Abstract

Within the logistics sector, access limitation problems have so far only been handled via bottom-up coordination. With the implementation of the European Union’s Emission Trading Scheme (EU ETS) a regulatory top-down approach for coordinating the use of shared resources got implemented. We analyze the new regulations using three core characteristics to examine whether the market-based mechanism could be used to coordinate similar economic problems. Insights about the major issues of sharing problems illustrate potential effects on the logistics sector.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

Sharing Concepts and the Logistics Sector

Today, society perceives greenhouse gas emissions as an increasing hazard for the environment. The implemented sociopolitical regulations have led to restrictions for the output of greenhouse gas emissions, and have created a new regulation of environmental resources. Other remaining environmental resources have also been substantially decreasing over the last years. This situation is a type of sharing problem and can be analysed as tragedy of the commons (Hardin 1968). It describes a situation where the strict limitation of resources is the only solution to prevent their complete loss.

There are two different approaches for solving the access limitation problem. The first uses a privatisation of public resources with the aim of persuading a central coordinator or broker to take care of a sustainable and long lasting use via bottom-up coordination. The second approach applies market-based self-regulation. It assigns the use of limited resources with a usage charge to solve the sharing problem (Schönberger 2012). The market-based approach takes the form of a regulatory top-down standardisation.

Surveillance and usage charges expose companies to a new situation of competition not only in terms of sales, but also in terms of the supply of limited resources: it affects margins, cooperation, prices and other risk factors. This new sharing concept poses further challenges, as the logistics sector has relied on bottom-up approaches for the coordination among companies. Hence, companies have to take the new challenges into account not only in terms of an organisational change, but also in terms of rethinking coordination and cooperation.

Market-based sharing concepts need a political decision about access limitation and its implementation. In practice, only one major field in which this regulatory sharing concept has been implemented exists, namely the European Union Emissions Trading Scheme (EU ETS). We use the EU ETS as a tool for understanding the core issues of sharing problems within a situation of fragmented and inconsistent information distribution, and we will use our insights to inquire into its impact on the logistics sector.

The quality of the mechanism will be investigated by using the following three core characteristics:

-

availability of information,

-

decisions on allocation plans,

-

distribution of costs and benefits in an equitable and fair manner.

Market-Based Instruments and the Coordination of Shared Resources

Since the end of the 1970s, market-based instruments have been discussed and are increasingly used as an alternative to more rigid regulations when pursuing environmental objectives (Stavins and Whitehead 1997). The objectives of market-based models include the coordination of the different interests of market participants and the implementation of environmental constraints set at a regulatory level. Market-based systems comprise trading systems, and provide incentives for market participants exceeding a simple compliance with emission limits. This promotes a cost-effective implementation of regulatory requirements (Kruger et al. 2007) and the coordination of shared resources within affected companies on an equal footing.

The discussion on instruments is still ongoing (Fischer and Springborn 2011). Stavins (1998) decomposed the question to what extent regulatory approaches can go towards solving the coordination of environmental resources. He discusses the role of individual governments, the resulting activities and the distribution of political responsibility. Even 15 years later, the question of the appropriate measures and the correct setting of emission caps vex the politically initiated resource allocation. The EU ETS is the only existing solution for the coordination and sharing problem, and will be discussed in the following section.

Distribution of Costs and Benefits—Implications for the Coordination of Shared Resources

In 1997, 84 nations signed the Kyoto Agreement to reduce greenhouse gas emissions, causing permanent damage to the environment. With this, the participating nations obliged to stick to defined levels of greenhouse gas emissions (Pizer 2005). To fulfil the main objectives of the Kyoto Agreement the EU introduced the EU ETS in 2003.Footnote 1 It became effective in 2005 and is aiming at the lasting reduction of CO2 emissions throughout the EU (Böhringer et al. 2009). The EU ETS represents the worldwide largest market-based solution, addressing the reduction of environmental issues (Kruger et al. 2007).

