Abstract

Following Corrado et al. (Review of Income and Wealth 55:658–660, 2009), we measure intangible assets at the listed firm level in Japan. Compared to the conventional Tobin’s Q, the revised Q including intangibles is almost 1 on average, as suggested by Hall (Brookings Papers on Economic Activity 1:73–118, 2000 and American Economic Review 91:1185–1202, 2001). The standard deviation of the revised Q is smaller than that of the conventional Q. Estimation results based on Bond and Cummins (Brookings Papers on Economic Activity 1:61–124, 2000) show that greater intangible assets increase firm value. In particular, in the IT industries, on average Tobin’s Q is higher than that in the non-IT industries, and the stock market reflects the value of intangibles in the IT industries. These results suggest that the government should adopt policies that promote investment, including intangibles in the IT industries, and change in industry structure in Japan.

This research was conducted as a part of the Research Institute of Economy, Trade and Industry (RIETI) research project (Study on Intangible Assets in Japan). We thank Kazumi Asako (Hitotsubashi University), Ryokichi Chida (Meiji University), Takashi Dejima (Sophia University), Kyoji Fukao (Hitotsubashi University), Masahisa Fujita (President, RIETI), Masayuki Morikawa (Vice President, RIETI), Keiichiro Oda (RIETI), Kazuo Ogawa (Osaka University), Kazuyuki Suzuki (Meiji University), Yohei Yamamoto (Hitotsubashi University), and participants of workshops at Gakushuin University, Hitotsubashi University, Meiji University, The 9th APEA Conference at Osaka University, and RIETI for excellent comments and suggestions. This study is partly supported by a Grant-in-Aid for Scientific Research from the Ministry of Education, Culture, Sports, Science and Technology (No. 22223004). MihoTakizawa also acknowledges the support from Grant-in-Aid for Young Scientists (B)(No. 24730252).The views expressed in this paper are those of authors and should not be attributed to any organization.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

5.1 Introduction

In the 1990s, new types of firms such as Amazon and Google were founded and grew rapidly under the IT revolution. There are several characteristics of these firms. As Brynjolfsson (2004) pointed out, they developed new software, invested in human capital, and formed organizational structures that enabled faster decision-making. Due to the success of these firms, economists have paid attention to the role of intangible assets on firm performance and firm value. Corrado et al. (2009) measured comprehensive intangible investment including software investment, investment in human capital, and reform in organizational structure, and showed the significant contribution of intangible assets to US economic growth. Following Corrado et al. (2009), the positive effects of intangible assets on economic growth were found in the advanced countries.Footnote 1

At the firm level, there have been several studies on the effects of R&D investment, which is a part of intangible investment on firm performances and firm value.Footnote 2 However, Hall (2000, 2001) pointed out that after the IT revolution, the stock market may be evaluating not only R&D stocks but also other types of intangible assets positively. To examine the determinants of firm value after the IT revolution, we need to measure a broader concept of intangible assets beyond R&D assets like Corrado et al. (2009).

Thus, in our paper, we measure comprehensive intangible assets following Corrado et al. (2009) by using data of Japanese listed firms. Based on our measurement, we examine the relationship between firm value and intangible assets, and estimate Tobin’s Q using not only intangible but also tangible assets. From the above studies, we find that the mean value of Tobin’s average Q becomes close to 1 and its variance becomes small when we consider intangible assets, as Hall (2000, 2001) expected. We also find that intangible assets are positively correlated with firm value. The estimation results show that the accumulation of intangible assets significantly increases firm value. The effect is particularly pronounced and significant in the IT related industries.

Our study consists of six sections. In the next section, we review the existing literature on the measurement of intangible assets and how intangible assets are evaluated in the stock market. In the third section, we explain how we measure intangible assets. In the fourth section, we examine several features of Tobin’s Q that take intangible assets into account. In the fifth section, we examine the effects of intangible assets on firm value by estimating a standard average Tobin’s Q. In the last section, we summarize our findings.

5.2 Intangible Assets and Firm Value: A Literature Review

Hall (2000, 2001) pointed out that the Tobin’s Q in the US consistently exceeded 1. He subsequently argued that as adjustment costs of tangible investment are accumulated as intangible assets within a firm, the gap between Tobin’s Q and 1 is accounted for intangible assets.Footnote 3 To examine Hall’s proposition, Brynjolfsson et al. (2002) estimated firm value using non-IT capital and IT capital, and found that the coefficients of IT capital were much greater than those of non-IT capital. Then, they argued that these large coefficients were affected by intangible assets, complementary to IT capital. Cummins (2005) and Miyagawa and Kim (2008) estimated firm value using not only non-IT capital and IT capital but also with R&D capital and advertisement capital. Although Cummins (2005) did not find a higher than normal rate of return for intangible assets, Miyagawa and Kim (2008) obtained the opposite results to Cummins (2005).

