Abstract

When (a − 1)X = Z, the zero-price effect was observed only for (a: large, X: small) and (a: small, X: small). When X was small, the zero-price effect was observed irrespective of the value of a. When X was large, the zero-price effect was not observed. Human behavior tend to deviate from irrational behavior assumed in traditional economics for small values of X irrespective of a. The price of zero must be irrationally chosen due to the overestimation of price of zero. When (a − 1)X > Z, the zero-price effect was observed only for (a: large, X: large) and (a: large, X: small). When a was large, the zero-price effect was observed irrespective of whether X was large or small. When a was small, the zero-price effect was not observed. Human behavior tend to deviate from irrational behavior assumed in traditional economics for large values of a irrespective of the value of a. In this manner, it has been indicated that the zero-price effect is not necessarily observable and holds under limited conditions.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keyword

1 Introduction

It has been suggested that decisions about free products, the price of which is zero, are different from simply subtracting costs from benefits (Ariely [1]). The benefits associated with the price of zero attached to free products are irrationally perceived to be higher. Under such a condition of price of zero, a large number of participants tended to prefer a less attractive product to a more attractive one. In such a situation, we seem to act as if pricing a product as free not only decreases its cost, but also increases its benefits. This corresponds to an irrational behavior to the price of zero, which distorts our judgment to an irrational one. It must, however, be noted that the price of a product discounted to the price of zero is very cheap. It is questionable whether such an irrational behavior can be generalized.

Imagine that a company thinks of introducing a new machine tool to a factory and decides to introduce one with free expendable supplies as a result of comparing with other ones. The company must feel an advantage of the introduced machine tool over other ones. If the expendable supplies are higher than those of other machine tools, the company must continue to pay for expensive expendable supplies. They eventually notice that the price of zero is no longer felt as a merit. In this manner, they reacted excessively to the price of zero and are compelled to pay for expensive expendable supplies.

When prices are mentioned, individuals apply market norms. On the other hand, when prices are not mentioned (when the price is zero), individuals apply social norms to determine their choices and effort (Heyman and Ariely [2]). Ariely et al. [3] have shown that when a candy is offered at 1 ¢ per piece, a participant is likely to take about four pieces, whereas when the price of the candy is zero, a participant tends not to take more than one. This must indicate that a participant effectively decrease the demand when the prices is reduced. Kahneman and Tversky [4] discussed our irrational behavior and showed that when it comes to gambles, zero probability (as well as certainty) is perceived as substantially different from small positive probabilities). Whereas the values of small probability are perceived as higher than they actually are, the perception of zero probability is accurate.

Although the zero-price effect is demonstrated using a variety of experiments, it is not certain whether this effect is generally observable or not. If the zero-price effect is not generally observable, it must be identified under what conditions the zero-price effect is observable. The change of discounted amount, the price, the difference of the price between two alternatives must be treated as experimental factors, and the effects of these factors on the zero-price effect must be investigated. The difference of price between alternatives, the price of alternatives, and the relationship between the zero-price and the discounted price, that is, the relationship between X and Z (two levels: Eqs. (2) and (3) in Sect. 2.2 below) were manipulated, and it was explored whether the zero-price effect is generally observable.

2 Method

2.1 Participants

A total of eighty two participants from 19 to 24 years old at Faculty of Engineering, Okayama University took part in the experiment. The limitation of answering time was not imposed on the participant. All participants had no knowledge on psychology and behavioral economics.

2.2 Irrational Behavior Caused by Pricing of Zero

(A) A product of $X is obtained for free.

(B) A product of $Y is discounted and sold with the price of $Z.

It is assumed that X and Y is related as follows.

where a > 1, Y > Z.

If it is assumed that Y > Y − Z > X, Eq. (2) holds.

If we can judge rationally, the alternative (B) must be chosen. If Eq. (3) is assumed, the alternatives (A) and (B) must be chosen with an equal probability from the rational point of view.

The following questionnaire survey was conducted to examine the effect of the price of zero on the choice of alternatives (A) and (B) as a function of a and X for both Eqs. (2) and (3).

2.3 Task

The experimental factors were the size of a (two levels: small and large) and the size of X (small and large), and the relationship between X and Z (two levels: Eqs. (2) and (3)). Thus, the following questionnaire was prepared for a total of eight conditions.

(1) Choose one from the following two alternatives (a: large, X: small, Eq. (2)).

A: A chocolate of 20 ¢ is free.

