Abstract

Over the last three decades, both macroeconomists and policymakers involved in fiscal policy have mainly focused on long-run issues. The consensus was government should adopt rules ensuring the long-run sustainability of public finance, and let an independent central bank take charge of controlling inflation and stabilizing GDP growth and unemployment. To a large extent, the Great Recession has challenged this view, and (partially) restored fiscal policy as a powerful macroeconomic stabilization instrument, while insisting on long-run fiscal sustainability requirements. First, this chapter reviews the literature on fiscal sustainability analysis and monetary-fiscal interactions; in particular, the author argues that long-run fiscal sustainability requirements and countercyclical fiscal policy should not be seen as necessarily antagonistic. Second, he proposes a critical appraisal, based on theoretical and empirical research, of the European fiscal framework and argues why it might be both too tight and too loose.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Introduction

Over the last three decades, under what is usually called the “Great Moderation,” both macroeconomists and policymakers involved in fiscal policy mainly focused on long-run issues. The consensus was that discretionary fiscal policy was mostly inefficient relative to monetary policy, to say the least. As a consequence, government should adopt rules ensuring the long-run sustainability of public finance, and let an independent central bank take charge of controlling inflation and stabilizing gross domestic product (GDP) growth and unemployment. This consensus was recently challenged following the experience of 2008’s subprime crisis and the following “Great Recession.” To some extent, fiscal policy has been restored as a powerful macroeconomic stabilization instrument during deep recessions, especially when monetary policy can no longer decrease the nominal short-run interest rate. But it also stressed the need of fiscal rules ensuring the long-run sustainability of public debt.

Nevertheless, the need for fiscal rules ensuring fiscal sustainability should not be seen as necessarily contradicting the short-run stabilization motives of fiscal policy. One of the lessons of European sovereign debt crisis may be that, in face of strong and negative demand shocks, a government must have enough “fiscal space” to use fiscal policy aggressively when needed (Blanchard et al. 2010).

What are the fiscal sustainability requirements? Despite being an (almost) infinitely lived-agent, government faces an intertemporal budget constraint like any other economic agent: it is expected to pay back its debts with future (present-value) primary surpluses; if not, it will at some point default—directly or indirectly—and lose access to financial markets as long as its borrower’s credibility is not restored. Fiscal rules and monitoring of fiscal policy precisely aim at preventing government from engaging upon an unsustainable path; that is, violating its intertemporal budget constraint and eventually defaulting on its debt.

When this occurs, violations of the government intertemporal budget constraint may take different forms, depending on institutional framework: direct default on public debt repayments, monetization by the Central Bank and/or through an increase in present and (un)expected future inflation, which are actually indirect forms of default, through an inflation tax. At some point, from a theoretical point of view, violations of a government’s sustainability constraint may result in some “unpleasant monetarist arithmetic,” to use the words of Sargent and Wallace (1981). Thus monetary–fiscal interactions’ effects on inflation, and more broadly speaking on macroeconomic stability, provide another set of theoretical arguments in favour of fiscal policy rules. Moreover, fiscal rules and fiscal surveillance are of great importance within a monetary union without federal budget. Uncoordinated national fiscal policies may have a significant impact on monetary policy’s ability to control inflation; but it also makes room for countercyclical fiscal policy, since common monetary policy cannot react to country-specific or asymmetric shocks.

The issue of public debt sustainability and fiscal policy rules has been at the centre of European macroeconomic debate since the Maastricht Treaty (1992), the Stability and Growth Pact (SGP) (1997) and the creation of the European Monetary Union (EMU) (1999). The European fiscal framework has been intensively criticized since the beginning of the 1990s. Its detractors regularly denounce the economic growth and employment costs of alleged procyclical European fiscal rules, while its promoters argue that sound public finances and financial stability are the sine qua non for strong and sustainable economic growth and therefore full employment. Based on theoretical and empirical research on fiscal policy, fiscal sustainability and monetary–fiscal interactions, we propose a critical appraisal of the European fiscal framework.

This chapter is organized as following. In Sect. 3.2, we explain why and how fiscal policy needs to be constrained, in particular within a monetary union. Fiscal rules are usually designed and justified to ensure fiscal sustainability and to prevent sovereign default. We present different fiscal sustainability concepts—intertemporal budget constraint, convergence to stable debt-to-GDP ratios, maximum level of public debt and deficit and “fiscal limits”—in recent research on fiscal policy and their implications in terms of fiscal rules and surveillance. Second, monetary–fiscal interactions are essential to understand the need for fiscal policy rules, and even more within a monetary union. Fiscal policy may have a significant effect on the long-run nominal interest rate but also on present and future inflation, jeopardizing the central bank’s ability to control inflation, and this would justify additional constraints on fiscal policy in order to prevent negative spillover effects between monetary union members and to prevent monetary policy from losing control of inflation. We also show that fiscal sustainability requirements and countercyclical fiscal policy should not be seen as necessarily antagonistic. In Sect. 3.3 we discuss the European Fiscal Framework based on empirical and theoretical research presented earlier. We argue that this framework might be both too tight and too loose: too tight because European fiscal rules are a priori much stricter than what would be required according to fiscal sustainability analysis; too loose because they induce a procyclical bias that, in addition to economic growth and employment costs, may be counterproductive in ensuring fiscal sustainability. We finally open the debate about the causes of the European sovereign debt crisis, which was at first interpreted as the result of irresponsible fiscal policies and therefore called for a tightening of fiscal rules. A new consensus narrative recently emerged which significantly changes the diagnosis as well as the economic policy responses it calls for. Section 3.4 draws some general conclusions about fiscal policy in a monetary union and more specific conclusions about the EMU and the European fiscal framework.

2 Why (and How) Does Fiscal Policy Need to Be Constrained?

Fiscal sustainability is usually defined for the government as the commitment to pay back its debt with future primary budget surpluses—budget surpluses excluding interest on public debt. Despite being quite intuitive, this assertion is actually very vague because government is (theoretically) infinitely lived. Consequently, it could roll over its debt forever and remain solvent as long as it runs enough future primary surpluses such that it pays back on average a small part of the interest charge: such a fiscal policy would strictly satisfy the government intertemporal budget constraint, despite government always being indebted. Considering this particular example, “fiscal sustainability” requirements—based on the government intertemporal budget constraint—seem very weak. Basically, research on fiscal policy tries to answer the following questions. What is “fiscal sustainability”? What are the minimum requirements the government intertemporal budget constraint (henceforth GIBC) imposes on fiscal policy—that is on taxes and non-interest spending, or primary budget surpluses? Is the GIBC sufficient to ensure fiscal sustainability or should we make additional assumptions—for instance on the maximum primary budget surplus a government can economically and politically run—to reach a robust fiscal sustainability criterion?

2.1 Public Debt Sustainability and Fiscal Policy Rules

Let us start from the GIBC (or present-value budget constraint). Consider a simplified representation of fiscal policy in which government non-interest spending is denoted by g t and revenues by τ t both expressed in percentage of GDP. The stock of public debt at the end of year t is represented by b t , in percentage of GDP. Define the primary budget surplus–GDP ratio as s t ≡ τ t − g t . Then public debt–GDP ratio evolves according the following public debt accumulation equationFootnote 1:

where i is the average nominal interest rate on public debt, g is the average growth rate of real GDP and π is the inflation rate. For simplicity, we use Fisher’s relation and define the real interest rate as r = i − π. It is worth noting that this accounting equation only describes the year-over-year accumulation of public debt; it does not per se yield any sustainability condition. Public debt–GDP ratio accumulation is mainly driven by primary surpluses (or deficits) and by public debt snowball effect (r − g)b t : if r > g public debt–GDP tends to increase by itself.

