Abstract

The CIVETS countries consist of Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa. They are emerging market countries that are most likely to rise quickly in economic standing. In this paper GARCH, GJR-GARCH and EGARCH models are used to explore the daily closing values for selected CIVETS equity indices. Return volatility, the persistence thereof and the best fitting model for volatility forecasting are determined. The results obtained for the GARCH models indicated that the GJR-GARCH model was the best fitting model for the equity indices of Colombia and Egypt. The EGARCH model was the best fitting model for the equity indices for Indonesia, Turkey and South Africa, whilst the result obtained delivered no clear best fitting model for the Vietnamese VN-Index. In addition, there is evidence of the leverage effect for all the Indices included in this study with the exception of the Vietnamese VN-Index. The presence of leverage effects implies that a negative shock will lead to greater volatility. A comparison is also made between the option prices produced by constructing the implied volatility skews of options generated by these models, both by inclusion of the Global Finance Crises (GFC) period and by exclusion of the period of the GFC.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

24.1 Introduction

The CIVETS countries consist of Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa. They are emerging market countries that are most likely to rise quickly in economic standing. There are important similarities between these countries, which include: (1) they all have a relative young population, (2) they are perceived to have well-developed and sophisticated financial systems and (3) they have the potential for high growth in domestic consumption.

These countries are widely spread around the world, resulting in exposures to different local, regional and international economic and political factors. These factors may influence equity market volatility on a local, regional or international basis which may influence the future risk and return perception of investors, both locally and internationally.

Volatility modelling of equity indices of the CIVETS countries was presented in Oberholzer and Venter (2015). In their study, the following indices were selected for each CIVETS country:

-

Colombia: IGBC Index.

-

The IGBC Index is capitalisation-weighted Index of the liquid and highest capitalised stocks traded on the Colombia Stock Exchange;

-

-

Indonesia: JKSE.

-

The Jakarta Stock Price Index (JKSE) is a modified capitalisation-weighted Index of all stocks listed on the regular board of the Indonesia Stock Exchange;

-

-

Vietnam: VNI.

-

The Vietnam Stock Index (VN-Index) is a capitalisation-weighted Index of all the companies listed on the Ho Chi Minh City Stock Exchange;

-

-

Egypt: EGX 100 Price Index.

-

The EGX 100 Price Index tracks the performance of the 100 active companies, including both the 30 constituent-companies of EGX 30 Index and the 70 constituent-companies of EGX 70 Index on the Egyptian Stock Exchange;

-

-

Turkey: XU100.

-

The XU100 tracks the performance of the top 100 companies on The Istanbul Stock Exchange. It is a capitalisation-weighted Index; and

-

-

South Africa: FTSE/JSE All-Share Index.

-

The FTSE/JSE All-Share Index represents 99 % of the full market capital value, i.e., before the application of any invest ability weightings, of all ordinary securities listed on the main board of the Johannesburg Stock Exchange.

-

In this paper we consider the best fitting GARCH family model, news impact curves generated from the different GARCH family models and implied volatility skews for the equity indices of the CIVETS countries. The volatility skews are generated by means of the Duan, Gauthier, Simonato and Sasseville (DGSS) models for EGARCH and GJR-GARCH processes. A comparison is made between the option prices produced by constructing the implied volatility skews of options generated by these models, both by inclusion of the GFC period and by exclusion of the period of the GFC.

24.2 Literature Review

The understanding of global capital markets, its integration and volatility behaviour is of great importance, as it directly influences capital cost and investment decision (Tabajara et al. 2014). Capital cost and investment decision play a major role in the economic development of any economy.

Korkmaz et al. (2012) considered the return and volatility spill over effects between the equity markets of the CIVETS. That study determined that the volatility spill over effect for the CIVETS countries is very small, but on occasion, the CIVETS equity markets display high degree of co-movement. Korkmaz et al. (2012) concluded that the causal relationships between the CIVETS equity markets are reflective of the presence of intra-regional return and volatility interdependence.

