Abstract

This paper examines the relationship between government spending and revenues in Greece for the 1980–2015 period, using cointegration autoregressive distributed lag test (ARDL test) as well as causality test developed by Toda and Yamamoto. The results of cointegration of ARDL test showed that there is a cointegrated relationship between government spending and revenues. Also, causality test showed that there is a unidirectional causal relationship between spending and revenues in Greece with direction from government spending toward revenues.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

JEL Classifications

18.1 Introduction

The relationship between government spending and revenues is one of the ordinary problems on public economics. There are four aspects about the relationship of government spending and revenues. The first one refers that government spending must be expanded according to revenues. Thus, spending should follow revenues. This means that if revenues (taxes) increase, in that case, government can increase spending. So revenues are a remedy for minimizing public deficits. This view is supported by Friedman (1972, 1978) and Blackley (1986) who show that there is positive causal relationship between revenues and spending.

The second view is supported by Peacock and Wiseman (1961) claiming that increases on government spending generate increases on revenues. They also claim that a large exogenous shock (unstable political situations) will cause increases on government spending thus increases on tax revenues.

The third view is that government can change spending and revenues (taxes) at the same time. This view is supported by Musgrave (1966) and is referred as fiscal synchronization hypothesis which entails that there is a bilateral causality between spending and revenues. Furthermore, Barro (1979) suggested a tax-smoothing model for the hypothesis of tax synchronization.

Finally, the view of Baghestani and McNown (1994) refers that government spending and revenues is determined by long-run economic growth so a causal relationship of revenues and spending is not expected.

The rest of this paper is organized as follows. Section 18.2 is a brief overview of the empirical literature. Section 18.3 describes data and methodology. Section 18.4 presents the empirical results. Finally, Sect. 18.5 gives concluding remarks.

18.2 Literature Review

Even if during the last decades many papers have been published in various countries, the direction of causal relationship between government spending and revenues has not yet been found. Many papers refer on the four aspects mentioned in the previous section. The use of different econometric methods and different periods ended up on different contradictory results. The results also differ as far as the direction of causality is concerned having an effect on the economic policymaking of each government both in long- and short-run level.

For developing countries there have been many studies which examined the relationship between government spending and revenues. Shah and Baffes (1994) on their paper for three Latin American countries (Argentina, Mexico, and Brazil) found a bilateral causal relationship between government spending and revenues for Argentina and Mexico, whereas for Brazil this relationship was unidirectional with a direction from revenues to spending.

Owoye (1995) investigated the causal relationship between revenues and spending for G7 countries. He found a bilateral causality for five out of seven countries, and for Japan and Italy he found a unilateral causal relationship with direction from revenues to spending.

Park (1998) examined causal relationship between government revenues and spending for Korea for the 1964–1992 period. The results showed a unilateral causal relationship from revenues to spending.

Al-Qudair (2005) examined the long-run relationship between public spending and revenues for the Kingdom of Saudi Arabia using Johansen cointegration technique and error correction model for causality testing. Cointegration results showed the existence of long-run relationship between public spending and revenues. Causality testing demonstrates the existence of bilateral causal relationship between government spending and revenues in long- and short-run basis.

Emelogu and Uche (2010) studied the relationship between government spending and revenues in Nigeria using data from 1970 to 2007. Using cointegration techniques such as Engel-Granger two-step method and Johansen procedure, they found a long-run relationship among variables. Afterward, causality test using error correction model showed a one-way causal relationship with a direction from revenues to spending.

The empirical paper of Ali and Shah (2012) in the case of Pakistan for the 1976–2009 period showed that there is no causal relationship between revenues and spending both in long- and short-run level.

Saysombath and Kyophilavong (2013) investigated the relationship between spending and revenues for Lao People’s Democratic Republic during the 1980 until 2010 period. Applying ARDL cointegration procedure in combination with Granger causality, they found a long-run causal relationship between spending and revenues with direction from spending to revenues.

Finally, Nwosu and Okafor (2014) examined the relationship between revenues and spending and divide each one in two groups. Revenues are divided in revenues on oil and non-oil, whereas spending is divided in current and capital. This paper employs data for the 1970–2011 period and Johansen cointegration technique and error correction mechanism. The results of this paper showed that total spending (current and capital) have a long-run and one-way causality relationship with total revenues (oil and non-oil) with a direction from total spending to total revenues.

