Abstract

The general framework for the use of automated valuation models, based on the specific legal and regulatory standards for the valuation of property used as collateral in Germany, is described below. With these requirements in mind, the calculation methods for Market Value and Mortgage Lending Values are examined first. There are three methods available in Germany, which are used as either the principal or a secondary method depending on the type of property being valued. There then follows a summary of the principal databases. Without high quality, reliable and up-to date property data, it would be impossible to produce reliable Market Values and Mortgage Lending Values. How is this information used in automated valuation models and what role do valuers assume in the process? The answers form a further focal point of this discussion.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

An important component in the granting of mortgage loans is the valuation of real estate as loan collateral. It is necessary in order to assess credit risk and to make the conditions of the loan appropriate for the level of risk involved. Very few automated valuation models (AV models) were used in Germany until just a few years ago. This has changed significantly, at least in terms of financing owner-occupied houses and condominium apartments. The majority of these types of residential properties are now valued using such models. Automated valuation models can be seen as software programs comprising three principal components; the central calculation module, a comprehensive database and a matching process. The calculation module is a system of deterministic equations, which reflect the typical valuation methods in the various countries. In Germany, the typical valuation methods are the Depreciated Replacement Cost, Income Capitalisation and Sales Comparison approaches. The second component comprises market and property databases. After entering unique property information, the user obtains specific valuation data from the database, from which the calculation module automatically generates suggested valuations. The importation of valuation data from the market and property databases is made using the property address and selected property characteristics. The important components of the matching and search functions are checking the address and the correlation of comparable prices, rents, capitalisation rates and cost estimates. The principal driving forces for using automated valuation models were the push for rationalisation within financial institutions and the progress made in terms of internet-based services. It is not just the speed and cost savings which have to be addressed, but more importantly, the quality of the valuation results generated. These depend on the proper implementation of valuation methods and the quality of the input data from the databases used for the valuation calculations. Both are critical elements of the explanations below, which are structured as follows. After the introduction, we will address a number of legal and regulatory peculiarities relating to real estate valuation, which need to be considered when granting mortgages in Germany. There then follow a few statistics relating to the size of the market. Section 4 deals with valuation methods used in this country, which in some cases differ significantly from those used in other countries. The Sect. 5 explains the specific databases, which are essential for the generation of valuation data. The principal information sources are the purchase price collections carried out by the land valuation boards (Gutachterausschüsse für Grundstückswerte), which provide land values across the whole of Germany, and the vdpResearch transaction database, which comprises sales information collected through the real estate financing process. Section 6 describes the matching process, i.e. the use of property-related data in automated valuation models. Section 7 comprises the concluding remarks.

2 Valuation for the Granting of Mortgage Loans

Properties are valued for a variety of reasons. In Germany this could be, for example, for determining rateable value for land tax purposes, a Market Value for inheritance tax and capital transfer tax purposes or an Insurance Value for building insurance. This study will refer to the computer-aided valuation of standard residential property (owner-occupied housesFootnote 1 and condominium apartments) for the provision of finance secured by a land charge. It is assumed here that financial institutions will refinance the loans via secured interest-bearing bonds (mortgage bonds—Hypothekenpfandbriefe). This type of refinancing, commonly used in Germany, inevitably places emphasis on the German Pfandbrief Act (Pfandbriefgesetz) and the Regulations for the Determination of Mortgage Lending Value (BelWertV) and the valuation regulations and valuation definitions contained within them, which serve to protect the creditors of financial institutions. For the purposes of mortgage bond cover, financial institutions which refinance via the issue of secured bonds have to ensure that mortgage land charges are limited to a maximum of 60 % of the valuation of the property. The valuation amount therefore determines the Mortgage Lending Value (Beleihungswert). This value is defined in §16 (2) of the German Pfandbrief Act. This provides that ‘The Mortgage Lending Value must not exceed the value resulting from a prudent assessment of the future marketability of a property by taking into account the long-term, sustainable aspects of the property, the normal regional market conditions as well as the current and possible alternative uses. Speculative elements must not be taken into consideration. The Mortgage Lending Value must not exceed the Market Value calculated in a transparent manner and in accordance with a recognised valuation method.’ The definition raises two issues. Firstly, the Mortgage Lending Value is an underlying value which is adjusted to exclude speculative market and property appraisal factors to make it relevant well beyond the valuation date. Secondly, the definition of Mortgage Lending Value refers expressly to the Market Value as its reference parameter and, as such, this must not be lower than the Mortgage Lending Value. The second issue has resulted in the customary banking practice of always obtaining a Market Valuation in addition, as part of the process of determining the Mortgage Lending Value. According to the German Pfandbrief Act, the Market Value is ‘the estimated amount for which a property serving as collateral could be sold on the valuation date in an arm’s length transaction between a willing seller and a willing buyer after a proper marketing period, where the parties had each acted knowledgably, prudently and without compulsion.’Footnote 2 Similar to the Mortgage Lending Value, this is an anticipated future value calculated on the basis of relevant property and market information using the ‘correct’ valuation model. But, in contrast to the Mortgage Lending Value, the Market Value relates to a specific valuation date; it varies over time, whilst the Mortgage Lending Value does not vary over time or is at least fixed temporarily. The way in which this difference between the two values is typically reflected in valuation practice in Germany will be explained below in Sect. 4. Now a few statistics relating to the size of the market: how many condominium apartments and owner-occupied houses are now being purchased or newly constructed in Germany and must, in principle, be valued?