Wallenius (2013) investigates the impact of macroeconomic news announcements on the CIVETS equity markets. Wallenius (2013) divided Europe macroeconomic news announcements into four groupings: (1) prices (2) real economy (3) money supply and (4) business climate and consumer confidence. The author concluded that all four groupings of Europe macroeconomic news announcements impacted the CIVESTS equity markets and that it should be considered as possible risk factors when investing in the CIVETS.

The impact of macroeconomic announcements of the CIVETS equity markets was also investigated by Fedorova et al. (2014). In their study the authors determine that European announcements of GDP, retail sales and unemployment have a significant impact on equity market volatility and, in certain instances, even on equity returns. Fedorova et al. (2014) concur with Tripathy and Garg (2013), Wallenius (2013), Tabajara et al. (2014), and Oberholzer and Venter (2015) that negative shock generates greater volatility shocks. The authors concluded that leverage effect should be considered in asset pricing, portfolio selection and the assessment of investment decision in respect to macroeconomic data releases.

Aboura (2003) used a Monte Carlo simulation to generate volatility skews by making use of the GARCH option pricing model by Duan (1995). The findings showed that there is a severe mispricing when it comes to short term call options and deep out of the money options. However, for long term options the volatility skews tend to be more stable. Labuschagne et al. (2015) used a similar approach using EGARCH and GJR-GARCH models to generate volatility skews for the BRICS securities exchanges. The results were compared to volatility skews generated using a risk-neutral historic distribution model. Findings showed that the GARCH model generated option prices produce smoother and more reliable volatility skews, this is because of the number of calibrated parameters when it comes to asymmetric GARCH models.

24.3 Data

The data used in this study was the closing values for the Colombian IGBC Index, the Indonesian Stock Price Index, the Vietnamese Stock Index or the VN-Index, the Egyptian EBX100 Price Index, the Istanbul Stock Exchange National 100 Index XU100 and FTSE/JSE All-Share Index. The historical time series was analysed as one dataset for the period 1 February 2006 until 18 March 2015. The dataset was obtained from Thomson Reuters Eikon. The dataset was analysed by making use of the univariate GARCH type family models. Daily values were used in the analysis. The volatility skews of 30 day options on the indices under consideration are presented.

24.4 Methodology

Three GARCH family models were used, namely GARCH, GJR-GARCH and EGARCH. The GARCH (Bollerslev 1986; Bollerslev et al. 1993) model predicts the period’s variance by using the weighted average of the long term historical variance. The forecast variance from the last period (the GARCH term) and the information regarding the volatility observed in the previous period (the ARCH term). The second model that was used is the EGARCH model (Nelson 1991).

The EGARCH model explicitly allows for asymmetries in the relationship between the return and volatility. Under the EGARCH model specification, negative shocks will result in a greater increase in volatility when compared to the effect of a positive shock. The EGARCH model highlights this empirically with equity indices which result in a “leverage effect” (Bollerslev 2011).

By parameterising the logarithm of the conditional variance as opposed to the conditional variance, the EGARCH model also avoids complications from having to ensure that the process remains positive. This is especially useful when conditioning other explanatory variables. Meanwhile, the logarithmic transformation complicates the construction of unbiased forecasts for the level of future variances (Bollerslev et al. 1993; Bollerslev 2011).

GJR-GARCH model formulation is interrelated to the Threshold GARCH, or TGARCH model proposed independently by Zakoian (1994) and the Asymmetric GARCH, or AGARCH, model of Engle et al. (1990). When estimating the GJR model with equity Index returns, it is characteristically found to be positive, thus implying that the volatility increases proportionally more following a negative than positive shocks. This asymmetry is sometimes referred to in the literature as a “leverage effect” (Engle et al. 1990; Engle and Ng 1993; Engle 2003).

