Abstract

The key challenge for EU Cohesion Policy is to improve SMEs access to capital and innovation. The objective of the article is to analyse use of the EU Structural Funds for innovative projects in SMEs from Pomerania Regional Operational Programme (ROP) 2007–2013. The analysis is based on 119 projects granted by the Measure 1.2. In order to achieve the main objective of the paper, the following detailed objectives are expected to be met: description of conditions and rules of grants awarding, analysis of SMEs in Pomerania region and finally, analysis of granted projects. The results of the analysis confirmed significant diversity of total values of projects, awarded grants and branches. The funded projects were implemented mostly in manufacturing. There were no beneficiaries from section H and section I which are very important for Pomerania’s economy. Most of the projects concerned implementation activity and only few of them were related to investment in R&D activity. More expensive projects and projects implemented in cooperation were more frequently financed with credit. In most cases firms have not declared employment growth. The research results should give recommendations for regional authorities on defining guidelines and implementing the Pomerania ROP 2014–2020.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

In accordance with the Europe 2020 Strategy, countries and regions need R&D and innovation to create smart, sustainable growth and to get Europe out of the current economic crisis (Pasimeni 2012). Innovation needs public support oriented on collaboration among innovation stakeholders (Gray and Wood 1991; Roberts and Bradley 1991). One of them are SMEs which often have difficulty in accessing capital and knowledge, coping with structural changes in markets and frequently lack experience. The aim of EU Cohesion Policy is to tackle these difficulties using a combination of hard and soft measures. The first group of measures comprises direct support to investment. The second group includes: the provision of business support services, training, an innovative environment, financial engineering and technology transfer, as well as the support of networks and clusters.

One of the instruments supporting innovation in Pomerania region is the Pomerania Regional Operational Programme (ROP) 2007–2013. The grants support innovative projects in companies with a strong development potential, however the definition of innovation differs from the National Operational Programme Innovative Economy. According to OSLO Manual (Ministerstwo Nauki i Szkolnictwa WyzszegoDepartament Strategii i Rozwoju Nauki 2005), the definition at regional level comprises four types of innovations: product, process, marketing and organisational innovation, and is considered at regional/local level in innovative projects and at company level in case of investment projects (Urzad Marszalkowski Wojewodztwa Pomorskiego 2010). In contrast to the National Operational Programme Innovative Economy, there are no time restrictions in relation to the applied technology. It is possible to prove innovativeness of a project on the basis of branch reports, market analysis or manufacturers opinions. Innovativeness in the Pomerania ROP 2007–2013 can be treated as access criterion, which means that demonstration of innovativeness is a precondition for applying for grant (innovative projects) or as appraisal criterion in investment projects, where additional points are granted in evaluation of projects.

Empirical literature on effects of the EU Structural Funds in the new EU Member States is rather limited in comparison to the old Member States, particularly at regional level (Cieslik and Rokicki 2013). The aim of the article is to analyse use of the EU Structural Funds for innovative projects in SMEs from the Pomerania ROP 2007–2013. In the analysis we use the projects data from the Pomerania Development Agency Inc., the Intermediate Body II for the Pomerania ROP 2007–2013. In order to achieve the main objective of the paper, the following detailed objectives are expected to be met: description of conditions and rules of grants awarding, analysis of SMEs in Pomerania region and finally, analysis of granted projects, using statistical methods.

2 SMEs in Pomerania Region and Funds for Innovative Projects

The gap between Pomerania’s development rate and that of the European Union continues to be wide. In 2009, the region’s average GDP per capita (PPS) represented about 59 % of the EU-27 average. When compared with national macroeconomic indicators, the regional economy is relatively strong. In 2009, its contribution to national GDP amounted to 5.7 % (seventh place in the country). The region’s GDP per capita placed Pomerania fifth in the country, after Mazowieckie, Dolnoslaskie, Slaskie and Wielkopolskie. The spread between sub-regions in 2009 ranged from 71 % of the national average in the Gdansk sub-region to 141 % in the Tri-City sub-region (Glowny Urzad Statystyczny 2014). These differences have been on similar levels over the last few years (Zarzad Wojewodztwa Pomorskiego 2012).