Studying sustainability of public debt and deficits requires examining the intertemporal budget constraint of government. From the public debt accumulation equation, one can deduce by successive iterations:

This intertemporal accounting equation states that initial stock of public debt (on the left-hand side) is equal to the sum of future expected present-value primary surpluses–GDP ratio and the expected long-run level of future present-value public debt–GDP ratio (on the right-hand side). From a purely accounting point of view, government can either repay initial public debt b t with present-value primary surpluses or rolling over debt—but how much and how long can a government roll over debt? Thus, fiscal sustainability analysis usually imposes a solvency criterion, called the No-Ponzi Game (NPG) condition.Footnote 2 The NPG condition states that a solvent government cannot roll over debt plus interests forever but needs to cover at least a small amount of its debt-service with primary surpluses. This is equivalent to say that the average rate of growth of public debt must be strictly lower than the average interest rate (Hamilton and Flavin 1986; Bohn 2007). As a consequence, NPG condition implies long-run present-value public debt–GDP ratio must be equal to zero. Hence, a sustainable fiscal policy must satisfy the following “Transversality Condition” (henceforth TC):

Then it is straightforward to derive GIBC:

What are the implications in terms of fiscal rules—that is, constraints on fiscal instruments (primary surpluses, revenues or non-interest spending)—such that GIBC holds? Analogous to monetary feedback policy rules, such as the Taylor Rule that relates the short-term interest rate to the current (or past) inflation rate and output gap, Model-Based Sustainability analysis proposes to study fiscal sustainability using fiscal feedback policy rules. Following Bohn (1998, 2008) and Mendoza and Ostry (2008) such empirical fiscal rules are generally specified as follows:

These feedback rules basically assume that fiscal policy’s instrument—in general, primary surplus–GDP ratio—reacts to:

-

Initial level of public debt–GDP b t , to account for fiscal sustainability motives;

-

Contemporaneous output gap x t + 1, defined as the gap between actual and potential (or trend) real GDP,Footnote 3 to account for “automatic stabilizers” and countercyclical fiscal policy;

-

Temporary fluctuations in public expenditures g t + 1, defined as the difference between actual and trend expenditures, to account for temporary primary surpluses or deficits;

-

The constant term α would be different from zero and negative, accounting for the fact fiscal policy is not required to run primary surpluses all the time, if the fiscal policy rule is satisfying a debt-stabilizing criterion (see below).

Based on a dynamic stochastic general equilibrium model (DSGE), Bohn (1998) shows a necessary and sufficient condition on these fiscal policy rules to satisfy GIBC and TC on public debt is such that primary surplus–GDP must increase after an increase in public debt–GDP:

Thus, GIBC imposes very weak requirements per se (Bohn 2007). Theoretically, as long as government can roll over its debts on financial markets, it could accumulate an ever-increasing amount of public debt–GDP, provided that this ratio grows at a rate lower than the real interest rate adjusted for real GDP growth rate. As a consequence, GIBC does not imply per se any upper bound on public debt–GDP ratio, raising questions whether GIBC and TC are really sufficient to ensure “fiscal sustainability.” Yet additional considerations on fiscal policy would be required to justify bounded debt–GDP ratios, which would be a stronger definition of fiscal sustainability. A prudent answer could be that they are the minimum requirements for sustainability, but still they do not exclude sovereign default, if government was not able to roll over debt on financial markets.

There are two main arguments to justify an upper bound on public debt–GDP ratio. One approach is structural, using simulated or estimated DSGE models, and relies on the assumption of an upper limit on primary surplus–GDP ratio (Bi 2012; Bi and Traum 2012; Bi and Leeper 2013). The upper boundary for primary surplus–GDP ratio is justified by two main reasons:

-

1)

The existence of a “Laffer curve” owing to distortionary taxation: there should be an optimal tax rate which maximizes tax revenue (Trabandt and Uhlig 2011);

-

2)

The fact government may not be capable of decreasing public spending–GDP ratio beyond some level for political reasons.

Given that s t ≤ s max and using GIBC, one can define a maximum public debt–GDP ratio, called the “fiscal limit,” at which government may default with a positive probability. The following equation combines the GIBC and the assumption made about s t to yield an analytic expression for the “fiscal limit” \( {b}_t^{\max } \):

where \( {\varLambda}_{t+ T, t}^{\max } \) represents the growth-adjusted stochastic discount factor, which also depends on the Laffer optimal tax rate, derived from general equilibrium models.

The fiscal limit is the maximum level of public debt–GDP ratio that could be backed by expected future present-value primary surpluses; beyond this level, fiscal policy would be necessarily playing a Ponzi Game against its creditors, implying a positive probability of default. A complete presentation of this concept accounts for uncertainty and effects of aggregate productivity shocks, or fiscal policy regime shifts on the future maximum primary surpluses (Bi 2012; Bi and Leeper 2013). Accounting for uncertainty implies the fiscal limit would not be deterministic but rather stochastic. Consequently, in a stochastic economy, sovereign default could occur at very various levels of public debt–GDP, even relatively low levels if the economy faces very adverse macroeconomic shocks and/or if a government is engaged on an unsustainable path, running persistent primary deficits.

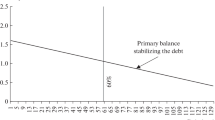

Another approach accounts for the “fiscal fatigue” phenomenon (Ghosh et al. 2013). Using panel data on 23 advanced economies and covering the years 1970–2007, Ghosh et al. found a non-linear relationship between primary balance and public debt such that, at high debt levels, fiscal policy is no longer able to increase sufficiently its primary balance to stabilize public debt. Facing risk-neutral international investors, government hits the fiscal limit when primary surplus–GDP can no longer offset public debt’s snowball effect (r − g)b t for high levels of public debt. The concept of fiscal limit leads to a definition of “fiscal space,” which is the difference between the actual level of public debt and its estimated maximum sustainable level. Fiscal space offers an alternative and complementary measure for fiscal sustainability as the financial leeway of a government that allows it to face very adverse macroeconomic shocks.

Daniel and Shiamptanis (2013) show that, in the presence of “fiscal limits,” a relevant fiscal sustainability criterion would be a debt-stabilizing rule around prudent public debt–GDP ratio—with sufficient fiscal space to face with adverse macroeconomic shocks. Such a debt-stabilizing rule requires that, on average, primary surpluses are greater than the growth-adjusted real interest rate; that is:

Under a debt-stabilizing fiscal policy rule, it is straightforward to show that:

with b * being the targeted level of debt–GDP (or steady-state) which also defines the debt-stabilizing primary surplus–GDP:

As long the debt-stabilizing condition holds, α would be negative, as is usually found in the data. Thus, one can provide a comprehensive interpretation of linear–fiscal policy rules in terms of deviations from steady-state values:

Linear–fiscal policy rules do not imply that government must always run primary surpluses but only when its debt–GDP ratio is above its reference long-run value b *.

Considering these long-run ratios, fiscal policy rules show themselves being useful theoretical and empirical tools both for fiscal sustainability analysis and the design of numerical reference values for fiscal variables—what we generally label “fiscal rules.” Suppose policymakers take economic environment r − g as given (which may be at some points a very restrictive assumption) and set reference values for b *, then they can deduce how much fiscal policy must react to public debt (γ) and what must be the long-run average debt-stabilizing primary surplus s *.