Although Cummins (2005) and Miyagawa and Kim (2008) focused on R&D capital and advertisement capital, Lev and Radhakrishnan (2005) recognized a portion of sales, general and administrative expenditures as organizational capital. By estimating the difference between market value and book value using organizational capital, they found that organizational capital significantly contributed to market value. Hulten and Hao (2008) estimated firm value of pharmaceutical companies by R&D capital, and organizational capital measured from sales, general and administrative expenditures, and showed that both of these types of intangible assets contributed to increasing firm value.

Abowd et al. (2005) constructed their own measure with respect to quality of human capital from employer-employee datasets. They estimated firm value by obtaining Compustat data using the measure of quality of human capital, and found that their measure was positively correlated with the value of the firm. Bloom and Van Reenen (2007) also constructed their own management score taking organizational management and human resource management into account, using their interview surveys. They showed that this management score was positively correlated with Tobin’s Q. Görzig and Görnig (2012) measured intangible assets by estimating the share of labor costs of IT, R&D, and management and marketing employees. Once they considered intangible assets, they showed that the dispersion of rate of return on capital was reduced dramatically.

5.3 Measurement of Intangible Assets in Japanese Listed Firms

Although previous studies have shown the contribution of intangible assets to firm value, they did not capture comprehensive intangible assets like Corrado et al. (2009). Therefore, among intangible assets classified by Corrado et al. (2009), we measure five types of intangibles; software, R&D, brand equity, firm specific human capital, and organizational change. This concept of intangibles is broader than that of previous studies.Footnote 4

Corrado et al. (2009) classified intangible assets into three categories: computerized information, innovative property, and economic competencies. Software investment is a part of investment in computerized information consists of three types of software; custom software investment, packaged software investment, and own account software investment. R&D investment is included in investment in innovative property.Footnote 5 Investment in economic competencies consists of brand equity, firm specific human capital, and organizational change. We measure these three components depending on the data in DBJ Corporate Financial Databank. The detailed methods we use to measure the five items mentioned above for each firm are as follows:

-

1.

Software: First, the ratio of workers engaged in information processing to the total number of employee is multiplied by the total cash earnings in order to measure the value of software investment. Then, we add the cost of information processing to this number to find total software investment. All the information is obtained from Basic Survey of Business Activities of Enterprises (BSBAE). We deflate this number by the deflator for software investment in the Japan Industrial Productivity (JIP) database.Footnote 6 , Footnote 7

-

2.

Research and Development (R&D): We subtract the cost of acquiring fixed assets for research from the cost of R&D (i.e., in-house R&D and contract R&D) to estimate the value of investment into R&D. All the information is obtained from BSBAE. The output deflator for research (private) in the JIP database is used to deflate this R&D investment.

-

3.

Brand equity: Brand equity is measured based on expenditures on advertising. The data of advertising expenses are obtained from the DBJ Corporate Financial Databank. We use the output deflator for advertising in the JIP database as the deflator for advertising investments.

-

4.

Firm specific human capital: First, we estimate each firm’s investment on firm-specific skills by multiplying (1) the total labor cost in the DBJ Corporate Financial Databank with (2) the industry-average ratio of total employee training cost to the total labor cost for each firm from the General Survey of Working Conditions and (3) the ratio of the on-the-job and off-the-job training costs for firm-specific skills to the total education cost (0.37).Footnote 8 In order to further consider the opportunity cost of the off-the-job training cost for skill improvement, we multiply the number computed in the abovementioned procedure to 2.51.Footnote 9

-

5.

Organizational change: Following Robinson and Shimizu (2006), who conducted a survey of the time-use of Japanese CEOs, we assume that 9 % of board members’ compensation—which we can obtain from the DBJ Corporate Financial Databank—accounts for investment in organizational change. This is deflated by the output deflator for education (private and non-profit) in the JIP database.

For all five investment category data detailed above, we employ the Perpetual Inventory (PI) method, in which we use FY1995 as the base year, to construct a data series of intangible assets from FY2000. All depreciation rates used for this computation follow that of Corrado et al. (2012).Footnote 10

5.4 Tobin’s Q with Intangibles

The conventional Tobin’s Q (Q C it ) at the firm level is measured as the ratio of firm value (V it ) to the replacement value of tangible assets ((1 − δ K )K it − 1) at the initial period of t.Footnote 11

where δ k is the depreciation rate of tangible assets. We measure the conventional Tobin’s Q as follows:

The conventional Tobin’s Q = (Stock value + Book values of commercial paper, corporate bond, and long-term debt)/(1 − δ K ) * (Replacement values of tangible assets + Inventory-Short-term debt).

