Abstract

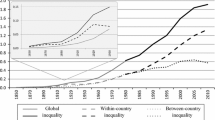

The concept of diversity and heterogeneity may be considered one of the central features of the European Union (EU) and applies both to the economic and the political dimensions of the project of European integration. Economically, the four rounds of enlargements by 16 countries and the introduction of the common market program, in addition to the European Monetary Union (EMU), noticeably increased the heterogeneity of the EU. In just two decades, the addition of these countries moved the European Union from a free trade association of 12 countries with a population of approximately 380 million to a common market area of 28 countries (most of which have also joined the EMU) with a population of almost 600 million. Thus, among the 12 EU countries that were EU members in the late 1980s, the second wealthiest country (ignoring Luxembourg, which is the wealthiest of these 12 countries but is an outlier) in terms of GDP per capita at purchasing power parities (the Netherlands) was approximately 1.8 times wealthier than the poorest country under the same metric (Greece); however, among the 28 countries that are currently members of the EU (two decades later), the same ratio was 2.9.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Corporate Social Responsibility

- European Union

- Data Envelopment Analysis

- European Union Country

- European Monetary Union

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Motivation and Background to This Collective Volume

The concept of diversity and heterogeneity may be considered one of the central features of the European Union (EU) and applies both to the economic and the political dimensions of the project of European integration. Economically, the four rounds of enlargements by 16 countries and the introduction of the common market program, in addition to the European Monetary Union (EMU), noticeably increased the heterogeneity of the EU. In just two decades, the addition of these countries moved the European Union from a free trade association of 12 countries with a population of approximately 380 million to a common market area of 28 countries (most of which have also joined the EMU) with a population of almost 600 million. Thus, among the 12 EU countries that were EU members in the late 1980s, the second wealthiest country (ignoring Luxembourg, which is the wealthiest of these 12 countries but is an outlier) in terms of GDP per capita at purchasing power parities (the Netherlands) was approximately 1.8 times wealthier than the poorest country under the same metric (Greece); however, among the 28 countries that are currently members of the EU (two decades later), the same ratio was 2.9.

Politically—putting aside the obvious differences in interests between countries of such vastly differing economic development levels—this diversity is documented by the increasingly complex institutional set-up and the growing concerns about the adequacy of governance within both the EU and the EMU resulting from the differing speeds of integration followed by different member countries. Thus although the concept of a multi-speed European Union is and always was a highly controversial topic in theoretical debates on European integration, the integration process in practice has repeatedly allowed individual countries to decide whether and when individual integration steps are adopted. Although this autonomy has significantly contributed to the progress of integration, it has also increased the complexity of governance issues and—as evidenced by the recent economic crisis—has led to significant economic vulnerabilities.

This heterogeneity—which is likely to increase, given that the EU in 2014 was negotiating membership with six countries, which all differ widely in terms of economic development and level of integration—also poses a number of questions with respect to the viability of a number of the EU’s joint common economic and political development initiatives, such as the EU 2020 strategy and its long-term goal of creating smart, sustainable and inclusive growth in Europe. Although the prolonged impact of the economic and financial crisis has clearly shifted the priorities of European economic policy to more short term crisis management, the underlying diversity in the EU also raises issues as to what type of policies, instruments and strategies can deliver such smart, sustainable and inclusive growth and how this growth can be achieved in different parts of Europe.

However, the same diversity may also be an asset for the EU because it has the potential to trigger substantial learning effects among governments. These could ultimately be used to substantially improve policy deliverance and efficiency in the EU.

Against this background, this book brings together a series of papers that were produced in a project at Mendel University in Brno and funded by the European Social Fund (ESF) of the EU and the Czech Ministry of Education, Youth and Sport. These papers analyse competitiveness, social exclusion and sustainability in the EU with a strong emphasis on the perspective of those member states that joined the EU after 2004. The aspirations of this book is to document the diversity in the current EU and analyse the challenges diversity poses to EU policies in attempting to establish such a growth path in an economic area as heterogeneous as the EU, using the example of a selected number of policy fields and initiatives.

