Abstract

The aim of this paper is to investigate the determinants of innovation activities and their impact on firm performance. For the empirical analysis of the study we employ Business Environment Enterprise Performance Surveys (BEEPS) firm-level data. To examine the relationship between innovation activities and firm performance we apply instrumental variable (IV) technique, which enables us to control for the endogeneity between innovation activities undertaken by entrepreneurial businesses and their performance. Our findings suggest that enterprises’ size, R&D intensity, competition, skilled workers and export activity have positive and significant impact on their incentive to undertake innovation activities. Considering the determinants of productivity, we find evidence that enterprises that have undertaken innovation activities (instrumented variable) and having higher degree of skilled workers and that are European Union member country enterprises perform better.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Innovation

- Performance

- Business Environment Enterprise Performance Surveys

- Instrumental variable (IV) technique

- Transition economies

1 Introduction

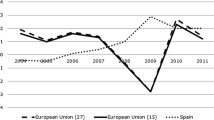

Based on the statistics showing that US experienced increasing average annual labour productivity from 1.2 % in the 1973–1995 period to 2.3 % from 1995 to 2006, whereas in 15 EU countries (members up to 2004) occurs productivity growth slowdown with annual rate of 2.4 % in the 1973–1995 period to 1.5 % from 1995 to 2006 one can say that there is evidence for US experiencing higher labour productivity growth than EU (Ark et al. 2008). Several studies have shown that the US increase in labour productivity is attributable to intensive development of innovation activities (O’Mahony et al. 2010; Crescenzi and Rodriguez-Pose 2011; De Faria and Mendonca 2011). In order to increase the innovation activities undertaken by firms in the EU the Lisbon Strategy set a goal for Europe to become “the world’s most competitive and dynamic knowledge-based economy in the world, capable of sustaining growth with more and better jobs and greater social cohesion” by 2010. This aspiration also presents the first priority area of the ‘Europe 2020’ Strategy, which is ‘smart growth’ through the development of knowledge, innovation, and education (European Commission 2010). Accordingly, EU has set itself an ambitious target—the Barcelona objective—of increasing R&D expenditures to 3 % of GDP in particular by improving the conditions for R&D investment by the private sector, and developing a new indicator to track innovation (European Commission 2010; Ramadani and Schneider 2013). In order for accomplishing these goals the OECD (2005) has prepared an ‘innovation strategy’, containing the following major themes: (i) the “openness” of innovation; (ii) the central role of entrepreneurship; (iii) creating and applying knowledge; (iv) applying innovation to address global and social challenges; and (v) improving the governance of policies for innovation. Entrepreneurship and innovation activities in transition economies are discussed in Ateljevic (2013), Tesic (2012), Dana (2010) and Smallbone and Welter (2009).

The literature on the correlation between innovation activities and firm performance (henceforth innovation-performance correlation) varies on different ways of defining innovation and on the measures employed, with challenges faced related to the problem of finding relevant variables for measuring innovation activities. The most often employed measures in the empirical literature are: R&D expenditure—as a measure of input; patents—as a measure of output; and introducing new product/new process—as output accepted by the market. Further we investigate the empirical evidence on the correlation between innovation activities and firm performance. The main focus is on the data and methodology used in these studies. This stream of literature mainly applies structural approach for modelling innovation.

For the purpose of the chapter we empirically investigate the innovation-performance correlation. A dataset derived from the Business Environment and Enterprise Performance Survey (BEEPS) of 2002, 2005 and 2009 is employed, and we apply instrumental variable technique.

The structure of the chapter is as follows. In Sects. 2 and 3 we review the literature related with the innovation-performance correlation, with main focus on the model and the determinants of innovation activity. Section 4 elaborates the sample and the data. Section 5 considers the methods of investigation and the empirical estimations. The interpretation of the results and conclusions are provided in Sect. 6.

2 Theoretical Background

2.1 Transition Process in Central and South Eastern Europe Economies: Reflections

Few months ago, the world celebrated the 25th Anniversary of Berlin Wall downfall and starting the transition process of former socialist countries—an event fueled by expectations and hopes for a better life. Reflecting upon this event from today’s perspective rise a lot of questions: Did the transition meet the expectations? Whether the defined aims and goals are really accomplished? Were there formulated clear strategies and approaches on how these countries will deal with the new circumstances? Did the transition process started too early and found them unprepared? Do the people live better after the transition? Did the people of these countries expected too much? Is still present the nostalgia for the past? What we have learnt from the transition? … and too many other questions, which are or still waiting to be answered.

On May 6–7, 2014, in Budapest, Hungary was organized a 2-day symposium, entitled ‘Transition in Perspective’. It was organized by Peterson Institute for International Economics and School of Public Policy at Central European University. The aim of the symposium was to assess the lessons learnt from the transition process and ‘builds’ a road ahead. Some of conclusions from this symposium are summarized as follows (Aslund 2014):

-

In terms of economic performance can be concluded that the overall transition was a success since each sub-region has increased its share of the global economy;

-

Avoiding rent seeking and gradualism was seen as the key for success to ensuring a parallel movement political and economic reforms;

-

The most crucial part of the transition process was the privatization of all state-owned enterprises;

-

The privatization process still remains a sensitive and controversial matter, for instance Russia and Hungary stand out as examples of the fragility of the post-socialist transition and the fact that privatization can be reversed.

-

It was concluded that the European Union and the International Monetary Fund are important tools, however, they cannot do the job on their own;

-

There is still a clear division between the Central and East European countries that have or are on that track to become members of the EU and the former Soviet republics, which are far more corrupted;

-

An important issue was the disrupting of the old communist elites, who were corrupted by their hypocrisy of obedience to an ideology that nobody believed in. A part of them, especially in Russia and Bulgaria, has turned out to be the secret police, being the least transparent, the most lawless, the most ruthless, and also the most international.

