Abstract

In the period from the 1950s to 2013, the American Food and Drug Administration (FDA) approved 1346 new molecular entities (NMEs) or new biologics entities (NBEs). On average, the approval rate was 20 NMEs per year. In the past 40 years, the number of new drugs launched into the market increased slightly from 15 NMEs in the 1970s to 25–30 NMEs since the 1990s. The highest number of new drugs approved by FDA was in 1996 and 1997, which might be related to the enactment of the Prescription Drug User Fee Act (PDUFA) in 1993.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

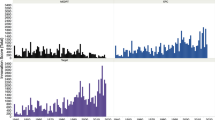

Innovation as a Driver of Growth for the Pharmaceutical Industry in the Past

In the period from the 1950s to 2013, the American Food and Drug Administration (FDA) approved 1346 new molecular entities (NMEs) or new biologics entities (NBEs). On average, the approval rate was 20 NMEs per year. In the past 40 years, the number of new drugs launched into the market increased slightly from 15 NMEs in the 1970s to 25–30 NMEs since the 1990s (Munos 2009). The highest number of new drugs approved by FDA was in 1996 and 1997 (see Fig. 2.1), which might be related to the enactment of the Prescription Drug User Fee Act (PDUFA) in 1993 (Kaitin and DiMasi 2011).

New drugs approved by FDA between 1993 and 2013. (Data derived from Hughes 2009; Munos 2009; Mullard 2012b, 2014b; www.fda.org); NMEs new molecular entities, BLAs biologic license applications, FDA Food and Drug Administration

It has been reported that in 2009 approximately 4300 pharmaceutical companies performed research and development (R&D) worldwide (Munos 2009). Compared to this figure, it is interesting to note that from 1950 to 2009 only 261 pharmaceutical companies have been successful in launching at least one new drug into the market (Munos 2009). Out of this group, only 12 % of the companies were in the pharmaceutical market for all 60 years (Munos 2009). The other organizations either failed, merged with a competitor, or were acquired. About 600 NMEs were launched by the companies that disappeared due to merger and acquisition (M&A; Munos 2009). Twenty-one pharmaceutical companies have launched 50 % of all new drugs until today, whereby 360 NMEs have been produced by nine pharmaceutical companies that have existed since 1950 (Munos 2009). Out of this group, Merck & Co. (www.merck.com), Eli Lilly (www.lilly.com), and Roche (www.roche.com) have been the most successful companies worldwide so far (Munos 2009). The fact that some companies were able to survive over a period of six decades shows that the health-care sector has provided a basis for the sustainable growth of pharmaceutical companies up to this point. But is there also ground for future growth and sustainability for pharmaceutical companies in the future?

The Pharmaceutical Industry Today

The R&D Investments of Top Pharmaceutical Companies

Today, the multinational pharmaceutical companies that perform R&D come from the traditional, main pharmaceutical markets, namely the USA, Europe, and Japan. Of the 15 companies listed in Table 2.1, seven companies are based in the USA, two in Japan, and six in Europe. None of these major players in the pharmaceutical industry come from emerging countries such as China, India, Russia, Brazil, or South Africa.

The pharmaceutical sector is still polypolic. The top 15 pharmaceutical companies have a combined market share of 51.8 %. Today’s leading pharmaceutical company worldwide is the Swiss Novartis with total group sales of US$ 50.8 billion in 2012. Its R&D investments have been enormous in recent years with the totals of US$ 8–9 billion annually (see Table 2.2).

On average, the top pharmaceutical companies have invested 15–20 % of their total sales into R&D in the past years, which has translated into R&D costs of more than US$ 5 billion annually (see Table 2.3). The overall average R&D rate of the pharmaceutical and biotechnology industry has been described to be 14.4 % in 2012 (European Commission 2013). Companies such as Novartis, Pfizer, Roche, and Sanofi have even invested more than US$ 8 billion per year showing the importance of R&D as a major driver of growth in the industry.

According to the European Commission, 15 of the top 50 companies that invest most in R&D worldwide are pharmaceutical companies (European Commission 2013). Thus, the pharmaceutical branch is one of the top investors in R&D worldwide. Roche (6), Novartis (7), Merck & Co. (8), Johnson & Johnson (9), and Pfizer (10) are within the top ten of the world leading R&D investors (European Commission 2013).

In total, the pharmaceutical industry is the sector that invests most in R&D worldwide. The International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) reported that in 2010 the pharmaceutical and biotechnology industries had R&D investments of more than US$ 85 billion (IFPMA 2012) with US$ 48.5 billion R&D investments reported by Pharmaceutical Research and Manufacturers of America (PhRMA) members (PhRMA 2013).

Resulting from increasing R&D expenditures during the years 2005–2012, the European Commission reported an investment in R&D of up to US$ 100 billion worldwide for the pharmaceutical and biotechnology sectors in 2012 (European Commission 2013). In the same report, the analysis showed that most of the multinational pharmaceutical companies have invested significantly more in R&D during the period between 2005 and 2012 (see Table 2.4; European Commission 2013).

The huge amounts pharmaceutical companies are spending in new drug R&D and the enormous total R&D investments of the whole industry have put pressure on the return on R&D investment and brought the sustainability of pharmaceutical R&D in question if the output, namely the number of new drugs launched, is not comparably high.

The Output of Pharmaceutical R&D

In the past 12 years, Novartis (www.novartis.com), Pfizer (www.Pfizer.com), and GlaxoSmithKline (www.gsk.com) have been the most successful pharmaceutical companies, as they launched 16, 13, and 12 new drugs into the market, respectively. Figure 2.2 summarizes the number of NMEs from the most efficient pharmaceutical companies that have been approved by the FDA over the period of 2001–2012.

