Abstract

The bioeconomy utilizes living organisms and processes them to produce of food, fuel, fine chemicals, and other substances. Macroalgae (seaweed) are promising feedstocks for energy and chemical products while sequestering carbon. A few species are already used as food products or supplements. There is a need for methodologies for economic and policy analysis of novel bioeconomy technologies, taking into account environmental side effects and physical and economic uncertainties. Farmers growing cellulosic energy crops face significant revenue uncertainty due to both production and price uncertainties. The literature reports a wide range of growth rates for macroalgae and the few business case studies show mixed results in terms of production frontier and profitability considerations. This paper contributes to existing literature on ex-ante assessment of algae-based biofuel production. The study points at both the scientific and economic challenges that require multidisciplinary effort to develop viable technologies, cost-effective harvesting equipment/techniques and processing facilities, and supporting infrastructure, as well as to, create the markets for novel, sustainably produced goods.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The bioeconomy provides a possible solution for the demand to natural resources by substitution of the unrenewable resources with resources derived from biomass [13]. The bioeconomy consists of complex supply chains that include biomass production, transportation, conversion into products at biorefineries, and distribution. One of the major challenges is developing economic decision-making tools to assess novel biotechnologies that incorporate the complex multi-level systems including environmental implications and uncertainties about feedstock production, refining technologies, markets, and policies.

Alternative biomass supply can come from micro- and macroalgae. Microalgae have been the focus of intense research in the last 50 years. However, cost-effective cultivation, harvesting and dehydration difficulties currently prevent broad scale, sustainable microalgae technologies implementation [22]. Marine macroalgae, also ranked among the most efficient photosynthetic organisms on earth, bear valuable chemical compounds [17]. In a parallel vein, in the recent years, macroalgae have been considered a “third or even fourth generation” biofuel feedstock [34].

The rapidly developing technology for cultivating and refining Macroalgae (mainly red, green and brown algae – seaweed groups) draw the attention of biologists (e.g. [24]) and bioengineers (e.g. [8, 20, 36, 52]). Macroalgae, which contain very little lignin and do not compete with food crops for arable land or potable water, have stimulated renewed interest as additional candidates for future sustainable food, platform chemicals and fuel (biofuel) feedstocks.

However, to date macroalgae still account for only a tiny percent of the global biomass supply with \(\sim 17\times 10^6\) wet weight (WW) ton of macroalgae in comparison to \(16\times 10^{11}\) tons of terrestrial crops, grasses and forests [42, 43, 46].

Concerns over net energy balance, potable water use, environmental hazards, and processing technologies call into question the potential for terrestrial biomass such as cereals crops and lignocellulose biomass to provide efficient sustainable answers to future food and energy challenges [19].

At the same time, an expanding body of evidence has demonstrated that marine macroalgae can provide a sustainable alternative source of biomass for food, feeds, fuel and chemicals generation [3, 33, 57, 58]. Lehahn et al. [34] identified the “potential reserves” analogue of near offshore macroalgae for biofuels. Their calculation suggests that near-future technologically and economically deployable areas, associated with up to 100 m water depth, and 400 Km distance from the shore, can provide \(10^{9}\) dry weight (DW) ton per year, which is equivalent to 18 EJFootnote 1 of energy.

There are several properties of macroalgae, which make them attractive feedstock for biofuels and high value chemicals (Table 1). First, macroalgae grow faster than terrestrial plants [8, 18, 27]. Second, macroalgae do not occupy arable land and do not consume fresh water [16], if cultivated offshore; thus they do not compete with traditional food agriculture [10, 21]. Third, macroalgae normally contain no or less lignin, eliminating the energy intensive lignin removal step in pre-treatment processes [4, 9]. The high carbohydrate content of macroalgae also makes them suitable for bioconversion into platform chemicals and biofuels molecules such as methane [36], hydrogen [47], syngas [52], ethanol [27], n-butanol [44], 2,3-butanadiol [37], etc.

Yet, the economic analyses of macroalgae as energy feedstock are scarce [20, 30]. Roesijadi et al. [46] highlighted the need for advances throughout the supply chain, and called for a detailed assessment of environmental resources, cultivation and harvesting technology, conversion to fuels and high value chemicals, connectivity with existing energy supply chains, and the associated economic and life cycle analyses in order to facilitate evaluation of this potentially important biomass resource. Moreover, no decision making frameworks addressing the economic challenges of introducing and commercializing these technologies are identified in the literature. The literature suggests that more quantitative understanding of the economics is essential for the development of the industry [28, 49]. The aim of this study is to investigate macroalgae utilization practices in present, and to characterize the key challenges for profitable macroalgae-based industry in the future. The study investigates the opportunities, advantages, limitations and other issues encountered to this emerging industry. The paper is structured as follows. In the next section macroalgal biomass as potential natural resource for a variety of outputs is presented. Section 3 compares five representative research studies to illustrate current state of the art of the macroalgae technological feasibility. Stylized profitability analysis is presented in Sect. 4. To conclude the paper, the key challenges of macroalgae utilization are discussed in Sect. 5.

2 Macroalgae Industry

Macroalgae have been harvested throughout the world as a food source and as a commodity for the production of hydrocolloids for centuries. Increasingly, seaweed is cultivated rather than collected from the wild. According to FAO statistics, the share of wild seaweed in global seaweed production fell from 28% in 1980 to 4.5% in 2010. This declining share reflects both the increased volume of cultivated seaweed and an absolute decrease in wild seaweed tonnage [56]. Currently the industry of macroalgae cultivation is mainly concentrated in Asia [24].