Basis for the EU ETS is the U.S. Acid Rain Programme, which represents the worldwide first trading system for emissions of significant extent and got implemented in 1990. It is considered as an effective instrument for achieving sustainable solutions for environmental objectives, aiming at the reduction of CO2 emissions (Ellermann and Buchner 2007). Due to regulatory bottlenecks, appearing in the form of trading systems for emission allowances, the state has established a new mechanism for coordinating the use and the consumption of shared resources. Up to now the combustion of fossil fuels for the energy production is generally not covered by statutory prohibitions. With the introduction of the EU ETS, the regulator intends to connect the use of fossil fuels with economic disadvantages. The objective is the sustainable reduction of fossil fuel use and thus the adherence of the pollution limits defined in the Kyoto Agreement (Veith et al. 2009) as well as fulfilling the societal claims for a limitation of greenhouse gas emissions. In terms of the systematic design it makes use of the findings of the research by Crocker, Dales and Montgomery from 1966, 1968, 1970 and 1972 (Veith 2010). Covering more than 11,000 power generating stations and industrial power plants, the EU ETS is the EUs basis for generating a cost-effective reduction of greenhouse gas within 31 participating countries.

Within this trading system, affected companies are required to hold an emission allowance for each tonne of CO2 they emit. Meanwhile the EU ETS is in the third trading period (2013–2020), following a test phase (2005–2007) and an implementation phase (2008–2012). Within each phase a certain amount of emission allowances is provided for the affected companies, getting continuously reduced (Dekker et al. 2012). The allocation is depending on the emission level each production unit generated in a determined base year. During the first two phases the allocation of emission allowances was nearly free of cost and very generous. In the second phase an adjustment of the emission limits analogous to the limits manifested in the Kyoto Agreement took place. However, this did not result in lasting effects on the part of companies affected by the emissions trading system. When the EU ETS was launched in 2005, the price for one emission allowance was in the range of 5.00 Euro, whereas it quickly came to an increase in the range of 20.00–30.00 Euros per emission allowance. After the publication of the emission output for the year 2005 it became obvious that the market was in an excessively allocated situation (Ellermann and Buchner 2007). As a consequence, the price for emission allowances fell sharply before setting at a level of 15.00 Euro for a few months. Already in the middle of 2007, the price for one emission allowance reached a level that was close to nothing (Hintermann 2010). This resulted from the almost free allocation in the years 2005–2012.

In contrast to the emissions trading scheme used in the U.S., the EU ETS offers the option of a decentralised influence and refinement of the framework. This decentralised definition of important factors such as the distributed amount of emission allowances and the basic design of distribution, offered individual member states the option to directly influence the mechanism on a national level (Ellermann and Buchner 2007; Kruger et al. 2007). Due to this regulatory leeway, single states were in the position to use a politically motivated interference while implementing environmental policy objectives. Out of an economic perspective the hybrid design in form of the national allocation modelling can lead to a situation of increased costs which is in conflict with the fundamental goals of the sharing mechanism, aiming at a cost-effective coordination of limited available resources. A solution was launched as a part of the redesign in the third trading period. Since 2013 the single allocation models have to follow a unified distribution system designed by the EU (Böhringer and Lange 2012). Additionally, one EU-wide emission cap, instead of 27 national caps, was established as part of the redesign.

Evaluating the base years used for the determination of future emission caps can be seen from two different perspectives. Right now, the shaping of the EU ETS is supporting production units which emitted enormous amounts of CO2 in 1990. This is possible due to the fact that the base year used within the EU ETS is 1990. In contrast to this, the shaping of the market-based mechanism allows innovative companies which are constantly reducing emissions to generate additional earnings through the disposal of emission allowances not being necessary for the fulfilment of the stipulated regulatory specifications (Kruger et al. 2007). Achieving this is only possible when market prices within the market-based sharing concept are on an attractive level providing additional earnings for market participants. This contributes to an equitable and fair distribution of costs and benefits, which is defined as a quality characteristic of a sharing concept at the beginning of this chapter.

To achieve attractive prices for emission allowances, the EU has determined additional changes for the third phase which started in 2013. Due to the initial allocation, which was free of charge, and thus the resulting excessively allocated situation in the first periods, the EU decided to increase the share of auctioned emission allowances. In particular sectors the share of auctioned emission allowances will increase to 70 % in 2020, starting at 20 % in 2013. In addition to the increased share of auctioned allowances, a decrease of the overall cap of 1.74 % per year will take place, resulting in a total decrease of 21 % in 2020 compared to the situation of 2005 (Böhringer and Lange 2012). With this, the EU implemented regulations in response to the lessons learned in the past periods making the EU ETS to an effective instrument for the coordination of shared resources. Still one of the primarily questions is which sectors should be included in the future and how many allowances should be allocated at no charge (Dekker et al. 2012).