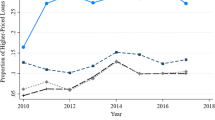

3 A Few Statistics on Market Size

When private households build new owner-occupied houses or condominium apartments, or make a purchase in the existing market, they typically require debt financing because of the high capital sums required for this. The great majority of such funds are made available by financial institutions, which carry out a valuation of the mortgaged property as part of the financing process. Therefore, the number of transactions in the existing market plus the number of owner-occupied houses built by owners are approximate indicators for the number of valuations of standard residential properties instigated by financial institutions. For a number of reasons, the actual number could be a lot higher: firstly, there are regular revaluations for the purposes of debt restructuring and loan extensions. Secondly, financing in many cases involves various financial institutions who often carry out their own valuations. Thirdly, there are also other special reasons such as the sale of loan portfolios, which means a requirement to revalue the collateral properties. Fourthly, some financing enquiries require an initial estimate of value, but do not result in a loan because the client opts for another financial institution, which then carries out a further estimate of value and a full property valuation. Between 2007 and 2013, around 70,000 new owner-occupied houses p.a. were built by private households in Germany, the majority of which would have required a valuation. The number of single-family and two-family dwellings transacted in the same period was more than three times as high at 240,000 p.a. In addition, around 250,000 condominium apartments p.a. are traded in the existing market and these are also generally purchased by private households. The aggregate of the three sums is around 560,000 new-build properties and transactions in the existing market p.a. There is some double counting here, as not only developers but also private households sometimes build single-family and two-family dwellings, and then sell them in the existing market after completion. The number does not include newly constructed condominium apartments. This comprises part-ownership in multiple occupancy apartment blocks, which the developer either keeps in its own portfolio and rents out after completion, or sells in the existing market and therefore features in the relevant statistics (Table 1).

4 Selection of Valuation Method

4.1 Preliminary Remarks

According to the Regulations for the Determination of Mortgage Lending Value (Beleihungs-wertermittlungsverordnung—BelWertV), there are basically three methods available for the determination of Mortgage Lending Value, namely the Income Capitalisation, Sales Comparison and Depreciated Replacement Cost approaches. The Income Capitalisation Approach comprises a feasibility analysis which examines the present values of the rent, yield and remaining useful lifespan of a property. The Depreciated Replacement Cost Approach examines the net asset value of the property comprising the land value, the value of external appurtenances and the value of the improvements. Finally, the Sales Comparison Approach looks at the value of a property in terms of the price now being paid in the market for comparable properties. Which of the approaches must be used in Germany, whether just one method or several simultaneously, which one is relevant to the valuations when using several methods, and which method is used only for the cross-check, depends on the property type and usability of the subject property. In terms of property type, owner-occupied houses and condominium apartments therefore differ in terms of usability depending whether or not they are suitable for owner-occupation. A property is suitable for owner-occupation if the layout, fitout and location could suit a purchaser for his own use over the long term. Both owner-occupied houses and condominium apartments may or may not, in principle, be capable of owner-occupation. One normally assumes that owner-occupied houses are always suitable. The following are the basic rules for the choice of valuation method (see also Table 2):

5 Owner-Occupied Houses

The relevant valuation method can be either the Depreciated Replacement Cost Approach or the Sales Comparison Approach, although the Depreciated Replacement Cost Approach clearly takes precedence. If a cross-check is carried out by way of support, the Income Capitalisation Approach must be used.