New molecular entities (NMEs) approved by Food and Drug Administration (FDA) between 2001 and 2012 by major pharmaceutical companies (data derived from Frantz and Smith 2003; Frantz 2004, 2006; Owens 2007; Hughes 2008, 2009, 2010; Mullard 2011, 2012b, 2013, 2014a; http://www.fda.gov/Drugs/DevelopmentApprovalProcess/HowDrugsareDevelopedandApproved/DrugandBiologicApprovalReports/NDAandBLAApprovalReports/ucm373420.htm). GSK GlaxoSmithKline, J&J Johnson & Johnson

The statistics of new drugs launched into the market in Fig. 2.2 include the NMEs per company that have been generated from internal sources and also the ones that come from external sources, such as licensing of drug candidates and acquiring new drugs by M&A. The total externally sourced pipeline of multinational pharmaceutical companies has been analyzed to be sourced on average by 50 % (29–80 %) from external sources (Schuhmacher et al. 2013); 25 % of the drug candidates have been licensed and the other 25 % were acquired from outside of the companies (Schuhmacher et al. 2013). Analyzing the sources of new drugs of three of the multinational pharmaceutical companies, namely Pfizer, Roche, and Sanofi, it becomes apparent that M&A activities have played a major role in the number of new drugs launched. For example, ten NMEs have been approved by the FDA for Pfizer between 2001 and 2012. Two additional new drugs improve Pfizer’s statistics directly, as two drugs had been registered for Pharmacia and Wyeth after the companies were acquired by Pfizer in 2003 and 2009, respectively. And four additional new drugs could be added to Pfizer as these drugs have been approved for Pharmacia or Wyeth at least 4 years before the companies have been acquired (see Table 2.4) (Table 2.5).

The multinational pharmaceutical companies listed in Fig. 2.2 have launched on average 0.6 NMEs per year between 2001 and 2012, with Novartis and Pfizer launching 1.3 and 1.16 NMEs, respectively. These figures are far below the industry goal to produce 2–3 NMEs per year per company that has been reported as a need of pharmaceutical companies to meet their growth objectives (Kola and Landis 2004; Munos 2009). Assuming a growth target of 5 % per year, a pharmaceutical company with total sales of US$ 15 billion would need to deliver 2.5–3 NMEs per year over a period of 10 years to meet this target (Kola and Landis 2004). A bigger pharmaceutical company of the size of Pfizer with total pharmaceutical sales of US$ 45 billion would need to launch 7.5–9 NMEs per year, if expecting to generate a growth of 5 % per year through pharmaceutical innovation (Kola and Landis 2004). None of the pharmaceutical companies have achieved this goal in the past years, bringing into question the dogma, that the main driver of growth in the pharmaceutical industry is innovation.

The Pharmaceutical Innovation Process

The pharmaceutical R&D process is highly regulated, lengthy, and risky. Traditionally, the process of discovering and developing a new drug is divided into preclinical research and clinical development, followed by a review and launch phase (see Fig. 2.3).

The Success Rates of Pharmaceutical R&D

As indicated in Fig. 2.3, pharmaceutical R&D has a low probability of success (PoS). Only one out of more than 100,000 compounds that have been screened in discovery research and, thereof, 10,000 compounds that have been tested during preclinical research make it to the market. In total, the probability of discovering, developing, and registering an NME has been estimated to be around 4 % (Paul et al. 2010; also see 2013 CMR International Pharmaceutical R&D Factbook, http://cmr-thomsonreuters.com/pdf/fb-exec-2013.pdf). Table 2.6 summarizes some articles and highlights the probabilities per phase of drug R&D.

CMR reported for the preclinical phase, Phase I and Phase II of clinical development, success rates per phase of 67, 46, and 19 %, respectively (2013 CMR International Pharmaceutical R&D Factbook, http://cmr-thomsonreuters.com/pdf/fb-exec-2013.pdf). In particular, the low PoS for the early clinical phases represents the goal that potentially unsuccessful compounds should fail early and inexpensively.

The underlying causes of the high attrition rates are manifold. Differences may depend on the drug class, the therapeutic area, the type of disease, the source of the drug candidate, and the size of the company. It has been reported that adverse pharmacokinetics and bioavailability were a major cause of attrition in the 1990s (Kola and Landis 2004). In the same opinion letter, it was stated that the lack of efficacy and safety were the major reasons for the low PoS in clinical development in 2000. In an analysis of ten big pharmaceutical companies in the period of 1991–2000, the reasons for attritions have been analyzed as being primarily efficacy and safety issues (Kola and Landis 2004).

In a review of the FDA approvals in 2012, it was reported that most of the failures in Phase II and Phase III resulted from the lack of efficacy (56 %), followed by safety (28 %) (Arrowsmith and Miller 2013). The lack of efficacy may be related in some therapeutic areas, such as oncology and central nervous system (CNS), with a lack of predictive animal models in the discovery research and the preclinical testing phases (Kola and Landis 2004). Today, the majority of drugs in the development refer to novel targets making drug development less predictable and, thus, less successful (Berggren et al. 2012). Biologics showed a higher PoS from Phase I to submission than small molecule drugs (SMOLs; DiMasi et al. 2010). The PoS of drugs that addressed acute diseases was also higher than the PoS of drugs treating chronic diseases (Pammolli et al. 2011). Furthermore, it could be shown that in-licensed drug candidates have a higher PoS for Phase I to submission than self-originated drugs (DiMasi et al. 2010) (Fig. 2.4). Finally, the size of a company may also have an impact on the attrition rates. While large organizations have a mean PoS of 7.86 % from Phase I to submission, small organizations have a PoS of 6.07 % (Pammolli et al. 2011). In the same context, biotechnology organizations seem to have lower success rates in clinical development than nonbiotechnology companies (Pammolli et al. 2011).