As shown by Lindenberg and Ross (1981), and Hall (2000, 2001) for the US and Tanaka and Miyagawa (2011) for Japan, the standard Q expressed by (1) has persistently exceeded 1. The mean value of the conventional Tobin’s Q shown in Table 5.1 is also 1.40.

Lindenberg and Ross (1981) explained the gap between the measured conventional Q and 1 as being due to monopoly rents, although they knew that unmeasured intangibles affected this gap. When we measure the Tobin’s Q considering intangible assets (N it − 1) as measured in Sect. 5.3, the revised Tobin’s Q (Q R it ) is expressed as follows:

where δ N is the depreciation rate in intangible assets.

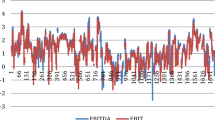

We show a revised Tobin’s Q including intangible assets in Table 5.2. The mean value of the revised Tobin’s Q is 0.99 which is almost equal to 1. The difference between the two mean values is significant. The standard deviation of the revised Q is smaller than that of the conventional Q, which is consistent with the results of Görzig and Görnig (2012), who showed that the dispersion of profit rates when including intangible assets is smaller than that without intangibles. The distributions of two types of Tobin’s Q are shown in Fig. 5.1. We find that the revised Tobin’s Q is distributed around 1 compared to the conventional one. The Kolmogorov-Smirnov test rejected the hypothesis that the two distributions are the same.

We divide all samples into two sectors: IT sectors and non-IT sectors.Footnote 12 The mean value of Tobin’s Q in IT sectors is higher than that in non-IT sectors in both cases. However, the mean value of the revised Q in the IT sectors is 1.13, which is much closer to 1 than the mean value of the conventional Q in the IT sectors. Also, the standard deviation of the revised Q in the IT sectors is reduced compared to that of conventional Q in the IT sectors (Tables 5.3, 5.4, 5.5, and 5.6).

Arato and Yamada (2012) measured aggregate intangible assets based on DBJ data. Their estimated ratio of intangible assets to tangible assets is 0.47 in the 1980s. As shown in Table 5.7, the corresponding rate of our estimates is 0.45, which is similar to that of Arato and Yamada (2012). The result shows that the ratio of intangible assets to tangible assets has not changed in Japan.

5.5 Do Intangible Assets Explain the Overvaluation of Tobin’s Q?

5.5.1 The Relationship of the Conventional Tobin’s Q with Intangibles

Although the revised Q is almost equal to 1 on average, the Tobin’s Q in each firm deviates from 1. Thus, we econometrically check the effects of intangible assets on the variation of Tobin’s Q. As we introduced in Sect. 5.2, Brynjolfsson et al. (2002), Cummins (2005) and Miyagawa and Kim (2008) estimated the effects of intangible assets on firm value. However, these studies focused on fewer components of intangibles than those classified by Corrado et al. (2009). Therefore, we examine the effect of intangibles following the classification by Corrado et al. (2009) on firm value.

Following Bond and Cummins (2000), the profit function (π) depends on tangible and intangible capital. Dividends at firm i (Di) are expressed as follows:

where I is investment in tangible assets, O is investment in intangible assets, and G and H are adjustment cost functions in tangible investment intangible investment, respectively.Footnote 13

Capital accumulation in tangible assets and intangible assets is expressed as follows:

We solve the optimization problems of firm i with respect to I, and O.

where qK and qN are Lagrange multipliers.

When the profit function is linear homogeneous, the firm value of firm i is expressed as a linear combination of each asset (Wildasin (1984) and Hayashi and Inoue (1991)).

From Eq. (5.5),

Substituting Eqs. (5.4a) and (5.4b) into Eq. (5.6), we obtain:

where \( {Q}_{it}^C=\frac{V_{it}}{\left(1-{\delta}_K\right){K}_{it}} \) is the standard average Q at firm i.

Equation (5.7) implies that the gap between the conventional Q ratio and 1 is explained by the ratio of intangible assets to tangible assets, the gross tangible investment/tangible assets ratio, and the gross intangible assets ratio.

5.5.2 Estimation Results

Based on Eq. (5.7), we estimate the following equation:

In Eq. (5.8), Xij is a control variable. Lindenberg and Ross (1981) pointed out that monopoly rents explained the overvaluation of firm value. In addition, financial constraints may affect the gap between a standard Q and 1. Then, we also estimate Eq. (5.8) with a price cost margin or external finance dependence as defined by Rajan and Zingales (1998). We expect that the coefficient of external finance dependence will be negative because a greater dependence on external finance reduces firm value. The basic statistics of the variables used in our estimation are summarized in Table 5.8.