6 Condominium Apartments

In the case of condominium apartments, it must be decided whether these are suitable for owner-occupation. In the case of condominium apartments which are not suitable for owner-occupation, the Income Capitalisation Approach will always be the principal valuation method; as a cross-check, either the Depreciated Replacement Cost or Sales Comparison Approaches may be used. In the case of condominium apartments which are suitable for owner-occupation, it must be decided which of the Depreciated Replacement Cost and the Sales Comparison Approaches is relevant to the valuation; it is generally the Sales Comparison Approach which is used. If a cross-check is carried out by way of support, then the Income Capitalisation Approach is used. In the following example, the three valuation methods for the Market Valuation and Mortgage Lending Valuation are shown separately. The illustration is limited to the basic principles inherent in the three methods; much of the detail has been dispensed with. However, it clearly shows the differences which are relevant to the determination of Market Value and Mortgage Lending Value.

7 Income Capitalisation Approach

7.1 Basic Principles

The Capitalised Income Value of a property comprises both the land value and the Capitalised Income Value of the improvements. Both values are determined separately. The land value element comprises mainly the product of the site area and the guideline land value (Bodenrichtwert). Guideline land values are average values for a location stated as €/m2 for the land, and these are regularly updated and published. There is a relevant guideline land value for almost every property in Germany, and these values may be adjusted to match the characteristics of a particular property according to the specific guidelines. Statistically, they are based on the purchase prices collected by the land valuation boards (Gutachterausschüsse für Grundstückswerte), which, together with the calculation of the guideline land values, are discussed in more detail in Sect. 5.2. The Capitalised Income Value of the improvements comprises the Capitalised Income Value of the improvements and any other building components (external appurtenances). This value is calculated as the present value (Barwert) of the anticipated future net rental income generated by the building.Footnote 3 This net rental income comprises the potential gross rental income less the assumed operating costs; the latter of which includes a number of different components such as the costs of maintenance, operation and management and a provision for loss of rent. The Income Capitalisation Approach as a whole may be represented by the following Formula (1):

The multiplier is calculated as in the Formula (2) below:

8 Differences Between the Market Value and Mortgage Lending Value Calculations

The principal differences in calculation method between the Market Value and the Mortgage Lending Value are as follows: calculation of net rental income assumed yield r, which is the main determinant of the multiplier V. The net income per m2 residential space is mainly dependent on the level of rent per m2. For the Market Value calculation, the typical market rent for comparable properties is used for unlet apartments, and for apartments which are let this would generally be the rent in the lease contract. In contrast, the sustainable rent is used for the Mortgage Lending Value calculation. The sustainable rent is the achievable existing rent in the local market for comparable properties; however, if this rent is above the current agreed rent according to the lease contract, then the contractually agreed rent should normally be used. The yield used to determine the present value of the net rental incomes for the Market Value is called the property yield (Liegenschaftszinssatz) and for the Mortgage Lending Value it is the capitalisation rate (Kapitalisierungszinssatz). The property yield can be determined by reference to the remaining useful lifespan of a residential property based on current sales. For the Mortgage Lending Value calculation, the capitalisation rate used is that ‘with which the future achievable prudently estimated net rental income from a property is typically discounted over the period during which it is anticipated that it will be received. It must be determined by reference to long-term trends in the applicable regional market.’Footnote 4 For residential properties, the capitalisation rate must not be under 5 %. The Appendix 3 to Regulations for the Determination of Mortgage Lending Value §12 (4) contains a suggested range of yields for residential property between 5 and 8 %.

9 Depreciated Replacement Cost Approach

9.1 Basic Principles

In Germany, the Depreciated Replacement Cost Approach is generally used as the principal valuation method for the financing of single-family and two-family dwellings. The Depreciated Replacement Cost comprises the land value and the value of the improvements, which also includes the external appurtenances. Similar to the Income Capitalisation Approach, the land value is the product of the site area and the guideline land value. The value of the improvements is calculated incrementally. First, the replacement cost of the improvements is calculated as at the valuation date. The calculation is based either on typical building costs per m2 gross external area (Bruttogrundfläche—BGF) or on relevant building costs for 1 m2 of residential space. To the value calculated in one of these ways is then added the value of the external appurtenances, which are typically included in the calculation as a flat rate addition. The amount resulting from this calculation is then reduced by depreciation due to age and by any deduction for building defects or damage. The result is the calculated present value of the improvements. This value is then added to the land value to produce the provisional Depreciated Replacement Cost. As the costs and prices may differ significantly, the provisional Depreciated Replacement Cost is then adjusted to the price conditions in the local market via a relevant multiplier. This multiplier is based on an empirical analysis of comparable properties. If the achievable prices on the local market are above the replacement cost, the multiplier is greater than 1; if the opposite is true, then the multiplier is less than 1.Footnote 5 Ultimately, the Depreciated Replacement Cost is therefore similar to the Sales Comparison Approach but, in addition to the analysis of comparable prices, the replacement cost and the land value of the subject property (net asset value) must also be calculated.