Fiscal sustainability analysis based on GIBC and fiscal policy rules yields important lessons on what constraints are needed for sustainability. First, a prudent fiscal policy should probably ensure convergence of public debt–GDP ratios towards prudent levels (Fall et al. 2015; Fournier and Fall 2015), with sufficient fiscal space in order to face adverse macroeconomic shocks, such as the 2008 financial crisis and the following Great Recession. Unfortunately, this does not definitively prevent government from hitting its fiscal limit when facing extremely adverse macroeconomic shocks, even if is committed to a strongly sustainable fiscal policy rule (i.e. the debt-stabilizing rule). Fiscal discipline cannot reduce fiscal risk to zero, and this fact may support the view that a central bank should act as a lender of last resort. Second, fiscal sustainability is a long-run requirement and fiscal numerical rules should account for the effects of automatic stabilizers or temporary public expenditures (or spending reversals); in practice, it supports fiscal numerical rules specified in terms of structural (or cyclically adjusted) balance.

2.2 Fiscal Discipline Within a Monetary Union

Since the very beginning of EMU, while the Maastricht Treaty was being negotiated, negative externalities coming from unsustainable fiscal policy at national level received a lot of attention (Wyplosz 1991; Buiter et al. 1993). Expansionary fiscal policy generally boosts demand and increases the real interest rate and the inflation rate. Outside a monetary union (MU), in a flexible exchange rate regime, these effects would be partially or totally offset through adjustment in the nominal exchange rate, as it often the case. On the contrary, within a monetary union adjustment occurs entirely through prices and real interest rate. Thus “excessive deficits” of one MU member may affect the real interest rate of all member countries and the inflation rate, in proportion to its relative size.

Concerns about undesirable effects of “excessive deficits” mostly focused on the monetary and financial instability that they could imply (Buiter et al. 1993). The motivation for preventing “excessive deficits” and unsustainable national fiscal policies, fiscal rules embedded in the Maastricht Treaty, was to ensure (nominal) convergence among members of EMU. What is the rationale behind fiscal rules as requirements for price-level stability?

There are two main approaches of monetary–fiscal interactions to the explanation of why fiscal policy should be constrained in order to control inflation stability: Sargent and Wallace’s (1981) “unpleasant monetarist arithmetic” and the Fiscal Theory of Price Level (Leeper 1991; Sims 1994; Woodford 1995, 2001; Cochrane 2001, 2005). Both approaches focus on GIBC and link the need for fiscal rules that ensure the sustainability of public debt to achieve inflation stability.

In their seminal paper, Sargent and Wallace show that strategic interactions between fiscal and monetary authorities can jeopardize a central bank’s ability to stabilize inflation, even in a purely monetarist economy. What matters is which authority moves first, the monetary or the fiscal authority. If fiscal policy decides to run excessive deficits, implying “fiscal dominance,” then it will accumulate public debt until it reaches its maximum sustainable level, given the demand for public bonds. Thus, even when the central bank follows a strict monetarist rule, controlling money supply growth and inflation in the short run, it will be forced to monetize public debt and increase the money supply when public debt hits its maximum level. So here is the main result of Sargent and Wallace: “tighter money now can eventually mean higher inflation tomorrow” if fiscal policy is dominant and even if monetary policy is tight today. Even more, under fiscal dominance, tighter money today implies an even higher inflation rate tomorrow, compared to what it would have been if monetary policy had been easier today.

It is important that Sargent and Wallace’s model does not depart from the quantity theory of money, since higher inflation arises from the fact that the monetary authority is forced to monetize public debt, which is to increase money supply. Sargent and Wallace show that the GIBC can affect the inflation rate significantly when fiscal policy dominates monetary policy. Consequently, achieving inflation stability requires credible and binding policy rules for each authority: the central bank must credibly commit to inflation stability and the government must commit to a sustainable fiscal policy. This supports the introduction of a no bailout clause between monetary and fiscal authorities; still, the credibility—and desirability—of such a clause remains questionable in the light of the recent sovereign debt crisis in Europe.

The Fiscal Theory of Price Level (FTPL) is somehow more radical than Sargent and Wallace’s “unpleasant monetarist arithmetic.” It basically states that “monetary policy alone does not provide the nominal anchor for an economy” and it is “a particular pairing of monetary policy and fiscal policy” (Canzoneri et al. 2010), which provides the nominal anchor and stabilizes inflation. According to the FTPL, even in the absence of seignorage revenue, binding rules on excessive deficits and public debt are necessary to achieve price stability. The FTPL starts from the assumption that government issues nominal debt rather than real debt and then rewrites the intertemporal budget constraint with nominal debt:

where B t is the nominal public debt (not scaled by GDP), P t is the price level and S t the real primary surplus of government. Fiscal theory considers the government’s IBC as an ex post equilibrium condition rather than an ex ante budget constraint on fiscal policy. Then, if government does not adjust its fiscal policy to make this constraint hold ex ante, then price level will have to adjust ex-post to make it hold in equilibrium. Within FTPL’s framework, two polar cases for fiscal policy arise. First, fiscal policy is Ricardian and future primary surplus adjusts such that GIBC holds ex ante; monetary authority can have full control over the price level through a standard interest rate rule. Second, fiscal policy is not Ricardian and does not satisfy its GIBC ex ante; GIBC is no longer a constraint for fiscal policy but a valuation equation for real public debt such that price-level P t adjusts in order to equalize ex post the real value of public debt to the sum of future primary surpluses. In this case, monetary policy loses control of the price level.

Leeper’s (1991) typology of monetary and fiscal interactions is a more restrictive definition of the FTPL. He studies different sets of monetary and fiscal policies achieving both stable inflation dynamics and stable nominal public debt dynamics, which requirements are stronger than the GIBC. He assumes monetary policy follows a Taylor Rule and fiscal policy follows a tax rule such that tax rate reacts to debt level. He characterizes monetary and fiscal policies as “active” and “passive”:

-

Monetary policy is labelled “active” if it satisfies Taylor’s principle;Footnote 4 if not, it is “passive” and it reacts less aggressively to inflation.

-

Fiscal policy is “passive” if the tax rate reacts to public debt more than the average interest rate, such it stabilizes debt; if not, it is “active” and does adjust taxes to debt (Fig. 3.1).

Consequently, Leeper describes four combinations possible for monetary and fiscal policies. Two combinations of monetary and fiscal policies—AM/PF or Regime M and PM/AF or Regime F—lead to a unique macroeconomic equilibrium, implying stable inflation and public debt dynamics along the balanced growth path. One combination—PM/PF—leads to indeterminacy and multiple equilibria: in this case, the economy is subject to self-fulfilling dynamics. The last case—AM/AF—leads to explosive dynamics of both inflation and public debt.

FTPL’s detractors such as Buiter (2002) strongly criticized this interpretation of GIBC as an equilibrium condition. In his view, GIBC is a real constraint on government behaviour and GIBC must hold for any price level. As a result, macroeconomic equilibria described by the FTPL are “invalid” in Buiter’s view. On the contrary, Woodford (2001) considers that government knows it can affect equilibrium price level and interest rates, which is not possible for other economic agents. Another question is the empirical validity of the FTPL: is there evidence of “fiscal inflation” episodes? Empirical literature has not reached any consensus yet. Canzoneri et al. (2001) show that fiscal sustainability imposes very weak restrictions, such that observed data on public debt and primary surplus would be consistent with GIBC and, as a result, making it difficult to distinguish between Ricardian and non-Ricardian fiscal policies. They show that US post-Second World War data may be well explained by the Ricardian regime. Creel and Le Bihan (2006) extend Canzoneri et al.’s method using cyclically adjusted balance data and find no evidence supporting the FTPL, using an international dataset that includes the USA, Germany, Italy, France and the UK.