Implications for the Logistics Sector

The consumption of environmental resources can be analysed as utilisation of shared resources. Due to regulatory bottlenecks, appearing in the form of trading systems for emission allowances, a new mechanism to coordinate the consumption of shared resources was established. This mechanism gets enforced by the EU and can be analysed as a top-down regulatory approach. All affected market participants share the same database resulting in an objective configuration through the good availability of data. Consequently the established market-based mechanism fulfils the first quality characteristic of an efficient sharing concept stipulated at the beginning of this chapter. Furthermore, this compulsory market compliance hides the classic problems of coordinating shared resources along a typically fragmented value chain, resulting in an almost ideal-typical shaping and the reduction of uncertainty. Due to this, a consistent basis for all affected market participants can be provided resulting in the fulfilment of the second quality characteristic. Within the EU ETS the resource bottleneck is coordinated by using a market-based mechanism. The price for emission allowances operates as a mechanism for exclusion within the emissions trading scheme. Evaluating the effectiveness of this ideal-typical coordination mechanism is possible by analysing the outcomes and the behaviour among affected companies. Outcomes are recorded as the quality characteristics of the market for emission allowances.

Due to the introduction of the new coordination mechanism, reactions on different company levels can be expected. A distinction can be made between the internal reactions in relation to the organisation and management of shared resources and the reactions of each individual affected company, acting under competition, towards the competitors within the logistics sector. Hence the question arises to which extent affected companies in cooperative structured sharing networks are willing to exchange emission allowances with potential competitors. The design of interactions between companies and the existence of incentives encouraging cooperative behaviour apart from the compulsory market compliance set by the regulator are also decisive quality standards of the market-based mechanism.

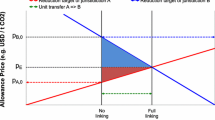

Affected companies can strategically vary the intensity of cooperation with competitors in the logistics sector. The potential range of feasible and legally possible reactions includes the autarkical trading of a company as well as the complete linkage and integration of different companies belonging to a particular branch or region. Investigating this constructs can draw inferences about the requirements for disclosure and enforcement within the market for shared resources and shows which incentives contribute to the participating in cooperatively shaped sharing networks. Followed by the question which role the parent market-mechanism takes, it is possible to examine whether the market-mechanism could be transferred to other economic issues.

Logistic services are a cornerstone of a functioning value chain. Attributable to the high energy consumption within the logistics sector, companies are especially affected by the new regulatory standards of the EU. Today the German Renewable Energies Act (EEG) and the EU ETS are connected. The EEG was resolved in 2000 to pursue the objectives of sustainability and climate protection.Footnote 2 §1 (1) of the EEG defines the objective of establishing a sustainable energy supply in Germany. In addition to the reduction in the use of fossil fuels, the EEG also addresses the consideration of economic costs and the reduction of long-term external effects. Particularly the development of new technologies in terms of generating energy from renewable energy sources is one of the key features pursued by the EEG. The objective of §1 (2) is to continuously increase the share of renewable energy in total electricity consumption. By 2020 it is set to increase the proportion of renewable energies to 35 %. In 2050 the proportion is targeted to be 80 %. In addition the establishment of §1 (3) of the EEG regulates the increase of renewable energies to have a share of at least 18 % of the complete energy consumption in 2020. With the implementation of the EEG an increase in the use of renewable energies can be observed within the EU, leading to a decrease in the use of fossil fuels and a decreasing demand for emission allowances. Due to this, the price for emission allowances will further decline, resulting in an ineffective allocation of limited resources when the regulator is not adapting the cap for emission allowances. This gets also visible by taking a look at plans of the German finance ministry. It planned to raise 780 million Euro, mostly from the trading within the EU ETS, for a climate and energy fund addressing the climate-neutral development of buildings in Germany but only earned 300 million Euro in 2012 (Dehmer 2013). This happened due to the fact that the prices for CO2 emission allowances in 2012 were only trading below a price of 10.00 Euro,Footnote 3 showing potential to improve the regulatory framework used for the coordination of limited resources.

Analysing the three major objectives stipulated at the beginning of this chapter, we examine the quality characteristics of a sharing concept. This has led to additional insights regarding market-based sharing concepts. Hence we are mapping a research agenda for an ongoing analysis of shared resources in the logistics sector. The main research topics can be illustrated as follows:

-

The question whether a bottom-up or top-down approach should be used has to be answered on a regulatory level.

-

Instruments have to be developed which take the volatility of the logistics sector into account.

-

Incentives are not supposed to lead to distortion for single companies or sectors.

-

The trade-off between persuading environmental objectives and company goals has to be reasonable.

