Abstract

The aim of this paper is to investigate the relationship between CO2 emissions (carbon dioxide emissions), energy consumption, and economic growth in Italy, using annual data covering the period 1960–2011. The unit root tests results indicated that the variables are not stationary in levels but in their first differences. Subsequently, Johansen’s cointegration test showed that there is a cointegrated vector between the examined variables. The vector error correction model (VECM) is used in order to find the causality relations among the variables. The empirical results of the study revealed that, in the short run, there is a unidirectional causality relation between economic growth and CO2 emissions with direction from economic growth to CO2 emissions, as well as a unidirectional causality relation running from economic growth to energy consumption. Moreover, the results showed that there is short-run bidirectional causality relation between energy consumption and CO2 emissions.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

JEL Classification

8.1 Introduction

The rapid industrialization of most countries, the population growth, the increasing energy consumption, and the change of lifestyle over the last decades have increased the threat of global warming. Carbon dioxide emissions are considered as the main cause of the greenhouse effect. Since 1990, the link between CO2 emissions and economic growth has been extensively studied. Many researchers have expressed their concerns about environmental degradation.

In the middle of the 1990s, the countries that had signed the agreement on climate changes realized that stricter rules were necessary in order to reduce CO2 emissions. In 1997 the Kyoto protocol was adopted, which introduced legally binding objectives for emissions reduction in developed countries.

The second period of the Kyoto protocol began on January 1st 2013 and is ending in 2020. Thirty-eight countries participate including the European Union (EU) and the 28 member states. The second period is covered by the Doha (Qatar) amendment, where the participating countries are committed to reduce their emissions at a level that is at least 18 % lower than it was in 1990. In this period, the EU was committed to reduce CO2 emissions at a level that is 20 % lower than 1990s levels.

The major weakness of the Kyoto protocol is that only developed countries are obligated to take action. Given that the United States has never signed it, Canada decided to withdraw before the end of the first commitment period, and Russia, Japan, and New Zealand do not participate in the second commitment period, the Kyoto protocol concerns only the 14 % of global emissions. However, more than 70 developed and developing countries have expressed nonbinding commitments for reducing or limiting their emissions.

At the Paris conference on December 12, 2015, representatives of 196 nations reached to a landmark agreement on climate change. The main elements of the new Paris agreement are:

-

Long-term objective: governments agreed to keep the increase of global average temperature well under 2 °C compared to the preindustrial levels and to continue the efforts for restriction on 1.5 °C.

-

Contributions: before the Paris conference, all countries had submitted comprehensive action plans as far as the reduction of their emissions.

-

Ambition: governments agreed to notify every 5 years their contributions for the determination of more ambitious objectives.

-

Transparency: in addition, governments agreed to report to each other and to the public their performance on the implementation of the objectives, ensuring in this way transparency and supervision.

-

Solidarity: EU and other developed countries will continue providing funding on the developing countries in order to help them reduce their emissions and protect them against the effects of climate change.

The aim of this paper is to examine the long-run relationship between CO2 emissions, energy consumption, and economic growth in Italy using annual data for the period 1960–2011, as well as the causal links between these variables.

The rest of paper is as follows: Sect. 8.2 presents the literature review. Section 8.3 describes data and methodology. Empirical results are discussed in Sect. 8.4. Concluding remarks are given in the final section.

8.2 Literature Review

In literature, there are three categories of studies on the relationship between CO2 emissions and economic growth. The first category focuses on the relationship between environmental pollutants and economic growth and investigates the validity of the environmental Kuznets (1955) curve. The second category investigates the relationship between economic growth and energy consumption, and finally the third category examines the dynamic relationship between economic growth, energy consumption, and environmental pollutants.

The relationship between economic growth, energy consumption, and environmental pollutants has been the subject of intensive research over the last decades. However, the empirical results seem to depend on the period the study was conducted and on the stage of economic development of each country.