B: A chocolate of $1 is discounted to 80 ¢.

(2) Choose one from the following two alternatives (a: large, X: large, Eq. (1)).

A: Artificial leather shoes of $80 are free if a suit is purchased.

B: Real leather shoes of $400 are discounted to $200 if a suit is purchased.

(3) Choose one from the following two alternatives (a: small, X: small, Eq. (1)).

A: An eraser of $1 is free.

B: A more usable eraser of $1.3 is discounted to 20 ¢.

(4) Choose one from the following two alternatives (a: small, X: large, Eq. (2)).

A: Clothes of $100 is presented by your friend.

B: Clothes of $130 is sold by $30 by your friend.

(5) Choose one from the following two alternatives (a: large, X: small, Eq. (1)).

A: Bread of 80c is free.

B: Bread of $4.8 is discounted to $2.8.

(6) Choose one from the following two alternatives (a: small, X: small, Eq. (2)).

A: Bottled water of $1 is free.

B: Bottled orange juice of $1.5 is discounted to 50 ¢.

(7) Choose one from the following two alternatives (a: large, X: large, Eq. (2)).

A: If you purchase a television set, you can get a DVD recorder of $50 for free.

B: If you purchase a television set, you can purchase a DVD recorder of $300 by $250.

(8) Choose one from the following two alternatives (a: small, X: large, Eq. (1)).

A: You can have a massage of $30 for free.

B: You can have a massage of $45 by $5.

As a control, the following questions without price of zero were also answered by the participants.

(1) Choose one from the following two alternatives (a: large, X: small).

A: A chocolate of ¢20.

B: A chocolate of $1.

(2) Choose one from the following two alternatives (a: large, X: large)

A: Artificial leather shoes of $80.

B: Real leather shoes of $400.

(3) Choose one from the following two alternatives (a: small, X: small)

A: An eraser of $1 is free.

B: A more usable eraser of $1.3.

(4) Choose one from the following two alternatives (a: small, X: large)

A: Used clothes of $100.

B: Used clothes of $130.

(5) Choose one from the following two alternatives (a: large, X: small).

A: Bread of 80 ¢.

B: Bread of $4.8

(6) Choose one from the following two alternatives (a: small, X: small, Eq. (2)).

A: Bottled water of $1.

B: Bottled orange juice of $1.5.

(7) Choose one from the following two alternatives (a: large, X: large).

A: A DVD recorder of $50.

B: A Blue ray recorder of $300.

(8) Choose one from the following two alternatives (a: small, X: large).

A: Massage service of $30.

B: Massage service of $45.

3 Results

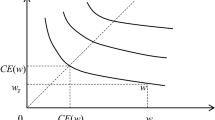

The percentage choice (A) for Eqs. (2) and (3) is shown in Figs. 1 and 2, respectively. The zero-price effect was defined as the subtraction of the percentage choice (A) at the non-zero-price condition from the percentage choice (A) at the zero-price condition and denoted by E zero. The comparisons of E zero among four combinations of a and X, and between Eqs. (2) and (3) is summarized in Fig. 3. The positive value of E zero indicates that the zero-price effect is observable.

4 Discussion

The zero-price effect is not always observable as shown in Figs. 1, 2 and 3. When Eq. (3) held (see Fig. 2), the zero-price effect was observed only for (a: large, X: small) and (a: small, X: small). When X was small, the zero-price effect was observed irrespective of the value of a. When X was large, the zero-price effect was not observed. When Eq. (3) holds, human behavior tend to deviate from rational behavior assumed in traditional economics for small values of X irrespective of a. Under the condition of Eq. (3), the small value of X might be a trigger of mapping difficulty and affect.

When Eq. (2) held (see Fig. 1), the zero-price effect was observed only for (a: large, X: large) and (a: large, X: small). When a was large, the zero-price effect was observed irrespective of whether X was large or small. When a was small, the zero-price effect was not observed. When Eq. (2) holds, human behavior tend to deviate from rational behavior assumed in traditional economics for large values of a irrespective of the value of X. Under the condition of Eq. (2), the small value of a might be a trigger of mapping difficulty and affect.

In this manner, it has been indicated that the zero-price effect is not necessarily observable and can be generalized to holds under limited conditions (small values of X under Eq. (3) and small values of a under Eq. (2)).