Phase transition rates of self-originated and in-licensed drug candidates (Data derived from: DiMasi et al. 2010)

Further reasons for the low PoS of pharmaceutical R&D may be founded in:

-

An advanced complexity of drug targets

-

The higher proportion of novel drug targets

-

The competition in target selection, as half of the drug targets are pursued by two or more pharmaceutical companies (Agarwal 2013)

-

The complex process of target validation (Sams-Dodd 2005)

-

The target-based drug discovery

-

The higher demands of regulatory authorities

-

A broader knowledge base increasing the complexity of clinical trials

-

The greater complexities of bigger multicentric clinical trials

In an analysis of 259 drugs that were launched between 1999 and 2008, it was shown that the phenotypic screening toped the target-based approach (Swinney and Anthony 2011). Thirty-one percent of the first-in-class drugs that were analyzed were based on a phenotypic screening, while 23 % were results of a target-based screening, 7 % were modified natural products, and 33 % were biologics. This is in comparison to the follower drugs that were analyzed, of which 51 % were based on a target-based approach, 18 % on the phenotypic screening, 8 % on natural products, and 19 % were biologics (Swinney and Anthony 2011). It was concluded that the hypothesis-driven target-based approach may contribute to higher attrition rates than the older and perhaps more productive method of drug research—the phenotypic screening (Swinney and Anthony 2011, Scannel et al. 2012). The challenge is that targets are parts of complex networks whose interactions can lead to unpredictable results. Most first-in-class drugs were discovered by phenotypic screening rather than by the target-based approach (Swinney and Anthony 2011).

The extremely low PoS of pharmaceutical R&D necessitates that pharmaceutical companies need to have an enormous number of drug projects in their R&D pipelines to ensure a continous flow of new drugs to the market.

The Timelines of Pharmaceutical R&D

The high number of R&D projects in the project portfolios of pharmaceutical companies together with the long timelines in preclinical research and drug development make drug R&D complex. Today, the total time from drug discovery to the registration of a new drug is about 14 years (Pammolli et al. 2011; Remnant et al. 2013). Table 2.7 highlights some research results and review findings in respect with R&D timing.

There have been diverse results reported in the past years on the total timing for drug R&D, which last on average between 12.3 and 14 years (Paul et al. 2010; Pammolli et al. 2011; Remnant et al. (2013); also see 2013 CMR International Pharmaceutical R&D Factbook, http://cmr-thomsonreuters.com/pdf/fb-exec-2013.pdf). The average clinical development phase and the average approval time for drugs approved between 2005 and 2009 were 6.4 years and 1.2 years, respectively (Kaitin and DiMasi 2009). It has been reported that the enactment of the PDUFA in 1992 resulted in a reduction of the average approval times by the FDA, which compensated the increasing time for the clinical development phases that have been reported in the studies listed in Table 2.7 (Kaitin and DiMasi 2009).

In a new and detailed analysis from 2010, it could be shown that discovery research, ranging from target identification to lead optimization, lasts 50 months on average, while the phases of preclinical testing and clinical development lasts for 12 and 78 months, respectively. The phase from submission to launch of a new drug lasts 18 months on average (Paul et al. 2010).

Differences in the timelines of clinical development phases of various therapeutic classes have also been reported. New drugs addressing CNS lasted longest, needing 10 years, while drugs for the treatment of AIDS antiviral had the shortest time lines, needing 4.9 years on average (Kaitin and DiMasi 2009).

In the past 5 years, the relative number of reviews by the FDA has been at a constant rate of 36–46 % of all NMEs approved by the FDA. In consequence, the impact of time saving by an advanced FDA review process has been notable.

In the studies in Table 2.7, timelines for basic research and post-approval times have not been included. Assuming that basic research in respect to a drug target lasts for several years before enough knowledge is available, that is a good rational to start with applied research of pharmaceutical R&D, and assuming that the post-approval Phase IV trials continue for years, the entire process of pharmaceutical R&D lasts for at least two decades.

The Cost of Pharmaceutical R&D

The low PoS in pharmaceutical R&D together with the long timelines and the strict regulatory requirements that make drug R&D so complex, result in enormously high costs for pharmaceutical innovation. In particular, the long timelines have an enormous impact on the costs of pharmaceutical R&D. As drug costs are associated with R&D expenditures that were invested many years ago, drug costs need to be capitalized until the day of return on investment. Excluding any other factors and assuming today’s timelines of 14 years for drug R&D, the total R&D costs of US$ 1.8 billion and total sales of US$ 250 million in the first year, followed by US$ 500 million in the second year, and US$ 1000 million in the third year, an additional 3 years are required till the day of return on investment. As a consequence, the costs of drug R&D need to be capitalized on a period of 14 years plus an additional time of 3 years. An increase in the interest rate and any prolongation of the R&D timelines has a negative impact on costs of drug R&D. The table 2.8 summarizes the development of costs of drug R&D in the past years.

It has been reported that the R&D costs have doubled every 8.5 years since 1950 (Munos 2009). The annual increase in capitalized costs per NME has been calculated to be 12.3 %. (Munos 2009). Before the 1990s, costs for drug R&D had been less than US$ 250 million (DiMasi 1991). In 2003, the average out-of-the-pocket costs were already US$ 403 million, and the capitalized costs had been calculated to be US$ 802 million (DiMasi et al. 2003). It has been stated that the increase was primarily related to increasing costs in clinical development ( + 350 % from 1991 to 2003) (DiMasi et al. 2003). Today, the total out-of-the-pocket costs for drug R&D have been calculated to be US$ 873 million, while the total capitalized costs are US$ 1.778 billion (Paul et al. 2010). It has been reported that the clinical development phases from Phase I to submission account for 63 % of these total R&D costs (Paul et al. 2010).

The reasons for the increasing R&D costs may relate with:

-

New technologies in drug research, such as combinatorial chemistry, DNA sequencing, high throughput screening, and computational drug design, that have been implemented to increase the throughput.

-

The increasing clinical trial sizes

-

The increasing costs for clinical infrastructure

-

A greater complexity of clinical trials conducted for drugs to treat chronic diseases (DiMasi et al. 2003)

-

A higher number of R&D personnel (Cohen 2005).

-

In particular, the clinical development functions accounted for more than 50 % of all R&D expenditures.

The cost calculations and assumptions listed in Table 2.8 may not be complete, as they do not include costs for basic research, costs related with Phase IV trials, costs for regulatory approvals in non-US markets, or costs for developing the same drug in new indications. Whereas the high capitalized costs are due to the long R&D timelines, most of the out-of-the-pocket costs are associated with the low PoS of drug R&D and, thus, with the costs of failed research projects and development compounds (Paul et al. 2010; Scannell et al. 2012).