2.1 Seaweed Chemical Composition

Chemical composition of macroalgae species is significantly different from terrestrial plants (Table 2). They include lower contents of carbon, hydrogen, and oxygen and higher contents of nitrogen and sulfur than that of land-based, lignocellulosic biomass. Macroalgae nearly absent lignin [30], as opposed to \(\sim 16\)% lignin in the case of corn stover [20]. And, the seaweed grows more rapidly than terrestrial crops due to higher efficiency of photosynthesis.

These characteristics of macroalgae have economic implications on both private and external costs and benefits of macroalgae-based feedstock utilization.

2.2 Energy

Over the years, many researchers have examined biofuel production from various types of macroalgae. Conversion factors of green seaweed to energy products, as reported in the literature, are summarized in Table 3.

Importantly, macro alga is a promising source for renewable energy production since it can fix the greenhouse gas (CO2) by photosynthesis [8]. The average photosynthetic efficiency is about 5% [2] - much higher than that of terrestrial biomass (1.8-2.2). Dissolved inorganic nutrients like nitrogen, phosphorous and carbon are taken up by macroalgae, helping to alleviate eutrophication in seas and oceans [17].

2.3 Food and Proteins

Apart from biofuel, macroalgae have a potential for additional end uses [20]. Macroalgae can be used to co-produce food and high value chemicalsFootnote 2 (Table 4). Hochman and Zilberman [23] report that the food industry of macroalgae is estimated to generate $5 billion a year, a further $600 million is estimated to have been generated from hydrocolloids extracted from the cell wall of the macroalgae at an average value of about $10,900 a ton.

Protein market is assessed as $100B with a growing rate of 4.5%. From it protein feed market is about $70B and growing 5% per year (Table 3). The protein food ingredients market is $18B, while in the USA alone it is $4.5B with a growing rate of 8–9%. Plant protein ingredient marker is assessed globally at $5.4B, with $2B in the USA and a growing rate of 8%. The main factors for plant protein market growth are industrial farming (20% growth in 5 years in USA), population growth 1.3%, increasing nutritional and food safety requirements, and consumers’ health-consciousness. An increase of 29% in high protein products was reported (DuPont, USDA, Martec, Euromonitor). Moreover, protein from macroalgae can supplement the soybean. Today, owing to its high protein content, the soybean is probably the single most important protein crop in the world. From 2005 to 2010 soy USA protein market doubled. The demand for plant proteins is expected to continue to grow and so the environmental pressure due to the industrial agriculture and growing vegetarian population. In 2005 the vegetarian food market reached $1.2B sales in the US alone. Meat substitutes sales reached $326M in the US and $2B in Europe at the end of 2009.

The use of macroalgae as a potential source of high value chemicals and in the rapeutic purpose has engrossed its commercial interest on macroalgae. For example, the most diversely used macroalgae derivative with substantial worldwide sales is Agar. The highest-value derivative of agar is called agarose and is used in a microbiological genetic-engineering application. Furthermore, macroalgae have shown to provide a rich source of natural bioactive compounds with antiviral, antifungal, antibacterial, antioxidant, anti-inflammatory, hypercholesterolemia and hypolipidemic and anti-neoplasteic properties [51].

Another example is Carrageenan - a gelling agent extracted from red seaweeds. It can be used as an emulsifier, a binder, or for suspension and stabilization in a remarkably wide range of products in the food processing, pharmaceutical and cosmetic industries. As an approved food additive, carrageenan is used worldwide to enhance dairy and meat products; it also has a variety of applications ranging from toothpaste to pet food. According to FAO statistics, world carrageenan seaweed farming production increased from less than 1 million wet tonnes in 2000 to 5.6 million wet tonnes in 2010, with the corresponding farmgate value increasing from USD72 million to USD1.4 billion [56].Footnote 3

In the next section we present the schematic structure of off-shore macroalgae cultivation and biorefinery, in order to define key drivers for the profitable production process.

2.4 Production Structure of Macroalgae

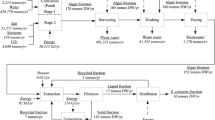

Macroalgae based production consists of several processes, each may be affected by a specific technology or input. Figure 1 schematically outlines the key milestones of macroalgae to biochemicals’ production. Cultivation, harvest and transportation are plant based decisions, whereas pretreatment and conversion are subject to refining technology.

Anaerobic digestion, fermentation, transesterification, liquefaction and pyrolysis can convert algal biomass into proteins and sugars that can result into food, chemicals and biofuels. At each stage of the production process the investor should decide between various options that ultimately affect the irreversible (sunk) and variable costs of the production, the productivity, and the output, therefore affecting the total profitability. The configuration of baseline production characteristics should be defined according to available resources and best technologies (e.g. [25, 30, 56]. In addition to the production cost, the value of seaweed products when reaching end users may also reflect the expenses on research and development (R&D), formulation, marketing, etc. [56]. Specific information on these aspects is generally lacking.Footnote 4

3 Case-Studies of Macroalgae Feasibility Analysis

In order to illustrate current state of the art of the macroalgae technological feasibility we compare five recent representative research studies summarized in Table 5. Cases I and II focus on techno-economic (TEA) analysis of cultivation of macroalgae, Case III provides a TEA of the biorefinery for macroalagae-based biofuels, Case IV focuses on the cost-benefit analysis (CBA) of an experiment-based cultivation of macroalgae as well as the biorefinery for macroalagae-based biofuels, while Case V presents the life cycle analysis (LCA) of the system that includes cultivation and processing.