-

During the transition process a positive impact of a strong civil society and national cohesiveness was emphasized;

-

Poland and Estonia were accentuated as the greatest economic and political successes seen from today’s perspective;

-

Even though Hungary and Poland were recognized as reform leaders in the 1990s, however, since 2001 these countries have regressed;

-

Even though Slovakia was delayed in economic reforms in the 1990s, however, it managed to catch up by adopting reforms in 2003–2004, producing the highest economic growth in Central and Eastern Europe in 2000–2010;

-

It was emphasized that Georgian Rose Revolution in 2003 contributed greatly to improvement; some improvement was experienced in Moldova while adjusting to the European Union.

Although in the first years of transition, most of Central and South Eastern Europe (CEE and SEE) countries were experiencing very disordered and uneven economic performance, however, in general, it can be concluded that they perform better today than before 1989 (Arriba Bueno 2010). Almost each of them has increased its GDP/per capita, i.e. only five countries have not reached their GDP per capita level of 1990 as yet (Aslund 2014). These countries are Macedonia, Kyrgyzstan, Moldova, Tajikistan and Ukraine (Wyplosz 2014). The pace of GDP/per capita in transition economies is presented in Table 1.

Good protection of property rights, effective execution of contracts and the law is directly related to fostering and development of the economic activities. The protection of property rights remains to be a real challenge for CEE and SEE economies. Based on International Property Rights Index 2013, from 131 analyzed countries, the most of CEE and SEE countries are ranked in the ‘second part’ of the list. These issues are broadly discussed in Di Lorenzo (2013). Even that in some countries in transition, such as Estonia, Slovakia, Czech Republic, Poland, Bulgaria and Romania, is identified a slight progress (Di Lorenzo 2013), the judicial system is still inefficient and subject to political influence (Ramadani 2013; Ramadani and Schneider 2013).

As it was noted in the conclusions of the above mentioned symposium, the privatization of state-owned enterprises was among the most important, but in meantime, the most contentious aspect of the transition process. Nowadays, the privatization process remained controversial, raising concerns about fairness, justice, and trust for the reason that a lot of state-owned enterprises have been handed to oligarchs and insiders in most of the countries, especially in Russia and Hungary (Aslund 2014). Here should be mentioned that each country has applied different privatization methods (see Table 2).

Long administrative and bureaucratic procedures represent a serious obstacle of doing business. Fiti and Ramadani (2013) noted high correlation between the administrative and bureaucratic procedures (expressed by the number of necessary procedures and required days for starting a new business) and corruption—the more procedures, the more opportunities for corruption. Regarding this issue, most of transition countries have marked significant improvements—most of them are in a better position comparing to some European Union (EU) countries, such as Spain, Greece and Malta (Doing Business 2014). If we see the Doing Business ranking list, from the group of transition countries, in Top five countries are ranked: Georgia (8th place), Lithuania (17th), Estonia (22nd), Latvia (24th) and Macedonia (25th). Here should be pointed that the introduction of the so-called one-stop system contributed significantly to shortening the procedures and timeframe to start a new business.

According to reports of the EBRD (2013), although in CEE and SEE countries there was a certain reduction of corruption in its three basic forms of existence: bribe tax (as a percentage of total sales of enterprises), kickback tax (as a percentage of the value of contracts in the form of additional and unofficial payments to ensure receipt of contracts) and bribery frequency (as percentage of respondents who said they accepted to pay bribes in customs, tax administration etc.), it still presents a serious problem. Shkolnikov and Nadgrodkiewicz (2010) stated that high-level scandals continue to blow up elsewhere. For example, corruption continues to devour Bulgaria and Romania, and for this reason they have been subjected to strong criticism from EU, who decided to withhold Bulgaria’s development funds; in the Czech Republic, officials from Defense Ministry were accused of corruption in connection with commissioning overpriced public contracts; in Hungary, the nation was shocked when the government admitted to lying about economic performance in order to win elections, in Poland have been identified many cases of excessive pressure of private interests on legislation; etc. Transparency International Corruption Perceptions Index 2013 shows that countries in transition are mostly ranked in positions from middle to high corrupted countries (Transparency International 2014).

Although progress is evidenced in almost all spheres of economic and politic life, nostalgia for the past in post-socialist countries still remains strong—most of the people feel that new system didn’t achieve to realize the expected and hoped results (Ellman 2012; Arriba Bueno 2010). Different surveys that were conducted in post-socialist countries can confirm this. For instance, in Hungary, 70 % of the people who were already adults at the time of the Berlin Wall fall are dissatisfied with the transformations in the political system; in Bulgaria, around 60 % of citizens believe they lived better under communism; in Poland, 44 % of people have positive thoughts about former communist rule—the numbers go higher among the elderly, 54 % (Shkolnikov and Nadgrodkiewicz 2010). Anelia Beeva, a Bulgarian girl around 30s once stated: “[Before] we went on holidays to the coast and the mountains, there were plenty of clothes, shoes, and food. And now the biggest chunk of our incomes is spent on food. People with university degrees are unemployed and many go abroad” (Mudeva 2009). Even though a lot of weaknesses and obstacles occurred during the transition process however, transition has had a lot of positive impact on the development of many post socialist countries.

2.2 Innovation and Performance

Firms today act under a big pressure by other firms, which offer the same or similar production or service, or they are under the pressure of the customers who expect more and more from the product they consume. In order to face with the new conditions and situations, firms are made to continuously search for new ways of production, namely offering new products or enhancing existing ones (Ramadani et al. 2013; Gerguri et al. 2013; Kariv 2010; Baronet and Riverin 2010). In other words, they should continuously introduce innovations. But, what in fact do innovations represent?