18.3 Data and Methodology

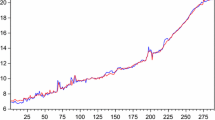

On Fig. 18.1, total revenues and government spending are presented as percent of GDP for Greece for the 1980–2015 period. On this diagram we have to point out that government spending all through the examined period is larger than revenues (Fig. 18.1).

18.3.1 Data

The study uses annual time series data and covers the 1980–2015 period. The government spending and government revenues are presented as percent of GDP. Data were obtained from the International Financial Statistics (IFS). All the data used in the study are in logarithmic form. This data transformation occurred in order to reduce the heteroscedasticity problem (see Gujarati 2004). The link between government spending and revenue is specified as follows:

and

where the GS t and the GR t denote government spending and revenue, respectively. The e t and ε t are error terms. We expect that α 1 and \( {\beta}_1 > 0 \).

Logarithmic transformation of the above equations would leave the basic equations as follows:

and

where L = natural logarithms.

18.3.2 Order of Integration

In this section we test the order of integration of time series. For this test, we use augmented Dickey–Fuller (ADF) test (1979, 1981) and Phillips–Perron (PP) (1988). The results on the test give the opportunity to determine the most suitable test of series cointegration or in other words, the long-run relationship between them.

18.3.3 Cointegration Tests

In this paper, we adopt the autoregressive distributed lag (ARDL) test as it was formed by the papers of Pesaran and Shin (1995) and Pesaran et al. (2001). This test in relation to other cointegration tests has some advantages such as the following:

-

It can be used also in series that are not integrated in the same order.

-

It has more power when the sample size is small.

-

It allows the series to have different lags.

-

It determines a dynamic model of unrestricted error within a linear transformation.

The equations for the ARDL approach are the following:

where p and q are the lag order of variables \( {\Delta \mathrm{LGS}}_{t-i} \) and \( {\Delta \mathrm{LGR}}_{t-j} \) , respectively.

We continue with the bounds test on Eqs. (18.5) and (18.6). This test uses F distribution and the null hypothesis of no cointegration of series is the following:

-

\( {H}_0:{\phi}_1={\phi}_2=0 \) and \( {H}_0:{\pi}_1={\pi}_2=0 \) (no cointegration of series)

-

against the alternative hypothesis of series cointegration

-

\( {H}_1:{\phi}_1\ne {\phi}_2\ne 0 \) and \( {H}_1:{\pi}_1\ne {\pi}_2\ne 0 \) (series cointegration)

If the bounds test will lead us to series cointegration, we can continue with the estimation of the long-run relationship of series from Eqs. (18.7) and (18.8), as well as the restricted error correction model from Eqs. (18.9) and (18.10).

where p and q are the lag order of variables \( {\Delta \mathrm{LGS}}_{t-i} \) and \( {\Delta \mathrm{LGR}}_{t-j} \) of Eq. (18.9) and \( {\Delta \mathrm{LGR}}_{t-i} \) and \( {\Delta \mathrm{LGS}}_{t-j} \) of Eq. (18.10), respectively. The terms z t and λ t are the error terms which are created by the cointegrating regressions of Eqs. (18.7) and (18.8).

18.3.4 Causality Analysis

On this section we examine the causal relationship between government spending and revenues using a seemingly unrelated regression model. Toda and Yamamoto (1995), in order to investigate causality, developed a method based on the estimation of an adjusted VAR model (k + d max), where k is the optimal time lag on the first VAR model and d max is the largest integration order on the variables of the VAR model. VAR model of Toda and Yamamoto causality is shaped as follows:

where k is the optimal time lag of the first VAR model, and d max is the largest integration order on the variables of the VAR model. The null hypothesis of no causality is defined for every equation on VAR model. For example, LGR t variable causes LGS t variable (\( {\mathrm{LGR}}_t\Rightarrow {\mathrm{LGS}}_t \)) when \( {\beta}_{1t}\ne 0,\forall i \). Toda and Yamamoto test for no Granger causality can be done for every integration order of variables, either they are cointegrated or not, given that the reverse roots of autoregressive polynomial should be inside of the unit circle. Thus, the Toda and Yamamoto causality test will be valid.