To fulfil these aspirations the team working on this book decided to organize the analysis focused upon three headline topics:

-

The first topic aimed to document and provide tools for the analysis and assessment of the heterogeneity in economic and social development, in addition to sustainable development, among current EU countries. The aim of this part of the analysis was to determine the main division lines defining the current heterogeneity of the EU and to determine to what extent the noticeable shift of the public debate from East–west to North–south differentials in economic development since the 2010 crisis is also reflected in data.

-

The second topic aimed to consider how this heterogeneity in the EU affects the design and efficacy of selected EU policies. Considering both the comparative advantages of the researchers involved and the identification of neglected topics in previous research, the decision was to focus on policies related to corporate social responsibility, SMEs and environmental taxation, as these policies are featured high on the EU’s policy agenda but have also been slightly neglected in the academic debate thus far.

-

The third topic aimed to highlight the potential to generate learning effects about efficient policies in the EU. Faced with a plethora of potentially rewarding research topics, the research team decided to focus on two commonly recognized central strategic issues for the future development of the EU: the development of peripheral countries and welfare state reform and the development of data collection and processing infrastructure, which is a topic that is frequently neglected in current debates but holds substantial potential for the generation of smart, inclusive and sustainable growth in the EU.

2 The Individual Contributions

2.1 Patterns of Heterogeneity

As a consequence of this work plan, the first part of this book takes stock of the diversity of the EU and its development since the financial and economic crisis. In the first chapter of this part of the book (chapter “The Competitiveness of the EU countries: A Multi-dimensional Cluster Analysis Approach”), Rozmahel, Issever Grochová, and Litzman analyse the diversity of EU countries in light of some new approaches to understanding, measuring and assessing competitiveness. Using cluster analysis, they analyse the results of comparing traditional cost-based measures of competitiveness to alternative approaches by focusing on institutional features (such as the business environment), human capital and infrastructure endowments, in addition to innovative capacity. They find that, although traditional cost-based measures of competitiveness suggest a clear division between the core EU countries and the periphery, in addition to the new member states, measures based on infrastructure, human capital and the institutional environment do not confirm the existence of these three country groups; in particular, the new member state group shows substantial diversity. However, when innovation potential is included as a measure of competiveness, a stable division of two country groups consisting of core countries, on one hand, and the periphery plus the new member states, on the other, emerges.

Repeating the analysis for different points in time, Rozmahel, Issever Grochová, and Litzman also reveal a remarkable convergence of the new member states towards the core EU countries in terms of institutional features, a more modest convergence in terms of cost-based measures, and a lack of convergence in terms of innovation potential. They interpret this finding as a positive sign of the new member states’ capacity to attract businesses, but suggest that the persistent deficits in innovation potential and the absence of support for innovation activities from both government as well as private actors in the new member states may hinder their competitiveness in the long run. Research, development and innovation support should thus be considered as priority issues in both periphery and new member countries.

Whereas the contribution of Rozmahel, Issever Grochová, and Litzman thus focuses on input indicators for economic growth, the contribution by Kapounek (in chapter “Long-Run Heterogeneity Across the EU Countries”) focuses directly on previous growth experiences in the EU. He is interested in the impact of the EMU on growth and convergence among the EU countries. In particular, Kapounek tests the hypothesis that the introduction of a single currency has provided an institutional advantage that can be directly analysed on the steady-state GDP levels. His results indicate that in the EU there are currently three groups of countries in terms of steady-state income. The first of these is a high GDP per capita group consisting of the EU-core countries that are not Eurozone members (i.e., Denmark, Sweden and the United Kingdom). The second is a low-income group consisting of Portugal, Slovenia, Greece and Cyprus. The third, by contrast, consists of the remaining EU member countries. Notably, these three groups reflect the recent shift in debates on economic differences in the EU from a discussion of East–west differentials to North–south differentials during the financial and economic crisis, in addition to differentiating between EMU and non-EMU countries.

