Abstract

In this paper, crisis periods on the 19 euro area stock markets are formally detected and explored. A statistical method of dividing market states into bullish and bearish markets based on monthly logarithmic returns of major stock market indexes is employed. The sample period begins on January 2004, ends on December 2015, and includes the 2007–2009 Global Financial Crisis (GFC) and the subsequent euro area crises. Moreover, correctness of formal identification of down market periods is discussed utilizing two methods for verifying the bear market conditions. The empirical results indicate February 2009 as the end of the GFC for almost all countries investigated, except for Slovenia, Lithuania, Malta, Estonia, and Latvia, for which March 2009 is obtained as the end of the GFC. Furthermore, the findings concerning the European crises during the period beginning from late 2009 are in accord with the existing literature.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

13.1 Introduction

The number of the eurozone countries has risen from eleven in 1999 to nineteen in 2015. The year 2009 was the tenth anniversary of the introduction of the euro. The 2007–2009 Global Financial Crisis (GFC) affected the European markets in general, but the euro area, along with most of the world, emerged from recession in 2009. However, the eurozone has suffered from the subsequent financial crises since late 2009.

The main goal of this paper is to formally detect and investigate crises on the 19 euro area stock markets. A direct identification of crisis periods is carried out by applying the Pagan and Sossounov (2003) statistical procedure of dividing market states into bullish and bearish markets, based on monthly logarithmic returns of major stock market indexes. We analyze 19 eurozone equity markets and, for comparison, the US stock market. The sample period begins on January 2004, ends on December 2015, and includes the 2007–2009 Global Financial Crisis and the subsequent euro area crises. Furthermore, a correctness analysis of formal identification of down market periods is provided using two methods for verifying the bear market conditions (Fabozzi and Francis, 1977). It is instructive to formally identify crises, as it enables us to provide sensitivity analyses of various relationships among international stock markets utilizing econometric and statistical tools, with respect to the pre-, post-, and crisis periods. In particular, the context of stock market integration and globalization is especially important for further research.

The remainder of this study is organized as follows. Section 13.2 presents a literature review concerning crisis periods in the eurozone stock markets. Section 13.3 specifies the methodological background of the statistical method of direct identification of down market periods. Section 13.4 presents data description and empirical results on the indexes in the euro area stock markets. Section 13.5 recalls the main findings and presents the conclusions.

Nomenclature | |

|---|---|

EU | European Union |

EC | European Commission |

EMU | European Economic and Monetary Union |

ECB | European Central Bank |

EFSF | European Financial Stability Facility |

EFSM | European Financial Stabilization Mechanism |

ESM | European Stability Mechanism |

GFC | the 2007–2009 Global Financial Crisis |

IMF | International Monetary Fund |

13.2 Crisis Periods in the Euro Area: A Brief Literature Review

There is a growing body of literature concerning the causes and consequences of financial crises in the world. As the aim of this paper is a direct statistical identification of crisis periods in the euro area equity markets, we focus our analysis of the previous literature on the studies related mostly to the European economies.

13.2.1 The 2007–2009 Global Financial Crisis on the European Stock Markets

According to the literature, e.g., Brunnermeier (2009), Claessens et al. (2010) among others, the GFC timeline, from the US perspective, was marked by the following events: (1) the increase in subprime delinquency rates in the spring of 2007, (2) the ensuing liquidity crunch in late 2007, (3) the liquidation of Bear Stearns in March 2008, and (4) the failure of Lehman Brothers in September 2008.