A Steady-State R&D Model

It has been reported that 24 research projects need to be started every year to statistically yield in one new drug launched annually (Paul et al. 2010). In view of the pharmaceutical companies’ growth objectives and goals to produce two to three NMEs per year, pharmaceutical companies would need to start more than 60 research projects in the phase target to hit annually.

Table 2.9 summarizes the idealistic situation of an R&D project portfolio of a pharmaceutical company that is launching 2.5 NMEs into the market every year. Statistically, the company would need to start more than 60 research projects annually, if doing internal R&D only, to have a steady state of 32 projects in Phase I, 28.8 projects in Phase II, and 9.8 projects in Phase III. Given the data of Table 2.9, it is obvious that multinational pharmaceutical companies need to have a certain R&D size of more than 100 active projects in clinical development phases to be successful.

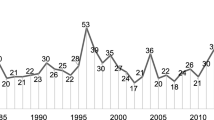

The Reduced R&D Efficiency

R&D efficiency has been defined as the ability of an R&D organization to translate an input, such as the investment, into an output, such as the number of new products launched to the market (Paul et al. 2010). Scannell and coauthors have analyzed the decline of the pharmaceutical R&D efficiency in a period from 1950 to 2010 and concluded that the number of new drugs approved per US$ 1 billion halved nearly every 9 years in the past 60 years, reaching a level of US$ 1 billion for 1 NME in 2000 (Munos 2009; Scannell et al. 2012). This trend is the result of a development in the pharmaceutical industry, whereby the number of new drugs launched by the industry was constant while the costs per new drug increased steadily. Today, the capitalized costs per new drug have been calculated to be US$ 1.778 billion although it could be assumed that the actual full costs of drug R&D are even higher (Paul et al. 2010). In an analysis by PriceWaterhouseCoopers (PWC), the costs per launch of a new drug were analyzed as the ratio of the total R&D costs of the industry to the total number of new drugs approved by the FDA (PWC 2012). It came out that the costs per NME in the years 2002–2011 were up to 4.6 billion (Fig. 2.5).

Development of industry-wide total R&D costs per new drug. R&D research and development (Data derived from: PWC 2012)

In a series of three papers, Forbes analyzed the costs of inventing new drugs, concluding that the average costs of drug development of top pharmaceutical companies are between US$ 3.3 and 13 billion (Harper 2012a, b, 2013). It has also been concluded that smaller pharmaceutical companies need less money to launch a new drug. This may relate to the fact that only successful small companies have been considered in the statistic and failed companies were disregarded. Finally, it was investigated that the top pharmaceutical companies, that have launched more than four NMEs in the 10 years from 2002 to 2011, invested more than US$ 5 billion per new drug. Table 2.10 summarizes an analysis of 11 multinational pharmaceutical companies, including their R&D costs, the number of NMEs approved by FDA between 2001 and 2012, and their R&D efficiencies.

In the analysis of Table 2.10, it becomes apparent that the pharmaceutical companies listed had total R&D costs of US$ 4.5–18.6 billion per new drug approved by FDA in the past 10 years. On average, pharmaceutical companies invested US$ 9 billion per new drug (median US$ 7.6 billion), an amount that is significantly higher than the figures that have been calculated in previous publications (see Table 2.8).

Possible reasons for the low R&D efficiency have been discussed previously in context of the low PoS of pharmaceutical R&D and the high costs for pharmaceutical innovation. Furthermore, an insufficient number of projects in preclinical and early clinical phases may have negatively impacted the R&D efficiency (Paul et al. 2010). The increasing number of approved drugs raised the hurdle for approval and reimbursement of new drugs (Scannell et al. 2012). In the same way, a lower risk tolerance of drug regulators may have increased both the challenges for launching new drugs and the development-associated costs (Scannell et al. 2012). It has been reported that the target-based screening in drug discovery replaced the phenotypic screening and that the potential of drug-screening methods in discovery research and their impact on timelines and PoS have been overestimated, while costs were increased (Swinney and Anthony 2011; Scannell et al. 2012). In the same context, a general belief that high-affinity binding to a single biological target is directly linked to a disease and, thus, the activity or inhibition of that target results in a medical benefit might be incorrect and misleading (Scannell et al. 2012). In addition, an increasing number of mergers might have influenced the efficiency of pharmaceutical R&D negatively (LaMattina 2011). And, finally, it has been said that the low-hanging fruits have already been picked, resulting in technically more complex investigations for new drug targets and related preclinical and clinical studies (Scannell et al. 2012).

PhRMA reported a stagnating overall R&D expenditure for its members since 2007 (PhRMA 2013) of minimum US$ 46.4 billion (2009) and maximum US$ 50.7 billion (2010). The industries’ output, measured in the total number of NMEs per year, has also been at a constant level during this time period. Both indicators show that, at least for the past years, the R&D efficiency of the pharmaceutical industry has not been reduced further and, in view of the NME output in the years 2011 and 2012 with 30 and 39 NMEs, respectively, there is hope for an increase in R&D efficiency in the future (see Table 2.11).

Consequences of the Reduced R&D Efficiency

The results of the reduced R&D efficiency have been enormous for the industry, as pharmaceutical innovations have been up to this point the major driver of its growth. The consequences have been either the attempt to reduce R&D costs, attrition rates and cycle times, or pharmaceutical companies have attempted to increase the R&D productivity, being defined as the relationship between the commercial value created by a new medicine, and the investment required to generate that new medicine (Paul et al. 2010). In detail, an increase in R&D productivity is possible by influencing the elements with the greatest impact on productivity, namely by an increase of the number of projects in the R&D pipeline, or an increase of the probability of technical and regulatory success per pipeline project, or an increase of the (financial) value per project, or a reduction of the cycle times, or the reduction of the costs per pipeline project. It has been reported that an improvement in R&D efficiency and R&D productivity is, in particular, possible by reducing attrition rate in Phase II and Phase III of clinical development (Paul et al. 2010).