Schumpeter (1934, p. 66), defined innovation in a broad sense, as “carrying out of new combinations” that include “the introduction of new goods (…), new methods of production (…), the opening of new markets (…), the conquest of new sources of supply (…) and the carrying out of a new organization of any industry”. He was the first to develop a three-stage classification: invention, innovation and diffusion, known as Schumpeterian trichotomy (Jaffe et al. 2004; Clausen 2011). Innovation in the Schumpeterian scheme encompasses one of the three stages, however it is often used broadly to refer to all stages of the technological change process. Lionnet (2003, p. 6) defines innovation as a process by which a novel idea is brought to the stage where it eventually produces money. It is a dynamic technical, economic and social process involving the interaction of people coming from different horizons, with different perspectives and different motivations. Ramadani and Gerguri (2011, p. 102) define innovations as “a process of creating a new product or service, new technologic process, new organization, or enhancement of existing product or service, existing technologic process and existing organization”.

According to Drucker (1993) there are four basic types of innovation:

-

Incremental Innovation—Doing more of the same things you have been doing with somewhat better results.

-

Additive Innovation—More fully exploiting already existing resources, such as product lines extensions, and can achieve good results. These opportunities should rarely be treated as high priority efforts. The risks should be small—and they should not take resources away from complementary or breakthrough opportunities.

-

Complementary Innovation—Offers something new and changes the structure of the business.

-

Breakthrough Innovation (Radical Innovation)—Changes the fundamentals of the business, creating a new industry and new avenues for extensive wealth creation.

The theoretical developments focused on firm performance started about 20 years ago (Romer 1986; Leeuwen 2008). Firm performance could be measured by different indicators, such as: profit, revenue, growth, productivity, efficiency, stock price, new markets, export, etc. Murphy et al. (1996) and Sohn et al. (2007) noted that firm performance is a multidimensional concept, whose indicators can be departmental, related to production, finance or marketing. Wolff and Pett (2006) say that performance indicators are consequential, related to growth and profit. Castany et al. (2005), Van Biesebroeck (2005), Pagés (2010), Geroski (1998), and Tybout (2000) in their studies concluded that firms which have better access to technology, managerial skills, finance, learning, flexible non-hierarchical structure perform better than the others.

Regarding innovation-performance correlation of firms, Tiwari and Buse (2007) developed a model, known as BCF model (better, cheaper and faster) which means that innovations make firms to produce better quality products and services, with lower costs and faster. Those companies that succeed to produce products with better quality, with lower costs and place them on the market faster than the others increase the possibility to build better competitive position in the market, to increase its profitability and to strengthen its stability. So, all this enables firms to enhance their overall performance. We measure these changes of the firms by the innovation variable which indicates the improvements in products and services, changes in process, new technology, skilled workers, etc.

As it was mentioned, there are different types of innovations. They also have different impact on enterprise’s performance. Goedhuys and Veugelers (2008), based on their research in Brazil concluded that: “Product innovation also translates into superior sales growth rates. This is particularly so when it is combined with process innovation. Process innovation alone, without the introduction of new products, runs the risk of being associated with lower growth performance. It is indeed possible that the benefits of more cost efficient production are only reaped after an initial period of restructuring, beyond what we can measure with our data set. Alternative measures, such as productivity, productivity growth, or profitability, may capture the beneficial influence of process innovation more rapidly” (p. 18). These issues are discussed also in Hervas-Oliver et al. (2014), Czarnitzki and Delanote (2014), Britton (1989), and De Propris (2002).

3 Empirical Evidence on Innovation Activities

The empirical literature on investigating innovative behaviour and its effect on firm performance face two major methodological challenges: (i) of how to measure innovation or technological change and (ii) with estimation technique to apply for taking into consideration the endogeneity problem. The first methodological challenge is accompanied with the difficulty of getting appropriate data which correspond to the definition of innovation. Consequently the empirical studies have mainly adjusted their analysis of innovation depending on available measure of innovation, by using proxies which reflect some aspects of the innovation process.

Based on these definitions, the most common measures used in the literature for analyzing the innovative process are as follows: (i) a measure of the inputs into the innovative process, such as R&D expenditure, (ii) an intermediate output, such as the number of inventions which have been patented, and (iii) a direct measure of innovative output, new product or new process. These proxy measures for the innovation process have their limitations. Not all R&D expenditures end in innovation output since this measure reflects only the resources committed to producing innovative output, but not the innovative process. The number of patents does not indicate whether this output has a positive economic value or whether it has successfully been introduced in the market. Whereas the new product and/or process is acknowledged as a proxy that directly quantifies the effect of innovation and its success in the market.

Considering the other methodological challenge, one can put it into two dimensions: (i) the determinants of innovation, and (ii) the impact of innovation on productivity, firm performance and economic welfare (Battisti and Stoneman 2010).

R&D activities are expected to be a major factor leading to product and process innovation and, therefore, R&D intensity has been used by the majority of studies (Crepon et al. 1998; Damijan et al. 2008; Falk 2008; Hashi and Stojcic 2013). There is a review of about 100 studies on innovation by Becheikh et al. (2006), summarizing the empirical studies investigating product/process innovations as dependent variable, conclude that 80 % of the studies find that R&D investment has a positive and significant effect on innovation activities. Acs and Audretsch (1991) find that the number of innovations increases with increased industry R&D expenditures but at a decreasing rate.

The firms export intensity is another frequently employed determinant that may affect innovation behaviour. The reasons to expect that exports stimulate innovation activities of firms are: (i) exporting firms can benefit more from the knowledge abroad (learning-by-exporting) for their innovation activities than non-exporting firms; (ii) they are exposed to more intense foreign competition which requires continuous upgrading of their products and processes; and (iii) they will gain more profit by introducing the innovative product to foreign markets. The empirical evidence reports a positive relationship between export intensity and the incentive to innovate (Lööf and Heshmati 2006; Alvarez and Robertson 2004; Damijan et al. 2005, 2008).

