Abstract

In the last two decades, data-driven policymaking has gained more and more importance due to the larger availability of data (and, more recently, Big Data) for designing proper and timely economic and social policies. This larger availability of data has let decision makers have a deeper insight of complex socio-economic phenomena (e.g. unemployment, deprivation, crime, social care, healthcare) but, at the same time, it has drastically increased the number of indicators that can be used to monitor these phenomena. Decision makers are now often in the condition of taking decisions with large batteries of indicators whose interpretation is not always easy or concordant. In order to simplify the decisional process, a large body of literature suggests to use synthetic indicators to produce single measures of vast, latent phenomena underlying groups of indicators. Unfortunately, although simple, this solution has a number of drawbacks (e.g. compensation between components of synthetic indicators could be undesirable; subjective weighting of the components could lead to arbitrary results; mixing information about different phenomena could make interpretation harder and decision-making opaque). Moreover, with operational decisions, it is necessary to distinguish between those situations when decisions can be embedded in automated processes, and those that require human intervention. Under certain conditions, the use of synthetic indicators may bring to a misleading interpretation of the real world and to wrong policy decisions. In order to overcome all these limitations and drawbacks of synthetic indicators, the use of multi-indicator systems is becoming more and more important to describe and characterize many phenomena in every field of science, as they keep the valuable information, inherent to each indicator, distinct (see, for a review: Bruggemann and Patil 2011).

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

In the last two decades, data-driven policymaking has gained more and more importance due to the larger availability of data (and, more recently, Big Data) for designing proper and timely economic and social policies. This larger availability of data has let decision makers have a deeper insight of complex socio-economic phenomena (e.g. unemployment, deprivation, crime, social care, healthcare) but, at the same time, it has drastically increased the number of indicators that can be used to monitor these phenomena. Decision makers are now often in the condition of taking decisions with large batteries of indicators whose interpretation is not always easy or concordant. In order to simplify the decisional process, a large body of literature suggests to use synthetic indicators to produce single measures of vast, latent phenomena underlying groups of indicators. Unfortunately, although simple, this solution has a number of drawbacks (e.g. compensation between components of synthetic indicators could be undesirable; subjective weighting of the components could lead to arbitrary results; mixing information about different phenomena could make interpretation harder and decision-making opaque). Moreover, with operational decisions, it is necessary to distinguish between those situations when decisions can be embedded in automated processes, and those that require human intervention. Under certain conditions, the use of synthetic indicators may bring to a misleading interpretation of the real world and to wrong policy decisions. In order to overcome all these limitations and drawbacks of synthetic indicators, the use of multi-indicator systems is becoming more and more important to describe and characterize many phenomena in every field of science, as they keep the valuable information, inherent to each indicator, distinct (see, for a review: Bruggemann and Patil 2011).

An effective approach to multi-indicator systems can be found in the theory of Partially Ordered Sets and its applications like Hasse diagrams. A Partially Ordered Set (POSET) is a generally adequate representation of our units of observation if we assume that they are affected by a latent phenomenon which is described by some, not entirely concordant, indicators. In that case, which is the common setting of multi-indicator systems, it is very often impossible to rank all observations according to the intensity of the latent phenomenon, as each indicator is likely to lead to a different ranking of the observed unit. Typically, that is the case in which some total order is ultimately imposed to the observations through a synthetic indicator or through any common data-driven dimensional reduction based on a generalized notion of distance between observations. However, if preserving whatever partial order can be found in the original data is more important than preserving relative distances between observations, partial order methods have considerable advantages over the typical approach.

In our opinion, actual POSET literature has not yet sufficiently analysed two topics that are of absolute relevance for policymakers. First of all, POSET theory and its outputs are still too difficult to be understood by most policymakers, and graphical outputs easier to understand than Hasse diagrams are desirable. Secondly, decision makers are interested not only in comparing statistical units (e.g. neighbourhoods, cities, hospitals, regions, and natural reserves) at one specific time to address resources and different policy interventions, but also in evaluating the effects of policy actions over time. In this chapter, we discuss how Partial Order Scalogram Analysis with base Coordinates (POSAC) can be used to give a bi-dimensional representation of multi-indicator systems while preserving their partial order, consistently with the POSET principles. Afterwards, we apply this technique to two sets of panel data in order to show how the time dimension can be included in POSAC analyses.