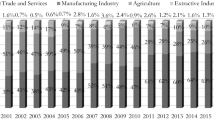

Pomerania region has one of the country’s most diverse economies. For decades the region has relied on maritime industries (shipbuilding, ship repairs, cargo handling, shipments, fisheries and fish processing, tourism) (Urzad Marszalkowski Wojewodztwa Pomorskiego 2010). Nowadays companies are operating in traditional and fast growing industries (ICT, chemical industry). There were 258,197 companies registered in Pomerania in 2011 and 265,033 in 2012 which makes 6.7 % of all companies in Poland. SMEs make up 99.9 % of all firms in Pomerania region. The most numerous are micro companies (95.7 %), followed by small- (3.5 %) and medium-sized enterprises (less than 1 %). Most of them are trading and motor vehicle repair companies (section G, NACE). There are also numerous construction (section F) and manufacturing (section C) enterprises. The remaining sections make up less than 10 % of all SMEs (Golejewska 2013).

Among industrial companies in Pomerania region, the share of those which have incurred outlays for innovative activities decreased from 19.1 % in 2008 to 15.5 % in 2009. In the same period, the share of service companies noted a fall from 12.7 to 9.6 %. In 2009, the highest expenditures on innovative activities per company were recorded in Pomerania region. The share of new or substantially modernised products in total revenues was the highest among Polish regions. In case of industrial companies, their share was above 23 % in 2008 and 28 % in 2009, in service companies—3.4 and 1.7 % respectively. Less than 25 % of innovation active enterprises were involved in innovation cooperation. In years 2007–2009 in innovation cooperation were involved 16.1 % of small, 30.5 % of medium and 51 % of big innovation active industrial companies and 11.7 % of small, 50 % of medium and 36 % of big innovation active service companies. In this period, only 1.7 % of innovation active industrial enterprises (6.4 % of total involved in innovation cooperation industrial companies) had agreements concerning innovation in cluster initiatives. In services, the shares amounted to 2.7 and 11.8 % respectively (Glowny Urzad Statystyczny 2010). In 2010–2012, innovation active industrial enterprises represented only 12.3 % and innovation active service enterprises −11.4 % of all enterprises in Pomerania region. In 2012, the share of new or substantially modernised products in total revenues in industrial companies amounted to over 36 % and was the highest in Poland. In the same year, the share in service companies was only 1.4 %. About 30 % of innovation active enterprises implemented cooperation on innovation, of which 16.4 % of industrial- and 30.2 % of service companies were cooperating in cluster initiatives (Glowny Urzad Statystyczny 2013).

While Pomerania’s numerous SMEs have the necessary development potential, it remains largely underused because of their poor access to capital. If their competitiveness is to be improved, they need investment support, particularly micro-companies in the region’s structurally disadvantaged areas (Urzad Marszalkowski Wojewodztwa Pomorskiego 2010). An important role in financing innovation-related instruments play EU Structural Funds, available and managed at regional and national level. To use them, regions are requested to define priorities and design appropriate strategies, in particular regional innovation strategies. Regions are managers of Regional Operational Programmes supporting human capital and an innovative economy and based on priorities of regional innovation strategies. The Pomerania ROP involves Community support for Pomerania within the framework of “Convergence” objective. The programme has been funded under the European Regional Development Fund (ERDF) and the accompanying national co-financing. According to the division of the funds among 16 Regional Operational Programmes, the ERDF money for the Pomerania ROP represented 5.35 % of the total allocation of this Fund to 16 Regional Operational Programmes. The total value of the Pomerania ROP was about EUR 1.3 billion, of which the national contribution (public and private) represented above EUR 350 million. Funding to support the Lisbon Strategy objectives (earmarking) amounted to 48.5 % of all the Pomerania ROP funding. The ERDF allocation for priority axis one amounted to almost EUR 180 million (19.1 % of total allocation). The priority one comprised direct and indirect SME financial support instruments. Measure 1.2 “Innovative solutions in SME”, which allocated over EUR 22 million, included projects involving research and technology development. Direct support was provided to new companies, set up as a result of innovation (including spin-off and spin-out) and for pro-innovation investments in existing companies. The Measure 1.2 co-financed:

-

1.

acquisition of R&D results, intellectual property rights, including patents, licenses, know-how or other technical knowledge related to the implemented product or service;

-

2.

exclusive rights (patents) for own technical solutions;

-

3.