Case I – TEA Cultivation [11]

This report, prepared in the framework of the European project EnAlgae, attempts to supply a transparent cost - revenue estimation for Laminaria digitate (brown seaweed) cultivation in North Western Europe (UK, Ireland, France and the Netherlands). The cultivation process is split up in the cultivation of plant material (culture strings with juvenile sporophytes) in a hatchery for 3–5 months and the on-sea production of seaweed biomass, where after growing out for 5–6 months the biomass is harvested in the spring. The detailed cost break includes among others sea aquaculture license. The study reaches a rather high price for macroalgae at the aquafarm gate required to cover production costs.

Case II – Cultivation [56]

This report, prepared for FAO, performs a cost-benefit analysis of carrageenan seaweed farming in four developing countries, accounting for about 90% of world cultivation of carrageenan seaweed in 2010: Indonesia, the Philippines, Solomon Islands, and the United Republic of Tanzania. It presents data on costs and revenues from actual cultivation of Kappaphycus and Eucheuma (red seaweed species) and supply chains in place. The cultivation is observed most of the year with 4 to 8 cycles of 45 days. Even though most of the 23 case studies revealed profitability, defining conditions for profitable production proved difficult. No distinct patterns in the productivity of different farming systems are detected, neither in terms of production per unit of cultivation line, nor in terms of production per unit of farming area. The authors claim that the direct comparison of the productivity of two farming systems may reflect mostly the differences in their farm locations (e.g. temperature, weather condition, and water quality) that affect the growth rate of seaweed and the number of growing cycles (as two primary factors determining the productivity).

Case III – TEA of Biorefinery [30]

The research presents a TEA of a simulated macroalgae biorefinery for fermentation-derived sugars, and specifically ethanol with co-production of alginate. This study does not assess the cultivation process. Instead, it assumes (rather low) feedstock price of $50–100/MT of DW for brown seaweed Saccharina latissima. The laboratory-based conversion technology is scaled-up to simulate the fermentation-derived products from macroalgae at an industrial-scale facility with 2000 MT/day dry biomass processing capacity. The cost structure is largely based on the study by the National Renewable Energy Laboratory (NREL) on the production of ethanol from corn stover [25], modified for the processing of macroalgae and its products. Results suggest the minimum ethanol selling price (MESP) in the range of $3.6–8.5/gal. For production of chemicals, sugar prices were in the range of 21–47/lb or 16–40/lb with macroalgae priced at $100/MT and $50/MT, respectively.

Case IV – CBA of Cultivation and Biorefinery [31, 32]

This study performs a CBA for bioethanol production using biomass of Ulva rigida (green seaweed species), co-cultured with fish in an intensive offshore aquaculture unit. This report takes into consideration offshore seaweed cultivation during summer and uses an ethanol production technology that is devoid of pre-treatments. Co-production of ethanol and Dried Distillers Grains with Solubles (DDGS) is considered. Growth yields in the off shore experiments in Israel are extrapolated to project large-scale production volumes. The economic analysis is performed using costs from studies by NREL [25]. The costs associated with the by-product sub-process are based on figures of dry-grind corn processing. For profit calculation, the study assumes prices for ethanol and DDGS according to the U.S. Department of Agriculture (USDA), (79/dry ton of U. rigida. and -630/dry ton of U. rigida respectively) and asks what production volume reaches profitability. The authors claim that only large scale production shows economic viability.

Case V - LCA of Cultivation and Biorefinery [48]

The study performs a comparative life cycle assessment of the offshore seaweed cultivation for the production of biorefinery feedstock. The biomass is converted into three products: bioethanol, liquid fertilizer and protein-rich ingredient for fish feed. The system represents Danish conditions with Laminaria digitata (brown seaweed species) average productivity of 10 Mg WW/ha and harvested in summer. There are no costs reported, but the authors adapt the design of cornstover bioethanol production by NREL [25] to model energy consumption in the industrial scale seaweed based biorefinery with bioethanol production using separate hydrolysis and fermentation. The results of this study show that the base case provides a net reduction in climate change factors. However, for the base case the research reports an increase in human toxicity that is seven times greater than the system can deal. The study indicates that the hotspot in the value chain is the biomass productivity.

Table 5 synthesizes the representative studies from developed and developing countries that employ different cultivation and conversion technologies, and allows to draw several general conclusions:

-

1.

Not all macroalgae are the same: Various macroalgae species (different colors) allow for different outputs. A critical decision in the offshore biomass production for biofuels is the species choice [17]. For example, different macroalgal species could be chosen for their production of low-cost fuel in combination with high value compounds and/or bioremediation applications, where an excess of nutrients can be converted in biomass for harvest and economic goods. Thus the entrepreneur needs first to decide what outputs to produce and then what seaweed species to use as feedstock.

-

2.

Feedstock production uncertainties: Even though production uncertainties are inherent in agriculture, farmers growing cellulosic energy crops face significant revenue uncertainty. Important constrains include light, temperature, nutrients, current velocity, and also the capability to resist the harsh conditions such as high waves and extreme currents in offshore waters. Nitrogen has often been indicated as the primary limiting factor for seaweed growth; however, phosphorus may also limit production in some systems [17]. Other environmental factors negatively affecting the performance of seaweed farming include grazing by fish or other organisms and rising sea temperatures, which could slow seaweed growth [26]. Literature reports a wide range of growth rates for macroalgae. In the FAO study (Case II) the growth rate varies between 0.2 to 10.86% per day for red seaweed, while Korzen et al. [31, 32] (Case IV) reach 15% of average daily growth for green seaweed.

-

3.