It is pertinent to note that there is no unanimity in determining the phases of the GFC among researchers. For example, Pisani-Ferry and Sapir (2010) proposed two phases of crisis in the EU. They advocated that the first phase started in August 2007 with a general liquidity strain. The second phase started in September 2008 with the bankruptcy of Lehman Brothers. Similarly, Mishkin (2011) divided the financial crisis into two distinct phases: the first from August 2007 to August 2008, called the US subprime mortgage crisis, and the second, which started in mid-September 2008, known as the GFC. Bartram and Bodnar (2009) presented a detailed investigation of the GFC and provided a timeline of events and policy actions for the crisis in equity markets. They advocated September 15, 2008 to October 27, 2008 as the common crisis period in the world. In Calomiris et al. (2012) the global crisis period was defined as the period between August 2007 and December 2008. Chudik and Fratzscher (2011) established January 1, 2005 to August 6, 2007 as the pre-crisis period, and August 7, 2007 to end July, 2009 as a common crisis period for both advanced and emerging economies in the world. Olbrys and Majewska (2014a) formally identified the GFC periods on the major Central and Eastern European (CEE) emerging stock markets, including some of the EMU members (i.e., Slovenia, Slovakia, Lithuania, Estonia, and Latvia). They perceived October 2007 to February 2009 as the common crisis period for the US and the CEE equity markets, except for Slovakia. Moreover, in the paper (Olbrys and Majewska, 2014b) the authors detected the GFC periods on the largest European stock markets and they received October 2007 to February 2009 as the common period for the New York and London equity markets. The results indicated that the GFC period for the Frankfurt stock exchange lasted from December 2007 to February 2009, while in the case of the Paris equity market it lasted from May 2007 to February 2009. However, the results confirmed February 2009 as the end of down markets in all countries investigated.

13.2.2 The Euro Area Crises

In light of the recently growing literature on the euro area topic, it is worth stressing that researchers are rather unanimous in observing crisis periods in the eurozone. Essentially, they describe the same events connected with the European crises during the period beginning from late 2009. It is evident that the major event occurred in October 2009, when a newly elected Greek government stunned the EMU markets with news that the fiscal deficit for 2009 would likely turn out to be more than twice the outgoing government’s projection of 6 % of GDP (Gibson et al., 2014a). The Papandreou government announced that public finance data had misreported deficit and debt. The European sovereign debt crisis became evident in 2010, starting with the reporting by the European Commission on January 8th that evidence had been found of severe irregularities in the Greek Excessive Deficit Procedure notifications (Mink and de Haan, 2013). Gibson et al. (2014b) and Provopoulos (2014) stressed that a sovereign-debt crisis in Greece spilled over to that country’s banking system and created twin crises. In other euro area countries, including Ireland, Spain, and Cyprus, the crises originated in the banking systems and spilled over to the sovereign debt. Moro (2014) emphasized that the European Great Crisis began with Greece, but suddenly it spread over some other countries of the eurozone like Portugal, Ireland, Italy, and Spain (sometimes referred to as the PIIGS countries). As a consequence, Europe since 2010 has faced a severe economic and financial crisis. Katsimi and Moutos (2010) pointed out that the Greek crisis has been in fact mainly a government-induced crisis, but the contagion from this crisis has spread across Europe.

Merler and Pisani-Ferry (2012) investigated the so-called “sudden stops” in the euro area. The authors indicated that five countries (i.e. Greece, Portugal, Ireland, Spain and Italy) experienced significant private capital inflows from 2002 to 2007–2009, followed by unambiguous and massive outflows. They showed that these eurozone “sudden stops” episodes were clustered in three periods: (1) the GFC period; (2) the period following the agreement of the first Greek programme in spring 2010, and (3) the summer of 2011. Likewise, Ardagna and Caselli (2014) stressed that the euro area crisis started in Greece and it engulfed various countries. Therefore, the authors focused their research on the political and economic aspects of two Greek bailout agreements: first in May 2010, and second in July 2011. Mink and de Haan (2013) examined contagion effects during the European crisis and they analyzed the impact of the news about the first Greek bailout on bank stock prices in 2010 using data for 48 European banks. The authors found that these news led to abnormal returns, even for banks without any exposure to Greece or other highly indebted euro countries. Constâncio (2014) pointed out that there are various narratives and interpretations about the way the crisis had unfolded in the euro area. Like some other researchers, he focused on five countries (i.e. Greece, Portugal, Ireland, Spain, and Italy), which were substantially affected by the European crisis. The author discussed a deep rationale for Banking Union in the euro area, and he concluded that the Banking Union is a central pillar of the strategy to make the EMU more effective and robust.