The results also have positive implications for the long-run potential of the new member states and periphery countries to catch up with the core Eurozone countries and corroborate the original hypothesis that the single currency provides an institutional advantage that increases total factor productivity and output over the long term. This analysis, however, suggests that the benefits of a single currency are utilized differently by different European countries and that the policy debates related to differences in economic development among Northern and Southern European EU countries are likely to fuel EU policy discussions for some time to come. From a policy perspective, resolving these disparities, according to Kapounek, may require adaptations in the policy framework with the key issue being that heterogeneity implies that regulation at the international (EU) level may have to be restricted to a few countries and not implemented across the entire currency area.

By contrast, the contribution by Hampel, Issever Grochová, Janová, Kabát and Střelec (in chapter “Sustainable Development in the EU”), shifts the focus onto social and sustainability issues. The starting point for their analysis is that half a decade after the financial and economic crisis, EU economic policy remains focused on the impact of the crisis, and the main challenge of the future will be the necessity of ensuring the efficient use of natural resources and guaranteeing sustainable development. These authors present and discuss a set of tools and indicators that allow to measure and evaluate not only the results of economic growth but also its complex social and environmental effects. In particular, their focus is on indicators that extend beyond the measurement of GDP. Thus, basing their analysis on the concept of sustainable development, they review different indicators used to measure sustainable development and explore the potential of data envelopment analysis (DEA) methods to measure the progress of individual EU countries towards sustainable development. These authors conclude that DEA analysis has a high potential in the fields of environmental management and ecological control because it provides an objective tool to measure the relative efficiency of achieving environmental and societal goals that are difficult to monetize and have hitherto proven to be to analyse with the more standard tools of economic analysis.

Furthermore, on a more substantial basis, their application to sustainable development indices shows substantial differences in sustainable economic performance among the EU member states. Compared with the CEE and periphery countries, the EU’s core countries generally have higher values for all studied indices. Conversely, the CEE countries have larger ecological footprints than the other countries, primarily due to the high proportion of heavy industry in their economies. When the DEA is applied, the CEE countries throughout have low efficiency levels ecologically and they lag behind both core and periphery countries with little tendency to catch up, which implies that the new EU member states have substantial room to improve in terms of the efficiency of environmental policy.

2.2 Policies for Competitiveness, Social Inclusion and Sustainability in the EU

Reflecting the set of objectives, the second part of the book focuses on selected policies for achieving competitiveness, social inclusion and sustainability in the EU. In particular, this part of the book focuses on policies directed at corporate social responsibility (CSR) and SME policies, as well as on environmental taxation, all of which have featured prominently on the European Commission’s policy agenda. Thus (in chapter “Current Developments in Corporate Social Responsibility in the EU”) Abramuszkinová-Pavlíková and Basovníková analyse and discuss current developments in CSR in the EU. They summarize the current state of CSR and CSR policies in the EU, including descriptions of certification processes such as ISO 26000 and SA8000. They also suggest that companies can be motivated to be socially responsible not only by market forces but also by the combination of political forces and public opinion because trust levels are important not only for other stakeholders but also for employees and their well-being, which is true for both large companies as well as SMEs.

However, the main thrust of Abramuszkinová Pavlíková’s and Basovníková’s analysis is centred on determining which firms are particularly prone to obtain SA8000 certifications and what the impacts are of such a certification on firm profitability and turnover using the example of Italian manufacturing companies. Their results suggest that SA8000 certification is primarily used by larger, more profitable companies and that it has a positive impact on firm growth but not on firm profitability. This finding is consistent with results that suggest that SA8000 certification is particularly important for companies expanding into new markets because such a certification is frequently required by state institutions for tendering for public contracts and is also important for supply-chain management of large multi-national firms in international value added chains. It is thus of particular value for firms who are expanding their markets. From a policy perspective, these results indicate that public procurement regulations could be a powerful tool to motivate all firms to implements such strategies, although severe challenges remain in motivating SMEs to commit to CSR strategies.