10 Differences Between the Market Value and Mortgage Lending Value Calculations

Figure 1 shows a summary of the basic structure of the Depreciated Replacement Cost Approach and demonstrates the differences between the Market Value and Mortgage Lending Value calculations. The first difference is that the Mortgage Lending Value—value of improvements (5b) differs from the Market Value—value of improvements (5a) by a flat rate deduction. This deduction takes into account the risk of possible decreases in construction costs, and must be at least 10 %. The second difference is the transition from the Depreciated Replacement Cost to the Market Value and Mortgage Lending Values: The Market Value is derived from the product of the Depreciated Replacement Cost (Market Value) and a Depreciated Replacement Cost factor, whilst the Mortgage Lending Value is the product of the Depreciated Replacement Cost (Mortgage Lending Value) and a sustainability factor. The two multipliers differ in that the sustainability factor is generally limited in two ways. Firstly, it must not exceed the Depreciated Replacement Cost factor and secondly, it must not be greater than 1.Footnote 6

11 Sales Comparison Approach

11.1 Basic Principles

In the Sales Comparison Approach, the property is valued on the basis of purchase prices for appropriate comparable properties, which have transacted in the recent past. These properties are characterised by the fact that they are sufficiently comparable with the subject property in terms of their principal characteristics affecting value.Footnote 7 These characteristics principally include the macro and micro locations and the age, state of repair and fitout of residential properties, which can typically form the basis of the stated price per m2 of residential space. Remaining differences between the comparable property and the property now being valued may be reflected, if possible, by compensatory additions and deductions. The Market Value is then calculated as the product of the residential area and a price per m2 of residential area. Differences between the Market Value and Mortgage Lending Value calculations

Market Value and Mortgage Lending Value calculations based on the Sales Comparison Approach differ in that the Market Value is adjusted downwards by a safety margin (see Fig. 2). The safety margin is dependent on cyclical market conditions; in boom times, the deduction may be higher than in weaker markets. Part 3 of Regulations for the Determination of Mortgage Lending Value (BelWertV) §19 (1) states that the safety margin must be at least 10 %.

Extract from the Guideline Land Value Map for Berlin Dated 1 January 2014. Notes \( \frac{480}{{{\text{W0}}A}} \)—Guideline land value €480/m2 for residential building land with a typical plot ratio (Geschossflächenzahl–GFZ) of 4.0. The plot ratio defines the ratio between the total gross external area of all complete floors in the building on a site and the total site area. 1613—Identification number of the individual guideline land value zone (e.g. by using the automated purchase price collection (AKS) for Berlin). SF—Special Use Zones, which are used as, for example, allotments, cemeteries, sports facilities and airports.  —Guideline land value zone boundary

—Guideline land value zone boundary

12 Preliminary Remarks

Automated valuation models started out as software programs comprising three principal components, namely the central calculation module, a comprehensive database and a matching process. Having described the calculation module in terms of the valuation methods, we now come to the topic of data. Each of the three valuation methods contains a series of variables, which require relevant information to be collected in order to be called an ‘automated’ valuation model at all. It would be too much at this stage to present a comprehensive and co-ordinated data catalogue. The empirical bases of a small number of factors, which are particularly important to the valuation, will be discussed below. These factors include land value, rents, prices for apartments and houses as well as property yields and capitalisation rates. Table 3 shows these together with other key variables for the valuation methods for the calculation of Market Value and Mortgage Lending Value. With this in mind, three sources which relate directly to individual properties are discussed below. These are the purchase price collections carried out by the land valuation boards, the vdpResearch transaction database and property-specific databases showing asking prices. The purchase prices are used primarily for generating land values. The vdpResearch transaction database is relevant to the generation of comparable rents and comparable prices, and to the calculation of property yields and Depreciated Replacement Cost variables. The property-specific asking price databases serve to complement the information from the transaction database.

13 Purchase Prices Collected by the Land Valuation Boards

Every property sale and purchase agreement in Germany must be notarised. Copies of these documents are delivered to the land valuation boards.Footnote 8 These then enter the key data of the sale and purchase agreements into the so-called purchase price collections, which are then used to create data for property valuations in line with the market. Land values are key components here.