18.4 Empirical Results

18.4.1 Order of Integration

The results on Table 18.1 show that series exhibit different integration order. The government spending series is in the null order I(0) in 10 % level of significance, whereas the government revenues series is integrated in the first order I(1). Thus, for the long-run relationship of the series, the most suitable is that of Pesaran et al. (2001), the autoregressive distributed lag (ARDL) methodology.

18.4.2 ARDL Bounds Testing Approach

From Eqs. (18.5) and (18.6) of unrestricted error model, we can find the maximum values of p and q lags using the final prediction error (FPE), Akaike information criterion (AIC), Schwarz information criterion (SIC), Hannan–Quinn information criterion (HQC), and likelihood ratio (LR) criteria. The results of these criteria are presented in Table 18.2.

The results on Table 18.2 show that in all criteria, the maximum number of lags for the series on both equations is 1. The order of optimal lag length on Eqs. (18.5) and (18.6) is chosen from the minimum value of AIC, SBC, and HQC criteria. On Table 18.3 we present the results of these criteria.

The results on Table 18.3 show that ARDL (p, q) model with p = 1 and q = 0 lags is the best for both equations. Continuing on Table 18.4, we employ the error independence test (LM test) until the first order (maximum number of lags).

The results on the table present that errors are not autocorrelated. We continue with the dynamic stability test of ARDL(1,0) model for both equations. This test is employed with unit cycle. If reverse roots of Eqs. (18.5) and (18.6) are inside the unit cycle, then the models are dynamically stable (Fig. 18.2).

The results of Diagram 2 show that there is a dynamic stability of models on both equations. It is advisable before we continue with bounds test to present the actual and fitted residuals from both equations using ARDL(1,0) and autoregressive unrestricted error correction model (Fig. 18.3).

We continue by conducting cointegration test of bounds autoregressive distributed lag. In other words, we test if φ1 and φ2 as well as π 1 and π 2 coefficients are null on our estimated models (Table 18.5).

The results on the table show that F-statistic value is larger only on Eq. (18.5) from the upper bound on Pesaran et al.’s tables (2001) for 10 % level of significance and (k + 1) = 2 variables. Thus, we say that there is a cointegrating relationship between the examined series only on Eq. (18.5) for 10 % level of significance.

On the following table, the results from the estimation of unrestricted error correction model are presented (Eq. 18.5).

The results on Table 18.6 show that both statistic and diagnostic tests are quite satisfying. Before continuing on the next step, we get the long-run results from the unrestricted error correction model Eq. (18.5).

So, we can stress that an increase of government revenues by 1 % will cause an increase on government spending by 0.48 % approximately.

We proceed to estimate the long- and short-run relationship of the series on Eqs. (18.7) and (18.9).

The results on Table 18.7 show that both statistic and diagnostic test are quite satisfying. The restricted dynamic error correction model, derived by ARDL bounds test through a simple linear transformation, incorporates the short-run dynamic with long-run equilibrium. The negative and statistical significant estimation of coefficients on error correction terms z t−1 on Eq. (18.9) shows a long-run relationship between the examined variables.

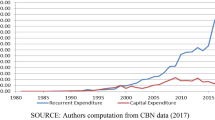

On the following diagrams (3) and (4), we examine the dynamic stability of restricted error correction model with Brown et al. (1975) tests (Figs. 18.4 and 18.5).

From the diagrams we can see that there is a dynamic stability on model’s coefficients that we examine.

18.4.3 Toda−Yamamoto Causality Test

Table 18.8 presents the results on causality test of Toda and Yamamoto according to Eqs. (18.11) and (18.12).

The results on the test show that there is a unidirectional causal relationship between spending and revenues for Greece with direction from government spending to revenues.

18.5 Summary and Conclusions

In this paper we examine the relationship between government spending and revenues in Greece, using Pesaran et al. (2001) cointegration given that data had different integration order. Afterward, we test the direction of causality among the examined variables using the Toda and Yamamoto methodology.