The rest of this chapter is organized as follows. First we review the basics of the POSAC technique and we discuss its output in some toy examples in order to evaluate its real accuracy as a graphical tool for decision-making support. Then, wepropose a way to analyse panel data in multi-indicator systems via POSAC and we provide two case studies in environmental and economics frameworks. Finally we discuss pros and cons of this technique and we suggest some further developments in this direction.

2 The POSAC Procedure

The principal output of the POSET analysis is the Hasse Diagram, a visual representation of comparability and incomparability across the elements of the set (see Bruggemann and Patil 2011 for a full description of the method). Despite its relevance, the Hasse diagram is not of immediate interpretation, especially for what concerns the level of incomparability. In addition, if the aim is to provide an instrument from which policymakers can directly benefit, it is important to keep the results’ interpretation as simple as possible and this is not always the case with the Hasse diagram, which is not a standard and widely used instrument. As a consequence, other partial order methods can be used to simplify the interpretation of results. In this context, Partial Order Scalogram Analysis with base Coordinates (POSAC) provides a two-dimensional representation of a partially ordered set \( \begin{array}{c}P\\ {}\hfill \left(n\times m\right)\hfill \end{array} \) composed by n elements and their m attributes (a 1, a 2, … a m ) with \( m>2 \) (Shye and Amar 1985; Shye 1985). In practice, POSAC is an iterative algorithm that builds a two-dimensional graph from a multidimensional dataset preserving order relations and incomparabilities as much as possible (Bruggemann and Patil 2011). The POSAC methodology works through different steps:

-

1.

First the m attributes of the n elements are converted into ranks; this reduces random incomparabilities and makes the method more robust to outliers and indifferent to the scales of the original variables (Raveh and Landau 1993; Bruggemann and Patil 2011).

-

2.

The algorithm computes the weak monotonicity coefficients of all attributes and identifies the two attributes that have the least positive correlation.

-

3.

A profile made of the ranking in each attribute is given to each element so that the profile for the k element is given by: \( {a}^{(k)}={a}_1^{(k)}\dots {a}_i^{(k)}\dots {a}_j^{(k)}\dots, {a}_m^{(k)} \). Themaximum and the minimum profiles are defined as those profiles having the maximum and minimum observed scores in all the m attributes and they are placed, respectively, in the top right corner (1,1) and in the bottom left corner (0,0) of the two-dimensional Cartesian space.

-

4.

The other profiles are then positioned in the two-dimensional graph starting from the initial placement of the a (k) profile (x k , y k ) that is obtained by solving the simultaneous linear equations:

$$ \left\{\begin{array}{l} {x}_k+{y}_k={\displaystyle \sum\nolimits_{t=1}^m}{a}_t^{(k)} \\[15pt] {x}_k-{y}_k={a}_i^{(k)}-{a}_j^{(k)}\hfill \end{array}\right. $$(1)and translating the coordinates to fit [0; 1].

-

5.

The final base coordinates of the profiles are afterwards obtained through an iterative procedure that maximizes the correct representation of profile pairs in their order or incomparability such that:

$$ {a}^{(k)}>{a}^{(h)}\leftrightarrow {x}_k>{x}_h\wedge {y}_k>{y}_h $$(2)$$ {a}^{(k)}\left|\right|\ {a}^{(h)}\leftrightarrow \left\{\begin{array}{c}\hfill {x}_k\ge {x}_h\wedge {y}_k\le {y}_h\hfill \\ {}\hfill {x}_k\le {x}_h\wedge {y}_k\ge {y}_h\hfill \end{array}\right. $$(3)

As a consequence, those profiles characterized by high scores in all the attributes will be placed close to the top right corner of the (x, y) plane while those profiles recording lower scores will be located close to bottom left corner of the (x, y) plane. Profiles with large scores for some attributes and small scores for others will instead be placed in the incomparability areas which are located in the bottom right and top left area of the graph.