According to Asteriou and Hall (2011) the GARCH (Eq. (24.1)), GJR-GARCH (Eq. (24.2)) and EGARCH (Eq. (24.3)) models can be specified as follows:

According to Brooks (2014), a news impact curve can be defined as the graphical representation of the degree of asymmetry of volatility to positive and negative shocks. The plot illustrates the next period volatility (h t ) that would arise from various positive and negative values of \( {u}_{t-1} \), given the calibrated parameters.

A volatility skew is a curve in the XY-plane obtained by plotting implied volatility versus strike price. To free a volatility skew of the unit of currency of the strike price, the strike price K is substituted by moneyness, i.e., K/S 0, where S 0 is the first observed price of the stock in the data sample. See Kotze et al. [8] for more information on volatility skews.

The asset return dynamics in the model of Duan et al. [5] in the real-world measure are given by

which, in the risk-neutral measure of the Black–Scholes–Merton option pricing model, can be written as

For the GJR-GARCH process, we define

and for the EGARCH process

where

is a standard normal variable under the risk-neutral measure and λ is a constant unit risk premium. Under the risk-neutral measure the asset return dynamics of the Duan model are equivalent to the one time period asset return dynamics of the Black–Scholes–Merton model. In this paper, a Monte Carlo simulation will be performed, by simulating n sample asset price paths given by the specifications above. This will be used to price a 30 day European call option, volatility skews will be obtained from the option prices computed using the Monte Carlo simulation of risk-neutral stock price paths. The EGARCH and GJR-GARCH model generated volatility skews will be compared.

24.5 Results

24.5.1 GARCH Family Models

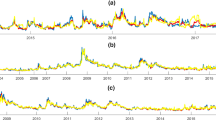

The log returns of the stock indices show signs of volatility clustering. The volatility of all the indices is high during the global financial crisis. The volatility of the Vietnamese index is fairly high from 2006 until the end of 2010, it seems to decrease thereafter (Fig. 24.1).

The histograms below show signs of leptokurtosis (fat tails). This is a common occurrence when it comes to financial returns data. In addition, the returns series do not look normally distributed (Fig. 24.2).

The descriptive statistics in Table 24.1 confirm our expectations. The Jarque–Bera probability is less than 0.05; this suggests that we can reject the null hypothesis of a normal distribution. Hence we can conclude that the log returns of the CIVETS indices are not normally distributed. Furthermore, the distributions are slightly negatively skewed and the kurtosis for each index is greater than three, this is evidence of a leptokurtic distribution.

The Augmented Dickey–Fuller unit root test in Table 24.2 indicates that the log returns of the CIVETS stock indices are stationary at level, with a one percent level of significance.

The ARCH LM test in Table 24.3 indicates that there is evidence of ARCH effects at a one percent level of significance. Therefore we can estimate the GARCH family models discussed in the previous sections.

When examining the coefficients of the estimated GARCH models in Table 24.4, it is clear that the sum of the coefficient of the lagged residual and the lagged conditional variance is less than, but close to one. This implies that shocks to the conditional variance will be persistent (Brooks 2008). The ξ 1 coefficients of all the models with the exception of Vietnam are statistically significant and of the correct sign. According to Asteriou and Hall (2011) this is evidence of asymmetries in the news. More specifically, bad news increases volatility more than good news. Furthermore, the AIC and SIC indicate that a GJR-GARCH model is the best fit for Columbia and Egypt, the EGARCH model is the best fit for Indonesia, Turkey and South Africa. When the GARCH models applied to the Vietnamese stock index are considered, it is evident that the AIC suggests that an EGARCH model is the best fit. However, the SIC indicates that a GARCH model is the best fit.