The researchers are rather unanimous that the ongoing European crisis is often described as a sovereign debt crisis, but it is actually a sequence of interactions between sovereign problems and banking problems. Among others, Shambaugh (2012) indicated that the euro area has faced three interlocking crises recently. The crises have been interlinked in several ways. Firstly, there has been a banking crisis, i.e., banks have been undercapitalized and have faced liquidity problems. Secondly, there has been a sovereign debt crisis, i.e., a number of countries have faced rising bond yields and challenges funding themselves. Thirdly, there has been a macroeconomic crisis, i.e., economic growth has been slow in the eurozone overall and unequally distributed across countries. Similarly, Lane (2012) stressed that the sovereign debt crisis has been deeply intertwined with the banking crisis and macroeconomic imbalances in the euro area. However, Taylor (2012) indicated that, historically, global imbalances are not as important as a factor in financial crises as is often perceived. He advocated that the credit boom explanation stands out as the most plausible predictor of financial crises since the late nineteenth century.

Bordo and James (2014) analyzed the eurozone financial crisis in the context of previous international financial crises. Among other conclusions, they pointed out that the later Cyprus crisis and its resolution exposed new dimensions to the clashes over the European debt and bank crises. The authors indicated that the discussion of a levy on bank deposits, and whether small customers should be exempted, puts a class conflict at the center stage. Zenios (2013) stressed that the Cyprus crisis, which started in 2011, is one of the most complex in the euro area, although in absolute terms it is a rather minor crisis. The author summarized the situation in Cyprus and he indicated following three aspects of the ongoing crisis: (1) debt of non-financial corporations and households is a drag on growth and it is significantly higher than in other eurozone countries; (2) government debt is a drag on growth and it is higher than in Ireland, similar to Spain, but not as high as in Greece; (3) banking sector problems are similar to those in Ireland and they dominate the government debt problems (Zenios, 2013, p. 29).

It is pertinent to note that five euro area countries (i.e., Spain, Ireland, Portugal, Greece, and Cyprus), which have been especially afflicted by the consequences of the current European crises, have received financial support from the international institutions (i.e., the EC, ECB, EFSF, EFSM, ESM, IMF). These countries have benefited from the economic adjustments programmes. The European Financial Stabilization Mechanism (EFSM) and the European Financial Stability Facility (EFSF) were parts of a wider safety net. The EFSM was activated for providing financial assistance to Ireland and Portugal. The EFSF was created as a temporary crisis resolution mechanism by the euro area Member States in June 2010. It has provided financial assistance to Ireland, Portugal, and Greece. In July 2013, the EFSM and EFSF were replaced by the European Stability Mechanism (ESM) which is now the sole and permanent mechanism for responding to new requests for financial assistance by the euro area Member States. However, De Grauwe (2012) analyzed the implications of the EMU fragility for the governance of the eurozone and he concluded that the ESM does not sufficiently recognize this fragility. Moreover, some of the features of the new financial assistance are likely to increase this fragility.

Table 13.1 summarizes information concerning the European economic adjustment programmes (the relevant stock markets in order of decreasing value of market capitalization at the end of 2014; see Table 13.2 for details). At the time of this writing (April 2016), Greece and Cyprus still remain in the official bailout programmes.

There is widespread consent that a successful European Great Crisis resolution will need to include at least the following four components: (1) a fiscal union; (2) a banking union; (3) an overhaul of EU/eurozone institutions that would enable fiscal and banking unions to be sustainable, and (4) short-term arrangements that chart a path towards the completion of the previous three points (Moro, 2014). O’Rourke and Taylor (2013) pointed out that the institutional architecture of the eurozone needs to be deepened if a recurrence of the ongoing crisis is to be avoided, and a banking union seems essential. Lane (2012) emphasized that the most benign perspective on the European crisis is that it provides an opportunity to implement reforms that are necessary for a stable monetary union.

Eichengreen (2010) provided deep analysis about whether the euro and the EMU will survive, and how to avert a breakup of the euro area. In 2010, he concluded that “it is unlikely that one or more members of the euro area will leave in the next 10 years and that total disintegration of the euro area is more unlikely still” (Eichengreen, 2010, pp. 11–12). Nevertheless, at the time of this writing the eurozone situation is quite different and considerably more complicated.