Increasing the Number of Projects in the R&D Pipeline

The global R&D pipeline, which is the number of pipeline projects in the phases of preclinical testing to market launch, has increased enormously in the past years. Since 2001, the total number of projects listed in the pipelines of pharmaceutical companies worldwide has increased from 5995 to 11,307 (Citeline 2013). In 2014, 5484 projects were listed in the preclinical testing phase, 1541 in Phase I, 2011 in Phase II, 744 in Phase III, 170 in a preregistration phase and 1074 in market launch (Citeline 2013). In the past 3 years, the global pipeline increased in all phases of clinical development resulting in corporate R&D pipelines of top pharmaceutical companies of more than 200 pipeline projects. The group of companies with the most projects in their R&D pipeline is: GSK (261), Roche (248), Novartis (223), Pfizer (205), and AstraZeneca (197) (Citeline 2013). Within the top 25 pharmaceutical companies with the most projects in their R&D pipeline, 17 companies increased their pipeline size between 2013 and 2014. At the same time, the number of companies with an active R&D pipeline increased from 2745 (2013) to 3107 (2014), giving a reasonable expectation that the global pipeline size will also increase in the future, if enough venture capital is allocated to early drug research.

Reducing Costs of R&D

The total R&D expenditures increased enormously from 1995 (US$ 15.2 billion) to 2007 (US$ 47.9 billion; PhRMA 2013). Since 2007, the members of the PhRMA have reduced their financial efforts in R&D and total numbers are stagnating. Today, the total R&D investments are US$ 48.5 billion (see Fig. 2.6).

Total R&D expenditures of PhRMA members in the years of 1995–2012. (Data derived from PhRMA 2013)

The nominal expenditures of the top pharmaceutical companies are listed in Table 2.12.

The nominal R&D spending of 12 of the top pharmaceutical companies has been developing differently in the past years. Between 2007 and 2013, eight pharmaceutical companies have increased their total R&D spending against the industry trend, while four of the companies have decreased their R&D costs. At least for this group of companies, there is no clear strategic trend towards reduced nominal R&D expenditures, although some companies have cut their R&D efforts enormously. As for example, Pfizer announced in 2011 to reduce R&D costs by closing labs and reducing research spending by up to US$ 3 billionFootnote 1 GSK published in 2012 to reduce the R&D and manufacturing organizations by 2016.Footnote 2 And Merck & Co. announced a 17 % reduction in R&D personnel.Footnote 3

Generally, a reduction in R&D costs is related to:

-

A general reduction of R&D personnel, with a focus on lowering costs by reducing overhead functions in R&D, which is typically more prevalent in bigger organizations.

-

A greater focus in project and portfolio management on project costs (David et al. 2010).

-

Outsourcing to low-cost countries to reduce operational and infrastructure costs (David et al. 2010).

In an analysis on strategic outsourcing, CEPTON Strategies reported a 15 % share of outsourcing for R&D with a total outsourcing volume of US$ 70 billion in 2008.Footnote 4 Today, the top clinical research organizations (CROs) are the full-service providers Quintiles and Covance with total revenues in 2013 of US$ 3.8 and 2.4 billion, respectively.

Some pharmaceutical companies have tried to use the M&As of the past years to generate nominally bigger R&D organizations with larger project portfolios, higher cross-fertilization, better economies of scale, and reduced R&D rates. As for example, Pfizer has been through two mega-mergers in the past 10 years producing a company that finally did not grow in the number of employees or in the relative rate of R&D investment, but increased the nominal spending in R&D and its portfolio size.

In addition to Pfizer (12.9 %), GSK and Sanofi have been able to reduce their R&D rates in the past years and have achieved an R&D rate in 2013 of 14.3 and 14.5 %, respectively. All three figures are clearly under the historical industry benchmark of 20 %, showing a newer industry trend towards significant lower R&D investments. These figures are still far from the R&D rate of the worldwide biggest generic company Teva that had total sales in 2013 of US$ 20,314 billion and total R&D costs of US$ 1.422 billion with a resulting R&D rate of 7 %. However, the figures of Teva show the theoretically possible savings for some of the multinational pharmaceutical companies on their way to reduce R&D costs, if they decide to change their business model from purely R&D-based to a generic-based pharmaceutical company.

Another option to increase the R&D efficiency has been the change in the R&D business model from a centralized in-house R&D to smaller, more focused, and better manageable R&D units (Garnier 2008). Thereby, the archetype has been the biotechnology industry and the reorganizations that took place in the past years aimed at providing a more biotech-like and entrepreneurial spirit in pharmaceutical R&D organizations (Douglas et al. 2010; Zhong and Mosley 2010).

Measuring Performance and Managing the Project Portfolio Actively

A greater management attention towards project costs, resource allocation, and the active management of the project portfolio has been described as an effective method and success factor. The R&D pipeline size and the progress of R&D projects should be managed in accordance with a steady-state pipeline model. In view of the companies’ success rates per phase and the timing of the projects, a model needs to be set up that enables pharmaceutical companies to continuously deliver new drugs to the market. The focus of R&D needs to change from late-stage development projects that may provide success in the near term to all phases of drug R&D. Consequently, an adequate number of projects need to be in all preclinical research phases, followed by a sufficient number of projects in all phases of clinical development. As the financial and human resources of pharmaceutical companies are limited, the number of projects in the late-stage development needs to be reduced to a level that enable the company to reallocate the free resources to earlier phases, in particular to Phases I and II, to finally increase the success rate in a continuous pipeline model. To run a portfolio model, R&D performance metrics need to be installed, including the access to benchmark data of competitor companies. The portfolio decisions need to be based on medical need, technical feasibility, and commercial value. The critical path of each R&D project needs to be identified, and project management along the critical path needs to be optimized to reduce cycle times. Finally, pharmaceutical companies need to invest only in R&D tasks that support project-related decision making, reduce costs of technology development, and, thus, free up resources that can be allocated to drug projects. All efforts together should help to focus on those R&D tasks that are related to high-priority-drug R&D projects, reduced cycle times, and reduced attrition rates of drug projects.

Opening R&D Towards External Innovation

In view of the increased pressure on time and costs of pharmaceutical R&D, pharmaceutical companies needed to enlarge their portfolio breadth to meet at least parts of their growth objective by launching new drugs. Today, pharmaceutical companies use open innovation to harness innovation externally (Chesbrough 2003; Hunter and Stephens 2010). For example, companies fill their internally generated project portfolios by acquiring drug candidates (see Table 2.13). It has been described that multinational pharmaceutical companies have acquired on average 50 % of their pipeline projects from external sources (Schuhmacher et al. 2013).