There is evidence in the empirical literature that skilled labour facilitates and induces innovation activities of firms (Kanter 1983). Studies investigating the relationship between human capital factors and innovation conclude that the ability of firms to innovate depends on the employees’ level of education (Kanter 1983; Gupta and Singhal 1993). Acs and Audretsch (1991), too, show a positive and statistically significant impact of skilled labour on innovative output.

Another problem of investigating innovation is identifying appropriate models to empirically investigate the process of technological change and its impact on performance. Studies that empirically examine the relationship between innovation activities and productivity can be divided into two major groups: (i) studies based on the multistage model of innovation (Crepon et al. 1998; Lööf and Heshmati 2006; Griffith et al. 2006; Hashi and Stojcic 2013), and (ii) studies that apply single model equations (Acs and Audretsch 1991; Domadenik et al. 2008; Damijan et al. 2005, 2008).

The most widely used analytical approach to investigate innovation is the multistage approach. These so-called CDM models are based on, and extend, the model originally developed by Crepon et al. (1998). It is a structural model with four stages formalized in four equations: (i) the firm’s decision to engage in innovation activities; (ii) the intensity with which the firm undertakes R&D; (iii) the innovation or knowledge production function; and (iv) the output production function, where knowledge is an input. By employing the CDM model these studies are also able to control for the endogeneity of innovation.

Hall and Mairesse (2006) summarise papers that have employed models similar to CDM for their analysis of innovation. They conclude that important progress has been made in modelling and employing appropriate econometric estimation methods by using innovation survey data. They emphasize that better results are obtained when researchers combine the survey data with census-type information on the accounting data of the firms, which enables the measurement of final outcomes in the form of profitability and productivity. Most of these studies conclude that innovation has a positive impact on productivity or productivity growth.

The other approach used by empirical studies investigating innovation activities is the single model equation. Acs and Audretsch (1991) and Scherer (1965, 1980) examine the relationship between firm size and innovation output, with cubic and quadratic regressions. Damijan et al. (2008) estimate the growth accounting model including R&D capital by applying OLS approach together with matching techniques and propensity score to discriminate between innovating and non-innovating firms and to explore whether innovation activity is the decisive factor driving firms’ productivity growth.

Damijan et al. (2008) combined firm-level data on innovation activity with financial data for a sample of Slovenian firms in the period 1996–2002 to investigate whether and to what extent firm’s ability to innovate is induced by its own R&D activity and to what extent by factors external to the firm. The empirical estimation is performed in two steps: (i) the impact of internal R&D capital and external R&D spillovers on innovation activity is estimated (probit model); then (ii) the impact of innovation activities on productivity growth is estimated (Cobb-Douglas production function).

Because of the data limitations we were unable to employ a CDM-type model and have had to examine the correlation between innovation activities and firm performance by following studies applying singe-equation models (Damijan et al. 2005, 2008). We first estimate the impact of R&D intensity on innovation activities in a probit model, and then continue with the estimation of the impact of innovations on productivity (using the predicted values of the first model). By employing the BEEPS data we have the advantage of performing the analysis in more than one country.

4 The Sample and the Data

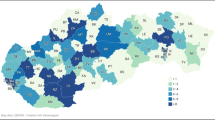

For the empirical analysis of this study we use World Bank/EBRD’s Business Environment Enterprise Performance Surveys (BEEPS) firm-level data conducted in 2002, 2005 and 2009. Out of the overall BEEPS dataset we make use of the data on 14 Central Eastern and South-Eastern European Economies. Since there are European Union member countries, we are able to provide comparative analysis between countries that recently joint EU (list of nine EU countries—CEE (alphabetic order): Bulgaria, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, and Slovakia) and those in South-eastern Europe (list of five South-East European countries—SEEs (alphabetic order): Albania, Bosnia and Herzegovina, Croatia, Macedonia FYR, and Serbia & Montenegro). The major advantages to be emphasized for this dataset are that: (i) it provides large number of observations comparable for SEEs for 2002, 2005 and 2009; and (ii) it includes 3 year retrospective information for each survey round which makes available data on firms over a 9-year period. The BEEPS questionnaire consists of questions which allow us to specify the variables of our interest by following the theory. For the purpose of the investigation we employ the pooled data for 2002, 2005 and 2009 in order to utilize the advantage of a larger number of observations having the final sample consisted of 7225.

One of the challenges faced by studies investigating innovation activities has been the identification of the determinants of innovation. These studies also highlight the impact of additional firm-characteristic such as ownership structure, export activity, R&D intensity, management skills, and others that may affect innovation activities. Factors that influence innovation activities also affect firm performance (productivity).

Considering the correlation between ownership structure and innovation activities, it is expected that foreign-owned firms, which can draw on the technical and management know-how of their parent companies, will be more efficient than their domestically owned rivals. In line with this, Falk (2008) using firm-level data of the third Community Innovation Survey (CIS) covering 12 European countries, found that foreign owned firms are more innovative than domestic firms (Love et al. 1996). Guadalupe et al. (2011), using a panel dataset of Spanish manufacturing firms (1990–2006), suggest that foreign ownership leads to a specific type of process innovation, involving both new machines and new methods of organising production. Domadenik et al. (2008), using a sample of Slovenian firms, found that domestic ownership display significantly higher R&D activities comparing to other types of ownership. On the other hand, there are a number of studies that did not find a significant difference between foreign owned and domestic firms (Chudnovsky et al. 2006).

R&D activities are expected to be a major factor leading to product and process innovation and, therefore, R&D intensity has been used by the majority of studies (Crepon et al. 1998; Damijan et al. 2008; Falk 2008; Hashi and Stojcic 2013). There is a review of about 100 studies on innovation by Becheikh et al. (2006), summarising the empirical studies investigating product/process innovations as dependent variable, conclude that 80 % of the studies find that R&D investment has a positive and significant effect on innovation activities. Acs and Audretsch (1991) find that the number of innovations increases with increased industry R&D expenditures but at a decreasing rate.