Processing technology uncertainties: The biorefinery yields present a wide range as well. The upper value can be ten times larger than the lower one (Tables 2 and 5), significantly affecting the potential profitability of the process.

-

4.

Variability of DW/WW ratio: Dry weight to wet (fresh) weight ratio of macroalgae is another parameter which values vary significantly (from 1/9 to 1/3, Table 5).

-

5.

Price uncertainties: should be analyzed in several aspects – price uncertainties that faces the farmer, price uncertainties of feedstock for biorefinery, and the price uncertainty of competitive outputs (backstop technology). A seaweed industry that contains many small-scale pricetakers is especially prone to boom-bust cycles. For example, the strong demand from China drove the price of dry cottonii in the Philippines from USD900/tonne in 2007 to almost USD3 000/tonne in 2008 causing the Philippines production to double from 1.5 million tonnes (wet weight) in 2007 to 3.3 million tonnes in 2008. The “seaweed rush” lasted only one year – the price dropped to USD1 300/tonne in 2009 [26]. Generally, when strong demand for dry seaweeds drives up the price, seaweed farmers tend to increase their planting efforts and/or harvest immature crops. However, if the price is low, seaweed farmers tend to reduce production, which creates sourcing difficulties for the local processors. On the other hand, processors would tend to reduce demand as prices rise by substituting cheaper alternatives [38]. A likely result would then be supply exceeding demand and consequently a collapse in price.

-

6.

The price and cost assumptions in the academic literature should be treated cautiously and verified against actual data, as prices vary over time and may experience sudden picks or drops. For instance, actual or assumed price to farmer in Table 5 varies from $50/MT of DW to $10,000/MT.

-

7.

Production functions: The studies’ effort to evaluate future costs of the process that is currently available mostly in small (lab) scale is remarkable and should not be underestimated. However, the studies mostly lack (or do not report) a structured production function that leads to a cost function. The common assumption is a linear approximation.

-

8.

Single cost sources: All the studies that assessed biorefinery used the conveniently available calculation module on large-scale ethanol production from cornstove by NREL [25]. Indeed, the popularity of this research signals that more up-to-date studies with a transparent open-source tool would increase our understanding of the economic viability of the novel biorefinery technologies.

-

9.

Developed versus developing: In contrast to aquaculture in the developed countries, carrageenan seaweed farming in Asia has minimum capital and technological requirements and, as such, produces feedstock at competitive prices.

-

10.

Supply chain: there are established supply chains for seaweed used for food production [56]. Supply chains for biorefinery processing are still to be developed. Contract uncertainties may occur due to asymmetric information [12]. That is, the innovator may not observe the ability of and effort being devoted by the contracted supplier.

-

11.

Value of environmental amenities: Even though intuitively macroalgae based biofuel is cleaner than fossil fuels, the environmental advantages still require more investigation. Seaweeds could improve the benthic ecosystem, and sequester carbon, thereby offering the potential for carbon credits. Seaweed grown on rafts can also become an attractive haven for fish. Other positive environmental externalities of seaweed farming include an alleged positive attitude towards conservation of local marine habitats, and some evidence that overexploitation of the fisheries has been reduced in some countries, because farmers have less time or inclination to fish. However, negative externalities should not be overlooked. For instance, disease is a major problem in the cultivation process, which not only discourages farmers but also contributes to supply uncertainty for processors. Ice-ice disease is a common disease that affects carrageenan seaweed farming worldwide. Primarily because of perennial ice-ice outbreaks, cottonii cultivation in Zanzibar (the United Republic of Tanzania) declined from over 1000 tonnes in 2001 to almost zero in 2008 [56]. In addition, introduced seaweed that do not become viable culture species could turn into an environmental nuisance [41].

4 Profitability of Macroalgae Cultivation

In order to demonstrate the general conclusions outlined in Sect. 3 above, we provide the profitability analysis for Case II – cultivation and food production (carrageenan) in major macroalgae farming countries and compare the results with the economic indicators of the seaweed cultivation in Europe – Case I.

4.1 The Analytical Framework

The economic performance of seaweed farming is determined by its economic costs and benefits. The main economic costs include capital, material inputs and labour. The economic benefits can be measured by the revenue and cash flow generated by seaweed production. Profit is an indicator of the net benefit, which measures trade-offs between benefits and costs. Various performance indicators (e.g. productivity, efficiency and profitability) are used to compare the economic costs and benefits.

In order to determine the economic feasibility of macroalgae -based production process, an assessment of Net Present Value (NPV) using operational revenues and costs, as well as capital costs, which are all linked to varying production volumes, is performed.

Let all expenses at point t be denoted with C(t) and all returns with B(t). An investment into macroalgae utilization process is profitable if it provides a positive NPV, meaning the discounted sum of expenses and returns is positive:

where \(q^{-t} =(1+i)^{-t}\) is the discount factor, i is the annual rate of return. At the breakeven point (zero profit condition), total costs should be equal to total revenues. In terms of Eq. (1) it means:

Minimal selling price (MSP) or breakeven sale price is an additional economic indicator that represents the zero-profit threshold i.e. the price that covers the costs per unit of production. It is estimated as the annual cost of capital per unit of production plus the variable cost per unit. In Sect. 4.2 we use the economic tools to characterize the profitability conditions of different case studies.

