Abstract

Many academicians and international investors qualify the Central and Eastern European countries (CEECs) as a very homogenous group of countries in terms of sovereign risk. However, the introduction of the euro and the removal of exchange rate risk in some of the CEECs, the differences in perceived sovereign credit risks, liquidity and availability of sovereign credit default swap (CDS) of the CEECs’ are the main factors influencing the changes in financial integration in the CEECs’ sovereign bond markets. The objective of this study—to assess the financial integration of the Central and Eastern European countries sovereign bond markets after the introduction of the euro. The research methods: the systemic, logical and comparative analysis of the scientific literature, price-based indicators of financial integration recommended by European Central Bank (ECB). This empirical study focuses on monthly sovereign bonds yields data for 10 CEECs: Bulgaria, Czech Republic, Croatia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, and Slovenia for a 15 year period, i.e. from 2000 to 2015. The results of this empirical study suggest that CEECs’ sovereign bond market’s fragmentation receded further; however, the fragmentation of this market still remains. The most significant increase in CEECs’ sovereign bond market fragmentation was observed during recent financial crisis. The introduction of the euro and the removal of exchange rate risk in some CEECs do not affect the convergence of government bond yields to the euro-zone level.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

This empirical study investigates the financial integration of the government bond markets of 10 CEECs (Bulgaria, Czech Republic, Croatia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, and Slovenia). The scientific literature states that the interrelation among different CEECs’ government bond yields has increased recently suggesting that government bond returns are driven more by common international factors rather than by local (country-specific) factors. However, financial market integration may also increases spillover effects and contagion risks. Ferguson et al. (2009) also note that financial integration could have both stabilizing and destabilizing effects. For this reason it is crucial important to accurately measure the degree of financial market integration and to identify reasons for financial markets being less-than-fully integrated.

Many academicians and international investors qualify the CEECs as a very homogenous group of countries in terms of sovereign risk. However, the European Union (EU) enlargement process, the introduction of the euro and the removal of exchange rate risk in some of the CEECs, the differences in perceived sovereign credit risks, liquidity and availability of sovereign CDS of the CEECs’ are the main factors influencing the changes in financial integration in the CEECs’ sovereign bond markets.

The objective of this study—to assess the financial integration of the Central and Eastern European countries sovereign bond markets after the introduction of the euro. The research methods: the systemic, logical and comparative analysis of the scientific literature, price-based indicators of financial integration recommended by European Central Bank (ECB). This empirical study focuses on monthly sovereign bonds yields data for 10 CEECs: Bulgaria, Czech Republic, Croatia, Hungary, Latvia, Lithuania, Poland, Romania, Slovak Republic, and Slovenia for a 15 year period, i.e. from 2000 to 2015.

2 Literature Review

Three related strands of the scientific literature investigate the integration of European government bond markets. The first strand of the literature (Orlowski and Lommatzsch 2005; Pungulescu 2013; Christiansen 2014; Răileanu-Szeles and Albu 2015; etc.) focuses on financial integration in the EU-27 area analyzing different group of countries (EU15 and EU12). The second strand of the literature (Pozzi and Wolswijk 2012; Abad and Chuliá 2014; Gill et al. 2014; etc.) focuses on the impact of recent financial crisis on the financial integration of EU and Economic and Monetary Union (EMU). While the third strand of the literature (Abad et al. 2010, etc.) investigates the impact of the introduction of the euro on the degree of integration of European sovereign bond markets.

Orlowski and Lommatzsch (2005) investigated convergence of sovereign bond yields of the EU New Member States (NMS) to the euro area yields. The empirical results of this study show that Germany’s sovereign bond yields are statistically significant factors of NMS government bond yields changes. This empirical study provides empirical evidence on increasing monetary convergence of the NMS in terms of sovereign bond yields suggesting that NMS could adopt the euro without any potential risk for destabilization of their financial markets.

Pungulescu (2013) analyzed financial market integration within the EU with special focus on the process of financial integration of EU before and after the Eastern enlargement. Pungulescu (2013) states that the financial integration of sovereign bond markets increased in both groups (EU-15 and EU-12) within the EU. However, a reversal process of the financial integration was observed in EU over the recent years (during the recent financial crisis) suggesting about divergence process in both groups of the EU.