Yet, using regime-switching techniques to estimate feedback policy rules for monetary and fiscal authorities, Favero and Monacelli (2005), Davig and Leeper (2007, 2011), Afonso and Toffano (2013) and Cevik et al. (2014) provide evidences of recurring changes in monetary and fiscal policy rules. Both monetary and fiscal policies periodically switch from active to passive (or passive to active), which would suggest that FTPL may be effectively at work (Davig and Leeper 2007, 2011).

One unexpected result of FTPL is that fiscal policy can eventually have large and significant effects on the economy. In a Regime F, debt-financed expansionary fiscal policy actually boosts aggregate demand through a positive wealth effect because Ricardian equivalence no longer holds and households expect that current deficits will not be financed through future taxes. As a result, government spending and tax multipliers are significantly higher when monetary policy is passive and fiscal policy active (Davig and Leeper 2011). When monetary policy becomes passive as it is constrained by the Zero Lower Bound (ZLB) on nominal interest rate, then fiscal multipliers would likely be much higher and inflation would be determined by fiscal policy. To sum up, the FTPL provides strong arguments to implement an active fiscal policy when monetary policy is constrained, as well as emphasizing the importance of public debt sustainability (or unsustainability) in the control of inflation.

Within a monetary union (a fortiori without coordinated fiscal policies), the FTPL as well as Sargent and Wallace’s unpleasant monetarist arithmetic support the implementation of strong, binding, fiscal policy rules ensuring sustainability of public debt in the long run to avoid inflationary pressures. Yet both sustainability analysis and the FTPL show fiscal sustainability requirements do not fundamentally contradict the stabilization purpose of fiscal policy, and make room for business cycle stabilization motives (deficit spending in recessions) and temporary public spending measures (public spending reversals, one-off and exceptional measures).

In a large monetary union, all member countries do not necessarily face the same shocks: there are symmetric shocks affecting all countries in the same way and country-specific (or asymmetric) shocks affecting them differently. In an influential paper, Galí and Monacelli (2008) show that an optimal monetary–fiscal policy mix in a currency union would require that monetary policy stabilizes the economy by reacting to symmetric shocks, while national fiscal policies react to country-specific shocks at the national level. Thus research supports flexible fiscal policy rules both allowing for stabilization and ensuring the long-run sustainability of public debt at the national level.

3 European Fiscal Rules: Too Tight? Too Loose? Or Both?

The Maastricht Treaty on the European Union (1992) and the following SGP (1997) implemented numerical fiscal policy rules at European Union (EU) level, divided into a preventive arm and a corrective arm. The preventive arm specified a Medium-Term Objective (MTO) of close-to-balance or in surplus fiscal stance; the corrective arm, called the Excessive Deficit Procedure (EDP), specified procedures to correct deviations from the Treaty’s reference values of 60 % of gross public debt-to-GDP and 3 % of deficit-to-GDP.Footnote 5 These rules were explicitly designed to ensure macroeconomic convergence and stability among EU member states, and in particular conditioning future participation to the EMU. Policymakers considered that sustainable fiscal policies were required to prevent both spillover effects among member states and inflationary effects of fiscal policy while monetary policy could successfully ensure price stability and promote economic growth.

Fiscal rules embedded in the Maastricht Treaty and the SGP have been intensively discussed over the last two decades. Are these rules sufficient to ensure fiscal sustainability and flexible enough to allow countercyclical fiscal policies? Some argued these rules, both the preventive and the corrective arm, were far too tight in regard to fiscal sustainability requirements. While at the beginning of the 2000s some argued there was no clear evidence that national fiscal policies had lost their ability to follow countercyclical stabilization objectives, recent research suggests the opposite: that national fiscal policies became more procyclical after the implementation of the SGP. More recently, the financial and economic crisis of 2008 and the following European sovereign debt crisis in 2010 raised concerns about the ability of European fiscal rules to prevent excessive deficits and debts within the EMU. Thus, we will present these debates on the European fiscal framework. Was the SGP too tight (with respect to the countercyclical objective of fiscal policy) or too loose (with respect to fiscal sustainability requirements)? Was the European sovereign debt crisis the result of excessive public deficits from euro area (EA) member states or rather the result of fundamental failures in the architecture of the EMU? Did it call for a tightening of European fiscal policy rules and fiscal monitoring? Does Europe need stronger fiscal rules or more flexibility and country-specific requirements regarding fiscal sustainability?

3.1 Are European Fiscal Rules Ensuring the Sustainability of Public Finance?

During the 1990s and the move toward the creation of the EMU, most EU member states and future EA members focused on the Maastricht reference values more than on the medium-term objective of a close-to-balance or surplus budget position; see Collignon (2012). As a matter of fact, the corrective arm (the EDP) obviously dominated the preventive arm. What could be the rationale behind this?

Actually, the medium-term objective defined in the Maastricht Treaty (balanced budget or in surplus) does not find any economic justification from a standard sustainability analysis: a balanced-budget rule would imply an ever-decreasing debt-to-GDP ratio—which is a far too strong requirement for fiscal sustainability. From a more general point of view, balanced-budget rules would even increase aggregate economic instability (Schmitt-Grohe and Uribe 1997), being at odds with the Maastricht Treaty and the SGP!

Reference values of 3 % deficit-to-GDP and 60 % of debt-to-GDP are more sensible from a sustainability analysis’ point of view since they are equivalent to a debt-stabilizing fiscal policy rule. Indeed, given a nominal growth rate of 5 % and a maximum value of 60 % gross debt–GDP ratio, we find that fiscal policy would stabilize debt by setting the deficit to 3 % of GDP. Yet the Maastricht Treaty’s reference values rely heavily on assumptions made on real GDP growth rate and inflation rate, respectively 3 % and 2 %. As pointed out by Buiter et al. (1993), countries with higher real growth rate and inflation could support a higher deficit-to-GDP ratio. As a matter of fact, EA member states diverged in terms of real GDP growth and inflation rates, reinforcing the criticism of a nominal deficit reference value as a guideline for fiscal surveillance.

Regarding fiscal sustainability analysis, a nominal (with interest) deficit guideline would not seem the most appropriate way to monitor sound fiscal policy, in addition to Buiter, Corsetti and Roubini’s criticisms. While a permanent deficit could still be consistent with (strong) fiscal sustainability, in other words stable debt-to-GDP ratio, fiscal policy should run primary surplus on average, over the business cycle—at least when r > g. What is more, the recent European sovereign debt crisis implied a strong divergence of real long-run interest rates among EA member states. This has asymmetric consequences on EA member states. It implies that stressed countries (higher real interest rates, lower real growth rate) are facing stronger sustainability requirements, implying a lower debt-stabilizing (with interest) deficit with respect to the 3 % deficit rule. Unstressed countries (lower real interest rates, higher real growth rates) are facing looser sustainability requirements, such that they could actually afford deficits close to 3 % of GDP (or maybe larger) without jeopardizing the long-run sustainability of public finances. As a result, the European deficit rule of 3 % appears to be sometimes too tight and sometimes too loose in a heterogeneous monetary and economic union. The bottom line is that one size does not fit all.