Evaluating the utility of a product in monetary terms is difficult. To illustrate this point, imagine a situation in which a consumer’s valuation of the lower value chocolate is somewhere between 1 and 5 ¢ and his or her valuation of the higher value chocolate is somewhere between 10 and 20 ¢. If one is confronted with the choice between 1 and 14 ¢, it would be unclear whether any of the options would give rise to a net benefit. On the other hand, the same consumer, when facing the choice between zero price and 13 ¢, could easily see that one of the options-the free option-would be certainly produce a net benefit. Thus, the zero-price effect might be attributed to the uncertainty in overall benefit associated with costly options, and the certainty in overall benefit associated with the price of zero.

It is also possible to speculate that cognitive mechanism behind the zero-price effect might have to do with affect. Options with no cost (price of zero) evoke a more positive affective response than options with both benefits and costs. Therefore, it might be assumed that more individuals use this affective reaction as a cue for their decision, the more frequently they will choose the option with price of zero (Slovic et al. [5, 6]). This affective perspective also points to circumstances under which the zero-price effect could be eliminated. If the cause of the zero-price effect is a reliance on an initial (overly positive) affective evaluation, making a non-affective and more cognitive evaluation might diminish the zero-price effect. The price itself might work for eliminating the zero-price effect depending on the situation.

On the basis of discussion above, especially mapping difficulty and affect might contribute to some extent to our irrational behavior that makes us overreact to the price of zero.

5 Conclusions

The results can be summarized as follows. The generalized conclusion is that the zero-price effect is not always observable. The conclusions can be stated as follows for Eqs. (2) and (3).

(1) When Eq. (3) held (see Fig. 2), the zero-price effect was observed only for (a: large, X: small) and (a: small, X: small). When X was small, the zero-price effect was observed irrespective of the value of a. When X was large, the zero-price effect was not observed. When Eq. (3) holds, human behavior tend to deviate from irrational behavior assumed in traditional economics for small values of X irrespective of a. The price of zero must be irrationally chosen due to the overestimation of price of zero. Under the condition of (a − 1)X > Z, the larger value of X leads to rational judgment. On the other hand, when X is small, human judgment tend to be distorted to an irrational one, and vulnerable to the price of zero.

(2) When Eq. (2) held (see Fig. 1), the zero-price effect was observed only for (a: large, X: large) and (a: large, X: small). When a was large, the zero-price effect was observed irrespective of whether X was large or small. When a was small, the zero-price effect was not observed. When Eq. (2) holds, human behavior tend to deviate from irrational behavior assumed in traditional economics for large values of a irrespective of the value of a. Under the condition of (a − 1)X = Z, it is speculated that the discount is recognized as not the amount of the discounted price but the discount percentage from the initial price X, and thus affected largely by larger value of a.

In this manner, it has been indicated that the zero-price effect is not necessarily observable and holds under limited conditions. The value of price X that is provided for free and the price to be compared as an alternative of X that is expressed by a were important determinants of zero-price effect.

References

Ariely, D.: Predictably Irrational. Harper, London (2009)

Heyman, J., Ariely, D.: Effort for payment: a tale of two markets. Psychol. Sci. 15(11), 787–793 (2004)

Ariely, D., Gneezy, U., Haruvy, E.: Social norms and the price of zero. Working paper, MIT, Boston, MA (2005)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econometrica 47(2), 263–291 (1979)

Slovic, P., Finucane, M., Peters, E., MacGregor, D.G.: The affect heuristic. In: Gilovich, T. (ed.) Heuristics and Biases: The Psychology of Intuitive Judgment, pp. 397–420. Cambridge University Press, New York (2002)

Slovic, P., Finucane, M., Peters, E., MacGregor, D.G.: Rational actors or rational fools: implications of the affect heuristic for behavioral economics. J. Socio Econ. 31(4), 329–342 (2002)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2017 Springer International Publishing Switzerland

About this paper

Cite this paper

Murata, A., Matsushita, Y., Moriwaka, M. (2017). Effects of Price of Zero on Decision Making: An Attempt to Generalize Human’s Irrational Behavior to Price of Zero. In: Schatz, S., Hoffman, M. (eds) Advances in Cross-Cultural Decision Making. Advances in Intelligent Systems and Computing, vol 480. Springer, Cham. https://doi.org/10.1007/978-3-319-41636-6_9

Download citation

DOI: https://doi.org/10.1007/978-3-319-41636-6_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-41635-9

Online ISBN: 978-3-319-41636-6

eBook Packages: EngineeringEngineering (R0)