Christiansen (2014) investigated the dynamics of the financial integration of EU sovereign bond markets. The empirical results suggest that the degree of financial integration of the government bond markets is higher in EMU comparing to non-EMU members as well as in EU-15 than in EU-12. Christiansen (2014) also states that the lower the credit rating of EMU countries is, the lower degree of financial integration is. This empirical study provides also substantial empirical evidence on decreased financial integration within EU, particularly in EMU countries, during the recent financial crisis period.

Răileanu-Szeles and Albu (2015) analyzed the process of financial integration in the EU. The empirical results indicate the presence of two (or even more) clusters of the EU countries in terms of sovereign bond yield. Răileanu-Szeles and Albu (2015) argue that the recent financial crisis has increased the divergences emerging within the EU, leading to the decline of the financial integration process within EU in the long-term.

Pozzi and Wolswijk (2012) investigated the integration of EMU government bond markets. The empirical results suggest that the country-specific factors were not statistically significant factors explaining the risk premiums of the government bond yields till the recent financial crisis. Pozzi and Wolswijk (2012) argue that the EMU sovereign bond markets were almost fully integrated by the end of 2006, however, divergence process of EMU government bond markets was observed during the period of 2007–2009.

Abad and Chuliá (2014) analyzed the dynamics of financial integration of EU government bond market during the European sovereign debt crisis and the global financial crisis. The empirical study by Abad and Chuliá (2014) provides substantial evidence that the recent global financial and the European sovereign debt crises had a significant effect on degree of financial integration of EU government bond markets. Additionally, Abad and Chuliá (2014) found substantial empirical evidence suggesting that the volatility in EU and US financial markets spill over to the EU government bond market.

Gill et al. (2014) investigated the impact of the recent global financial crisis on EMU financial integration. The empirical analysis reveals that the global financial crisis has different effect on sovereign bond market of the EMU center and periphery countries. Gill et al. (2014) provide empirical evidence that changes in investors’ perceptions during the recent global financial crisis had an impact on sovereign bond market of EMU periphery countries, however, a similar effect was not observed on the EMU center countries.

Abad et al. (2010) analyzed the impact of the euro introduction on the degree of financial integration of EU government bond markets. Abad et al. (2010) investigated the role of two important sources of systemic risk (world and euro-zone risk) on government bond yields in the EMU and non-EMU countries. The empirical evidence suggests that the impact of the euro introduction on the degree of financial integration of EU government bond markets was significant. Abad et al. (2010) argue that world risk factors are less important for EMU countries; however, this group of countries is more vulnerable to EMU risk factors. In contrary, non-EMU countries are more vulnerable to external risk factors.

3 Research Methodology and Data

The experts of ECB (ECB 2005) propose two broad categories of financial integration indicators: price-based indicators and quantity-based indicators. Price-based indicators of financial integration measure differences in asset prices while quantity-based indicators of financial integration assess the degree of global diversification of investors’ portfolios.

According to the recommendations of ECB (ECB 2005), measures of financial integration in government bond markets are based on sovereign bond yield differentials with respect to the German sovereign 10-year bond yield. Government bonds yield spreads provide a direct measure of the degree of financial integration. Two price-based indicators of financial integration (standard deviation of CEECs’ governments’ bond yield spreads and evolution of beta coefficients of CEECs’ governments’ bond yields) will be used in order to assess the financial integration of the CEECs’ sovereign bond markets.

The cross-country standard deviation of the CEECs’ governments’ bond yield spreads will be calculated on the monthly data basis. The standard deviation of the CEECs’ governments’ bond yield spreads S t takes the following form (Eq. 1):

where y c,t denotes the yield on the sovereign bond of the CEE country c with 10-year maturity on month t and y b,t is the yield on the government bond of Germany for that maturity (10-year).

If the CEECs’ governments’ bond markets are fully integrated and country-specific changes in perceived credit risks of country do not occur, CEECs’ governments’ bond yields should only react to news common to all governments’ bond markets. Changes in governments’ bond yields of individual countries should react only to common news and the effect of common news and events should be reflected in a change of the German government bond yield. In order to separate common from local factors, the following regression is run (Eq. 2):

where α denotes a country- and time-varying intercept; β is a CEE country- and time-dependent beta with respect to the German bond yield; ΔR is the change in the bond yield and ε is a country-specific shock.

The conditional betas of the CEECs’ governments’ bond yields are derived by estimating the above regression (Eq. 2) using the first 18 months. Subsequently, the data window is moved one month ahead and the equation is re-estimated, until the last observation is reached. In this way a time series for β c,t is thus obtained.