4.2 Profitability of Carrageenan Seaweed

What can we learn from existing seaweed cultivation practices? In order to answer this question, we analyze the data from 13 case studies from largest carrageenan seaweed farming countries: The Philippines, Indonesia, Tanzania and Solomon Islands. The four case-study countries accounted for about 90% of world cultivation of carrageenan seaweed in 2010 [56]. Common characteristics of red algae cultivation in these developing countries are summarized in Table 6. The cultivation of fresh seaweed is usually conducted by a number of small-scale, independent seaweed growers. Various cultivation practices are in place and can be typed into: off-bottom, floating ramp and floating line. The lifespan of cultivation farm commonly lasts from 2 to 5 years. Fresh seaweeds decompose quickly after harvest. Sun-drying remains the main (if not the only) option in practice. The industry standard for the maximum moisture content of dry cottonii is 38–40%. Post-harvest treatment is usually done by seaweed growers.

The physical capital needed for carrageenan seaweed farming usually includes farming systems, vessels, shelters, drying facilities, and miscellaneous equipment or tools. Figure 2 presents capital efficiency measured in terms of initial investment in US$ per km of cultivation line and yield reported in each of the case studies as annual productivity of cultivation line in tonne of DW per km.

Evidently, more capital does not insure a higher yield. Based on the case studies from developing countries, Fig. 2 provides a rough approximation for marginal productivity of capital reflecting its diminishing nature. The capital investment per km of cultivation line is lower in case studies with higher production. Similarly, no cultivation technique (off-bottom, floating raft or line, etc.) is observed to be the most efficient. Possible explanation is that in addition to capital and cultivation technique there are other major growth affecting factors, such as seasonality and inclement weather. Nevertheless, we are in early stages of investigation of the technology and much more information is needed to reach solid conclusions.

Figure 3 presents the breakeven price equivalent to MSP and defined in Eq. (2), and the annual productivity per km of cultivation line. Higher break-even price is addressed to more sophisticated and/or commercialized farms. In this case the breakeven price is the minimal farm gate price for profitable cultivation. Accordingly, the trend line is a stylized profitability frontier indicating of the lower limit for market prices for unprocessed seaweed. All the case studies in the developing countries had positive profits (Fig. 4), ranging from USD89 per tonne of dried seaweed to USD842/tonne. Macroalgae price is the key factor affecting profit. The profit margin (i.e. the ratio of profit to farm revenue) of most of the cases exceeded 50%.

To compare, the yield reported in the Case I – EnAlgae project for the North Western Europe [11], is within the middle of the range of the Case II studies (Fig. 5). However, the break-even price, as we calculated based on the EnAlgae project, is on average 10 times higher than the annual costs in the case studies collected in the developing countries. Given cost differences, developing countries may be able to sustain algae production systems with lower yields.

The difference in costs is explained by a short production cycle, low capital requirement, and relatively simple farming technology in developing countries (Case II) versus the North-Western Europe (Case I). Macroalgae cultivation and post-harvest treatment as reported for North-Western Europe are labour – intensive activities entailing relatively high amounts of initial capital and laboratory costs.

5 Summary and Discussion

In this work we discuss the economic opportunities and challenges of macroalgae utilization. The study outlines the state of the art of technological and economic abilities of macroalgae cultivation and conversion. The focus on macroalgae is driven by the fact that being cultivated off-shore, they do not compete for scarce land and potable water. In addition, recent developments in bio-refinery show the potential to produce not only food and coloring, but also sugars for biofuels, proteins, and high value chemicals. Evidently, carrageenan seaweed farming, has evolved into a successful commercial endeavor in a number of tropical countries endowed with clear, unpolluted intertidal environments and protected beach locations.

Nevertheless, several major challenges should be taken into consideration for successful macroalgae economy. First, the rate of macroalgae growth and the conversion factors – two key parameters in productivity- show a wide range of values and therefore have a major effect on cost effectiveness of the technology. Macroalgae growth depends on saturation kinetics by light intensity, ambient dissolved inorganic nutrient concentrations and temperature [7]. Cultivation uncertainty is exacerbated by stochastic weather, seasonal variability between regions, within years and between years. The biomass productivity is the main constraint against being competitive with other energy and protein producing technologies [48].

Previous studies suggested to combine macroalgae cultivation with other sea related economic activities [5, 6, 29, 31, 32, 39]. Co-management with other offshore systems like wind farms and fisheries to increase economic and environmental benefits, and to diversify the revenue sources should be considered.

Another way to diversify revenue is the co-production in the stage of feedstock conversion (to e.g. biofuels and food). The variation in shares of co-products between, for example, butanol-acetone, ethanol and methane as well as protein, may affect substantially the net benefits of the production process. More research on the key aspects of co-production that leads to increased profitability of biorefinery is crucial.

Next, investments in macroalgae utilization are risky not only due to the uncertainty in feedstock cultivation, but also in processing technology, contracting, and demand. Considering uncertainty is most pertinent when a new processing technology, such as new biofuel refining technology, is invented. Design of a sustainable biorefinery, which will generate sustainable food, fuels and chemicals is a complex task and is largely influenced by local raw material supplies, advances in multiple technologies and socio-economic conditions [15]. In addition, comprehensive scientific studies on the question whether the novel bio-refinery can increase the yield by the order of 10 in a rigid manner to assure profitable process should be undertaken.

Decisions about the scale of operation and the division of supply of inputs between in-house and external operations are key in the design of a basic supply chain [12]. These decisions are affected by the investors financial situation, the political and social system, the technology available, etc. The strategy about the capacity of feedstock plant as well as the refinery may change over time; the innovator may experiment by starting at small scale. Once the production system is established, the innovator may either expand operations or reach out to cooperatives to provide it with inputs. Therefore, more research on economies of scale in macroalgae cultivation and refinery is crucial for industry establishing.