The firms export intensity is another frequently employed determinant that may affect innovation behaviour. The reasons to expect that exports stimulate innovation activities of firms are: (i) exporting firms can benefit more from the knowledge abroad (learning-by-exporting) for their innovation activities than non-exporting firms; (ii) they are exposed to more intense foreign competition which requires continuous upgrading of their products and processes; and (iii) they will gain more profit by introducing the innovative product to foreign markets. The empirical evidence reports a positive correlation between export intensity and the incentive to innovate (Lööf and Heshmati 2006; Alvarez and Robertson 2004).

There is evidence in the empirical literature that skilled labour facilitates and induces innovation activities of firms (Kanter 1983). Studies investigating the correlation between human capital factors and innovation conclude that the ability of enterprises to innovate depends on the employees’ level of education (Kanter 1983; Gupta and Singhal 1993). Acs and Audretsch (1991), too, show a positive and statistically significant impact of skilled labour on innovative output.

The variables used in models estimating the determinants of innovation activities vary according to the studies and the data available. Most often as a dependent variable in this correlation are used: R&D intensity, share of innovative sales, labour productivity and others. Lööf and Heshmati (2006) apply a version of CDM model to Swedish data for the mid-1990s on both manufacturing and service firms. They employ a richer list of variables to measure the success of innovation output: value added per employee, sales per employee, profit before and after depreciation, and the sales margins. They differ from other papers using this model with their measure of innovation input—the total sum of expenditures on eight different categories of innovation engagements including: (i) R&D based products, services or process innovations within the firm, (ii) non-R&D based innovation activities, (iii) purchase of services for innovation activities, (iv) purchase of machinery and equipment related to products, services and process innovations, (v) other non-machinery and equipment-related innovation activities, (vi) industrial design or other preparations for production of new or improved products, (vii) education directly related to innovation activities, and (viii) introduction of innovations to the market—as a more comprehensive indicator than simple R&D expenditure, including innovation activities based on non-R&D spending. Table 3 gives the description of the variables employed in the model.

According to the statistics the average labor productivity has increased for 25 % from 2002 to 2005, while it has doubled it mean from 2005 to 2009. The average size of the companies in the sample is 22 employees. On average firms R&D investments are approximately 4 % (R&D expenditure to sales ratio). The average of firms that have exported directly is 10–12 %. Firms are established mainly 16–20 years ago (the 1980s–1990s). For companies surveyed in 2002, on average 33 % of the employees have university degree, and this percentage drops to 14 % for 2009. Considering innovation activities, 62 % of the companies have indicated that they have introduced new product and/or process in 2002, and the number of innovative firms has increased for 25 % by 2009. The next section continues with the empirical investigation of the determinants of innovation activities and their impact on firm performance. Pooled data procedures on CEE and SEE countries are applied.

5 Methodology and Empirical Findings

In order to explain the extent of innovation activity in CEE and SEE countries, we empirically investigate the correlation between firm’s innovation and labour productivity. A major problems that arises in the literature investigating the correlation between innovation activities and firm performance is endogeneity (Peters 2008). Considering the endogeneity problem, innovation activities and firm performance are determined simultaneously, i.e. innovation activities are endogenous. This implies that endogeneity should be taken into account when investigating the correlation between innovation activities and firm performance. Endogeneity appears in equations where there is correlation between an independent variable and the disturbance term.Footnote 1 When there is endogeneity among the variables, Baltagi et al. (2003) show that there is substantial bias in OLS and the random effect estimators and both yield misleading inference.

One solution to the problem is the use of instrumental variables (IV), which is consistent and has a large-sample normal distribution (Baum 2006). Satisfactory instruments with meaningful economic rationale are not always easy to find, especially not valid ones that satisfy the two key properties—that it must be uncorrelated with the error term but correlated with the independent variable. The simple IV estimator assumes the presence of independent and identically distributed (i.i.d.) errors.

The test of endogeneity of the innovation activity variable shows that it must be considered endogenous in the fitted model, as one can be seen below:

-

H0: Regressor is exogenous

Wu-Hausman F test: | 9.46999 F(1,1209) | P-value = 0.00214 |

Durbin-Wu-Hausman chi-sq test: | 9.48188 Chi-sq(1) | P-value = 0.00208 |

We apply the instrumental variable (IV) technique, as one of the solutions of the problem (Green 2012). The empirical estimations of the innovation-performance correlation are generated in two steps. The first model presents the probability of the firms to innovate (probit model) which reveals the importance of individual factors on firms’ innovation activity. The second estimations present a semi-logarithmic specification of the productivity model, which incorporates the predicted values of the first regression in conjunction with other firm characteristics.

The general model we will refer to can be written as follows:

The impact of individual factors, such as share of R&D expenditure on total sales (or dummy invested in R&D variable), direct exports, pressure from foreign competitors, share of employees with university degree, on the probability to innovate of a firm ‘i’ in period ‘t’ are examined. Innovation activities as dependant variable present product and/or process innovation.

Following the methodological approach applied in the literature and because of the suspected endogenous correlation between innovation activities and firm performance the IV technique is applied. The regression coefficients and corresponding p-values of the probit model regression of the probability to innovate together with the empirical results of productivity model are presented in Table 4.

Before going to the interpretation of the coefficient, the diagnostics of the regressions are provided. The obtained results indicate that we have insufficient evidence to reject null hypothesis that the model has correct functional form at 5 % level of significance. The diagnostic tests suggest that there is insufficient evidence to accept the null hypothesis that the residuals have normal distribution. Furthermore, there is insufficient evidence to reject null hypothesis of homoscedasticity in the model.

Considering the instrumental variable regression, the validity test of the instruments employed, F-test, shows that they are jointly significantly different from zero. The statistics of 20.20 indicates the strength of the instruments.