First, we estimate Eq. (5.8) by OLS. To avoid endogeneity, we take a 1-year lag for all explanatory variables except firm age. The estimation results are shown in Table 5.9. In Column (1), we focus on the effect of intangible assets on the overvaluation of the conventional Q. In this estimation, the ratio of intangible to tangible assets significantly explains the overvaluation of the Q ratio. In Column (2), we regress firm value on three variables included in Eq. (5.7). The estimation results show that all variables are positive and the ratio of intangible to tangible assets, and the tangible investment/tangible assets ratio are significant. Due to the strong correlation between intangible assets/tangible assets and intangible investment/tangible assets ratio, the coefficient of intangible investment/tangible assets ratio may be not significant.

In Columns (3) and (4), we estimate Eq. (5.8) including control variables. In Column (3), all three variables in Eq. (5.7) are positive and significant. In addition, the coefficient of external finance dependence is negative and insignificant, as we expected. In Column (4), the ratio of intangible assets to tangible assets and the price cost margin are positive and significant, while intangible and tangible investments are not significant.

Next, we estimate Eq. (5.8) utilizing the instrumental variable method. Instruments are the ratio of white-collar to total workers, and external finance dependence. The results in Table 5.10 indicate that the ratio of intangible assets to tangible assets is positive and significant in all estimations. However, the intangible investment/tangible assets ratio is negative in Columns (2) and (3). It is possible that negative coefficients of intangible investment/tangible assets are caused by the multicollinearity between intangible assets and intangible investment.

We also conduct panel estimations. As the Hausman test suggests that the random effect estimation is better than fixed effect estimation, we show the results of random effect estimations in Table 5.11. Table 5.11 shows that the ratio of intangible assets to tangible assets is positive and significant in all estimations. As the coefficient of price cost margin is also positive and significant, monopoly rents also contribute to the valuation of firm, as Lindenberg and Ross (1981) suggested.

Brynjolfsson et al. (2002), Basu et al. (2003), and Cummins (2005) emphasized that intangible assets are complementary to IT assets. Miyagawa and Hisa (2013) found that intangible investment in the IT sectors improve TFP growth. In Sect. 5.4, we found that the Tobin’s Q in IT sectors is higher than that in non-IT sectors. Then, we divide all samples into those in the IT sectors and non-IT sectors and estimate Eq. (5.8) by the instrumental variable method in each sector. Table 5.12 shows that estimation results in IT sectors are similar to those in Table 5.10. The ratio of intangible to tangible assets is positive and significant in all estimations when the coefficients of intangible and tangible investments are not significant. However, in the non-IT sectors, the coefficients of the ratio of intangible to tangible assets are not necessarily significant, while the signs of the coefficients are positive in all estimations. The estimation results in Table 5.12 imply that only intangible assets in the IT industries contribute significantly to the evaluation of firm value.Footnote 14 In addition, the price cost margin is positive and significant in the IT and non-IT sectors, as can be seen in Tables 5.10 and 5.11.

As explained in Sect. 5.3, we measure five types of intangible assets; software, R&D, brand equity, firm specific human capital, and organizational change. We examine what kind of assets the stock market assesses favorably. Estimation results in Table 5.13 show that the stock market assesses assets in software and firm specific human capital favorably, while the assessments of R&D, brand equity, and organizational change are inconclusive. These results imply that the stock market does not necessarily consider all components of intangibles as positive.

Figure 5.1 shows that the sample deviation from the mean value is not symmetric. In this case, quantile regression—that estimates parameters based on the error measured as a deviation from the median value in each quantile—is useful to check the robustness of our results. We separate the distribution of a conventional Tobin’s Q into four quantiles and conduct quantile regression. Table 5.14 shows the estimation results of quantile regression that correspond to the OLS estimations in Table 5.9. As in Table 5.9, the firm value reflects intangible values in all estimations. In addition, intangible investment also contributes positively and significantly to the increase in firm value (Column (2)), while the coefficient of this variable is not significant in Table 5.9. As a result, the above two alternative estimations confirm the positive and significant contributions of intangible assets to firm value.