The environmental Kuznets curve assumes that the relationship between various indicators of environmental degradation and income per capita is an inverted U-shaped function of income per capita. According to this curve, the use of natural resources or the use of carbon dioxide increases when income per capita increases. In this context Grossman and Krueger (1991), Ang (2007), and Acaravci and Ozturk (2010) tried to examine the existence of Kuznets curve for different economies. Their results were contradictory and in many cases did not prove that the inverted U exists.

In the second category which examines the relationship between economic growth and energy consumption are included, among others, the studies of Kraft and Kraft (1978), Masih and Masih (1996), and Apergis and Payne (2009). All the above studies investigate the direction of causality among the considered variables.

Finally, the third category which is a combination of the two previous categories examines the dynamic relationship between economic growth, energy consumption, and environmental pollutants. Some recent studies on this category are Govindaraju and Tang (2013), Halkos and Tzeremes (2011), Akin (2014), Magazzino (2016), Dritsaki and Dritsaki (2014), and Ozturk and Uddin (2015). Their results show the existence of causal relationship between energy consumption and CO2 emissions.

8.3 Data and Methodology

8.3.1 Data

In this study we use annual data of CO2 emissions (CO2) (metric tons per capita), energy consumption (EN) (kg of oil equivalent per capita), GDP per capita (GDP) (in constant 2005 US dollars), and trade openness (TRD) which is considered as a proxy of foreign trade of Italy. All data collected from World Development Indicators (WDI 2015) published by the World Bank.

8.3.2 Methodology

The relationship between CO2 emissions, energy consumption, GDP per capita, trade openness, and the square of trade openness can be expressed as follows:

where

\( {\mathrm{CO}}_{2\mathrm{t}}= \) per capita CO2 emissions

\( {\mathrm{EN}}_t= \) energy use per capita

\( {\mathrm{GDP}}_t= \) per capita income

\( {\mathrm{TRD}}_t= \) trade openness

\( {\mathrm{TRD}}_t^2= \) the square of TRD t

\( {\varepsilon}_t= \) white noise

Implementing the logarithmic transformation and adding the trend variable, the above equation is expressed as follows:

where

t is the trend variable.

L indicates that all the variables are expressed in natural logarithms.

The transformation of the data is made to reduce the potential problem of heteroscedasticity (see Gujarati 2004). According to equation (Eq. (8.2)), it is expected that the higher level of energy consumption will lead to greater economic activity having as a result higher CO2 emissions. Therefore, we expect the β 1 coefficient to be positive. The literature on environmental quality and economic development focuses mainly on the analysis of the existence of the environmental Kuznets (1955) curve. Thus, the sign of β 2 coefficient can be either positive or negative. The expected sign of coefficient β 3 depends on the stage of economic development of each country. The sign will be positive in the case of the developing countries, as these countries have industries with high pollution level. On the other, the sign will be negative in the case of developed countries. These countries can reduce their pollution level by reducing their production and importing goods from other economies. Finally, the sign of the coefficient β 4 is expected to be negative due to trade openness which promotes technology transfer.

After determining the signs of the coefficients, the next step is to test if they are statistically significant. Many researches in their studies indicate an inability to support the environmental Kuznets curve. Moreover, several studies show that carbon dioxide emissions are positively related with trade openness and the square of trade openness, having as a result the multicollinearity problem in these variables (see studies of Galeotti et al. (2006) and Ozturk and Uddin (2015). In this study, applying the collinearity test among the series of trade openness (LTRD) and the square of trade openness (LTRD2), we found that there is multicollinearity in the examined model.

Therefore, we remove these variables from the model (Eq. (8.2)). The following model arises:

So, we begin the estimation process from the model (Eq. (8.3)). The purpose of the paper is to examine the long-run relationship between CO2 emissions, energy consumption, and economic growth in Italy. The methodological approach of the study includes the following steps:

-

We check the stationarity properties of the series applying the augmented Dickey–Fuller (ADF) test (1979, 1981) as well as the Phillips–Perron (PP) test (1988).

-

If all variables are integrated of order one, then Johansen’s (1995) cointegration test is the most appropriate to be used. In the case that the variables do not have the same integration order, Pesaran’s et al. (2001) cointegration test is the most appropriate.