6 Discussion and Conclusions

Two major models are estimated using the BEEPS 2002, 2005, and 2009 dataset: (i) the innovation probit model—with the undertaken innovation activities (dummy variable) employed as dependant variable and (ii) the productivity semi-logarithmic model—with the labor productivity as dependant variable. The probit model results—show significant effect of some of the innovation activities determinants, which are in accordance with the theoretical literature.

The R&D variable in the regression appears to have positive and significant correlation with innovation activities. The firms’ innovative activities are higher if the firm has competitive pressure from foreign firms. The coefficient of the level of education of the employees as the share of employees with university degree is significant and positively related to the decision to innovate. The regression results show positive significant impact of export intensity on innovation activities when using R&D intensity as independent variable.

The interpreted coefficients are statistically significant at 1 % level of significance, offering evidence that the H0 hypothesis, (\( {\theta}_{it} = 0 \)) can be rejected for these cases. According to chi2 statistics the explanatory variables are jointly significant (since Prob > chi2 = 0.000) at 1 % level of significance, therefore the null hypothesis that all regressors are jointly insignificant may be rejected.

Productivity model regression—is estimated using instrumental variable techniques (instruments used for innovation activities are R&D intensity and direct export). The results show positive and statistically significant impact of instrumented variable, undertaken innovation activities, on firm performance. This impact confirms our hypothesis that more innovative firms’ tend to perform better.

The EU membership dummy variable is positive and significant, showing that EU member state firms perform better than the ones that operate in non-EU countries.

Summarising these findings it is evident that the firms in SEEs have improved their performance during the transition period, which is also reflected by the increase in the average labour productivity by 25 % from 2002 to 2005, and doubled its mean from 2005 to 2009. Since improved performance of firms in the transition period are due to factors such as innovation activities, R&D investment, managers experience, EU membership, etc. one can highlight the need for policies to assist these firms to improve their products and services and those that are not EU members to foster their accession.

Specifically, the results indicate that innovation activities undertaken by firms have a positive impact on firm performance. The investigation on SEEs shows that R&D intensity positively influences the firm’s innovativeness. This implies that R&D should be supported by the government through mechanisms such as innovation vouchers, matched funding of R&D expenditure, tax credit for R&D spending, etc. Other ways of fostering R&D may be through getting businesses to work more closely with universities and research institutions and helping researchers, innovators and businesses bring together specific knowledge, skills, technical resources. Since R&D intensity is higher in EU member economies, they should be a leading example for other non-EU countries.

Our empirical investigation also found education as another significant determinant of innovation activities of firms. Policies for improving the education system should be created to support new generations of skilled workers, ensuring a sufficient supply of individuals with science and engineering skills by making education more relevant, change the system from the traditional rote learning method to methods encouraging independent thinking, etc.

This study extends and reviews the empirical literature with respect to the incentives of firms to undertake innovation activities and to investigate how these changes affect firm performance. Our findings (using BEEPS 2002, 2005, and 2009 in CEE and SEE countries) show that R&D intensity, foreign ownership, age, export activities, skilled workers and pressure from foreign competitors are significant and positively related to firm innovation activities. We further examine the impact of (the predicted values of) innovation activity model on performance and thus conclude positive and significant correlation. Additional to the impact that arises from the innovation model, we conclude that foreign ownership and skilled workers have positive and statistically significant impact on performance. Summarizing these findings it is evident that the firms in CEE and SEE countries have improved their performance during the transition period.

Out of these results we come to the recommendation that R&D investments should be supported by the government through mechanisms such as innovation vouchers, matched funding of R&D expenditure, tax credit for R&D spending, etc. Other ways of fostering R&D may be through getting businesses to work more closely with universities and research institutions and helping researchers, innovators and businesses bring together specific knowledge, skills, technical resources. Since R&D intensity is higher in EU member economies, they should be a leading example for other non-EU countries.

Another recommendation is that policies for improving the education system should be created to support new generations of skilled workers, ensuring a sufficient supply of individuals with science and engineering skills by making education more relevant, change the system from the traditional rote learning method to methods encouraging independent thinking, etc.

Notes

- 1.

Based on Dana and Ramadani (2015).

- 2.

The violation of the zero-conditional-mean-assumption (E[u|x] = 0) can also arise for two other causes than endogeneity: omission of relevant variables and measurement error in regressors.

References

Acs, J. Z., & Audretsch, B. D. (1991). Innovation and small firms. Cambridge, MA: MIT Press.

Alvarez, R., & Robertson, R. (2004). Exposure to foreign markets and plant level innovation: Evidence from Chile and Mexico. Journal of International Trade and Economic Development, 13(1), 57–87.

Ark, B., O’Mahony, M., & Timmer, M. (2008). The productivity gap between Europe and the US: Trends and causes. Journal of Economic Perspectives, 22(1), 25–44.

Aslund, A. (2014). Transition in perspective: 25 years after the fall of communism. Accessed August 22, 2014, from http://blogs.piie.com/realtime/?p=4312

Ateljevic, J. (2013). Economic development and entrepreneurship in transition economies: A contribution to the current scholarly debate. Journal of Balkan and Near Eastern Studies, 15(3), 237–239.

Baltagi, B. H., Song, S. H., & Koh, W. (2003). Testing panel data regression models with spatial error correlation. Journal of Econometrics, 117, 123–150.

Baronet, J., & Riverin, N. (2010). The impact of regional innovation systems on the level of corporate entrepreneurship activity. International Journal of Entrepreneurship and Small Business, 10(3), 359–385.

Battisti, G., & Stoneman, P. (2010). How innovative are UK firms? Evidence from the fourth UK community innovation survey on synergies between technological and organizational innovations. British Journal of Management, 21, 187–206.

Baum, C. (2006). An introduction to modern econometrics using Stata. College Station, TX: Stata Press.