Kubíčková, Tuzová and Toulová (chapter “The Internationalisation of Small and Medium-Sized Enterprises as a Path to Competitiveness”), by contrast, is the first of two contributions in the book that focus on the role of SMEs and SME policies in implementing the Europe 2020 strategy. These authors synthesize an impressive number of studies that they conducted, which focus on SMEs operating in different sectors in the Czech Republic, with the aim to explore the specifics of and communalities in the motives for, barriers to and the perceived success factors of internationalization of SMEs in different sectors and in different EU countries.

Their results suggest some common features but also a number of differences among both countries and sectors. Whereas SMEs in various sectors of the Czech economy have similar motives for entering foreign markets, their priorities differ across sectors. Similarly, comparing the most frequently reported motives for the internationalization of Czech SMEs with the motives for internationalization of SMEs presented in the literature covering the entire world shows that reactive motives prevail (slightly) for Czech SMEs. The most significant barriers to entry into foreign markets for Czech SMEs are those involving finding international opportunities, difficulties in establishing contacts with foreign customers, and the lack of employees who possess the necessary knowledge and experience in foreign trade operations. In comparison with international studies, Czech companies thus perceive almost the same barriers as foreign SMEs, but the order of their importance again differs from that found in international studies. Finally, there are certain differences in the motives for and the perceived barriers to internationalization as well as in the perception of success factors in internationalization among not only SMEs from different European countries but also among SMEs from different sectors within the same country.

Based on these results, the authors therefore argue against “one-size-fits-all” policies to support SME internationalization efforts. Rather, the specifics of the internationalization process in particular countries and sectors should be considered when designing such policies.

Beranová, Tabas and Vavřina (chapter “Key Aspects of Competitiveness: Focus on European Small and Medium-sized Enterprises”) is the other contribution focusing on SMEs in the book. The emphasis of this article, however, is on the role of innovation in shaping competitiveness. Their research aims to identify differences in the capital structure and financial performance of innovative and non-innovative industries by focusing on the two most innovative branches in the EU (i.e., ICT and manufacturing) and on the two branches that have experienced the greatest changes in innovativeness: the real-estate business, which has the highest growth in innovation; and the accommodation and food services industry, which has the deepest decrease. These authors find only minimal differences in the capital structures and financial performance of innovative branches and the accommodations and food services industries according to evidence based on the corporate financial statements of businesses. Conversely, there are large differences between innovative branches and the real-estate business. Both the unchanged capital and property structures in the context of increased profitability measured by EBITDA primarily resulted in the preservation of profits in enterprises and innovations that are financed mostly from internal financial resources. In other words, enterprises only accept debt levels that do not change their capital structures. Based on these results, the authors discuss the rationale for policies designed to provide financial support for innovation.

The aim of the final chapter of the second part of this book (chapter “Pigouvian Carbon Tax Rate: Can It Help the European Union Achieve Sustainability?”) by Nerudová and Dobranschi is to argue the applicability of a Pigouvian tax on negative externalities such as carbon emissions. The authors suggest that in a second best framework, carbon taxation should use an adjusted Pigouvian principle, which levies a lower carbon tax than originally advocated by Pigou, because this tax is levied in an already distortionary fiscal system, and because a portion of the external costs of pollution are borne by the polluter. This theoretical argument is complemented by an empirical analysis, which suggests that current carbon taxes have had a limited impact on environmental innovation in the past. Additional instruments, such as subsidies, may therefore be required to ensure full effectiveness of environmental taxation.

Accordingly, the authors argue that an efficient abatement policy that will curb carbon emissions strongly depends on additional instruments that must be implemented to enhance its effectiveness. In particular if carbon taxes are implemented, the revenues from these taxes should be used to support abatement capital formation and to provide incentives for green technology development. Moreover, revenue recycling through capital or payroll tax cuts should seek to boost the production and consumption of less carbon-intensive goods.