The POSAC graph identifies two diagonals of particular interest, the main diagonal (called Joint axis: \( J=X+Y \)) and the off-diagonal (called Lateral axis: \( L=X-Y \)). By construction, if one profile has higher score in the J coordinate than another, this means that the first profile is better (or worse, accordingly with the direction of the indicators) in all the original attributes than the second profile. Therefore, comparable profiles will be plotted along the J axis in a consistent ranking. On the contrary, those profiles plotted along the L axis cannot be ordered and they represent incomparable situations.

2.1 A Few Toy Examples

We believe that the use of a two-dimensional graph to plot a partial ordered set has undeniable benefits over the use of a Hasse diagram in terms of accessibility of results even for policymakers without a strong quantitative knowledge. Due to these properties, the POSAC procedure has been applied in several fields of research (Pagani et al. 2015; Tzfati et al. 2011; Sabbagh et al. 2003) including studies concerning crime (di Bella etal. 2015; Canter 2004; Raveh and Landau 1993), European countries comparison (Annoni and Bruggemann 2009; di Bella et al. 2016) or education (Eisenberg and Dowsett 1990).

The POSAC procedure is relatively old but no efforts have been made to update and improve the current procedure and overcome some of the shortcomings of the method. Indeed, despite of its benefits in terms of simplicity and interpretability, the POSAC procedure has also a series of limitations which have not been properly addressed in the past but which can, if overcome, make the POSAC procedure a suitable instrument for policymaking decisions. First off, POSAC can be currently run only using one software for statistical analysis (i.e. SYSTATFootnote 1) or using the original FORTRAN code, but both the two options are not as flexible or widespread as other software solutions (e.g. R, STATA, MATLAB). Moreover, POSAC analysis can’t be easily adapted to the researcher’s needs; for instance, it is not possible to define a weighting of profiles according to their frequencies: if two statistical units have the same profile, the POSAC procedure simply drops all the duplicates. More generally, the POSAC procedure itself can’t be customized and the actual reliability of POSAC analysis is largely unexplored. For this reasons we decided to analyse the POSAC output in a series of toy examples with different degrees of correlation among sets of indicators to detect how the positioning of profiles in the POSAC (x, y) plane, the reliability of the model and the interpretability of the results change under different correlation structures.

In the first toy example, we consider the complete set of profiles that can be obtained from three indicators defined on three levels. The Hasse diagram and the POSAC representationFootnote 2 of this set are given in Fig. 1: whereas the Hasse diagram points out the complex incomparability structure of the poset, the POSAC representation shows a large number of violations of conditions (2) and (3) and the proportion of profile pairs correctly represented is 69.2 %.Footnote 3 This low performance of POSAC is due to the regular tri-dimensional structure of the poset that POSAC can’t obviously reproduce in a bi-dimensional plane and the result given in Fig. 1 is only one of the possible equivalent POSAC projections. So, POSAC does not seem to be a good tool to plot symmetric posets but these cases are quite rare and often some profiles, albeit theoretically possible, are not found in real datasets.

To address this problem and to explore the POSAC capability of mapping profiles we considered that profiles occurrences in real data are a result of the indicators distributional form and correlation. For example, if we have indicators that are highly correlated with positively skewed distributions we should expect to have more occurrences for profiles that are plotted in the top-right part of the POSAC plane; if we have symmetrically distributed positively correlated indicators, the most common profiles will lay along the J-axis, mainly in the centre of the POSAC plane; as long as the correlation among the indicators decreases, the more the most common profiles will be found along the L-axis. Therefore, being not possible to weight the profiles for the POSAC representations, we implemented a procedure to represent various sets of indicators with different correlation structures among the indicators. The procedure we followed is described by the following steps:

-

1.

We generated 100,000 random values from a three-variate standardized normal distribution having correlation structure R.

-

2.

We split the three vectors of randomly generated indicators values into four buckets (ntile function in R environment) assigning the appropriate bucket number to each value obtaining 100,000 profiles from 111 to 444.

-

3.

We computed the profiles frequencies distribution

-

4.