This empirical study focuses on monthly long-term (10 years) government bonds interest rates (EMU convergence criterion) for 10 CEECs’: Bulgaria (BGR), Czech Republic (CZE), Croatia (HRV), Hungary (HUN), Latvia (LVA), Lithuania (LTU), Poland (POL), Romania (ROM), Slovakia (SVK), Slovenia (SVN), and other 14 euro-area member states (Belgium (BEL), Germany (DEU), Ireland (IRL), Greece (GRC), Spain (ESP), France (FRA), Italy (ITA), Cyprus (CYP), Luxembourg (LUX), Malta (MLT), the Netherlands (NLD), Austria (AUT), Portugal (PRT), Finland (FIN)). While at present, harmonized government long-term interest rates are available only for 27 of the EU member states, Estonia is not included in the sample. The indicator available at the moment for Estonia, taking into account the specific situation of this country, is not fully harmonized. Monthly long-term government bonds interest rates data for the period of 2000 M01–2015 M07 have been obtained from Eurostat.

4 Research Results

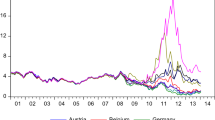

According to European Central Bank (ECB 2015), in 2009 a remarkable divergence in the CEECs sovereign bonds yields emerged when financial markets participants began to perceive an apparent credit risk for some CEECs sovereigns (see Fig. 1). ECB’s experts state that some CEECs sovereign bond yields already elevated due to country-specific macro and fiscal risks became additionally influenced by self-reinforcing premium related to sovereign bonds market fragmentation. The size of divergence in CEECs government bond yields declined markedly in 2011 to a 1 percent level in 2015. The cross-country differences kept declining in 2012–2014 remained at the same level than in the period 2000–2008. This could be explained by remaining government bond market segmentation, but could also be driven by continued differences in economic and fiscal outlook across CEECs (ECB 2015).

According to European Central Bank (ECB 2015), the price differentials among the CEECs sovereign bonds are not only driven by differences in credit risk premium, but also by differences in CEECs sovereign bonds market liquidity. During financial crises times, the prices on more liquid CEECs sovereign bonds are significantly higher than that on less sovereign bonds. The premium on liquid CEECs sovereign bonds can be quantified from the spread between sovereign and agency bonds with the same credit risk and different liquidity level. The decline in the liquidity premium of the CEECs sovereign bonds is another driver contributing to the reduction in CEECs sovereign bonds spreads illustrated below. In this context, Fig. 1 shows that CEECs sovereign bonds yields spreads continue to have a relatively low average level and a large dispersion compared with the period before 2009. Moreover, although the average CEECs sovereign bonds yields spreads increased slightly and dispersion fell during 2011–2012, these indicators did not show any further significant improvement in 2015 (ECB 2015).

Figure 1 also shows the evolution over time of the standard deviations of government yield spreads over 10-year German bonds in EMU. The figure shows a significant drop in these indicators in the run-up to the EMU, which then remain close to zero from 2001 onwards. The sharp decline of these indicators signals that the EMU government bond market has reached a very high level of integration. Overall, EMU sovereign bond markets showed a limited degree of remaining fragmentation in 2015.

According to ECB (2015), EC (2015), sovereign bond market price indicators suggest about EU sovereign bond market segmentation. Sovereign bond market quantity-based indicators suggest about fragmentation of the EMU sovereign bond market and a divergence process of EMU sovereign bond market resulted of several factors. First, the differences in economic sentiment across EMU countries declined due to the implementation of structural reforms in distressed EMU countries. Second, the monetary policy measures implemented by ECB maintain confidence throughout 2014. Third, the monetary policy by ECB affected a shift of investment of international and domestic investors’ towards higher-risk assets. These changes lowered the sovereign bonds spreads of several EU countries and contributed to a reduced fragmentation of the EU sovereign bond market. The EMU sovereign ratings continue to be very low, however, a large dispersion of EMU sovereign ratings is observed compared with the period before 2009. Moreover, although the average EMU sovereign rating increased slightly and dispersion of EMU sovereign ratings fell during 2013, EMU sovereign ratings and CDS premium on sovereigns bonds did not show any further significant improvement in 2014 (ECB 2015).

The developments of standard deviation of CEECs sovereign bond yields spreads over time suggest about the higher degree of financial integration (the lower the dispersion) during pre-crisis and post-crisis periods. The most significant effect on increased dispersion of the CEECs sovereign bond yields spreads in 2009 had an increased credit risk of Lithuania, Latvia, Hungary, and Romania (see Fig. 2).