2.3 Strategies and Instruments: The Potential for Policy Learning

The third part of the book addresses key elements of potential development strategies for the EU. In particular, the aim in this section was to focus on the potential for learning effects that could be triggered by the diversity of EU countries. In the first chapter of this part (chapter “A Lesson for the Contemporary European Periphery from the Transition Process of the CEE Countries”), Kouba asks what the distinguishing factors are between successful and less successful CEE countries in the transition period and what can be learnt from the transition process in the CEE countries for the development strategies of the Southern European periphery countries. Focusing on the first question, Kouba identifies the level of (non-elite) political stability, quality of the institutional framework, maturity and compatibility of informal institutions and the initial economic development level as the key determinants of the success of the transition and integration process of the CEE countries. The countries that have reached positive features within these categories were predestined to become members of the EU. Moreover, the prospect of accession to the EU in itself was a factor involved in the success of the transition process. However, the ex-ante strategies of economic transition and individual economic policies in different stages of transition were not essential for the success of the integration process from a long-term perspective.

Kouba‘s findings therefore suggest that to create a competitive and sustainable economic model for Southern European periphery countries, the policy of enforcing budgetary savings is inevitable but that a positive vision of the future is also needed. However, according to his findings, whether the way to competitiveness should be based on certain sectors, such as the knowledge economy, cheap exports or tourism, is of lesser importance because there could be many ways to achieve prosperity. Rather than the particular forms of economic policies, the existence of a positive vision and the broad-based support of this vision across the political spectrum are decisive for successful transforming peripheral countries.

Procházka, Landa, Procházková and Klimánek (chapter “Geospatial Infrastructure for European Union Sustainable Development”), by contrast, focus on the role of information systems and data collection in designing smart, sustainable and inclusive strategies in the EU, as an often overlooked aspect of the economic discussions on growth strategies. In particular, their case study of projects developing the joint geospatial data infrastructure of the EU notes that there is a general understanding that spatial data are essential for analyses that evaluate and monitor sustainable development. In particular, all developed countries have created national agencies that are focused on spatial data collection and maintenance. Nonetheless, the debate about a unified geospatial infrastructure allowing spatial data to be shared from different countries seamlessly within the EU is now decades-old. Based on these observations, the authors discuss the possibility of developing this strategy on the basis of the current INSPIRE directive of the European Commission.

Aside from the concrete suggestions for the further development of a European geospatial data infrastructure, Procházka, Landa, Procházková and Klimánek’s contribution presents a case study illustrating how technological progress, national regulations and data collection interact to enable (or constrain) the development of infrastructure that, on the one hand, is necessary to steer, measure and evaluate the success of sustainable development and that, on the other hand, is also often instrumental for innovation and the development of new products and is thus pivotal for future economic growth.

Finally, in the last contribution to this book, Huber, Leoni and Pitlik (chapter “Reforming Welfare States”) present a literature survey on the current challenges faced by European welfare states and discuss potential strategies to address these challenges from both economic and political-economic perspectives. These authors argue that policies directed at removing social inequalities based on inequality of opportunity and a social investment approach are more likely to be conducive to growth than not. Therefore, the frequently postulated trade-off between efficiency and equality does not generally apply. Countries looking for growth-friendly social policies should thus primarily focus on policies to provide equal opportunities and avoid exclusion or discrimination on the basis of gender, ethnicity or other characteristics.

However, these authors are also aware that a policy based on removing inequalities in opportunities alone is unlikely to meet the changing demands faced by the welfare state. Some form of “traditional” redistribution and social insurance against the risks of unexpected income losses will also have to be a feature of any European welfare state of the future. In this respect, the authors argue that an analysis of the redistribution over the life cycle and the impact of life cycle events as well as a more detailed analysis of unpaid work is required to design effective polices in a world in which globalization, migration, ageing, technological change, evolving work patterns, shifting family structures and other forms of social modernization and changes in life style are confronting governments with increased political demands to address old and new social risks.