5.6 Concluding Remarks

The IT revolution has changed the growth strategy of firms. Software investment has become as important as tangible investment. Firms have focused on accumulation in human capital and restructured their organizations to be compatible with the new technology. Many economists such as E. Brynjolfsson, C. Corrado, R. Hall, C. Hulten, B. Lev, and L. Nakamura summarized these new types of expenditures as intangible investment and examined its effects on firm value. However, many studies have focused on the effects of specific components of intangible assets on firm value, because it is difficult to measure intangibles at the firm level.

Based on the classification of intangibles by Corrado et al. (2009), we measure a broader concept of intangibles than those in the previous studies using the listed firm-level data in Japan. The mean value of Tobin’s Q including intangible assets is almost equal to 1, while the mean value of conventional Tobin’s Q exceeds 1, as Hall (2000, 2001) suggested. The standard deviation of the revised Q is smaller than that of the conventional Q, which is consistent with the results of Görzig and Görnig (2012). These results imply that stock prices reflect the value of intangibles.

Although the results also imply that the market concludes that there are no growth opportunities of Japanese listed firms on average in the 2000s, there are still differences in Tobin’s Q. The Tobin’s Q in the IT industries is consistently higher than that in the non-IT industries. This difference in market value suggests that firms in the IT industries should expand their businesses, and firms in the non-IT industries should restructure their businesses. The result is consistent with Miyagawa and Hisa (2013), who argued that intangible investment improves productivity in the IT industries. The Japanese government should take growth strategies such as to promote investment including intangibles in the IT industries and to assist firms in the non-IT industries transform themselves to a business in a growth industry.

Using our measures, we examined the effects of intangibles on firm value. Estimation results following Bond and Cummins (2000) showed that greater intangible assets increase firm value. As these results are robust in the IT industries in particular, they support our policy implications. However, not all intangible assets are valued in the stock market. The values of innovative property and economic competencies are inconclusive. One possible reason for the long-term slump of the Japanese stock market is that investors are not valuing high level R&D investment and human resources in Japanese firms. The upcoming reform in accounting standards that will evaluate intangible assets will contribute to the revitalization of the Japanese stock market.

Notes

- 1.

Intangible investment was measured at the aggregate level by Marrano et al. (2009) for the UK, Fukao et al. (2009) for Japan, Delbeque and Bounfour for France and Germany, Hao et al. (2008) and Piekkola (2011) for the EU countries, Barnes and McClure (2009) for Australia, and Pyo et al. (2010) for Korea. At the sectoral Level, Miyagawa and Hisa (2013) measured intangible investment and showed positive effect on productivity growth.

- 2.

- 3.

Hall uses the term ‘e-capital’ instead of organization capital.

- 4.

The measurement of tangible assets evaluated at replacement cost is also explained in Appendix 1.

- 5.

Although innovative property accounts for various items possibly including science and engineering R&D, mineral exploitation, copyright and license costs, and other product development, design, and research expenses, we measure only R&D expenditures, due to the lack of reliable data for intangibles except R&D in innovative property.

- 6.

In this procedure, we were not able to measure purchased software investment, which is included in the capital expenditure in the balance sheets of each firm. We ignore this part due to data limitations on capitalized software in our data.

- 7.

The JIP database consists of 108 industries. The website of the database is http://www.rieti.go.jp/en/database/JIP2011/index.html. Fukao et al. (2007) explain how this database was constructed.

- 8.

For the ratio of the job training costs for firm-specific skill to overall employee training costs, we use the results in Ooki (2003).

- 9.

Ooki (2003) estimates the ratio of the average opportunity cost of off-the-job training to the total employee training cost paid by firm (all industry) in 1998 as 1.51. Ooki (2003) uses the micro-data obtained from “The Japan Institute for Labor Policy and Training’s Survey on Personnel Restructuring and Vocational Education/Training Investment in the Age of Performance-based Wage Systems” (Gyoseki-shugi Jidai no Jinji Seiri to Kyoiku/Kunren Toshi ni Kansuru Chosa).

- 10.

The depreciation rates of software, R&D, advertising, human capital and organizational change are 31.5%, 15%, 55%, 40% and 40%, respectively.

- 11.

As for the derivation of the conventional Q, we follow Bond and Cummins (2000).

- 12.

The classification of IT industries and non-IT industries is shown in Appendix 2.

- 13.

There are two types of adjustment cost functions. The first type of adjustment cost implies additional costs associated with gross investment. The second type of adjustment cost implies that gross investment includes adjustment costs associated with accumulation of capital. In our study, we use the first type of adjustment cost function.

- 14.

We also conduct OLS estimations in each sector. The estimation results are similar to Table 5.11. Although the ratio of intangible to tangible assets in the IT industries is positive and significant, the signs of this variable are inconclusive in the non-IT industries.