R&D activities in SMEs;

-

4.

implementation of innovative manufacturing processes, products and services, organizational systems and market solutions, including implementation of R&D results;

-

5.

implementation and commercialization of innovative products and services and product and technology platforms.

Preferred were projects with over-regional impact, which fitted in with the Pomerania Regional Innovation Strategy (RIS) and establishing partnerships with several organisations working together (Zarzad Wojewodztwa Pomorskiego 2012). Evaluated were purpose and involvement of the partners (organisational and financial). As preferred were regarded projects based on cooperation between enterprises and the R&D sector. In the evaluation process also the following criteria were examined: the introduction of interrelated: innovative products and innovative services, innovative products and innovative processes or innovative services and innovative processes (production, technological, organisational); contribution to energy and raw material efficiency and emission reduction, the use of cross-financing, the relationship with other investment projects implemented in a company and solutions contributing to implementation of the principle of equal opportunities and non-discrimination (Zarzad Wojewodztwa Pomorskiego 2009).

3 Empirical Analysis

The analysis is based on 119 projects granted by the Measure 1.2 of the Pomerania ROP in three competitions. In the first one, with closing date for entries on 30 January 2009, over PLN 27 million (1 EUR ≈ PLN 4) were awarded to 24 companies. In the next competition with closing date on 23 November 2009, over PLN 39 million were divided among 49 applicants. In the last case with closing date on 29 February 2012, the allocation of PLN 22.5 million was divided among 46 applicants. The maximum support for a project run by a micro or small company could not exceed 60 % of eligible expenditures, and 50 % in case of a medium-sized company, in both cases no more than EUR 500 thousand (PLN 2 million). In the last competition, the maximum support has been reduced to 50 % for micro and small enterprises and to 40 % for medium enterprises. The maximum value of financial support was reduced by half (Golejewska 2013). There were no limits on minimum and maximum project value. The expenditures eligible for support in the Measure 1.2 were inter alia costs of transfer of ownership of land and building; costs of purchase or leasing of equipment; purchase costs of construction works and building materials; purchase costs of R&D results; intellectual property rights, including patents, licences, know-how and non-patented technical knowledge; and costs of obtaining a patent.

3.1 Analysis of Funded Projects

In the analysed competitions, 44 micro-, 39 medium- and 36 small-sized enterprises obtained co-financing. The distribution of projects by size of enterprise differs significantly from the distribution of enterprises in Pomerania region. It is particularly visible in case of medium-sized enterprises, which represented almost 33 % of all beneficiaries and only less than 1 % of enterprises in Pomerania region. Their share in total costs of projects and eligible costs is even higher. The total costs of co-financed projects amounted to over PLN 270 million, of which almost PLN 108 million concerned medium enterprises. To PLN 14 million less amounted costs of projects submitted by small enterprises. Micro-sized enterprises implemented the cheapest projects with the total value of PLN 68.5 million. The same is true for eligible costs with the highest share of medium- and the lowest share of micro-sized enterprises. A much smaller advantage attained medium enterprises in the amount of co-financing (35 %), which was a result of assumption adopted in the field of maximum support of the project. Table 1 presents the co-financed projects by size of enterprise.

The average share of eligible costs in total costs of projects in all three competitions amounted to almost 80 %. The highest share was in micro-sized companies—81 %, the lowest in small-sized enterprises—78 %. The highest funding received medium companies—on average 38 % of eligible costs, altogether almost PLN 33 million. A little less, above PLN 32 million received small enterprises (on average 44 % of eligible costs). Projects of micro-sized enterprises were supported by co-financing at the average level of 44 %. The differences in average funding level resulted from programming documents. Lower than maximal, average funding level was a result of preferences granted to projects, in which own contribution was higher than required in the Measure 1.2 of the Pomerania ROP.