Parallel to the development of project portfolios that were generated from internal and external sources, some pharmaceutical companies have aligned their organizational structures to access external innovation more efficiently. For example, GSK launched its Center for Excellence for External Drug Discovery in 2007, an externally focused R&D center that facilitates drug discovery alliances with external partners.Footnote 5 In 2010, Pfizer established the Centers for Therapeutic Innovation (CTI), an open innovation model that aims at founding global partnerships between Pfizer and academic medical centers.Footnote 6 Additionally, as early as 2002, Eli Lilly started the Fully Integrated Pharma Network (FIPNet), the Phenotypic Drug Discovery Initiative, the Target Drug Discovery Initiative, and Chorus, (Ernst & Young 2010).Footnote 7 , Footnote 8 Further examples of open innovation initiatives are the crowd-sourcing platform Grants for Targets of Bayer and PD2 of Eli Lilly (Lessl et al. 2011, see footnote 7). The potential of Open Source Drug Discovery and the African Network for Drug and Diagnostics Innovation have also been discussed (Munos 2010).

In the course of the opening of the R&D organizations, collaborations with academic institutions have also played an important role. It has been published that 30 % of all novel drugs come from academia and that academic institutes are a major source of drug projects (Kneller 2010).

In addition to drug targets, knowledge, and know-how in some therapeutic areas, academic collaboration partners can provide technologies and capabilities that are of value for pharmaceutical companies. As for example, the Division of Signal Transduction Therapy (DSTT) is a collaboration between the University of Dundee, the Medical Research Council (MRC), and six pharmaceutical companies, namely AstraZeneca, Boehringer Ingelheim, GSK, Janssen Pharmaceutica NV, Merck Serono, and Pfizer to perform research on the development of new drug treatments for major global diseases.Footnote 9 The Tuberculosis Drug Accelerator (TBDA) is a consortium of Abbott, AstraZeneca, Bayer, Eli Lilly, GSK, Merck & Co., and Sanofi together with Texas A&M University, Weill Cornell Medical College, and the Bill & Melinda Gates Foundation that was created to discover new treatments against tuberculosis.Footnote 10 Further major pharma–academia collaborations are compiled in Table 2.14.

Sustainable Growth in Times of Reduced R&D Efficiency

If R&D efficiency, defined as the costs per launch, is reduced, and if pharmaceutical companies are not able to increase their R&D efficiencies by the measures discussed before, they still can try to compensate it by increasing the value per drug launched, if the payers are willing to pay high prices for the new drugs. If the increase in the value per drug compensates for the rising costs completely, the R&D productivity is stable. If it overcompensates, the R&D productivity would increase. It has been highlighted that the value of one NME, measured as the 5-year post-launch sales, grew in the time period from 2010 (US$ 10 billion) to 2012 (US$ 16 billion) (EvaluatePharma 2013b). In contrast to this analysis, it is expected that the average peak sales per NME declines from US$ 900 million (2012) to US$ 600 million (2015), showing the increasing difficulty of offering benefits over existing treatments in light of the increasing price pressure (Berggren et al. 2012). In this context, the projected revenues of all NMEs launched between 2012 and 2016 are expected to be US$ 58 billion, whereas losses by patent expirations between 2013 and 2016 are forecasted to be US$ 123 billion, showing that the new revenues will not compensate for the revenue losses by patent expirations in the industry (Berggren et al. 2012; Schacht 2012; EvaluatePharma 2013a). It is challenging to project whether the industry will compensate the decline of R&D efficiency with an increase in value per drug launched, but the numbers presented herein show at least that the pharmaceutical industry needs to invent alternative scenarios to maintain sustainability.

Increasing Pressure from Generic Drugs

Pharmaceutical innovation has been, until now, the major driver of growth for the pharmaceutical industry. The reduced R&D efficiency and the challenges in increasing the value per drug launched make it necessary that pharmaceutical companies keep an eye out for other growth options. In a 2010 forecast by KPMG, it was said that growth of NMEs in the period of 2010–2015 are compensated by the losses resulting from patent expirations. Growth in the industry will come from the generics business ( + US$ 47 billion) and emerging markets ( + US$ 150 billion) (KPMG 2011). The total global spending on medicines has been forecasted to reach approximately US$ 1200 billion in 2017, an increase of US$ 205–235 billion from 2012.Footnote 11 In the same analysis, it has been said that growth in the developed countries will primarily come from new treatments in chronic diseases, such as cancer and diabetes. Growth in the “pharmerging” countries will result from an increase in sales in traditional therapy areas, although populations in “pharmerging” countries will also become older and obese, resulting in further growth options for the pharmaceutical industry. The worldwide prescription drug sales are forecasted to a total volume of US$ 895 billion in 2018 with a compound annual growth rate (CAGR) of 3.8 % between 2012 and 2018 (EvaluatePharma® 2013). Reviewing the growth of the global pharmaceutical market in geographical regions, two independent analyses have been made showing that the emerging countries will be the major drivers of growth with forecasted market potentials of US$ 499 and US$ 487 billion by 2020 (KPMG 2011; PWC 2012).

The challenge for the pharmaceutical industry is the low pharmaceutical sales per capita in “pharmerging” countries, which is 5–20 times lower than the pharmaceutical sales per person in developed countries (see Table 2.15). In particular, in the “pharmerging” countries, both health-care systems and private patients struggle to pay for new medicine.

Today, the market share of generic drugs in “pharmerging” countries is dominant. In 2012, generic drugs had a market share in China of 76 %, while off-patent drugs and innovative drugs with patent protection had a stake of 20 and 4 %, respectively (IMAP 2012). IMS has forecasted that generics will achieve a larger market share in developed and “pharmerging” countries by 2017 (see footnote 11). Consequently, some of the multinational pharmaceutical companies already generate today a major part of their total revenues outside the traditional main markets of Europe, USA, and Japan by selling generic drugs (PWC 2012). It has been forecasted that the emerging countries will contribute as much to global pharmaceutical profits as the USA by 2020 (KPMG 2011). Thus, even if there is an increase in the worldwide total sales of the pharmaceutical industry, the lower profits of the “pharmerging” countries result in lower profit margins of pharmaceutical companies. This development will result in lower investments in R&D in the future and will increase the pressure on R&D organizations to improve their R&D efficiencies.