Resulting from this, an improvement of the economical, ecological and social design of sharing systems can be expected. Examples include the efficient coordination of shared resources, the limitation of greenhouse gas emissions, the acceleration of an efficient capital allocation and the long-term securing of employment in the logistics sector and its affiliated sub-areas.

Conclusion

Taken as a whole, the investigated mechanism can be seen as a positive regulatory experience and a success in solving the access limitation problem of shared resources. Up to now only 50 % of the CO2 output within the EU is covered by the present regulatory approaches, showing further potential for an expansion.

The implemented sharing mechanism contributes to the three core characteristics stipulated at the beginning of this chapter. It provides the availability of information by hiding the classic problems along a typically fragmented value chain. The mechanism creates a consistent basis for all affected market participants, and enhances decisions on allocation plans by reducing uncertainty. By using a trading system for coordinating the consumption of shared resources the mechanism contributes to the distribution of costs and benefits in an equitable and fair manner.

Due to its good transferability, the approach of market-based self-regulation can also be used to coordinate other economic issues, resulting in a growing publicity and the adaption across sectors. This could include limitations in the use of heavy fuel oil, diesel and kerosene in the shipping and aviation sector. A worldwide inclusion across countries and sectors will further improve the outcomes of regulatory implemented coordination systems and reduce disadvantages for single sectors or regions.

Notes

- 1.

For an overview of the EU ETS regulations see http://ec.europa.eu/clima/policies/ets/index_en.htm.

- 2.

For an overview of the EEG see http://www.erneuerbare-energien.de/die-themen/gesetze-verordnungen.

- 3.

For market information see http://www.eex.com/de/Marktdaten/Handelsdaten/Emissionsrechte.

References

Böhringer C, Lange A (2012) Der europäische Emissionszertifikatehandel: Bestandsaufnahme und Perspektiven. Wirtschaftsdienst 92(13):12–16

Böhringer C, Rutherford TF, Tol RSJ (2009) The EU 20/20/2020 targets: an overview of the EMF22 assessment. Energy Econ 31(Supplement 2):268–273

Dehmer D (2013) The German Energiewende: the first year. Electr J 26(1):71–78

Dekker R, Bloemhof J, Mallidis I (2012) Operations research for green logistics—an overview of aspects, issues, contributions and challenges. Eur J Oper Res 219(3):671–679

Ellermann DA, Buchner BK (2007) The European union emissions trading scheme: origins, allocation, and early results. Rev Environ Econ Policy 1(1):66–87

Fischer C, Springborn M (2011) Emissions targets and the real business cycle: intensity targets versus caps or taxes. J Environ Econ Manage 62(3):352–366

Hardin G (1968) The tragedy of the commons. Science 162(3859):1243–1248

Hintermann B (2010) Allowance price drivers in the first phase of the EU ETS. J Environ Econ Manag 59(1):43–56

Kruger J, Oates WE, Pizer WA (2007) Decentralization in the EU Emissions Trading Scheme and lessons for global policy. Rev Environ Econ Policy 1(1):112–133

Pizer WA (2005) The case for intensity targets. Clim Policy 5(4):455–462

Schönberger J (2012) Verknappung und Limitation öffentlicher Güter: Herausforderungen, Perspektiven und Forschungsbedarf für eine engpass-orientierte Logistik. In: Ivanov D, Sokolov B, Käschel J (eds) Flexibility and adaptability of global Supply Chains, Tagungsband des 7. Deutsch-Russischen Logistik-Workshops St. Petersburg 2012, pp 426–433

Stavins RN (1998) Significant issues for environmental policy and air regulation for the next decade. Environ Sci Policy 1(3):143–147

Stavins RN, Whitehead B (1997) Market-based environmental policies. In: Chertow MR, Esty DC (eds) Thinking ecologically: the next generation of environmental policy. Yale University Press, New Haven, pp 105–117

Veith S (2010) The EU Emissions Trading Scheme: aspects of statehood, regulation and accounting. Peter Lang, Frankfurt

Veith S, Werner JR, Zimmermann J (2009) Capital market response to emission right returns: evidence from the European power sector. Energy Econ 31(4):605–613

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this paper

Cite this paper

Brandt, S., Zimmermann, J. (2016). The Regulation of Shared Resources—Impacts on the Logistics Sector. In: Kotzab, H., Pannek, J., Thoben, KD. (eds) Dynamics in Logistics. Lecture Notes in Logistics. Springer, Cham. https://doi.org/10.1007/978-3-319-23512-7_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-23512-7_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-23511-0

Online ISBN: 978-3-319-23512-7

eBook Packages: EngineeringEngineering (R0)