Becheikh, N., Landry, R., & Amara, N. (2006). Lessons from innovation empirical studies in the manufacturing sector: A systematic review of the literature from 1993–2003. Technovation, 26, 644–664.

Bennett, J., Estrin, S., Maw, J., & Urga, G. (2004). Privatisation methods and economic growth in transition economies (CEPR Discussion Paper, No. 4291).

Britton, R. (1989). The missing link: Parental sexuality in the oedipus complex. In J. Steiner (Ed.), The oedipus complex today: Clinical implications. London: Karnac.

Castany, L., López-Bazo, E., & Moreno, R. (2005). Differences in total factor productivity across firm size. A distributional analysis. Barcelona: University of Barcelona.

Chudnovsky, D., Lopez, A., & Pupato, G. (2006). Innovation and productivity in developing countries: A study of argentine manufacturing enterprises’ behaviour (1992–2001). Research Policy, 35, 266–288.

Clausen, H. T. (2011). Examining the schumpeter hypothesis in the context of closed and open innovation: Survey evidence from Norway and Sweden. International Journal of Entrepreneurship and Small Business, 12(2), 158–172.

Crepon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation, and productivity: An econometric analysis at the firm level. The Economics of Innovation and New Technology, 7, 115–158.

Crescenzi, R., & Rodriguez-Pose, A. (2011). Innovation and regional growth in the European Union. London: Springer.

Czarnitzki, D., & Delanote, J. (2014). R&D policies for young SMEs: Input and output effects (ZEW Discussion Papers 15–032). ZEW—Zentrum für Europäische Wirtschaftsforschung/Center for European Economic Research.

Damijan, J. P., Jaklic, A., & Rojec, M. (2005). Do external knowledge spillovers induce enterprises’ innovations: Evidence from Slovenia. Leuven: Katholieke Universiteit.

Damijan, J. P., Kostevc, C., & Polanec, S. (2008). From innovation to exporting or vice versa: Causal link between innovation activity and exporting in slovenian microdata. Leuven: Katholieke Universiteit.

Dana, L.-P. (2010). When economies change hands: A survey of entrepreneurship in the emerging markets of Europe from the Balkans to the Baltic States. New York: Routledge.

Dana, L.-P., & Ramadani, V. (2015). Context and uniqueness of transition economies. In L.-P. Dana & V. Ramadani (Eds.), Family businesses in transition economies. Heidelberg: Springer.

de Arriba Bueno, R. (2010). Assessing economic transition in Eastern Europe after twenty years. Transformations in Business and Economics, 9(20), 42–63.

De Faria, P., & Mendonca, J. (2011). Innovation strategy by firms: Do innovative firms grow more? International Journal of Entrepreneurship and Small Business, 12(2), 173–184.

De Propris, L. (2002). Types of innovation and inter-firm co-operation. Entrepreneurship and Regional Development, 14(4), 337–353.

Di Lorenzo, F. (2013). 2013 report: International property rights index. Washington, DC: Americans for Tax Reform Foundation/Property Rights Alliance.

Doing Business (2014). Understanding regulations for small and medium-size enterprises. Washington, DC: International Bank for Reconstruction and Development/World Bank.

Domadenik, P., Prasnikar, J., & Svejnar, J. (2008). How to increase R&D in transition economies? Evidence from Slovenia. Review of Development Economics, 12(1), 193–208.

Drucker, F. P. (1993). Innovation and entrepreneurship. New York: Harper and Row.

EBRD. (2013). Transition report: Stuck in transition? London: European Bank for Reconstruction and Development.

Ellman, M. (2012). What did the study of transition economies contribute to mainstream economics? (RRC Working Paper Special Issue No. 2). Kunitachi: Hitotsubashi University.

European Commission. (2010). EUROPE 2020—A strategy for smart, sustainable and inclusive growth. Washington, DC: Delegation of the European Union to the United States.

Falk, M. (2008). Effects of foreign ownership on innovation activities: Empirical evidence for 12 European countries. Wien: Austrian Institute of Economic Research.

Fiti, T., & Ramadani, V. (2013). Entrepreneurship. Tetovo: Southeast European University (In Albanian language).

Gerguri, S., Rexhepi, G., & Ramadani, V. (2013). Innovation strategies and competitive advantages. Modern Economics: Problems, Trends, Prospects, 8(1), 10–26.

Geroski, P. (1998). An applied econometrician’s view of large company performance. Review of Industrial Organization, 13(3), 271–294.

Goedhuys, M., & Veugelers, R. (2008). Innovation strategies, process and product innovations and growth: Firm-level evidence from Brazil. Belgium: University of Leuven.

Green, W. H. (2012). Econometric analysis (7th ed.). Upper Saddle River, NJ: Prentice-Hall.

Griffith, R., Huergo, E., Mairesse, J., & Peters, B. (2006). Innovation and productivity across four European countries. Oxford Review of Economic Policy, 4(22), 483–498.

Guadalupe, M., Kuzmina, O., & Thomas, C. (2011). Innovation and foreign ownership (CEPR Discussion Paper No. 8141).

Gupta, A., & Singhal, A. (1993). Managing human resources for innovation and creativity. Research Technology Management, 36(3), 8–41.

Hall, B., & Mairesse, J. (2006). Empirical studies of innovation in the knowledge-driven economy. Economics of Innovation and New Technology, 15(4/5), 289–299.

Hashi, I., & Stojcic, N. (2013). The impact of innovation activities on firm performance using a multi-stage model: Evidence from the community innovation survey 4. Research Policy, 42(2), 353–366.

Hervas-Oliver, J. L., Sempere-Ripoll, F., & Boronat-Moll, C. (2014). Process innovation strategy in SMEs, organizational innovation and performance: A misleading debate? Small Business Economics, 43(1), 873–886.