Are European fiscal policy rules sufficient to ensure fiscal sustainability? From a theoretical perspective, these rules are conceptually based upon a debt-stabilizing condition, which is most probably the relevant sustainability concept in an economy with fiscal limits. Still, if the real growth rate of GDP is to exceed the long real interest rate on a government’s bonds (i.e. r < g) a stable debt–GDP ratio is not necessarily a proof of responsible fiscal behaviour. The relevant condition would rather be the NPG condition (i.e. a positive response of primary surplus to the initial level of public debt), which is not guaranteed to hold under a nominal deficit rule in this case. In addition, as explained earlier, a nominal deficit rule does not necessarily fit all member states, and it would be more efficient to impose a positive average (structural) primary surplus, which is the relevant fiscal indicator for sustainability analysis.

In the early 2000s, Afonso (2005) described what he called the “Unpleasant European Case.” Despite their stabilizing of debt–GDP ratios by the end of the 2000s, he found many European countries were likely to be at risk regarding the sustainability of public finance. Yet Afonso’s dataset stopped in 2003, which did not provide enough data to evaluate the European fiscal framework. In contrast with Afonso’s results, more recent papers (Collignon 2012; Daniel and Shiamptanis 2013) found evidence that European fiscal policies became more responsible during the 2000s, after the implementation of the SGP. These empirical results suggest the European fiscal framework was sufficient to promote responsible fiscal policies in terms of primary surplus, and despite excessive deficit procedures engaged against EA member states during the first decade of EMU.

Following 2008, the European sovereign debt crisis has been immediately—maybe too rapidly—interpreted as the result of irresponsible (or at least imprudent) fiscal policies in the early 2000s; current account imbalances within the EA were also considered but with less emphasis in the public debate. The strengthening induced by the Six-Pack reform (2011), Two-Pack reform and the Fiscal Compact (2013) directly comes from this narrative of the crisis. We will develop these questions in Sect. 3.3.3.

During the 2000s, European policymakers tried to deal with the flaws of European fiscal framework by adding “exceptional measures” to the SGP, taking into account structural rather than nominal deficits and improving the preventive arm. Recent reforms (2005 and 2011 Six Pack Reform) of the SGP introduced several amendments. They reinforced the preventive arm of the SGP by defining MTOs in term of structural deficit rather than nominal. They also explicitly defined the required adjustment path toward them as a benchmark improvement of 0.5 % per year (or an average of 0.25 % per year during two consecutive years) of structural balance. 2011’s reform toughened the structural adjustment (higher than 0.5 % per year) for member states with debt–GDP ratios above 60 %. Both reforms also specified when EA member states could deviate from their MTOs: “for major structural reforms with verifiable impact on long-run sustainability such as pension reforms” (2005’s reform), “unusual events outside the control of the country with a major impact on the financial position of general government” and “in case of severe economic downturn in the euro area or the union as a whole” (European Commission 2013). Still, the corrective arm (the EDP) and especially the threshold of 3 % deficit–GDP ratio were not reconsidered. We think this results largely from ignoring the fact that EA member states diverge in terms of real growth, inflation and long-run interest rates. As long as European policymakers stick to the idea that EA member states will “naturally” converge in nominal and real terms, the deficit rule of 3 % might not be efficient at stabilizing both public debt and the economy.

Finally, one of the biggest flaws of the European fiscal framework was probably the exclusive focus on public debt and deficits while ignoring private debt and current deficits. As a result, ignoring private capital flows and private debt biases the analysis and narrative of the European sovereign debt crisis as being mainly the result of irresponsible fiscal policies; we will see further on that the European sovereign debt crisis might rather be analysed primarily as a classic sudden stop crisis. Still, the 2011 Six-Pack reform acknowledged the importance of external imbalances (Bénassy-Quéré and Ragot 2015), and the risk of a banking crisis and its consequences on public finances (Bénassy-Quéré and Roussellet 2014). Thus, it improved the European economic surveillance framework by introducing the Macroeconomic Imbalance Procedure (MIP), which follows the SGP pattern with a preventive and a corrective arm.

3.2 Procyclical Bias in European Fiscal Policy Rules

Beside fiscal sustainability issues, an important question was about the alleged “procyclical bias” of the European fiscal policy rules. From a theoretical point of view, both neoclassical (tax-smoothing models) and Keynesian economics (countercyclical fiscal policy) support deficit spending during recessions. This point was already made by Buiter et al. (1993): the SGP was really ambiguous about whether countercyclical deficits in excess of 3 % were acceptable. Actually, these excessive deficits were supposed to be exceptional and temporary, which support the view that the SGP induced de facto a procyclical bias in European fiscal policy.

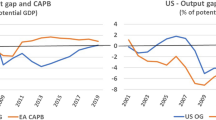

In the early 2000s, Gali and Perotti (2003) produced empirical evidence against the conventional view that “the Maastricht Treaty and then Stability and Growth Pact have impaired the ability of EU governments to conduct a stabilizing fiscal policy and to provide an adequate level of public infrastructure.” Using annual data from the Organization for Economic Cooperation and Development (OECD) Economic Outlook, ranging from 1980 to 2002, they estimated a linear fiscal policy rule linking the structural primary deficit–GDP ratio to output gap, initial debt–GDP ratio and past primary deficit–GDP. They found fiscal policy in EMU “has become more counter-cyclical over time, following what appears to be a trend that affects other industrialized countries.” Regarding the decline in public investment, they found “industrialized regions not subject to the SGP have experienced an even greater decline.” Still, they noted that deep, severe recessions have been rare in the post-Maastricht period, implying the SGP fiscal rules were not really binding. They concluded that the impact of the SGP could be different in the future.

Yet recent empirical research has challenged this result. Beetsma and Giuliodori (2010) distinguish two stages in fiscal policy: the planning stage and the implementation stage, using real-time data. They use panel data running from 1995 to 2006, for EU-14 plus the USA, Canada, Japan, Norway and Australia. Their results are twofold. First, they found planned fiscal policy was acyclical in EU countries but countercyclical in non-EU countries. Second, they provide evidence that EU countries react procyclically to unexpected changes in the output gap while non-EU countries react acyclically during the implementation stage. Collignon (2012) also provides empirical evidences that fiscal policy became more procyclical in the EU countries than in the non-EU countries.

These results are also confirmed by an International Monetary Fund (IMF) working paper (Eyraud and Wu 2015). Interestingly, this paper shows that, if European fiscal policy had been more countercyclical in the first decade of the EMU (1998–2008), it would have entered the crisis in a far stronger fiscal position (see figure 5, p. 13, op. cit.). It well illustrates the complementarity between the requirements of long-run sustainability of public debt and the need for a countercyclical fiscal policy. The lack of flexibility and the quasi-exclusive focus on fiscal sustainability within the European fiscal framework,Footnote 6 which likely induce the procyclical bias observed in the data, would eventually threaten the long-run sustainability of public debt.

What are the consequences of the procyclical bias of the European fiscal framework in terms of economic activity and employment? Creel et al. (2013) developed a medium-scale DSGE model with price rigidity and forward-looking agents to compare three different rules: the Maastricht Treaty (3 % of deficit–GDP), the Fiscal Compact framework and a public investment rule. Their simulations show that the Fiscal Compact is likely to be more deflationary and recessionary than both the status quo and the public investment rule. The public investment rule displays the lowest output cost. Creel et al. conclude by saying: “such a drastic consolidation strategy (i.e. the Fiscal Compact) embedded into EU constitutional laws threaten future macroeconomic performances of Eurozone countries.”