References

Abowd, J. M., Haltiwanger, J., Jarmin, R., Lane, J., Lengermann, P., McCue, K., et al. (2005). The relation among human capital, productivity, and market value. In C. Corrado, J. Haltiwanger, & D. Sichel (Eds.), Measuring capital in the new economy (pp. 153–203). Chicago, IL: University of Chicago Press.

Arato, H., & Yamada, K. (2012). Japan’s intangible capital and valuation of corporations in a neoclassical framework. Review of Economic Dynamics, 15, 293–312.

Barnes, P., & McClure, A. (2009). Investments in intangible assets and Australia’s productivity growth (Productivity Commission Staff Working Paper). Melbourne: Productivity Commission.

Basu, S., Fernald, J. G., Oulton, N., & Srinivasan, S. (2003). The case of the missing productivity growth: Or, does information technology explain why productivity accelerated in the United States but not the United Kingdom? In M. Gertler & K. Rogoff (Eds.), NBER macroeconomics annual, 2003 (pp. 9–63). Cambridge, MA: MIT Press.

Bloom, N., & Van Reenen, J. (2007). Measuring and explaining management practices across firms and countries. Quarterly Journal of Economics, 122, 1351–1408.

Bond, S., & Cummins, J. (2000). The stock market and investment in the new economy: Some tangible facts and intangible fictions. Brookings Papers on Economic Activity, 1, 61–124.

Brynjolfsson, E. (2004). Intangible assets, translated to Japanese by Diamond Inc., Tokyo.

Brynjolfsson, E., Hitt, L., & Yang, S. (2002). Intangible assets: Computers and organization capital. Brookings Papers on Economic Activity, 1, 137–181.

Corrado, C., Haskel, J., Jona-Lasinio, C., & Iommi, M. (2012). Intangible capital and growth in advanced economies: Measurement and comparative results. Presented at the 2nd World KLEMS Conference at Harvard University.

Corrado, C., Hulten, C., & Sichel, D. (2009). Intangible capital and U.S. economic growth. Review of Income and Wealth, 55, 658–660.

Cummins, J. G. (2005). A New Approach to the Valuation of Intangible Capital. In C. Corrado, J. Haltiwanger, & D. Sichel (Eds.), Measuring capital in the new economy (pp. 47–72). Chicago, IL: University of Chicago Press.

Delbecque, V., & Bounfour, A. (2011). Intangible investment: Contribution to growth and innovation policy issues (The European Chair on Intellectual Capital Management Working Paper Series, No. 2011-1A).

Fukao, K., Hamagata, S., Inui, T., Ito, K., Kwon, H., Makino, T., et al. (2007). Estimation procedure and TFP analysis of the JIP database 2006 (revised) (RIETI Discussion Paper Series 07-E-003). Tokyo: The Research Institute of Economy, Trade and Industry.

Fukao, K., Miyagawa, T., Mukai, K., Shinoda, Y., & Tonogi, K. (2009). Intangible investment in Japan: Measurement and contribution to economic growth. Review of Income and Wealth, 55, 717–736.

Görzig, B., & Görnig, M. (2012). The dispersion in profits rates in Germany: A result of imperfect competition? Presented at the 32nd General Conference of International Association for Research in Income and Wealth at Boston, USA.

Griliches, Z. (1981). Market value, R&D, and patents. Economic Letters, 7, 83–187.

Hall, B. H. (1993). The stock market’s valuation of R&D investment during the 1980’s. American Economic Review, 83, 259–264.

Hall, R. (2000). E-capital: The link between the stock market and the labor market in the 1990s. Brookings Papers on Economic Activity, 1, 73–118.

Hall, R. (2001). The stock market and capital accumulation. American Economic Review, 91, 1185–1202.

Hall, B. H., & Oriani, R. (2006). Does the market value R&D investment by European firms? Evidence from a panel of manufacturing firms in France, Germany, and Italy. International Journal of Industrial Organization, 24, 971–993.

Hao, J., Manole V., & van Ark B. (2008, June 10). Intangible assets in Europe: Measurement and international comparability. Presented at the final conference of EUKLEMS Project.

Hayashi, F., & Inoue, T. (1991). The relation between firm growth and Q with multiple capital goods: Theory and evidence from panel data on Japanese firms. Econometrica, 59, 731–753.

Hulten, C. R., & Hao, X. (2008). What is a company really worth? Intangible capital and the ‘market to book value’ puzzle (NBER Working Paper No. 14548).

Hulten, C. R., & Wykoff, F. C. (1979). Economic depreciation of the U.S. capital stock. Report submitted to the U.S. Treasury Department Office of Tax Analysis, Washington, DC.