Financial support varied from PLN 24 thousand to PLN 2 million. Enterprises have received on average PLN 768.6 thousand, however average values varied by type of enterprise. The highest grants have received small enterprises—almost PLN 895 thousand, followed by medium enterprises—PLN 838.5 thousand and micro-sized enterprises—almost PLN 604 thousand. The mean values were increased by the projects with maximum value of PLN 2 million (or close to it). For this reason the median value was significantly lower than the mean value. For all the granted projects the median value amounted to almost PLN 563 thousand (see Table 2).

There were even greater differences with respect to individual competitions (see Table 3). In case of the first competition, the average value of grant was over PLN 1 million. In the second competition companies have received on average PLN 0.9 million and in the last one about half less. Low values in the last competitions resulted from reduced maximum value of financial support to PLN 1 million.

Most of the projects focused on implementation activity. 64 out of 95 projects related to implementation of innovative manufacturing processes, products and services, organizational systems and market solutions, including implementation of R&D results.Footnote 1 46 projects concerned implementation and commercialization of innovative products and services and product and technology platforms. Support to research and innovation activities was the subject of co-financing in only 19 projects and acquisition of R&D results, intellectual property rights, including patents, licenses, know-how or other technical knowledge related to the implemented product or service in nine projects. There was only one project concerning exclusive rights for own technical solutions. In most cases, the projects met the criteria of a few project types. The funded projects are implemented in different sectors, with dominance of industrial production. 55 % of them are implemented in section C (manufacturing) which is very diversified. Numerous beneficiaries are also operating in section M (professional, scientific and technical activities) and section Q (health care and social welfare). Only 7 % of funded projects are implemented in section J (information and communication). Similar percentage of innovative projects concerned sections F and G (construction and commerce). The share of other sections remains marginal. There were no beneficiaries from section H (transportation and storage) and section I (hotels and restaurants) which is worth mentioning because of the fact that these sections are of great importance for Pomerania’s economy.

Table 4 presents technological intensity of co-financed projects. Majority of manufacturing projects is implemented in medium-low- and low-technology industries (47 projects). Only 8 out of 65 classified projects are implemented in high-technology industries, mainly in manufacturing of precision electronic instrument and electronic devices. The remaining ten projects were implemented in manufacturing of food products, textiles and leather products. It is positive that, contrary to manufacturing, in services more than 80 % of projects relates to knowledge-intensive services (KIS). They are implemented mainly in IT, financial, medical and advertising services.

On the other hand, regions which are not innovation leaders should invest in branches, not necessarily high-tech, but with the greatest growth potential referred to as smart specialisation areas (Camagni and Capello 2013). In short, smart specialisation is “about generating unique assets and capabilities based on the region’s distinctive industry structures and knowledge bases” (Foray et al. 2012). Smart specialisation industries have been initially identified for Pomerania region but the number of co-financed projects implemented within them remains rather low (23). The largest number of innovative projects—six, are implemented in construction, mostly by small businesses involved in the construction of roads and the specialized construction, four in furniture industry, implemented mainly by medium-sized enterprises and three in ICT and sport, leisure and tourism each, implemented by micro and small enterprises. Unfortunately, there are no projects in business process outsourcing and transport and logistics, which are of great potential for development of Pomerania region.

Funds for co-financed projects are transferred from the EU and national budgets as pre-payment and reimbursement (Zarzad Wojewodztwa Pomorskiego 2011). Pursuant to the guidelines, one of the requirements to apply for a grant is a financial stability of the applicant. In accordance with the results, the minority of projects (36 out of 119) was financed with credit. In 14 cases the applicants were micro-sized companies. However, the use of credit facility with reference to total costs of project and eligible costs amounted to more than 50 % and in case of grants, to over 40 %. Projects financed with credit were characterized by 50 % higher total costs in comparison to projects financed solely with own resources. The results imply that companies with good financial standing rather do not need credit facility to finance their contribution, however the availability of bank lending for SMEs can be a significant driver of absorption of the EU Structural Funds, in particular in case of more expensive projects. The use of credit facility with reference to costs and co-financing presents Table 5.