24.5.2 News Impact Curves

In the graphs above, we consider the news impact curves of the best fitting GARCH models as suggested by the AIC. This gives an indication of how conditional volatility arises for different values of \( {u}_{t-1} \). This illustrates the degree of asymmetry of volatility. The AIC suggests that asymmetric GARCH models are a better fit. This is evident in the news impact curves illustrated below. The best fitting model suggested by the AIC of Columbia and Egypt is specified by using an indicator function. Furthermore, the best fitting model of the other indices is specified using the smoother exponential function, this allows for the leverage effect to be exponential. This is shown clearly by the news impact curves below. In addition, the news impact curve of Vietnam seems fairly symmetric, this is intuitive because the leverage coefficients are statistically insignificant (Fig. 24.3).

24.5.3 Volatility Skews

The EGARCH and GJR-GARCH processes are used to model the returns of various indexes from the CIVETS countries. These returns are in turn used to value the price of options in the Black–Scholes–Merton framework. Two different sets of data were used—one including the data from the Global Financial Crisis (GFC) and the other without. The effects of the GFC are then traced by firstly pricing the options, then converting the options into the implied volatility state in order to be able to compare the different volatility skews without having a conflict of currency conversions. The following central bank rates are used a proxy for the risk-free interest rate of each CIVETS member. The results are found below (Table 24.5).

24.5.3.1 Exclusion of GFC Data for Calibration of GARCH Processes

The corresponding implied volatility skews generated are similar in shape for both the EGARCH and GJR-GARCH processes. The options tend to be more expensive at lower levels of moneyness. The rankings of the level of the implied volatility skews are generally the same for both the EGARCH and the GJR-GARCH calibrated models, with the exception of the Egyptian EGX 100 index. The Columbian IGBX index has the lowest implied volatility skew, which also coincides with the lowest interest rate. Vietnam, however, has the second highest interest rate from the CIVETs, but has the highest implied volatility skew for the EGARCH calibrated model. This may indicate that there is less liquidity in the Vietnamese market, which causes the prices of options to increase. On the other hand, Egypt has the highest interest rate, yet the index’s implied volatility skew lies below that of others. This might indicate liquidity in Egypt’s markets.

The JKSE index and the FTSE/JSE ALSI index are closer together for the GJR-GARCH process than for the EGARCH process. For the GJR-GARCH process the VNI and the EGX 100 Index are below the XU 100 Index, but above the XU 100 Index for the EGARCH process.

Next, the EGARCH and GJR-GARCH calibrated implied volatility skews are depicted for 30 day options and the data for the period of the GFC is included for the calibration of the EGARCH and GJR-GARCH processes used to construct the volatility skews in the following figures. The data used consists of daily closing prices starting from the first trading date in 2006, until the 18th March 2015.

24.5.3.2 Inclusion of GFC Data for Calibration of GARCH Processes

The corresponding implied volatility skews generated are similar in shape for both the EGARCH and GJR-GARCH processes.

The FTSE/JSE ALSI index moved away from the IGBX index when using the GJR-GARCH process. The EGX 100 Index, the VN-Index and the JKSE Index are much closer together when using the GJR-GARCH process. The JSKE index and the FTSE/JSE ALSI index are closer together for the GJR-GARCH process than for the EGARCH process. For the GJR-GARCH process the VNI and the EGX 100 Index are below the XU 100 Index, but above the XU 100 Index for the EGARCH process. Generally the options become more expensive when including data from the GFC. This is caused by the return distribution which changes slightly when including data from the GFC. The indexes are generally more volatile in periods of financial turbulences such as the GFC, which in turn causes the return distribution to gain fatter tails. If the underlying asset has fatter tail distributions, then the price of the options will increase, since a positive payoff is more likely. Hence, the prices of the options increase, and since the implied volatility is a direct indication of the price of the options, the implied volatility increases. The effect is not very drastic, as the financially turbulent time series data is truncated by financially stable time series data, thus diminishing the effect of the GFC data.

All the volatility skews in Figs. 24.4, 24.5, 24.6 and 24.7 seem to have higher implied volatility for lower strikes and lower implied volatility for higher strikes. The natural hedge suggested for a skew with such a shape is to buy puts in order to protect value and sell calls to offset the prices of the puts.