13.3 Statistical Procedure for a Formal Identification of Down Markets

A direct, formal identification of crisis periods is possible based on statistical procedures for dividing market states into up and down markets, e.g., Lee et al. (2011), Lunde and Timmermann (2000). Pagan and Sossounov (2003) developed an algorithm that seems to be successful in locating bull and bear market periods in time. We employ a three-stage procedure of dividing market states into up and down markets Olbrys and Majewska (2014a,b, 2015a) and our methodology builds on Pagan and Sossounov (2003). In the first step, we conduct a preliminary identification of turning points, i.e., peaks and troughs, based on the conditions (13.1)–(13.2), respectively:

where P t represents the market index of month t, and from successive peaks/troughs we choose the highest/deepest one, respectively. Pagan and Sossounov (2003) stressed that in the business cycle literature an algorithm for describing turning points in time series was developed by Bry and Boschan (1971), but they modified this algorithm by taking the 8 months window (instead of six) in marking the initial location of turning points. In the second step, we rule out the phases (peak-trough or trough-peak) that last for less than 4 months, and cycles (peak-trough-peak or trough-peak-trough) that last for less than 16 months. Pagan and Sossounov (2003) pointed out that in business cycle dating the minimal cycle length is 15 months, hence 16 months were chosen to create a symmetric window of eight periods. Moreover, they advocated 4 months as the minimal length of a phase. In the last step we calculate the amplitudes A for each phase (amplitude is the difference in the natural logs of the index value in subsequent turning points). During the bull/bear market period there must be a large enough (of at least 20 %) rise/fall in the index value. This means that the amplitude of a given phase must fulfill the condition A ≥ 0. 18 or A ≤ −0. 22 for the bull or bear market period, respectively (Olbrys and Majewska, 2015a, pp. 552–553).

13.4 Data Description and Empirical Results on the US and Euro Area Stock Markets

The data consists of monthly logarithmic returns of the 19 euro area major stock market indexes and the New York market index—S&P500. There are 144 monthly observations for each series for the period beginning January 2004 and ending December 2015. The period contains all data necessary to employ the procedure described in Sect. 13.3.

13.4.1 Preliminary Statistics

Table 13.2 includes basic information about the eurozone members. Moreover, it reports summarized statistics for monthly logarithmic returns for the S&P500 and 19 major indexes of the euro area stock markets (in order of decreasing value of market capitalization at the end of 2014), as well as statistics testing for normality.

Several results in Table 13.2 are worth special notice. The sample means are not statistically different from zero. The measure for skewness shows that the return series are skewed, except for the SBITOP (Slovenia), CSE GENERAL (Cyprus), OMXT (Estonia), and OMXR (Latvia) series. The measure for excess kurtosis shows that almost all series are highly leptokurtic with respect to the normal distribution, except for the CAC 40 (France), FTSE MIB (Italy), and MSE (Malta) series. The Doornik and Hansen (2008) test rejects normality for almost all return series at the 5 % level of significance, except for the FTSE MIB (Italy) and MSE (Malta) series.

13.4.2 Formal Identification of Crisis Periods on the Euro Area Stock Markets

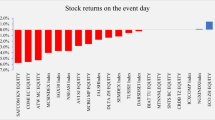

As was asserted in Sect. 13.3, we employ the three-stage procedure of dividing market states into bullish and bearish markets to identify crisis periods. Figure 13.1 presents the down market periods for the S&P500 and 19 indexes on the eurozone stock markets, obtained from the procedure. The empirical results are generated in the whole sample period from January 2004 to December 2015.

Overall information about the US and euro area down market periods obtained from the procedure of dividing market states, in the whole sample period January 2004 to December 2015 (the stock market indexes in order analogous to that in Table 13.2)

13.4.3 Correctness Analysis

This subsection briefly discusses the correctness of formal identification of down market periods. Two methods for verifying the bear market conditions were employed, both proposed by Fabozzi and Francis (1977): (1) the substantial moves procedure, and (2) the up and down market procedure.