Investments in production capacity or consumption infrastructure are also susceptible to market uncertainties from, for example, fluctuations in energy prices [45] and demand uncertainty that is often associated with new product introduction. Similarly to traditional crops, the price paid to seaweed farmers is determined in part by the complexity of the supply chain and partly by the quality of the macroalgae. But, crops destined for conversion into bio-fuels have prices determined in large part by the ethanol market, which is linked to the volatile gasoline market [54].

Energy crop price volatility is likely to be aggravated as ethanol shifts in and out of status as a cost-effective fuel substitute for gasoline, based on the relative prices of petroleum and corn grain, the leading current ethanol feedstock in the United States. More investigation on the impact of output price variability on technology adoption decisions is essential.

Price volatility is also compounded by the absence of relevant, reliable and timely production statistics and market intelligence. Unlike for some agricultural commodities such as coffee or tea, there are no organized markets to provide benchmarking international prices for seaweed [53]. Unavailability of reliable information is especially detrimental to uninformed seaweed farmers who are at the lowest end of the seaweed value chain and often forced to accept whatever price is offered.

Moreover, it is essential to identify the fuel that may provide higher value than the ethanol, as of now, maclaogae-based bioethanol cannot compete corn-ethanol or sugar cane based ethanol. To generalize, rather than competing with existing goods, the scientific challenge can be the investigation of the potential to utilize macroalgae for unique foods, high value chemicals and fuels.

Besides, the transparency and multidisciplinary interaction will increase the learning curve and will make macroalgae production more structured and efficient. Alternative specifications for biorefinery and cultivation processes in a transparent way would allow replication and induce the improvement of methodologies. The multidisciplinary effort is required for improving the knowledge of production and cost functions to lead to establishing of economic models.

Not less important is the uninvestigated effect the mass cultivation of offshore macroalgae might have on the environment. On the one hand, the transition from small to big scale macroalgae cultivation involves direct and external effects that may completely reshape the process. On the other hand, if macroalgae-based biofuel crowds-out the use of fossil fuels and crop-based bioethanol, it mediates the environmental externalities, as well as negative effects on agricultural supply and land use [60]. Further analysis on macroalgae external costs and benefits is required for an accurate policy intervention. The analysis on the technological prospects of macroalgae biorefinery should evaluate the social net benefit too. Consequently, the recommendation upon optimal fuel mix is to be based on social (vs. private) costs.

Notes

- 1.

Exajoule.

- 2.

Carrageenan, mannitol, agar, laminarin, mannan, ulvan, fucoidin, and alginate, carbohydrates, (mannitol has a lower calorific value, and has been found to be effective as a sweetener in various food product and pharmaceutics). Extracted algin quickly absorbs water (200–300times its own weight) and thus is effective as an additive in dehydrated products, as well as the paper and textile industries. It has also found use as a food thickener and stabilizer.

- 3.

Valderrama et al. [56] present an overview of trade trends of carrageenan in the 2000s.

- 4.

References

Abudabos, A.M., et al.: Nutritional value of green seaweed (Ulva lactuca) for broiler chickens. Italian J. Animal Sci. 12(28) (2013)

Aresta, M., Dibenedetto, A., Carone, M., Colonna, T., Fragale, C.: Production of biodiesel from macroalgae by supercritical CO2 extraction and thermochemical liquefaction. Environ. Chem. Lett. 3(3), 136–139 (2005)

Bruhn, A., Dahl, J., Nielsen, H.B., Nikolaisen, L., Rasmussen, M.B., Markager, S., Olesen, B., Arias, C., Jensen, P.D.: Bioenergy potential of Ulva lactuca: biomass yield, methane production and combustion. Bioresour. Technol. 102(3), 2595–2604 (2011)

Bruton, T., Lyons, H., Lerat, Y., Stanley, M., BoRasmussen, M.: A review of the potential of marine algae as a source of biofuel in Ireland. (Sustainable Energy Ireland) (2009)

Buck, B., Krause, G., Michler-Cieluch, T., Brenner, M., Buchholz, C., Busch, J., Fisch, R., Geisen, M., Zielinski, O.: Meeting the quest for spatial efficiency: progress and prospects of extensive aquaculture within offshore wind farms. Helgoland Mar. Research 62, 269–281 (2008)

Buck, B.H., Krause, G., Michler-Cieluch, T., Brenner, M., Buchholz, C.M., Busch, J., et al.: Meeting the quest for spatial efficiency: progress and prospects of extensive aquaculture within offshore wind farms. Helgoland Mar. Research 62, 269–281 (2008)

Buschmann, A., Varela, D., Cifuentes, M., Hernndez-Gonzlez, M., Henrquez, L., Westermeier, R., Correa, J.: Experimental indoor cultivation of the carrageenophytic red alga Gigartina skottsbergii. Aquaculture 241, 357–370 (2004)

Chen, H., Zhou, D., Luo, G., Zhang, S., Chen, J.: Macroalgae for biofuels production: progress and perspectives. Renew. Sustain. Energy Rev. 47, 427–437 (2015)

Cho, Y., Kim, M., Kim, S.: Ethanol production from seaweed, enteromorpha intestinalis, by sepa-rate hydrolysis and fermentation (SHF) and simultaneous saccharifi- cation and fermentation (SSF) with saccharomyces cerevisiae. KSBB J. 28, 366–371 (2013)

Daroch, M., Geng, S., Wang, G.: Recent advances in liquid biofuel production from algal feedstocks. Appl. Energy 102, 1371–1381 (2013)

van Dijk, W., van der Schoot, J.R.: An Economic Model for Offshore Cultivation of Macroalgae. Public output report of the EnAlgae project, Swansea (2015)