One cannot oppose these two issues: fiscal sustainability requirements and countercyclical fiscal policy. Both theoretical research and empirical evidence rather suggest that fiscal sustainability is a long-run requirement and can support deficit-financed fiscal stimulus during recessions, on the condition that fiscal policy must tighten during expansions. Recent experience of non-EA countries with respect to EA countries shows that the first could both stabilize their debt–GDP ratio and reduce the output gap quicker than the latter while undergoing less austerity or, at least, not too soon following the Great Recession and with an accommodative (or passive) monetary policy.

The debate on “austerity” and procyclical fiscal consolidation focuses on the size of fiscal multipliers.Footnote 7 The consensus before the Great Recession was that fiscal multipliers were low, probably close to 0.5 or even lower. Yet both empirical and theoretical researches have challenged the common wisdom of low fiscal multipliers. Empirical research has shown the size of fiscal multipliers can vary a lot according to the state of the economy, and reach values well above 1 or even 2 in some cases. For instance, fiscal multipliers appear to be larger during recessions than expansions (Auerbach and Gorodnichenko 2012a, b). Riera-Crichton et al. (2015) show that fiscal policy has asymmetric effects depending on the state of the economy (expansion versus recession) and on the stance of fiscal policy (procyclical versus countercyclical) using a panel dataset of OECD countries. Two main results emerge from their analysis. First, estimated countercyclical fiscal multipliers are very large (the long-run multiplier is 2.3 in normal recessions and 3.1 in extreme recessions). Second, while the austerity motto “short-run pain, long-run gain” may be correct in normal recessions, it is no longer the case in extreme recessions, as they conclude: “applied to the current debate on austerity in the Eurozone, this would imply that debt to GDP ratios would increase in response to cuts in fiscal spending.” Regarding the debate on austerity in Europe, Blanchard and Leigh (2013) produce empirical evidence that professional forecasters (including the IMF) have underestimated the size of fiscal multipliers in the years following the Great Recession and the sovereign debt crisis: while these multipliers were probably about 0.5 before the crisis, their results for European countries, in 2010–2011, indicate they were significantly above 1 in the early stage of the sovereign debt crisis.

Theoretical research also provides new explanations for larger fiscal multipliers. New Keynesian DSGE models with imperfect competition and staggered price-setting did not produce fiscal multipliers above 1 for one fundamental reason: in these models, the Ricardian equivalence holds,Footnote 8 and therefore fiscal spending shocks induce negative wealth effects for consumers, thus having a crowding-out effect on private consumption (being at odds with most empirical findings). This puzzle has been solved in many different ways. Relaxing some fundamental hypothesis of DSGE models dramatically changes the value of fiscal multipliers and produce a crowding-in effect in private consumption. For instance, taking into account Limited Asset Market Participation makes the Ricardian equivalence fall as a fraction of consumers are credit constrained and cannot smooth consumption over time (Bilbiie et al. 2008). Another way to solve the puzzle is to assume that consumers have non-separable preferences between consumption and labour such that hours worked and private consumption both increase after a positive government spending shock (Bilbiie 2011; Monacelli and Perotti 2008). Still one of the most important theoretical propositions is the analysis of fiscal policy when monetary policy is at the ZLB. Building on the old (Keynesian) wisdom that fiscal policy is more “effective” when monetary is accommodative, many theoretical papers have shown fiscal multipliers are far above 1 when the nominal interest rate is at the ZLB (Christiano et al. 2011; Corsetti et al. 2010; Denes et al. 2013; Eggertsson and Krugman 2012). And as already mentioned, an alternative monetary/fiscal policy mix can also make the Ricardian equivalence property fall and imply bigger fiscal multipliers (Davig and Leeper 2011). Yet the “sovereign risk channel” (i.e. the effect on private sector funding costs of sovereign default risk) can substantially reduce the size (and even invert the sign) of fiscal multipliers, suggesting that fiscal stimulus could eventually be self-defeating in countries in which sovereign financial distress tends to increase private sector funding costs (Corsetti et al. 2013).

3.3 Was the European Debt Crisis the Result of Irresponsible Fiscal Policies?

The European sovereign debt crisis revived the debate about fiscal policy rules in the EU and the EMU. It opposes two antagonist views of fiscal policy. The first is the orthodox view promoting balanced-budget rules and decreasing debt–GDP ratios, and is based on the Expansionary Fiscal Contraction (EFC) hypothesis, following the seminal paper by Giavazzi and Pagano (1990) and the work of Alberto Alesina and Silvia Ardagna (Alesina et al. 2015; Alesina and Ardagna 2010). This approach follows from the political economy of public debt and relies heavily on the so-called “confidence effect” of fiscal consolidations. Taking the contrary view, the second one puts emphasis on new empirical evidences of state-dependent and time-varying fiscal multipliers as well as new theoretical results on fiscal multipliers in new Keynesian DSGE models (Auerbach and Gorodnichenko 2012b; Blanchard and Leigh 2013; Corsetti et al. 2010; Riera-Crichton et al. 2015). It also contradicts EFC supporters on empirical grounds, arguing for an upward bias in Alesina and Ardagna’s estimates of expansionary effect of fiscal consolidation (Guajardo et al. 2014; Jorda and Taylor 2015).

Yet, despite serious criticisms of it, the EFC hypothesis obviously won the political battle in Europe at the very beginning of the European sovereign debt crisis. The early narrative of this crisis found the European irresponsible (or imprudent) fiscal policy was the main culprit, rather than excessive current account deficits and excessive private borrowing in the periphery countries. As mentioned earlier, it explains the strong tightening of the European fiscal rules after the six-pack, two-pack and Fiscal Compact reforms, and the relative disconnection between the SGP and the MIP; see (Bénassy-Quéré and Ragot 2015).

On the contrary, five years after the beginning of the European sovereign debt crisis, another consensus narrative emerged among macroeconomists. Lane (2012) had already suggested the so-called European sovereign debt crisis was not (primarily) caused by excessive deficits in the early 2000s,Footnote 9 but rather by original flaws in the EMU architecture (absence of banking union, federal buffer mechanisms), leading to large current account imbalances and excessive private borrowing within the EMU. More recently, a panel of economists from the CEPR (Centre for Economic Policy and Research) proposed a new consensus narrative of the European crisis (The Eurozone Crisis 2015), claiming it was a sudden-stop crisis, not a sovereign debt crisis as claimed by the EFC hypothesis supporters. According to this narrative, financial fragility, excessive private borrowing in non-productive sectors and current account imbalances were the source of the crisis, when the sudden stop occurred following 2008–2009’s global crisis; and the sovereign debt crisis is rather a consequence than a cause of the financial crisis. This narrative also stresses the “causes of the causes” of the Eurozone crisis: “policy failures that allowed the imbalances to get so large,” “lack of institutions to absorb shocks at the Eurozone level” and “crisis mismanagement” (Baldwin and Giavazzi 2015). To some extent, this narrative supports the view that the European fiscal framework (the Maastricht Treaty and in particular the “no bail-out” clause, the SGP) were probably not credible enough to prevent both excessive current account deficits and public deficits. In particular, they did not prepare the EU and the EMU to deal with a sudden-stop crisis, which was likely to cause a banking crisis and a sovereign debt crisis, for the simple reason that the European fiscal framework was implicitly built on the belief such a systemic crisis could not happen.