Generally a higher interest rate will cause the implied volatility skews to become higher. However, if a country has a high central bank rate but a low implied volatility skew, then this may imply that the markets are more liquid, which causes the options to trade at cheaper levels, and thus the implied volatility is less. Similarly, if a country has a low interest rate, but a high implied volatility level, then the implications might be that the markets are less liquid, which in turn causes the option to trade at higher levels, and thus the implied volatility is greater.

Increasing the interest rate will move the implied volatility skews up, while a decrease in the interest rate will shift the implied volatility skews down. The lower levels of moneyness are generally more sensitive to movements in the interest rates than the higher levels of moneyness.

References

Aboura S (2003) GARCH option pricing under skew. Available at SSRN 459641

Asteriou D, Hall SG (2011) Applied econometrics. Palgrave Macmillan, New York

Bollerslev T (1986) Generalised autoregressive conditional heteroskedasticity. J Econom 3:307–327

Bollerslev T (2011) Arch and garch models. Duke University, Durham

Bollerslev T, Engle RF, Nelson DB (1993) Arch models, The handbook of econometrics. University of Chicago, Chicago

Brooks C (2008) Introductory econometrics for finance. University Press, Cambridge

Brooks C (2014) Introductory econometrics for finance. Cambridge University Press, Cambridge

Duan JC (1995) The GARCH option pricing model. Math Financ 5(1):13–32

Engle R (2004) Risk and volatility: econometric models and financial practice. Am Econ Rev 94(3):405–420

Engle RF, Ito T, Lin WL (1990) Meteor showers or heat waves? heteroskedastic intra-daily volatility in the foreign exchange market. Econometrica 58:525–542

Engle RF, NG VK (1993) Measuring and testing the impact of news on volatility. J Finance 20:419–438

Fedorova E, Wallenius L, Collan M (2014) The impact of euro area macroeconomic announcements on CIVETS stock markets. Proc Econom Finance 15:27–37

Korkmaz T, Çevik Eİ, Atukeren E (2012) Return and volatility spillovers among CIVETS stock markets. Emerg Mark Rev 13(2):230–252

Kotzé A, Oosthuizen R, Pindza E (2015) Implied and local volatility surfaces for South African index and foreign exchange options. J Risk Financ Manag 8(1):43–82

Labuschagne CCA, Venter PJ, Von Boetticher ST (2015) A comparison of risk neutral historic distribution—E-GARCH—and GJR-GARCH model generated volatility skews for BRICS securities exchange indexes. International conference on applied economics, ICOAE, Kazan. Elsevier (Conference proceedings to be published July 2015)

Nelson DB (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59:347–370

Oberholzer N, Venter P (2015) Univariate GARCH models applied to the JSE/FTSE stock indices. International conference on applied economics, ICOAE, Kazan, Elsevier (Conference proceedings to be published July 2015)

Tabajara PJ, Fabiano GL, Luiz EG (2014) Volatility behaviour of BRIC capital markets in the 2008 international financial crisis. Afr J Bus Manage 8:373–381

Tripathy N, Garg A (2013) Forecasting stock market volatility evidence from six emerging markets. J Int Bus Econ 14:69–93

Wallenius L (2013) The impact of European macroeconomic news announcements on CIVETS stock markets. Masters, Lappeenranta University of Technology

Zakoian JM (1994) Threshold heteroskedasticity models. J Econ Dyn Control 15:931–955

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Labuschagne, C.C.A., Oberholzer, N., Venter, P.J. (2017). Univariate GARCH Model Generated Volatility Skews for the CIVETS Stock Indices. In: Tsounis, N., Vlachvei, A. (eds) Advances in Applied Economic Research. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-48454-9_24

Download citation

DOI: https://doi.org/10.1007/978-3-319-48454-9_24

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-48453-2

Online ISBN: 978-3-319-48454-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)