14 Land Values (Guideline Land Values)

The prices made available by the land valuation boards based on their analysis of the purchase price collections are called ‘guideline land values’. By its very name, the term emphasises that these are suggested values which, by their nature, are not legally binding. All the same, they are accepted almost unreservedly by property market participants and in valuations as the relevant value. Guideline land values are published in the form of so-called guideline land value maps. Some of the values relate to individual properties and some comprise geographically contiguous guideline land value zones, which are estimated to be comparatively homogenous in terms of their land value.Footnote 9 The guideline land values are calculated on the basis of the Sales Comparison Approach. The inclusion of the guideline land values into the automated valuation models is fraught with difficulties for a number of reasons. The land valuation boards generally only update the guideline land values every two years. When prices are changing fast, this may result in more or less significant over-estimates and under-estimates of the actual price level in the property markets. The guideline land values are calculated by the land valuation boards on the basis of the Sales Comparison Approach. In illiquid markets when transaction activity is limited, there are often not enough sales from which to make reliable use of the Sales Comparison Approach. The guideline land values derived from the sales serve both as a comparable and as an orientation benchmark to establish current prices in the property market. In particular, because the values come from an authoritative source, they have significant influence on price negotiations between buyer and seller. Just like the limited frequency of updates, the self-referential nature of guideline land values smoothes cyclical changes. The organisation and working methods of the land valuation boards and their branch offices are the responsibility of the federal states. There are in fact 16 different implementation and land valuation board ordinances in Germany. In the federal state of Baden-Württemberg, the land valuation boards are organised at municipal level, whilst in the other states they mainly operate at administrative district and autonomous town level. The organisational differences and the differences between the ordinances affect both the quality of the data and also access to the information. Despite these difficulties, guideline land values are widely accepted and are an integral component of property valuation. The inclusion of guideline land values in automated valuation models for properties located in Germany is now obligatory.

15 Further Valuation Variables

In addition to guideline land values, the land valuation boards also provide other data sources for use in real estate valuation. These include comparable prices, particularly Depreciated Replacement Cost multipliers and property yields. However, this data does not have anything like the same relevance as the guideline land values in terms of the automated valuation models. There are two reasons for this. The first relates to the differences in the organisation of the land valuation boards described above, which make it almost impossible to obtain comprehensive valuation variables. Secondly, the calculation of the valuation variables varies from state to state and often within the states themselves. This is particularly relevant when calculating the Depreciated Replacement Cost multipliers. These are defined as the ratio of the purchase price to replacement cost. Various assumptions are required for the calculation of the replacement costs. Despite all efforts to standardise the production of the data, these assumptions vary significantly between the individual land valuation boards, so that the Depreciated Replacement Cost multipliers produced by them are not comparable. The result is that, at present, the factors cannot be used in automated valuation models.

16 vdpResearch Transaction Database

As described in Sect. 3, around 550,000 owner-occupied houses and condominium apartments are purchased every year in the existing market in Germany. These transactions feed not only into the purchase prices collected by the land valuation boards, but also in principle into the vdpResearch transaction database. The database comprises property data collected in the real estate financing process and the associated property valuations. If, in order to purchase a property, a loan is taken from a financial institution which participates in the transaction database, the purchase will be picked up by the database. More than 330 financial institutions belonging to various groups currently participate in the transaction database (as at 2014). These include the major banks, direct banks, savings banks, co-operative banks and the Raiffeisen banks. The database is highly diversified in terms of the types of institutions feeding in data and its regional coverage is representative of the market. The database grows by around 60,000 new records every quarter. The individual variables of these records are clearly defined and recalibrated as necessary to standardise them. At the end of 2014, the transaction database comprised around two million records, which are filtered for the purposes of analysis. The most important contents of the database are firstly, data on rents and prices and the associated contract dates. Secondly, the database contains information allowing statistical analysis relating to important characteristics of the individual property, which substantiate the rent or the price. Important information of this type principally includes the residential location, the property fitout, its age, size and state of repair. Further important factors, depending on the property type, include the plot ratio and site area, and also suitability for third party use. As the transaction database contains comprehensive documented purchase prices and rents, as well as the accompanying principal characteristics affecting the price of the properties, it is possible to analyse the data using hedonic regression models. In particular, the following information can be generated by reference to the database: comparable prices and comparable rents, Depreciated Replacement Cost factors and property yields The generation of data by a co-ordinated and consistent model is governed by the following considerations: the individual valuation variables are produced on the basis of the general valuation rules (such as the Regulations for the Determination of Mortgage Lending Value) according to a unified method nationwide. This ensures firstly, that the contents of the variables are not affected by the differing understanding of the individual users and secondly, that the variables are comparable across all locations and can be used by regional banks all over the country. From an international perspective, the German residential market appears sluggish. Nonetheless, in order to describe the market dynamic adequately, the valuation variables are updated quarterly. This is viewed as sufficient to observe the ups and downs of the markets whilst not asking too much of the existing records. The resulting valuation variables must be appropriate for in-house automated valuation models, as well as for models operated by others. Others include financial institutions which have developed and use their own automated valuation models. These must take sufficient account of differences in understanding the contents of the individual variables. The data is generated such that the detail of the results is consistent with information from other sources. This means above all that information from the transaction database can be analysed in conjunction with existing analyses of information from the purchase prices collected by the land valuation boards. The features shown here have made it possible to develop a standard analysis on the basis of the Regulations for the Determination of Mortgage Lending Value, which has a comparatively short update cycle (quarterly), can be adjusted by way of small changes to suit existing automated valuation models and allows for the revision of valuation parameters using other statistics.