We selected the profiles that cover the 75 % of the cases (i.e. occurrences)

In other words, we simulated the distribution of the profiles associated to three correlated indicators (I 1, I 2, I 3) recoded on four ranks and we selected only the most common profiles. The different correlation matrices we used are the following:

R 1 identifies a situation with three highly and equally correlated indicators. The simulation procedure selected 17 profiles (out of 64) that account for at least the 75 % of the total occurrences. The resulting POSAC output is given in Fig. 2a: most of the profiles are plotted along the J-axis because, being the indicators strongly correlated, the profiles with evident incomparabilities have lower frequencies and therefore they are not included in the 75 % selection. But, although the proportion of profile pairs correctly represented is 0.941, even in this case, there are some projection issues due to fact that being the indicators equally correlated the POSAC procedure can’t find a predominant indicator according to which the projection should be done and therefore there are various equivalent projections just like the case of Fig. 1.

R 2 identifies a situation with two highly correlated indicators (I 1 and I 3) and one (I 2) weakly correlated with other two. The POSAC output for the 22 selected profiles is given in Fig. 2b: the profiles still basically follow the J-axis but the low correlation that one indicator has with the other two strongly correlated indicators introduces an incomparability element that causes a number of profiles to be plotted far from the J-axis. The POSAC plot puts in evidence the incomparability role of indicator I 2 whose values increase along the L-axis from the right to the left. There are still a number of incorrect representations (the proportion of profile pairs correctly represented is 0.896) such as profiles 123 and 232 or 311 and 411, but generally it seems possible to see how the comparability structure due to indicators I 1 and I 3 is generally respected.

R 3 identifies a last toy example in which the correlation levels vary from medium-weak to strong. This may be quite realistic in real data when consistent indicators are selected. The POSAC output for the 18 selected profiles is given in Fig. 2c. This is best result among the battery of toy examples: all the pairs are correctly represented (100 %); the L-axis is mainly driven by I 1 whereas the other two indicators drive the J-axis component.

In light of these last three toy examples, it seems quite evident that the first one shown in Fig. 1 may closely correspond to the representation of three uncorrelated and uniformly distributed indicators, situation that is a nonsense for policy evaluation.

As a concluding remark for this section, POSAC seems to be a very useful tool to support decision-making but the lack of any form of weighting of profiles or indicators is a real issue that should be addressed in the future. Mediating among various incomparabilities without any weighting of profiles (for instance considering their occurrences) but considering all of them with the same importance, POSAC output may be ambiguous or difficult to interpret for policymakers if not unreliable. This issue seems to be mitigated when a limited number of indicators with a not perfectly balanced correlation structure (e.g. R 3) are given.

3 POSAC in the Context of Panel Data

Partial order methods and POSAC have an important field of application in multi-indicator systems that support policymaking. Once effectively represented, a partial order of government agencies based on last year’s performance scores, or one of public universities based on success indicators of a certain enrollment class, may help taking strategic decisions. In many cases, though, a partial order based on a single time period is not sufficient to support informed decision-making: annual scores may be volatile and trends may be as important as outcomes. For example, a partial order of the neighbourhoods of a city based on well-being indicators, if built on a single time period, could not reveal if an area with good scores was the only one to have regressed from last year, compared to significant improvements in all other areas. In order to overcome this limitation, POSAC can be adapted to represent at least certain sets of panel data and the evolution of a certain partial order over some periods of time (di Bella et al. 2016; Schneider et al. 2005).

In a POSET of panel data, our set is described by a matrix \( {P}_{nt\times m} \), where n elements are defined by m attributes a 1 … a m measured at t time periods. Consequently, our POSAC will be a representation of n × t profiles and each element k will correspond to t profiles \( {a}^{\left(k{t}_1\right)},{a}^{\left(k{t}_2\right)}\dots {a}^{(kt)} \). The maximal and minimal profiles a M and a m will also be determined according to this expanded population.