Pomerania region comprises 16 counties, 4 county’s cities and 123 municipalities (25 urban, 17 urban-rural and 81 rural). The region is divided into four sub-regions: Gdansk-, Slupsk-, Starogard Gdanski- and Tri-City sub-region. The region is largely urbanised, with over 67 % of population living in cities. It makes the region Poland’s fourth most urbanised area. Development and land use are most intensive in the Tri-City metropolitan area on the Bay of Gdansk (Golejewska 2013). Pomerania region is characterised by a great diversity of economic development in its sub-regions. Differences in the number of companies, employment rate and average income are in particular visible at county level. The strongest is Tri-City sub-region and counties bordering it. In a weaker state are the areas of the former Slupsk and Elblag provinces, characterised by high unemployment rate and low wages. The results of analysis show high geographical concentration of granted projects in the Tri-City sub-region and counties bordering it, particularly in Kartuski (13 projects), Wejherowski (10 projects) and Gdanski (9 projects) districts. Also Bytowski district stands out positively among other counties with nine granted projects, of which eight in the last competition. The maximum number of projects in other counties did not exceed three. Figure 1 presents geographical distribution of granted projects. Gdansk accounted for 40 % of total co-financing, followed by Gdynia—almost 17 % and Kartuski district—little over 10 %.

The vast majority of granted projects is implemented in the same county as firm’s head office (100 out of 119). Micro-sized companies implemented their projects more often outside the county of their head office (25 % of all projects) and they more often declared an increase in employment in these projects (55 % of projects in comparison to 24 % of projects implemented in the same county as firm’s head office). In general, implementation of projects was not related to employment creation, which was not a criterion of project evaluation. In 57 % of projects no single new job was created. On average, one project generated 1.5 of a full-time job. The number of jobs created in innovative projects is uneven. The greatest number of jobs was generated in Gdansk, Gdynia, Kartuski and Bytowski district, in total 137.25, representing 78.5 % of the total number of created jobs. The largest providers of employment were small enterprises.

In most cases firms applied single-handed. Though preferences given to partnership projects, on cooperation have decided only 21 applicants: 7 micro-, 6 small- and 8 medium-sized companies. This indicates that they rather carefully cooperate with external partners in implementing projects, which may result from misgivings that the partners will not meet their engagement and the project would not be completed. This tendency is worrying, in particular in the context of benefits of this kind of cooperation. There is sectorial and geographical concentration of projects implemented in partnership. Most frequently, partners were present in manufacturing (eight projects) and trade and repair (four projects). 13 out of 21 projects were implemented in the Tri-City sub-region. Most of the partnership projects focused on implementation of innovative manufacturing processes, products and services, organizational systems and market solutions, including implementation of R&D results. Much less frequently they were related to R&D activities in SMEs and implementation and commercialization of innovative products and services and product and technology platforms.

There is a correlation found between the implementation of projects in partnership and the use of credit facility. 60 % of projects implemented in partnership were financed with credit. It should however be noted that, pursuant to the guidelines, the partnership is not limited to the financial contribution but it relates also to technical and organisational support. As partners, preferred are the key cluster members and representatives of the research and development sector. Building business-university links is a difficult and long process which requires overcoming many multi-dimensional barriers. Despite relatively high potential of the research and development sector in Pomerania region, it is not sufficiently focused on business use. R&D teams often do not have practical proposals for cooperation which meet the expectations of entrepreneurs. The current level of spending on R&D also does not promote effective use of scientific potential of Pomerania region.

4 Conclusion

High impact on innovation activity of enterprises, particularly R&D activity, have factors related to shortage of financial resources, limited options of securing sufficient financing and development of own R&D infrastructures. Additionally, low development of innovation implementation system in Pomerania region limits the possibility to use it. A positive feature of Pomerania region is a relatively high, compared to the country, and steadily increasing share of the private sector in the financing of R&D (47.5 % in 2012). Although low percentage of Pomerania’s firms implements innovation, those firms, which do it, achieve one of the best results in a country. Since 2006 Pomerania region is a leader in terms of the share of new or substantially modernised products in total revenues. Thus, in the region there is a potential and at the same time a need for funding for innovative projects.

