x and having maximum lifetime till age w, \(_tp_x\) represents the probability of living between ages x and \(x+t\) and \(q_{x+t}\) shows the probability of dying between ages \(x+t\) and \(x+t+1\).

Let \(A_x\) denote the actuarial present value for a whole life insurance issued on a person whose age is (x). For a life insurance policy, mortality cost for each year is computed separately and its aggregate constitutes the net single premium. It is expressed as

Another life insurance type, n-year Term Life, provides the benefit only if the insured dies within the n-years of issue date. We denote the actuarial present value for the n-year term insurance with a benefit \( b_t\), as

As the discount function, \(V_t\), is a function of continuous interest rate, the expected value, \(E[V_t]\), and the variance, Var[\(V_t\)] under the assumption of stochastic interest rate and its impact on net premium has to be determined.

Proposition 1

Let \(y_t\) follow ARMA(1, 1) at time t given in Eq. (3). The present value of a single payment, \(V_n\), for \(t=n\) is

The parameters in \({V}_n\) derived above are defined in Eq. (3).

Proof

Proposition 2

Given \(V_n\) defined in Eq. (8), the expected value becomes

where M defines the moment generating function.

Proof

Here, \(\varepsilon _t \sim N(0,\sigma _{\varepsilon }^2)\) and \(M(t)=\exp (\sigma _{\varepsilon }^2t^2/2)\). Considering \(\varepsilon _0=0\) and \(-1<\varphi _1<1\), the last term in proof is taken as equal to 1 [21]. Using this property,

the expected value of the present value finally is derived as

Proposition 3

The actuarial present value of n-year term-life insurance,  , under ARMA(1,1) stochastic interest rate assumption is derived as

, under ARMA(1,1) stochastic interest rate assumption is derived as

where \(C_1=e^{(\varphi _1+\beta _1)\left( \frac{1-\varphi _1^n}{1-\varphi _1}\right) \varepsilon _0}M(-1)\prod _{j=1}^{n-1}M\left[ -\left( 1+(\varphi _1+\beta _1)\sum _{t=0}^{n-j-1}\varphi _1^t\right) \right] \).

Taking \( \varepsilon _0=0\) and letting \(n=k+1\), \(C_1\) becomes

Proposition 4

The variance of  is derived as

is derived as

Here, \(C_2=e^{-2(\varphi _1+\beta _1)\left( \frac{1-\varphi _1^n}{1-\varphi _1}\right) \varepsilon _0}M(-2)\prod _{j=1}^{n-1}M\left[ -2\left( 1+(\varphi _1+\beta _1)\sum _{t=0}^{n-j-1}\varphi _1^t\right) \right] \). Taking \(\varepsilon _0=0\) and \(n=k+1\), is simplified to

The propositions given above yields a formulation on the actuarial valuation of n-year term insurance under stochastic interest rate.

4 The Impact of Stochastic Mortality on

A life table shows fundamental parameters of a population for each age or age group, such as; the number of survivors, the number of deaths, the probability that they die or live to their next birthday and the life expectancy. It describes the mortality and survival pattern of a population. Mortality data and life tables, originate from observations concerning a whole national population or a specific part of a population (e.g. retired workers, disabled people, etc.) or an insurers portfolio, and so on. The past life table data does not assure its future outcome. Hence in order to price insurance products properly, actuaries must use projections of future insured events. To do this, actuaries developed mathematical models for estimating the mortality. The assumptions on constructing life tables require the observation of a closed group which needs many years to come up with an accurate estimate of the death rates. For this reason, the yearly population census, death and birth rates are employed to construct an efficient model. Additionally, the improvement in technology, medicine result in increase in the expected lifetime. Therefore, the time change on the mortalities show also a stochastic pattern. One of the models which takes into account the time influence and allows a good prediction on the future mortalities is Lee-Carter Model (LC) [22]. It expresses the mortality as a probability process and it is one of the most commonly used one in the literature to forecast the future mortality. It is essentially built for life expectancy forecasting, but can also be used for mortality forecasting.

LC model defines the force of mortality, \(\mu _{x+t}\), at age x and at time t using parameters \(\alpha _x\), \(\beta _x\), and \(k_t\) as

where \(m_{x,t}\) represents the central death rate, \(\alpha _x\) is the average level of mortality at each age, \(\beta _x \) shows the sensitivity to \(\kappa _t\) at different ages, \(\kappa _t\) shows the general speed of mortality improvement over time, and \(\varepsilon _{x,t}\) explains the error term and captures the remaining variations under the conditions

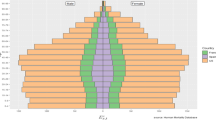

The U.S. Mortality rates between years 1933 and 2014 retrieved from open source internet website [23] are utilized for estimating the following 16-year mortalities using the LC model. The time behavior of the parameter and mortality estimates are presented in Fig. 4. The parameters on estimating the central death rates of US total population for ages 0–110, over the chosen period are illustrated in top two and bottom-right figures. Based on these estimates, the behavior of mortality rates is shown in the lower-right graph. The parameter \(\alpha _x\) has an increasing rate by age, whereas, \(\beta _x \) and \(\kappa _t\) both decrease with respect to age. The time influence on the change on mortality rates can be observed in Fig. 5. The difference between the survival probability in 2014 and the forecast in 2030 present is observable, especially, between ages 80–100.