A POSAC of panel data has a few distinguishing features. The maximal profile is built with the highest observed scores of each attribute as usual, but in this case these are looked for across several time periods. As a consequence, this maximal may combine observed scores from different time periods. In spite of this difference, the interpretation is about the same: the maximal profile is a benchmark of the best possible scores that we know can be achieved (based on the fact that someone actually achieved them, at some point in time). Another distinguishing feature has greater analytical implications. All the profiles between the maximal and the minimal can now be compared according to three criteria (instead of just one): position relative to all other profiles, position relative to profiles at the same time period and position of profiles relative to the same element in different time periods. The second case can obviously be treated as an ordinary POSAC. The first case provides a rather immediate visualization of time lag in the development of certain performance levels when profiles belonging to different elements and different time periods are comparable and close to each other. For example, using the appropriate indicators, a POSAC of panel data could represent the lag of some countries in developing their industrial sector. Finally, the third case is an opportunity to use POSAC to track change in a partial order context and then to compare change trajectories. The trajectories can be visualized in POSAC by connecting a succession of profiles of the same element in consecutive time periods with directed segments. Segments that are broadly parallel to the J-axis show that the profiles of a certain element are getting closer to the maximal or to the minimal profile; segments parallel to the L-axis indicate changes between incomparable situations.

In order to illustrate the potential use of POSAC of panel data, we present two cases. The first is focused on environmental data concerning six different greenhouse and pollutant gas emissions measured across nine European countries every 10 years starting in 1990. The second deals with five well-known parameters (Maastricht parameters) that regulated the convergence of European countries in the transition from national currencies to the Euro. This POSAC represents 15 European countries, some transitioning to Euro with the first group, some transitioning later, and some not transitioning at all. The parameters are measured in 1997, 1999 (at the introduction of the Euro as a virtual currency) and in 2001.

3.1 Case Study 1: Greenhouse and Pollutant Gas Emissions

The international community has produced, since 1992 and the Rio conference, a number of documents, treaties and agreements on climate change and greenhouse gas reduction, with the goal of stabilizing the interference of human activity with the planetary climate system. Several other pollutant gas emissions related to anthropic activities and constituting a danger for human health and the ecosystem are measured and regulated as well. Relatively long-time series measuring these kinds of emissions are available on the data portal of the United Nations Environment Programme.Footnote 4

There are several factors that make this dataset interesting for POSAC, all ultimately implying that measuring the performance of countries based on their levels of emissions makes more sense in a partial order context. Consistently with the definition of orderability in a multidimensional system, all the emission indicators refer to a clearly identifiable latent variable (air pollution and greenhouse effect). This makes a ranking of countries meaningful even in the presence of multiple indicators, particularly if they are measured per capita. Furthermore, such ranking makes sense because these indicators are correlated with each other, but correlation is definitely less than perfect, meaning that we expect several cases of non-comparability. Finally, we have theoretical bases (e.g. Fulton et al. 2011) for the presence of non-comparability and good reason not to collapse this ranking into a total order. The first reason is that we expect some trade-offs between different emissions and we want to identify them: different technological and process arrangements of the same activity may produce more emissions of one kind and less of another. The second reason is that some characteristics and conditions of a country that cannot be modified in the near future may imply high emissions of some kind and low emissions of some other. This is the case with different economic structures (like prevalence of industry or agriculture), different levels of urbanization and mobility systems, different climates and so on. In this case as well, the ranking is more informative if provided in terms of partial order and with POSAC, thus allowing the identification of groups of countries with similar issues. Given the focus of international institutions on reducing emissions and on identifying quantitative targets for countries subscribing climate change agreements, this dataset is also particularly relevant in a panel data context. The ranking at a certain time is not as important as improvement in consecutive time periods and relative to other countries, as these parameters are going to provide the framework for policy decisions, evaluations of compliance to commitments and, possibly, for sanctions against non-compliance.

Our dataset includes nine European countries for which data is complete: differences in size are neutralized by using emissions per capita and, in spite of other differences (industrial structure, population density, market economies or transition economies in 1990, etc.), their recent history makes them broadly comparable. In fact, based on many sets of common rules shared by the nine countries, we expect some degree of convergence, and based on changes in technology and structure of the manufacturing sector in Europe and increased awareness about emissions, we expect visible improvements. Each country is represented by three profiles, one for year 1990, one for year 2000 and one for year 2010.