17 Asking Price Databases

One further source for providing evidence of valuation variables for automated valuation models are databases of advertised prices, of which there are a number operating in Germany. In addition to asking prices and asking rents, as a rule these extensive data collections often contain a description of the property. This means that the statistics can be analysed using traditional hedonic regression models. The use of asking prices and asking rents as evidence for valuation variables is controversial. Particularly because asking prices may differ significantly from transaction prices, an empirically reliable property valuation based on advertised prices is fraught with significant problems. With this in mind, asking prices are used solely for the purpose of cross-check analyses.

18 Summary

Ultimately, automated valuation models require databases which comprise a large number of transaction prices. The purchase prices collected by the land valuation boards and the vdpResearch transaction database provide two data sources in Germany, which together satisfy this requirement comprehensively. The guideline land values derived from the purchase price collections provide comprehensive details relating to land values for individual sites. The vdpResearch transaction database is useful for correlating prices based on the characteristics of the individual properties. The regression models used for these produce implicit prices in the form of estimated coefficients, which can then be used in the valuation of real estate.

19 Matching Process and Presentation of Results

19.1 Preliminary Remarks

In order to use guideline land values, implicit price and other information in automated valuation models, the information must be directly linked to the subject property. The link usually relates to the address and characteristics of the property, which form the principal components of the property’s value. The address is used to derive the relevant land value and the characteristics are used to derive implicit price information. The quality and extent of this link depend on how well the characteristics can be described and on the accuracy of the information available. The quality of the valuations therefore depends equally on the description of the property and the databases (or the analyses based on these). The databases were described in the preceding section. We now come to the question of how the characteristics of subject properties must be input in order to achieve high-quality valuations. A regulatory provision relating to the responsibility of the user (valuer) must also be addressed here. The effect of this provision is that the models used in Germany would be better described using the adjective ‘computer-assisted’ than the expression ‘automated’. As users of automated valuation models, financial institutions are often faced with the problem that their initial information relating to a property is incomplete or incorrect. The reasons for this can lie in a combination of the lending process and the competitive situation. In the following example, client C makes a personal or online approach to Bank B with the minimum package of documents required with a request for mortgage finance for an owner-occupied apartment he wishes to purchase. The client usually approaches not just one bank but rather a number to secure the most reasonable financing terms. Before making an offer, the banks willing to provide finance will require an indication of the creditworthiness of the client and the value of the property to be used as collateral. The offer has to be provided quickly in order to remain competitive. Unless these issues are addressed, the provision of finance is risky.Footnote 10 In order to be competitive, the ‘valuation calculation’ must be carried out quickly and inexpensively. This means that the bank will have to make its decision based on the documents provided by the client, which may be only partly verifiable. Against this background, the CIBFootnote 11 automated valuation model used by vdpResearch and discussed as an example below may be divided into two sub-models (see Fig. 4). Both sub-models may be used separately from each other or incrementally in combination. The first sub-model comprises an Indicative Value. This is an initial quick and inexpensive estimate of the value of the collateral property for the purposes of the sales team, and for which only outline information on the property is required; there is no Market Value or Mortgage Lending Value calculation. This is a matter for the second sub-model, which is specifically intended for use at the back office stage. The second sub-model is significantly more detailed and, correspondingly, makes greater demands on information sources. All valuation factors can be adjusted manually, which is necessary in order to conform to regulations. At his own discretion, the user can choose to take responsibility by bringing to the valuation his own insight and information based on his professional experience. Both sub-models are the same in that initially they make use of the same information. This means that the only variations between the Indicative Value and the detailed Market Value and Mortgage Lending Value calculations will be those arising from the property information and the use of the model. The Indicative Value and the Market Value and Mortgage Lending Value calculations will be described below.