Hulten, C. R., & Wykoff, F. C. (1981). The measurement of economics depreciation. In C. Hulten (Ed.), Depreciation, inflation and the taxation of income from capital (pp. 81–125). Washington, DC: Urban Institute Press.

Lev, B., & Radhakrishnan, S. (2005). The valuation of organization capital. In C. Corrado, J. Haltiwanger, & D. Sichel (Eds.), Measuring capital in the new economy (pp. 73–99). Chicago, IL: University of Chicago Press.

Lindenberg, E., & Ross, S. A. (1981). Tobin’s Q ratio and industrial organization. Journal of Business, 54, 1–32.

Marrano, M., Haskel, J., & Wallis, G. (2009). What happened to the knowledge economy? ICT, intangible investment, and Britain’s productivity revisited. Review of Income and Wealth, 55, 661–716.

Miyagawa, T., & Hisa, S. (2013). Estimates of intangible investment by industry and productivity growth in Japan. The Japanese Economic Review, 64, 42–72.

Miyagawa, T., & Kim, Y. (2008). Measuring organizational capital in Japan: An empirical assessment using firm-level data. Seoul Journal of Economics, 21, 171–193.

Ooki, E. (2003). Performance-based wage systems and vocational education/training investment (Gyoseki-shugi to Kyoiku Kunren Toshi) (in Japanese). In K. Imano (Ed.), Implications of performance-based wage systems for individuals and organizations (Ko to Soshiki no Seikashugi). Tokyo: Chuo Keizai Sha.

Piekkola, H. (2011). Intangible capital in EU 27 – Drivers of growth and location in the EU. Proceedings of the University of Vaasa. Reports 166.

Pyo, H., Chun, H., & Rhee, K. (2010). The productivity performance in Korean industries (1990-2008): Estimates from KIP database. Presented at RIETI/COE Hi-Stat International Workshop on Establishing Industrial Productivity Database for China (CIP), India (IIP), Japan (JIP), and Korea (KIP) held on October 22, 2010.

Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. American Economic Review, 88, 559–586.

Robinson, P., & Shimizu, N. (2006). Japanese corporate restructuring: CEO priorities as a window on environmental and organizational change. The Academy of Management Perspectives, 20, 44–75.

Tanaka, K., & Miyagawa, T. (2011). Oogatatousi ha kigyo pafo-mansu wo koujou saseruka? (Does large investment improve firm performance? In K. Asako & T. Watanabe (Eds.), Econometric analyses of finance and business cycles (pp. 191–235). Tokyo: Minerva Shobo (in Japanese).

Wildasin, D. E. (1984). The q theory of investment with many capital goods. American Economic Review, 74, 203–210.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1. Measurement of Tangible Capital Stock

5.1.1 1.1 Capital Stock

In reference to Hayashi and Inoue (1991), we created the dataset of tangible capital stock by assets.

We employ the Permanent Inventory (PI) method, in which we use FY1980 or FY1990 as the base year.

We create firm level data of the capital stock using six assets, (1) non-residential building, (2) construction, (3) machinery, (4) ship/vehicle/transportation equipment, (5) tool appliance equipment, and (6) other tangible assets as follows:

where K m it is the capital stock of asset m for firm i at time t, I m it is real investment, and δ m is the depreciation rate. After calculating the capital stock of each asset, we estimate the real tangible capital stock, K it by firm level, by adding them together as follows.

In the following, we introduce the variables used in calculating the real tangible capital stock.

5.1.2 1.2 Nominal Investments

The nominal investment of each asset is defined as the amount of each acquisition credited against the retirement and decrease in the tangible asset by the sale of another one. While Hayashi and Inoue (1991) used the retirement and decrease valued by replacement price, we use the book value.

5.1.3 1.3 Capital Price by the Type of Capital Goods

In order to deflate nominal investments, we use the following price indices in “Corporate goods Price Index (CGPI)” by Bank of Japan.

-

“Construction material price index” for (1) non-residential building and (2) construction

-

“Transportation equipment price index” for (4) ship/vehicle/transportation equipment

-

“Manufacturing product price index” for (6) other tangible assets

For (3) machinery or (5) tool appliance equipment, we use the relevant price indices in the CGPI. At first we calculate the industry level weight for each machinery or tool using the “Fixed Capital Formation Matrix” by the Cabinet office, of the Government of Japan. We calculate the weighted average price indices using the weights and the relevant price indices in CGPI for (3) machinery or (5) tool appliance equipment.