Each profile consists of observed emissions per capita of six greenhouse and pollutant gas emissions (Table 1): methane (CH4), carbon monoxide (CO), nitrous oxide (N2O), different non-methane volatile organic compounds (NMVOC), different nitrogen oxides (NOX), and sulphur dioxide (SO2).

Figure 3 presents the POSAC output. Most countries in our dataset are now more virtuous in terms of emissions than they were in 1990 and improvements are more unequivocal from year 2000 onwards. The only country in our dataset that is not comparable (and better) than in 1990 is Portugal, which has an increase of 8.5 % of its per capita emissions of methane in the last quarter century. Interestingly, our countries are progressively splitting into two distinct groups: in the top left corner are countries that have high emissions of methane and low emissions of sulphur dioxide (Netherlands, the UK, France and, recently, Portugal). This is a circumstance that has become relatively common in recent years. On the bottom right corner are countries which, at the opposite, have low methane emissions but high emissions of sulphur dioxide (Spain, Germany, Italy and Hungary). This kind of unbalance was more frequent in 1990 and in 2000, before European countries had to comply with EU norms concerning the desulphurization of fuels and the abatement technologies of these kinds of emissions.Footnote 5 The divide between countries with high methane emissions and countries with high sulphur dioxide emission has nonetheless become more evident.

3.2 Case Study 2: Euro Convergence Criteria

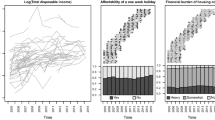

In 1992, the member countries of the European Community signed the Maastricht treaty, which would lead to the creation of the European Union and the common currency, the Euro. At article 121, countries were required to comply with a set of “convergence criteria” before entering the final stage of the Economic and Monetary Union and adopting the common currency. The criteria were all meant to ensure price stability after the adoption of the Euro and revolved around four indicators and one rule: the harmonized index of consumer prices (HICP), the government budget deficit to GDP ratio (BDFtGDP), the government debt to GDP ratio (DBtGDP) and the average yield of 10-year government bonds (BOYE), plus the requirement of not devaluing their national currency in the 2 years prior to the adoption of the common currency. Once again the dataset is an ideal testing ground for POSAC with panel data. The latent variable behind all criteria is explicit: favourable environment for price stability.

These indicators are given in Table 2 and are correlated only to a degree and the actual evolution of the monetary union around year 2000 offers plenty of opportunities to look at different situations, with countries struggling to comply with the criteria and finally adopting the common currency, others still distant from compliance and some more that qualify but decide to keep their national currency anyway. In order to magnify these differences, we chose years 1997, 1999 and 2001 as time periods and 15 EU countries. The complete time series of the indicators for all EU current member states are published online and free of charge on the website of Eurostat.Footnote 6

We straightforwardly converted the rule into a fifth quantitative indicator by counting the number of months in the 2 years prior to each time period during which the national currency remained pegged to the common currency under the European Monetary System (ECU/ERM/EURO).

In Fig. 4, the POSAC output shows rather high levels of incomparability and a tendency of 1999 profiles to be as good as those measured in 2001 in terms of preconditions for price stability. A group of profiles in the bottom right corner represents countries that, in the reference time period, had high yields on long-term government bonds but very low inflation. That happened in the UK, in Belgium, in Sweden and a few more countries including Italy in 1997. At the opposite, countries in the top left corner had relatively high inflation and yet low long-term bond yields. Remarkably, the first group consists mostly of 1997 and some 1999 profiles, whereas the second group includes almost exclusively 2001 profiles. In general, a good number of countries improved their compliance before 1999 and the adoption of the common currency but, a couple of years later, we find that all countries in our dataset, including some of those that kept their national currency, have higher HICP inflation and lower government bond yields. Based on these results, one could argue that, between year 1999 and year 2001, the adoption of the Euro was followed by an improvement of sovereign credit risk, which was certainly a goal of the common currency, but also by an unexpected increase in consumer prices, which the convergence criteria were meant to avoid.