The results of the analysis confirmed significant diversity of total values of innovative projects, awarded grants and branches. The majority of innovative projects have been implemented in manufacturing. Only a small part of them are in high-technology sectors that are very important for diffusion of innovation. A totally different situation is observed in services. Unfortunately, only a small part of projects related to investment in firm’s R&D activity. Most of them focus on implementation activity. The changes in enterprises focus mostly on incremental innovations which change the scale of the firm but are not unique to the branch (which meets the definition of innovation in the ROP). In Pomerania region, enterprises refrain from cooperation when implementing innovative projects, which prevents from full exploitation of innovation capacity ofthe region. The results show high concentration of projects in Tri-City Agglomeration and adjacent districts, which confirms the role of agglomeration in promoting technology transfer and innovation. On the basis of the results it can be stated that companies with good financial standing finance their contribution rather using their own funds, however the availability of bank lending for SMEs can be a significant driver of absorption of the EU Structural Funds, particularly in case of more expensive innovative projects.

In the current EU programming period, support is directed to enterprises implementing innovative solutions, as well as to enterprises starting up or developing their R&D activity and cooperating with universities and scientific institutions (with an enterprise as a project leader). The Pomerania ROP 2014–2020 will also support new enterprises (start-ups) based on innovative solutions, including spin-offs and spin-outs, which will be financed through seed and venture capital. Beside the repayable instruments, the use of grants and mixed instruments is envisaged. As a rule, potential beneficiaries should be active in branches identified as regional smart specialisation areas (Zarzad Wojewodztwa Pomorskiego 2013). The experience of 2007–2013 programming period should be used in the current period. Definition of innovation at regional level in the ROP still needs further clarification. The decision-makers should implement instruments to support cooperation between enterprises and representatives of the research and development sector and measures improving access of SMEs to bank lending.

Notes

- 1.

In the first competition, types of projects have been not considered.

References

Camagni, R., & Capello, R. (2013). Regional innovation patterns and the EU regional policy reform: Toward smart innovation policies. Growth and Change. Journal of Urban and Regional Policy, 44(2), 355–389.

Cieslik, A., & Rokicki, B. (2013). Wpływ unijnej polityki spójnosci na wielkosć produktu i zatrudnienia w polskich regionach (The impact of cohesion policy on production and employment in Polish regions). GospodarkaNarodowa, 3(259), 57–77.

Foray, D., Goddard, J., Beldarrain, X. G., Landabaso, M., McCann, P., Morgan, K., et al. (2012). Guide to research and innovation strategies for smart specialisations (RIS 3). Luxembourg: European Commission.

Glowny Urzad Statystyczny. (2010). Dzialalnosc innowacyjna przedsiebiorstw 2006-2009, Informacje i Opracowania Statystyczne (Innovative Activity of Enterprises in 2006-2009. Statistical Information and Studies). Warszawa: GUS.

Glowny Urzad Statystyczny. (2013). Dzialalnosc innowacyjna przedsiebiorstw 2010-2012, Informacje i Opracowania Statystyczne (Innovative activity of enterprises in 2010-2012. Statistical information and studies). Warszawa: GUS.

Glowny Urzad Statystyczny. (2014). Bank Danych Lokalnych (Local Data Bank). Retrieved March 15, 2014, from http://stat.gov.pl/bdl/app/strona.html?p_name=indeks

Golejewska, A. (2013). Co-financing innovative projects in SMEs from EU structural funds. The case of Pomerania region in Poland. In V. Dermol, N. Trunk Širca, & G. Dakovićeds (Eds.), Active Citizenship by Knowledge Management & Innovation Proceedings of the Management, Knowledge and Learning International Conference MakeLearn 2013 (pp. 419–425). Bangkok-Celje-Lublin: ToKnowPress.

Gray, B., & Wood, D. J. (1991). Collaborative alliances: Moving from practice to theory. Journal of Applied Behavioral Science, 27, 3–22.

Ministerstwo Nauki i Szkolnictwa Wyzszego Departament Strategii i Rozwoju Nauki. (2005). Podrecznik Oslo. Zasady gromadzenia i interpretacji danych dotyczacych Innowacji (Oslo Manual. The Rules of Collecting and Interpreting Innovation Data). Paryz, Warszawa: OECD i Eurostat.

Pasimeni, P. (2012). Measuring Europe 2020: A new tool to assess the strategy. International Journal of Innovation and Regional Development, 4(5), 365–385.