Another measure of financial integration of bond market, referred to as “beta-convergence”, is based on perception that the more integrated the sovereign bond market is, the more sovereign bond yields should react to common global and regional factors instead of local domestic factors. However, common global and regional factors will not fully explain changes in sovereign bond yields as local domestic factors related to credit and liquidity risks will continue to have an effect on sovereign bonds yields. Figure 3 represents the evolution of the beta-convergence (the estimated correlation of changes in the 10-year government bond yield of a given CEE country with changes in the German 10-year government bond yield). The betas of CEECs’ government bond yields varied substantially over time, however, some countries (e.g. Czech Republic) converged towards 1, the perfect financial integration level.

The available prices-based indicators of financial integration show that with the introduction of the euro and the removal of exchange rate risk in some CEECs government bond yields have not converged to the EMU level. For this reason the importance of local factors continue to have some influence on CEECs government bond yields. This may partly be explained by differences in liquidity and the availability of developed derivatives markets tied to the various individual bond markets. Additionally, government bond yields in different countries also reflect differences in perceived credit risks of CEECs.

5 Conclusions

The developments of standard deviation of CEECs sovereign bond yields spreads over time suggest about the higher degree of financial integration (the lower the dispersion) during pre-crisis and post-crisis periods. The most significant effect on increased dispersion of the CEECs sovereign bond yields spreads in 2009 had an increased credit risk of Lithuania, Latvia, Hungary, and Romania. The betas of CEECs’ government bond yields varied substantially over time; however, some countries (e.g. Czech Republic) converged towards 1, the perfect financial integration to the EMU level. The results of this empirical study suggest that CEECs’ sovereign bond market fragmentation receded further, however the fragmentation of this market still remains. The most significant increase in CEECs’ sovereign bond market fragmentation was observed during recent financial crisis. The introduction of the euro and the removal of exchange rate risk in some CEECs do not affect the convergence of government bond yields to the EMU level.

References

Abad, P., & Chuliá, H. (2014). European government bond market integration in turbulent times (Working Paper 2014/24 1/26). Research Institute of Applied Economics.

Abad, P., Chuliá, H., & Gómez-Puig, M. (2010). EMU and European government bond market integration. Journal of Banking & Finance, 34(12), 2851–2860.

Christiansen, C. (2014). Integration of European bond markets. Journal of Banking & Finance, 42, 191–198.

European Central Bank (ECB). (2005). Indicators of financial integration in the Euro area. Germany: European Central Bank.

European Central Bank (ECB). (2015). Financial integration in Europe. Germany: European Central Bank.

European Commission (EC). (2015). European financial stability and integration. Brussels: European Commission.

Ferguson, R., Hartmann, P., Panetta, F., & Portes, R. (2009). International financial stability. Ninth Geneva Report on the World Economy. Switzerland: International Center for Monetary and Banking Studies.

Gill, I. S., Sugawara, N., & Zalduendo, J. (2014). The center still holds: Financial integration in the Euro area. Comparative Economic Studies, 56, 351–375.

Orlowski, L. T., & Lommatzsch, K. (2005). Bond yield compression in the countries converging to the Euro. William Davidson Institute Working Papers Series WP799.

Pozzi, L., & Wolswijk, G. (2012). The time-varying integration of Euro area government bond markets. European Economic Review, 56(1), 36–53.

Pungulescu, C. (2013). Measuring financial market integration in the European Union: EU15 vs. new member states. Emerging Markets Review, 17, 106–124.

Răileanu-Szeles, M., & Albu, L. (2015). Nonlinearities and divergences in the process of European financial integration. Economic Modelling, 46, 416–425.

Acknowledgement

This research was funded by a grant (No. MIP-016/2015) from the Research Council of Lithuania.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper

Deltuvaitė, V. (2017). Recent Developments in Financial Integration in the Central and Eastern European Countries Sovereign Bond Markets. In: Bilgin, M., Danis, H., Demir, E., Can, U. (eds) Country Experiences in Economic Development, Management and Entrepreneurship. Eurasian Studies in Business and Economics, vol 5. Springer, Cham. https://doi.org/10.1007/978-3-319-46319-3_39

Download citation

DOI: https://doi.org/10.1007/978-3-319-46319-3_39

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-46318-6

Online ISBN: 978-3-319-46319-3

eBook Packages: Business and ManagementBusiness and Management (R0)