4 Conclusions

Although POSAC shows some evident limitations, it is a tool of absolute interest to support decision-making for a number of reasons: the POSAC output is much simpler to understand than Hasse diagrams because the bi-dimensional Cartesian space is much more familiar for decision makers; moreover, in this Cartesian space profiles are clearly positioned from “good” to “bad” cases along the J-axis and the reading of the POSAC is straightforward; it allows a meaningful representation of panel data. Nevertheless, it has some limitations and drawbacks: the percentage of correct representation of the partial orderings drops quite rapidly even with a low number of indicators and their levels. Secondly, the routine for POSAC computation is actually available only in the SYSTAT environment or through the original FORTRAN routines published in Shye (1985). Consequently, the code is not easily editable and, actually, it is not easily possible to improve this technique, as, for instance, giving a different priority to the correct representation of certain profiles because they are observed multiple times.

Nevertheless, it is actually the sole alternative to Hasse diagrams for a visual representation of set of partially ordered indicators and it is therefore of extreme interest for the applicatory contexts herein discussed although its limitations. All these considerations (based on purpose on extreme examples) make us believe that, despite its undeniable potentiality, POSAC procedure may benefit from a revision of the original algorithm.

Notes

- 1.

All the POSAC plots given in this chapter were done in R environment using squared POSAC (x, y) coordinates from SYSTAT 11.0 output.

- 2.

Each point is plotted accordingly to the (x, y) POSAC coordinates and the labels represent the indicators ranking from 1 (the lowest) to 4 (the highest). So point 111 represents the profile associated to the lowest scores in the three indicators and 444 to the highest.

- 3.

- 4.

- 5.

- 6.

References

Annoni P, Bruggemann R (2009) Exploring partial order of European countries. Social Indic Res 92(3):471–487

Bruggemann R, Patil G (2011) Ranking and prioritization for multi-indicator systems. Springer, New York

Canter D (2004) A partial order scalogram analysis of criminal network structures. Behaviormetrika 31(2):131–152

di Bella E, Corsi M, Leporatti L (2015) A multi-indicator approach for smart security policy making. Soc Indic Res 122(3):653–675

di Bella E, Corsi M, Leporatti L, Cavalletti B (2016) Wellbeing and sustainable development: a multi-indicator approach. Agric Agric Sci Procedia 8:784–791

Eisenberg E, Dowsett T (1990) Student drop‐out from a distance education project course: a new method of analysis. Dist Educ 11(2):231–253

Fulton M, Mellquist N, Bluestein J (2011) Comparing life-cycle greenhouse gas emissions from natural gas and coal. Environ Prot 6:1–29

Pagani RN, Kovaleski JL, Resende LM (2015) Methodi Ordinatio: a proposed methodology to select and rank relevant scientific papers encompassing the impact factor, number of citation, and year of publication. Scientometrics 105:2109–2135

Raveh A, Landau S (1993) Partial order scalogram analysis with base coordinates (POSAC): its application to crime patterns in all the states in the United States. J Quant Criminol 9(1):83–99

Sabbagh C, Cohen EH, Levy S (2003) Styles of social justice judgments as portrayed by partial-order scalogram analysis: a cross-cultural example. Acta Sociol 46(4):323–338

Schneider V, Fink S, Tenbücken M (2005) Buying out the state: a comparative perspective on the privatization of infrastructures. Comp Pol Stud 38(6):704–727

Shye S (1985) Multiple scaling. The theory and application of partial order scalogram analysis. Elsevier, New York

Shye S, Amar R (1985) Partial order scalogram analysis by base coordinates and lattice mapping of items by their scalogram roles. In: Canter D (ed) Facet theory: approaches to social research. Springer, New York, pp 277–298

Tzfati E, Sein M, Rubinov A, Raveh A, Bick A (2011) Pretreatment of wastewater: optimal coagulant selection using partial order scaling analysis (POSA). J Hazard Mater 190(1–3): 51–59

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter

di Bella, E., Corsi, M., Leporatti, L. (2017). POSET Analysis of Panel Data with POSAC. In: Fattore, M., Bruggemann, R. (eds) Partial Order Concepts in Applied Sciences. Springer, Cham. https://doi.org/10.1007/978-3-319-45421-4_11

Download citation

DOI: https://doi.org/10.1007/978-3-319-45421-4_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-45419-1

Online ISBN: 978-3-319-45421-4

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)