Step 1: Indicative Value

In principle, the Indicative Value and the full Market Value and Mortgage Lending Value calculations are made by the same valuation module, but they vary significantly in the range of control and selection options available. In the case of the Indicative Value, just the address and a few property characteristics are required to generate an automatic value indication. All other characteristics are determined automatically from the address itself or, for the time being, made the subject of a general assumption for all purposes. When the user has entered the address, the first step is to select the property type. If this is a single-family or two-family dwelling, the house type must next be entered; if the property is a condominium apartment, then it must be decided whether the apartment is suitable for owner-occupation or not. There are seven further factors required in the case of single-family or two-family dwellings and six for a condominium apartment (see Table 4). With the exception of fitout and state of repair, this information may be taken directly and quickly from the building description or the sale and purchase agreement, which greatly reduces the risk of error. Fitout and state of repair are estimated based on information provided by the client, but information provided by the client is supported if possible by photographs or other documentation. The estimates are made on the basis of a scale with five categories, from very good to poor. All other information is entered quantitatively, with the exception of the building types which are categorised as follows: solid, pre-fabricated (solid), pre-fabricated (wood), low-energy house, passive house‚ zero energy house and pre-fabricated (concrete–Plattenbau).

The Indicative Value serves as a proposed value for the Market Value and Mortgage Lending Value calculations. In addition, the quality of the residential location is assessed on the basis of the address. In the case of single-family or two-family dwellings, Indicative Valuations are carried out on the basis of the Depreciated Replacement Cost Approach. Indicative valuations for condominium apartments suitable for owner-occupation are carried out on the basis of the Sales Comparison Approach, with comparative values produced using hedonic regression analyses.Footnote 12 For condominium apartments which are not suitable for owner-occupation, Indicative valuations are made on the basis of the Income Capitalisation Approach. The residential location is assessed using a geographical statistical approach comprising guideline land values and comparable prices.

Step 2: Market Value and Mortgage Lending Value Calculations

As explained above, the automated Market Value and Mortgage Lending Value calculations conceived for the back office process are more detailed than the Indicative Value calculation, and the level of detail can be controlled by the user. The process begins with the input of the address and property type, which are the primary drivers of the valuation process.Footnote 13 The next inputs are the selected property characteristics, for which more detail is required than for the Indicative Value. The most important of these are the energy performance rating and assessment of the residential location, which are generated by the model in the case of the Indicative Value.

Table 5 shows these additional items. In addition, there are further inputs which are not shown in the table. Firstly, it is possible to enter a more detailed description of the building fitout. This optional additional function requires a qualitative estimate of individual sections on a 5-point scale from very high quality to basic. Secondly, the Market Value and Mortgage Lending Value model allows for the input of refurbishment status for all component sections. This function is also optional and, if required, can be shown in place of the general categorisation of the state of repair.

Thirdly, the rights from section II of the land register can be integrated into the valuation calculation. The land register is a public register which publishes the rights attaching to a site. It shows details relating to the ownership of the site and any encumbrances and restrictions affecting it. These encumbrances and restrictions include easements, pre-emption rights, heritable building rights and restrictions on disposal. Typical encumbrances include easements such as rights of way and personal easements such as usufruct.

In contrast to the items 1 and 2 of the additional data, No. 3 is not optional. If there are any encumbrances and restrictions, they must be entered for the Market Value and Mortgage Lending Value calculation. Here, there are variances between the Market Value and Mortgage Lending Value. In contrast to the Market Value, the ranking of the encumbrances and restrictions is relevant to the Mortgage Lending Value.Footnote 14 If the land charge is ranked after the mortgage, then the bank can avoid this lower ranking right by way of a compulsory auction.Footnote 15 In the Market Value and Mortgage Lending Value calculations, the encumbrances and restrictions are generally investigated for the Market Value and Mortgage Lending Values, but in the case of the Mortgage Lending Value they are shown for information purposes only. If the inputs necessary for the Mortgage Lending Value calculations are entered, then the model will automatically calculate the valuation variables. Depending on the valuation method being used, these may take the form of inherent prices for particular characteristics, derived yields and/or costs. The values created are suggestions, which can be accepted or modified by the user. This means that all valuation cells may be edited by the user. As explained above, editing needs to be possible for regulatory reasons. Whether and to what extent this option is of purely formal or actual practical relevance depends on a number of factors including the quality of the suggested valuation data. The result of the valuation calculation is a Market Value or Mortgage Lending Value based on the relevant (primary) valuation method. In addition, Market Values and Mortgage Lending Values are calculated using the secondary valuation method. These are used only to cross-check the results. The Market Values and Mortgage Lending Values calculated on the basis of the relevant valuation method are generally close to the results of the Indicative Value. The Indicative Value and the Market Value and Mortgage Lending Value calculations refer to one database and use the same valuation module, but, in the case of the Market Value and Mortgage Lending Value calculations, the user just has far more room for manoeuvre. The high level of concurrence is good in that typically the loan is granted on the right terms from the start.