Sustainability Must Come from R&D

In view of the limited growth options that are offered to the pharmaceutical sector in the coming years, pharmaceutical companies need to focus on the increase in R&D efficiency and R&D productivity. In addition to what has been said before, pharmaceutical companies should follow the following strategies:

-

Focus on therapeutic areas and drug candidates with the greatest PoS.

-

Focus R&D activities on drug candidates that can provide benefit to real patients’ needs.

-

Provide real differentiated new products.

-

Focus on personalized medicine, as biomarker-based patient stratification has been cited to increase PoS across all phases in drug development of oncology drugs (Hayashi et al. 2013).

-

Further, reduce R&D costs by focusing R&D on core competences and outsource nondifferentiating activities to external experts.

-

Create asset pools and combine R&D activities of pharmaceutical companies.

-

Provide tailor-made products for developed and “pharmerging” countries and differentiate the drug prices, respectively.

Furthermore, a mega-fund has been proposed to increase financial funding of industry-wide R&D activities,as smaller companies are critically important for discovering innovative drugs (Kneller 2010; Fernandez et al. 2012). The mega-fund could finance target identification and validation. In combination with a broader externalization of pharmaceutical R&D to smaller and specified companies, this would help to mitigate technical risks associated with early drug research, while using the competences of pharmaceutical companies in preclinical testing and clinical development (Mullard 2012a). There is hope in respect to the large number of novel targets that, if investigated and clinically validated, could be basis for new, more efficacious, and safer drugs (Berggren et al. (2012); Scannell et al. 2012). There is reasonable expectation that new drugs can provide a therapeutic benefit that comes from interacting with different targets.

Other options to increase R&D efficiency and productivity are drug repositioning and incremental innovations, such as the screening of abandoned, failed, or approved drugs for new uses, or the improvement of formulations or new uses of existing drugs (Cohen 2005; Mullard 2011). These strategies are not new for the industry, but could get more significance, if pharmaceutical companies realize that there are defense strategies other than patent rights based on novelty and inventive step. Optionally, a prolongation of the 5-year supplementary protection certificate (SPC) for pharmaceuticals might also provide more funding to for pharmaceutical R&D.

Pharmaceutical R&D is and will be a very expensive adventure with an overall low PoS and long timelines. In particular, the challenge of high costs makes it more and more difficult to pharmaceutical companies to afford R&D and to provide new drugs to the market. Any option that might increase funding, in particular, in the research of new drugs, would be very helpful and supportive and would help the pharmaceutical industry to keep sustainability.

Notes

- 1.

- 2.

- 3.

- 4.

CEPTON Strategies – Strategic outsourcing across the pharmaceutical value chain (http://www.cepton.net/publications/download/cepton-Strategic-outsourcing-across-the-pharmaceuticals-value-chain.pdf)

- 5.

- 6.

- 7.

- 8.

- 9.

- 10.

- 11.

IMS Institute, The global Use of Medicine: Outlook Through 2017, http://www.imshealth.com/deployedfiles/imshealth/Global/Content/Corporate/IMS%20Health%20Institute/Reports/Global_Use_of_Meds_Outlook_2017/IIHI_Global_Use_of_Meds_Report_2013.pdf

References

Agarwal P. Novelty in the target landscape of the pharmaceutical industry. Nat Rev Drug Discov. 2013;12:575–6.

Arrowsmith J, Miller P. Trial watch: phase II and phase III attrition rates 2011–2012. Nat Rev Drug Discov. 2013;12:569.

Berggren R, et al. Outlook for the next 5 years in drug innovation. Nat Rev Drug Discov. 2012;11:435–6.

Chesbrough H. Open innovation. In The new imperative for creating and profiting from technology. Boston: Harvard Business School Press; 2003.

Citeline. Pharma R & D annual review. 2013. http://www.citeline.com/wpcontent/uploads/Annual-Review-2014b.pdf. (2013). Accessed 28 Oct 2014.

Cohen FJ. Macro trends in pharmaceutical innovation. Nat Rev Drug Discov. 2005;4:78.

David E, et al. Pharmaceutical R&D: the road to positive returns. Nat Rev Drug Discov. 2010;8:609–10.

DiMasi JA. Cost of innovation in the pharmaceutical industry. J Health Econ. 1991;10:107–42.

DiMasi JA, et al. The price of innovation: new estimates of drug development costs. J Health Econ. 2003;22:151–85.

DiMasi JA, et al. Trends in risks associated with new drug development: success rates for investigational drugs. Clinic Pharmacol Ther. 2010;87(3):272–7.

Douglas FL, et al. The case for entrepreneurship in R&D in the pharmaceutical industry. Nat Rev Drug Discov. 2010;9:683–9.

Ernst & Young. Beyond the Borders—Global Biotechnology Report 2010. 2010

European Commission—Joint Research Centre. The 2013 EU Industrial R & D Investment Scoreboard 2013. http://iri.jrc.ec.europa.eu/documents/10180/1960e4e9–37ea-4774-a8d1-c4b1629e7ab1. Accessed 28 Oct 2014.

EvaluatePharma®. Annual company reports (2011). Datamonitor® 2011.

Evaluate Pharma. 2012 Year in review. 2013a. http://info.evaluatepharma.com/rs/evaluatepharmaltd/images/EPV_Review_2012.pdf. Accessed 28 Oct 2014.

EvaluatePharma®. World Preview 2013, Outlook 2018 Returning to Growth. 2013b. http://download.bioon.com.cn/view/upload/201307/26155533_4502.pdf. Accessed 28 Oct 2014.

Fernandez J-M, et al. Commercializing biomedical research through securitization techniques. Nat Biotechnol. 2012;30:964–75.

Frantz S. 2003 approvals: a year of innovation and upward trends. Nat Rev Drug Discov. 2004;3:103–5.