The first procedure partitioned the sample into three subsets: (1) months when the market moved up substantially, (2) months when the market moved down substantially, and (3) months when the market moved neither up nor down substantially. Substantial moves were arbitrarily defined as months when the absolute value of market return was larger than half of one standard deviation of the market returns measured over the total sampled period (Fabozzi and Francis, 1977, pp. 1094–1095). Therefore, using the first procedure we tested whether during the down market months the absolute value of expected market return was larger than half of one standard deviation of the stock market returns measured over the total sampled period, for all markets investigated. According to the second procedure, we explored whether the expected index returns were negative during the crisis periods for all stock markets investigated. Table 13.3 reports detailed information about the US and euro area down market periods presented in Fig. 13.1. Moreover, it contains the empirical results of checking the bear market conditions for all periods.

To sum up, the results reported in Table 13.3 revealed that all determined periods were placed into the down category based on the second procedure for checking the bear market conditions (the answer “Yes” in the last column). Besides, the first procedure confirmed the GFC periods in all cases, also for the US stock market (the fourth column of Table 13.3). The empirical results indicated February 2009 as the end of the GFC for almost all countries investigated, except for Slovenia, Lithuania, Malta, Estonia, and Latvia, for which March 2009 was obtained as the end of the GFC. Moreover, Slovakia was the exception for which quite different crisis periods were specified. Otherwise, the results concerning the euro area crises are much more diverse. We obtained 22 down market periods in the eurozone during the period beginning from late 2009, but only 8 of them have been confirmed based on the substantial moves procedure. Nevertheless, our empirical results of a formal detection of down market periods on the euro area stock markets are rather consistent with the existing literature.

13.5 Conclusion

The purpose of this paper was a formal identification of crises on the nineteen eurozone stock markets and, for comparison, on the US market, during the period 2004–2015. The Pagan and Sossounov (2003) methodology of dividing market states into up and down markets was employed, as it seems to be useful in locating bear market periods in time, e.g., Olbrys and Majewska (2014a,b, 2015a). The empirical results confirmed February 2009 as the end of the GFC for almost all countries investigated, except for Slovenia, Lithuania, Malta, Estonia, and Latvia, for which March 2009 was obtained as the end of the GFC. Furthermore, the findings concerning the European crises during the period beginning from late 2009 are in accord with the existing literature.

The precise identification of crises allows to provide a sensitivity analysis of various relationships and linkages among international equity markets using econometric and statistical tools with respect to different periods, especially in the context of stock market integration and globalization. Nowadays, there is a growing body of empirical literature concerning integration effects on the EMU stock markets, e.g., Büttner and Hayo (2011), Hardouvelis et al. (2006), and the references therein. Therefore, an important problem is verifying to what extent the results obtained during research depend on the choice of the period investigated, especially taking the pre-, post-, and crisis periods into consideration, e.g., Olbrys and Majewska (2015b). Moreover, the precise detection of crises is certainly important in practice, as researchers found that profits to investment strategies depend critically on the state of the market. Unfortunately, due to the global nature of crisis causes and consequences in the eurozone, diversification usually provides little help to investors, as markets simultaneously drop.

References

Ardagna S, Caselli F (2014) The political economy of the Greek dept crisis: a tale of two bailouts. Am Econ J Macroecon 6(4):291–323

Bartram SM, Bodnar G (2009) No place to hide: the global crisis in equity markets in 2008/2009. J Int Money Financ 28(8):1246–1292

Bordo M, James H (2014) The European crisis in the context of the history of previous financial crises. J Macroecon 39:275–284

Brunnermeier MK (2009) Deciphering the liquidity and credit crunch 2007–2008. J Econ Perspect 23(1):77–100

Bry G, Boschan C (1971) Cyclical analysis of time series: selected procedures and computer programs. NBER, New York

Büttner D, Hayo B (2011) Determinants of European stock market integration. Econ Syst 35:574–585

Calomiris CW, Love I, Martinez Peria MS (2012) Stock returns’ sensitivities to crisis shocks: evidence from developed and emerging markets. J Int Money Financ 31(4):743–765

Chudik A, Fratzscher M (2011) Identifying the global transmission of the 2007–2009 financial crisis in a GVAR model. Eur Econ Rev 55:325–339