20 Concluding Remarks

Since the Millennium, automated valuation models have become an integral part of the valuation of owner-occupied houses and condominium apartments in Germany. This development was accompanied by the establishment and publication of transaction databases across the whole of Germany. The purchase prices collected by the land valuation boards and the vdpResearch transaction database are of great importance in this regard. The latter was set up for our own use in deriving empirically accurate valuation data and to create transaction-based price indices. Despite initial reservations on the part of the banking sector, automated valuation models have now gained a high level of acceptance. Against this background and the high level of competitiveness in the banking industry, these models will no become increasingly widespread in the next few years. This appears not least from the increasing number of associations in the banking industry which are actively encouraging the integration of automated valuation models into their own IT processes. The use of automated valuation models in the mortgage lending process in Germany is significantly affected by regulatory rules. These rules relate to both the selection of valuation method and the interaction between the valuer and the automated valuation model. Whether a residential property is valued using the Income Capitalization, Depreciated Replacement Cost or Sales Comparison Approach is entirely determined by the type of property to be valued and its suitability for owner-occupation; the availability and quality of data play no role at this point. The continued high importance of valuers in the valuation of real estate is recognised in the fact that automated valuation models, by definition, generate merely suggestions in terms of Market Value and Mortgage Lending Value. The appraisal carried out by the valuer then turns these suggestions into substantive Market Values and Mortgage Lending Values. This is achieved technically by allowing all automatically generated cells to be adjusted by the user. It is for this reason that the term computer-assisted valuation model is generally used in Germany rather than automated valuation model.

Notes

- 1.

The terms ‘owner-occupied house’ and ‘single-family and two-family dwellings’ are used to mean the same thing in the following text. The property types ‘single-family and two-family dwellings’ include ‘detached single-family and two-family dwellings’, ‘terraced houses’ and ‘semi-detached houses’.

- 2.

German Pfandbrief Act (Pfandbriefgesetz) §16 (2). There is a similar definition in German Building Code (Baugesetzbuch) §194.

- 3.

The net rental income of the building is the total annual net rental income of the property less the annual return on land value (Verzinsung des Bodenwertes).

- 4.

See Crimmann, Mortgage Lending Value, p. 157.

- 5.

Therefore, like ‘Tobin’s q’, this multiplier also indicates whether it is worthwhile to purchase an existing building or construct a new-build. If the multiplier is greater than 1, then a new-build will be more beneficial than purchasing an existing property. If it is less than 1, the opposite is true.

- 6.

In exceptional cases, there may be a limited departure from the second rule.

- 7.

What is ‘sufficient’ in terms of comparability unfortunately remains unclear.

- 8.

Land valuation boards are autonomous and independent panels, which according to German Building Code (Baugesetzbuch) §195 Sect. 1 receive copies of all notarised real estate sale & purchase agreements.

- 9.

See also Fig. 3. This is an extract from the guideline land value map for Berlin dated 1 January 2014.

- 10.

With the emergence of finance provision via the internet and the increased presence of direct banks in the market, the proportion of enquiries resulting in a loan may have decreased significantly. Unfortunately, the only available information available is from confidential discussions; there is no information based sufficiently on fact.

- 11.

The acronym CIB stands for Computergestützte Immobilien-Bewertung (computer-assisted real estate valuation).

- 12.

An alternative method would be to classify comparable prices from the databases using appropriate selection filters to ensure comparability. In Germany, this alternative is fraught with significant problems because of data protection laws, which means that this is not common practice at present.

- 13.

The inputs from the Indicative Value can of course be used here if this is preferable and appropriate.

- 14.

If there are a number of rights entered in the land register, these are organised in order of ranking. The order of ranking reflects the order in which they are entered in the land register, as they indicate the order in which any proceeds from a compulsory auction of the property would be distributed.

- 15.

See Wolfgang Crimmann, Mortgage Lending Value, p. 115.

Reference

Crimmann, W. (2011). Mortgage lending value (Vol. 49). Berlin: Association of German Pfandbrief Banks.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

Eilers, F., Kunert, A. (2017). Automated Valuation Models for the Granting of Mortgage Loans in Germany. In: d'Amato, M., Kauko, T. (eds) Advances in Automated Valuation Modeling. Studies in Systems, Decision and Control, vol 86. Springer, Cham. https://doi.org/10.1007/978-3-319-49746-4_4

Download citation

DOI: https://doi.org/10.1007/978-3-319-49746-4_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-49744-0

Online ISBN: 978-3-319-49746-4

eBook Packages: EngineeringEngineering (R0)