Du, Xiaoxue, Liang Lu, Thomas Reardon, David Zilberman.: The Economics of Agricultural Supply Chain Design: A Portfolio Selection Approach. Am. J. Agr. Econ. 98 (5): 1377–1388. DuPont. n.d. Accessed Oct 2016. http://www.dupont.com/

Enriquez, J. 1998.: Genomics and the worlds economy. Science 281: 925-926. EPA. n.d. Accessed Nov 2016. http://www.eia.gov/tools/faqs/faq.cfm?id=74&t=11

Euromonitor. n.d. Time to Explore Algal Bioactives. Accessed Oct 2016. http://blog.euromonitor.com/2013/10/time-to-explore-algal-bioactives.html

Fatih, D.M.: Biorefineries for biofuel upgrading: a critical review. Appl. Energy 86, 151–161 (2009)

Fedoroff, N.V., Battisti, D.S., Beachy, R.N., Cooper, P.J.M., Fischhoff, D.A., Hodges, C.N., Knauf, V.C., et al.: Radically rethinking agriculture for the 21st century. Science 327(5967), 833–834 (2010)

Fernand, F., Israel, A., Skjermo, J., Wichard, T., Timmermans, K.R., Golberg, A.: Offshore macroalgae biomass for bioenergy production: environmental aspects, technological achievements and challenges (in press)

Frost-Christensen, H., Sand-Jensen, K.: The quantum efficiency of photosynthesis in macroalgae and submerged angiosperms. Oecologia 91(3), 377–384 (1992)

Gerbens-Leenes, W., Hoekstra, A.Y., van der Meer, T.H.: The water footprint of bioenergy. Proc. National Acad. Sci. 106(25), 10219–10223 (2009)

Ghadiryanfar, M., Rosentrater, K.A., Keyhani, A., Omid, M.: A review of macroalgae production, with potential applications in biofuels and bioenergy. Renew. Sustain. Energy Rev. 54, 473–481 (2016)

Goh, C.S., Lee, K.T.: A visionary and conceptual macroalgae-based third-generation bioethanol (TGB) biorefinery in Sabah, Malaysia as an underlay for renewable and sustainable development. Renew. Sustain. Energy Rev. 14, 842–848 (2010)

Hannon, M., Gimpel, J., Tran, M., Rasala, B., Mayfield, S.: Biofuels from algae: challenges and potential. Biofuels 1(5), 763–784 (2010)

Hochman, G., Zilberman, D.: Chapter 4 in Plants and Bio Energy. In: McCann, M., Buckeridge, M., Carpita, N. (eds.) Algae Farming and its Bio-products, pp. 49–64. Springer, New York (2014)

Hughes, A.D., Maeve, M.S., Black, K.D., Stanley, M.S.: Biogas from macroalgae: is it time to revisit the idea? Biotechnol. Biofuels 5(1), (2012)

Humbird, D., Davis, R., Tao, L., Kinchin, C., Hsu, D., David, D., Aden, A.: Process design and economics for biochemical conversion of lignocellulosic biomass to ethanol. Natl. Renew. Energy Technol. 275-300 (2011)

Hurtado, A.Q.: Social and economic dimensions of carrageenan seaweed farming in the Philippines. In: Valderrama, D., Cai, J., Hishamunda, N., Ridler, N. (eds.) Social and Economic Dimensions of Carrageenan Seaweed Farming, pp. 91–113. FAO, Rome (2013)

John, R.P., Anisha, G.S., Nampoothiri, K.M., Pandey, A.: Micro and macroalgal biomass: a renewable source for bioethanol. Bioresour. Technol. 102, 186–193 (2011)

Jones, C.S., Mayfield, S.P.: Algae biofuels: versatility for the future of bioenergy. Current Opinion Biotechnol. 23(3), 346–351 (2012)

Jung, K., Lim, S.R., Kim, Y., Park, J.M.: Potentials of macroalgae as feedstocks for biorefinery. Bioresour. Technol. 135, 182–190 (2013). (Pukyong National University)

Konda, N.V.S.N., Murthy, S.S., Simmons, B.A., Klein-Marcuschamer, D.: An investigation on the economic feasibility of macroalgae as a potential feedstock for biorefineries. Bioenergy Research 8, 1046–1056 (2015)

Korzen, L., Yoav, P., Shiri Zemah, S., Mordechai, S., Aharon, G., Avigdor, A., Alvaro, I.: An economic analysis of bioethanol production from the marine macroalga Ulva (Chlorophyta). Technology, vol. 3(2), World Scientific Publishing Co (2015)

Korzen, L., Peled, Y., Shiri Zemah, S., Mordechai, S., Aharon, G.: An economic analysis of bioethanol production from the marine macroalga Ulva (Chlorophyta). Technology, vol.3 (2, 3), pp. 114–118. World Scientific Publishing Co (2015)

Kraan, S.: Mass-cultivation of carbohydrate rich macroalgae, a possible solution for sustainable biofuel production. Mitig. Adapt. Strateg. Global Chang. 18, 27–46 (2013)

Lehahn, Y., Kapilkumar,.N.I., Alexander, G.: Global potential of offshore and shallow waters macroalgal biorefineries to provide for food, chemicals and energy: feasibility and sustainability. Algal Research 17, 150–160 (2016)

Martec. n.d.: http://www.martecgroup.com/expertise/energy/. Accessed Oct 2016

Matsui, J.T., Amano, T., Koike, Y., Saiganji, A., Saito, H.: 2006. Methane Fermentation of Seaweed Biomass. American institute of chemical engineers (2006)