The results of this paper show that there is a long-run relationship between government revenues and spending, while the results of causality show a unidirectional causal relationship with direction from government spending to revenues. This result points out that the increase of government spending, without the respective increase of revenues, will expand budget’s deficit. Thus, government will have only one choice and that is borrowing, leading to more debt. Therefore, to stop this policy, the government should:

-

Reduce the size of large consecutive spending and turn to investment spending.

-

Reduce function’s cost.

-

Differentiate its economic policy and try to find out other revenue sources (apart from taxes) in a way that will repair the difference between revenues and spending thus reducing budget’s deficit.

-

Finally, taxes play an important role in the economy. Taxes on various sectors should be reformed in such a way that economy will start with new investment which will bring more revenues.

References

Ali R, Shah M (2012) The causal relationship between government expenditure and revenue in Pakistan. Interdiscip J Contemp Res Bus 3(12):323–329

Al-Qudair KHA (2005) The relationship between government expenditure and revenues in the Kingdom of Saudi Arabia: testing for co-integration and causality. J King Abdul Aziz Univ Islam Econ 19(1):31–43

Baghestani H, McNown R (1994) Do revenues or expenditures respond to budgetary disequilibria? South Econ J 63:311–322

Barro R (1979) On the determination of the public debt. J Polit Econ 81:940–71

Blackley R (1986) Causality between revenues and expenditures and the size of federal budget. Public Finance Q 14:139–156

Brown RL, Durbin J, Ewans JM (1975) Techniques for testing the constance of regression relations overtime. J R Stat Soc 37:149–172

Dickey D, Fuller WA (1979) Distribution of the estimates for autoregressive time series with a unit root. J Am Stat Assoc 74(366):427–431

Dickey D, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49(4):1057–1072

Emelogu CO, Uche MO (2010) An examination of the relationship between government revenue and government expenditure in Nigeria: co-integration and causality approach. Cent Bank Nigeria Econ Financial Rev 48(2):35–57

Friedman M (1972) An economist’s protest. Thomas Horton and Company, New Jersey

Friedman M (1978) The limitations of tax limitation. Policy Rev 5:7–14

Gujarati DN (2004) Basic econometric, 4th edn. The McGraw-Hill companies Inc, New York

MacKinnon JG (1996) Numerical distribution functions for unit root and cointegration tests. J Appl Econ 11(6):601–618

Musgrave R (1966) Principles of budget determination. In: Cameron H, Henderson W (eds) Public finance: selected readings. Random House, New York

Newey WK, West KD (1994) Automatic lag selection in covariance matrix estimation. Rev Econ Stud 61:631–653

Nwosu DC, Okafor HO (2014) Government revenue and expenditure in Nigeria: a disaggregated analysis. Asian Econ Financial Rev 4(7):877–892

Owoye O (1995) The causal relationship between taxes and expenditures in the G7 countries: cointegration and error correction models. Appl Econ Lett 2(1):19–22

Park WK (1998) Granger causality between government revenues and expenditures in Korea. J Econ Dev 23(1):145–155

Peacock AT, Wiseman J (1961) The growth of public expenditure in the United Kingdom. Princeton University Press, Princeton

Pesaran MH, Shin Y, Pesaran MH, Shin Y (1995) An autoregressive distributed lag modelling approach to cointegration analysis. Cambridge University, Department of Applied Economics, Cambridge, DP No. 9514

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–46

Saysombath P, Kyophilavong P (2013) The causal link between spending and revenue: the Lao PDR. Int J Econ Finance 5(10):111–117

Shah A, Baffes J (1994) Causality and comovement between taxes and expenditure: historical evidence from Argentina, Brazil and Mexico. J Dev Econ 44(2):311–331

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66:225–250

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Dritsaki, C. (2017). The Causal Relationship Between Government Spending and Revenue: An Empirical Study from Greece. In: Tsounis, N., Vlachvei, A. (eds) Advances in Applied Economic Research. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-48454-9_18

Download citation

DOI: https://doi.org/10.1007/978-3-319-48454-9_18

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-48453-2

Online ISBN: 978-3-319-48454-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)