Frantz S. 2005 approvals: safety first. Nat Rev Drug Discov. 2006;5:92–3.

Frantz S, Smith A. New drug approvals for 2002. Nat Rev Drug Discov. 2003;2:95–6.

Frye S, et al. US academic drug discovery. Nat Rev Drug Discov. 2011;10:409–10.

Garnier JP. Rebuilding the R & D engine in big pharma. Hav Bus Rev. 2008;86:68–79.

Harper M. The cost of creating a new drug now $ 5 billion, pushing big pharma to change. 2012a. http://www.forbes.com/sites/matthewherper/2013/08/11/how-the-staggering-cost-of-inventing-new-drugs-is-shaping-the-future-of-medicine/. Accessed 28 Oct 2014.

Harper M. The truly staggering cost of inventing new drugs. 2012b. http://www.forbes.com/sites/matthewherper/2012/02/10/the-truly-staggering-cost-of-inventing-new-drugs/. Accessed 28 Oct 2014.

Harper M. How much does pharmaceutical innovation cost? A look at 100 companies. 2013. http://www.forbes.com/sites/matthewherper/2013/08/11/the-cost-of-inventing-a-new-drug-98-companies-ranked. Accessed 28 Oct 2014.

Hayashi K, et al. Impact of biomarker usage on oncology drug development. J Clin Pharm Ther. 2013;38:62–7.

Hughes B. 2007 FDA drug approvals: a year of flux. Nat Rev Drug Discov. 2008;7:107–9.

Hughes B. 2008 FDA drug approvals. Nat Rev Drug Discov. 2009;8:93–6.

Hughes B. 2009 FDA drug approvals. Nat Rev Drug Discov. 2010;9:89–92.

Hunter J, Stephens S. Is open innovation the way forward for big pharma? Nat Rev Drug Discov. 2010;9:87–8.

IMAP. Global Pharma & Biotech M & A Report 2012. 2012. http://www.imap.com/imap/media/resources/Pharma_Report_2012_FINAL_2F6C8ADA76680.pdf.

Kaitin KI, DiMasi JA. Pharmaceutical Innovation in the 21st Century: New Drug Approvals in the First Decade, 2000–2009. Clin Pharmacol Ther. 2011;89(2):183–8.

Kneller R. Nat Rev Drug Discov. 2010;9:867–82.

Kola I, Landis J. The importance of new companies for drug discovery: origins of a decade of new drugs. Nat Rev Drug Discov. 2004;3:711–6.

KPMG. Future Pharma, five strategies to accelerate the transformation of the pharmaceutical industry by 2020. 2011. http://www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/Documents/future-pharma.pdf. Accessed 28 Oct 2014.

LaMattina JL. The impact of mergers on pharmaceutical R&D. Nat Rev Drug Discov. 2011;10:559–60.

Lessl M, et al. Grants4Targets–an innovative approach to translate ideas from basic research into novel drugs. Drug Discov Today 2011;16:288–92.

Mullard A. 2010 FDA drug approvals. Nat Rev Drug Discov. 2011;10:82–5.

Mullard A. Economists propose a US$30 billion boost to biomedical R&D. Nat Rev Drug Discov. 2012a;11: 735–7.

Mullard A. 2011 FDA drug approvals. Nat Rev Drug Discov. 2012b;11:91–4.

Mullard A. 2012 FDA drug approvals. Nat Rev Drug Discov. 2013;11:87–90.

Mullard A. 2013 FDA drug approvals. Nat Rev Drug Discov. 2014;13:85–91.

Munos B. Lessons from 60 years of pharmaceutical innovation. Nat Rev Drug Discov. 2009;8:959–68.

Munos B. Can open-source drug R&D repower pharmaceutical innovation? Clin Pharmacol Ther. 2010;87:534–6.

Owens J. 2006 drug approvals: finding the niche. Nat Rev Drug Discov. 2007;6:99–101.

Pammolli F, et al. The productivity crisis in pharmaceutical R&D. Nat Rev Drug Discov. 2011;10:428–38.

Paul SM, et al. How to improve R&D productivity: the pharmaceutical industry’s grand challenge. Nat Rev Drug Discov. 2010;9:203–14.

PhRMA. Pharmaceutical Industry 2013 Profile. 2013. http://www.phrma.org/sites/default/files/pdf/PhRMA%20Profile%202013.pdf. Accessed 28 Oct 2014.

PWC. From vision to decision Pharma 2020. 2012. www.pwc.com/pharma2020 (2012). Accessed 28 Oct 2014.

Remnant J, et al. Measuring the return from pharmaceutical innovation 2013. http://thomsonreuters.com/business-unit/science/subsector/pdf/uk-manufacturing-measuring-the-returnfrom-pharmaceutical-innovation-2013.pdf (2013).

Sams-Dodd F. Target-based drug discovery: is something wrong? Drug Discov Today 2005;10:139–47.

Scannell JW, et al. Diagnosing the decline in pharmaceutical R&D efficiency. Nat Rev Drug Discov. 2012;11:191–200.

Schacht WH. Drug patent expirations: Potential effects on pharmaceutical innovation. CRS Report for Congress. http://ipmall.info/hosted_resources/crs/R42399_120302.pdf (2012).

Schuhmacher A, et al. Models for open innovation in the pharmaceutical industry. Drug Discovery Today 2013;18:1133–7.

Swinney DC, Anthony J. Nat Rev Drug Discov. 2011;11:507–19.

Zhong X, Mosley GB. Mission possible: managing innovation in drug discover. Nat Biotechnol. 2007;25:945–6.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Schuhmacher, A. (2015). Can Innovation Still Be the Main Growth Driver of the Pharmaceutical Industry?. In: Morgon, P. (eds) Sustainable Development for the Healthcare Industry. Perspectives on Sustainable Growth. Springer, Cham. https://doi.org/10.1007/978-3-319-12526-8_2

Download citation

DOI: https://doi.org/10.1007/978-3-319-12526-8_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-12525-1

Online ISBN: 978-3-319-12526-8

eBook Packages: Business and EconomicsBusiness and Management (R0)