Roberts, N. C., & Bradley, R. T. (1991). Stakeholder collaboration and innovation: A study of public policy initiation at the state level. Journal of Applied Behavioral Science, 27, 209–227.

Urzad Marszalkowski Wojewodztwa Pomorskiego. (2010). Regionalny Program Operacyjny dla Wojewodztwa Pomorskiego (RPO WP) na lata 2007-2013 przyjety decyzja Komisji Europejskiej nr K(2010)6061 z dnia 3 wrzesnia 2010 r. zmieniajacej decyzje nr K(2007)4209 z dnia 4 wrzesnia 2007 r.(Pomerania Regional Operational Programme 2007-2013, adopted by Commission Decision No K(2010)6061 of 3 September 2010, amending Decision No K(2007)4209 of 4 September 2007). Gdansk: UrzadMarszalkowskiWojewodztwaPomorskiego.

Zarzad Wojewodztwa Pomorskiego. (2009). Zalacznik nr 2 do uchwaly nr 1242/252/09 Zarzadu Wojewodztwa Pomorskiego z dnia 1 pazdziernika 2009 r., Informacja o trybie stosowania kryteriow wykonalnosci i kryteriow strategicznych wyboru projektow w ramach Regionalnego Programu Operacyjnego dla Wojewodztwa Pomorskiego na lata 2007-2013(Annex No 2 to Resolution No 1242/252/09 of the Board of Pomorskie Voivodeship of 1 October 2009, Information on Application of the Feasibility and Strategic Criteria within Pomerania Regional Operational Programme 2007-2013). Gdansk: Zarzad Wojewodztwa Pomorskiego.

Zarzad Wojewodztwa Pomorskiego. (2011). PrzewodnikBeneficjenta RPO WP 2007-2013 dlaDzialan 1.1-1.2, Zalacznik nr 2 do uchwaly nr 1420/96/11 ZarzaduWojewodztwaPomorskiego z dnia 29.11.2011 r. (The Guide for Beneficiary of Pomerania Regional Operational Programme 2007-2013 for Measures 1.1-1.2, Annex No 2 to Resolution No 1420/96/11 ofthe Board of Pomorskie Voivodeship of 29 November 2011). Gdansk: Zarzad Wojewodztwa Pomorskiego.

Zarzad Wojewodztwa Pomorskiego. (2012). Uszczegolowienie Regionalnego Programu Operacyjnego dla Wojewodztwa Pomorskiego na lata 2007-2013, Zalacznik nr 2 do uchwaly nr 1149/182/12 Zarzadu Wojewodztwa Pomorskiego z dnia 25 wrzesnia 2012 r. (Description of Pomerania Regional Operational Programme 2007-2013, Annex No 2 to Resolution No 1149/182/12 of the Board of PomorskieVoivodeship of 25 September 2012). Gdansk: Zarzad Wojewodztwa Pomorskiego.

Zarzad Wojewodztwa Pomorskiego. (2013). Regionalny Program Operacyjny dla Wojewodztwa Pomorskiego (RPO WP) na lata 2014-2020, Projekt do konsultacji spolecznych, zaakceptowany przez Zarzad Wojewodztwa Pomorskiego (uchwala Nr 1116/288), 27.09.2013. (Pomerania Regional Operational Programme 2014-2020, A Draft for Public Consultation Approved by the Board of PomorskieVoivodeship, Resolution No 1116/288 of 27 September 2013). Gdansk: ZarzadWojewodztwaPomorskiego.

Acknowledgement

The authors would like to thank the team of the Pomerania Development Agency for provision of detailed data.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this paper

Cite this paper

Golejewska, A., Gajda, D. (2015). How Polish Firms Use the EU Funds for Innovative Projects? Final Evaluation of Pomerania Region in Poland. In: Bilgin, M., Danis, H., Demir, E., Lau, C. (eds) Innovation, Finance, and the Economy. Eurasian Studies in Business and Economics, vol 1. Springer, Cham. https://doi.org/10.1007/978-3-319-15880-8_1

Download citation

DOI: https://doi.org/10.1007/978-3-319-15880-8_1

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-15879-2

Online ISBN: 978-3-319-15880-8

eBook Packages: Business and EconomicsBusiness and Management (R0)