5 Sensitivity Analyses and Concluding Comments

The sensitivity of the actuarial present value and its variance to deterministic and stochastic approaches is performed according to two important variables which are taken into account in this study. The first one considers a deterministic annual interest rate of \(9\%\) (denoted D) and random interest rates following an ARMA(1, 1) (denoted S). The latter one compares the valuations with respect to the type of mortality table. Total (male and female) mortality table for the year 2014 and forecasted mortality table for 2030 using LC model are compared under stochastic and deterministic interest rate cases. Equations (12) and (14) are employed to quantify  , Var(

, Var( ),

),  and Var(

and Var( ) which denote the expected values and variances for deterministic (D) and stochastic (S) cases, respectively. Table 2 summarizes these results with respect to the ages. Figures 6 and 7 are presented to expose the impact of stochastic approach on the valuation compared to the deterministic case. The variance of the actuarial present value is observed to be low for young and very old ages, however, high between ages 50 and 90 in both cases.

) which denote the expected values and variances for deterministic (D) and stochastic (S) cases, respectively. Table 2 summarizes these results with respect to the ages. Figures 6 and 7 are presented to expose the impact of stochastic approach on the valuation compared to the deterministic case. The variance of the actuarial present value is observed to be low for young and very old ages, however, high between ages 50 and 90 in both cases.

Based on the proposed approach, we conclude that the stochastic modeling of interest rates yields higher actuarial present values and variances for both deterministic and stocastic mortality approaches. Even though the maximum volatility is around \(15\%\) compared to the deterministic one, stochastic interest model results in more conservative approach in handling the risk which will result in higher premium rates. This may be a discouraging temptation in marketing life insurance products, however, it reduces the adverse selection.

As the life insurance products are long-term investments for both insurer and insured, the deterministic assumptions will not be realistic, especially considering the longevity risk and non-stationary financial markets. This study enables researchers and insurance experts to quantify the risk to be taken if the actuarial valuation is done under stochastic framework and to estimate the impact of volatility in the valuation of life insurance products with respect to financial markets. As future work, the reaction to the maket for an emerging market can be investigated and compared with the developed country case.

References

Boyle, P.P.: Rates of return as random variables. J. Risk Insur. 43(4), 693–713 (1976)

Panjer, H.H., Bellhause, D.R.: Stochastic modeling of interest rates with applications to life contingencies. J. Risk Insur. 47, 91–110 (1980)

Bellhouse, D.R., Panjer, H.: Stochastic modeling of interest rates with applications to life contingencies, Part II. J. Risk Insur. 48, 628–637 (1981)

Giacotto, C.: Stochastic modeling of interest rates: actuarial versus equilibrium approach. J. Risk Insur. 53, 435–453 (1986)

Dhaene, J.: Stochastic interest rates and autoregressive integrated moving average processes. ASTIN bull. 19(2), 131–138 (1989)

Frees, E.W.: Net premiums in stochastic life contingencies. Trans. Soc. Actuar. 40(1), 371–385 (1988)

Frees, E.W.: Stochastic life contingencies with solvency considerations. Trans. Soc. Actuar. 42, 91–148 (1990)

Parker, G.: Moments of the present value of a portfolio of policies. Scand. Actuar. J. 1, 53–67 (1994)

Lai, S.-W., Frees, E.W.: Examining changes in reserves using stochastic interest models. J. Risk Insur. 6(3), 535–574 (1995)

Zaks, A.: Annuities under random rates of interest. Ins. Math. Econ. 28, 1–11 (2000)

Debicka, J.: Moments of the cash value of future payment streams arising from life insurance contracts. Ins. Math. Econ. 33(3), 533–550 (2003)

Merton, R.C.: Theory of rational option pricing. Bell J. Econ. Manag. Sci. 4, 141–183 (1973)

Vasicek, O.: An equilibrium characterization of the term structure. J. Financ. Econ. 5, 177–188 (1977)

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theory of the term structure of interest rates. Econometrica 53, 385–407 (1985)

Engle, R.F.: Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50, 987–1007 (1982)

Bollerslev, T.: Generalized autoregressive conditional heteroskedasticity. J. Econom. 31, 307–327 (1986)

Nelson, D.B.: Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59, 347–370 (1991)

Ergökmen, N.G.: Stochastic modeling of random interest rates in life insurance. Unpublished M.Sc, Thesis, Middle East Technical University, Turkey (2001)

Market yield on U.S. Treasury securities. http://www.federalreserve.gov/releases/h15/data.htm

Box, G.E.P., Jenkins, G.M.: Time Series Analysis, Forecasting and Control, 2nd edn. Holden-Day, San Francisco (1976)

Said, D.E., Dickey, D.A.: Testing for unit roots in autoregressive moving average models of unknown order. Biometrika 71, 599–607 (1984)

Lee, R.D., Carter, L.R.: Modeling and forecasting US mortality. J. Am. Stat. Assoc. 87(419), 659–671 (1992)

http://www.mortality.org/cgi-bin/hmd/country.php?cntr=USA&level=1

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Yıldırım, B., Selcuk-Kestel, A.S., Coşkun-Ergökmen, N.G. (2017). Actuarial Present Value and Variance for Changing Mortality and Stochastic Interest Rates. In: Pinto, A., Zilberman, D. (eds) Modeling, Dynamics, Optimization and Bioeconomics II. DGS 2014. Springer Proceedings in Mathematics & Statistics, vol 195. Springer, Cham. https://doi.org/10.1007/978-3-319-55236-1_24

Download citation

DOI: https://doi.org/10.1007/978-3-319-55236-1_24

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-55235-4

Online ISBN: 978-3-319-55236-1

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)