5.1.4 1.4 Base Year

As the analysis period in this work is after 2000, the base year for (1) non-residential building and (2) structure (was “construction” earlier) is FY1980 and that for (3) machinery, (4) ship/vehicle/transportation equipment, (5) tool appliance equipment, and (6) other tangible assets is FY1990.

The base year for the companies that were newly listed after FY1980 or FY1990 is the very year when they were listed. As a benchmark, we took the book value of each tangible asset in the base year.

5.1.5 1.5 Depreciation Rate

We use the depreciation rate that Hayashi and Inoue (1991) created using Hulten and Wykoff (1979, 1981). Specifically, the rates are the following: (1) non-residential building, 4.7 % (2) construction, 5.64 % (3) machinery, 9.489 % (4) ship/vehicle/transportation equipment, 14.7 % (5) tool appliance equipment and (6) other tangible assets are both 8.838 %.

Appendix 2. Classification of IT Sectors

JIP code | IT-using manufacturing sector |

|---|---|

20 | Printing, plate making for printing and bookbinding |

23 | Chemical fertilizers |

24 | Basic inorganic chemicals |

29 | Pharmaceutical products |

34 | Pottery |

38 | Smelting and refining of non-ferrous metals |

42 | General industry machinery |

45 | Office and service industry machines |

46 | Electrical generating, transmission, distribution and industrial apparatus |

53 | Miscellaneous electrical machinery equipment |

56 | Other transportation equipment |

59 | Miscellaneous manufacturing industries |

JIP code | IT-using non-manufacturing sector |

|---|---|

63 | Gas, heat supply |

67 | Wholesale |

68 | Retail |

69 | Finance |

70 | Insurance |

79 | |

82 | Medical(private) |

85 | Advertising |

86 | Rental of office equipment and goods |

88 | Other services for businesses |

92 | Publishers |

JIP code | IT-producing manufacturing sector |

|---|---|

47 | Household electric appliances |

48 | Electronic data processing machines, digital and analog computer, equipment and accessories |

49 | Communication equipment |

50 | Electronic equipment and electric measuring instruments |

51 | Semiconductor devices and integrated circuits |

52 | Electronic parts |

57 | Precision machinery & equipment |

JIP code | IT-producing non-manufacturing sector |

|---|---|

78 | Telegraph and telephone |

90 | Broadcasting |

91 | Information services and internet based services |

JIP code | Non-IT intensive manufacturing sector |

|---|---|

8 | Livestock products |

9 | Seafood products |

10 | Flour and grain mill products |

11 | Miscellaneous foods and related products |

12 | Prepared animal foods and organic fertilizers |

13 | Beverages |

14 | Tobacco |

15 | Textile products |

16 | Lumber and wood products |

17 | Furniture and fixtures |

18 | Pulp, paper, and coated and glazed paper |

19 | Paper worked products |

21 | Leather and leather products |

22 | Rubber products |

25 | Basic organic chemicals |

26 | Organic chemicals |

27 | Chemical fibers |

28 | Miscellaneous chemical products |

30 | Petroleum products |

31 | Coal products |

32 | Glass and its products |

33 | Cement and its products |

35 | Miscellaneous ceramic, stone and clay products |

36 | Pig iron and crude steel |

37 | Miscellaneous iron and steel |

39 | Non-ferrous metal products |

40 | Fabricated constructional and architectural metal products |

41 | Miscellaneous fabricated metal products |

43 | Special industry machinery |

44 | Miscellaneous machinery |

54 | Motor vehicles |

55 | Motor vehicles parts and accessories |

58 | Plastic products |

JIP code | Non-IT intensive non-manufacturing sector |

|---|---|

62 | Electricity |

64 | Waterworks |

65 | Water supply for industrial use |

66 | Waste disposal |

71 | Real estate |

73 | Railway |

74 | Road transportation |

75 | Water transportation |

76 | Air transportation |

77 | Other transportation and packing |

81 | Research (private) |

87 | Automobile maintenance services |

89 | Entertainment |

93 | Video picture, sound information, character information production and distribution |

94 | Eating and drinking places |

95 | Accommodations |

96 | Laundry, beauty and bath services |

97 | Other services for individuals |

Rights and permissions

Copyright information

© 2015 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Miyagawa, T., Takizawa, M., Edamura, K. (2015). Does the Stock Market Evaluate Intangible Assets? An Empirical Analysis Using Data of Listed Firms in Japan. In: Bounfour, A., Miyagawa, T. (eds) Intangibles, Market Failure and Innovation Performance. Springer, Cham. https://doi.org/10.1007/978-3-319-07533-4_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-07533-4_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-07532-7

Online ISBN: 978-3-319-07533-4

eBook Packages: Business and EconomicsEconomics and Finance (R0)