4 Conclusions

Fiscal rules are necessary to ensure public sustainability, around prudent debt–GDP ratios and to ensure monetary policy can reach its price-stability objective. According to macroeconomic theory on fiscal sustainability and monetary–fiscal interaction, these rules do not contradict countercyclical motives of fiscal policy. What is more, the recent economic and financial crisis has shown how important countercyclical fiscal policy is when the economy is hit by severe negative demand shocks. Future policymakers should keep in mind that fiscal consolidation in good times can allow them to run large deficits when needed, with a sufficient safety margin against any “fiscal limit” on the public-debt-to-GDP ratio.

Yet the European fiscal framework has been shown to be sometimes too tight and sometimes too loose to ensure fiscal sustainability. In our opinion, the biggest flaw remains its serious procyclical bias, which jeopardizes both fiscal sustainability objectives and economic growth and stability; the recent reforms (Six-Pack, Two-Pack and Fiscal Compact) are not likely to reduce the procyclical bias of fiscal policy according to macroeconomic research.

A broader approach of economic surveillance now includes current account imbalances and private debt through the MIP, which is (in our view) the most important improvement in the European economic surveillance procedure. Further reforms should aim at simplifying European fiscal rules, reducing the procyclical bias (in particular in the implementation stage of fiscal policy) and giving a more important role to the analysis of current account imbalances.

Notes

- 1.

For simplicity, this presentation neglects stock-flow adjustments (SFA), defined as the difference between total variation of public debt and overall public deficit. SFA are mostly a statistical and national accounting issue rather than a theoretical one. We also consider that interest rate, inflation rate and growth rate of real GDP are equal to their average values. This is a strong assumption to study public debt sustainability sometimes labeled as “ad hoc sustainability”, see Bohn (2008); but we chose the most simple framework for clarity purposes.

- 2.

Named after Charles Ponzi’s fraudulent investment operation.

- 3.

Potential real GDP is the level of real GDP that can be produced at a constant rate of inflation. It mainly depends on capital stock and utilization rate of capital, potential labour force, NAIRU (Non-Accelerating Inflation Rate of Unemployment) and factors’ productivity.

Potential real GDP is generally estimated using structural models. As an alternative to structural methods, trend real GDP is an econometric approach consisting into the decomposition of real GDP between a trend component and a cyclical component, interpreted as the “output gap”.

Although, each measure has advantages and shortcomings, structural methods are generally preferred to purely econometric methods because of the “end-point bias” (indeed econometric methods generally tend to underestimate the output gap at end of sample) but also because of “spurious business cycles.”

- 4.

Taylor’s principle implies that the central bank raises the short term interest rate by more than 1 percentage point in response to a 1 percentage point increase in the inflation rate.

- 5.

These reference values are defined such that a 3 % deficit-to-GDP is compatible with a stable debt-to-GDP level of 60 %, assuming an average real GDP growth of 3 % and an average inflation rate of 2 %.

- 6.

Until the Six-Pack Reform and the implementation of the MIP, the European Semester was exclusively focused on public debt and deficits, neglecting current account deficits.

- 7.

Fiscal multipliers (public spending and tax multipliers) are generally defined as the extra euro(s) of real GDP generated by a 1 euro increase in public spending (or by a 1 euro decrease in taxes).

- 8.

In the baseline DSGE model, fiscal policy is passive, that is, stabilizing public debt, and monetary policy is active, that is, strongly reacting to inflation, following Leeper’s terminology. Therefore, what matters is the level of public spending, not the way public spending is financed, through tax or debt. To express it differently, the timing of taxation does not matter.

- 9.

Yet he acknowledges that “the failure of national governments to tighten fiscal policy substantially during the 2003-2007 was a missed opportunity, especially during a period in which the private sector was taking on more risk,” in line with the claim that fiscal policy has been insufficiently countercyclical since the implementation of the SGP.

References

Afonso, A. (2005). Fiscal sustainability: The unpleasant European case. FinanzArchiv: Public Finance Analysis, 61.

Afonso, A., & Toffano, P. (2013). Fiscal regimes in the EU. Working Paper Series No. 1529. European Central Bank.

Alesina, A., & Ardagna, S. (2010). Large changes in fiscal policy: Taxes versus spending. NBER Chapters. National Bureau of Economic Research, Inc.

Alesina, A., Barbiero, O., Favero, C., Giavazzi, F., & Paradisi, M. (2015). Austerity in 2009–2013. NBER Working Paper No. 20827. National Bureau of Economic Research, Inc.

Auerbach, A.J., & Gorodnichenko, Y. (2012a). Fiscal multipliers in recession and expansion. NBER Chapters. National Bureau of Economic Research, Inc.

Auerbach, A. J., & Gorodnichenko, Y. (2012b). Measuring the output responses to fiscal policy. American Economic Journal: Economic Policy, 4, 1–27.

Baldwin, R., & Giavazzi, F. (2015). The Eurozone crisis: A consensus view of the causes and a few possible solutions. VoxEU.org.

Beetsma, R., & Giuliodori, M. (2010). Fiscal adjustment to cyclical developments in the OECD: An empirical analysis based on real-time data. Oxford Economic Papers, 62, 419–441. doi:10.1093/oep/gpp039.

Bénassy-Quéré, A., & Ragot, X. (2015). A policy mix for the Euro area (No. 21), CAE Reports. Conseil d’Analyse Economique.

Bénassy-Quéré, A., & Roussellet, G. (2014). Fiscal sustainability in the presence of systemic banks: The case of EU countries. International Tax and Public Finance, 21, 436–467.

Bi, H. (2012). Sovereign default risk premia, fiscal limits, and fiscal policy. European Economic Review, 56, 389–410.

Bi, H., & Leeper, E. (2013). Analyzing fiscal sustainability. Working paper. Bank of Canada.

Bi, H., & Traum, N. (2012). Estimating sovereign default risk. American Economic Review, 102, 161–166.

Bilbiie, F. O. (2011). Nonseparable preferences, Frisch Labor Supply, and the consumption multiplier of government spending: One solution to a fiscal policy puzzle. Journal of Money, Credit and Banking, 43, 221–251. doi:10.1111/j.1538-4616.2010.00372.x.

Bilbiie, F. O., Meier, A., & Müller, G. J. (2008). What accounts for the changes in U.S. fiscal policy transmission? Journal of Money, Credit and Banking, 40, 1439–1470. doi:10.1111/j.1538-4616.2008.00166.x.

Blanchard, O. J., & Leigh, D. (2013). Growth forecast errors and fiscal multipliers. American Economic Review, 103, 117–120.

Blanchard, O., Dell’ariccia, G., & Mauro, P. (2010). Rethinking macroeconomic policy. Journal of Money, Credit and Banking, 42, 199–215.

Bohn, H. (1998). The behavior Of U.S. public debt and deficits. The Quarterly Journal of Economics, 113, 949–963.

Bohn, H. (2007). Are stationarity and cointegration restrictions really necessary for the intertemporal budget constraint? Journal of Monetary Economics, 54, 1837–1847.

Bohn, H. (2008). The sustainability of fiscal policy in the United States. In R. Neck & J. Sturm (Eds.), Sustainability of public debt (pp. 15–49). Cambridge, MA: MIT Press.

Buiter, W. H. (2002). The fiscal theory of the price level: A critique. The Economic Journal, 112, 459–480. doi:10.1111/1468-0297.00726.

Buiter, W., Corsetti, G., & Roubini, N. (1993). Excessive deficits: Sense and nonsense in the treaty of Maastricht. Economic Policy, 8, 57–100. doi:10.2307/1344568.