Claessens S, Dell’Ariccia G, Igan D, Laeven L (2010) Cross-country experience and policy implications from the Global Financial Crisis. Econ Policy 62:267–293

Constâncio V (2014) The European crisis and the role of the financial system. J Macroecon 39:250–259

De Grauwe P (2012) A fragile eurozone in search of better governance. Econ Soc Rev 43(1):1–30

Doornik JA, Hansen H (2008) An omnibus test for univariate and multivariate normality. Oxf Bull Econ Stat 70(Supplement 1):927–939

Eichengreen B (2010) The breakup of the euro area. In: Alesina A, Giavazzi F (eds) Europe and the euro. University of Chicago Press, Chicago, pp 11–56

Fabozzi FJ, Francis JC (1977) Stability tests for alphas and betas over bull and bear market conditions. J Financ 32(4):1093–1099

Gibson HD, Hall SG, Tavlas GS (2014a) Fundamentally wrong: market pricing of sovereigns and the Greek financial crisis. J Macroecon 39:405–419

Gibson HD, Pavilos T, Tavlas GS (2014b) The crisis in the euro area: an analytic overview. J Macroecon 39:233–239

Hardouvelis GA, Malliaropulos D, Priestley R (2006) EMU and European stock market integration. J Bus 79(1):365–392

Katsimi M, Moutos T (2010) EMU and the Greek crisis: the political-economy perspective. Eur J Polit Econ 26:568–576

Lane PR (2012) The European sovereign debt crisis. J Econ Perspect 26(3):49–68

Lee J-S, Kuo C-T, Yen P-H (2011) Market states and initial returns: evidence from Taiwanese IPOs. Emerg Mark Financ Trade 47(2):6–20

Lunde A, Timmermann A (2000) Duration dependence in stock prices: an analysis of bull and bear markets. University of California, San Diego

Merler S, Pisani-Ferry J (2012) Sudden stops in the euro area. In: Breugel policy contribution, 2012/06, pp 1–16

Mink M, de Haan J (2013) Conagion during the Greek sovereign debt crisis. J Int Money Financ 34:102–113

Mishkin FS (2011) Over the cliff: from the subprime to the global financial crisis. J Econ Perspect 25(1):49–70

Moro B (2014) Lessons from the European economic and financial great crisis: a survey. Eur J Polit Econ 34:S9–S24

Olbrys J, Majewska E (2014a) Direct identification of crisis periods on the CEE stock markets: the influence of the 2007 U.S. subprime crisis. Proc Econ Financ 14:461–470

Olbrys J, Majewska E (2014b) Quantitative identification of crisis periods on the major European stock markets. Pensee 76(1):254–260

Olbrys J, Majewska E (2015a) Bear market periods during the 2007–2009 financial crisis: direct evidence from the Visegrad countries. Acta Oecon 65(4):547–565

Olbrys J, Majewska E (2015b) Testing integration effects between the CEE and U.S. stock markets during the 2007–2009 Global Financial Crisis. Folia Oeconomica Stetinensia 15(1):101–113

O’Rourke KH, Taylor AM (2013) Cross of Euros. J Econ Perspect 27(3):167–192

Pagan AR, Sossounov KA (2003) A simple framework for analysing bull and bear markets. J Appl Econ. 18(1):23–46

Pisani-Ferry J, Sapir A (2010) Banking crisis management in the EU: an early assessment. Econ Policy 62:341–373

Provopoulos GA (2014) The Greek economy and banking system: recent developments and the way forward. J Macroecon 39:240–249

Shambaugh JC (2012) The euro’s three crises. Brook Pap Econ Act 44(1):157–231

Taylor AM (2012) External imbalances and financial crises. NBER working paper No. 18606

Zenios SA (2013) The Cyprus debt: perfect crisis and a way forward. Cyprus Econ Policy Rev 7(1):3–45

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Majewska, E., Olbrys, J. (2017). Formal Identification of Crises on the Euro Area Stock Markets, 2004–2015. In: Tsounis, N., Vlachvei, A. (eds) Advances in Applied Economic Research. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-48454-9_13

Download citation

DOI: https://doi.org/10.1007/978-3-319-48454-9_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-48453-2

Online ISBN: 978-3-319-48454-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)