-

The third step is to check the causal relationship between the variables using the appropriate tests.

Figure 8.1 presents the progress of the three variables, per capita energy consumption, per capita CO2 emissions, and GDP per capita for Italy during the years 1960–2011. The descriptive statistics of the variables are shown in Table 8.1.

8.4 Empirical Results

8.4.1 Unit Roots Tests

Applying the unit root tests of ADF, by Dickey and Fuller (1979, 1981), and PP, by Phillips and Perron (1988), we present the results in Table 8.2.

The results of Table 8.2 showed that all variables are stationary in their first differences, namely, they are integrated of order one (i.e. I (8.1)). Therefore, we continue applying Johansen’s cointegration approach in order to examine the long-run relationship among the variables.

8.4.2 Cointegration Test

Since Johansen’s approach is sensitive to the lag length, before applying the cointegration test, we have to find the order of the VAR model. The optimal lag length is selected by the minimum value of the criteria AIC, SBC, and HQC. Table 8.3 presents the results of these criteria.

All the criteria indicate that the optimal lag length is equal to 1. Therefore, the order of the VAR model is equal to 1.

Johansen’s cointegration test is based on the trace statistic and on the maximum eigenvalue statistic. The maximum number of cointegrating vectors is one less than the number of variables. For the trace test, the null hypothesis is that there are r cointegrating vectors against the alternative of more than r. The null hypothesis of maximum eigenvalue test remains the same as before; however, the alternative is that there are exactly r + 1 cointegrating vectors. The results of Johansen’s cointegration test are presented in Table 8.4.

The results of Table 8.4 (trace test statistics and maximum eigenvalue statistics) support the presence of one cointegrating vector at 1 % level of significance. We~conclude that there is a strong evidence of cointegration among the examined variables. The cointegrating vector is shown below:

8.4.3 Error Correction Model (ECM)

Since there exists a cointegrating vector (long-run relationship), a dynamic error correction model can be derived through a linear transformation. The dynamic ECM incorporates the short-run dynamic with the long-run equilibrium, from which we can examine the causal relationship between the variables.

The dynamic unrestricted error correction model is expressed as follows:

where ECM t-1 stands for the lagged error correction term from the long-run cointegration equation (Eq. (8.6)).

8.4.4 The VECM Granger Causality

After the long-run relationship, we continue applying the VECM in order to determine the direction of causality between the examined variables. The equations that are used to test Granger causality are the following:

where i (i = 1,…p) is the optimal lag length determined by the Schwarz information criterion (SIC); ECM t-1 is the lagged residual obtained from the long-run relationship presented in equation (Eq. (8.3)); λ 1, λ 2, and λ 3 are the adjustment coefficients; and u 1t , u 2t , and u 3t are the disturbance terms assumed to be uncorrelated with zero means N(0,σ).

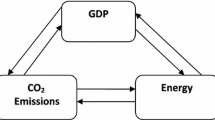

From the results of Table 8.5, we see that there is a short-run unidirectional causal relationship between economic growth and CO2 emissions with direction from economic growth to CO2 emissions, as well as a unidirectional causal relationship running from economic growth to energy consumption. This means that a high level of economic growth leads Italy to a high level of energy consumption. Moreover, the results show that there is a bidirectional causality relation between energy consumption and CO2 emissions.

In the long run, we see that the estimated coefficient of ECT in the equation of ΔLCO2 is negative and statistically significant at 1 % level. This implies that there is convergence of dynamic equilibrium in the long run. The value of the estimated coefficient of the ECT shows the speed of adjustment (convergence).

The negative sign of the coefficient of ECT confirms the expected convergence of the process in the long run, of energy consumption and economic growth on carbon dioxide emissions.

8.5 Conclusion and Policy Implications

This study investigates the relationship among CO2 emissions (carbon dioxide emissions), energy consumption, and economic growth in Italy, using Johansen’s maximum likelihood procedure in a multivariate model over the period 1960–2011. Findings suggest that there is a strong evidence of cointegration among the examined variables, which indicates that there is a long-run equilibrium relationship.