Furthermore, Huber, Leoni and Pitlik suggest that welfare state reforms entail not only economic questions regarding the design of optimal policies but also the problem of how the general public and third-party actors as well as vested interests can be motivated to support reforms. Theories of welfare state reform resistance are, however, severely flawed if they do not account for the role of core beliefs in the process of attitude formation, and in procedural fairness considerations, in particular. Voters must have a minimum level of confidence in their democratic institutions to accept the uncertainties involved in far-reaching institutional changes. Notably, trust in European institutions can act as a substitute, to an extent, for trust in national institutions.

3 Summary

In sum, the results of this collective volume address a number of central issues in the advancement and development of a “smart”, “sustainable” and “inclusive” growth strategy for the EU. These results highlight such central questions as whether the trade-offs between growth and sustainability as well as social inclusion can be solved but also relate to how both national and European institutions can be developed to internalize both social and ecological externalities. Whereas these issues are clearly too complex to be completely settled in a volume such as the present book, the contributions relating to documenting the diversity of the current EU countries suggest that, although the public debate has noticeably shifted from an East–west centred discussion to a focus on North–south disparities in the last decade, this shift is only partially reflected in actual data.

In particular, in assessing the major division lines in the current EU, the results of these analyses suggest that, as a general matter, much depends on the indicators used and that the stronger the focus of researchers extends beyond GDP indicators and indicators of advanced comparative advantages (such as research and innovation), the stronger is the re-emergence of the traditional East–west (rather than the North–south) divide in the EU. Rather than being characterized by a single (East–west or North–south) divide, the EU is therefore split in a multitude of directions and fashions, in which East–west and North–south divides superimpose themselves or alleviate one another. Depending on the concrete indicator considered, this division will lead to very different results. Heterogeneity in the EU is thus a fundamentally multi-dimensional phenomenon, with results depending strongly on the concrete indicator considered.

Therefore, the results with respect to individual policies followed in the second part of this book warn that overly simplistic “one-size-fits-all” growth strategies and associated benchmarking exercises may not be conducive to achieving their goals. Instead, we would argue that resolving the current economic problems of the EU requires strategies that take due account of the vast heterogeneity of its member states in economic, institutional and political terms and embeds differentiated strategies in a sound framework of multi-level governance. Different member states of the EU have largely different experiences with reforms and policies and are also characterized by rather different needs, some of which must be addressed by national policy makers, whereas others can be addressed by EU wide policies.

The results of this part of the volume, however, also indicate that the analytical basis for the design of such overarching but country-specific strategies remains missing. Developing such a basis would require a much more detailed analysis of national systems than is currently available and therefore will remain as a highly active area of policy-oriented research in the future. In particular, we expect that detailed research into the sources and consequences of the heterogeneity of the EU and on the implications of these sources and consequences for the effectiveness of policy in particular fields will be a productive field of research in the future.

The results of the final part of this book focusing on the strategic aspects of heterogeneity, by contrast, suggest that the heterogeneity of the EU could—if used productively—also become one of the main sources of its comparative advantages. If countries and regions use their diverse experiences to learn from one another, there may be substantial improvements in policy making as a result. The results of this part, however, also suggest that reaping these potential benefits of diversity, requires investments into the joint data and analytical infrastructure to inform such learning as well as taking into account the political constraints affecting the decisions of policy actors.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Huber, P., Nerudová, D., Rozmahel, P. (2016). Introduction. In: Huber, P., Nerudová, D., Rozmahel, P. (eds) Competitiveness, Social Inclusion and Sustainability in a Diverse European Union. Springer, Cham. https://doi.org/10.1007/978-3-319-17299-6_1

Download citation

DOI: https://doi.org/10.1007/978-3-319-17299-6_1

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-17298-9

Online ISBN: 978-3-319-17299-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)