Canzoneri, M. B., Cumby, R. E., & Diba, B. T. (2001). Is the price level determined by the needs of fiscal solvency? American Economic Review, 91, 1221–1238.

Canzoneri, M., Cumby, R., & Diba, B. (2010). The interaction between monetary and fiscal policy (Handbook of monetary economics). Elsevier.

Cevik, E. I., Dibooglu, S., & Kutan, A. M. (2014). Monetary and fiscal policy interactions: Evidence from emerging European economies. Journal of Comparative Economics, 42, 1079–1091.

Christiano, L., Eichenbaum, M., & Rebelo, S. (2011). When is the government spending multiplier large? Journal of Political Economy, 119, 78–121.

Cochrane, J. H. (2001). Long-term debt and optimal policy in the fiscal theory of the price level. Econometrica, 69, 69–116.

Cochrane, J. H. (2005). Money as stock. Journal of Monetary Economics, 52, 501–528.

Collignon, S. (2012). Fiscal policy rules and the sustainability of public debt in Europe. International Economic Review, 53, 539–567. doi:10.1111/j.1468-2354.2012.00691.x.

Corsetti, G., Kuester, K., Meier, A., & Muller, G. J. (2010). Debt consolidation and fiscal stabilization of deep recessions. American Economic Review, 100, 41–45.

Corsetti, G., Kuester, K., Meier, A., & Müller, G. J. (2013). Sovereign risk, fiscal policy, and macroeconomic stability. Economic Journal, 123, F99–F132. doi:10.1111/ecoj.12013.

Creel, J., & Le Bihan, H. (2006). Using structural balance data to test the fiscal theory of the price level: Some international evidence. Journal of Macroeconomics, 28, 338–360.

Creel, J., Hubert, P., & Saraceno, F. (2013). An assessment of the stability and growth pact reform in a small-scale macro-framework. Journal of Economic Dynamics and Control, 37, 1567–1580.

Daniel, B. C., & Shiamptanis, C. (2013). Pushing the limit? Fiscal policy in the European monetary union. Journal of Economic Dynamics and Control, 37, 2307–2321.

Davig, T., & Leeper, E.M. (2007). Fluctuating macro policies and the fiscal theory. NBER Chapters. National Bureau of Economic Research, Inc.

Davig, T., & Leeper, E. M. (2011). Monetary-fiscal policy interactions and fiscal stimulus. European Economic Review, 55, 211–227.

Denes, M., Eggertsson, G. B., & Gilbukh, S. (2013). Deficits, public debt dynamics and tax and spending multipliers. Economic Journal, 123, F133–F163. doi:10.1111/ecoj.12014.

Eggertsson, G. B., & Krugman, P. (2012). Debt, deleveraging, and the liquidity trap: A fisher-minsky-koo approach. The Quarterly Journal of Economics, 127, 1469–1513.

European Commission. (2013). Building a strengthened fiscal framework in the European union: A guide to the stability and growth pact. Publications Office.

Eyraud, L., & Wu, T. (2015). Playing by the rules: Reforming fiscal governance in Europe. IMF Working Paper No. 15/67. International Monetary Fund.

Fall, F., Bloch, D., Fournier, J.-M., & Hoeller, P. (2015). Prudent debt targets and fiscal frameworks. OECD Economic Policy Paper No. 15. OECD Publishing.

Favero, C.A., & Monacelli, T. (2005). Fiscal policy rules and regime (In)stability: Evidence from the U.S. SSRN Scholarly Paper No. ID 665506. Social Science Research Network, Rochester, NY.

Fournier, J.-M., & Fall, F. (2015). Limits to government debt sustainability. OECD Economics Department Working Paper No. 1229. OECD Publishing.

Galí, J., & Monacelli, T. (2008). Optimal monetary and fiscal policy in a currency union. Journal of International Economics, 76, 116–132. doi:10.1016/j.jinteco.2008.02.007.

Gali, J., & Perotti, R. (2003). Fiscal policy and monetary integration in Europe. Economic Policy, 18, 533–572.

Ghosh, A. R., Kim, J. I., Mendoza, E. G., Ostry, J. D., & Qureshi, M. S. (2013). Fiscal fatigue, fiscal space and debt sustainability in advanced economies. Economic Journal, 123, F4–F30. doi:10.1111/ecoj.12010.

Giavazzi, F., & Pagano, M. (1990). Can severe fiscal contractions be expansionary? Tales of two small European countries. NBER Chapters. National Bureau of Economic Research, Inc.

Guajardo, J., Leigh, D., & Pescatori, A. (2014). Expansionary austerity? International evidence. Journal of the European Economic Association, 12, 949–968. doi:10.1111/jeea.12083.

Hamilton, J. D., & Flavin, M. A. (1986). On the limitations of government borrowing: A framework for empirical testing. American Economic Review, 76, 808–819.

Jorda, O., & Taylor, A.M. (2015). The time for austerity: Estimating the average treatment effect of fiscal policy. Economic Journal n/a–n/a. doi:10.1111/ecoj.12332

Lane, P. R. (2012). The European sovereign debt crisis. Journal of Economic Perspectives, 26, 49–68.

Leeper, E. M. (1991). Equilibria under “active” and “passive” monetary and fiscal policies. Journal of Monetary Economics, 27, 129–147.

Mendoza, E. G., & Ostry, J. D. (2008). International evidence on fiscal solvency: Is fiscal policy “responsible”? Journal of Monetary Economics, 55, 1081–1093.

Monacelli, T., & Perotti, R. (2008). Fiscal policy, wealth effects, and markups. NBER Working Paper No. 14584. National Bureau of Economic Research, Inc.

Riera-Crichton, D., Vegh, C. A., & Vuletin, G. (2015). Procyclical and countercyclical fiscal multipliers: Evidence from OECD countries. Journal of International Money and Finance, 52, 15–31.

Sargent, T. J., & Wallace, N. (1981). Some unpleasant monetarist arithmetic. Federal reserve bank of Minneapolis. Quarterly Review, 1–17.

Schmitt-Grohe, S., & Uribe, M. (1997). Balanced-budget rules, distortionary taxes, and aggregate instability. Journal of Political Economy, 105, 976–1000.

Sims, C. A. (1994). A simple model for study of the determination of the price level and the interaction of monetary and fiscal policy. Economic Theory, 4, 381–399.

The Eurozone Crisis. (2015). The Eurozone crisis: A consensus view of the causes and a few possible solutions, ed. VoxEU eBooks. London: CEPR Press.

Trabandt, M., & Uhlig, H. (2011). The Laffer curve revisited. Journal of Monetary Economics, 58, 305–327. doi:10.1016/j.jmoneco.2011.07.003.

Woodford, M. (1995). Price-level determinacy without control of a monetary aggregate. Carnegie-Rochester Conference Series on Public Policy, 43, 1–46.

Woodford, M. (2001). Fiscal requirements for price stability. Journal of Money, Credit and Banking, 33, 669–728.

Wyplosz, C. (1991). Monetary union and fiscal policy discipline. CEPR Discussion Paper No. 488. CEPR Discussion Papers.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 The Author(s)

About this chapter

Cite this chapter

Aldama, P. (2017). Fiscal Sustainability and Fiscal Rules in a Monetary Union: Theory and Practice in Europe. In: Douady, R., Goulet, C., Pradier, PC. (eds) Financial Regulation in the EU. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-44287-7_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-44287-7_3

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-319-44286-0

Online ISBN: 978-3-319-44287-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)