Mazumdar, S., Lee, J., Oh, M.-K.: Microbial production of 2,3 butanediol from seaweed hydrolysate using metabolically engineered Escherichia coli. Bioresour. Technol. 136, 329–336 (2013)

McHugh, D.J.: The Seaweed Industry in the Pacific Islands. ACIAR Working Paper (2006)

Michler-Cieluch, T., Krause, G., Buck, B.H.: Reflections on integrating operation and maintenance activities of offshore wind farms and mariculture. Ocean and Coast. Manag. 52, 57–68 (2009)

Nikolaisen, L., Jensen, P.D., Bech, K.S., Dahl, J., Busk, J., Brdsgaard, T., Rasmussen, M.B.: Energy Production from Marine Biomass (Ulva lactuca). Danish Technological Institute (2011)

Pickering, T., Skelton, P., Sulu, R.: Intentional introductions of commercially harvested alien seaweeds. Botanica Marina 50, 338–350 (2007)

Pimentel, D. (ed.): Global Economic and Environmental Aspects of Biofuels. CRC Press, Boca Raton (2012)

Pimentel, D., Marcia H.P. (eds.): Food, Energy, and Society. CRC Press, Boca Raton (2007)

Potts, T., et al.: The production of butanol from Jamaica bay macro algae. Environ. Prog. Sustain. Energy 31, 29–36 (2012)

Rajagopal, D., Sexton, S., Hochman, G., Zilberman, D.: Recent developments in renewable technologies: R&D investment in advanced biofuels. Annu. Review Resource Econ. 1(1), 1–24 (2009)

Roesijadi, G., Jones, S., Snowden-Swan, L., Zhu, Y.: Macroalgae as a Biomass Feedstock: A Preliminary Analysis. PNNL 19944, Pacific Northwest National Laboratory, Richland (2010)

Sambusiti, C., Bellucci, M., Zabaniotou, A., Beneduce, L., Monlau, F.: Algae as promising feedstocks for fermentative biohydrogen production according to a biorefinery approach: A comprehensive review. Renew. Sustain. Energy Rev. 44, 20–36 (2015)

Seghetta, M., Hou, X., Bastianoni, S., Bjerre, A.-B., Thomsen, M.: Life cycle assessment of macroalgal biorefinery for the production of ethanol, proteins and fertilizers - a step towards a regenerative bioeconomy. J. Clean. Prod. 137, 1158–1169 (2016). doi:10.1016/j.jclepro.2016.07.195

Singh, A., Nigam, P.S., Murphy, J.D.: Mechanism and challenges in commercialisation of algal biofuels. Bioresour. Technol. 102(1), 26–34 (2011)

Song, F., Jinhua, Z., Scott, M.S.: Switching to perennial energy crops under uncertainty and costly reversibility. Am. J. Agric. Econ. 93(3), 768–783 (2011)

Suganya, T., Nagendra Gandhi, N., Renganathan, S.: Production of algal biodiesel from marine macroalgae Enteromorpha compressa by two step process: optimization and kinetic study. Bioresour. Technol. 128, 392–400 (2013)

Suutari, M., Leskinen, E., Fagerstedt, K., Kuparinen, J., Kuuppo, P., Blomster, J.: Macroalgae in biofuel production. Phycol. Research 63(1), 1–18 (2015)

Tinne, M., Preston, G., Tiroba, G.: Development of seaweed marketing and licensing arrangements. Technical report 1, Project ST 98/009: Commercialisation of Seaweed Production in the Solomon Islands (2006)

Tyner, W.E.: The US ethanol and biofuels boom: its origins, current status, and future prospects. BioScience 58(7), 646–653 (2008)

USDA. n.d.: https://naldc.nal.usda.gov/naldc/home.xhtml. Accessed Oct 2016

Valderrama, D., Cai, J., Hishamunda, N., Ridler, N. (eds.): Social and Economic Dimantions of Carrageenan Seaweed Farming. Fisheries and Agriculture Technical paper. FAO, Rome (2013)

van der Wal, H., Sperber, BLHM., Houweling-Tan, B., Bakker, RRC., Brandenburg, W., Lpez-Contreras, AM.: Production of acetone, butanol, and ethanol from biomass of the green seaweed Ulva lactuca.128 (2013)

Wargacki, A.J., Leonard, E., Win, M.N., Regitsky, D.D., Santos, C.N.S., Kim, P.B., Cooper, S.R., Raisner, R.M., Herman, A., Sivitz, A.B.: An engineered microbial platform for direct biofuel production from brown macroalgae. Science 335(6066), 308–313 (2012)

Yantovski, E.I.: The solar energy conversion through seaweed photosynthesis and zero emissions power generation. Surf. Eng. Appl. Electrochem. 44(138), (2008)

Zilberman, D., Rajagopal, D., Kaplan, S.: Effect of biofuel on agricultural supply and land use. In: Khanna, M., Zilberman, D. (eds.) Handbook of Biofuel. Springer, New York

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Palatnik, R.R., Zilberman, D. (2017). Economics of Natural Resource Utilization - the Case of Macroalgae. In: Pinto, A., Zilberman, D. (eds) Modeling, Dynamics, Optimization and Bioeconomics II. DGS 2014. Springer Proceedings in Mathematics & Statistics, vol 195. Springer, Cham. https://doi.org/10.1007/978-3-319-55236-1_1

Download citation

DOI: https://doi.org/10.1007/978-3-319-55236-1_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-55235-4

Online ISBN: 978-3-319-55236-1

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)