Jaffe, B. A., Newell, R. G., & Stavins, R. (2004). Technology policy for energy and the environment. In A. B. Jaffe, J. Lerner, & S. Stern (Eds.), Innovation policy and the economy. Cambridge, MA: MIT Press.

Kanter, R. M. (1983). The change masters: Innovation for productivity in the American corporation. New York: Simon and Schuster.

Kariv, D. (2010). The role of management strategies in business performance: Men and women entrepreneurs managing creativity and innovation. International Journal of Entrepreneurship and Small Business, 9(3), 243–263.

Leeuwen, V. G. (2008). Innovation snd performance: A collection of microdata studies. Netherlands: Proefschrift Technische Universiteit Delft.

Lionnet, P. (2003). Innovation: The process. Lisbon: ESA Training.

Lööf, H., & Heshmati, A. (2006). On the relationship between innovation and performance: A sensitivity analysis. Economics of Innovation and New Technology, 5(4/5), 317–344.

Love, J. H., Brian, A., & Dunlop, S. (1996). Corporate structure, ownership and the likelihood of innovation. Applied Economics, 28(6), 737–746.

Mudeva, A. (2009, November 8). Special report: In Eastern Europe, people pine for socialism. Reuters. Accessed August 26, 2014, from http://www.reuters.com/article/idUSTRE5A701320091108

Murphy, G. B., Trailer, J. W., & Hill, R. C. (1996). Measuring performance in entrepreneurship research. Journal of Business Venturing, 36(1), 15–23.

O’Mahony, M., Rincon-Aznar, A., & Robinson, C. (2010). Productivity growth in Europe and the US: A sectoral study. Review of Economics and Institutions, 1(1). doi:10.5202/rei.v1i1.5.

OECD. (2005). Innovation to strengthen growth and address global and social challenges. Paris: OECD Publishing.

Pagés, C. (2010). The age of productivity. New York: Palgrave Macmillan.

Peters, B. (2008). Innovation and firm performance: An empirical investigation for German Firms. Heidelberg: Springer.

Ramadani, V. (2013). Entrepreneurship and small business in Republic of Macedonia. Strategic Change, 22(7/8), 485–502.

Ramadani, V., & Gerguri, S. (2011). Innovation: Principles and strategies. Strategic Change, 20(3/4), 101–110.

Ramadani, V., Gerguri, S., Rexhepi, G., & Abduli, S. (2013). Innovation and economic development: The case of FYR of Macedonia. Journal of Balkan and Near Eastern Studies, 15(3), 324–345.

Ramadani, V., & Schneider, C. R. (2013). Entrepreneurship in the Balkans. Heidelberg: Springer.

Romer, P. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94(5), 1002–1037.

Scherer, F. M. (1965). Firm size, market structure, opportunity, and the output of patented inventions. The American Economic Review, 55(5), 1097–1125.

Scherer, F. M. (1980). Industrial market structure and economic performance. Boston: Houghton-Mifflin.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge: Harvard University Press.

Shkolnikov, A., & Nadgrodkiewicz, A. (2010). The fall of the Berlin Wall: Twenty years of reform in central and Eastern Europe. Caucasian Review of International Affairs, 4(1), 73–81.

Smallbone, D., & Welter, F. (2009). Entrepreneurship and small business development in post-socialist economies. London: Routledge.

Sohn, S. Y., Joo, Y. G., & Han, H. K. (2007). Structural equation model for the evaluation of national funding on R&D project of SMEs in consideration with MBNQA criteria. Evaluation and Program Planning, 30, 10–20.

Tesic, J. (2012). Openness to trade and vulnerabilities of small transitional economies in the global economic crisis. In J. Ateljevic (Ed.), Proceedings of the 2nd International Scientific Conference REDETE 2012. Faculty of Economics University of Banja Luka, pp. 22–34.

Tiwari, R., & Buse, S. (2007). Barriers to innovation in SMEs: Can the internationalization of R&D mitigate their effects? Proceedings of the First European Conference on Knowledge for Growth: Role and Dynamics of Corporate R&D (CONCORD 2007), Seville, Spain, October 8–9, 2007.

Transparency International. (2014). Transparency international corruption perceptions index 2013. Accessed August 26, 2013, from http://www.ey.com/Publication/vwLUAssets/EY-Transparency-International-Corruption-Perceptions-Index-2013/$FILE/EY-Transparency-International-Corruption-Perceptions-Index-2013.pdf

Tybout, J. R. (2000). Manufacturing firms in developing countries: How well do they do and why. Journal of Economic Literature, 38(1), 11–44.

Van Biesebroeck, J. (2005). Firm size matters: Growth and productivity growth in African manufacturing. Economic Development and Cultural Changes, 53(3), 545–583.

Wolff, J. A., & Pett, T. L. (2006). Small firm performance. Journal of Small Business Management, 44(2), 268–284.

World Bank. (2014). GDP per capita (current US$). Accessed September 8, 2014, from http://data.worldbank.org/indicator/NY.GDP.PCAP.CD

Wyplosz, C. (2014). Twenty-five years later: Macroeconomic aspects of transition. Accessed August 24, 2014, from http://graduateinstitute.ch/files/live/sites/iheid/files/sites/international_economics/shared/international_economics/prof_websites/wyplosz/Papers/Transition%20June%202014.pdf

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Abazi-Alili, H., Ramadani, V., Gërguri-Rashiti, S. (2016). Innovation and Firm-Performance Correlations: The Case of Central and South Eastern Europe Countries. In: Ateljević, J., Trivić, J. (eds) Economic Development and Entrepreneurship in Transition Economies . Springer, Cham. https://doi.org/10.1007/978-3-319-28856-7_9

Download citation

DOI: https://doi.org/10.1007/978-3-319-28856-7_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-28855-0

Online ISBN: 978-3-319-28856-7

eBook Packages: Business and ManagementBusiness and Management (R0)