The vector error correction model was used to capture the short-run and the long-run dynamic relationships. The obtained results revealed that in the short run there is a unidirectional causal relationship between economic growth and CO2 emissions with direction from economic growth to CO2 emissions, as well as a unidirectional causal relationship between economic growth and energy consumption with direction from economic growth to energy consumption. This means that in Italy the level of economic activity and energy consumption go together. In addition, the results showed that there is a bidirectional causality relation between energy consumption and CO2 emissions. In the long run, we see that the estimated coefficient of ECT in the equation of ΔLCO2 is negative and statistically significant at 1 % level implying that CO2 emissions could play an important adjustment role in the long-run equilibrium.

This can be explained as follows. Although Italy is rich in carbon and endowed with renewable energy sources such as solar, wind, and bioenergy, it uses carbon heavily. Consequently, carbon has the highest emission rate of carbon dioxide compared with other sources.

Italy has to displace the energy use from carbon to alternative renewable energy sources even more rapidly. These measures will help Italy to maintain growth expectations, as well as to implement the EU’s plan for climate change as agreed by the new Paris agreement.

References

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35(12):5412–5420

Akin CS (2014) The impact of foreign trade, energy consumption and income on CO2 emissions. Int J Energy Econ Policy 4(3):465–475

Ang J (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778

Apergis N, Payne JE (2009) Energy consumption and economic growth in Central America: evidence from a panel cointegration and error correction model. Energy Econ 31:211–216

Dickey D, Fuller WA (1979) Distribution of the estimates for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dickey D, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

Dritsaki C, Dritsaki M (2014) Causal relationship between energy consumption, economic growth and CO2 emissions: a dynamic panel data approach. Int J Energy Econ Policy 4(2):125–136

Galeotti M, Lanza A, Pauli F (2006) Reassessing the environmental Kuznets curve for CO2 emissions: a robustness exercise. Ecol Econ 57:152–163

Govindaraju VGRC, Tang CF (2013) The dynamic links between CO2 emissions, economic growth and coal consumption in China and India. Appl Energy 104:310–318

Grossman G, Krueger A (1991) Environmental impacts of a North American free trade agreement. NBER Working Paper, No 3194

Gujarati DN (2004) Basic econometric, 4th edn. The McGraw-Hill Companies Inc, New York

Halkos GE, Tzeremes NG (2011) Growth and environmental pollution: empirical evidence from China. J Chin Econ Foreign Trade Stud 4(3):144–157

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press, Oxford

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403

Kuznet S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

MacKinnon JG (1996) Numerical distribution functions for unit root and cointegration tests. J Appl Econ 11(6):601–618

MacKinnon JG, Haug AA, Michelis L (1999) Numerical distribution functions of likelihood ratio tests for cointegration. J Appl Econ 14(5):563–577

Magazzino C (2016) The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int J Sustain Energy. 35(9):844–857, doi:10.1080/14786451.2014.953160

Masih AMM, Masih R (1996) Energy consumption, real income and temporal causality; results from a multi-country study based on cointegration and error correction modeling techniques. Energy Econ 18:165–183

Newey WK, West KD (1994) Automatic lag selection in covariance matrix estimation. Rev Econ Stud 61:631–653

Ozturk I, Uddin GS (2015) Causality among carbon emissions, energy consumption and growth in India. Econ Res 25(3):752–775

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

World Development Indicators (2015) The World Bank. http://data.worldbank.org/-data-catalog/world-development-indicators. Accessed 15 Apr 2016

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Stamatiou, P., Dritsakis, N. (2017). Dynamic Modeling of Causal Relationship Between Energy Consumption, CO2 Emissions, and Economic Growth in Italy. In: Tsounis, N., Vlachvei, A. (eds) Advances in Applied Economic Research. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-48454-9_8

Download citation

DOI: https://doi.org/10.1007/978-3-319-48454-9_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-48453-2

Online ISBN: 978-3-319-48454-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)